- GRIT

- Posts

- 👉 Buffett Loaded Up on Google Stock

👉 Buffett Loaded Up on Google Stock

AST SpaceMobile, Disney, Government Reopening

👉 Week in Review — Too Long; Didn’t Read:

Key Earnings Announcements:

AST SpaceMobile posted their first quarter of “real” revenue due to a significant acceleration in commercial activity.

Nebius sold out their capacity while announcing a $3B deal with Meta.

Disney’s theme parks help generate predictable cash flow while their entertainment division remains uncertain.

Investor Events / Global Affairs:

The government shutdown came to an end (at least until the end of January).

Google plans to spend $40B on data centers in Texas.

Hedge funds decreased their exposure to the Magnificent Seven.

Economic Updates:

A new jobs report is finally coming next week.

Fed members have become increasingly hawkish over the past few weeks.

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

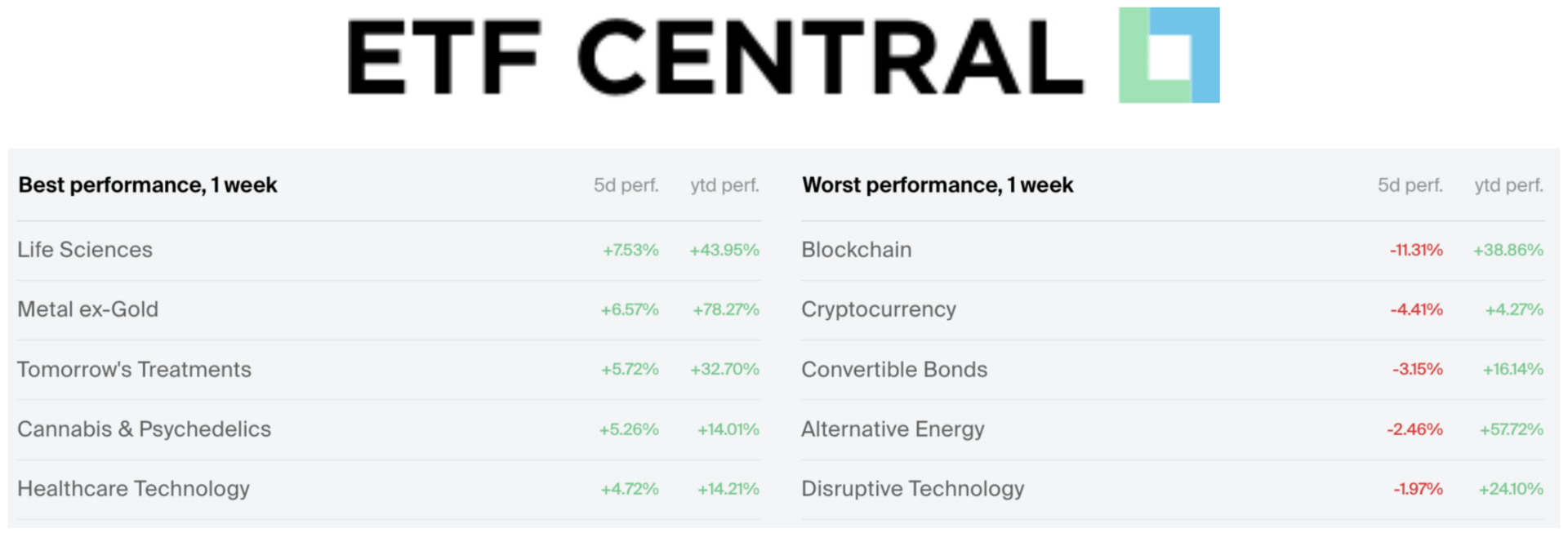

👉 Best and Worst ETF Performers of the Week

👉 Key Earnings Announcements:

AST SpaceMobile posted their first quarter of “real” revenue due to a significant acceleration in commercial activity, Nebius sold out their capacity, and Disney’s theme parks help generate predictable cash flow while their entertainment division remains uncertain.

AST SpaceMobile (ASTS)

Key Metrics

Revenue: $14.7 million, an increase of +1,239% YoY

Operating Loss: -$163.4 million, compared to -$302.4 million last year

Net Loss: -$122.8 million, compared to -$171.9 million last year

Earnings Release Callout

“AST SpaceMobile continues to lead the direct-to-device space-based cellular broadband industry. During the past few months, commercial activity has significantly accelerated, demonstrating the robust demand for our solution across the ecosystem.

Our definitive commercial agreements with Verizon and stc Group are milestone achievements, representing transformational partnerships stemming from our commercial and network operator partner strategy as we continue to build long-term commercial relationships with industry leaders around the world, which includes agreements with over 50 MNO partners with nearly 3 billion subscribers globally.”

My Takeaway

AST SpaceMobile remains a high-risk, high-potential player in the nascent arena of space-based cellular networks. This quarter marks a meaningful step forward in revenue generation, however, the figure still falls short of market expectations and remains very small relative to where the business intends to go.

AST continues to burn cash: adjusted operating expenses of around $67.7 million and a net loss of about $122-123 million reflect the heavy investment required to build the infrastructure, execute launches, secure spectrum and commercial contracts, and scale manufacturing.

AST is operating in a rare niche — space-based cellular connectivity for standard smartphones — and the demand signals are strong: over 50 MNOs, nearly 3 billion subscriber reach, and over $1 billion in contracted commitments. That gives AST a potentially large addressable market and meaningful future runway.

AST is planning five orbital launches by end of Q1 2026, and aims to build a fleet of 45-60 satellites by end of 2026. The company reaffirmed its H2 2025 revenue guidance of $50-$75 million, and noted that while Q3 revenue was only ~$14.7 million, “commercial activity has significantly accelerated” and the business is moving toward its next phase.

Despite being early, I remain bullish. Wall Street is forecasting $2.2B in annual EBITDA in 2028, and at a $22B market cap right now, that’s a 10X multiple. Assuming they’ll deliver upon that expectation and continue to sign these billion-dollar deals, an 18-25X adj. EBITDA multiple seems reasonable — representing a $130-150 / share three year price target (+150% upside).

Long AST SpaceMobile.

Nebius (NBIS)

Key Metrics

Revenue: $146.1 million, an increase of +355% YoY

Operating Loss: -$130.3 million, compared to -$80.6 million last year

Net Loss: -$119.6 million, compared to -$94.2 million last year

Earnings Release Callout

“2025 has been a building year as we put in place the infrastructure and framework for future rapid growth. This year, we believe that we have successfully laid the foundations for an outstanding 2026 — a year that should firmly position us among the top AI cloud businesses globally. And at the same time, 2026 is still just the beginning.”

My Takeaway

Nebius delivered one of the strongest top-line growth quarters in the AI infrastructure space — a more than four-fold increase year-over-year. This growth reflects the continued demand for GPU cloud and AI compute capacity, a sector where Nebius has established itself as a critical provider to hyperscalers and emerging enterprise AI customers.

The company announced a $3 billion multi-year contract with Meta, adding to its already massive $17.4 billion Microsoft-aligned agreement, establishing Nebius as one of the go-to partners for next-generation AI infrastructure. These long-term contracts provide a high-visibility revenue runway and reinforce Nebius’s role in powering the AI workloads of the world’s largest technology companies.

Operationally, management emphasized that capacity — not demand — is the limiting factor. Nebius disclosed that it has sold out all current capacity, and future growth depends entirely on how quickly it can bring new data-center sites online. With targets of reaching 2.5 gigawatts of contracted power by 2026, Nebius is undertaking one of the largest power-infrastructure expansions in the AI compute industry.

The company’s ~$4 billion demand pipeline demonstrates that AI compute demand remains insatiable, and Nebius’s strategy of locking in long-term, multi-billion contracts provides stability in an otherwise capital-intensive and competitive sector.

Long Nebius.

The Walt Disney Company (DIS)

Subscribe to GRIT Premium to read the rest.

Become a paying subscriber of GRIT Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • WEEK IN REVIEW: Full access to the internet's best recap of the markets, every single week. This includes comprehensive earnings breakdowns, portfolio updates, and more. This is the perfect compliment to the "Investing Week Ahead" post that you already receive at the beginning of each week.

- • MONTHLY LIVESTREAMS: Join Austin Hankwitz live every month to dive deep into his portfolio, explore the latest trends, discuss any changes he’s making, and cover market-moving topics.

- • PORTFOLIO ACCESS – Austin Hankwitz, Warren Buffett, Bill Ackman, and other professional / billionaire investor portfolios.

- • MONTHLY STOCK DEEP DIVES – Comprehensive stock analysis on an individual ticker, delivered at the end of each month.

- • RESOURCES – A wide variety of investment resources for both beginners and advanced investors to accelerate your portfolio.