- GRIT

- Posts

- 👉 Ethereum Hits $4,300!

👉 Ethereum Hits $4,300!

Hims & Hers Health, Advanced Micro Devices, Celsius Holdings

Together with XFunds

👉 Week in Review — Too Long; Didn’t Read:

Key Earnings Announcements:

Hims & Hers reported their first-ever core revenue miss

Advanced Micro Devices generated $1 billion in free cash flow

Celsius Holdings reported profits 2X higher than Wall Street’s estimates

Investor Events & Global Affairs:

401(k) plans can now include private equity, real estate, cryptocurrency, and other alternative assets

Apple raised their investment commitment to US manufacturing to $600 billion

The Trade Desk announced their CFO’s departure

Major Economic Events:

The US trade deficit fell -16% in June hitting 2-year lows

US labor productivity rebounded to +2.4% in Q2

US services activity unexpectedly stalled in July

Happy Sunday.

Before we get started, we wanted to offer a warm welcome to the +912 new subscribers who joined us this week, and the 1,295 of you who have joined us thus far in August!

In case you’re new around here, I’m Austin Hankwitz — I’ve been publishing earnings analysis on publicly-traded companies for over half a decade. My podcast, Rich Habits, has hit #1 on Spotify’s Business Podcast chart four times since it’s inception only two years ago.

At the start of 2023, I began my journey of building a $2M Dividend Growth Portfolio from scratch. This twice-weekly newsletter is how I keep you all updated on my progress.

For me, early retirement means $2M invested. For you, it might mean something else. Regardless of your early-retirement number — I hope these weekly synopses of my portfolio progress + what’s been happening in the markets helps you on your own journey.

Every Sunday, we publish the internet’s best summary of what happened in the markets the week prior — earnings analysis, acquisition announcements, economic data, world news, and more.

If you want full access to that info, my portfolio, legendary investor portfolios, livestreams, resources, and more — click here!

Crypto is more than a buzzword — it’s a growing part of the global economy. But accessing it can be complex, volatile, and yield nothing.

The Nicholas Crypto Income ETF (BLOX) aims to change that.

Diversified holdings in crypto-related equities and ETFs

Exposure to Bitcoin and Ether via leading custodians like Fidelity, Coinbase, and Gemini

Income-focused overlay using strategic options to generate weekly cash flow

BLOX is for investors who want crypto exposure and income potential — without the headaches.

👉 Portfolio Updates (YTD Performance):

Eight months later and we’re back on top!

As you all might remember, I purchased ~$75K worth of Ethereum around ~$4,000 each back in December 2024. Ethereum then declined -63% to $1,500 each. We held strong, bought some along the way, and now we’re back on top!

Ethereum is now up +188% from those April lows (I hope you’ve been dollar cost averaging) and our total Ethereum position is closing in on $110K in value.

As a reminder, I firmly believe we’ll see another +50-100% rally in Ethereum over the coming months and I plan to take advantage of that rally by selling 80-90% of my entire position between $6,500 and $8,000 each. I’ll have turned ~$75K into $185K within 12 months — reflecting a +146% return.

Not bad!

Additionally, Chainlink has begun to see some momentum after releasing their “Chainlink Reserve.” This is essentially their way of conducting “share buybacks” we we see publicly traded companies do on an annualized basis. Except instead of authorizing a specified dollar amount to be used for buybacks, Chainlink is using percent of their on-chain and off-chain transaction revenue to fill this reserve.

Since the reserve was announced, the price of Chainlink has surged +38% from $16 to $22. I expect this momentum to continue toward $40 or even $50 over the coming months, at which time I plan to exit 80-90% of my position.

For those of you asking “Wait, I didn’t know you had a Chainlink position?”

I don’t publicly talk about. I haven’t added to it in over five years, and it’s not exactly part of this $2M dividend growth portfolio I’m building alongside you all since 2023. However, if I’m able to play my cards right, I’ll be able to add a sizable amount of capital to the portfolio very soon!

Let’s now jump to the stocks section of the portfolio.

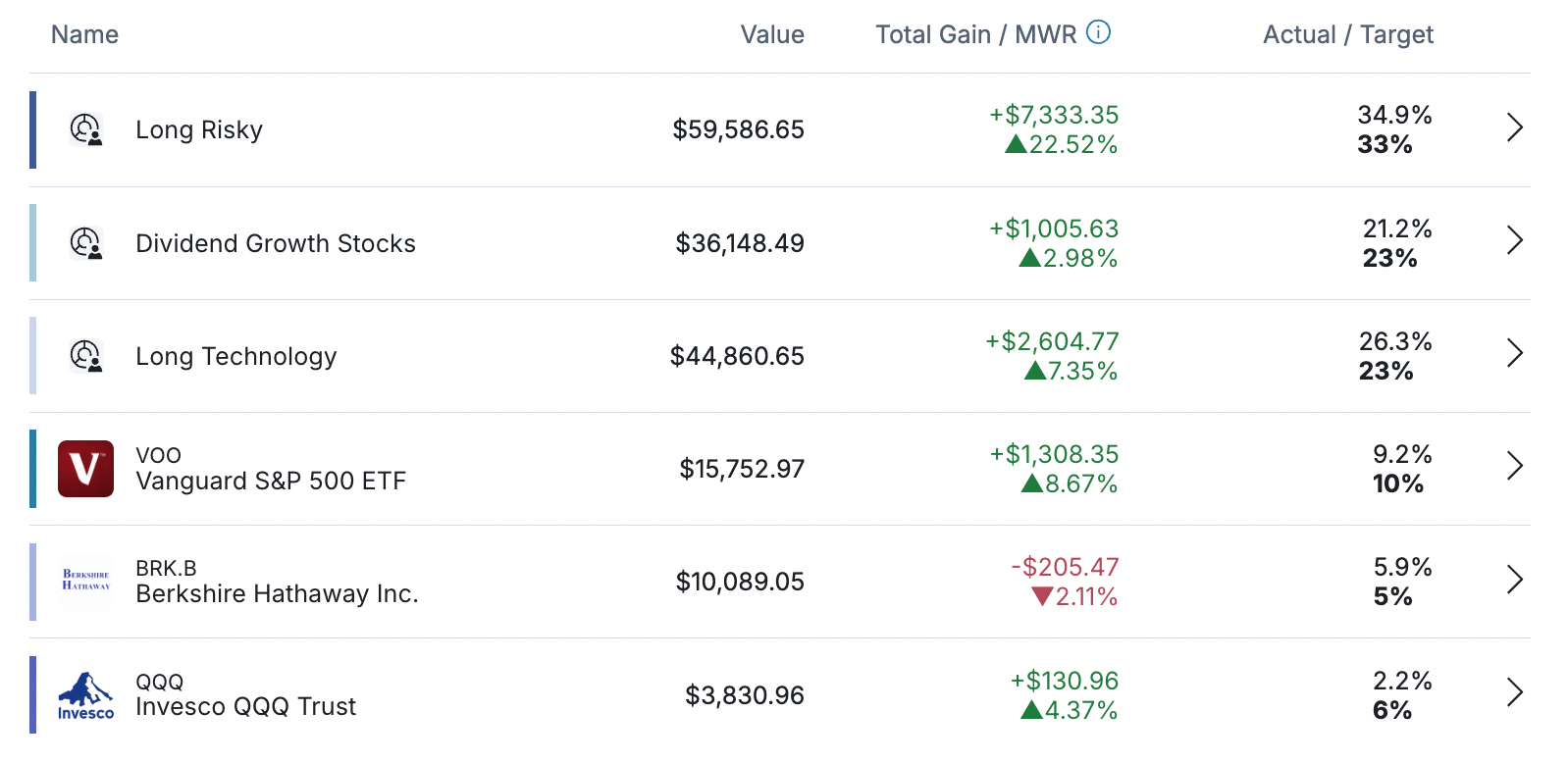

Still encouraged to see the year-to-date total performance of the portfolio outperforming the S&P 500 by a few percentage points. Our Long Technology subsection of the portfolio is beginning to catch up, while our Long Risky subsection of the portfolio outperforms by double-digits.

At this point, I don’t plan to add any new positions to the portfolio, but instead add more capital to the existing positions.

The income-focused section of the portfolio continues to trend in the right direction. I love knowing that these ETFs aren’t just tracking the total performance of their underlying indices, but they’re paying me nearly $800 / month across the three of them. Can’t wait to see just how much that grows over time!

Bitcoin (and a random Ethereum position I never moved off of this platform) continues to trend in the right direction. Bitcoin is on the road to $145K, and I hope to see that number realized in the coming months.

All in all, the portfolio is north of $500K at the moment, something I’m incredibly proud of. Year-to-date, we’ve outperformed across all sections — with some major stock winners in the Long Risky subsection, our massive bet on Ethereum, and our continued optimism with Bitcoin and NEOS ETFs.

Once I exit my cryptocurrency positions in the coming months, we’ll redeploy that capital into stocks and ETFs across the rest of the portfolio in a very big way — that’s when things get fun!

Want to see every position inside my stock and crypto portfolio?

Click here to become a Premium subscriber for $31 / month. You’ll also unlock access to our monthly livestreams, GRIT Guides on Investing, and more.

👉 Key Earnings Announcements:

Hims & Hers reported their first-ever core revenue miss, Advanced Micro Devices generated $1 billion in free cash flow, and Celsius Holdings reported profits 2X higher than Wall Street’s estimates.

Hims & Hers Health (HIMS)

Key Metrics

Revenue: $544.8 million, an increase of +72% YoY

Operating Income: $26.7 million, an increase of +142% YoY

Profits: $42.5 million, an increase of +219% YoY

Earnings Release Callout

“We’re seeing consistent growth across our business as we continue to democratize access to precision care. In the second quarter, revenue grew 73% and Adjusted EBITDA more than doubled relative to the prior year; both were driven by robust growth in Subscribers utilizing personalized treatment plans.

As we move into the second half of 2025, our focus is on investing in capabilities that will deepen the value customers can access on our platform. This includes plans to strengthen the personalization infrastructure in our pharmacies, to expand lab testing capabilities to further tailor care, and to grow our international presence in key markets.”

My Takeaway

HIMS delivered mixed results with a first-time revenue miss.

Total revenue of $544.8 million came in above the midpoint of their guidance, but below Wall Street’s expectations of $551.7 million. While the GLP-1 revenue contribution continues to decelerate as the company phases out 503B fulfillment, their core revenue (excluding GLP-1 contribution) declined sequentially for the very first time. This first-time decline in core revenue was driven by subscribers transitioning to daily offerings vs. 90-day subscriptions.

In terms of spending, the company is entering an investment period of at least a year — specifically in marketing and technology as they continue to try and leverage AI-powered personalization technology to scale globally. Their entry into Canada could generate some meaningful upside for the business — although that impact wouldn’t be realized until 2026.

Despite the turbulence, the company remains on track to deliver upon their long-term 2030 target of $6.5 billion in revenue and $1.3 billion in adj. EBITDA. At the moment, the company is trading ~32X forward adj. EBITDA — a very fair valuation considering their long-term potential. I’ll continue to expand my position if the stock drops into the $40s.

Holding shares.

Advanced Micro Devices (AMD)

Key Metrics

Revenue: $7.7 billion, an increase of +32% YoY

Operating Loss: -$134.0 million, compared to $269.0 million last year

Profits: $872.0 million, an increase of +229% YoY

Earnings Release Callout

“We achieved 32% year-over-year revenue growth and generated record free cash flow this quarter, reflecting our disciplined execution. Our strategic investments across hardware, software and systems position us well to support robust future growth and drive long-term shareholder value.”

My Takeaway

AMD delivered a strong quarter, with revenue of $7.7 billion — a solid $270 million beat against Wall Street’s expectations. The company also gave an encouraging Q3 outlook of $8.3 billion. Their Q2 revenue strength was driven by record sales and consistent market share gains of EPYC server CPUs and Ryzen client CPUs — in both AI and traditional enterprise markets.

Their Data Center business segment (EPYC, CPUs, and GPUs) was a major contributor to Q2 results, with revenue of $3.2 billion (+14% YoY). AMD set new records for both cloud and enterprise CPU sales and achieved its 33rd consecutive quarter of share gains in the CPU market. Hyperscale customers (Google and Oracle) continued to deploy EPYC with over 100 new AMD-based cloud instances launched during the quarter.

For Q3, AMD’s growth is expected to be driven by a strong double-digit increase in their Data Center business segment, especially as their new MI350 begins to ramp up in sales. Looking ahead, the company remains very bullish on its server CPU opportunity driven by AI and cloud tailwinds. Management highlighted rising investments in general-purpose compute for AI that is driving increased CPU usage, as with “agentic AI” applications. AMD’s AI roadmap is positioning the company to earn “tens of billions” in Data Center revenue over time.

AMD generated over $1 billion in free cash flow during the quarter and returned $478 million of that to shareholders in the form of share repurchases.

Holding shares, and very bullish.

Celsius Holdings (CELH)

Subscribe to GRIT Premium to read the rest.

Become a paying subscriber of GRIT Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • WEEK IN REVIEW: Full access to the internet's best recap of the markets, every single week. This includes comprehensive earnings breakdowns, portfolio updates, and more. This is the perfect compliment to the "Investing Week Ahead" post that you already receive at the beginning of each week.

- • MONTHLY LIVESTREAMS: Join Austin Hankwitz live every month to dive deep into his portfolio, explore the latest trends, discuss any changes he’s making, and cover market-moving topics.

- • PORTFOLIO ACCESS – Austin Hankwitz, Warren Buffett, Bill Ackman, and other professional / billionaire investor portfolios.

- • MONTHLY STOCK DEEP DIVES – Comprehensive stock analysis on an individual ticker, delivered at the end of each month.

- • RESOURCES – A wide variety of investment resources for both beginners and advanced investors to accelerate your portfolio.