- GRIT

- Posts

- 👉 Ford Has Lost -$3.5B On Their EVs Thus Far In 2025

👉 Ford Has Lost -$3.5B On Their EVs Thus Far In 2025

Tesla, Netflix, & Amazon's AWS Outage

👉 Week in Review — Too Long; Didn’t Read:

Key Earnings Announcements:

Tesla delivered record revenue of $28.1 billion.

Netflix’s ad-tier subscription is now available in more than a dozen countries.

Ford’s EV business segment continues to burn a hole in their pocket.

Investor Events / Global Affairs:

Trump appears to have nearly reached a deal with China.

Google’s quantum computing capabilities continue to accelerate.

AWS had a major power outage that impacted millions of Americans this week.

Economic Updates:

The market welcomed a relatively tame inflation data release

Consumer sentiment dropped to its lowest level since May.

Happy Sunday.

We’ve got two exciting announcement for you:

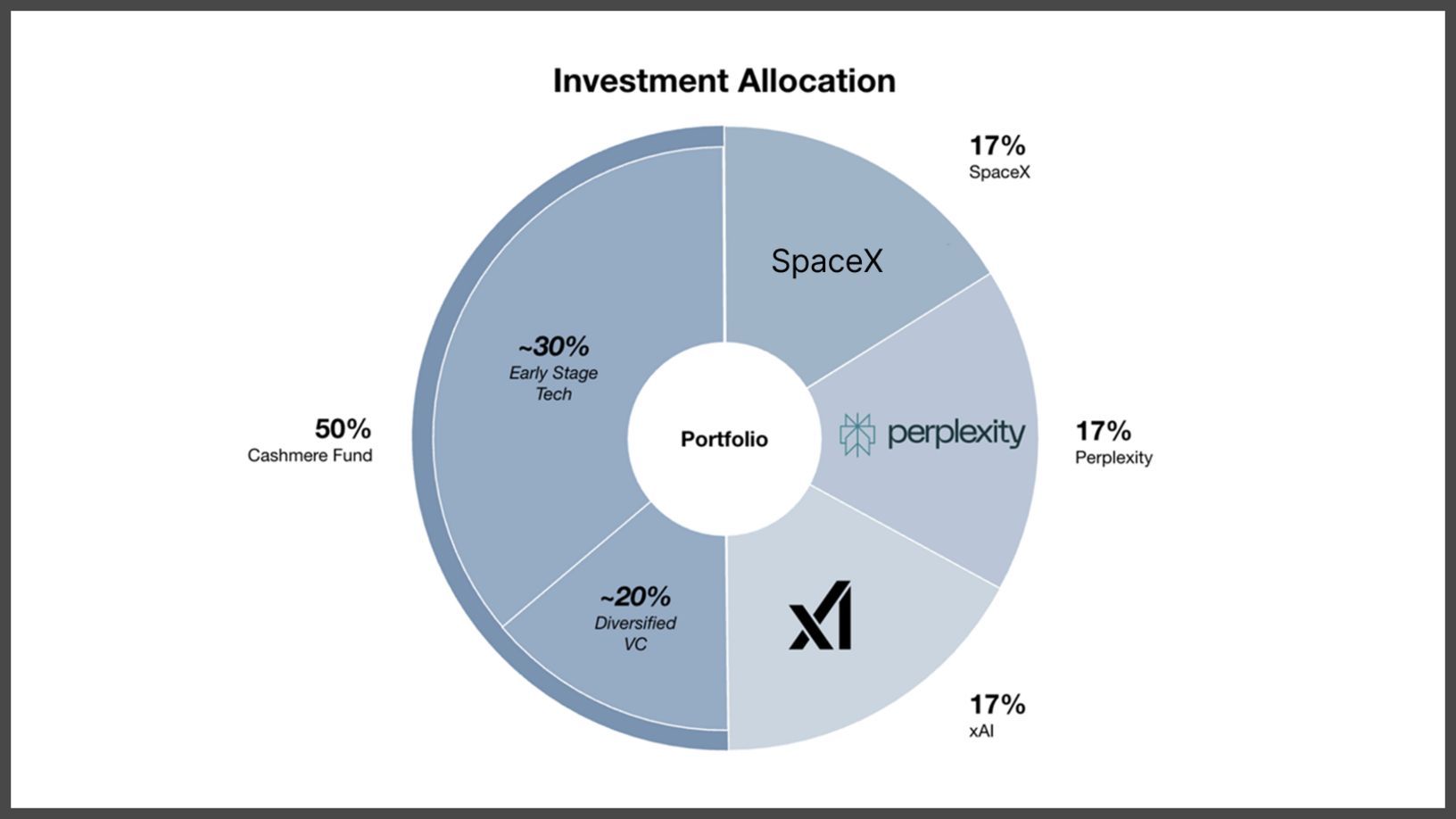

1) An Opportunity to Invest in xAI, Perplexity, SpaceX, and more

For the first time ever, accredited investors can invest alongside me in SpaceX, Perplexity, xAI, and all 38 holdings inside The Cashmere Fund (including MrBeast’s Beast Industries, Katy Perry’s De Soi, Graza, and more) — all through one single investment ($7,500 minimum).

The structure is simple, yet powerful:

17% SpaceX

17% xAI

17% Perplexity

50% Cashmere Fund

This vehicle provides broad-based exposure across tech and consumer sectors, from Pre-Seed to Pre-IPO — and it’s all accessible through our partnership with Republic.

CLICK HERE TO LEARN MORE. Because I’m partnered with Republic, this opportunity is open to the public. As long as you’re accredited, you can participate. Feel free to share the details with your friends!

2) Free Webinar with CNBC’s Katie Stockton

I’ll be doing a stock pick breakdown with Katie Stockton on Friday, October 31st (Halloween) at 12pm ET. Katie is a renowned technical analyst and consistent CNBC Contributor. Join us or at least sign up to get the recording!

Every Sunday, we publish the internet’s best summary of what happened in the markets the week prior — earnings analysis, acquisition announcements, economic data, world news, and more.

If you want full access to that info, my portfolio, legendary investor portfolios, livestreams, resources, and more — click here!

👉 Portfolio Updates

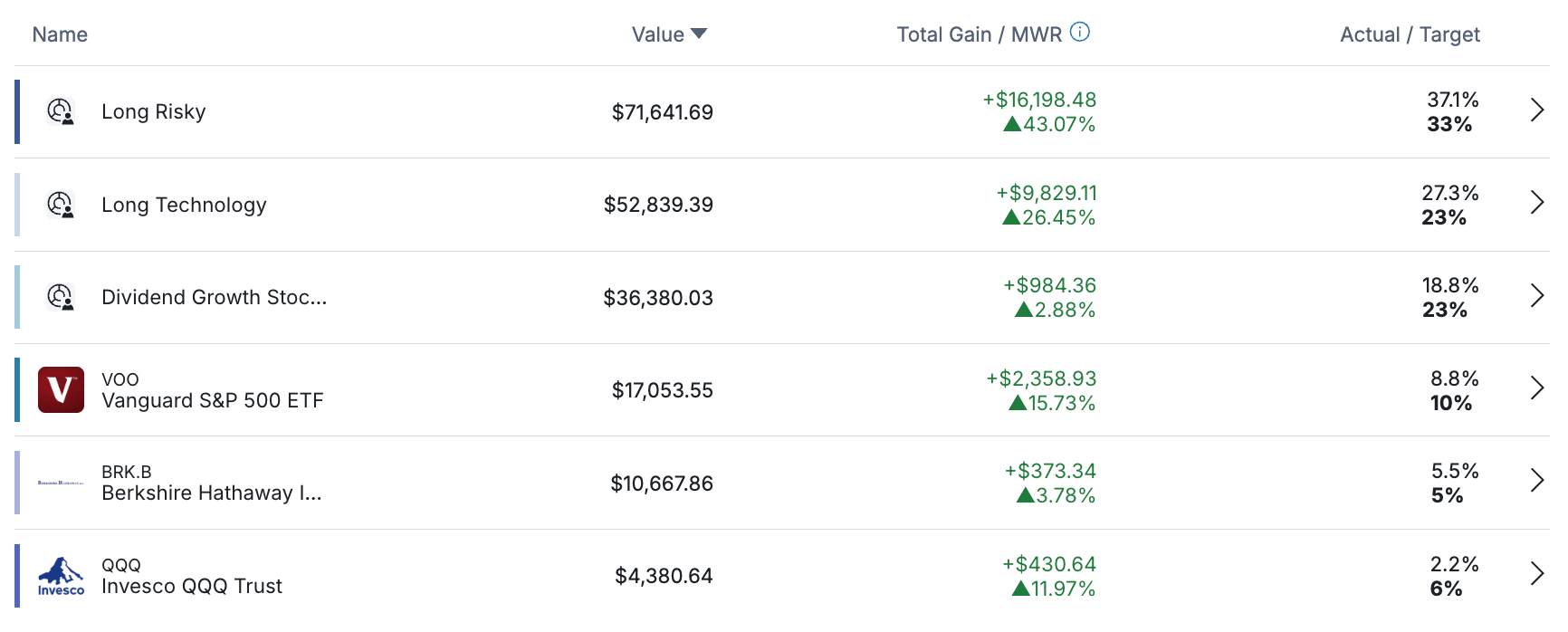

The stock-only portfolio remains steady. I’ve made very few changes recently, as the stability it has provided throughout October’s volatility has been excellent.

Year-to-date returns hover around +23%, outperforming both the S&P 500 (+16%) and the Nasdaq-100 (+21%). I plan to invest several thousand more between now and the end of the year — and I intend to deploy this capital aggressively. In my view, we’re entering a “melt-up” phase across both the equity and crypto markets. I don’t believe we’ve reached the top of this so-called “AI bubble” by any stretch of the imagination.

Not only is the Fed cutting rates, but Jerome Powell has also indicated a potential pause in quantitative tightening (QT) and a shift back toward quantitative easing (QE). Inflation continues to trend steadily lower, the government shutdown appears close to resolution, and U.S.–China trade agreements are largely progressing — all of which could serve as further catalysts for market momentum.

In my opinion, now is not the time to be sitting on the sidelines.

I haven’t been adding much to this section of the portfolio over the past few months, as most of my new capital has been directed toward the “Long Risky” subsection. That segment now represents 37% of my total portfolio, with year-to-date returns north of +43% — roughly double the Nasdaq-100 and nearly triple the S&P 500.

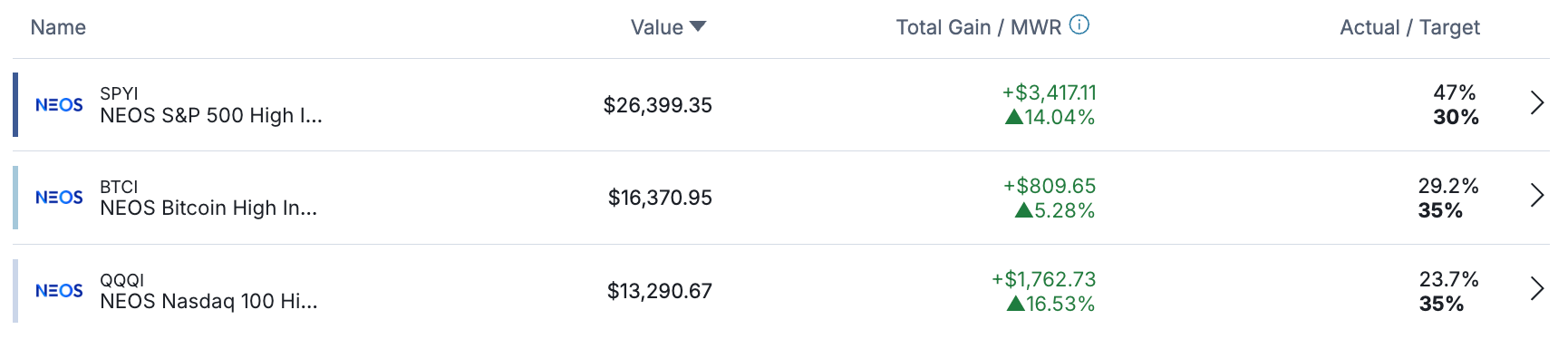

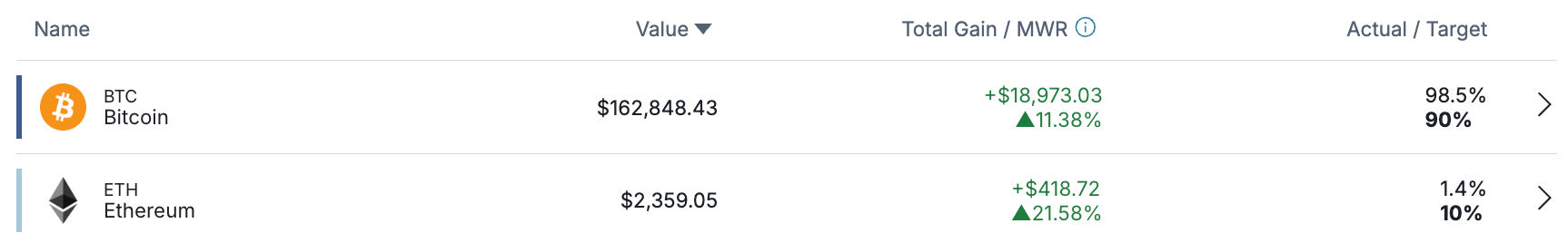

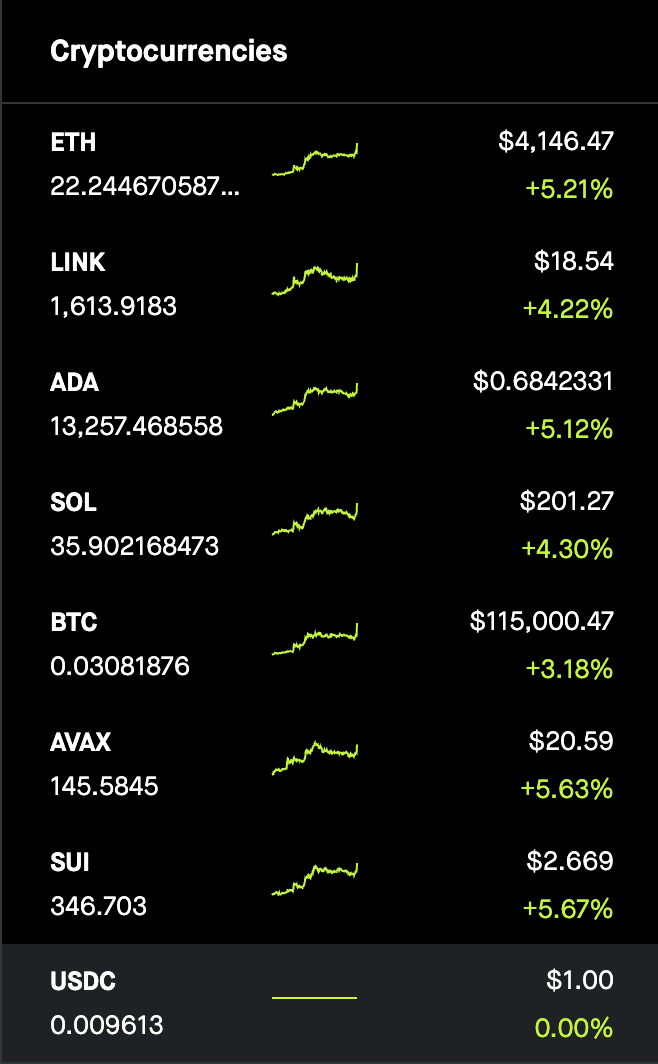

Crypto remains a significant position in my portfolio, totaling several hundred thousand dollars. I plan to exit 80–95% of this position over the coming weeks and months, ideally as we experience a blow-off top across the crypto markets.

👉 Key Earnings Announcements:

Tesla delivered record revenue of $28.1B, Netflix’s ad-tier subscription is now available in more than a dozen countries, and Ford’s EV business segment continues to burn a hole in their pocket.

Tesla (TSLA)

Key Metrics

Revenue: $28.1 billion, an increase of +12% YoY

Operating Income: $1.6 billion, compared to $2.7 billion last year

Profits: $1.4 billion, compared to $2.2 billion last year

Earnings Release Callout

Our focus remains on scaling our core hardware business by maximizing our deliveries and deployments, as these products will deliver increasing value to our customers over time via services powered by AI. Every Tesla vehicle delivered today is designed for autonomy while every Tesla energy storage product is capable of being enhanced and optimized by our virtual power plant or Autobidder functionality. We continue to deliver a fleet of products that brings AI into the real world as we pursue a future of sustainable abundance as outlined in our Master Plan Part IV.

My Takeaway

Tesla delivered record revenue of $28.1 billion driven by a global delivery total exceeding 497,000 vehicles and strong energy-storage deployments of 12.5 GWh. Despite that top-line strength, operating income fell by 40% driven by higher input costs, more than $400 million in tariff expenses, and a sharp decline in regulatory-credit sales.

During the call, management emphasized Tesla’s ongoing transition from a pure automaker to a broader AI and robotics company. Elon Musk highlighted plans to begin limited robotaxi operations in up to ten U.S. cities by the end of the year, discussed progress on the in-house “AI5” self-driving chip in partnership with major semiconductor manufacturers, and reiterated the long-term ambition for the Optimus humanoid robot to play a commercial role by the late 2030.

Management also pointed to macro uncertainty — trade policy changes, supply-chain shifts, and geopolitical tension — as ongoing headwinds for production efficiency and cost control.

For investors, the story remains a dual narrative: Tesla is successfully scaling revenue and innovation but struggling to protect existing profitability. The core business faces competitive and cost pressures, while the long-term upside hinges on execution in self-driving technology, AI infrastructure, and robotics. If those bets pay off, Tesla could justify a much higher multiple against what would be tens of billions in profits.

I remain a satisfied shareholder. Long Tesla.

Netflix (NFLX)

Key Metrics

Revenue: $11.5 billion, an increase of +17% YoY

Operating Income: $3.2 billion, an increase of +12% YoY

Profits: $2.5 billion, an increase of +8% YoY

Earnings Release Callout

We’re finishing the year with good momentum and have an exciting Q4 slate, including the final season of Stranger Things, new seasons of The Diplomat and Nobody Wants This, Guillermo del Toro’s Frankenstein, Kathryn Bigelow’s A HOUSE OF DYNAMITE, Rian Johnson’s Wake Up Dead Man: A Knives Out Mystery as well as more live events including NFL Christmas Day games and the Jake Paul vs. Tank Davis boxing match.

My Takeaway

Netflix delivered revenue of about $11.5 billion driven by steady subscriber growth, higher prices in key markets, and accelerating momentum in its advertising business. Subscriber growth was broad-based, with notable gains in Asia-Pacific and Europe, as Netflix’s crackdown on password sharing continued to drive conversions from freeloaders into paying members. Average revenue per user climbed modestly as the company raised subscription prices in several regions and saw improving engagement across both its standard and ad-supported tiers.

The ad-tier segment, now available in more than a dozen countries, grew advertising revenue by double digits sequentially, and management reiterated its target to more than double ad sales in 2025.

Content engagement remained robust, with Netflix recording its highest-ever share of overall TV time in major markets like the U.S. and U.K. The company cited several tentpole releases and expanding live-event programming as key contributors to that performance. Executives also highlighted the growing importance of new business verticals, such as interactive content, gaming, and generative-AI-driven personalization, which are intended to extend viewing time and create additional monetization opportunities.

The company is entering a more mature phase defined by higher ARPU, diversified revenue streams, and strong content economics, rather than pure subscriber expansion. Execution around advertising, live content, and global pricing will determine whether Netflix can sustain double-digit growth and justify its premium valuation going forward.

Long Netflix.

Ford (F)

Subscribe to GRIT Premium to read the rest.

Become a paying subscriber of GRIT Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • WEEK IN REVIEW: Full access to the internet's best recap of the markets, every single week. This includes comprehensive earnings breakdowns, portfolio updates, and more. This is the perfect compliment to the "Investing Week Ahead" post that you already receive at the beginning of each week.

- • MONTHLY LIVESTREAMS: Join Austin Hankwitz live every month to dive deep into his portfolio, explore the latest trends, discuss any changes he’s making, and cover market-moving topics.

- • PORTFOLIO ACCESS – Austin Hankwitz, Warren Buffett, Bill Ackman, and other professional / billionaire investor portfolios.

- • MONTHLY STOCK DEEP DIVES – Comprehensive stock analysis on an individual ticker, delivered at the end of each month.

- • RESOURCES – A wide variety of investment resources for both beginners and advanced investors to accelerate your portfolio.