- GRIT

- Posts

- IPO MARKET ISN'T DEAD (yet)

IPO MARKET ISN'T DEAD (yet)

Good Morning!

On today's agenda: ARM's IPO skyrockets by 23%, a landmark strike shakes up the Big Three auto giants, and the Fed gears up for one more rate hike. Buckle up!

First time reading? Sign-up here.

Let’s get into it!

UNITED AUTO WORKERS MAKE HISTORY WITH UNPRECEDENTED STRIKE

Source: ABC News

For the first time in 88 years, the UAW is striking at Ford, GM, and Stellantis (formerly Fiat Chrysler) all at once. Over 13K workers are on strike. Why? They want more money. The union wants a 36% pay raise in four years. GM and Ford offered 20%, Stellantis 17.5%.

Ford claims agreeing to union demands would've led to a $15B loss and bankruptcy over the last decade. UAW's counter? Automakers are rolling in billions and can afford it, arguing labor is just 4-5% of vehicle costs.

How long will the strike last? Not sure. The union has enough money for 11 weeks (if all workers walked out). Stellantis, Ford, and GM have enough cars for 75, 62, and 51 days.

GRIT TAKE: This isn't just a U.S. drama—it's a global spectacle. Unions and automakers worldwide are tuned in. If the strike drags on, dealers could face empty lots and car prices might go up, throwing a wrench in the Fed's anti-inflation plans. Stay glued to this unfolding story.

ARM IPO SURGES +23%

Source: Bloomberg

ARM's Wall Street debut is a smash hit, with shares rocketing to $63—a 23% leap from its $51 IPO price. Add in a 6% pre-market bump, and we're talking a potential 31% gain.

Wall Street must be popping the premium bubbly, relieved that the IPO scene isn't flatlining. With IPOs down 50% this year from the 5-year average, ARM's success is a shot in the arm for upcoming tech IPOs like Instacart and Klaviyo.

The first analyst to weigh in, Charles Shi of Needham & Co., gave ARM a 'HOLD' rating, calling the valuation "full." He sees growth potential in smartphones but thinks it's not enough to justify the stock's lofty IPO valuation.

GRIT TAKE: Hold onto your wallets—ARM's stock is sky-high, trading at 25x its revenue and a jaw-dropping 130x its earnings. The only other tech giant in that league? Nvidia. ARM's valuation is now $68 billion, just a hair below Micron Technology, which rakes in 10 times more revenue. Fun fact: ARM doesn't even make chips; they design them and cash in on royalties. While the stock's inflated price is banking on AI's future, let's not forget most of their current cash flow comes from smartphones. So, is it worth the hype? I'm skeptical.

FED: ONE MORE HIKE

Source: Bloomberg

The economy's doing better than many thought, and experts polled by Bloomberg predict the Federal Reserve will hike interest rates again in 2023. However, don't expect a rate increase at next week's Fed meeting; they're likely to hold steady at a 22-year high of 5.25-5.5%.

Growth forecasts are also on the rise. The Fed's June prediction for 2023 was a mere 1%—now experts think it could hit 2%. Inflation remains a headache, though. The year-end forecast is 3.2%, way above the Fed's 2% target.

On the bright side, fewer economists expect a recession in the next year. The odds have dropped from 67% to 45%.

Keep an eye on the Fed's balance sheet – its getting tighter. They plan to trim it from $8.1 trillion to $7.8 trillion by year-end, and down to $6.8 trillion by 2025.

GRIT TAKE: If I were calling the shots, I'd hike rates next week—no dilly-dallying. With inflation picking up steam again and retail sales looking robust, it's crucial to show the market we mean business about tackling inflation. Pausing now could send the wrong message and backfire. Let's not play with fire.

Coming Up…

Today: Empire Manufacturing data, industrial production and University of Michigan preliminary reading of September consumer sentiment indicator.

All eyes on the FED meeting Wednesday: will they raise? Stay tuned!

Headlines You Need To Know:

JP Morgan to offer payroll services

Disney holds initial talks on sale of ABC

India races to contain deadly virus outbreak

Hunter Biden indicted on gun charges

IRS shuts door on pandemic tax credit

Libya’s flood disaster was decades in the making

Oil rally picks up steam

GM sweetens UAW offer to include 20% pay increase

FTX gets court approval to sell billions in crypto

Kevin McCarthy pulls back pentagon spending

CEO with $110 million in pay is suddenly out

Just for fun…

This Mouthwash Is Making People Millions…

Source: Listerine

Listerine is making people millions through an accidental royalty deal that has lasted for over 100 years. Listerine is the world’s most popular mouth wash brand. They are worth over $500 million dollars and owned by Johnson/Johnson. Listerine was founded in the early 1870s by J.J. Lawrence. However, Listerine never took off. So Lawrence made a royalty deal with a local pharmacy where the Pharmacist would receive $6 per every 144 bottles sold. The local pharmacist died and his son took over. He completely changed the branding of Listerine and the mouthwash sales went completely nuts. The contract that the founder and local pharmacist signed, it turned out, had one massive flaw: The two men never created an end date for the royalty payments. As long as Listerine was sold, they would get their $6 cut. Fast forward to 2023, and Johnson/Johnson pays out $23 million in royalty payments a year to a wide variety of people and groups. Even Governor Chris Christie makes $30,000 a year from royalty payments.

3 Most Important Charts Right Now

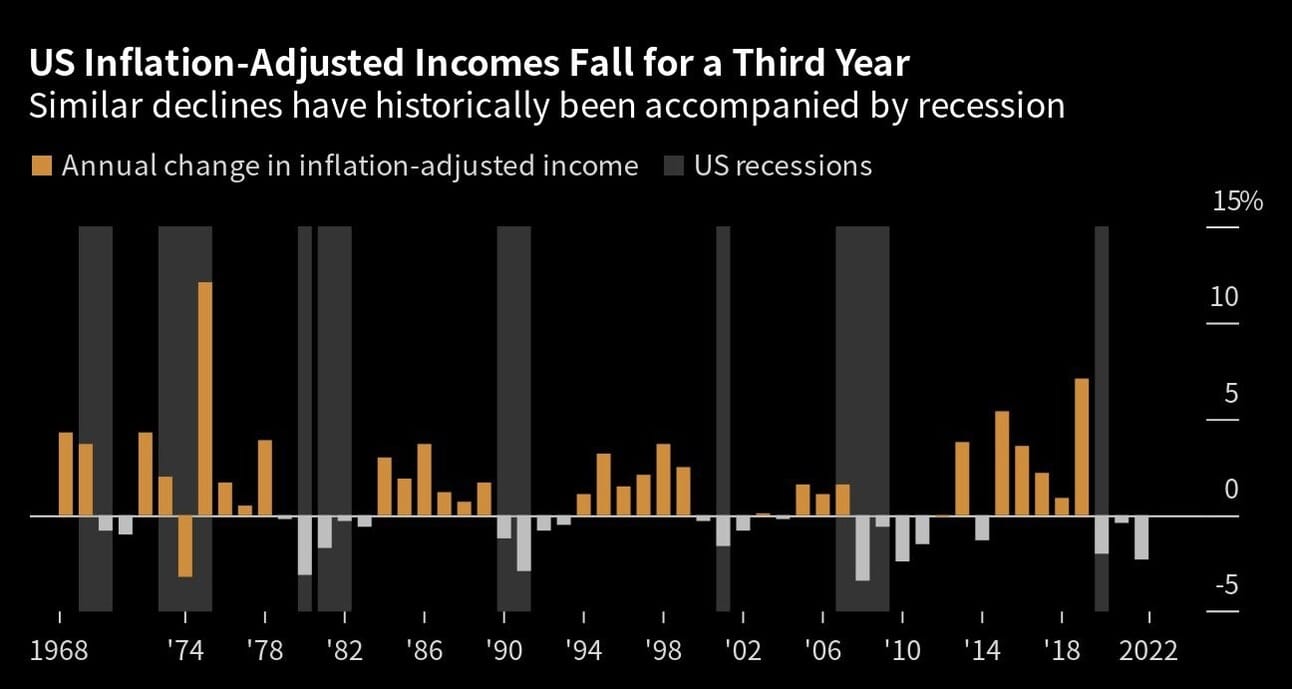

US Inflation-Adjusted Incomes

Inflation-adjusted incomes fall for a third year

Source: Bloomberg

Serious Credit Card Delinquency

Serious credit card delinquency is on the rise

Source: Insider

US Labor Force Participation Rate

16 to 24-year-old labor is on the rise

Source: Bloomberg, Tavi Costa

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

DISCLAIMER: Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]

Reply