- GRIT

- Posts

- 👉 Major AI Headlines Kick Off 2026

👉 Major AI Headlines Kick Off 2026

Amazon, Google, Nvidia

👉 Week in Review — Too Long; Didn’t Read:

Key Earnings Announcements:

Constellation Brands returned $400M to shareholders this quarter.

Helen of Troy lowered their 2026 guidance to reflect worse-than-expected tariffs charges.

Investor Events / Global Affairs:

Nvidia once again impressed at CES.

Walmart announced a partnership with Google Gemini.

Novo Nordisk announced a partnership with Amazon Pharmacy.

Economic Updates:

The job market continues to cool.

Inflation expectations are keeping economists guessing.

CLICK HERE to sign up for this week’s livestream! It will take place tomorrow — Monday, January 12th at 5pm ET. If you can’t make it, you’ll still be able to access the recording.

Hiring in 8 countries shouldn't require 8 different processes

This guide from Deel breaks down how to build one global hiring system. You’ll learn about assessment frameworks that scale, how to do headcount planning across regions, and even intake processes that work everywhere. As HR pros know, hiring in one country is hard enough. So let this free global hiring guide give you the tools you need to avoid global hiring headaches.

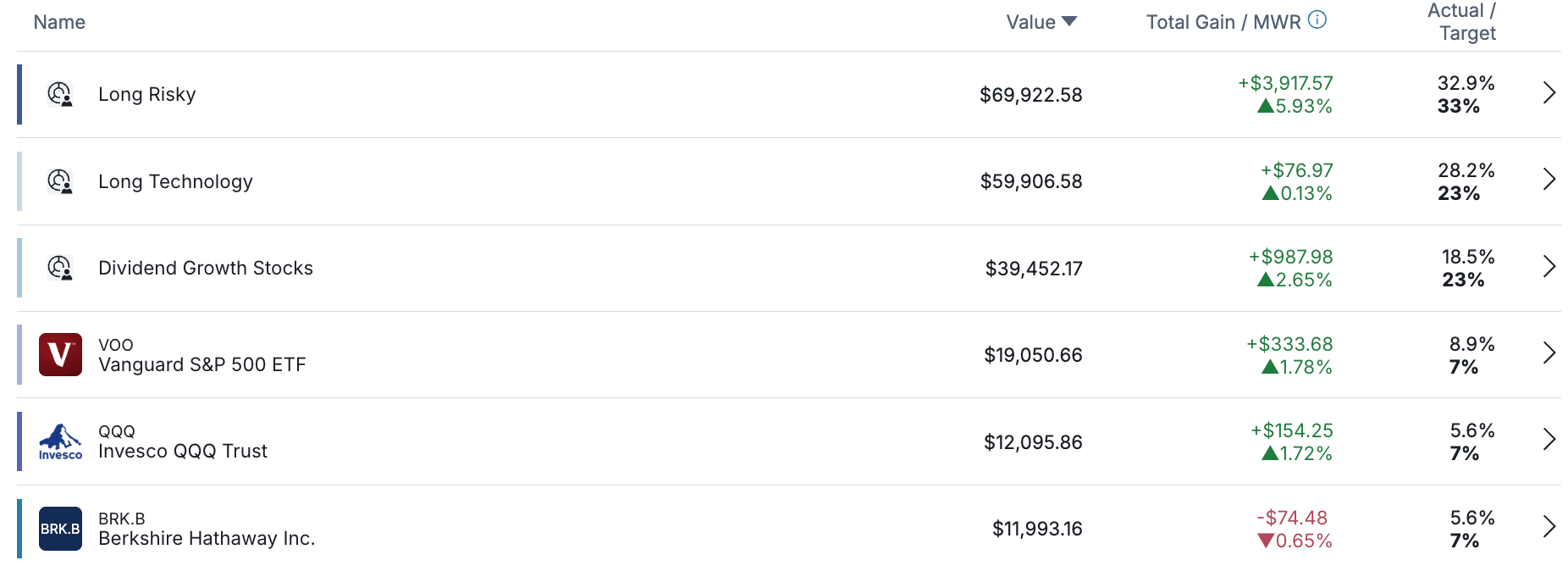

👉 Portfolio Updates

We are BACK! Who’s ready for a killer 2026?

For those of you who’ve been following the portfolio closely, you’ve likely already seen this — I rebalanced a ton of positions last week.

And it seems like it’s working! The portfolio, in aggregate, is up +2.7% YTD compared to the Nasdaq-100’s +1.1% and S&P 500’s +1.2%.

A little bit of momentum can go a long way — and we’ll take it!

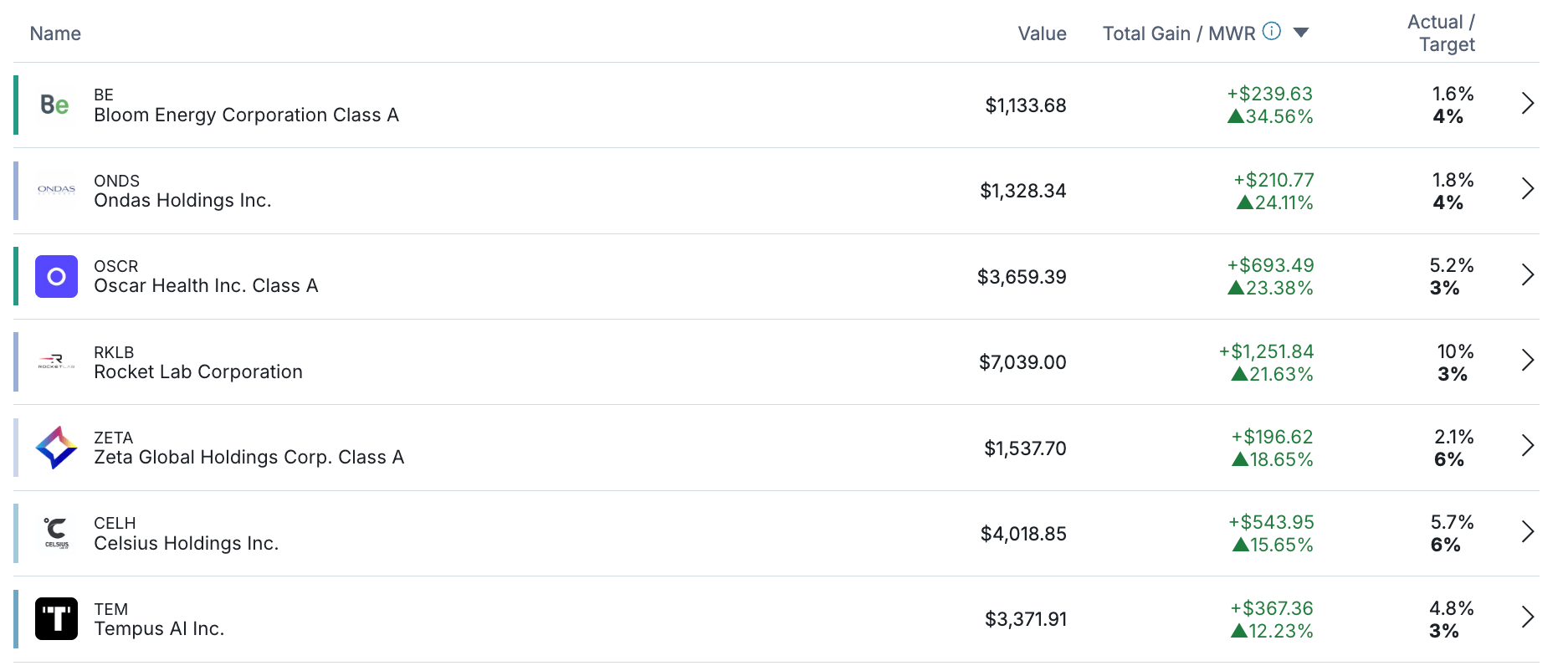

Some positions in the “Long Risky” subsection of the portfolio are already up double digits — very cool! Massive shoutout to Chris Camillo on the Bloom Energy recommendation.

Highly recommend logging into your GRIT VIP account and taking a look at the updated portfolio — as I’m investing $30K into it during the month of January. Couldn’t be more excited about these names for the coming years!

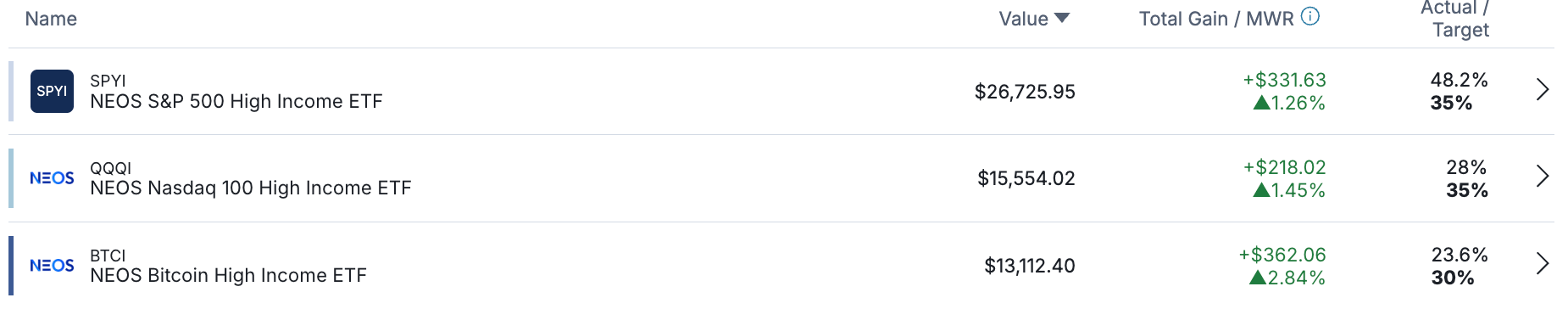

The monthly income portfolio continues to do exactly that — pay me several hundred each month in tax-efficient income. Couldn’t be happier with its performance, especially as I continue to DCA into BTCI during this bear market.

Looking forward to checking back in with these names after Q4 earnings are released in the coming weeks.

👉 Best and Worst ETF Performers of the Week

👉 Key Earnings Announcements:

Constellation Brands returned $400M to shareholders this quarter, and Helen of Troy lowered their 2026 guidance to reflect worse-than-expected tariffs charges.

Constellation Brands (STZ)

Key Metrics

Revenue: $2.2 billion, compared to $2.5 billion last year

Operating Income: $692.0 million, compared to $793.0 million last year

Profits: $522.2 million, compared to $629.1 million last year

Earnings Release Callout

“Our Beer Business delivered dollar and volume share gains in tracked channels and gained incremental distribution points, while our Wine and Spirit Business continued to outperform the U.S. wine industry. By focusing on factors within our control, we are confident that we are positioning the company for long-term success.”

My Takeaway

The company managed to beat expectations by leveraging strong cost discipline and pricing power to protect margins, even as top-line volumes declined. The Beer segment generated $2.01 billion in net sales, down marginally by 1%. Flagship brands like Modelo Especial and Corona Extra saw depletion declines of 4% and 9% respectively. The portfolio found a new growth engine in Pacifico, which surged 15%.

The standout metric was the Beer segment's operating margin, which expanded by 10 basis points to 38.0%. This demonstrates the company's ability to offset headwinds like aluminum tariffs and lower operating leverage through effective pricing and over $40 million in quarterly cost savings.

Cash flow remained positive, with the company generating $1.45 billion in free cash flow during 2025 and returning nearly $400 million to shareholders during the quarter.

Looking ahead, management reaffirmed its full-year 2026 guidance. The company expects EPS to land between $11.30 and $11.60. Free cash flow is projected to be between $1.3 billion and $1.4 billion, ensuring continued capital returns to shareholders.

No position. It’s hard to believe in alcohol long-term after Gen-Z’s recent move away from it.

Helen of Troy (HELE)

Key Metrics

Revenue: $512.8 million, compared to $530.7 million last year

Operating Loss: -$8.3 million, compared to $75.1 million last year

Net Loss: -$84.0 million, compared to $49.6 million last year

Earnings Release Callout

“We delivered third quarter results in line with our outlook and are making progress toward stabilizing the business despite the challenging external environment. We grew revenue in key brands – OXO, Osprey, and Olive & June – expanded Organic DTC sales and generated positive free cash flow despite tariff-related headwinds.”

My Takeaway

Helen of Troy delivered a mixed quarter characterized by a beat on adjusted earnings but significant headwinds from tariffs and a cautious consumer. The company is in the midst of a strategic turnaround under new leadership, aiming to stabilize the business by diversifying its supply chain and reinvigorating its core brands.

Operating income swung to a loss of $8.4 million, compared to a profit of $75.1 million in the same quarter last year. Similarly, net income fell to a loss of $84.1 million, compared to a profit of $49.6 million in the prior year. These losses were largely driven by a substantial $65.9 million non-cash asset impairment charge; however, even excluding this charge, profitability was pressured by tariff-related costs.

The Home & Outdoor segment saw sales decline -7%. The Beauty & Wellness segment experienced sales that were effectively flat as the $37.7 million revenue contribution from the acquisition of Olive & June offset declines in organic hair appliance and thermometer sales. International sales struggled, falling -8% due to weakness in the Chinese market.

Gross margin contracted by 200 basis points to 46.9%, primarily due to unfavorable impacts of tariffs and higher inventory costs. CEO Scott Uzzell’s commentary on the "bifurcated" economy. He noted that while high-income consumers are resilient, the mass market is pulling back on discretionary spending. The central operational theme was the aggressive pivot away from Chinese manufacturing to mitigate tariffs, with a goal to reduce China exposure to roughly 25-30% of COGS by the end of the fiscal year.

The company lowered its 2026 EPS guidance to a range of $3.25 to $3.75, reflecting the ongoing financial toll of tariffs and the need for continued investment in brand stabilization.

Yikes. Not touching this one with a 10-foot pole. No position.

👉 Investor Events / Global Affairs:

Nvidia once again impressed at CES, Walmart announced a partnership with Google Gemini, and Novo Nordisk announced a partnership with Amazon Pharmacy.

Takeaways from Nvidia at CES

Source: Getty Images / Patrick T. Fallon

At CES 2026, Nvidia made it clear that its ambition now stretches far beyond consumer graphics, positioning itself as the backbone of an AI-powered physical world. CEO Jensen Huang emphasized “physical AI,” systems trained in simulated environments and deployed into real-world machines like robots, factories, and autonomous vehicles.

Nvidia showcased platforms such as Cosmos and Alpamayo to power robotics and self-driving technology, even signaling plans to test a Level 4 robotaxi service as early as 2027. Notably absent were new consumer GPUs, underscoring Nvidia’s strategic shift away from gamers and toward hyperscalers, governments, and industrial-scale AI users.

Instead, the spotlight was on Rubin, Nvidia’s next-generation, full-stack AI platform designed to handle the massive compute, energy, and data demands of modern AI models. Nvidia also doubled down on its version of “open” AI, releasing foundational models across industries while ensuring everything runs on its hardware. Taken together, the keynote felt less like a product launch and more like a declaration that Nvidia intends to sit beneath nearly every AI system shaping the future.

“The ChatGPT moment for physical AI is here — when machines begin to understand, reason, and act in the real world.”

Walmart (WMT) and Google (GOOG) Gemini Partner to Enhance Shopping Experience

Subscribe to GRIT Premium to read the rest.

Become a paying subscriber of GRIT Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • WEEK IN REVIEW: Full access to the internet's best recap of the markets, every single week. This includes comprehensive earnings breakdowns, portfolio updates, and more. This is the perfect compliment to the "Investing Week Ahead" post that you already receive at the beginning of each week.

- • MONTHLY LIVESTREAMS: Join Austin Hankwitz live every month to dive deep into his portfolio, explore the latest trends, discuss any changes he’s making, and cover market-moving topics.

- • PORTFOLIO ACCESS – Austin Hankwitz, Warren Buffett, Bill Ackman, and other professional / billionaire investor portfolios.

- • MONTHLY STOCK DEEP DIVES – Comprehensive stock analysis on an individual ticker, delivered at the end of each month.

- • RESOURCES – A wide variety of investment resources for both beginners and advanced investors to accelerate your portfolio.