- GRIT

- Posts

- 👉 Major Portfolio Updates

👉 Major Portfolio Updates

Nine buys & sells...

Happy Friday.

Before we dive in — we’d like to wish each of you a Happy Memorial Day Weekend. While this weekend is known for fun in the sun, we encourage you to remember the core meaning behind the holiday. Thank you to all those who have paid the ultimate sacrifice and lost their lives serving in the US Armed Forces.

To the thousands of readers who have lost family members or friends — we are also honoring you this weekend.

In lieu of a normal “Week in Review” this Sunday, I wanted to sit down and walk you all through every change I’ve made to the portfolio this week. The markets are still open as of writing, which means if you’d like to make any changes to your own portfolio before the long weekend — have at it!

We’ll be back to our regularly scheduled programming on Tuesday (5/27).

Let’s dig in to the changes!

⚡ Portfolio Updates:

Every six months or so I try to sit down and give my entire investment portfolio and once over. I review performance, holdings, dividend growth, earnings expectations, and more. Throughout this week I did exactly that for the “Dividend Growth Stocks” subsection of my portfolio.

If you want to unlock access to the dozens of positions inside ALL subsections of my portfolio, consider upgrading your subscription! Alongside portfolio access, you unlock monthly livestreams, celebrity portfolio updates, guides and e-books, any much more.

Let’s kick things off with the two companies I’ve sold.

Verizon Communication (VZ)

The original reason I purchased stock in Verizon came from Wall Street’s expectations for them to grow their free cash flow in a meaningful way over the coming quarters — and they did exactly that. Free cash flow grew by +46% in 2023 & 2024. That +46% growth in free cash flow was the exact move I was looking for!

I realized a +16% cash return via dividends and an +11% return via share price appreciation, for a total return of +27%.

Verizon’s free cash flow is expected to grow moderately throughout the coming years, which could be a good opportunity for patient investors. However, I think there are better opportunities elsewhere.

Tractor Supply Company (TSCO)

The original reason I purchased this stock was because of Wall Street expectations for their EPS growth over the coming years. Unfortunately, the company wasn’t able to meet those expectations as their EPS only grew by +3%. Despite this, their stock price still experienced some wild swings — allowing me to cash in a profit.

I opened this position back on May 19, 2023 — so almost two years ago to the day! I invested $1,098 and sold that investment for $1,630, realizing a +49% return via price appreciation. I received a +7% cash return via dividends throughout that time — reflecting a total return of +56% over two years.

Tractor Supply Company’s earnings per share is expected to grow by double digits in 2026 and again in 2027. However, similar expectations were given for 2023 and 2024. I’m not sure I’m ready to let another two years tick by with my funds invested into this company hoping for a more aggressive outcome.

Additionally, their stock price seems to be overvalued at the moment.

Now that we’ve walked through the companies I’ve sold, let’s walk through the seven companies I’ve bought!

Motorola Solutions (MSI)

Yes, the same Motorola your old flip phone used to be.

Except nowadays they’re focused on providing public safety and enterprise security solutions to customers all around the world. Think video security, communication devices, and software to monitor it all.

A few reasons why I’m excited about this company’s next 3-5 years:

Nearly half of their revenue is recurring — they’re selling software with high gross margins.

They use their strong free cash flow ($2.5B expected for 2025) to repurchase stock and pay down debt.

More than 70% of their revenue comes from Public Safety (tax-payer funded Police, Fire, Emergency Medical, National Security, etc.)

$14.7B backlog in future revenue due to multi-year service agreements.

The company’s stock price is down -16% from their recent all-time high, and I believe getting in now around this $420 / share range (27x forward P/E) is a reasonable place to start. Their long-term average P/E multiple is 25.7x, representing some meaningful upside if we can get multiple expansion in the future.

Additionally, their payout ratio is 29% and they’ve been paying and growing their dividend for 12 straight years with a 5-year dividend CAGR of +11.5%.

Waste Management (WM)

Yes, the company that picks up your garbage once per week from your driveway.

With a $250 price target from Wall Street (+8% upside from current levels) and expectations to grow adj. EBITDA by +15% in 2025 and another +8% in 2026, this company seems to be doing everything right… despite whatever economic uncertainty rippling through the markets.

Historically speaking, their stock price is currently on the frothy side — but there’s clear growth ahead.

They’ve been paying and raising their dividend every year for the last 21 years, with their 5-year dividend CAGR sitting at 8.1%. The stock is also up +16% YTD, far outpacing the S&P 500.

Arthur J. Gallagher Co. (AJG)

This might be a new company on your radar.

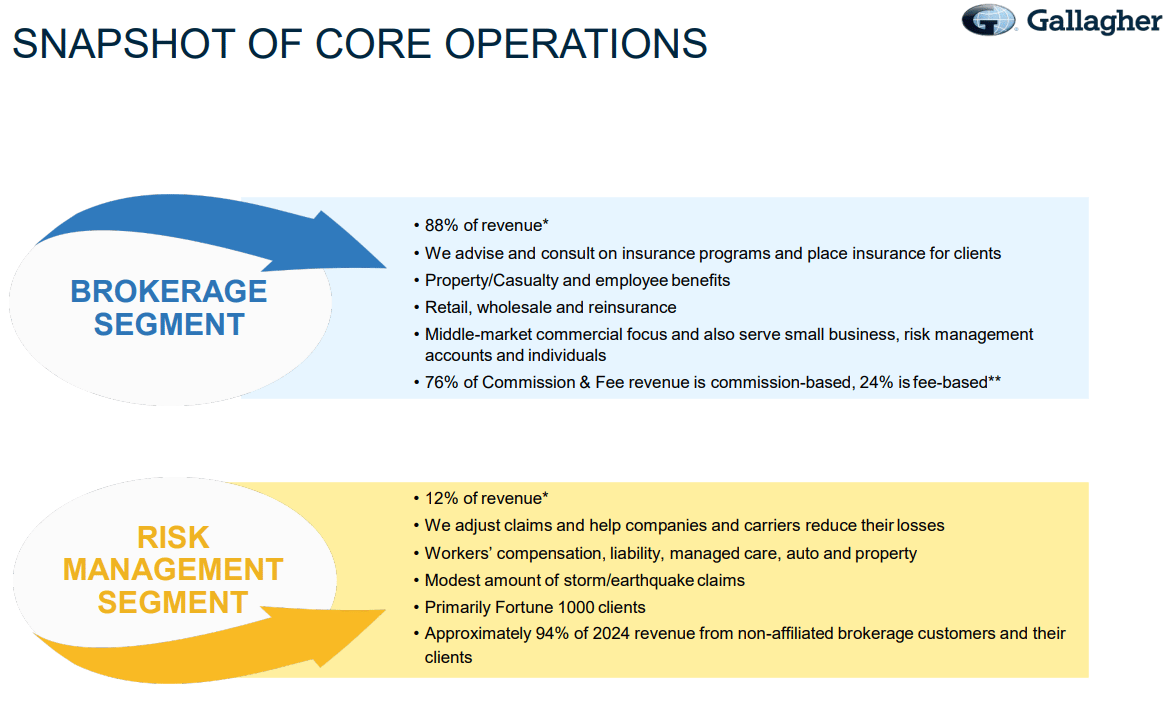

They’re an $86B global insurance company based out of Illinois. The company has two business segments — brokerage and risk management. Their brokerage business segment is exactly what it sounds like — they offer brokerage and consulting services to entities of all types. Their risk management segment provides contract claim settlements, loss control services, and various other services.

Wall Street continues to believe AJG will report double-digit revenue growth with meaningful margin expansion through 2027, initiating 2027 EPS estimates at $14.88 per share.

Their average forward P/E multiple has been 26.5x for years, which means if they execute upon their $14.75 2027 EPS expectations at a 26.5x multiple, their share price should land somewhere around $400 — representing +20% upside in about 18-months time.

Their share price is a bit on the frothy side at the moment, which means I’m excited to buy any weakness. They’ve been paying a growing dividend for 14 years straight, with a +7.1% 5-year dividend CAGR.

Brown & Brown Co. (BRO)

Another insurance company you might not have heard of.

Subscribe to GRIT Premium to read the rest.

Become a paying subscriber of GRIT Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • 2 WEEKLY NEWSLETTERS - “The Investing Week Ahead” 📈 delivered every Monday morning. “Week in Review” 🔍 hitting your inbox every Sunday evening.

- • MONTHLY LIVESTREAMS - Join Austin Hankwitz for private livestreams each month. Dive deep into his portfolio and explore market moves.

- • MONTHLY STOCK DEEP DIVES – Super Deep Dives on our top stocks of the month

- • PORTFOLIO ACCESS – Austin Hankwitz, Warren Buffett, Bill Ackman, and other professional and billionaire LIVE investor portfolios

- • RESOURCES – 9,000+ pages of investment resources for beginners and advanced investors to accelerate your portfolio

- • COURSES - Digital courses covering various investing topics like dividends, small-cap stocks, and more

- • DIVIDENDS - Access to comprehensive dividend digital resources