- GRIT

- Posts

- 👉 MU's Data Center Revenue Doubled

👉 MU's Data Center Revenue Doubled

FedEx, Nike, Tariff Talks

Together with X Funds

👉 Week in Review — Too Long; Didn’t Read:

Key Earnings Announcements:

Nike’s wholesale order book grew both sequentially and year-over-year

Micron’s data center revenue more than doubled year-over-year

FedEx pulls full-year guidance for the first time in five years

Investor Events & Global Affairs:

Trump terminated Canada trade talks

Crypto is gearing up for bright news from Congress

Google launched a retail AI app

Novo Nordisk put Hims & Hers through a roller coaster of a week

Major Economic Events:

The Fed’s preferred inflation gauge came in slightly hotter than expected

Q1’s final GDP reading disappointed a lot of economists

Happy Sunday.

Before we get started, we wanted to offer a warm welcome to the +1,425 new subscribers who joined us this week!

In case you’re new around here, I’m Austin Hankwitz — I’ve been publishing earnings analysis on publicly-traded companies for over half a decade. My podcast, Rich Habits, has hit #1 on Spotify’s Business Podcast chart four times since it’s inception only two years ago.

At the start of 2023, I began my journey of building a $2M Dividend Growth Portfolio from scratch. This twice-weekly newsletter is how I keep you all updated on my progress.

For me, early retirement means $2M invested. For you, it might mean something else. Regardless of your early-retirement number — I hope these weekly synopses of my portfolio progress + what’s been happening in the markets helps you on your own journey.

Every Sunday, we publish the internet’s best summary of what happened in the markets the week prior — earnings analysis, acquisition announcements, economic data, world news, and more.

If you want full access to that info, my portfolio, legendary investor portfolios, livestreams, resources, and more — click here!

Looking to gain exposure to crypto without the wild swings? The Nicholas Crypto Income ETF (BLOX) offers a unique solution: exposure to the crypto ecosystem and the opportunity for weekly income.

BLOX is designed to provide:

Access to Bitcoin & Ether through ETFs and ETPs

Equity exposure to crypto industry leaders — from miners to DeFi platforms

Weekly income through options strategies on portfolio holdings

Whether you’re crypto-curious or looking to add yield potential to your portfolio, BLOX gives you broad exposure in a single ticker.

👉 Learn more at NicholasX.com/BLOX

👉 Portfolio Updates (YTD Performance):

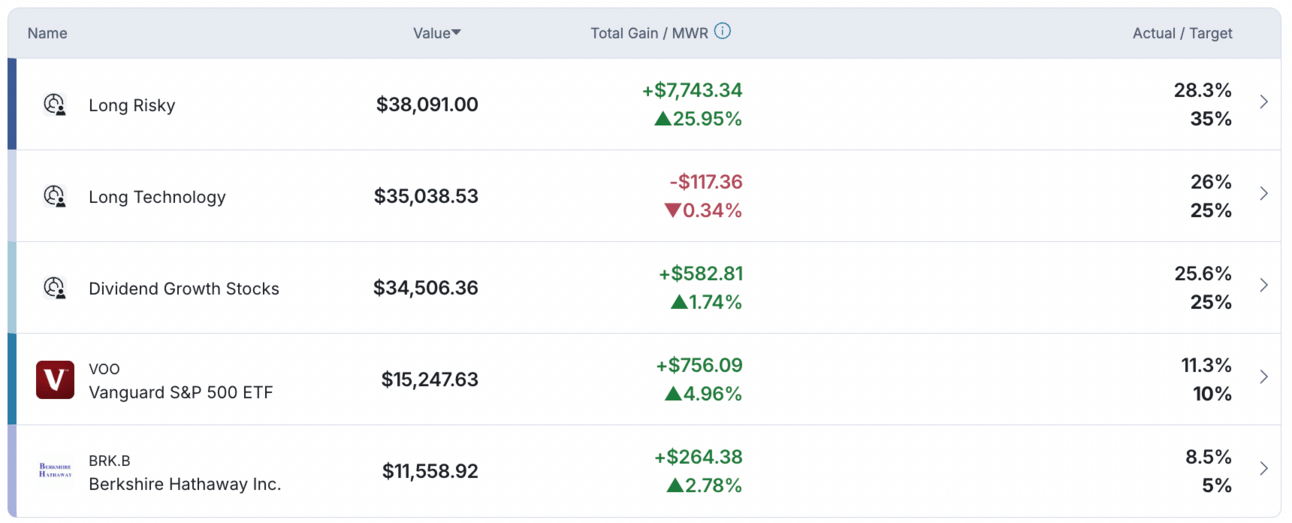

My stock portfolio is trending in the right direction, with the “Long Risky” subsection still up +26% YTD despite the NVO / HIMS debacle that caused HIMS stock to crash -30% earlier this week.

Weirdly enough, the “Long Technology” subsection is flat YTD, which is primarily driven by Apple and Tesla’s underperformance. Excited to see my AMD position up +28% already!

The “Dividend Growth Stocks” subsection is also relatively flat YTD, with Kroger stock leading the charge (up +18% YTD). Other real-estate focused positions, like VICI Properties and Realty Income Corporate are also up double-digits this year.

Finally, my S&P 500 and Berkshire Hathaway positions are just chugging along. Always a good idea to have exposure to these funds. I plan to deploy $30K toward this stock portfolio throughout July, so stay tuned!

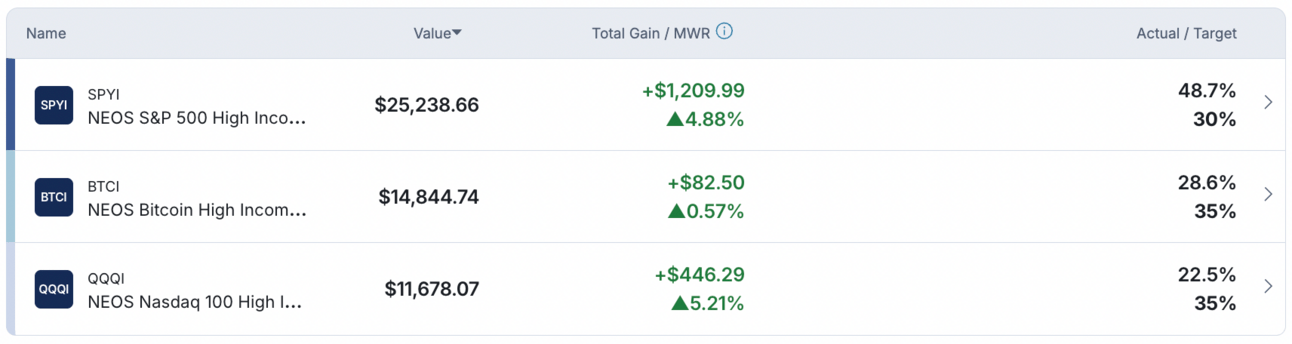

My “Monthly Income” portfolio (comprised entirely of NEOS ETFs) is trending in the right direction as well. I’ll generate roughly $775 this month from these funds — not bad! I plan to reinvest those distributions back into their respective funds in the weightings shown above.

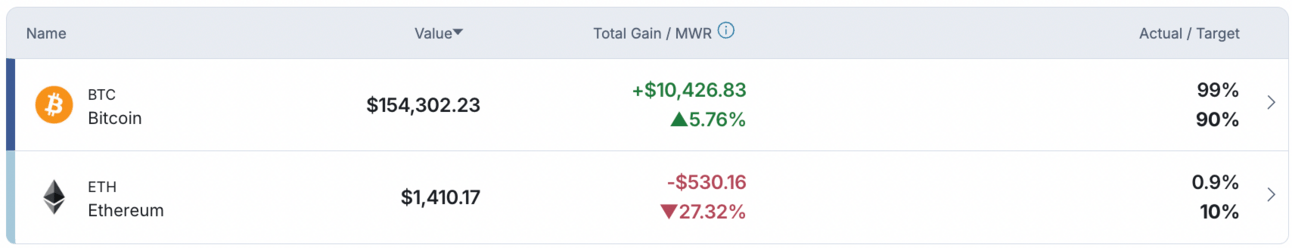

My Bitcoin position is in the green this year, as the crypto markets experience some relief over the weekend. Looking forward to seeing a $125-145K Bitcoin during the back-half of 2025!

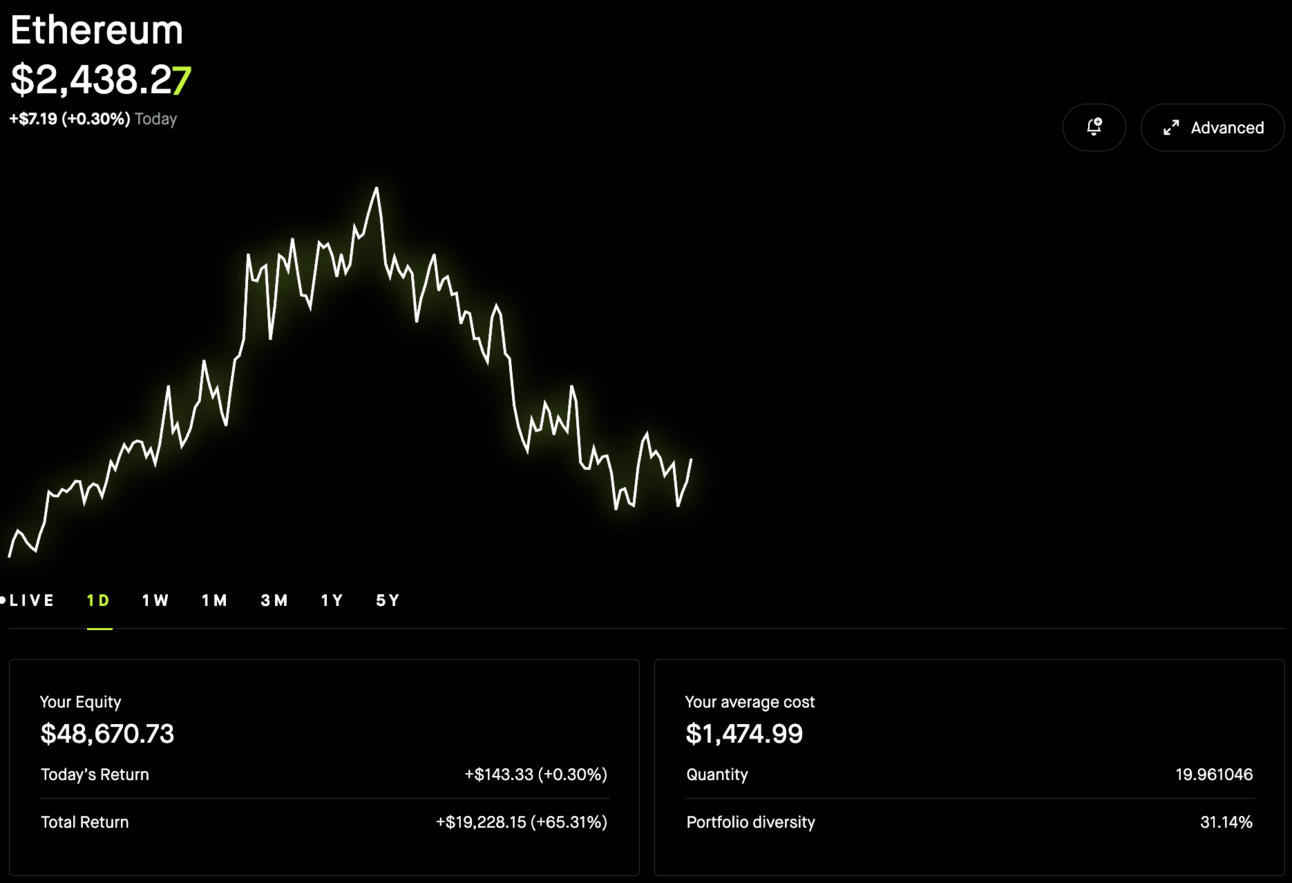

Also looking forward to this Ethereum position to take us back to the $75-100K range during the back-half of this year. Perhaps a $5K ETH is around the corner? Regardless, I’m long.

The $30K I plan to deploy toward my stock portfolio during the month of July will primarily be invested into AI-focused growth stocks. Advanced Micro Devices, Nvidia, and some AI 2.0 names we’re excited about inside of the “Long Risky” subsection of the portfolio.

Want to see every position inside my stock and crypto portfolio?

Click here to become a Premium subscriber for $31 / month. You’ll also unlock access to our monthly livestreams, GRIT Guides on Investing, and more.

👉 Key Earnings Announcements:

Nike’s wholesale order book grew both sequentially and year-over-year, Micron’s data center revenue more than doubled year-over-year, and FedEx pulls full-year guidance for the first time in five years.

Nike (NKE)

Key Metrics

Revenue: $11.0 billion, compared to $12.6 billion last year

Operating Income: $318.0 million, compared to $1.7 billion last year

Profits: $211.0 million, compared to $1.5 billion last year

Earnings Release Callout

“While our financial results are in-line with our expectations, they are not where we want them to be. Moving forward, we expect our business to improve as a result of the progress we're making through our Win Now actions. The fourth quarter reflected the largest financial impact from our Win Now actions, and we expect the headwinds to moderate from here.”

My Takeaway

Shares of Nike stock skyrocketed after the company reported earnings — Wall Street now believes their negative earnings per share revision cycle is finally over and the company can begin trending in the right direction again.

A few key takeaways:

1) Its wholesale order book grew both sequentially and year-over-year.

2) Q4 likely marked the bottom in both sales and margins, with further improvements ahead.

3) Newness across sportswear and lifestyle silhouettes are offsetting remaining headwinds from classic franchises.

Management’s commentary during their earnings call re: an uptick in traction in performance running (up high-single digits), a strong consumer response to new basketball silhouettes (A’ja’s Wilson’s A’ One selling out in three minutes), and new points of distribution (Amazon) bolstered Wall Street’s renewed conviction that the sales inflection we’re all looking for is coming later this year.

Additionally, Wall Street believes Nike’s agility in navigating tariffs should not be discounted, and further illustrates the power of the Nike model when executed correctly.

It’s time to add this to the “Long Risky” subsection of the portfolio!

Micron Technology (MU)

Key Metrics

Revenue: $9.3 billion, an increase of +37% YoY

Operating Income: $2.2 billion, an increase of +202% YoY

Profits: $1.9 billion, an increase of +468% YoY

Earnings Release Callout

“Micron delivered record revenue in fiscal Q3, driven by all-time-high DRAM revenue including nearly 50% sequential growth in HBM revenue. Data center revenue more than doubled year-over-year and reached a quarterly record, and consumer-oriented end markets had strong sequential growth. We are on track to deliver record revenue with solid profitability and free cash flow in fiscal 2025, while we make disciplined investments to build on our technology leadership and manufacturing excellence to satisfy growing AI-driven memory demand.”

My Takeaway

Micron Technologies outperformed Wall Street’s aggressive expectations during the quarter helped by better than expected pricing trends. These pricing trends also yield a better outlook for next quarter, with MU standing again to benefit — particularly in their DRAM category.

A few key takeaways:

1) HMB trends are on track with +50% growth quarter-over-quarter. Wall Street believes this trend supports their positive thesis, but growth isn’t crazy enough to prompt them to raise their estimates for the remainder of the year. Wall Street believes HBM growth is the most influencer driver of future earnings expansion.

2) DRAM outlook only slightly improved. Micron Technologies’ language around 2025 DRAM demand improved from mid-to-high teens growth to high-teens growth, driven largely an improvement in industrial markets (customer order patterns finally appear to be improving).

Data center revenue more than doubled year-over-year, reaching record levels, while HBM sales grew nearly +50% sequentially — surpassing $1.5B in quarterly revenue. Wall Street’s $165 price target is derived from a forward P/E multiple of 11X on their 2026 EPS estimates.

Keeping an eye on this one, but no shares.

FedEx (FDX)

Subscribe to GRIT Premium to read the rest.

Become a paying subscriber of GRIT Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • WEEK IN REVIEW: Full access to the internet's best recap of the markets, every single week. This includes comprehensive earnings breakdowns, portfolio updates, and more. This is the perfect compliment to the "Investing Week Ahead" post that you already receive at the beginning of each week.

- • MONTHLY LIVESTREAMS: Join Austin Hankwitz live every month to dive deep into his portfolio, explore the latest trends, discuss any changes he’s making, and cover market-moving topics.

- • PORTFOLIO ACCESS – Austin Hankwitz, Warren Buffett, Bill Ackman, and other professional / billionaire investor portfolios.

- • MONTHLY STOCK DEEP DIVES – Comprehensive stock analysis on an individual ticker, delivered at the end of each month.

- • RESOURCES – A wide variety of investment resources for both beginners and advanced investors to accelerate your portfolio.