- GRIT

- Posts

- 👉 Netflix's Advertising Business to Double in 2025

👉 Netflix's Advertising Business to Double in 2025

ASML, TSMC, ETH

👉 Week in Review — Too Long; Didn’t Read:

Key Earnings Announcements:

Netflix’s Ads business is set to double in 2025

Taiwan Semiconductor has yet to experience tariff headwinds

China makes up 27% of ASML Holdings’ memory business

Investor Events & Global Affairs:

Howard Lutnick confirmed that August 1st is a “hard deadline” for tariffs

Uber invested $300M into Lucid to help build 20,000 robotaxis

Meta settled an $8B lawsuit outside of court — avoiding major testimonies

Major Economic Events:

Core U.S. inflation rose just +0.2% in June (below expectations for the 5th straight month)

Retail sales came in better than expected.

Happy Sunday.

Before we get started, we wanted to offer a warm welcome to the +876 new subscribers who joined us this week, and the 2,905 of you who have joined us so far throughout the month of July!

In case you’re new around here, I’m Austin Hankwitz — I’ve been publishing earnings analysis on publicly-traded companies for over half a decade. My podcast, Rich Habits, has hit #1 on Spotify’s Business Podcast chart four times since it’s inception only two years ago.

At the start of 2023, I began my journey of building a $2M Dividend Growth Portfolio from scratch. This twice-weekly newsletter is how I keep you all updated on my progress.

For me, early retirement means $2M invested. For you, it might mean something else. Regardless of your early-retirement number — I hope these weekly synopses of my portfolio progress + what’s been happening in the markets helps you on your own journey.

Every Sunday, we publish the internet’s best summary of what happened in the markets the week prior — earnings analysis, acquisition announcements, economic data, world news, and more.

If you want full access to that info, my portfolio, legendary investor portfolios, livestreams, resources, and more — click here!

Smart Investors Don’t Guess. They Read The Daily Upside.

Markets are moving faster than ever — but so is the noise. Between clickbait headlines, empty hot takes, and AI-fueled hype cycles, it’s harder than ever to separate what matters from what doesn’t.

That’s where The Daily Upside comes in. Written by former bankers and veteran journalists, it brings sharp, actionable insights on markets, business, and the economy — the stories that actually move money and shape decisions.

That’s why over 1 million readers, including CFOs, portfolio managers, and executives from Wall Street to Main Street, rely on The Daily Upside to cut through the noise.

No fluff. No filler. Just clarity that helps you stay ahead.

👉 Portfolio Updates (YTD Performance):

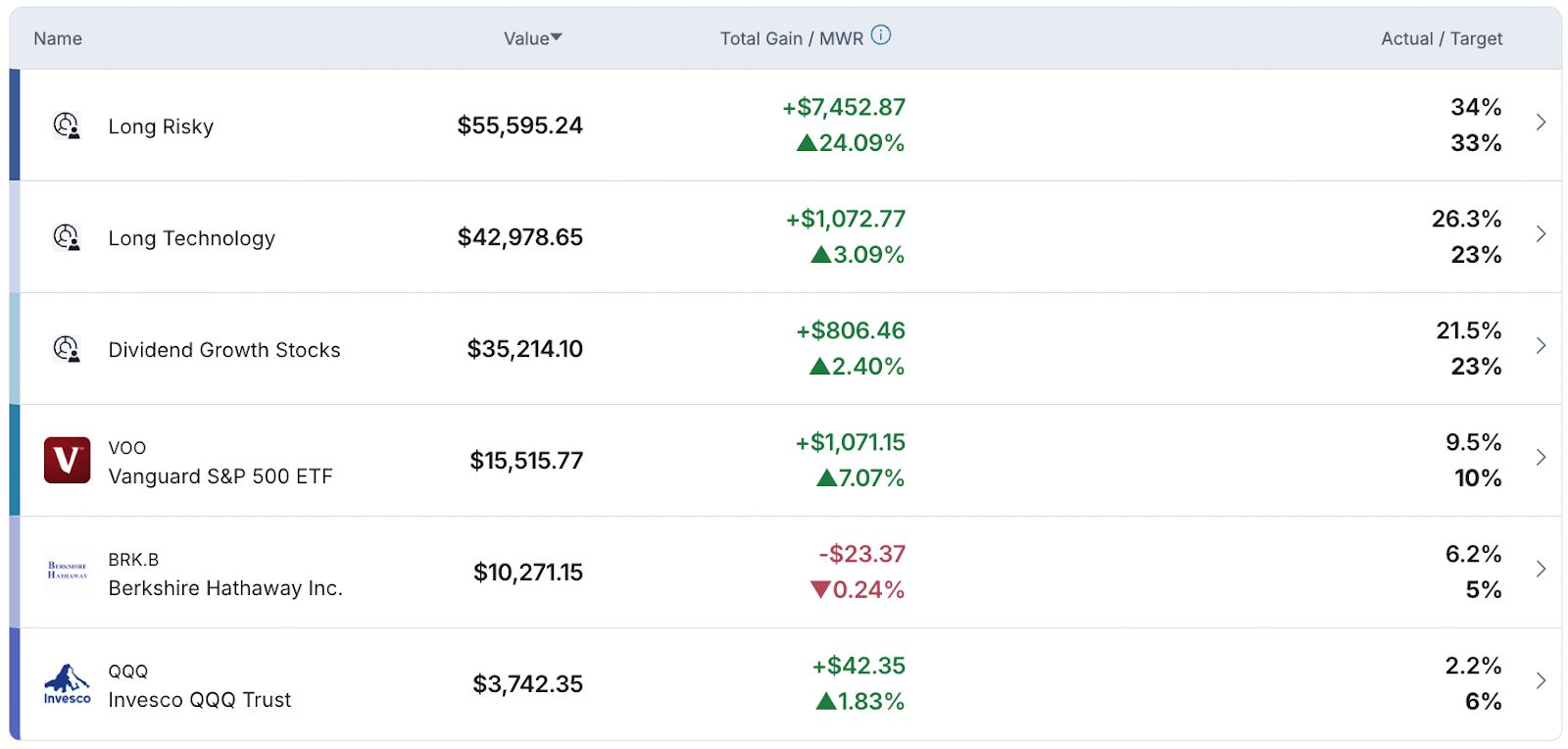

A quick reminder to our thousands of Paid Subscribers — the portfolio is completely up to date as of writing this, which means you should have 100% visibility into the $586,093 portfolio we’ve built so far together!

As you can see from the screenshot shared above, the stock portfolio is rocking and rolling. The “Long Risky” subsection is up +24% YTD, having now grown to over $55K in value. The “Long Technology” and “Dividend Growth Stocks” subsections are both in the green by low-single digits. My Berkshire Hathaway position has fallen slightly in the red — I plan to trim that position slightly and redeploy those funds into the Nasdaq-100 (QQQ) below it.

In case you’re new around here…

Long Risky = high-octane growth stocks

Long Technology = big tech

Dividend Growth Stocks = blue chip dividend kings

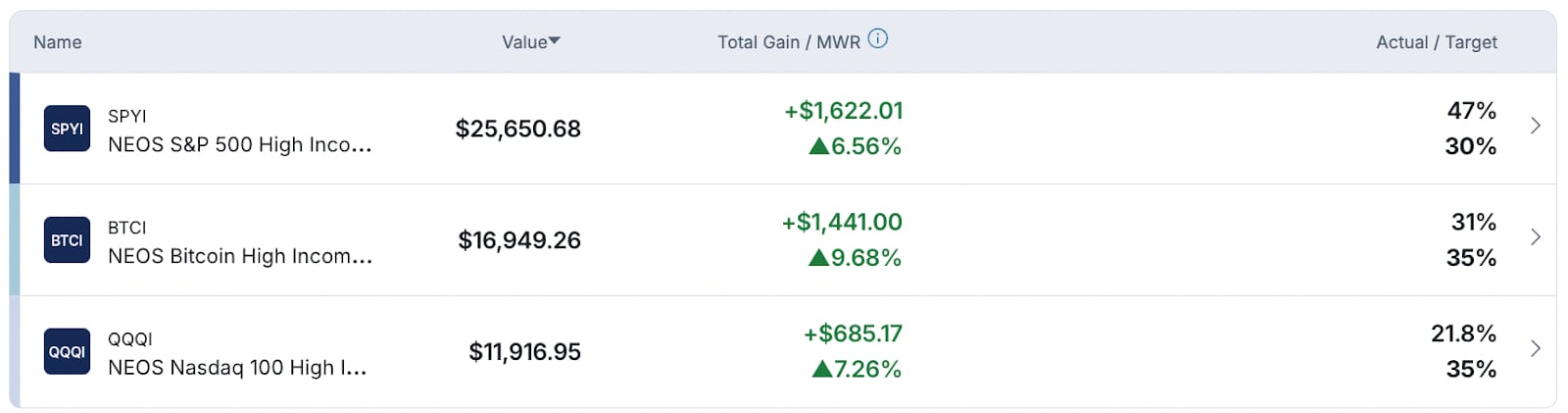

The monthly income portfolio is growing slowly but steadily — with some recent momentum from Bitcoin helping a ton. Excited to continue to deploy net new capital into this portfolio over the coming months with the goal of it growing to $100K by the end of the year.

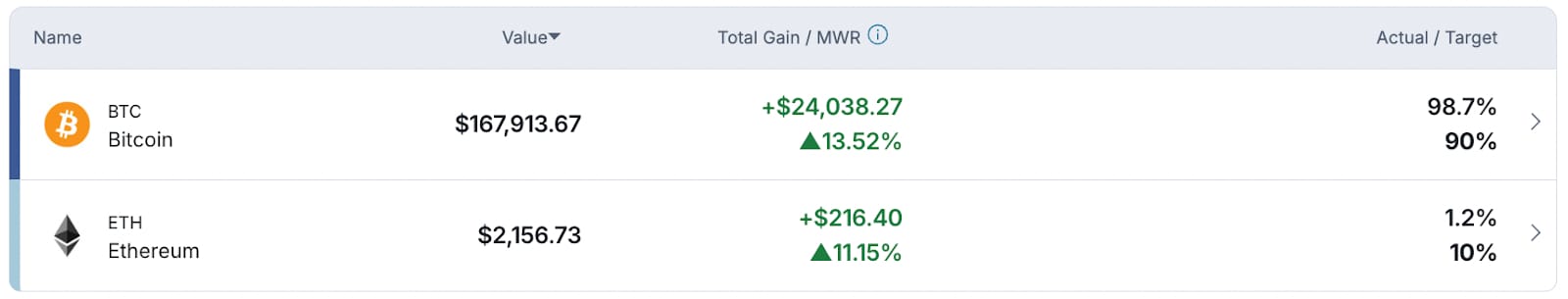

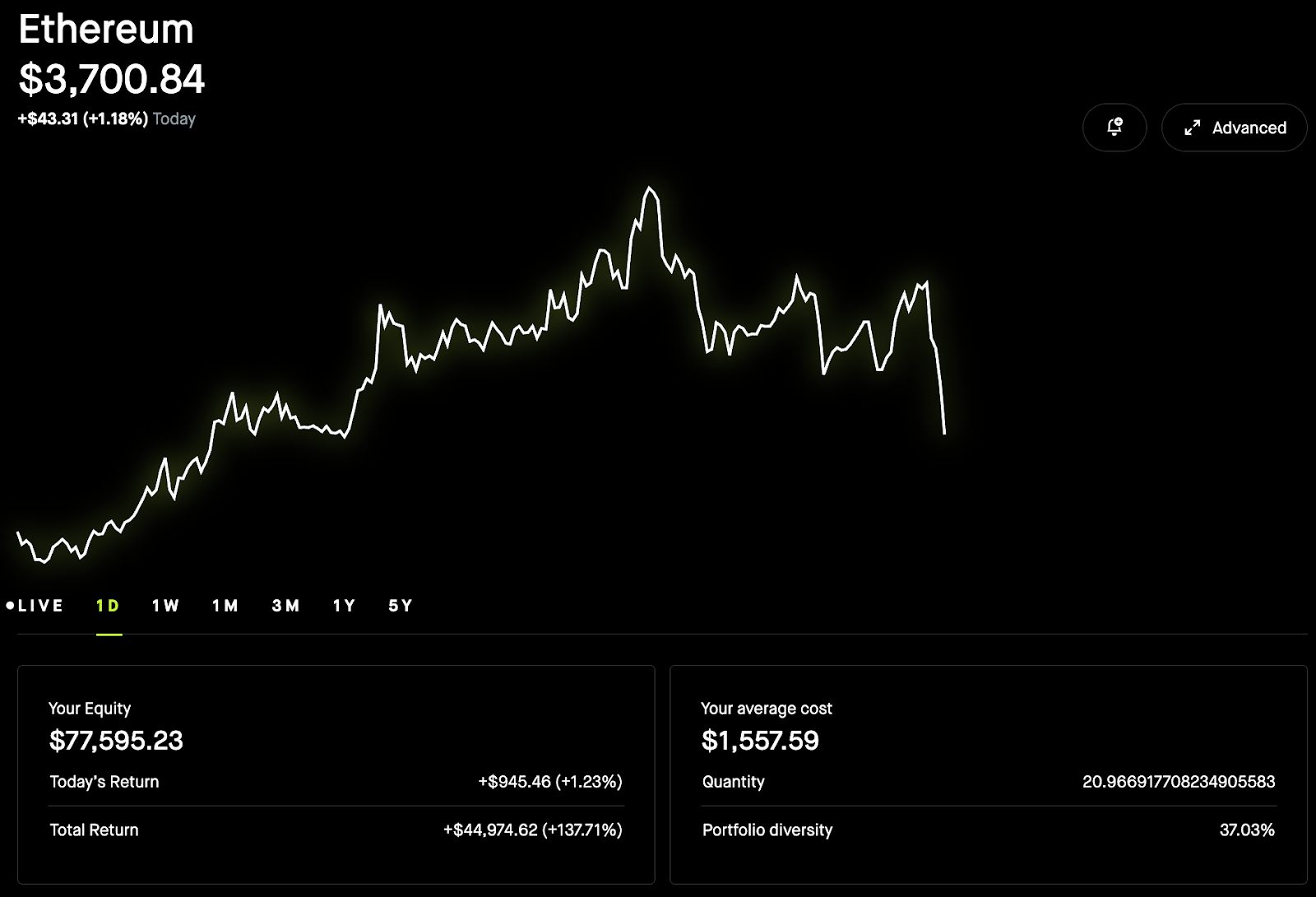

Bitcoin remains a major winner in the portfolio. As of late, Ethereum is beginning to pick up speed! Hoping this continues to trend toward $6,000 over the coming weeks and months. Our entire ETH position is closing in on $100K in value (currently sitting at $93K across platforms).

My goal is to take it easy for the remainder of July and early-September as the indices are very much stretched (technically speaking) — some consolidation would be welcomed here.

Want to see every position inside my stock and crypto portfolio?

Click here to become a Premium subscriber for $31 / month. You’ll also unlock access to our monthly livestreams, GRIT Guides on Investing, and more.

👉 Key Earnings Announcements:

Netflix’s Ads business is set to double in 2025, Taiwan Semiconductor has yet to experience tariff headwinds, and China makes up 27% of ASML Holdings’ memory business.

Netflix (NFLX)

Key Metrics

Revenue: $11.1 billion, an increase of +16% YoY

Operating Income: $3.8 billion, an increase of +45% YoY

Profits: $3.1 billion, an increase of +46% YoY

Earnings Release Callout

“We continue to make progress building our ads business and still expect to roughly double ads revenue in 2025. A key focus this year is enhancing our capabilities for advertisers. We completed the rollout of the Netflix Ads Suite, our in-house first-party ad tech platform, to all of our ads markets and early results are in-line with our expectations.

We believe our ad tech platform is foundational to our long-term ads strategy and, over time, will enable us to offer better measurement, enhanced targeting, innovative ad formats and expanded programmatic capabilities. We also recently announced we will integrate Yahoo DSP into our programmatic offering.”

My Takeaway

With high expectations from investors, Netflix continues to deliver. While the company no longer reports net new subscriber additions nor revenue per member (RPM), their quarterly results and commentary suggest that subscriber growth continues to rise and that consumers absorbed the Q1 price increases with little resistance.

As Netflix enhances their Ads business (as shared above in the earnings release callout), Wall Street remains confident that growth will continue into 2026 and beyond. The company is planning to spend $18B on new content across movies, high-demand series, games, and live events in 2025. This additional spend should help propel their ad revenue contribution for the next several years. By adding and improving their live events, advertising targeting, and expanding ad partnerships across this new content, Netflix’s Ads business is poised for success.

Netflix’s confidence to double ad revenue in 2025, while maintaining a favorable subscriber mix at the premium end despite the price increases, makes me believe they’ll continue to deliver free cash flow to shareholders for several years to come. The company raised their 2025 guidance for revenue to $45B, up from $43.5B primarily driven by a weaker US dollar, as well as solid underlying trends.

Holding shares.

Taiwan Semiconductor (TSMC)

Key Metrics

Revenue: $933.8 billion an increase of +39% YoY

Operating Income: $463.4 billion, an increase of +62% YoY

Profits: $398.3 billion, an increase of +61% YoY

Earnings Release Callout

“Our business in the second quarter was supported by continued robust AI and HPC-related demand. Moving into third quarter 2025, we expect our business to be supported by strong demand for our leading-edge process technologies.”

My Takeaway

Despite significant currency headwinds, TSMC’s quarterly revenue exceeded the company’s prior guidance in both USD and NT. Management provided a robust outlook for growth during the current quarter of $31.8-33B USD, implying a +6% increase quarter-over-quarter. And despite a -4.4% currency related gross margin headwind, TSMC is forecasting gross margins to hover around 56% at the midpoint.

While the company lifted its full year revenue outlook, it implies a high-single digit revenue decline during Q4. Management acknowledged this on their earnings call due to macro and policy uncertainty vs. a shift in the fundamental demand for their business. This implied Q4 revenue dip would represent the first Q4 sequential sales decline since 2015. Despite their issued guidance, Wall Street remains bullish and is forecasting continued momentum given the expected resumption of US AI chip sales to China.

Regarding tariffs, management mentioned they had yet to see any significant change in customer behavior, but that it was monitoring the situation closely to assess any potential impacts on end market demand.

Holding shares.

ASML Holdings (ASML)

Subscribe to GRIT Premium to read the rest.

Become a paying subscriber of GRIT Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • WEEK IN REVIEW: Full access to the internet's best recap of the markets, every single week. This includes comprehensive earnings breakdowns, portfolio updates, and more. This is the perfect compliment to the "Investing Week Ahead" post that you already receive at the beginning of each week.

- • MONTHLY LIVESTREAMS: Join Austin Hankwitz live every month to dive deep into his portfolio, explore the latest trends, discuss any changes he’s making, and cover market-moving topics.

- • PORTFOLIO ACCESS – Austin Hankwitz, Warren Buffett, Bill Ackman, and other professional / billionaire investor portfolios.

- • MONTHLY STOCK DEEP DIVES – Comprehensive stock analysis on an individual ticker, delivered at the end of each month.

- • RESOURCES – A wide variety of investment resources for both beginners and advanced investors to accelerate your portfolio.