- GRIT

- Posts

- 👉 Oracle Is Sitting On $523B In RPOs

👉 Oracle Is Sitting On $523B In RPOs

Adobe, SpaceX, Disney

👉 Week in Review — Too Long; Didn’t Read:

Key Earnings Announcements:

Oracle is now sitting on half a trillion in remaining performance obligations.

Adobe repurchased 7.2 million shares of stock.

Investor Events / Global Affairs:

Warner Bros drama continues to swell between Netflix and Paramount.

Disney will take a $1B equity stake in OpenAI.

SpaceX is eyeing a $1.5T IPO in 2026.

Economic Updates:

The Fed cut interest rates again, but drama is rising around 2026 policy moves.

President Trump dubbed Kevin Warsh as current leader for becoming the next Fed Chairman.

CLICK HERE to sign up for next week’s livestream! It will take place tomorrow — Monday, December 15th at 5pm ET. If you can’t make it, you’ll still be able to access the recording.

Does your car insurance cover what really matters?

Not all car insurance is created equal. Minimum liability coverage may keep you legal on the road, but it often won’t be enough to cover the full cost of an accident. Without proper limits, you could be left paying thousands out of pocket. The right policy ensures you and your finances are protected. Check out Money’s car insurance tool to get the coverage you actually need.

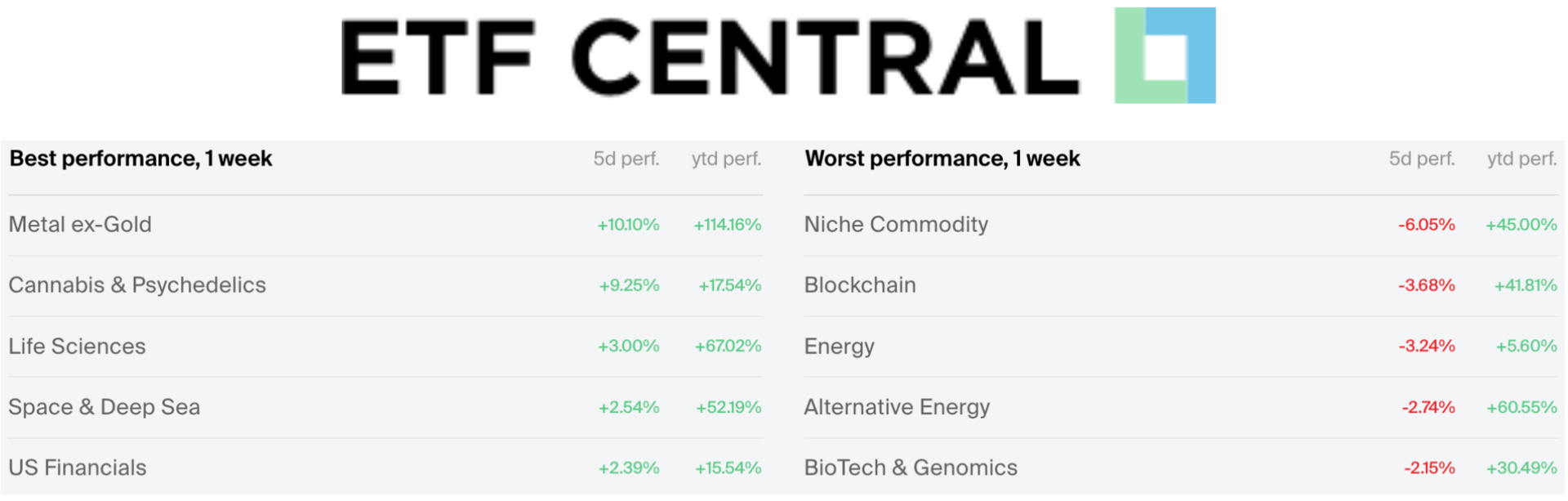

👉 Best and Worst ETF Performers of the Week

👉 Key Earnings Announcements:

Oracle is now sitting on half a trillion in remaining performance obligations, and Adobe repurchased 7.2 million shares of stock.

Oracle (ORCL)

Key Metrics

Revenue: $16.1 billion, an increase of +14% YoY

Operating Income: $4.7 billion, an increase of +12% YoY

Profits: $6.1 billion, an increase of +95% YoY

Earnings Release Callout

“Remaining Performance Obligations (RPO) increased by $68 billion in Q2—up 15% sequentially to $523 billion—highlighted by new commitments from Meta, NVIDIA, and others. We are now committed to a policy of chip neutrality where we work closely with all our CPU and GPU suppliers.

Of course, we will continue to buy the latest GPUs from NVIDIA, but we need to be prepared and able to deploy whatever chips our customers want to buy. There are going to be a lot of changes in AI technology over the next few years and we must remain agile in response to those changes.”

My Takeaway

Oracle delivered a quarter defined by a weird contrast between insane future demand and the current costs required to meet those demands. While the company’s backlog is literally half a trillion dollars now ($523 billion), their immediate reality includes aggressively spending capital — so much so that it has temporarily turned their cash flow negative.

Oracle spent $12 billion on CapEx in the quarter alone to build out AI infrastructure. Trailing twelve-month free cash flow turned negative to the tune of $10 billion. Management raised their full-year CapEx guidance by +$15 billion, now expecting to spend roughly $50 billion in 2026.

CEO Safra Catz defended the massive spending, describing it as "success-based capital" tied directly to signed contracts in their backlog. They argued that their automated data center designs allow them to bring capacity online faster than competitors.

From the analyst Q&A, the primary concern was the sustainability of the capital spending and its impact on cash flow. Analysts questioned the margin profile of these new AI infrastructure deals. Management acknowledged that Infrastructure-as-a-Service margins are initially lower than SaaS but insisted that operating leverage will improve as the new data centers reach capacity. They remained firm that the spending is de-risked because it is backed by the massive RPO.

Watching Oracle stock rise from $170 to $310 and now back to $170 is a great illustration of how this AI bubble hype can move markets. I don’t have a position and don’t plan to open one anytime soon.

No position.

Adobe (ADBE)

Key Metrics

Revenue: $6.2 billion, an increase of +10% YoY

Operating Income: $2.3 billion, an increase of +13% YoY

Profits: $1.9 billion, an increase of +11% YoY

Earnings Release Callout

“Adobe’s record FY2025 results reflect our growing importance in the global AI ecosystem and the rapid adoption of our AI-driven tools. By advancing our innovative generative and agentic platforms and expanding our customer base, we are excited to target double-digit ARR growth in FY2026.”

My Takeaway

Adobe delivered a strong quarter, achieving record revenue and profits that is beginning to prove out the successful integration of generative AI into their core platforms.

Adobe remains a cash generation machine, producing a record $3.2 billion in operating cash flow during the quarter. The company repurchased 7.2 million shares. The company’s Remaining Performance Obligations climbed 13% YoY, to $22.52 billion, giving investors a high-degree of visibility into the company’s future revenue.

Management shared several major takeaways during the earnings call, including their vision of an "agentic" future where Adobe tools don't just help create content but actively manage workflows. They highlighted that AI features are driving higher retention and attracting new users to the platform.

Looking ahead, management issued 2026 revenue guidance to fall around $26.0 billion, or about +10% growth YoY.

Long ADBE; I now believe their stock is undervalued.

👉 Investor Events / Global Affairs:

Warner Bros drama continues to swell between Netflix and Paramount, Disney will take a $1B equity stake in OpenAI, and SpaceX is eyeing a $1.5T IPO in 2026.

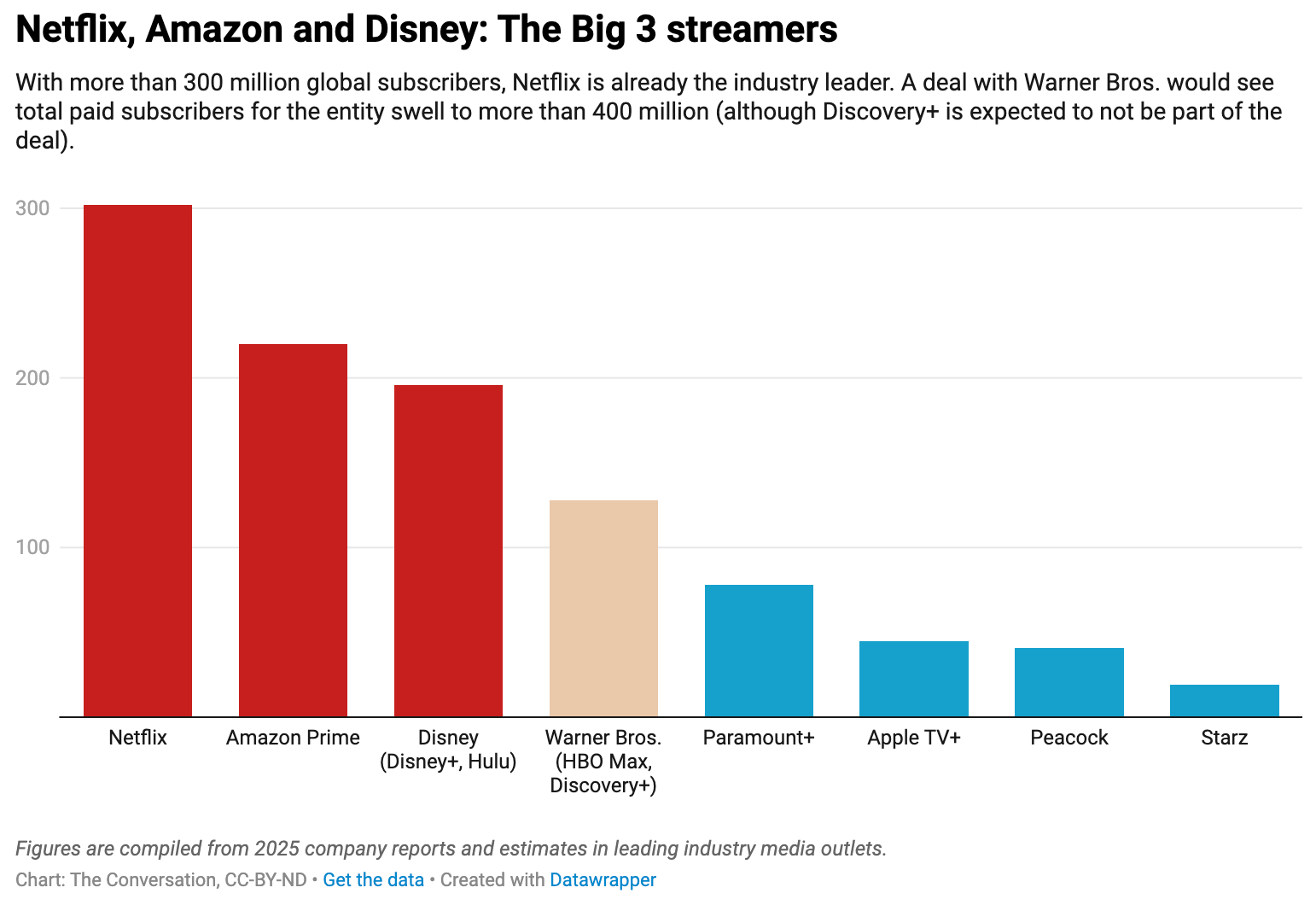

The Warner Bros Sale and Hollywood’s Consolidation Crisis

Sources: BBC | Getty Images

Hollywood is reeling as Warner Bros faces a potential breakup or sale, with Netflix and Paramount Skydance battling to acquire the studio amid an already severe industry downturn. Creative workers fear more job losses and fewer buyers for film and TV projects, while weighing what they see as two bad options: control by a tech giant accused of undermining movie theaters or billionaire owners with close political ties. Netflix’s interest centers on Warner Bros’ most valuable assets like the studio lot, HBO, and its film and TV archive, while Paramount Skydance has launched a massive, foreign-backed hostile takeover bid that has raised censorship and political influence concerns.

Much of the anger in Hollywood is directed at Warner Bros Discovery CEO David Zaslav, who critics blame for mismanaging the company during mergers and presiding over layoffs while earning tens of millions in compensation. The sale comes after years of disruption from the pandemic, labor strikes, consolidation, and the failure of the post-Covid production boom to return, leaving many workers struggling or out of work. For many in the industry, the buyer almost feels secondary to the larger reality that Hollywood is shrinking, consolidating, and being permanently reshaped by streaming, capital concentration, and technology.

“If Netflix gets the deal they want, they will buy Warner Bros' crown jewels – the 102-year-old studio, HBO, and its vast archive of films and TV shows – leaving Warners's legacy TV networks, like CNN, TNT Sports and Discovery, for another buyer.”

Disney (DIS) Invests $1B in OpenAI

Subscribe to GRIT Premium to read the rest.

Become a paying subscriber of GRIT Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • WEEK IN REVIEW: Full access to the internet's best recap of the markets, every single week. This includes comprehensive earnings breakdowns, portfolio updates, and more. This is the perfect compliment to the "Investing Week Ahead" post that you already receive at the beginning of each week.

- • MONTHLY LIVESTREAMS: Join Austin Hankwitz live every month to dive deep into his portfolio, explore the latest trends, discuss any changes he’s making, and cover market-moving topics.

- • PORTFOLIO ACCESS – Austin Hankwitz, Warren Buffett, Bill Ackman, and other professional / billionaire investor portfolios.

- • MONTHLY STOCK DEEP DIVES – Comprehensive stock analysis on an individual ticker, delivered at the end of each month.

- • RESOURCES – A wide variety of investment resources for both beginners and advanced investors to accelerate your portfolio.