- GRIT

- Posts

- 👉 Tariff Drama Remains in 2026

👉 Tariff Drama Remains in 2026

Delta Air Lines, BlackRock, Taiwan Semiconductor

👉 Week in Review — Too Long; Didn’t Read:

Key Earnings Announcements:

BlackRock added $698 billion in new assets under management during 2025.

Taiwan Semiconductor plans to ramp up their 2-nanometer chips in 2026.

Delta Air Lines’ partnership with American Express generated $8.2 billion in remuneration for the year.

Investor Events / Global Affairs:

Trump shook the markets over the holiday weekend with the threatening of new tariffs.

Crypto companies took a hit after pushing back against the CLARITY Act.

Netflix secured a $7B deal with Sony.

Economic Updates:

Inflation for consumers came in cooler than expected

Inflation for producers was hotter than expected.

Happy Martin Luther King Jr. Day to each of you! Let’s dive into everything you should know from the past week in the markets.

Write like a founder, faster

When the calendar is full, fast, clear comms matter. Wispr Flow lets founders dictate high-quality investor notes, hiring messages, and daily rundowns and get paste-ready writing instantly. It keeps your voice and the nuance you rely on for strategic messages while removing filler and cleaning punctuation. Save repeated snippets to scale consistent leadership communications. Works across Mac, Windows, and iPhone. Try Wispr Flow for founders.

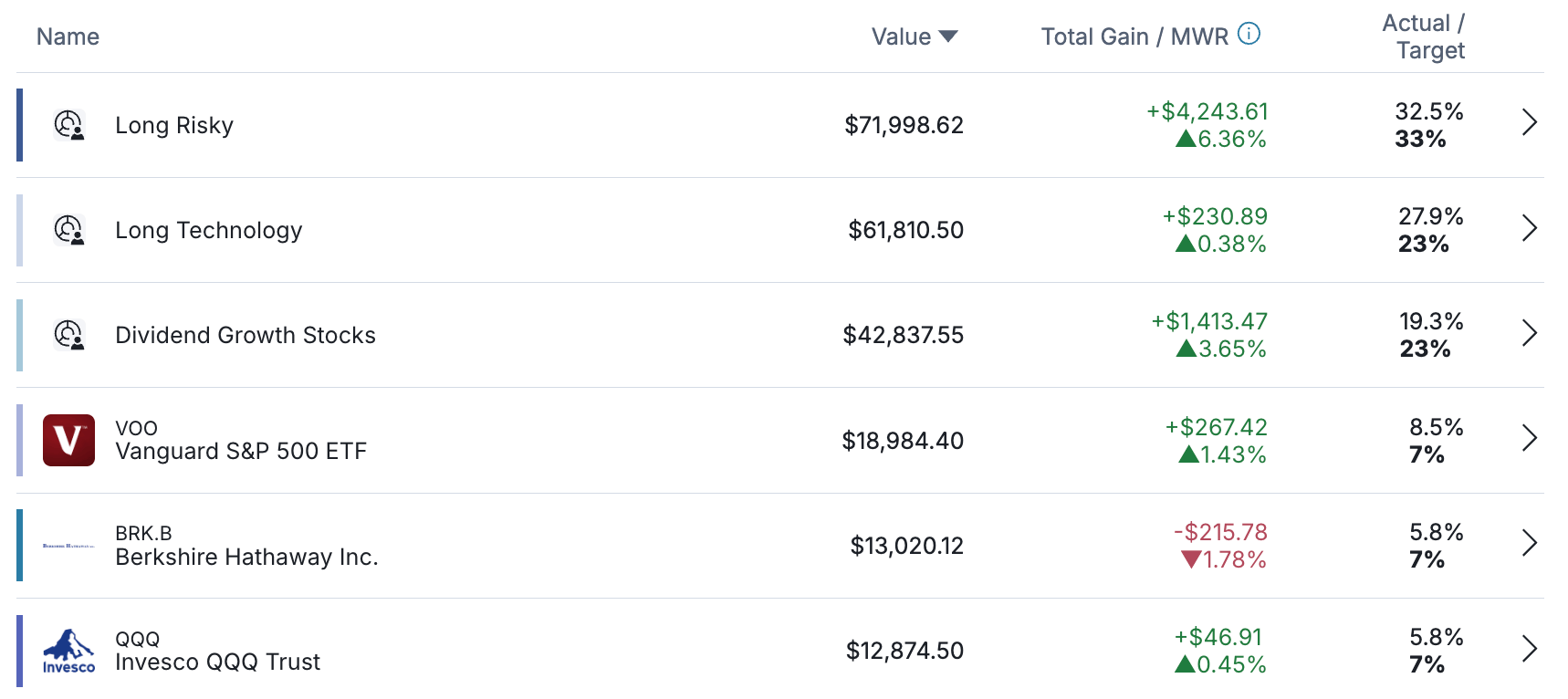

👉 Portfolio Updates

No major updates to the portfolio. Simply dollar cost averaging into the above-shown subsections. I’m thinking about making a weighting switch between “Long Risky” and “Long Technology,” but I haven’t yet made up my mind.

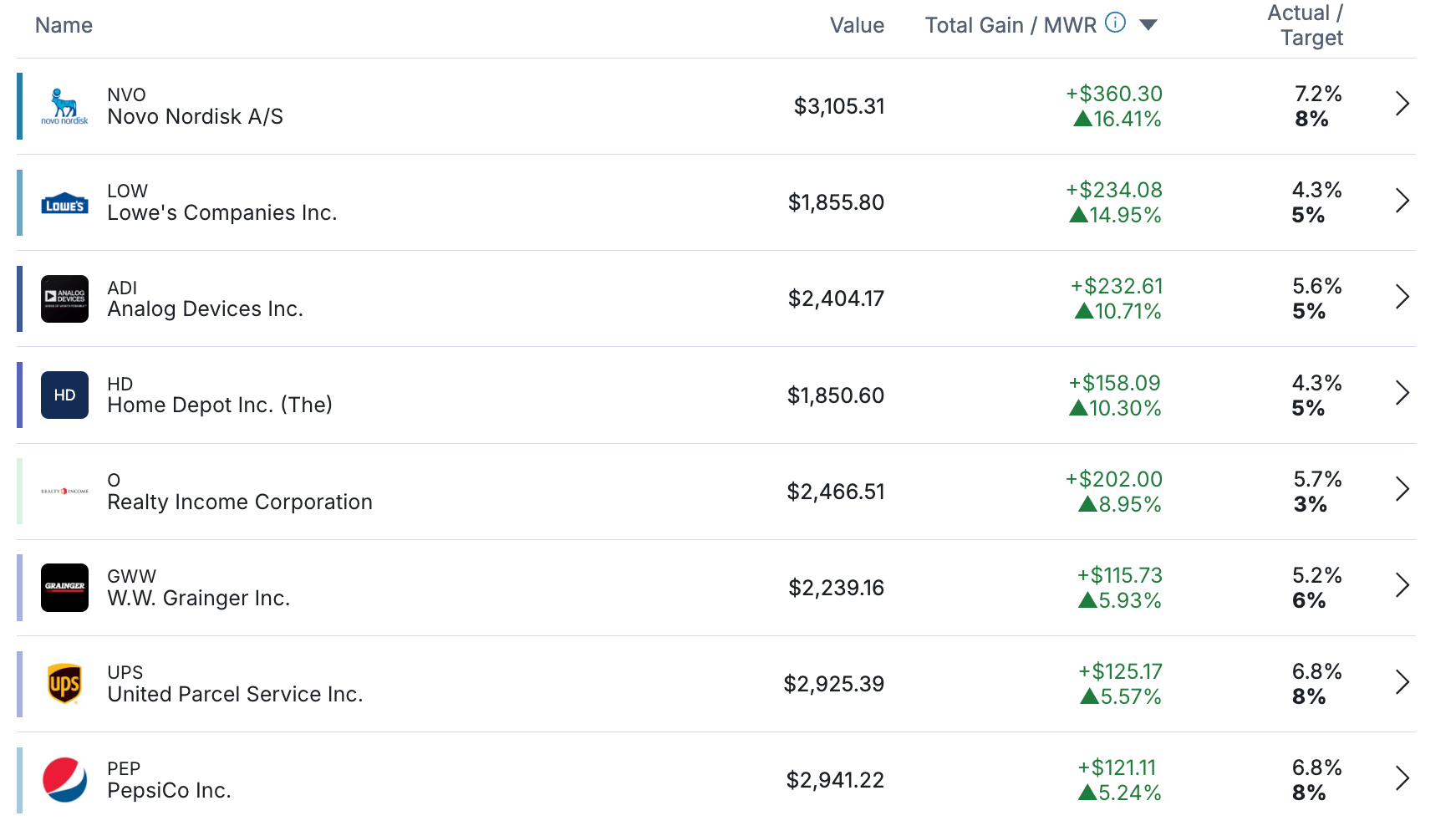

Regardless, interesting to see “Dividend Growth Stocks” outperforming the “Long Technology” subsection year-to-date — seems like this outperformance is driven by Novo Nordisk, Lowe’s, and Analog Devices.

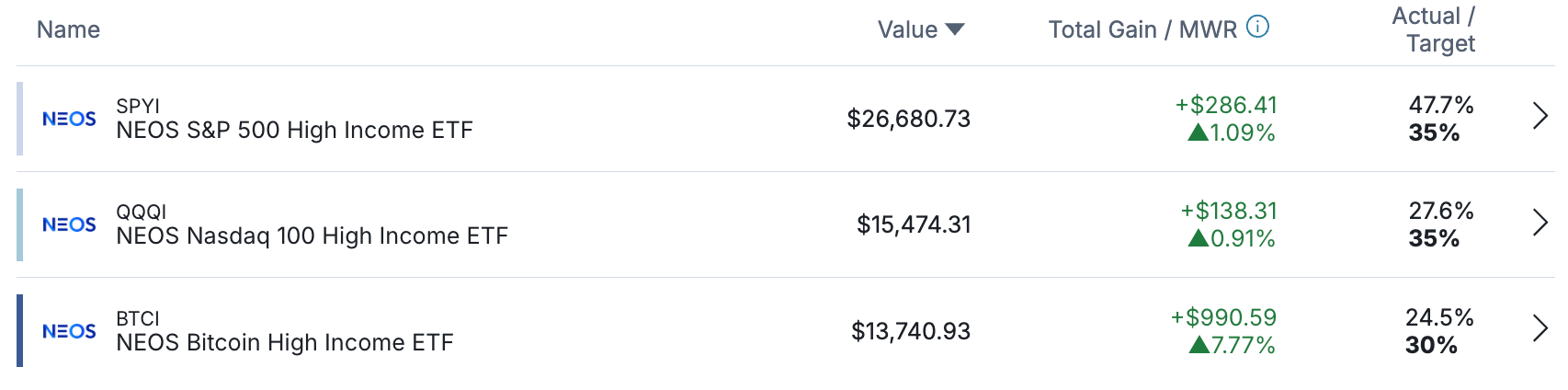

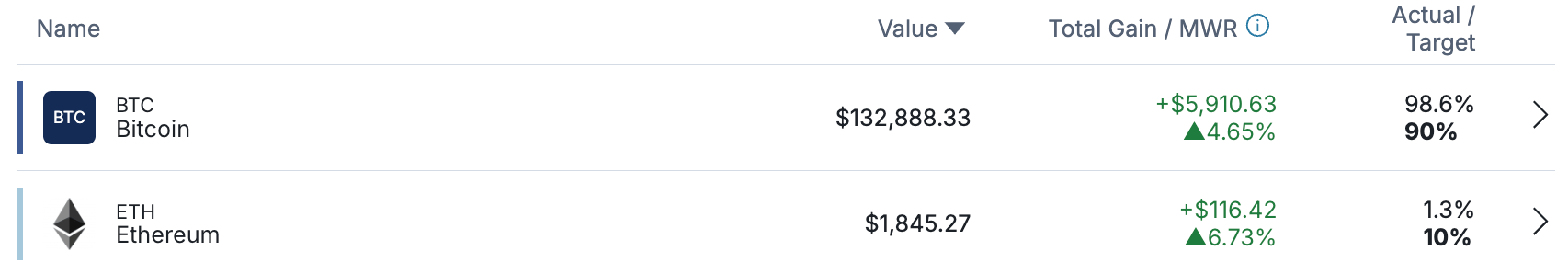

Remain excited about the monthly income and crypto subsections of the portfolio as well. Seeing Bitcoin put in these higher lows sure is nice — I remain optimistic we’ll see a crossing of $100K sooner than later.

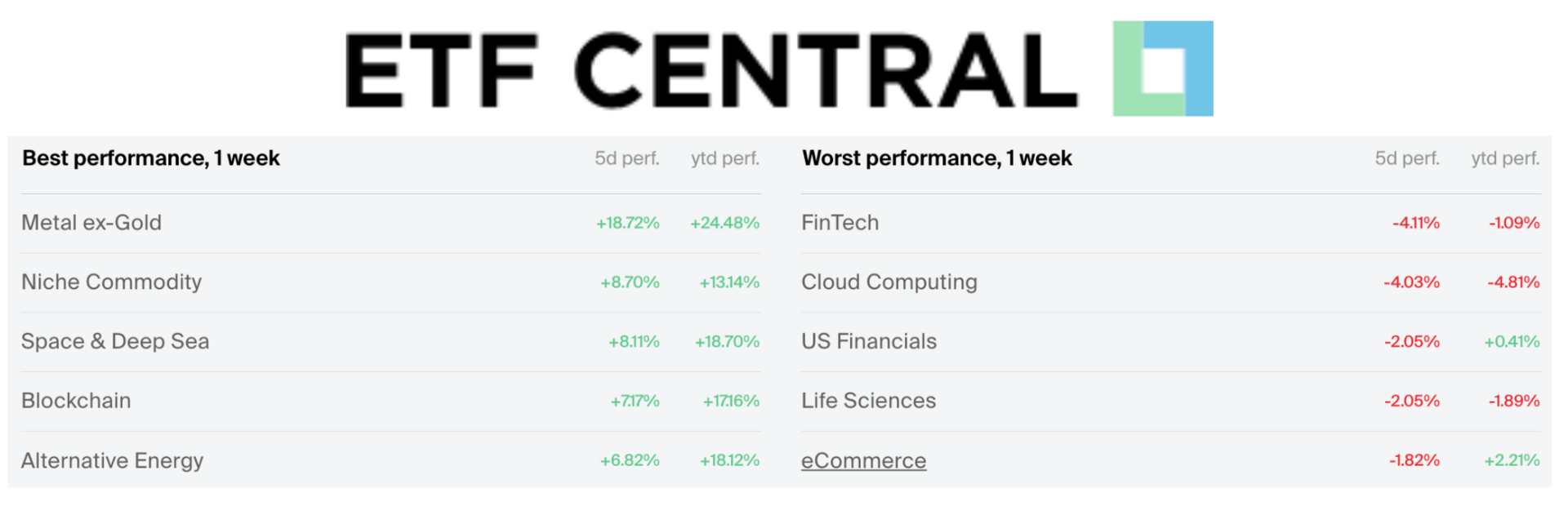

👉 Best and Worst ETF Performers of the Week

👉 Key Earnings Announcements:

BlackRock added $698 billion in new assets under management in 2025, Taiwan Semiconductor plans to ramp up their 2-nanometer chips in 2026, and Delta Air Lines’ partnership with American Express generated $8.2 billion in remuneration for the year.

BlackRock (BLK)

Key Metrics

Revenue: $7.0 billion, an increase of +23% YoY

Operating Income: $1.7 billion, compared to $2.1 billion last year

Profits: $1.1 billion, compared to $1.7 billion last year

Earnings Release Callout

“BlackRock enters 2026 with accelerating momentum across our entire platform, coming off the strongest year and quarter of net inflows in our history. Clients entrusted us with $698 billion of new assets in 2025, powering 9% organic base fee growth. And we ended the year with back-to-back quarters of double-digit organic base fee growth, including 12% in the fourth quarter.”

My Takeaway

BlackRock delivered a historic quarter for asset gathering, shattering records for Assets Under Management and net inflows. Despite their GAAP profitability being offset by costs associated with their aggressive asset acquisition strategy, their underlying growth engine (ETFs and private market platforms) is firing on all cylinders. The iShares ETF franchise was a standout performer, pulling in a record $527 billion for the year. Additionally, the technology services segment grew revenue by 24%, bolstered by the addition of Preqin’s data capabilities.

BlackRock demonstrated its commitment to shareholder returns by raising its quarterly dividend by 10% to $5.73 per share. The company also announced plans to repurchase $1.8 billion in shares throughout 2026. Larry Fink, BlackRock’s CEO, argued that the combination of BlackRock’s traditional public market dominance with the new private market capabilities of GIP and HPS creates a unique value proposition that allows clients to consolidate their portfolios with a single partner. They also set an ambitious goal of raising $400 billion in gross private market assets by 2030.

I don’t have a position in BlackRock, but considering their dividend growth and long-term track record it’s time I open one for 2026.

Taiwan Semiconductor (TSM)

Key Metrics

Revenue: $31.5 billion, an increase of +39% YoY

Operating Income: $15.4 billion, an increase of +44% YoY

Profits: $12.9 billion, an increase of +47% YoY

Earnings Release Callout

“Our fourth quarter business was supported by the continued strong ramp of our industry-leading 3-nanometer technology. We are observing that the demand for AI-related computing power is not just 'real'—it is structural and insatiable. We expect 2026 to be another healthy growth year for TSMC as we ramp N2 (2-nanometer) and continue to expand our advanced packaging capacity to meet customer needs."

My Takeaway

TSMC delivered a dominant quarter. The results confirm that the semiconductor cycle has fully turned, powered by structural demand for AI infrastructure and a recovery in the smartphone market.

The story is all about the mix shift toward the bleeding edge. 3-nanometer technology accounted for 32% of total wafer revenue, cementing itself as the primary revenue driver alongside 5-nanometer. The High Performance Computing (HPC) platform, which houses AI chips, grew 52% and now makes up 61% of the company's total revenue. The smartphone segment also showed strength, growing 18% as new AI-enabled handsets drove silicon content growth.

Gross margins expanded to 57.5%, driven by high utilization rates and yield improvements on the advanced nodes. Management signaled confidence in their ability to maintain pricing, citing the massive energy efficiency value their chips provide to datacenter operators. They also alluded to growing outsourcing revenue from integrated device manufacturers (like Intel), further validating their technological lead.

Management confirmed that their Arizona fab is now operational and shipping volume wafers with yields comparable to Taiwan. Management reiterated that AI demand is “insatiable.” He confirmed that the next-generation 2-nanometer (N2) node is on track for late 2026 and is seeing even stronger initial interest than N3. Despite doubling capacity in 2025, TSMC plans to double it again in 2026 to unclog the supply chain for customers like Nvidia.

Long TSMC.

Delta Air Lines (DAL)

Key Metrics

Revenue: $16.0 billion, an increase of +3% YoY

Operating Income: $1.5 billion, compared to $1.7 billion last year

Profits: $1.2 billion, compared to $1.5 billion last year

Earnings Release Callout

"The Delta team delivered a strong close to our Centennial year, demonstrating the differentiation and durability we've built. The strength in the consumer sector is at the higher end of the curve... the lower-end consumer is struggling. We fortunately do not live there. Our industry-leading performance delivered for our customers and employees, creating value for our owners consistent with our long-term framework."

My Takeaway

Delta Air Lines delivered a record-setting revenue performance to close out the year. However, the results also highlighted the rising cost of doing business in the current airline environment, as profitability metrics declined year-over-year despite the top-line growth. This decline in profitability was primarily driven by higher labor costs following the ratification of new pilot contracts and persistent inflationary pressures.

The divergence between premium and economy passengers was the central theme. Premium revenue grew 7%, significantly outpacing the main cabin, and now accounts for the majority of the airline's revenue alongside loyalty income. The American Express partnership remains a juggernaut, generating $8.2 billion in remuneration for the year, up 11%.

The company maintained cost discipline with non-fuel unit costs rising a modest 2%. Delta's cash generation engine remains intact, producing $2.3 billion in operating cash flow for the quarter and $4.6 billion in free cash flow for the year. This liquidity allowed the company to reduce its leverage to 2.4x, solidifying its investment-grade profile, while also funding a massive $1.3 billion profit-sharing payout for employees.

Management noted that while the lower-end consumer is struggling with inflation, Delta's core high-income customer base continues to spend heavily on travel. This dynamic validates Delta's decision to avoid competing on price with budget carriers. Management also highlighted that 2026 is expected to be a year of 20% earnings growth as they lap the initial step-up in labor costs.

Looking ahead, free cash flow is expected to remain robust, targeting a range of $3 billion to $4 billion, which will support further debt reduction and shareholder returns.

No position.

👉 Investor Events / Global Affairs:

Trump shook the markets over the holiday weekend with the threatening of new tariffs, crypto companies took a hit after pushing back against the CLARITY Act, and Netflix secured a $7B deal with Sony.

Trump Threatened Tariffs on Countries That Oppose Greenland Deal

Source: AP Photo/Evgeniy Maloletka

President Donald Trump announced plans to impose 10% tariffs on imports from several European countries starting Feb. 1, with the stated aim of pressuring Denmark to negotiate the sale of Greenland to the United States. The tariffs would apply to goods from Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands, and Finland, and would rise to 25% on June 1 unless an agreement is reached. The move threatens to disrupt a major U.S.–EU trade deal finalized last year, prompting leaders in the European Parliament and senior officials from the European Union to signal that implementation of the agreement may be paused. Trump framed the tariffs as a national security measure, arguing that U.S. control of Greenland is necessary to counter China and Russia, while stating that the U.S. remains open to negotiations.

Danish and Greenlandic officials have reiterated that Greenland is not for sale, with Greenland’s government opposing U.S. ownership and Denmark characterizing its increased military presence in the Arctic as defensive. European leaders and some U.S. lawmakers warned that the tariff threat could strain transatlantic relations, and legal uncertainty remains over the authority Trump would use to impose the measures, which is currently under review by the Supreme Court.

“These Countries, who are playing this very dangerous game, have put a level of risk in play that is not tenable or sustainable… Therefore, it is imperative that, in order to protect Global Peace and Security, strong measures be taken so that this potentially perilous situation end quickly, and without question.”

Crypto Companies Push Back on CLARITY Act

Subscribe to GRIT Premium to read the rest.

Become a paying subscriber of GRIT Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • WEEK IN REVIEW: Full access to the internet's best recap of the markets, every single week. This includes comprehensive earnings breakdowns, portfolio updates, and more. This is the perfect compliment to the "Investing Week Ahead" post that you already receive at the beginning of each week.

- • MONTHLY LIVESTREAMS: Join Austin Hankwitz live every month to dive deep into his portfolio, explore the latest trends, discuss any changes he’s making, and cover market-moving topics.

- • PORTFOLIO ACCESS – Austin Hankwitz, Warren Buffett, Bill Ackman, and other professional / billionaire investor portfolios.

- • MONTHLY STOCK DEEP DIVES – Comprehensive stock analysis on an individual ticker, delivered at the end of each month.

- • RESOURCES – A wide variety of investment resources for both beginners and advanced investors to accelerate your portfolio.