- GRIT

- Posts

- TESLA SOARS 6% PRE-MARKET

TESLA SOARS 6% PRE-MARKET

Good Morning!

Good Morning Everyone! Today we’re talking Tesla's price target skyrockets 60% 🚀, U.S. consumers on the brink 🛒, and mass layoffs rattling Wall Street! 🏦👻

First time reading? Sign-up here.

Let’s dive in!

BANK JOB CUTS SKYROCKET

Source: LinkedIn

Banking's in a tough spot right now, with some investment banks seeing a 50% revenue drop and 2023 labeled as one of the "worst deal-making environments in a decade." It's no surprise that layoffs are dominating the headlines. Just last week, Goldman Sachs and Barclays announced their plans to trim their workforce. UBS joined the fray this morning, revealing cuts to hundreds of wealth jobs in Asia, adding to their already announced plans to cut over 35,000 jobs as part of their Credit Suisse rescue mission.

Goldman isn't stopping there—they're planning another round of job cuts likely in October, targeting the "underperformers" and expecting to let go of 1-5% of their total staff. Barclays is also sharpening the axe, with plans to cut about 5% of client-facing staff in their trading division and some global deal-makers. It's a turbulent time in the banking sector, to say the least.

GRIT TAKE: For some banks, these layoffs are the most dramatic since the 2008 financial crisis. What's next? Overextended bankers might start unloading their luxury assets—think Hamptons beach houses and swanky cottages. With interest rates skyrocketing, cash could be drying up fast for some! For a full list of layoffs click here.

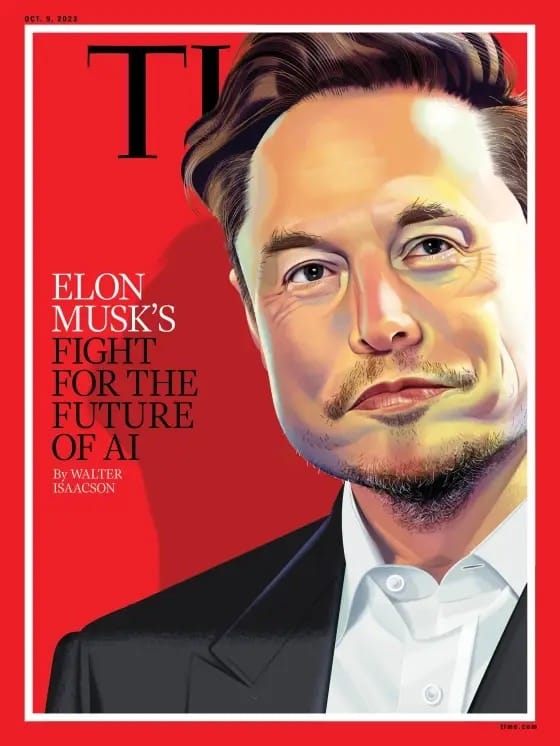

TESLA SOARS 6% PRE-MARKET

Source: Times

Tesla's soaring +6% pre-market, thanks to a bullish Morgan Stanley upgrade. Analyst Adam Jonas just jacked the stock target from $250 to $400—that's a +60% upside, all fueled by AI buzz.

Jonas is betting big on Tesla's Dojo supercomputer, a 5-year project aimed at perfecting autonomous driving. He claims this tech could add a whopping $500 billion to Tesla's value and even went as far as to say software could become Tesla's main moneymaker.

Hold tight—Jonas hints Tesla has an "asymmetric advantage" in a market potentially worth $10 trillion. And keep your eyes peeled for the next version of Tesla's full self-driving system, expected by year-end

GRIT TAKE: Tesla's stock has more than doubled this year, and Morgan Stanley's new target nearly matches its record close of $409.97 last November. Keep in mind, Morgan Stanley is a key advisor to Elon Musk—even in the $44 billion Twitter takeover. But let's talk numbers: the stock's trading at 64x forward earnings, and that valuation still has me scratching my head. While I may not be buying the stock, here's what I am snagging: Walter Isaacson's upcoming Elon Musk biography, out September 12th. His Steve Jobs bio is a must-read, one of my favourite books of all time!

U.S CONSUMER CRACKING?

Source: Debt.org

Bloomberg's latest survey drops a bombshell: Over half of respondents predict personal consumption—our economic growth engine—will decline in 2024, with some even eyeing Q4.

Sure, the economic data looks peachy on the surface, but here's the underbelly: pandemic savings are drying up, credit card debt's at an all-time high (alongside soaring interest rates), and more folks are missing payments on credit cards and auto loans.

Oh, and let's not forget: millions of Americans are about to get hit with student loan bills again.

Something's gotta give, folks.

GRIT TAKE: Buckle up, the next week is a rollercoaster for the U.S. consumer. First up, Wednesday's inflation data, a major factor in the Fed's Sept 20th decision to hike rates or hit pause. If the Fed chills, consumers can breathe. If rates climb, brace for impact! Then comes Thursday's retail sales for August, expected to be sluggish. If that's the case, it could trigger a stock market sell-off.

Coming Up…

🗓️ This Week's Hot List:

🇺🇸 TODAY: 9/11 memorials nationwide. Plus, Nvidia & JPMorgan execs hit the stage 🎤 and Oracle's earnings drop. 💰

🍎 Tuesday: iPhone 15 reveal & First Republic Bank earnings. 📱💵

📈 Wednesday: U.S. Inflation data heats up & Arm Holdings' mega IPO. 🚀

🛒 Thursday: U.S. Retail Sales, PPI & ECB rate decisions. 🏦

🔧 Friday: United Auto Workers may strike for big pay & perks. 📢

Stay Tuned! 📺🔥

Headlines You Need To Know:

Birkenstock files for IPO

Ripple says it will fight the SEC lawsuit ‘all the way through’

BP Chief quits over his past relationship with staff

Speaker McCarthy launches House impeachment inquiry

Everything Apple just announced at its 2023 event

Binance USA CEO departs as crypto platform cuts staff

What Kim Jong Un and Vladmir Putin gain from meeting

India spends big on what it needs most to catch up to China

Taylor Swift could change the movie theater industry

Three roadblocks keeping Ukraine mired in the war

Walmart cuts starting pay for starting workers

Trudeau is stuck in India with faulty aircraft

Putin wants his hitman back

Just for fun…

A Small-Town of Coca-Cola Millionaires

Source: Atlas Obscura

A small town in Florida was once the richest town per capita all because one man convinced the entire city to invest in Coca-Cola stock. Quincy, Florida is a very small town that has a population of 7,000 people, but it won’t take very long for you to find a Coca-Cola millionaire. In the midst of the Great Depression, a banker named Pat Munroe noticed that people were using their very last nickels to buy a bottle of Coca-Cola. At the time, Coca-Cola shares were very cheap. Not only did Munroe invest in multiple Coca-Cola shares himself, he urged many of his neighbors to do so. He was a trusted banker, and many of them followed his advice. As you probably know, the investment was a massive success. If you would have purchased 5 shares, it would be worth millions today. The farming town was able to keep afloat during hard times with its Coca-Cola dividends. They amassed huge fortunes from their early shares, which they passed down through the generations of their families.

3 Most Important Charts Right Now

401(k) balances in the U.S.

401(k) balances have bounced back from a losing year in 2022.

Source: Fidelity, CNBC

Projected Job Growth Tumbles

Only 4.7 million US jobs are projected to be added from 2022-2032

Source: Bureau of Labor

Wages vs. Inflation

CPI has steadily come down this year.

Source: Bureau of Labor

TWEET OF THE DAY

Absolutely LOVED the movie.

Can’t Stop. Won’t Stop. GameStop.

Thrilled to have been invited to the world premiere of Sony’s and Elevation Pictures' “Dumb Money”

— Genevieve Roch-Decter, CFA (@GRDecter)

1:02 AM • Sep 9, 2023

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]

Reply