- GRIT

- Posts

- 👉 The Continued Downfall of Nike

👉 The Continued Downfall of Nike

Spotify, Government Shutdown, Exxon

Together with XFunds

👉 Week in Review — Too Long; Didn’t Read:

Key Earnings Announcements:

Nike’s margins collapsed due to digital weakness, China softness, and tariffs.

Investor Events / Global Affairs:

OpenAI’s valuation hit $500 Billion, surpassing Elon Musk’s SpaceX.

Spotify appointed Co-CEOs as Daniel Ek will move into Chairman role.

Intel stock rose on reports of talks to bring AMD onboard as a customer.

Exxon plans to eliminate 2,000 positions as part of global restructuring.

Economic Updates:

The government could remain closed beyond this week.

The jobs report wasn’t released due to the shutdown, but data continues to suggest limited hiring.

Happy Sunday.

In case you’re new around here, I’m Austin Hankwitz — I’ve been publishing earnings analysis on publicly-traded companies for over half a decade. My podcast, Rich Habits, has hit #1 on Spotify’s Business Podcast chart four times since it’s inception only two years ago.

At the start of 2023, I began my journey of building a $2M Dividend Growth Portfolio from scratch. This twice-weekly newsletter is how I keep you all updated on my progress.

For me, early retirement means $2M invested. For you, it might mean something else. Regardless of your early-retirement number — I hope these weekly synopses of my portfolio progress + what’s been happening in the markets helps you on your own journey.

Every Sunday, we publish the internet’s best summary of what happened in the markets the week prior — earnings analysis, acquisition announcements, economic data, world news, and more.

If you want full access to that info, my portfolio, legendary investor portfolios, livestreams, resources, and more — click here!

Looking to gain exposure to crypto without the wild swings? The Nicholas Crypto Income ETF (BLOX) offers a unique solution: exposure to the crypto ecosystem and the opportunity for weekly income.

BLOX is designed to provide:

Access to Bitcoin & Ether through ETFs and ETPs

Equity exposure to crypto industry leaders — from miners to DeFi platforms

Weekly income through options strategies on portfolio holdings

Whether you’re crypto-curious or looking to add yield potential to your portfolio, BLOX gives you broad exposure in a single ticker.

👉 Learn more at NicholasX.com/BLOX

👉 Portfolio Updates (YTD Performance):

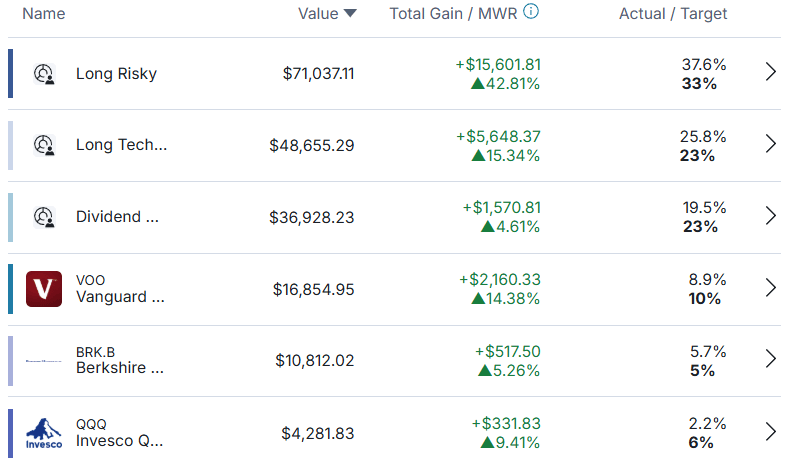

The stock-only portion of my portfolio is up +19.3% YTD, surpassing the S&P 500’s +14.4% by roughly 5%. This stock-only portfolio is being carried higher (+42.8%) by the “Long Risky” subsection of the portfolio — a list of high-octane growth stocks.

This stock-only portfolio will pay me $1,303 in dividend this year, which is exciting!

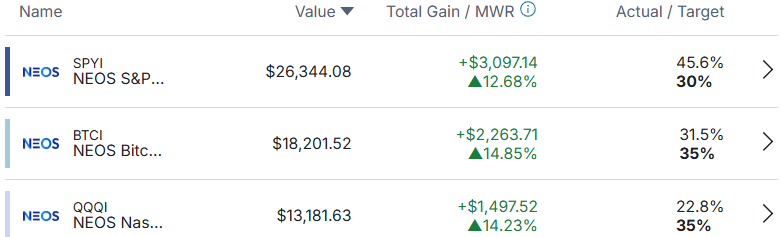

Speaking of dividends, the monthly income section of my portfolio is smooth sailing — delivering roughly $800 / month in income on a consistent basis.

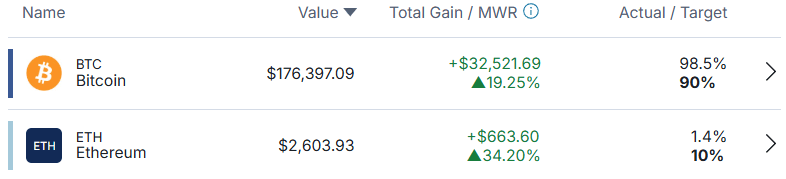

Who else is pumped for Q4 — specifically as it relates to cryptocurrency?

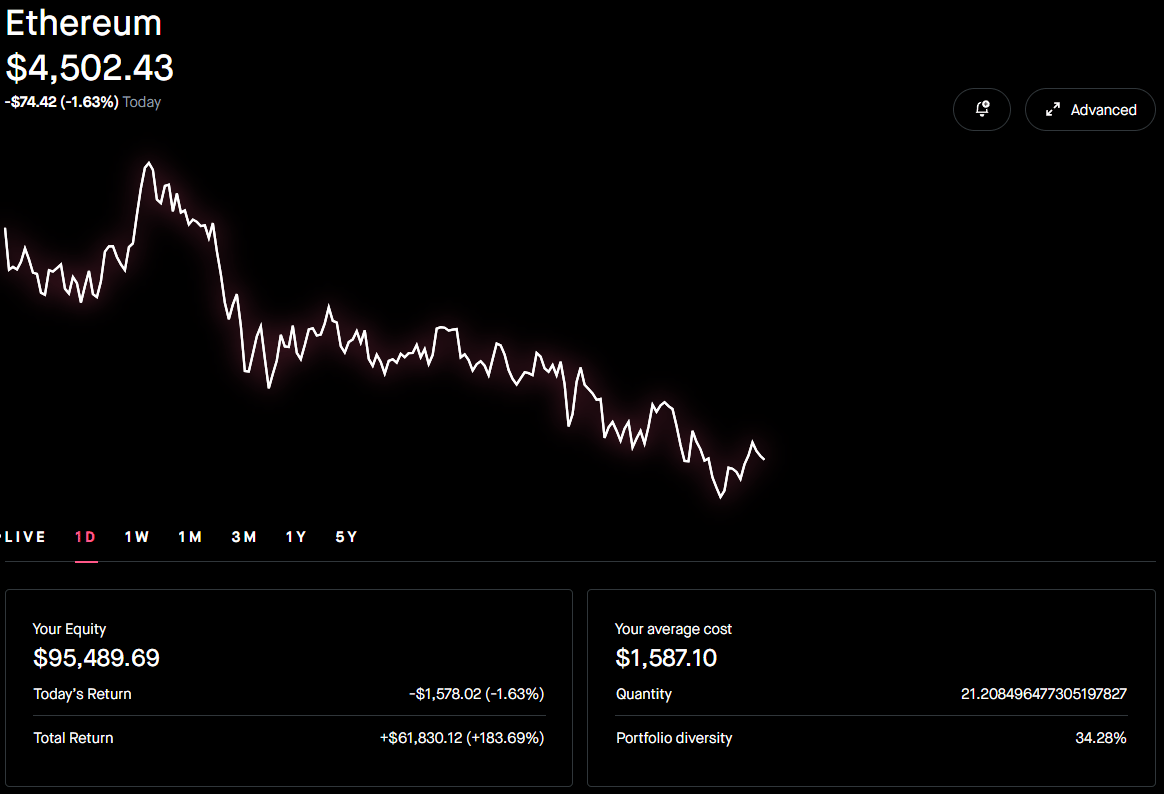

Bitcoin is going to hopefully surpass the $135-150K range, Ethereum the $5,500-7,000 range, and Chainlink the $35-40 range. I’ll be taking advantage of this “blow off top” in the markets and cashing in on 80-90% of my crypto portfolio to re-balance my net worth away from the asset class (as it makes up a significant portion).

Want to see every position inside my stock and crypto portfolio?

Click here to become a Premium subscriber for $31 / month. You’ll also unlock access to our monthly livestreams, GRIT Guides on Investing, and more.

👉 Key Earnings Announcements:

Nike’s margins collapsed due to digital weakness, China softness, and tariffs.

Nike Inc. (NKE)

Key Metrics

Revenue: $11.7 billion, an increase of +1% YoY

Operating Income: $922.0 million, compared to $1.3 billion last year

Profits: $727.0 million, compared to $1.1 billion last year

Earnings Release Callout

“This quarter NIKE drove progress through our Win Now actions in our priority areas of North America, Wholesale, and Running. While we’re getting wins under our belt, we still have work ahead to get all sports, geographies, and channels on a similar path as we manage a dynamic operating environment. I’m confident that we have the right focus in Win Now and that our new alignment in the Sport Offense will be the key to maximizing NIKE, Inc.’s complete portfolio over the long-term.”

My Takeaway

Subscribe to GRIT Premium to read the rest.

Become a paying subscriber of GRIT Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • WEEK IN REVIEW: Full access to the internet's best recap of the markets, every single week. This includes comprehensive earnings breakdowns, portfolio updates, and more. This is the perfect compliment to the "Investing Week Ahead" post that you already receive at the beginning of each week.

- • MONTHLY LIVESTREAMS: Join Austin Hankwitz live every month to dive deep into his portfolio, explore the latest trends, discuss any changes he’s making, and cover market-moving topics.

- • PORTFOLIO ACCESS – Austin Hankwitz, Warren Buffett, Bill Ackman, and other professional / billionaire investor portfolios.

- • MONTHLY STOCK DEEP DIVES – Comprehensive stock analysis on an individual ticker, delivered at the end of each month.

- • RESOURCES – A wide variety of investment resources for both beginners and advanced investors to accelerate your portfolio.