- GRIT

- Posts

- 👉 The Highlights of an UGLY Week

👉 The Highlights of an UGLY Week

Fed Rate Cuts, Nvidia, Walmart

👉 Week in Review — Too Long; Didn’t Read:

Key Earnings Announcements:

Nvidia confirm the $4 trillion AI infrastructure build-out is accelerating.

Walmart’s global eCommerce sales spiked by +27% while their high-margin ad revenue grew by +53%.

Lowe’s delivered consecutive positive comparable sales for the first time since the fourth quarter of 2021.

Investor Events / Global Affairs:

The change in odds of a Fed rate cut in December has been a rollercoaster.

Saudi Arabia pledged $1T worth of commitments to U.S. investments.

Palo Alto Networks made a $3.3B acquisition.

Economic Updates:

Treasury Secretary Bessent shared optimism about 2026.

U.S. retail sales showed some signs of potential resilience.

Home insurance costs continue to climb, with premiums rising over 9% this year and more than 60% in the past five years. However, coverage hasn’t kept pace, leaving many homeowners paying significantly more for less protection. With affordability becoming a growing concern, it’s more important than ever to compare options—check out Money’s handy home insurance tool to find the best fit for you.

👉 Portfolio Updates

Hell of a week in the markets — I spent a few hours on Friday writing out my detailed thoughts here in this Google Doc. Since writing that analysis, the odds for a rate cut in December have skyrocketed from ~25% to ~70% overnight. Perhaps something to do with this post on X?

My base case as stated in the analysis (assuming that sellers remained in control of this market) is that we’d experience a drawdown to the indices’ respective 200-day moving averages. However, if we get a rate cut in December, which seems to be a likely outcome now, this might not take place — we would instead experience a market recovery. Remember, rate cuts are good for risk-on assets.

The recent market all-time high perfectly coincided with December rate cut expectations evaporating in late-October. Bitcoin is up +4% since the odds flipped in favor of a rate cut — let’s see how this plays out.

From a portfolio update perspective, I’ve been buying Mag 7 like my life depends on it. I’ve specifically purchased Amazon, Apple, and Google. I also began to nibble at Hims & Hers, On Holding, Shopify, Crowdstrike, and Robinhood. I also bought shares of the Roundhill GLP-1 & Weight Loss ETF, OZEM.

As stated in my analysis linked above, I also bought a little of Bitcoin and Ethereum at $82K and $2.7K, respectively, in anticipation of a dead cat bounce.

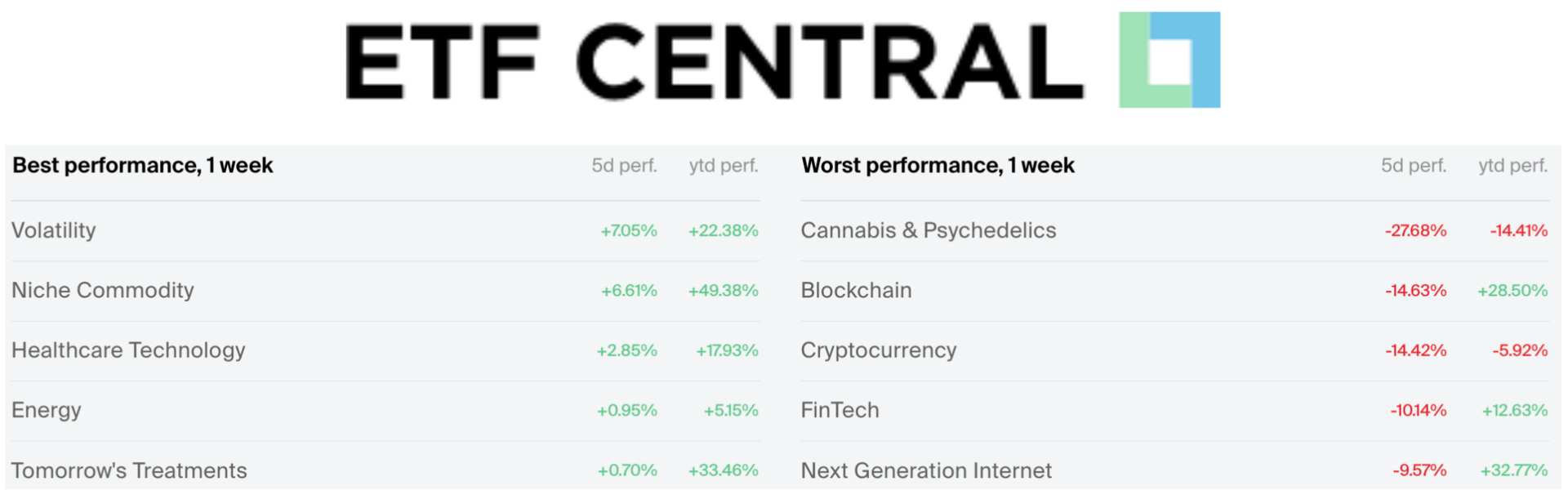

👉 Best and Worst ETF Performers of the Week

👉 Key Earnings Announcements:

Nvidia confirm the $4 trillion AI infrastructure build-out is accelerating, Walmart’s global eCommerce sales spiked by +27% while their high-margin ad revenue grew by +53%, and Lowe’s delivered consecutive positive comparable sales for the first time since the fourth quarter of 2021.

Nvidia (NVDA)

Key Metrics

Revenue: $57.1 billion, an increase of +63% YoY

Operating Income: $36.0 billion, an increase of +64% YoY

Profits: $31.9 billion, an increase of +65% YoY

Earnings Release Callout

“Blackwell sales are off the charts, and cloud GPUs are sold out. Compute demand keeps accelerating and compounding across training and inference — each growing exponentially. We’ve entered the virtuous cycle of AI. The AI ecosystem is scaling fast — with more new foundation model makers, more AI startups, across more industries, and in more countries. AI is going everywhere, doing everything, all at once.”

My Takeaway

The company continues to demonstrate that the AI infrastructure build-out is still in its early innings, delivering another "beat and raise" quarter driven almost entirely by the insatiable demand for Hopper and the ramping production of Blackwell.

CEO Jensen Huang confirmed that Blackwell production is ramping at full speed. He noted that the demand for Blackwell is "extraordinary" and exceeds supply, a dynamic expected to persist for several quarters. The "step-function" increase in performance per watt (10x throughput per megawatt vs. Hopper) is driving customers to upgrade aggressively to reduce total cost of ownership.

Management also addressed the “Circular Revenue” accusations. They view these investments as strategic accelerators for the ecosystem. Jensen stated that Nvidia's platform runs every AI model, and these partnerships ensure their hardware remains the standard.

CFO Colette Kress reiterated their long-term thesis, estimating that the world will see $3–4 trillion in AI infrastructure build-out by the end of the decade. She emphasized that we are likely still in the early stages of modernizing $1 trillion worth of traditional data centers into "AI factories." Colette also reiterated that a growing revenue stream is "Sovereign AI"—nations building their own domestic compute infrastructure (e.g., Japan, France, India). This is becoming a multi-billion dollar vertical distinct from US hyperscalers.

Looking ahead to Q4, Nvidia issued guidance of $65B in revenue, plus or minus 2%.

We are witnessing the early stages of a $3–4 trillion infrastructure modernization cycle, and Nvidia’s moat appears as wide as ever.

Long NVDA.

Walmart (WMT)

Key Metrics

Revenue: $179.5 billion, an increase of +6% YoY

Operating Income: $6.7 billion, flat YoY

Profits: $6.1 billion, an increase of +34% YoY

Operating Income:

Earnings Release Callout

“The team delivered another strong quarter across the business. eCommerce was a bright spot again this quarter. We’re gaining market share, improving delivery speed, and managing inventory well. We’re wellpositioned for a strong finish to the year and beyond that, thanks to our associates. It’s been an honor to serve them as CEO, and I’m as excited about the future of this company as I’ve ever been. John Furner is a fantastic leader with a proven track record. I couldn’t be happier for him and for Walmart.”

My Takeaway

Walmart delivered a robust quarter catalyzed by broad-based strength across all segments of the business. The company continues to leverage its high-margin alternative revenue streams—specifically advertising and eCommerce — to drive profitability even as they navigate a leadership transition and a complex macro environment.

Global eCommerce sales surged +27%, with the U.S. market growing +22%. This marks the seventh consecutive quarter of greater than +20% growth, fueled by store-fulfilled pickup and delivery. The advertising business grew +53% globally, bolstered by the integration of VIZIO and a +33% jump in Walmart Connect within the US. International net sales grew +11%, led by strength in Flipkart, Walmex, and China, where digital sales now make up more than half of the sales mix.

Management shared several major takeaways during the earnings call. The headline news was the announcement of CEO Doug McMillon's retirement, to be succeeded by John Furner, the current CEO of Walmart US — a transition the market views as stable. Management also highlighted that upper-income households continue to drive share gains, staying for the convenience of the Walmart+ membership.

It seems like Walmart’s bottom line is finally benefitting from their years of investment into eCommerce and digital advertising.

Long WMT.

Lowe’s (LOW)

Subscribe to GRIT Premium to read the rest.

Become a paying subscriber of GRIT Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • WEEK IN REVIEW: Full access to the internet's best recap of the markets, every single week. This includes comprehensive earnings breakdowns, portfolio updates, and more. This is the perfect compliment to the "Investing Week Ahead" post that you already receive at the beginning of each week.

- • MONTHLY LIVESTREAMS: Join Austin Hankwitz live every month to dive deep into his portfolio, explore the latest trends, discuss any changes he’s making, and cover market-moving topics.

- • PORTFOLIO ACCESS – Austin Hankwitz, Warren Buffett, Bill Ackman, and other professional / billionaire investor portfolios.

- • MONTHLY STOCK DEEP DIVES – Comprehensive stock analysis on an individual ticker, delivered at the end of each month.

- • RESOURCES – A wide variety of investment resources for both beginners and advanced investors to accelerate your portfolio.