- GRIT

- Posts

- 👉 The iPhone 17 "Supercycle"

👉 The iPhone 17 "Supercycle"

Meta, Microsoft, Apple

👉 Week in Review — Too Long; Didn’t Read:

Key Earnings Announcements:

Microsoft lost $440B in market cap as investors question the strength of their remaining performance obligations.

Meta’s Ray-Ban smart glasses’ revenue increased by +200%.

Apple’s China-specific revenue exploded by +38%.

Investor Events / Global Affairs:

Gold & silver had their worst day since 1980.

The crypto bear market accelerated over the weekend.

Elon Musk might pull off one of the craziest company mergers of all time.

Economic Updates:

The U.S. government is (partially) shut down once again.

Kevin Warsh was picked to lead the Fed.

Jerome Powell announced the Fed is keeping to its “loosely neutral” stance.

👉 Portfolio Updates

I’ve decided to exit 90% of my crypto position earlier this week. No, I wasn’t able to time the top at $127K as I was waiting for a relief rally back to the 200-day moving average. However, I was able to side-step this disgusting sell-off.

In my opinion, we’ll experience a near-term relief rally, maybe chop sideways in the process, put in a lower high, before an ultimate dump to $40-60K in Bitcoin (pulling alt coins down with it). I firmly believe around October 2026 Bitcoin will be at or around a price worth nibbling at. The goal is not to perfectly time the ups and downs, but instead to be majority right on major moves over a multi-year time horizon.

At the moment, I believe Bitcoin remains in a bear market and there are more interesting places to invest for 2026. Let’s talk about this more interesting places — starting with a handful of ETFs.

Beyond the VOO and QQQ ETFs I’ll always own, I’m going to be re-allocating Bitcoin proceeds to the following:

IEMG — this is an emerging markets play. I believe emerging markets will continue to outperform as we’re in a mid-term election year, the dollar declines, commodities continue their ‘super cycle,’ and valuations seem historically low.

PAVE — a simple play on AI infrastructure for the coming 5-10 years.

MLPI — I believe energy is breaking out of a sideways multi-year consolidation, and MLPs will benefit greatly. Using NEOS’ ETF to generate some extra income along the way in case I’m wrong and Trump somehow causes crude oil to remain low.

VXUS — emerging markets + developed markets. Non-USA as we’re navigating a mid-term election year.

ILF — I believe this ETF offers exposure to an interesting opportunity. Brazil’s interest rates have peaked, causing liquidity to flood back into equities and borrowing. Mexico is evolving from “cheap labor” to “strategic re-shoring” for USA-based companies. Then sprinkle on top of this their deep value and the dividends and you have an awesome margin of safety (8-12X forward P/E compared to SPX’s 23X).

URA — I believe the nuclear energy theme is still in the early innings.

The above are ETFs I plan to own for years to come. Not instead of Bitcoin, but alongside Bitcoin. I still own ~10% of my Bitcoin position, and plan to keep that in perpetuity. As mentioned above, when we see crypto start to hopefully put in a bear market bottom during Q4 of this year I’ll begin to nibble and build that position back up like I did in 2023.

Additionally, I plan to buy 500 shares of Amazon stock. I don’t plan to do this immediately, I’ll likely buy a few before earning this week and most of this position after earnings — but I plan to have these shares in the coming weeks, maybe a month or so depending on the macro environment. I’ll sell covered calls against these shares to generate a “risk-free” 3-4% annual yield on my position.

I believe Amazon is going to be one of, if not the biggest beneficiary from the rise AI in the long-term. Their AWS business, their advertising business, their shipping business — so many things can go right for this company over the coming 3-5 years because of AI that would double their annual operating cash flow; sending their stock up 2-4X over that period of time.

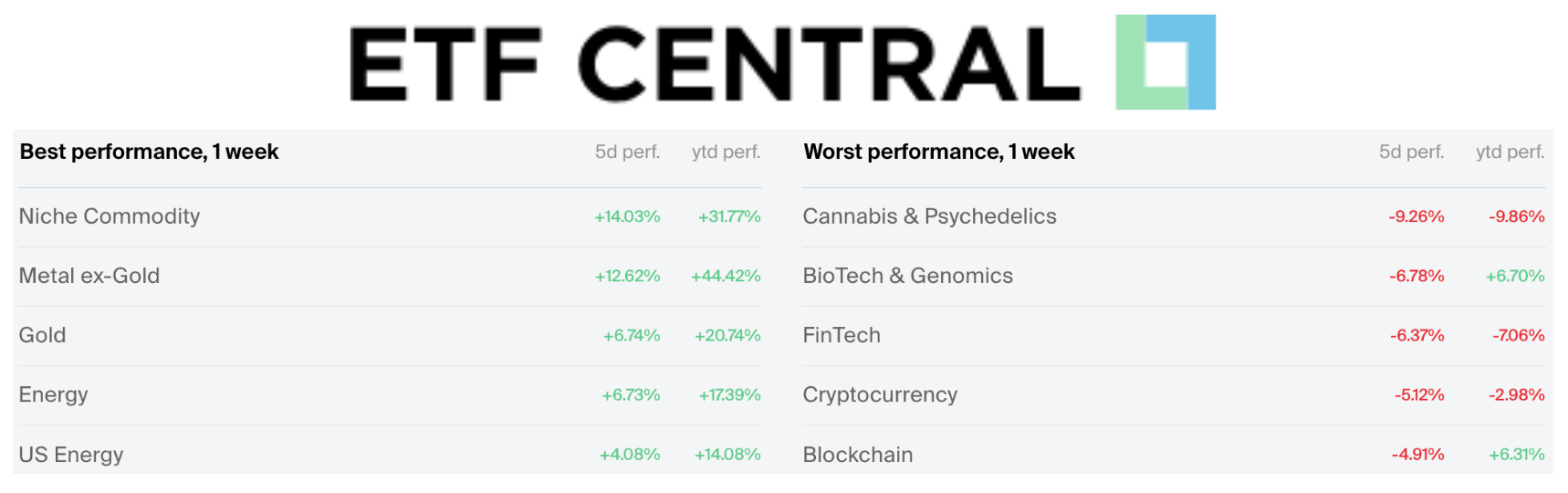

👉 Best and Worst ETF Performers of the Week

👉 Key Earnings Announcements:

Microsoft lost $440B in market cap as investors question the strength of their remaining performance obligations, Meta’s Ray-Ban smart glasses’ revenue increased by +200%, and Apple’s China-specific revenue exploded by +38%.

Microsoft (MSFT)

Key Metrics

Revenue: $81.3 billion, an increase of +17% YoY

Operating Income: $38.3 billion, an increase of +21% YoY

Profits: $38.5 billion, an increase of +60% YoY

Earnings Release Callout

“We are only at the beginning phases of AI diffusion and already Microsoft has built an AI business that is larger than some of our biggest franchises. Microsoft Cloud revenue crossed $50 billion this quarter, reflecting the strong demand for our portfolio of services. We are moving from talking about AI to applying AI at scale."

My Takeaway

Microsoft delivered a quarter defined by massive scale and significant accounting complexity. The company achieved record revenue and shattered cloud growth expectations, while simultaneously reporting historic capital expenditures and one-time investment gains that heavily distorted its headline profitability metrics. Profits saw a massive +60% jump to $38.46 billion — however, this figure includes a $7.6 billion non-cash gain from the recapitalization of its investment in OpenAI.

Their "Intelligent Cloud" segment was the star, with Azure revenue growing +39%, accelerating from the previous quarter and beating Wall Street expectations. This proves that the "AI Supercycle" is driving real consumption. Commercial Remaining Performance Obligations (RPO) exploded by +110% to $625 billion, though management clarified that nearly half of this backlog comes from commitments to OpenAI and Anthropic — which is a big reason why we saw their stock price fall. Investors are worried their future revenue is going to be paid to them by a company struggling to generate revenue themselves.

Microsoft spent $37.5 billion on CapEx in just three months—a 66% increase year-over-year—to fund its AI data center build-out. Despite this massive outflow, the company generated $35.8 billion in operating cash flow and returned $12.7 billion to shareholders. CEO Satya Nadella's shared that their AI business is now larger than many of their legacy franchises. CFO Amy Hood defended the massive capital spending, describing it as "demand-driven" and noting that capacity constraints are actually capping Azure's growth potential.

Long Microsoft.

Meta Platforms (META)

Key Metrics

Revenue: $59.9 billion, an increase of +24% YoY

Operating Income: $24.7 billion, an increase of +6% YoY

Profits: $22.8 billion, an increase of +9% YoY

Earnings Release Callout

“We ended 2025 strong, with more than 3.5 billion people now using at least one of our apps every day. Our business performed very well, thanks to record-breaking holiday demand and AI-driven performance gains. We are now seeing a major AI acceleration. I expect 2026 to be a year where this wave accelerates even further on several fronts. We're starting to see agents really work."

My Takeaway

Meta Platforms delivered a quarter defined by a staggering commitment to future infrastructure. The company beat expectations on both the top and bottom lines, proving that its core advertising business has fully recovered and is being supercharged by AI. However, the sheer scale of the planned capital expenditures for 2026 signaled to the market that the cost of competing for AI leadership is rising exponentially.

The advertising engine is firing on all cylinders. Revenue from the "Family of Apps" grew +24%, driven by the adoption of the Advantage+ automation suite and improved ad ranking algorithms. Conversely, the Reality Labs division continued to struggle financially, posting a record operating loss of -$6.2 billion for the quarter and -$19.1 billion for the full year, while revenue in the segment declined -12%. A bright spot for hardware was the Ray-Ban Meta smart glasses, which saw sales triple in 2025, validating the pivot toward wearables.

Meta plans to spend between $115 billion and $135 billion on CapEx in 2026, a massive increase from 2025 levels, to fund data centers and GPUs for its "Superintelligence Labs." Despite this historic spending plan, the company generated $14.1 billion in free cash flow during the quarter and continued to return capital to shareholders via $6.3 billion in buybacks and dividends.

The company expects Q1 revenue to range between $53.5 billion and $56.5 billion, implying a 30% year-over-year growth rate at the midpoint. This strong top-line outlook helps justify the aggressive expense guidance, as management targets delivering operating income growth in 2026 despite the massive step-up in investment.

Long Meta.

Apple (AAPL)

Key Metrics

Revenue: $143.8 billion, an increase of +16% YoY

Operating Income: $50.9 billion, an increase of +19% YoY

Profits: $42.1 billion, an increase of +16% YoY

Earnings Release Callout

"We are reporting our best-ever quarter with $143.8 billion in revenue, up 16% from a year ago. The demand for iPhone 17 was simply staggering, with revenue growing 23% year-over-year and setting all-time records across every geographic segment. We continue to see momentum in emerging markets, particularly in China, where our new AI features are driving a record number of switchers."

My Takeaway

Apple delivered a blockbuster quarter that signals the official arrival of the long-awaited "AI Supercycle." After years of modest hardware growth, the iPhone 17 lineup has catalyzed a massive upgrade wave, driving double-digit revenue growth and record profitability. The results provide definitive proof that Apple’s strategy of integrating practical, on-device AI features is winning over consumers, especially in critical markets like China.

The iPhone was the undisputed star, generating $85.3 billion in revenue — a staggering 23% jump year-over-year. This growth was complemented by the Services segment, which reached a new all-time high of $30.0 billion, growing 14%. The most surprising and positive development was the 38% revenue explosion in Greater China, reversing a multi-year trend of declines and signaling that Apple has regained its footing against local competitors.

The company produced $53.9 billion in operating cash flow. This liquidity funded an aggressive capital return program, with $25 billion spent on share buybacks and nearly $4 billion in dividends. CEO Tim Cook explicitly linked the upgrade cycle to "Apple Intelligence," noting that AI features are the top driver for customers trading in older devices. CFO Luca Maestri highlighted that while demand is exceptional, the company is facing supply constraints on advanced 3nm chips, which may limit upside in the short term.

The company expects Q1 revenue to grow between 13% and 16% year-over-year, suggesting the iPhone momentum will carry well into the year.

Long Apple.

👉 Investor Events / Global Affairs:

Gold & silver had their worst day since 1980, the crypto bear market accelerated over the weekend, and Elon Musk might pull off one of the craziest company mergers of all time.

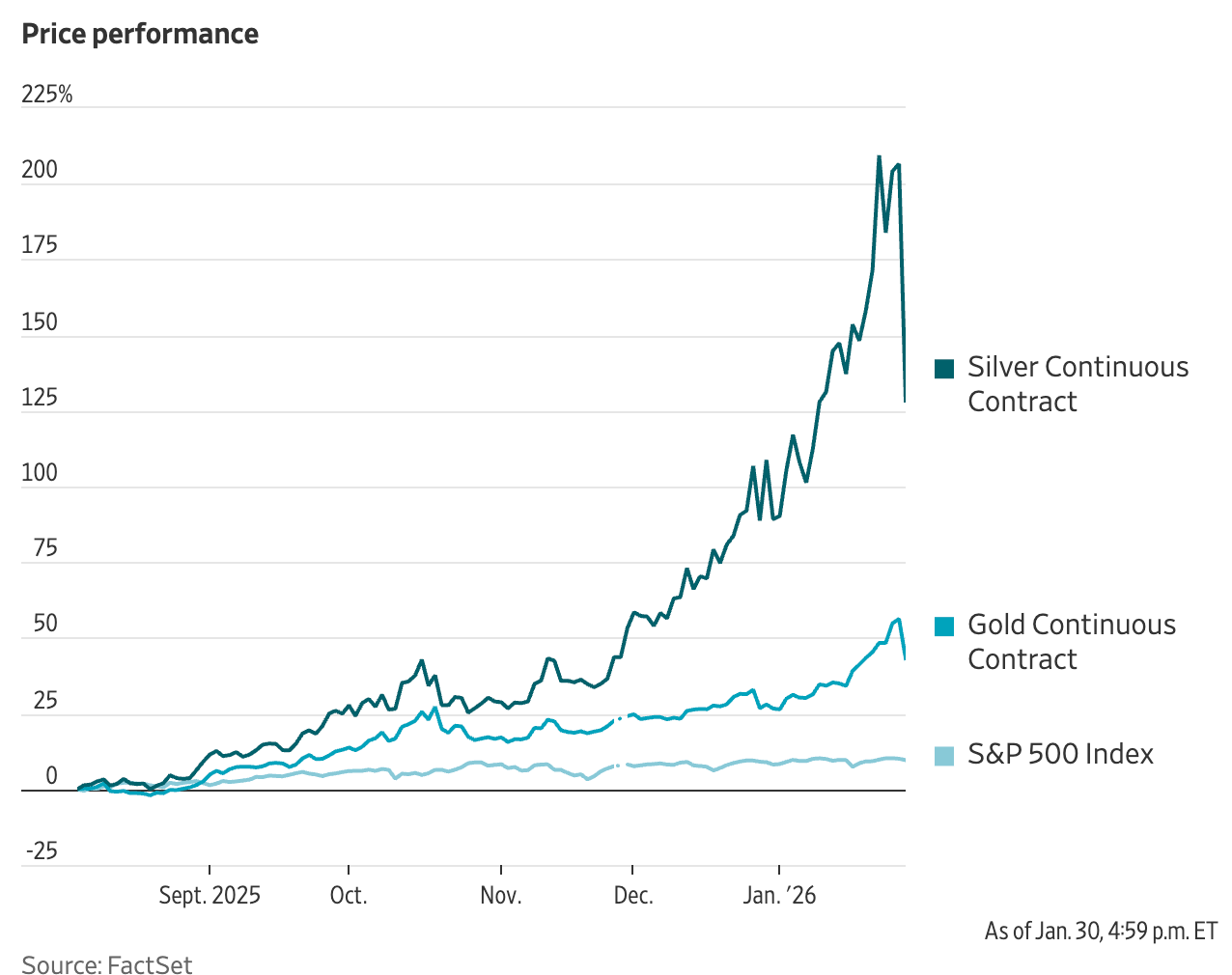

Gold & Silver Have Worst Day Since 1980 After Fed Chair Announcement

Gold and silver suffered their worst one-day declines since 1980, with silver plunging -31% and gold posting a record single-day dollar drop after months of parabolic gains. The selloff was triggered by reports that President Trump would nominate Kevin Warsh, viewed by Wall Street as hawkish on inflation, to replace Jerome Powell as Fed chair.

That expectation eased fears of currency debasement, strengthened the dollar to its best day in months, and rapidly unwound the popular “debasement trade” that had fueled precious metals. Gold futures fell -11% while the sharp reversal caught investors across central banks, vaults, and trading desks off guard due to thin liquidity and crowded positioning.

The move weighed on mining stocks and broader markets, pushing the S&P 500 and Dow down 0.4% and the Nasdaq down 0.9%. Analysts say the plunge likely reflects a mix of profit-taking, risk management, and fragile market structure rather than retail panic, even as uncertainty remains about what precisely drove such extreme volatility.

More on the Fed Chair announcement below!

“We had identified about three or four weeks ago that it turned into a momentum trade, not a fundamental trade… We were just riding it, waiting for this type of thing to happen.”

Bitcoin Broke Below $80K During Intense Weekend Selloff

Subscribe to GRIT Premium to read the rest.

Become a paying subscriber of GRIT Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • WEEK IN REVIEW: Full access to the internet's best recap of the markets, every single week. This includes comprehensive earnings breakdowns, portfolio updates, and more. This is the perfect compliment to the "Investing Week Ahead" post that you already receive at the beginning of each week.

- • MONTHLY LIVESTREAMS: Join Austin Hankwitz live every month to dive deep into his portfolio, explore the latest trends, discuss any changes he’s making, and cover market-moving topics.

- • PORTFOLIO ACCESS – Austin Hankwitz, Warren Buffett, Bill Ackman, and other professional / billionaire investor portfolios.

- • MONTHLY STOCK DEEP DIVES – Comprehensive stock analysis on an individual ticker, delivered at the end of each month.

- • RESOURCES – A wide variety of investment resources for both beginners and advanced investors to accelerate your portfolio.