- GRIT

- Posts

- 👉 Trump Headlines Dominated the Week

👉 Trump Headlines Dominated the Week

Netflix, United, Intel

Together with Quantify Funds

👉 Week in Review — Too Long; Didn’t Read:

Key Earnings Announcements:

Netflix guided to a record $50B in revenue for 2026.

Intel reported a -$450M loss due to heavy manufacturing investments.

United Airlines reported record revenue due to their premium cabin segmentation.

Investor Events / Global Affairs:

Takeaways from Trump at the World Economic Forum.

Another government shutdown appears to be likely.

Amazon expanded further into healthcare AI.

Economic Updates:

Core PCE held steady.

GDP growth continued to accelerate.

Pending home sales plummeted.

Together with Quantify Funds

Total Return & Weekly Options Income

Tax efficient options strategies

Return Stacking - Addition without Subtraction

Learn more at https://docs.quantifyfunds.com/kbjMUv7t8hq

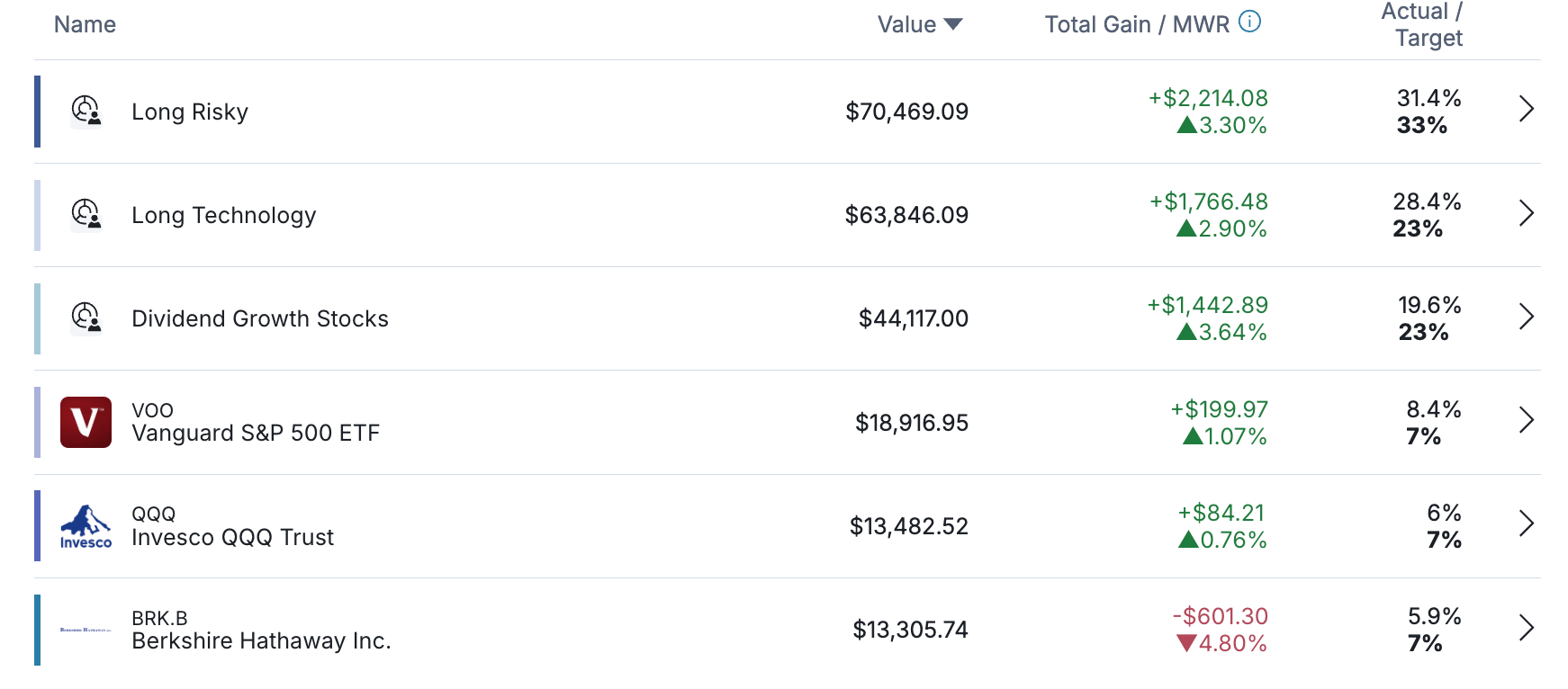

👉 Portfolio Updates

The portfolio continues to trend in the right direction year-to-date, up around $5K in market gains (+2.4%). This strength is being led by the “Dividend Growth Stocks” subsection, up +3.6%. There’s about a half dozen names in this subsection up double digit percentage points — with the largest gainer up around +20% YTD.

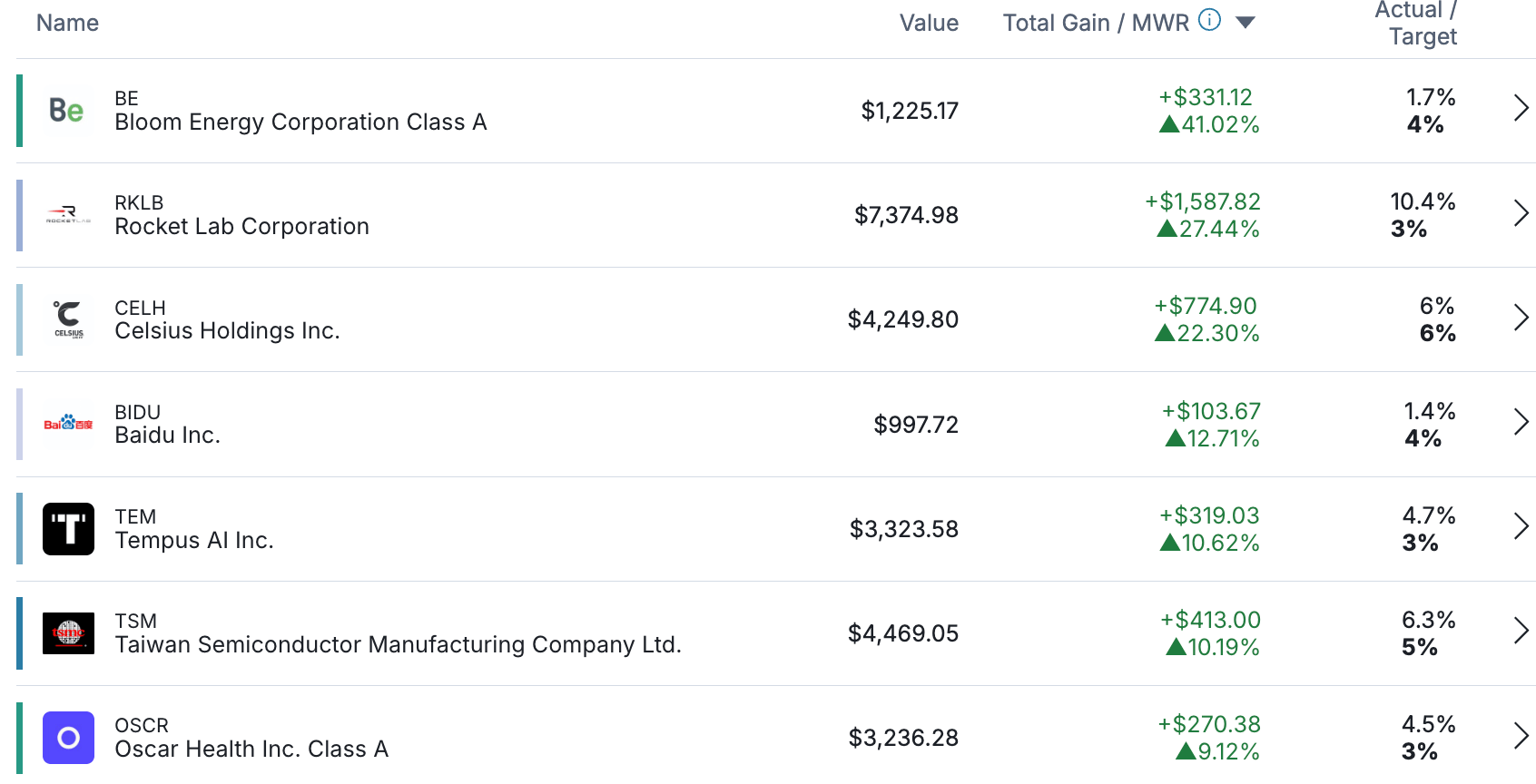

In the “Long Risky” subsection we’re seeing plenty of double digit gainers, with Bloom Energy up +41% YTD.

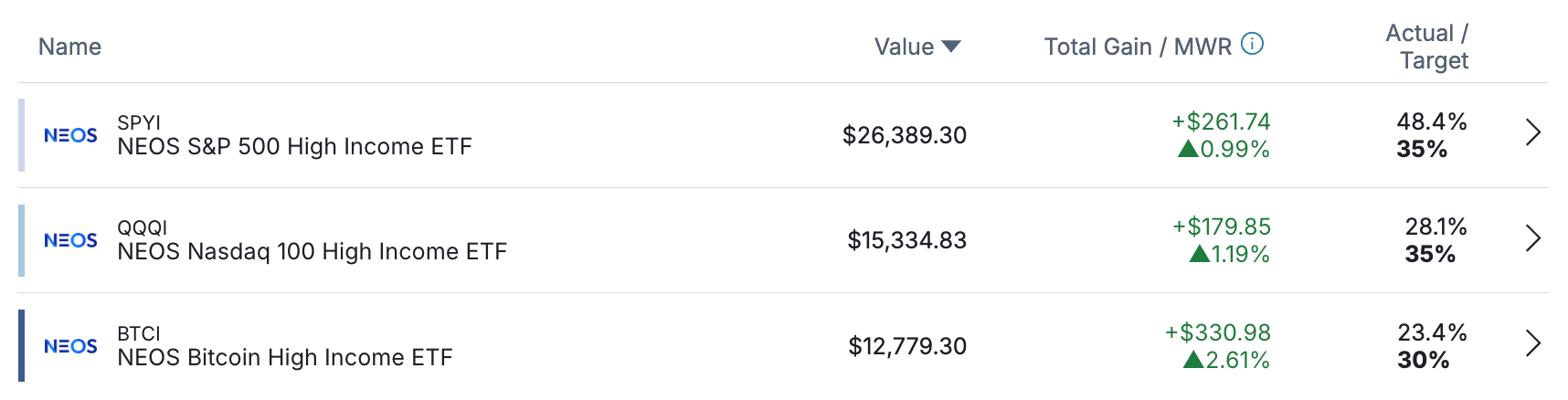

The “Monthly Income” subsection is doing exactly what it’s supposed to be doing — generating tax-efficient monthly income. Very happy with this!

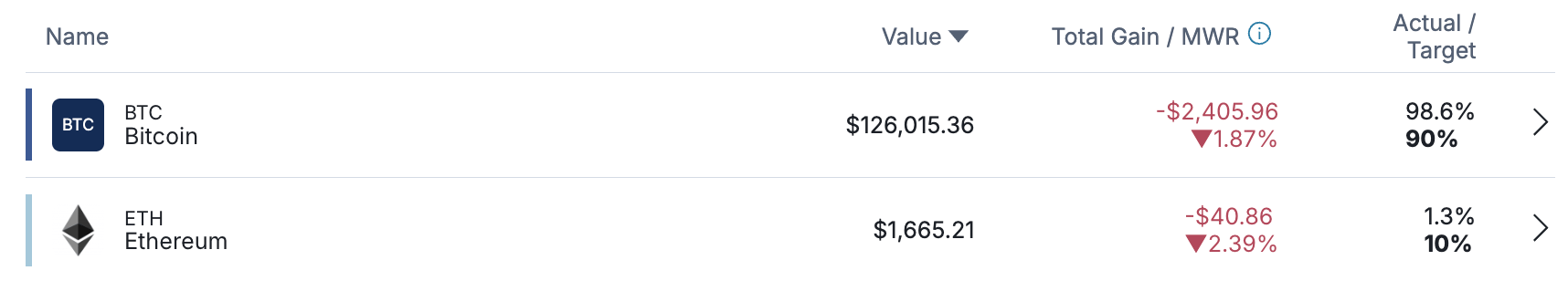

Finally, the crypto portfolio is relatively flat YTD. I still firmly believe we’ll experience one more push to the upside in Bitcoin before a “Crypto Winter” ensues.

I plan to continue to deploy around $10K / month of capital toward this portfolio as a whole in 2026. I also plan to exit my Berkshire Hathaway position and instead park it 50/50 in IWM and RSP — as I believe small caps and “equal-weight” S&P 500 will experience strength in 2026. Stay tuned!

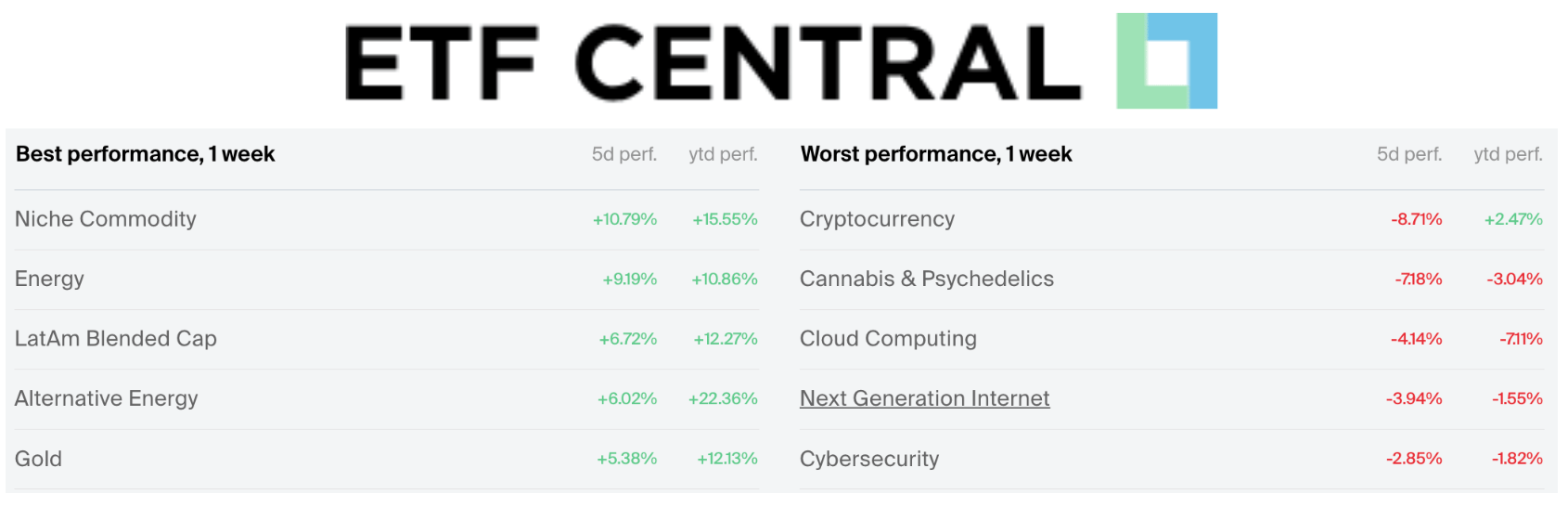

👉 Best and Worst ETF Performers of the Week

👉 Key Earnings Announcements:

Netflix guided to a record $50B in revenue for 2026, Intel reported a -$450M loss due to heavy manufacturing investments, and United Airlines reported record revenue due to their premium cabin segmentation.

Netflix (NFLX)

Key Metrics

Revenue: $12.1 billion, an increase of +18% YoY

Operating Income: $3.0 billion, an increase of +30% YoY

Profits: $2.4 billion, an increase of +29% YoY

Earnings Release Callout

“In 2025, we met or exceeded all of our financial objectives... growing ad sales by 2.5x and delivering record member engagement. As we look to 2026, we are focused on closing the acquisition of Warner Bros. Studios and HBO, which we see as a strategic accelerant to our library and production capabilities. We are still under 10% of TV time in all major markets, so the opportunity ahead remains massive.”

My Takeaway

The company achieved record revenue and subscriber numbers, driven by a powerful content slate and the successful execution of its live sports strategy with the NFL. Diving into the business highlights, the most significant metric was the subscriber count, which crossed the 325 million paid membership milestone. This growth was fueled by the "cultural phenomenon" of the NFL Christmas games and the return of heavy-hitting franchises like Stranger Things. The advertising business has also matured into a serious revenue stream, growing 2.5x year-over-year to exceed $1.5 billion, with management projecting it will double again in 2026.

Operating margins expanded to 24.5%, free cash flow for the year reached an impressive $9.5 billion, and the company is well capitalized to purchase Warner Bros. Discovery.

Co-CEOs Ted Sarandos and Greg Peters emphasized that despite their size, they still command under 10% of TV time in major markets, leaving plenty of room for growth. They highlighted the "Live" strategy as a retention tool, noting that live sports viewers churn less. The integration of Warner Bros. was described as a key priority for 2026, with plans to offer HBO content as part of a premium tier.

The company expects full-year revenue to surpass $50 billion for the first time, landing between $50.7 billion and $51.7 billion. Operating margins are forecasted to expand further to 31.5%, and the company expects to generate approximately $11 billion in free cash flow.

Slowly but surely building a position. Long Netflix.

Intel (INTC)

Key Metrics

Revenue: $14.9 billion, an increase of +4% YoY

Operating Loss: -$450.0 million, compared to $2.6 billion last year

Net Loss: -$210.0 million, compared to $2.7 billion last year

Earnings Release Callout

“This quarter marks the culmination of our relentless pursuit to regain process leadership. We have successfully taped out Panther Lake on Intel 18A, and the node is now manufacturing-ready with defect densities within our target range. While the financial transformation is ongoing, the technical turnaround is complete. We are now entering the execution phase of IDM 2.0.”

My Takeaway

The quarter was defined by the successful validation of the 18A manufacturing process and a resurgence in the PC market, offset by continued struggles in the Data Center against entrenched competitors.

Diving into the business highlights, the Client Computing Group (CCG) was the standout performer, growing revenue 12% to $9.3 billion. This growth was fueled by the "AI PC" cycle, with strong demand for the new Lunar Lake processors boosting average selling prices. Conversely, the Data Center & AI (DCAI) segment struggled, with revenue declining 8% to $3.6 billion as market share losses to AMD continued, despite growing interest in the Gaudi 3 AI accelerator. The Intel Foundry segment saw external revenue grow 14%, but operating losses widened to $2.8 billion as the company pours capital into new factories.

CEO Pat Gelsinger’s declared that the "technical turnaround is complete." He confirmed that the 18A node is manufacturing-ready and meeting defect density targets, a critical milestone for the IDM 2.0 strategy. Management also leaned heavily into the "AI PC" narrative, projecting that 40% of PCs shipped in 2026 will be AI-capable, a trend that favors Intel’s volume leadership.

Intel issued guidance for the first quarter of Fiscal 2026. Revenue is expected to range between $12.5 billion and $13.5 billion, reflecting typical seasonality. GAAP gross margin is forecasted to tick up to 38.0%.

No position.

United Airlines (UAL)

Key Metrics

Revenue: $14.4 billion, an increase of +6% YoY

Operating Income: $1.1 billion, compared to $1.4 billion last year

Profits: $850.0 million, compared to $1.0 billion last year

Earnings Release Callout

“Our 'United Next' strategy is working. The industry has structurally changed, and we are on the winning side of that change. Customers are voting with their wallets for a premium experience and a global network that can take them anywhere. While we navigate supply chain constraints, our operational reliability and product segmentation are delivering record revenue and solidifying our position as the flag carrier of the U.S."

My Takeaway

United Airlines delivered a record revenue performance to close the year, leveraging its massive international network and premium cabin segmentation to offset rising structural costs. The airline continues to validate its "United Next" strategy, successfully capturing high-yield travelers while using Basic Economy to compete effectively against struggling low-cost carriers.

The international segment remains United's crown jewel, with passenger revenue growing 9% led by the Atlantic and Pacific regions. Premium revenue outpaced the rest of the cabin, growing 11%, proving that customers are willing to pay up for comfort. The MileagePlus loyalty program continued its strong performance, generating $2.1 billion in third-party cash flow. Operationally, the company is managing through significant Boeing delivery delays by pivoting to Airbus aircraft and extending the lives of existing planes to maintain capacity discipline.

CEO Scott Kirby asserted that the industry has fundamentally changed in favor of premium, global carriers. He highlighted that customers are "voting with their wallets" for reliability and network breadth.

United issued strong guidance for Fiscal 2026. The company expects Q1 revenue to grow between 4% and 6%. For the full year, they forecasted Adjusted EPS between $11.00 and $12.00, implying confidence in their ability to expand margins as they fully digest the recent labor cost increases.

No position.

👉 Investor Events / Global Affairs:

Takeaways from Trump at the World Economic Forum, Another government shutdown appears to be likely, and Amazon expanded further into healthcare AI.

Takeaways from Trump at the World Economic Forum in Davos

Source: Fabrice Coffrini/AFP via Getty Images

At the World Economic Forum in Davos, Donald Trump said he has reached a long-term “framework” deal on Greenland focused on Arctic security and mineral rights, while backing off threatened tariffs on Europe. He also hinted that he has effectively chosen the next chair of the Federal Reserve, narrowing the field to one finalist but declining to name them ahead of Jerome Powell’s term ending in May.

Trump strongly defended his proposal for a one-year 10% cap on credit card interest rates, framing it as a necessary affordability measure despite warnings from major banks. On Iran, he said he hopes further US military action won’t be needed, while reiterating that Iran must halt its nuclear ambitions and leaving force on the table.

He also emphasized housing affordability, arguing that large institutional investors buying single-family homes have crowded out individual buyers. Overall, the interview underscored Trump’s blend of aggressive deal-making abroad and populist economic policies at home centered on costs, credit, and housing.

“We probably won't get anything unless I decide to use excessive strength and force where we would be, frankly, unstoppable. But I won't do that… Now everyone's saying, 'Oh, good.' That's probably the biggest statement I made, because people thought I would use force," Trump said. "I don't have to use force. I don't want to use force. I won't use force."

Another Government Shutdown Seems Likely

Subscribe to GRIT Premium to read the rest.

Become a paying subscriber of GRIT Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • WEEK IN REVIEW: Full access to the internet's best recap of the markets, every single week. This includes comprehensive earnings breakdowns, portfolio updates, and more. This is the perfect compliment to the "Investing Week Ahead" post that you already receive at the beginning of each week.

- • MONTHLY LIVESTREAMS: Join Austin Hankwitz live every month to dive deep into his portfolio, explore the latest trends, discuss any changes he’s making, and cover market-moving topics.

- • PORTFOLIO ACCESS – Austin Hankwitz, Warren Buffett, Bill Ackman, and other professional / billionaire investor portfolios.

- • MONTHLY STOCK DEEP DIVES – Comprehensive stock analysis on an individual ticker, delivered at the end of each month.

- • RESOURCES – A wide variety of investment resources for both beginners and advanced investors to accelerate your portfolio.