- GRIT

- Posts

- 👉 Your Big Tech Earnings Breakdown

👉 Your Big Tech Earnings Breakdown

Amazon, Google, Meta

👉 Week in Review — Too Long; Didn’t Read:

Key Earnings Announcements:

Alphabet delivers $100 billion in quarterly revenue for the first time.

Microsoft RPOs grew by +51% to $392 billion.

Amazon is planning to spend $125 billion this year in capital expenditures.

Investor Events / Global Affairs:

Meta dropped after revealing significant AI spending.

PayPal surged after announcing an OpenAI partnership.

Fiserv crashed after one of the worst earnings reports in recent memory.

Economic Updates:

The government is still shut down, but the Fed cut interest rates amid uncertainty.

Happy Sunday.

Before we breakdown the week for you — be sure to check out our latest news below!

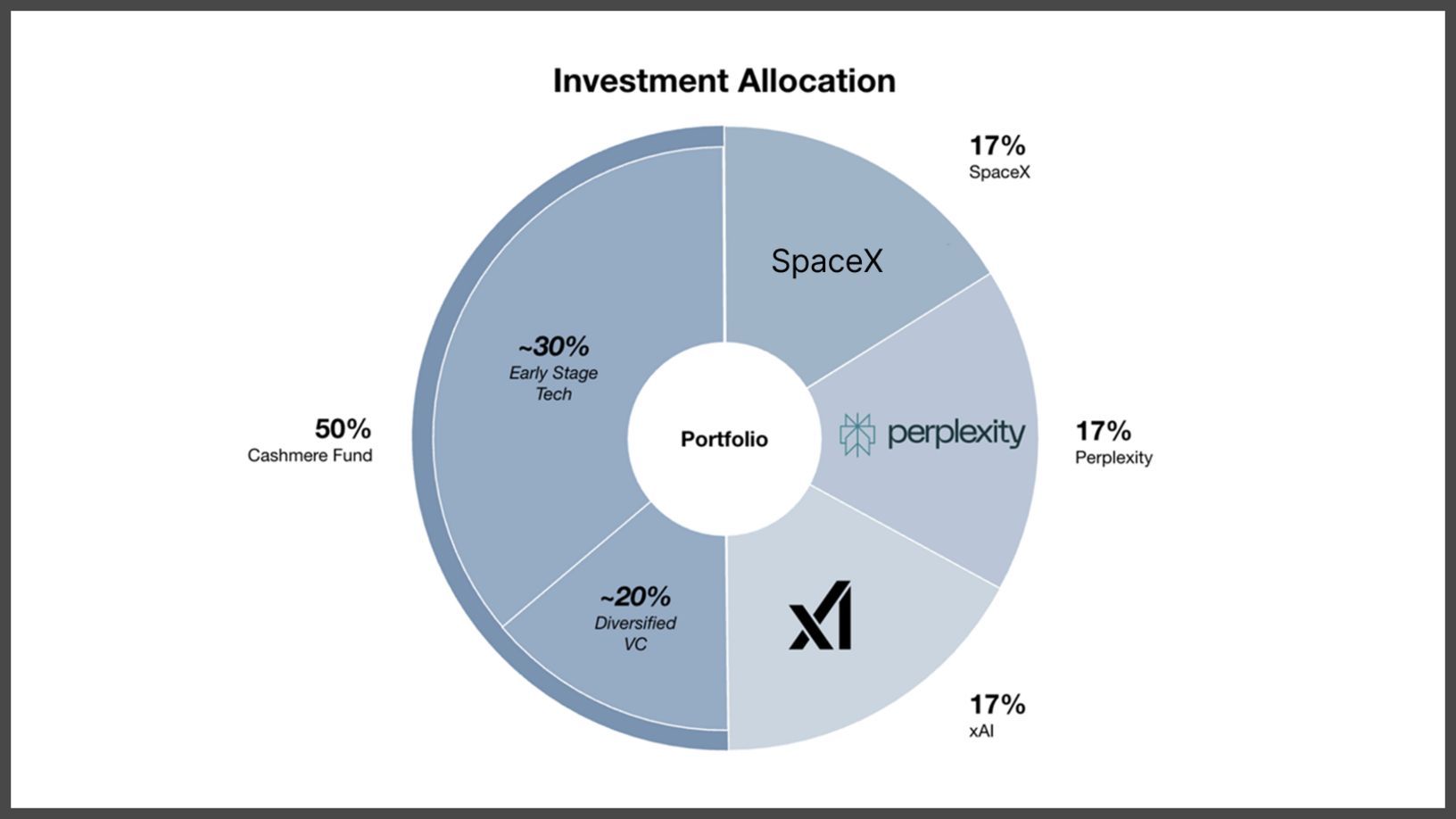

For the first time ever, accredited investors can invest alongside me in SpaceX, Perplexity, xAI, and all 38 holdings inside The Cashmere Fund (including MrBeast’s Beast Industries, Katy Perry’s De Soi, Graza, and more) — all through one single investment ($7,500 minimum).

The structure is simple, yet powerful:

17% SpaceX

17% xAI

17% Perplexity

50% Cashmere Fund

This vehicle provides broad-based exposure across tech and consumer sectors, from Pre-Seed to Pre-IPO — and it’s all accessible through our partnership with Republic.

CLICK HERE TO LEARN MORE. Because I’m partnered with Republic, this opportunity is open to the public. As long as you’re accredited, you can participate. Feel free to share the details with your friends!

Your career will thank you.

Over 4 million professionals start their day with Morning Brew—because business news doesn’t have to be boring.

Each daily email breaks down the biggest stories in business, tech, and finance with clarity, wit, and relevance—so you're not just informed, you're actually interested.

Whether you’re leading meetings or just trying to keep up, Morning Brew helps you talk the talk without digging through social media or jargon-packed articles. And odds are, it’s already sitting in your coworker’s inbox—so you’ll have plenty to chat about.

It’s 100% free and takes less than 15 seconds to sign up, so try it today and see how Morning Brew is transforming business media for the better.

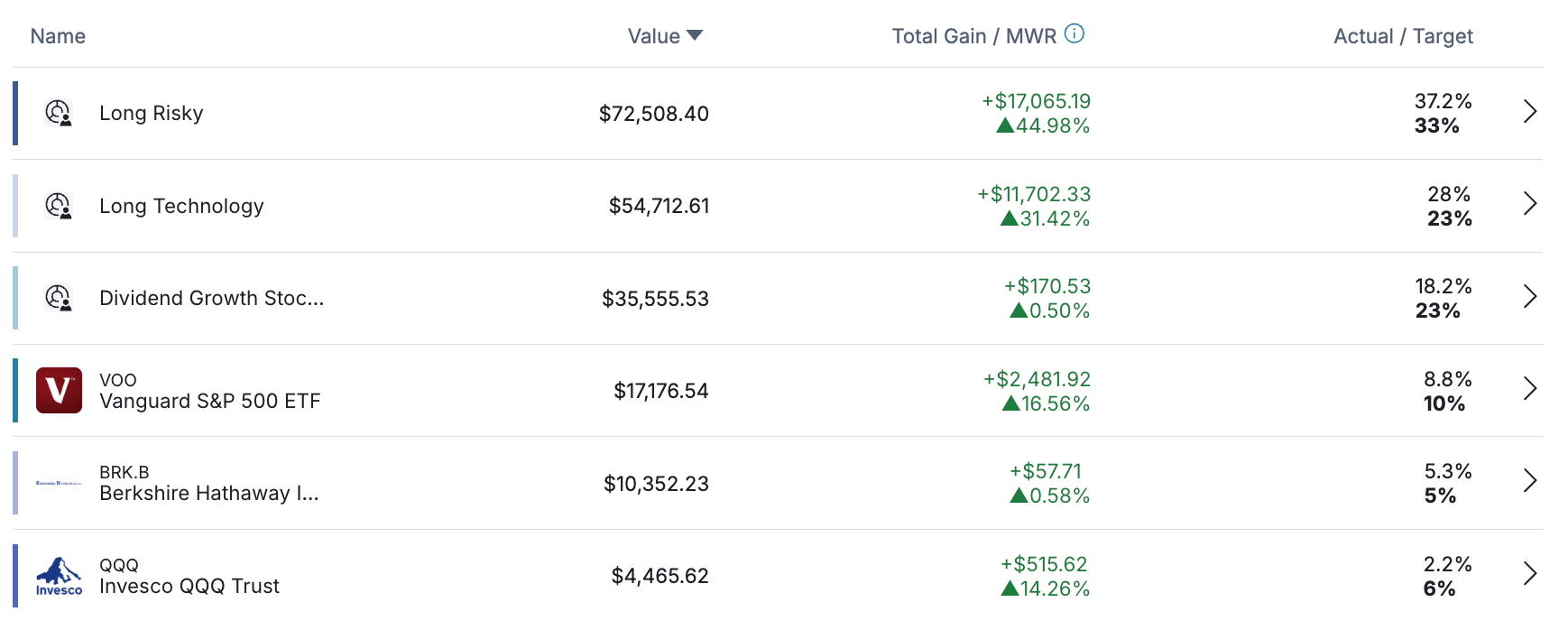

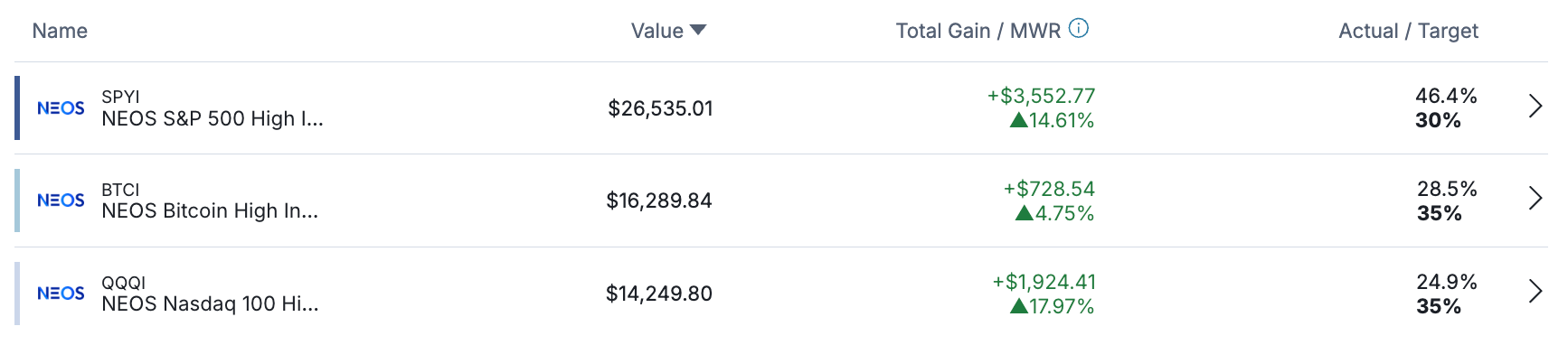

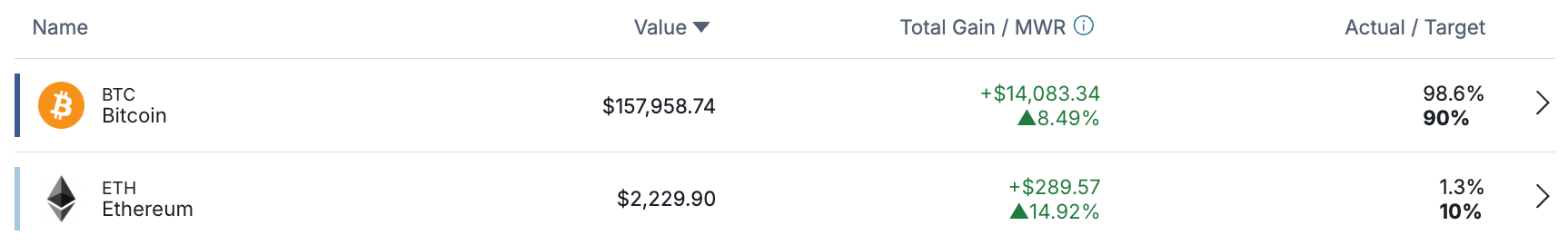

👉 Portfolio Updates

No material changes made to the portfolio over the week. I reinvested my NEOS distribution of about $800 back into QQQI. Besides that, waiting to deploy new capital over the coming weeks in November.

👉 Key Earnings Announcements:

Alphabet delivers $100 billion in quarterly revenue for the first time, Microsoft RPOs grew by +51% to $392 billion, and Amazon is planning to spend $125 billion this year in capital expenditures for AI.

Alphabet (GOOGL)

Key Metrics

Revenue: $102.3 billion, an increase of +16% YoY

Operating Income: $31.2 billion, an increase of +31% YoY

Profits: $35.0 billion, an increase of +33% YoY

Earnings Release Callout

“Alphabet had a terrific quarter, with double-digit growth across every major part of our business. We delivered our first-ever $100 billion quarter. Our full stack approach to AI is delivering strong momentum and we’re shipping at speed, including the global rollout of AI Overviews and AI Mode in Search in record time. In addition to topping leaderboards, our first party models, like Gemini, now process 7 billion tokens per minute, via direct API use by our customers. The Gemini App now has over 650 million monthly active users. We continue to drive strong growth in new businesses. Google Cloud accelerated, ending the quarter with $155 billion in backlog. And we have over 300 million paid subscriptions led by Google One and YouTube Premium.”

My Takeaway

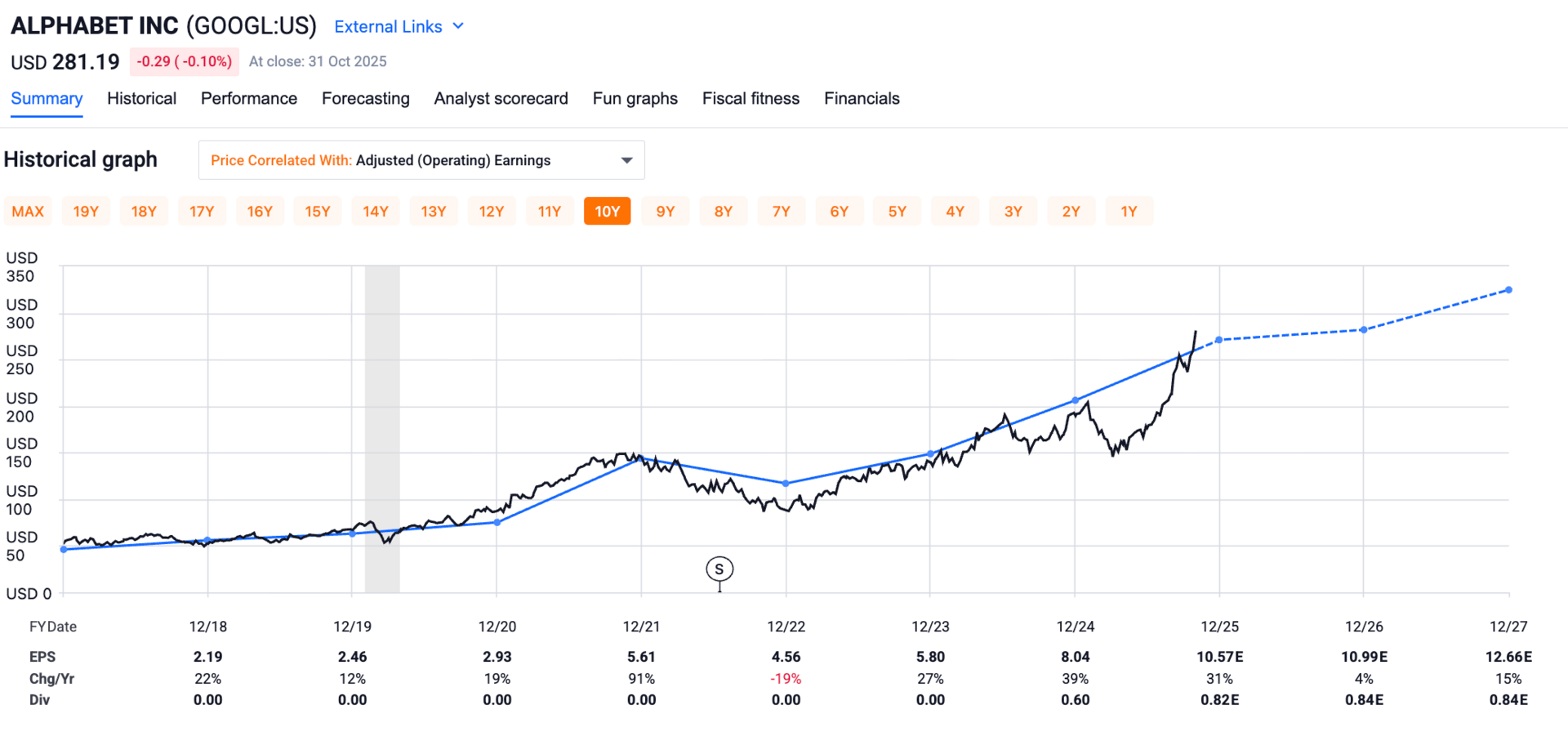

Who else remembers when everyone was running for the hills earlier this year claiming Google Search was going to become extinct thanks to ChatGPT? Over the long-term, maybe — but not yet. The company reached an incredible milestone of delivering $100B+ in quarterly revenue for the first time. It’s hard to completely understand the scale of that, especially considering they’re running a business at a 30% operating margin.

Profitability appears to be holding firm despite heavy investment and the scale of operations. The company also took the opportunity to raise its full-year CapEx guidance to $91-$93 billion, underlining that it is doubling down on future infrastructure—data centers, AI compute, next-gen hardware—to support new growth waves.

It’s obvious to me Alphabet (Google) is going to continue to be a long-term winner in the AI race — it was their race to lose and they’re obviously not going to go down without a fight. Congrats to everyone who remained optimistic about the company’s future. The above graph does a wonderful job illustrating how patience can pay off if your investment thesis and conviction remain.

Long Google.

Microsoft (MSFT)

Key Metrics

Revenue: $77.6 billion, an increase of +18% YoY

Operating Income: $38.0 billion, an increase of +24% YoY

Profits: $27.7 billion, an increase of +13% YoY

Earnings Release Callout

“Our planet-scale cloud and AI factory, together with Copilots across high value domains, is driving broad diffusion and real-world impact. It’s why we continue to increase our investments in AI across both capital and talent to meet the massive opportunity ahead.

We delivered a strong start to the fiscal year, exceeding expectations across revenue, operating income, and earnings per share. Continued strength in the Microsoft Cloud reflects the growing customer demand for our differentiated platform.”

My Takeaway

Microsoft is firing on all cylinders! Revenue grew by +18%, signalling that Microsoft’s platforms remain robust across enterprise and consumer segments. The Intelligent Cloud segment led the charge, growing roughly mid‐20s percent and reinforcing Microsoft’s role as a cornerstone of enterprise digital transformation.

Profitability remains strong. The large capital expenditures—about $34.9 billion in the quarter—underscore just how aggressively Microsoft is moving into AI infrastructure and ahead of what it sees as the next major wave in computing. While such spending could impair near-term margin expansion, the company appears confident in its ability to monetize these investments.

The growth of RPO (remaining performance obligation) to ~$392 billion, up ~51% YoY, provides visibility into future revenue streams, suggesting that many of Microsoft’s customers are locking into multi-year commitments, which should help stabilize growth ahead.

Strategically, Microsoft is balancing scale, investment, and monetization. The company is clearly pivoting toward being not just a cloud provider, but a fundamental AI infrastructure player—its massive spend and RPO backlog reflect that ambition. Still, the execution challenge is real: turning billions of dollars in capex and infrastructure into sustained margin growth and higher return on invested capital is a longer‐term story rather than an immediate payoff.

Long Microsoft.

Amazon (AMZN)

Subscribe to GRIT Premium to read the rest.

Become a paying subscriber of GRIT Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • WEEK IN REVIEW: Full access to the internet's best recap of the markets, every single week. This includes comprehensive earnings breakdowns, portfolio updates, and more. This is the perfect compliment to the "Investing Week Ahead" post that you already receive at the beginning of each week.

- • MONTHLY LIVESTREAMS: Join Austin Hankwitz live every month to dive deep into his portfolio, explore the latest trends, discuss any changes he’s making, and cover market-moving topics.

- • PORTFOLIO ACCESS – Austin Hankwitz, Warren Buffett, Bill Ackman, and other professional / billionaire investor portfolios.

- • MONTHLY STOCK DEEP DIVES – Comprehensive stock analysis on an individual ticker, delivered at the end of each month.

- • RESOURCES – A wide variety of investment resources for both beginners and advanced investors to accelerate your portfolio.