- GRIT

- Posts

- 👉 $100K+ Portfolio Update

👉 $100K+ Portfolio Update

Constellation Brands, Oil Prices, Port Strike Updates

Happy Sunday, everyone.

To those of you that are continuing to deal with the aftermath of Hurricane Helene — you remain in our thoughts and prayers. To those of you that are preparing for Hurricane Milton — please do what’s necessary to prepare!

Let’s jump into everything from the past week in the market.

Portfolio Updates:

After taking sort of a “capital deploying hiatus” in September, October has been off to a great start! I’ve made some interesting changes — let me explain.

First and foremost, one of my primary goals with the portfolio is to grow my Berkshire Hathaway (BRK.B) position to ~$15K in value. I continued to inch toward that goal earlier this week by adding another +$2,500 — bringing my position to ~$6,300 in value.

Again, we’re only up +6.5% on the idea because we began the trade early-August.

Now the real update — I’m doubling down on monthly income via my portfolio. As you all know, the largest positions inside of the “Dividend Growth Stocks” section include SPYI and QQQI. Well, now the largest position held across all stocks in the portfolio is SPYI.

At the moment, I have ~$45,000 invested into this monthly-paying covered call ETF. By the end of the month, this position will be closer to $100,000 — paying me ~$1,000 per month in tax-free income. In case you’re not familiar with SPYI, here’s a detailed analysis I wrote a few months ago comparing it to the most popular covered call ETFs.

As you can see, I’m hyper-bullish on the ETF when it comes to tax-free income paired with upside price appreciation in rising markets. The monthly income generated from this position in my portfolio will be entirely reinvested back into the ETF.

Before you all call me crazy — yes, the price appreciation of the ETF has “only” been +6.2% YTD, but the total return is +16.5% YTD (when you include the monthly income). SPYI is outperforming both XYLD and JEPI year-to-date by +3.4% and +3.1%, respectively — while offering tax-free income compared to JEPI’s “equity-linked notes.”

$100,000 invested into an income-producing ETF with strong total returns + another $117,000 invested into a well-diversified portfolio of dividend growth stocks and other high-octane names = a portfolio I can get excited about!

Can’t forget about the $150K invested into Bitcoin and Ethereum!

2024 is shaping up to be another market-beating year. I don’t want to jinx anything, but with less than 3 months left, we’re hanging in there and certainly trending in the right direction.

If you’ve not yet become a paid subscriber — what are you waiting for?

We’re actively deploying 10s of thousands of dollars every single month into the markets in the most transparent way possible … with screenshots!

Join us by clicking this link — you’ll get full portfolio access :)

Week in Review — Too Long, Didn’t Read:

Carnival has already booked 50% of 2025’s availability, Nike continues to fall out of favor, Constellation Brands delivered over $300M in cost savings in only 12-months, Oil continues to surge higher, Hurricane Helene left a very messy insurance situation, Tesla slightly missed on delivery numbers, the jobs report delivered smooth results for anxious economists and the port strike is finished for the remainder of the year.

Key Earnings Announcements:

Carnival has already booked 50% of 2025’s availability, Nike continues to fall out of favor, and Constellation Brands delivered over $300M in cost savings in only 12-months.

Carnival Corporation (CCL)

Key Metrics

Revenue: $7.9 billion, an increase of +15% YoY

Operating Income: $2.2 billion, an increase of +34% YoY

Profits: $1.7 billion, an increase of +62% YoY

Earnings Release Callout

"We delivered a phenomenal third quarter, breaking operational records and outperforming across the board. Our strong improvements were led by high-margin, same-ship yield growth, driving a 26 percent improvement in unit operating income, the highest level we have reached in fifteen years.

We are poised to deliver record operating performance for full year 2024, with adjusted EBITDA now expected to cross $6 billion and adjusted return on invested capital to be approximately 10.5 percent.”

My Takeaway

While the company seems to be delivering record-breaking financial results, their stock is still in the red year-to-date (down -2%) — and has yet to recover to pre-Covid highs (down -50%).

So let’s break this all down…

Management noted the company has already booked 50% of next year’s availability, and 66% of the next 12-months’ — and all at higher prices than before. While this is certainly encouraging, Wall Street still believes that there comes a point where the still-expanding bookings curve inflects — halting the continued pricing power. They don’t believe this will happen over the coming 12-months, which means 2025 very well might be an awesome year for Carnival — but I think this assumption is what’s really holding back their stock from trending higher.

Wall Street is expecting $6.5B in adj. EBITDA for the company in 2025, while giving them a $19 price target. This price target is assuming the company delivers upon that $6.5B in 2025 adj. EBITDA — then assigning their average ~8.6X multiple against it.

On a price-to-earnings basis, the company’s stock trades at 10.5X 2025’s EPS estimates — which is historically “cheaper” than it’s ~12.5X average. If you’re someone looking to take a bite of the cruise line industry, maybe this is your chance?

For me, I’m staying on the sidelines with Carnival — no shares.

Nike (NKE)

Key Metrics

Revenue: $11.6 billion, compared to $13.0 billion last year

Operating Income: $7.5 billion, compared to $8.8 billion last year

Profits: $1.0 billion, compared to $1.5 billion last year

Earnings Release Callout

“NIKE's first quarter results largely met our expectations. A comeback at this scale takes time, but we see early wins — from momentum in key sports to accelerating our pace of newness and innovation. Our teams are energized as Elliott Hill returns to lead NIKE's next stage of growth.”

My Takeaway

Well, that sucked.

Revenue — down. Operating income — down. Profits — down. Everything — down.

Let’s rewind for a moment here — Nike, for most of its history, has been an absolute powerhouse. Athleisure took the world by storm in 2020 as everyone was working from home — and hasn’t really slowed down since. Legacy companies like Nike and Lululemon benefitted from this trend in the beginning, but as capitalism tells us — when there’s opportunity there’s competition.

Nike sort of floundered throughout 2021, 2022, and then really began to meet their demise in 2023. The company has hired a new CEO to right the ship — but righting a ship of this caliber in only a few months simply can’t be done.

When it comes to companies like Nike, investors need to consider two key trends — 1) gross profit margins stabilizing, allowing the company to continue to sell with less and less promotion, and 2) sales contraction stabilizing and perhaps even improving.

Neither of those things are happening right now for Nike — which tells me there’s more bleeding to come. Inventory levels for Nike remain elevated in an already promotional environment, and management expects gross margins to contract -1.5% next quarter.

Nike will recover — let me be very clear when I say that. However, their “new CEO” or their “new marketing plan” or “whatever else they can do to right the ship” is not going to happen overnight. This is a multi-year recovery process for the company, and until I see a “bottom” in the two key trends shared above I’ll remain on the sidelines.

No shares.

Constellation Brands (STZ)

Key Metrics

Revenue: $2.9 billion, an increase of +3% YoY

Operating Loss: -$1.2 billion, compared to $978.7 million last year

Net Loss: -$1.2 billion, compared to $700.7 million last year

Earnings Release Callout

“We achieved an important milestone of our capital allocation priorities, having reached our target ~3.0X net leverage ratio. We also returned an additional $250 million of cash to shareholders through share repurchases, while continuing to pay our dividend and advance our brewery investments.”

My Takeaway

As you can see above, if you’re someone who believes in this company — today’s valuation might be an awesome long-term (2-3 years) opportunity.

With that being said, I suspect the reason their stock price has underperformed as of late reflects 1) the market’s skepticism about their implied acceleration in beer consumption, and / or 2) the market does not believe STZ will be able to re-accelerate cash flow given macro-driven headwinds (inflation).

Their top line revenue growth will remain up for debate — but what you can’t argue with is their execution against their cost savings plan implemented in November 2023 — $300M of savings thus far!

This money will either de-risk their beer category, or find its way down to the bottom line. And as STZ turns the corner on their capital expenditure re-investment cycle — free cash flow acceleration should be on the horizon. This could catalyze more share buybacks (bullish), a sizeable dividend hike (bullish), or faster debt repayment (bullish) — either way, more cash = higher stock price.

I’m going to add this one to the watchlist — there are clear stock price appreciation catalysts going on here, and I want in.

No position, but that might change.

Investor Events / Global Affairs:

Oil continues to surge higher, Hurricane Helene left a very messy insurance situation, and Tesla slightly missed on delivery numbers.

Middle East Tensions Send Oil Soaring

Oil prices surged +9.1% this week, marking the largest weekly gain since March 2023. The increase followed escalating tensions between Israel and Iran, which raised fears of disruption to Middle East oil supplies. West Texas Intermediate (WTI) settled above $74 per barrel, up +0.9%, after initially rising as much as +2.5%.

The rally slowed when President Biden advised Israel against striking Iran’s oil fields. Iran is currently pumping 3.3 million barrels per day and is the third-largest OPEC producer. Analysts believe an Israeli attack on Iran’s oil infrastructure is unlikely. Energy markets remain volatile, with options markets reflecting investor concerns about further price increases.

“While probabilities for worst-case scenarios are very low, everyone is still biting nails for what will happen in the coming days as we await the retaliatory attack by Israel on Iran.”

Hurricane Helene Causes Insurance Chaos

Source: WSJ

First off — the most important thing to recognize from the recent hurricane is the horrendous loss of life and continued recovery issues. With that being said, let’s talk about this insurance situation…

Homeowners affected by Hurricane Helene are in for a shock as many insurance policies may not cover the full extent of damages. One of the deadliest U.S. hurricanes in recent years has caused $15 billion to $26 billion in property damage, though insured losses will likely be much lower (around $5 billion to $15 billion). Insurers have toughened their policies by adding exclusions for wind-driven rain and increasing deductibles for wind damage — often leaving homeowners responsible for significant repair costs.

In some areas, deductibles have risen to 3% to 5%. This means that a homeowner with a million-dollar property could be liable for up to $50,000 in losses.

Additionally, flood damage is rarely covered by standard home insurance policies, and fewer than 1% of households in the worst-affected inland counties have flood insurance. With the gap between flood risk and coverage growing, many homeowners and small business owners may face rising premiums and legal battles over claims in the coming months.

“The hurricane and storm surge path proved that no one is safe… It’s going to be much more difficult for owners of small businesses and multifamily properties as they rebuild to find insurance that isn’t three or four times what they were paying before.”

Tesla (TSLA) Slightly Missed on Delivery Numbers

Source: Bloomberg / CNBC / Getty Images

Tesla's stock dropped by up to -3.7% after it reported Q3 deliveries of 462,890 vehicles, slightly below analyst expectations. Analysts, including those from FactSet and LSEG, had projected deliveries between 463,310 and 469,828 vehicles. Tesla’s production for the quarter totaled 469,796 vehicles, higher than last year’s 430,488 units produced in the same period.

Tesla continues to feel the heat of increasing competition, particularly in China, from companies like BYD, Geely, and Nio. In the U.S., rivals like Ford and General Motors are also growing their electric vehicle (EV) sales, though Tesla remains the top seller of EVs.

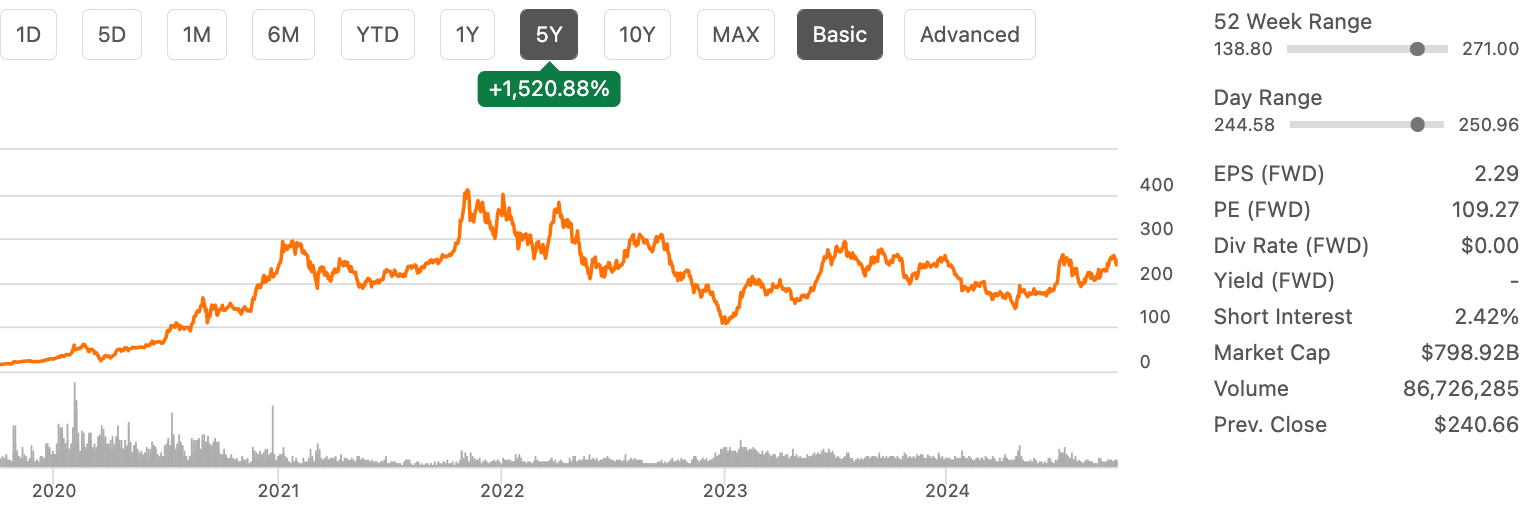

Tesla (TSLA) Stock Performance, 5-Year Chart, Seeking Alpha

Tesla’s stock rose +32% in the third quarter, although it still trails the Nasdaq’s +19% gain for the year. Investors are now looking ahead to Tesla’s upcoming earnings report, with a particular focus on profit margins.

Major Economic Events:

The jobs report delivered smooth results for anxious economists and the port strike is finished for the remainder of the year.

Jobs Report

U.S. job growth surged in September, with nonfarm payrolls increasing by +254,000, the highest in six months. This exceeded the +150,000 estimate, while the unemployment rate unexpectedly fell to 4.1%.

Hourly earnings rose by +4.0% year-over-year, the fastest pace since May, further highlighting wage growth. The leisure, hospitality, health care, and government sectors led the gains, though manufacturing cut jobs for the second consecutive month.

The strong labor report, combined with healthy demand for workers and low layoffs, reduces the likelihood of a larger-than-quarter-point interest rate cut by the Federal Reserve in November.

Additionally, the underemployment rate dropped to 7.7% — the first decline in nearly a year. The participation rate remained steady at 62.7%.

“We think the prospect of soft landing for the economy has brightened... It’s probably premature to conclude that the Federal Reserve’s 50-basis-point rate cut has already stabilized the labor market. What’s more likely is that the Fed’s next move will be a 25-bp cut in November.”

Port Strike Updates

Source: WSJ / Mark Felix / Getty Images

U.S. ports have reopened after dockworkers ended a three-day strike that had closed major ports from Maine to Texas. The strike concluded when employers offered a +62% wage increase over six years, up from a previous +50% offer.

The new deal, which also includes conditions for efficiency gains, was reached after pressure from both the federal government and Florida Governor Ron Desantis activating the Florida National Guard to operate ports.

The strike affected the flow of essential goods like cars and bananas, and the reopening is expected to clear a backlog of over 40 ships. The agreement extends the prior contract to January 2025, while negotiations on other issues (mostly automation) continue.

Source: WSJ

“It is good news the strike has ended, but shippers are not out of the woods just yet. It is only a tentative agreement and automation at ports will remain a major stumbling block… Now they have just 100 days to reach an agreement, otherwise we could see further strike action.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at info@gritcap,io

Reply