- GRIT

- Posts

- 👉 2024 Portfolio Performance Review

👉 2024 Portfolio Performance Review

+74.9% total return & more...

Happy New Year, everyone.

2024 was a year that took a lot of people by surprise.

We were coming off of a +27% total return in the S&P 500 in 2023, artificial intelligence was just beginning to rear its head, and it was an election year.

We also saw the Fed cut rates for the first time since Covid, companies purchased over $1T in corporate buybacks, and valuations in specific sectors of the markets hit sky-high levels.

I want to spend some time reviewing my portfolio’s performance, composition, and weightings. I also plan to share some new ideas near the end of this post, so stay tuned.

2024 Portfolio Performance

During the calendar year of 2024 I personally invested $180,480 toward the Dividend Growth Portfolio. That $180,480 turned into $315,731 in value, resulting in a +74.9% total return throughout the year.

Not bad!

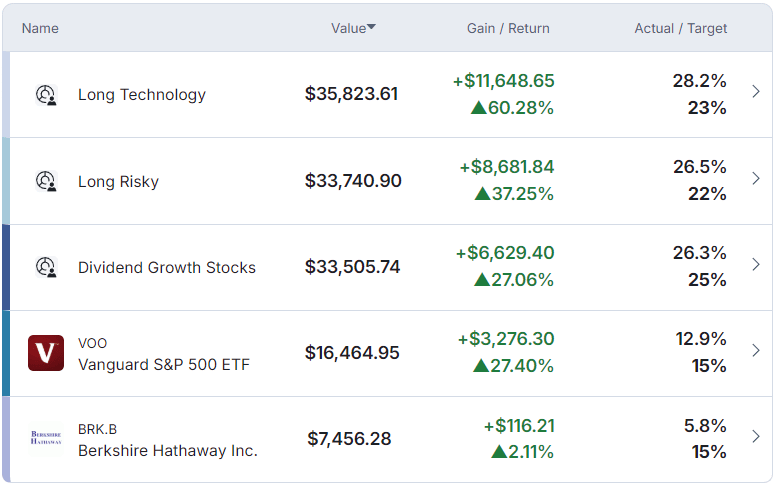

Broken out by asset class, I invested $31,427 into stocks and ETFs — returning 37.1%. This brings our single stock and ETF portfolio’s value up to $126,800 as shown below.

I invested $100,256 into the “Monthly Income” section of my portfolio during the month of October — of which, 75% of it is now invested into Ethereum. It was 100% invested into SPYI until about a month ago.

This section of the portfolio is now worth $95,278 — a -2.8% loss during the last ~8 weeks of the year.

With that being said, I’m very optimistic about Ethereum’s potential price performance during Q1 of 2025 and will continue to hold a 75% weighting of ETHA inside of this section of the portfolio. I fully expect Ethereum’s price to increase from the $3,600 level it is today to ~$5,000 during Q1. If that’s the case, this ~$70K position should increase to ~$100K in value.

Finally, I invested $48,796 into Bitcoin throughout 2024.

This has brought my Bitcoin position up to $237,126 in value. The market gain on that $48,796 was $111,364 — a +103.2% return during the year.

As a quick reminder, my goal is to build my portfolio to $2M in value so that I can retire off of dividend growth stocks. However, getting to $2M is much easier when you’re investing into high-octane asset classes like cryptocurrency, AI-focused stocks, and other growth sectors.

Let’s now break down some of the components of the portfolio.

Biggest Winners & Losers

As shown below, the biggest winning “section” of my portfolio throughout 2024 were the “Long Technology” names — which essentially I define as “Big Tech.” To no one’s surprise, these names continued to dominate 2024 with my two biggest winners being Nvidia and Tesla.

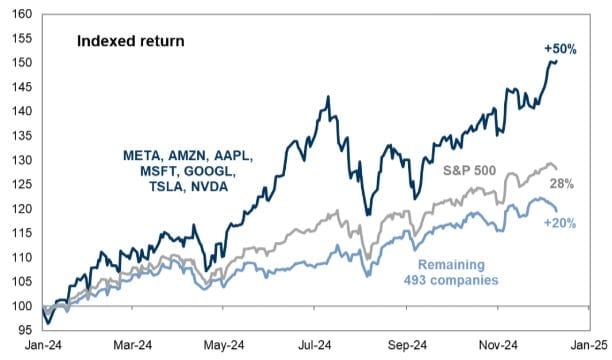

It’s pretty interesting to reflect upon just how dominant the Mag 7 was during the year, after so many people (including myself) remained skeptical of their continued outperformance.

While the S&P 500 was up +28% during 2024, the Mag 7 was up +50% — with the “Other 493” companies up only +20%.

Nvidia led the pack, up a whopping +151% inside of the portfolio due to their continued data center-specific revenue. Tesla experienced a crazy comeback during the last quarter of the year largely due to Elon’s relationship with Donald Trump.

The biggest “loser” inside of this section of the portfolio was Microsoft, up only +13% — underperforming the S&P 500.

Next, the “Long Risky” section of the portfolio.

I define this section of the portfolio as “Small-to-mid cap companies who are either inching toward profitability or are recently declared profitable.” Think of these names as opportunistic ideas.

The biggest winners inside of this section of the portfolio included Hims & Hers Health, On Holdings, and CrowdStrike.

In my opinion, some of the biggest equity winners anyone experienced in the markets in 2024 came from this subsection — companies who were destroyed during the Fed rate hikes of 2022 and whose stock prices were immensely undervalued.

As you might remember, I wrote a deep dive analysis encouraging people to buy HIMS stock back in December 2022 on Seeking Alpha.

The stock is up +300% since publishing that article.

The biggest loser in this section of the portfolio was Adobe, down -22%.

Next, the “Dividend Growth Stocks” section of the portfolio. This is the bread and butter of my long-term investing strategy — owning growing businesses at fair prices who pay a higher dividend to me every single year. These dividends should continue to grow dramatically throughout 2025 if all goes well.

I was paid $1,342 in dividend income in 2024, and it should grow by +28% in 2025 to $1,718.

And who ever said dividend growth stocks have to be boring?

My best performers inside of this section of the portfolio both delivered over +100% returns during 2024 — with an +11% dividend raise from Broadcom and a +26% dividend raise from Williams-Sonoma. This is the key to building wealth — own assets that pay you more and more every year.

The biggest loser in this section of the portfolio was Union Pacific, down -0.7%.

Let’s now talk about the hardest thing to get right in a portfolio — weightings.

Portfolio Weightings

As you might have noticed in those screenshots above, some of my biggest winners throughout the year only had a few thousand invested into them to start the year — which means if I had simply allocated more capital to them throughout 2024 my gains could have been tremendously higher.

Hims & Hers is a great example of this. Am I excited about the stock? Of course! Are they a very small company whose product is largely a commodity? Also, yes.

On Holdings is another example. Was I bullish on the stock? For sure — I love their shoes and everyone I know owns a pair! But they were also very new to the stock market and it’s hard to say what their future holds.

Finally, Williams-Sonoma is another example. I had allocated only a 2% weighting to this name!

I pride myself in being able to pick winning stock and investment ideas — equities and cryptocurrency alike. What’s tricky for me is the percent weightings and the allocation. Sometimes it works — as you can see with Tesla. It was my highest weighting inside of that subsection of the portfolio and it delivered exceptional returns… but not until the last quarter of the year.

Same deal with CrowdStrike — I knew this company would continue to be a long-term winner in the cybersecurity space so I bet big on them.

I will continue to learn from my mistakes alongside you all year after year.

Being able to allocate the “right” percent weighting to some of these names is a skill I hope to master one day. Until then, thank you for continually bearing with me!

In summary, the portfolio crushed it in 2024.

The Big Tech positions carried the team, as my opportunistic ideas also had some great returns. We experienced a few losers, but nothing out of the ordinary. My biggest takeaway is to learn how to better weight my positions in order to optimize my returns while mitigating risk.

Looking Toward 2025

New year, same strategy — build wealth with high-octane growth names while continually leaning into income and diversification when appropriate.

As you all know, I plan to continue to own Bitcoin and Ethereum throughout 2025 — with clear “sell targets” that once met will allow me to exponentially grow the value of this portfolio. If these realistic sell targets are met, that’ll be roughly +$320,000 in realized profit in only 2.5 years time.

Not bad!

Once that happens, I’ll deploy the capital elsewhere throughout the portfolio.

However, I do want to share a few changes I plan to make.

After running every position in my portfolio through FastGraphs, I’ve concluded the following companies are currently overvalued and should be trimmed:

Costco (COST)

Apple (AAPL)

Snap On (SNA)

Analog Devices (ADI)

Crocs (CROX)

Additionally, I’ve lost my investment conviction in Adobe. I’ll be exiting that position in its entirety in 2025.

When it comes to new names to the portfolio, I’ve been thinking about adding the following:

Snowflake (SNOW)

Palantir

MongoDB

As you all know, Artificial Intelligence isn’t going anywhere — and I truly believe 2025 will be the year Software-AI stocks shine. The companies who are able to prove to Wall Street that their AI-specific revenue is catalyzing tangible growth in their businesses. These names should continue to do just that.

Palantir is trading extremely high, and I’m not going to buy at these prices. Snowflake could be a name I add sooner than later, as well as MongoDB.

Additionally, I believe 2025 will be the year everyone finally figures out the true value humanoid robots bring to the table.

We know FigureAI (OpenAI) has been working on their own humanoid robot for a while, as has Tesla. Google DeepMind just partnered with Apptronik. Smart money (AKA Big Tech) is jumping into this and has been for the last 12-months without much noise from the markets.

I think that dramatically changes in 2025.

Here’s an article that explains why Nvidia is betting big on humanoid robots in 2025.

“The ChatGPT moment for physical AI and robotics is around the corner,” Deepu Talla, Nvidia’s vice-president of robotics, told the Financial Times, adding that he believed the market had reached a “tipping point”.

Finally, let’s talk about what I believe will be the biggest percent return opportunity for my portfolio in 2025… event contracts.

If you’re unfamiliar, an event contract is essentially a bet that something will or will not come true. You buy the contract for some predetermined amount of money, and if the event takes place the contract’s value automatically becomes $1.

For example, you can buy 1,000 event contracts for $0.90 for $900 — and if the event comes true your $900 bet is now worth $1,000. That’s an +11% return on your $900 bet. Now that’s the key word here, isn’t it? BET.

Betting isn’t investing, it’s gambling. If we want to gamble, we should go to Vegas, right?

Well, not necessarily.

There are event contracts on Kalshi and Polymarket that seem to be absolute no-brainers — some examples include “Will Donald Trump be inaugurated?” Well, duh. He won the presidency, of course he’ll be inaugurated.

This event contract is paying out 8% on a 19-day time horizon. That’s an entire year of the S&P 500’s average return paid to you in 19-days on what seems to be the simplest most no-brainer bet of all time.

Another one is “Will Ethereum hit $4,000 in 2025?”

Well, it was just trading at $4,000 a few weeks ago — it’s pretty easy to imagine it’ll go back to that price SOMETIME during 2025. That bet is currently paying 15% during a 363-day time horizon. If it hits that price sooner, you obviously get paid sooner.

Or will Donald Trump attend Jimmy Carter’s funeral on January 9th?

Sure, it’s only a +2% return — but it’s a +2% return in 6-days.

I guess what I’m saying is I have no idea if the S&P 500 will deliver another 20% or higher annual return in 2025 — as it’s wildly unlikely.

With valuations at levels not seen since the Dot Com Bubble in 2000, finding places to park capital is tricky. I believe there are event contracts that can deliver 2-8% returns in a few days / weeks / months time which compounded on one another can certainly return 20-40% during 2025 if done correctly.

I’m not saying this is safe.

I’m not saying this is smart.

I’m not saying this is what you should be doing with your money!

I’m simply saying this is a really interesting concept and it’s something I believe will help me deliver double-digit returns in 2025.

If what I said in this post got you excited, become a paid-subscriber! It’s $31 / month and unlocks my full portfolio, monthly livestreams, deep-dives into the earnings reports of stocks every week, economic updates every week, and more!

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]

Reply