- GRIT

- Posts

- 👉 The Most Pivotal Week of 2025

👉 The Most Pivotal Week of 2025

Apple, Amazon, Meta, Microsoft

Together with Double

Welcome to your new week.

Let’s dive right in… this could be the most jam-packed week of 2025 thus far!

This edition of Rate of Return is brought to you by Double.

Tired of AUM fees eroding your investment returns? Double offers sophisticated automated portfolio investing for just $1/month.

Automated Management: We handle the complexities, including rebalancing and automated tax-loss harvesting to help optimize after-tax returns.

Direct Indexing Power: Choose from 50+ indexes or build your own set of truly customized strategies.

Unbeatable Value: Get powerful features without AUM fees eating into your growth. All for a flat $1/month.

Unlock greater customization and potential tax advantages with Direct Indexing, made easy by Double.

Stop overpaying. Start optimizing today: https://double.finance

Key Earnings Announcements:

You can’t ask for much more in a single week. We have Amazon, Apple, Meta, Microsoft, and a LOT more.

Monday (4/28): Domino’s Pizza, MGM Resorts, Nucor, Transocean, Waste Management

Tuesday (4/29): Bookings Holdings, Coca-Cola, First Solar, JetBlue, PayPal, Pfizer, Royal Caribbean, SoFi, Spotify, Starbacks, Visa

Wednesday (4/30): ADP, Caterpillar, Generac, Humana, Meta, Microsoft, Robinhood, Qualcomm

Thursday (5/1): Airbnb, Amazon, Apple, CVS, Lilly, Mastercard, McDonald’s, Reddit, SiriusXM, Shake Shack

Friday (5/2): Apollo, Brookefield, Cigna, Chevron, Exxon Mobil, FuboTV, Wendy’s

What We’re Watching:

Amazon (AMZN)

Amazon reports Thursday, down -13.9% YTD despite Q4 2024’s $187.8B revenue (up +10% YoY) — driven by AWS’s +19% growth to $28.8B. Insiders sold $5B in stock over the past year with very limited buys, raising valuation concerns.

As you’d expect — tariffs will be a major question mark for Amazon as sellers from across the world have been vocal about raising their prices. Another interesting point to watch will be Project Kuiper’s 27-satellite launch this month positions it to challenge Starlink.

AWS’ high margins and surging advertising income (50%+ of operating income) could shield against trade wars. However, the constant worry of a recession risk threatens consumer spending. Tariffs may also disrupt AWS spending by 2-3%.

The market has already gotten a major “box checked” by Google’s strong earnings last week. Amazon knocking this earnings report out of the park would be another big hurdle for the market to move higher.

“Amazon’s diversified revenue streams, particularly its high-margin AWS, subscriptions, and advertising segments, position it uniquely to withstand the pressures of a trade war, making it a resilient long-term investment even in a challenging macro environment.”

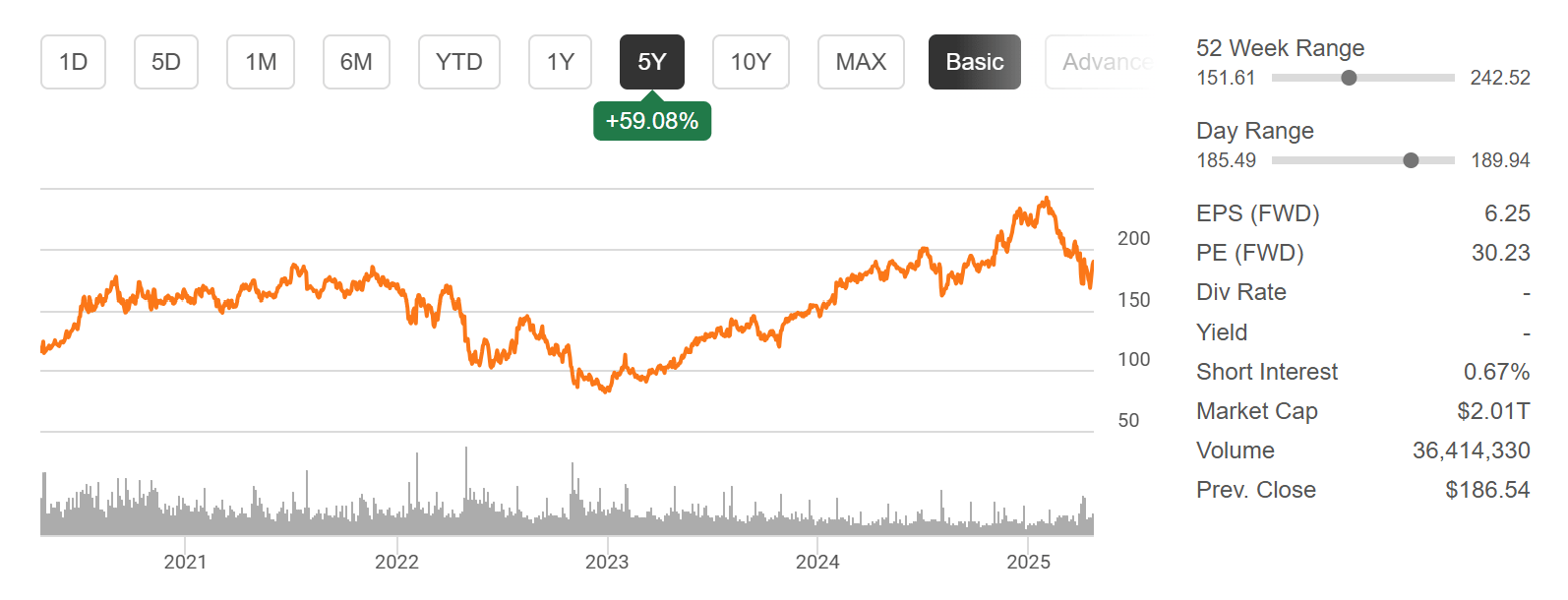

Amazon.com, Inc. (AMZN) Stock Performance, 5-Year Chart, Seeking Alpha

Apple (AAPL)

Apple reports Thursday, down -16.4% YTD despite tariff exemptions on iPhones after CEO Tim Cook’s lobbying. Q1 2025 saw iPhone sales slip -5% YoY in China, while Apple aims to shift all U.S. iPhone production to India by 2026 — facing roadblocks like China blocking equipment exports and India’s infrastructure gaps.

Tariffs could cost Apple $38B annually, but exemptions have lifted shares short-term. With still so much uncertainty, recession risk and softer iPhone upgrades threaten the growth of Apple — while India production delays add supply chain worries. Apple’s last earnings report noted that it was the company’s “best quarter ever” (more below). We’ll see if the outlook feels as bright this time around.

“Today Apple is reporting our best quarter ever, with revenue of $124.3 billion, up 4 percent from a year ago. We were thrilled to bring customers our best-ever lineup of products and services during the holiday season. Through the power of Apple silicon, we’re unlocking new possibilities for our users with Apple Intelligence, which makes apps and experiences even better and more personal. And we’re excited that Apple Intelligence will be available in even more languages this April.”

“India will help, but it’s not moving the needle on China’s dependence for Apple. It will take years to make this move, as Apple is caught in the tariff storm.”

Apple, Inc. (AAPL) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

Treasury Secretary Bessent continues to be a market-mover, it’s a “critical week” for Russia / Ukraine negotiations, and Canada will elect its next Prime Minister today.

Treasury Secretary Bessent Remains in the Trade War Spotlight

Source: Anna Moneymaker/Getty Images

U.S. Treasury Secretary Scott Bessent remains a pivotal figure in President Trump's aggressive trade war strategy, leading tariff negotiations with China and over 75 nations. Amid a 90-day tariff pause, Bessent has not confirmed Trump's claims of direct talks with Chinese leadership, stating he is unaware of such discussions but emphasizing that "trade conversations are happening" to secure "bespoke" deals. With markets rattled by 145% U.S. tariffs on Chinese goods and China's 125% retaliatory duties — Bessent defends the approach to rebalance trade and boost U.S. manufacturing.

One thing is for certain — Secretary Bessent has become perhaps the most “market-moving man” in the world besides President Trump. It also seems that he’s among the most trusted Cabinet member when it comes to Trump’s comfort with their public appearances.

"In game theory, it's called 'strategic uncertainty,'" Bessent said of Trump's back-and-forth tariff strategy. "So you're not going to tell the person on the other side of the negotiation where you're going to end up. Nobody's better at creating this leverage than President Trump."

“We are setting the fundamentals for a strong dollar, a strong economy, and a strong stock market. Investors need to know that the U.S. government bond market is the safest and soundest in the world.”

“Critical Week” for Russia / Ukraine Negotiations

Source: Office of the President of Ukraine via Getty Images

This week marks a pivotal moment for Russia-Ukraine peace talks as Trump’s 100-day deadline nears, with Secretary of State Marco Rubio calling it “critical” after Trump questioned Putin’s commitment following deadly Kyiv strikes. Trump met Zelenskyy Saturday, floating tougher sanctions, while envoy Steve Witkoff’s Moscow visit yielded Putin’s openness to bilateral talks. With all that being said though — the masses (and the market) aren’t convinced that we’re truly closer to a stalemate.

We’ll see if anything comes to fruition this week — and if it does — what happens to the market.

“This is Sleepy Joe Biden’s War, not mine. It was a loser from day one, and should have never happened, and wouldn’t have happened if I were President at the time. I’m just trying to clean up the mess that was left to me by Obama and Biden, and what a mess it is. With all of that being said, there was no reason for Putin to be shooting missiles into civilian areas, cities and towns, over the last few days. It makes me think that maybe he doesn’t want to stop the war, he’s just tapping me along, and has to be dealt with differently, through “Banking” or “Secondary Sanctions?” Too many people are dying!!!”

Canada Will Elect a Prime Minister Today

Source: Christopher Katsarov / AFP / Getty Images

Canadians are voting today to elect a new prime minister, with Liberal Mark Carney and Conservative Pierre Poilievre locked in a tight race largely shaped by how each would handle relations with President Trump. The main issues are reorienting Canada's economy away from U.S. dependence and negotiating new trade and security deals, as both candidates promise tax cuts, military spending increases, and protection of Canadian sovereignty. Carney emphasizes his economic leadership experience, while Poilievre has gained support by focusing on affordability challenges after a decade of Liberal rule.

Early in the year, Conservatives led by over 20 points, but Trump's recent trade threats and Carney’s leadership helped the Liberals overtake them, now holding a three-point lead. Turnout is expected to be heavy, which often benefits opposition parties, though this election pits demands for change against desires for stability. Results are expected after 9:30 p.m. ET, and the key number to watch is 172 seats needed for a majority government.

It’s going to be very interesting to see how the finalization of this election will either inhibit or promote the progress of trade negotiations between Canada and the U.S.

Source: Bloomberg

"This is Canada. We decide what we do here… The president's latest comments are more proof, as if we needed any, that the old relationship we had with the United States is over."

"I have a message for President Trump… Yes, you'll do damage to us in the short term. But we will fight back and we will build back."

Major Economic Events:

There’s not only earnings reports on the horizon — but also one of the biggest week of economic updates year-to-date.

Monday (4/28): N/A

Tuesday (4/29): Advanced Retail Sales, Advanced U.S. Trade Balance in Goods, Advanced Wholesale Inventories, Consumer Confidence, Job Openings, S&P Case-Shiller Home Price Index

Wednesday (4/30): ADP Employment, Chicago Business Barometer (PMI), Consumer Spending, Core PCE, Employment Cost Index, GDP, Pending Home Sales, PCE

Thursday (5/1): Auto Sales, Construction Spending, Initial Jobless Claims, ISM Manufacturing, S&P Final U.S. Manufacturing

Friday (5/2): Factory Orders, Hourly Wages, U.S. Nonfarm Payroll, U.S. Unemployment Rate

What We’re Watching:

Q1 GDP (First Reading)

One thing is guaranteed… we’re going to find out this week if the Atlanta Fed has been unnecessarily bearish on their Q1 GDP outlook — or if they’re a reliable source for GDP forecasting.

The US economy is expected to have nearly stalled in Q1 2025, with economists forecasting just +0.4% annualized growth — a sharp slowdown from +2.4% in Q4 2024. If confirmed, it would mark the slowest pace since 2022. Markets are bracing for the GDP reading on Wednesday, with concerns mounting that tariffs and rising trade barriers could tip the economy into contraction in the months ahead.

“We estimate real GDP decelerated sharply in the first quarter to 0.4%, from 2.4% in the final quarter of 2024. The trade deficit is set to be the largest drag, as businesses front-loaded goods imports ahead of the Trump administration’s tariff surge. Consumers also rushed to buy goods that are likely to face higher prices from the tariffs, such as cars, though they otherwise remained cautious.”

Core PCE Index

Core PCE Price Index YoY Change, 5-Year Chart

Core PCE — the Fed’s preferred inflation gauge — rose +0.4% in February, its biggest monthly gain since early 2024. On an annual basis, core inflation ticked up to +2.8%, topping expectations and signaling that price pressures remain stubborn beneath the surface.

This week, Core PCE is expected to rise just +0.1% MoM and +2.5% YoY. Both of these would be welcome results by the market.

“Consumers are resistant to price increases… Ultimately, inflation boils down to a household’s budget constraint and conditions are deteriorating here.”

Jobs Report

After a strong March showing (+228K jobs), economists expect a slower gain of +133K jobs in April, with unemployment steady at 4.2%. March’s growth was fueled by health care, social assistance, and transportation jobs — but signs of cooling could emerge as broader sectors remain flat.

We’ll see how this week’s jobs report changes any beliefs in the eyes of the Fed.

“March’s solid nonfarm payroll gains suggest neither President Donald Trump nor Fed Chair Jerome Powell will be in a hurry to offer support for the stock market after this week’s sharp, tariff-driven selloff.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Cover image source: David Ramos / Staff, MLADEN ANTONOV / Contributor, SEBASTIEN BOZON / Contributor, Kelly Sullivan / Stringer / Getty Images

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]