- GRIT

- Posts

- 👉 5 of the "Magnificent 7" Are Reporting

👉 5 of the "Magnificent 7" Are Reporting

Alphabet, Amazon, Apple, Meta, Microsoft

Welcome to your new week.

The biggest earnings reports are HERE! Let’s get you ready for this week in the markets.

Before we dive in — a reminder that our paid subscribers will be having their next PORTFOLIO UPDATE and Q&A LIVESTREAM!

It will take place TODAY (10/28) at 4pm ET!

If you want to have access to my portfolio, digital resources, livestreams, and more — consider upgrading your subscription by clicking this link!

Blossom: The HOTTEST Social Media Platform For Investors!

Have you tried out Blossom yet?

Blossom is the NEW and rapidly-growing social media platform (with already over 175,000+ users) built specifically for investors.

On Blossom, you can transparently see the portfolios and trades of friends, family, and other users — while seamlessly tracking your portfolio to get in-depth insights.

If you love the stock market — you can stay up to date with market news, trends, and events amongst a community of DIY investors.

Whether you’ve been investing for years or are just getting started… Blossom’s thriving community empowers you to connect, learn, and share insights with fellow investors —all in one place.

Also, it’s completely free to join!

Key Earnings Announcements:

Five of the ‘Magnificent Seven’ companies are set to report earnings: Alphabet, Amazon, Apple, Meta, & Microsoft.

Monday (10/28): Ford, Onsemi, Phillips, Waste Management

Tuesday (10/29): Advanced Micro Devices, Alphabet, Chipotle, Chubb, McDonald’s, Mondelez International, PayPal, Pfizer, SoFi, Super Micro Computer, Visa

Wednesday (10/30): AbbVie, Amgen, Automatic Data Processing, Booking Holdings, Caterpillar, Eli Lilly, Meta, Microsoft

Thursday (10/31): Altria, Amazon, Apple, Bristol-Myers Squibb, Comcast, ConocoPhillips, Eaton, Intel, Linde, Mastercard, Merck, Regeneron, Uber

Friday (11/1): Chevron, Exxon Mobil

What We’re Watching:

Meta Platforms (META)

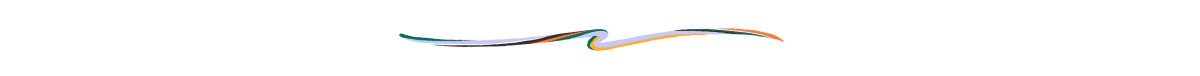

Meta’s (+62% YTD) upcoming earnings call is set to showcase its powerful advertising ecosystem and expansive user base of 3.3 billion — driven by rising ad impressions, engagement, and advertiser demand.

Enhanced by Meta AI and a strong recommendation algorithm, user engagement is reaching new highs — setting the stage for consistent mid-teens earnings growth. New revenue streams are also emerging, with product expansions in WhatsApp, Llama, Threads, and AR/VR.

Despite valid concerns around rising expenses and CAPEX, Meta's strategic pivots and operational discipline have paid off, making it one of the best-performing big-tech stocks over the past two years. Investors are watching for updates on Meta’s ad load, user metrics, and recommendation system powered by machine learning.

“The main theme in the foreseeable future though, remains Meta Advantage. Meta is constantly adding more and more capabilities to this AI-driven platform for advertisers, which enables automated ad campaigns, including optimization, targeting, creative, and more. This should be the number one driver for increasing demand from advertisers in the near-to-mid term.”

Meta Platforms, Inc (META) Stock Performance, 5-Year Chart, Seeking Alpha

Microsoft (MSFT)

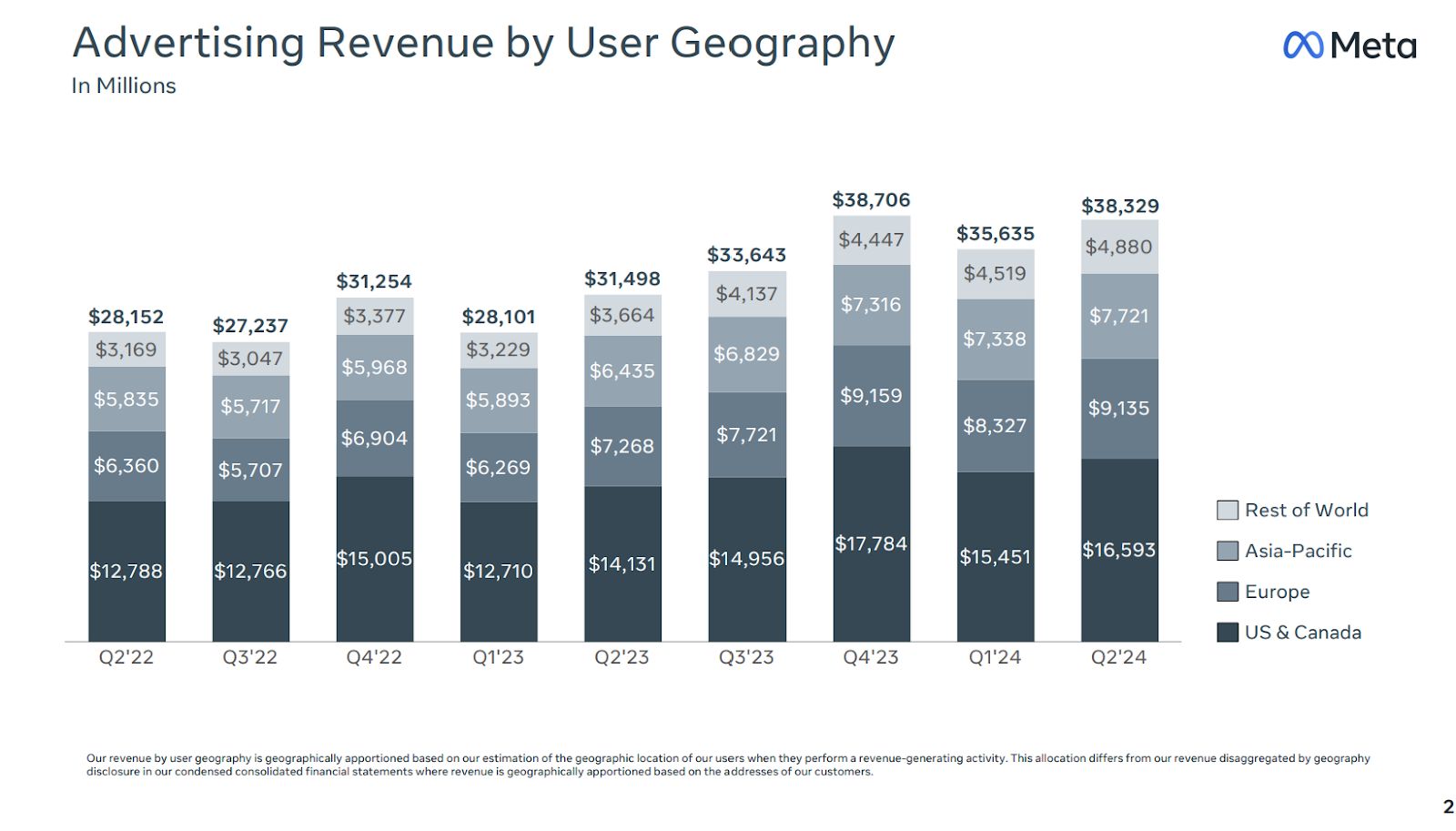

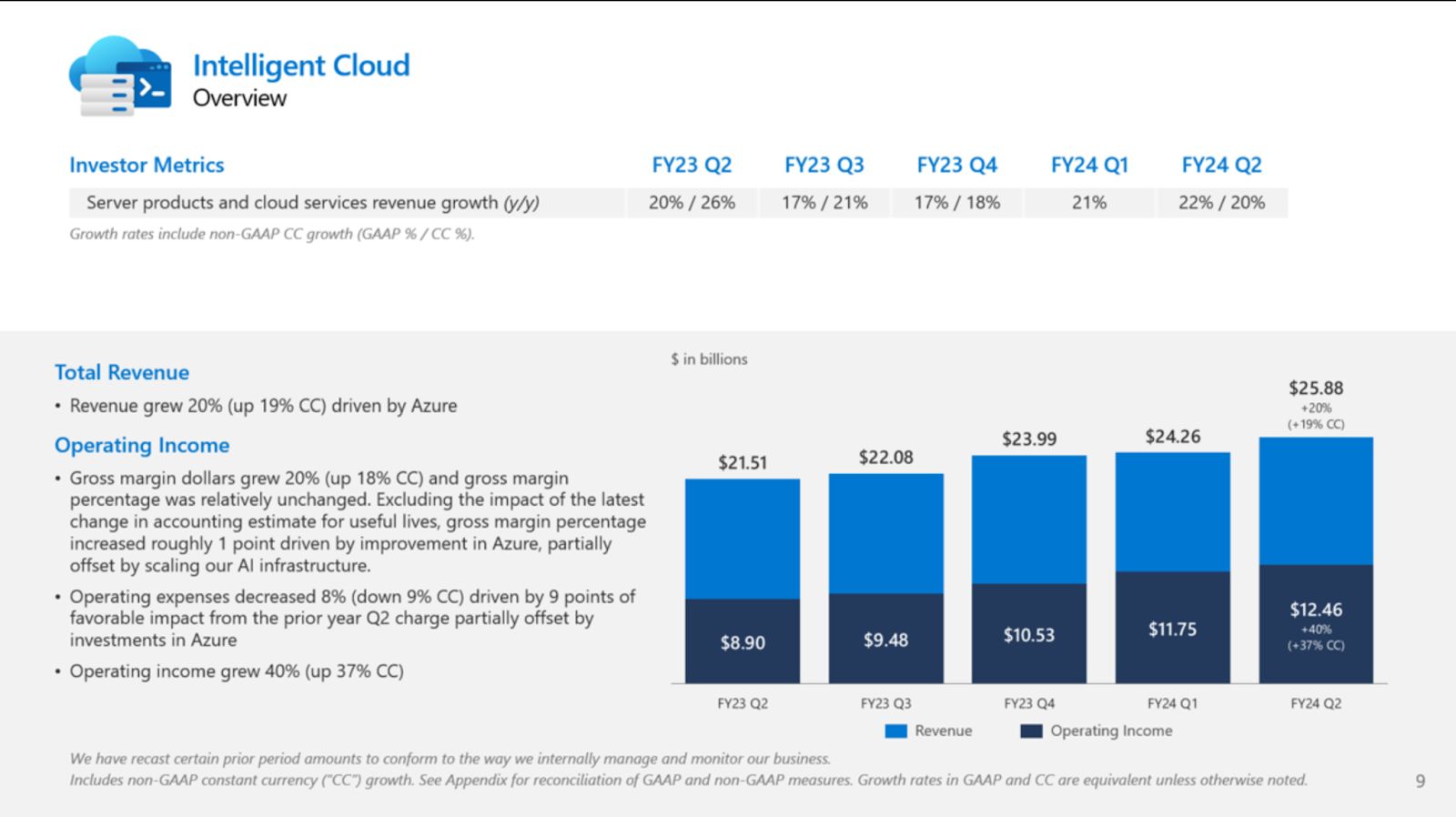

Microsoft's (+14% YTD) upcoming earnings call will be packed with updates on Azure's cloud growth, generative AI advances, and new investor metrics.

Recent announcements further highlight Microsoft's solid financial footing. Last month — the board approved a quarterly dividend increase to $0.83 per share (a +10% bump payable December 12) and introduced a new $60 billion share repurchase program.

Microsoft's double-digit revenue growth, expanding EBITDA margins, and strategic R&D investments keep it firmly positioned as a leader in AI and cloud — with key partnerships like its $30 billion AI fund with BlackRock and NVIDIA enhancing this momentum.

Analysts want to hear more about how Microsoft is exploring new AI monetization through autonomous AI agents in Copilot Studio and Dynamics 365.

“The tech giant is expected to report revenues of $64.57 billion for the first quarter of fiscal year 2025. Microsoft’s Productivity and Business Processes unit is expected to report revenue of $23.6 billion, its Intelligent Cloud unit is expected to report $26.8 billion, and its Personal Computing unit is expected to report $14.1 billion in revenue for the quarter, according to estimates. The company is expected to report earnings per share, or EPS, of $3.11 for the first quarter”

Microsoft Corp (MSFT) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs

This is one of the last big weeks of the year for conferences as we quickly approach the holiday season. This week we will see: GenAI Summit in Silicon Valley, Binance Event in Dubai, and TechCrunch Disrupt in San Francisco.

GenAI Summit in Silicon Valley

The three-day GenAI Summit in Silicon Valley will bring together top tech innovators and AI visionaries — with Microsoft and Amazon among the key participants. Running from Nov 1st-3rd, the summit will feature keynote speeches from influential leaders in AI, providing deep insights into the latest advancements in generative AI.

Exhibitors will have the unique opportunity to showcase their groundbreaking products and services to an engaged audience of over 10,000 attendees, including 150 speakers, 500 startups, 1,000 founders and CEOs, 20 international media outlets, and more than 2,000 developers dedicated to generative AI's future.

Binance Blockchain Event in Dubai

Source: Binance

Binance Blockchain Week Dubai 2024, held from October 30-31, brings together top voices in the blockchain world under the theme 'Momentum' to explore the industry’s recent strides and future potential. Day One opens with insights from Binance CEO Richard Teng and Dubai Future Foundation’s H.E. Khalfan Belhoul, followed by discussions on a global crypto economy blueprint with leaders like Dr. Marwan Alzarouni. Afternoon sessions dive into Web3 adoption challenges, the role of generative AI, and emerging blockchain infrastructure trends, featuring notable figures like Elliptic’s Tom Robinson and The Sandbox’s Sébastien Borget.

On day two, the focus shifts to public perception, data analytics, and effective onboarding strategies — led by experts from Solana and TikTok. Later, the spotlight turns to the future of digital currency with Circle’s Jeremy Allaire and the evolution of decentralized trading, gaming, and Web3 accessibility. The conference concludes with a closing session by Polygon’s Sandeep Nailwal — leaving attendees with a fresh perspective on scaling blockchain for the mainstream.

Even if you don’t care about Binance or any of these companies — these are the types of events that can have a material impact on the crypto market. We’ll be reporting back on any worthwhile updates that may come out of the event.

Techcrunch Disrupt in San Francisco

TechCrunch Disrupt, happening October 28-30 in San Francisco, is set to spotlight the latest tech innovations and industry shifts with insights from influential leaders. Central to the event is the Startup Battlefield 200 — where 200 early-stage startups showcase their cutting-edge advancements and 20 finalists will try to claim a $100,000 grand prize.

Attendees can expect a lineup of notable speakers, including GM CEO Mary Barra, Slack CEO Denise Dresser, Rocket Lab CEO Peter Beck, and Khosla Ventures Founder Vinod Khosla. There will range of activations, roundtables, and networking events that could yield market-moving news and quotes as well.

Major Economic Events:

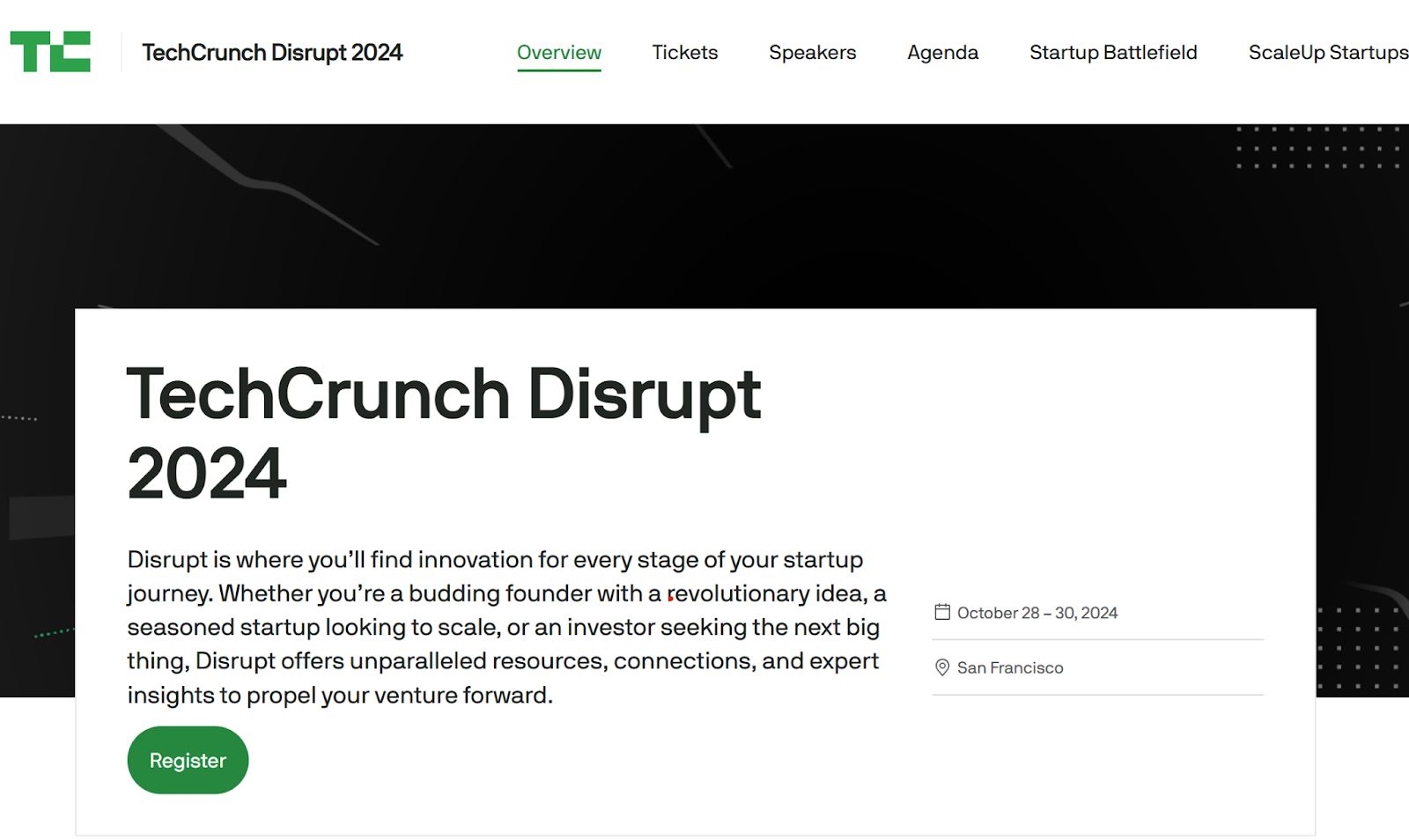

Reports on US GDP growth and unemployment take center stage this week.

Monday (10/28): N/A

Tuesday (10/29): October Consumer Confidence, S&P Case-Shiller home price index, September Job Openings

Wednesday (10/30): ADP Employment, GDP

Thursday (10/31): Core PCE, initial jobless claims, pending home sales, PCE Index, personal income growth, personal spending growth

Friday (11/1): ISM manufacturing, October auto sales, October Manufacturing PMI, US hourly wages growth, US unemployment

What We’re Watching:

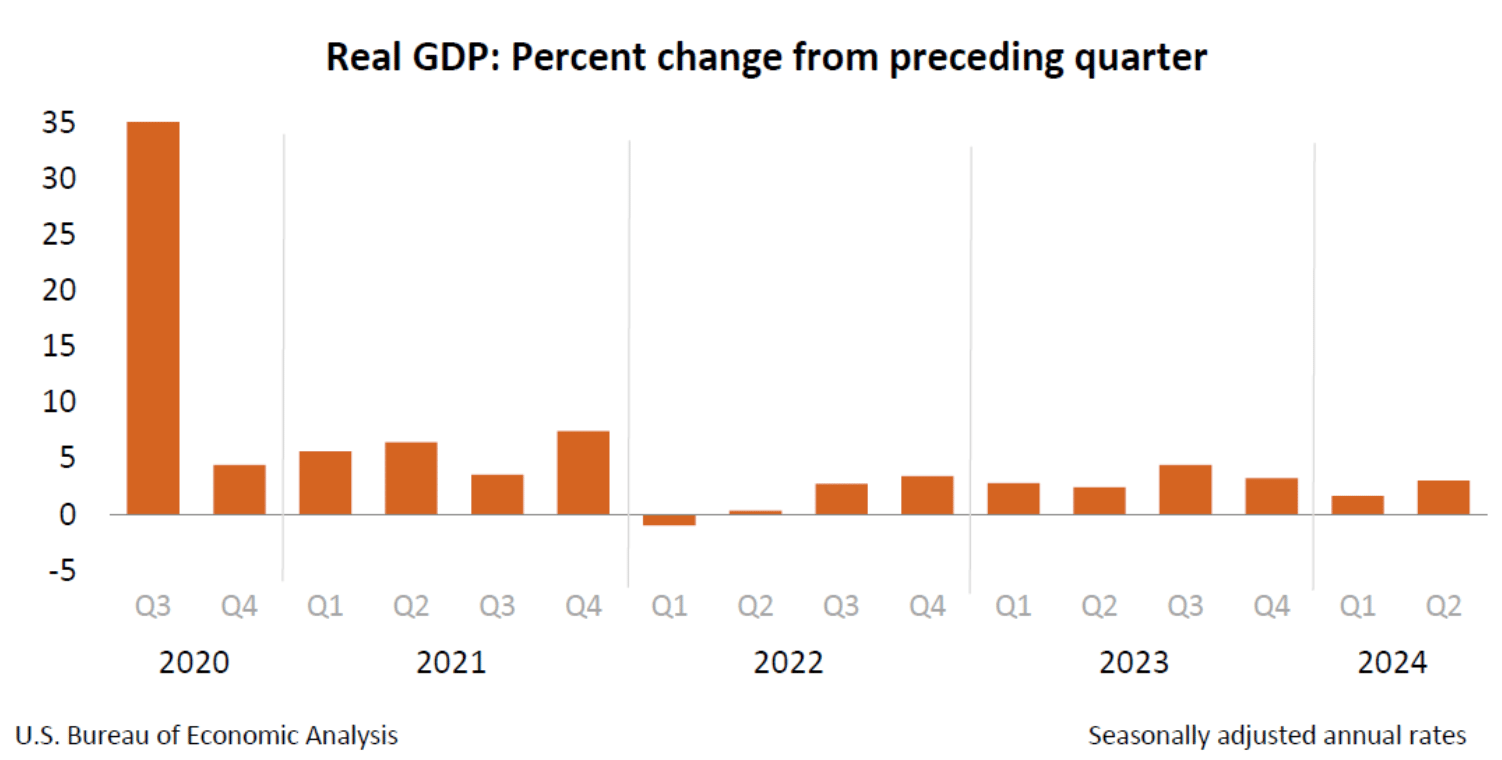

U.S. Q3 GDP

The U.S. economy grew at an annualized rate of +3.0% in Q2 2024, holding steady with the previous estimate and marking a significant rise from the revised +1.6% expansion in Q1. The primary drivers of this growth were consumer spending, private inventory investment, and nonresidential fixed investment. Imports also increased, reflecting higher demand.

Economists have a median forecast of +3.2% for this week’s first Q3 2024 GDP reading.

The Atlanta Fed has a lower expectation…

"After recent releases from the US Census Bureau and the National Association of Realtors, the nowcast of third quarter real gross private domestic investment growth decreased from 3.2 percent to 2.7 percent.”

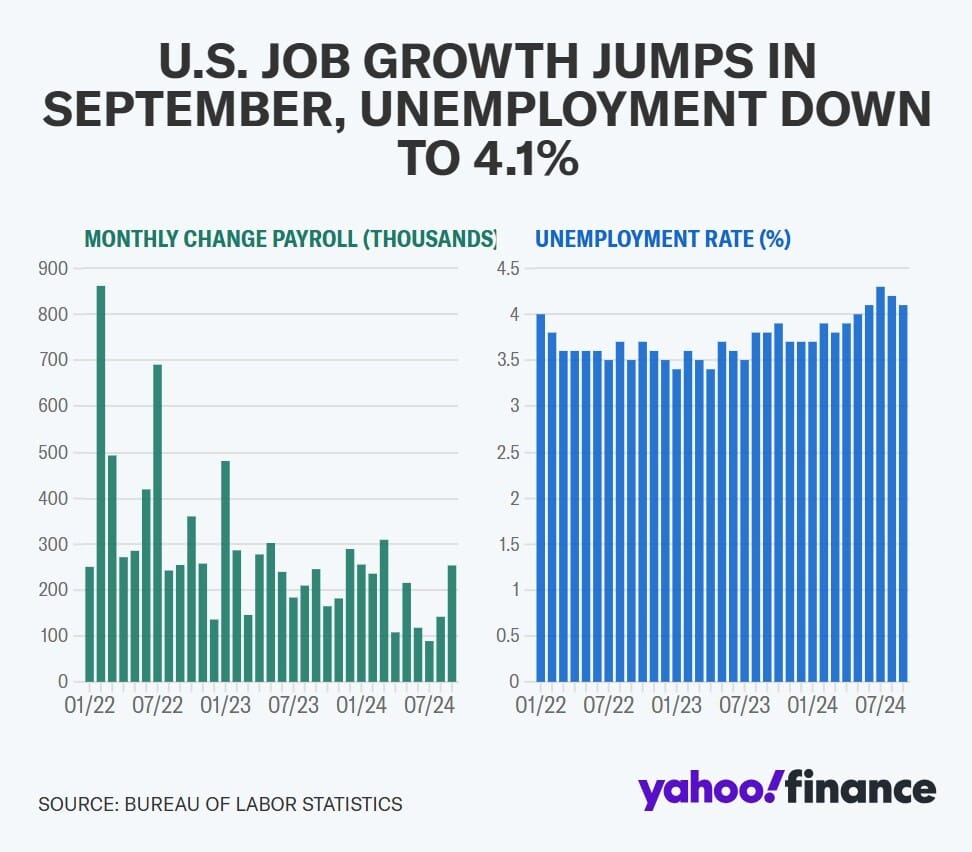

U.S. Unemployment

U.S. unemployment fell to 4.1% in September 2024, marking the lowest rate in three months and beating market expectations, which had anticipated no change from August's 4.2%.

The job market showed strength, with the number of unemployed individuals dropping by 281,000 to 6.834 million, and employment levels rising by 430,000 to reach 161.864 million.

"After two hurricanes, a strike, and rolling furloughs, we anticipate a lot of noise in next Friday’s October employment report.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Cover Image Credit: People.com

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]

Reply