- GRIT

- Posts

- 👉 5 of the Magnificent 7 Report Earnings This Week

👉 5 of the Magnificent 7 Report Earnings This Week

Google, Microsoft, Trump & China

Welcome to your new week.

Believe it or not… the last two months of 2025 are quickly approaching. Between trade deals, rate cuts, the government shutdown, the holidays, and much more — it’s time to lock in!

If you’re interested in becoming a premium subscriber to Grit Capital’s Rate of Return Newsletter, click here for 20% off an annual subscription!

Let’s dive in to everything you need to know this week.

We’ve got two exciting announcement for you:

1) An Opportunity to Invest in xAI, Perplexity, SpaceX, and more

For the first time ever, accredited investors can invest alongside me in SpaceX, Perplexity, xAI, and all 38 holdings inside The Cashmere Fund (including MrBeast’s Beast Industries, Katy Perry’s De Soi, Graza, and more) — all through one single investment ($7,500 minimum).

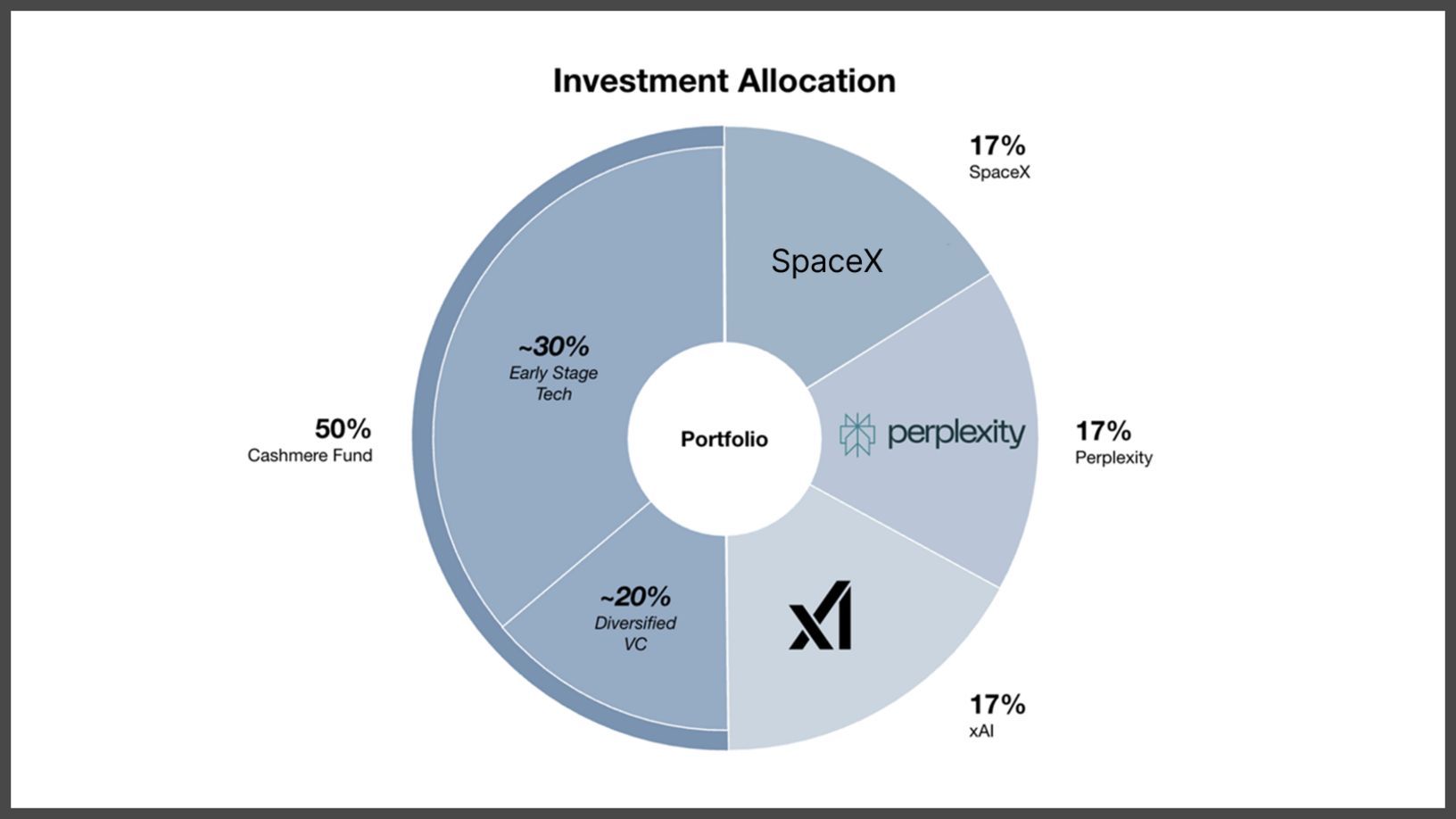

The structure is simple, yet powerful:

17% SpaceX

17% xAI

17% Perplexity

50% Cashmere Fund

This vehicle provides broad-based exposure across tech and consumer sectors, from Pre-Seed to Pre-IPO — and it’s all accessible through our partnership with Republic.

CLICK HERE TO LEARN MORE. Because I’m partnered with Republic, this opportunity is open to the public. As long as you’re accredited, you can participate. Feel free to share the details with your friends!

2) Free Webinar with CNBC’s Katie Stockton

I’ll be doing a stock pick breakdown with Katie Stockton on Friday, October 31st (Halloween) at 12pm ET. Kaite is a renowned technical analyst and consistent CNBC Contributor. Join us or at least sign up to get the recording!

Key Earnings Announcements:

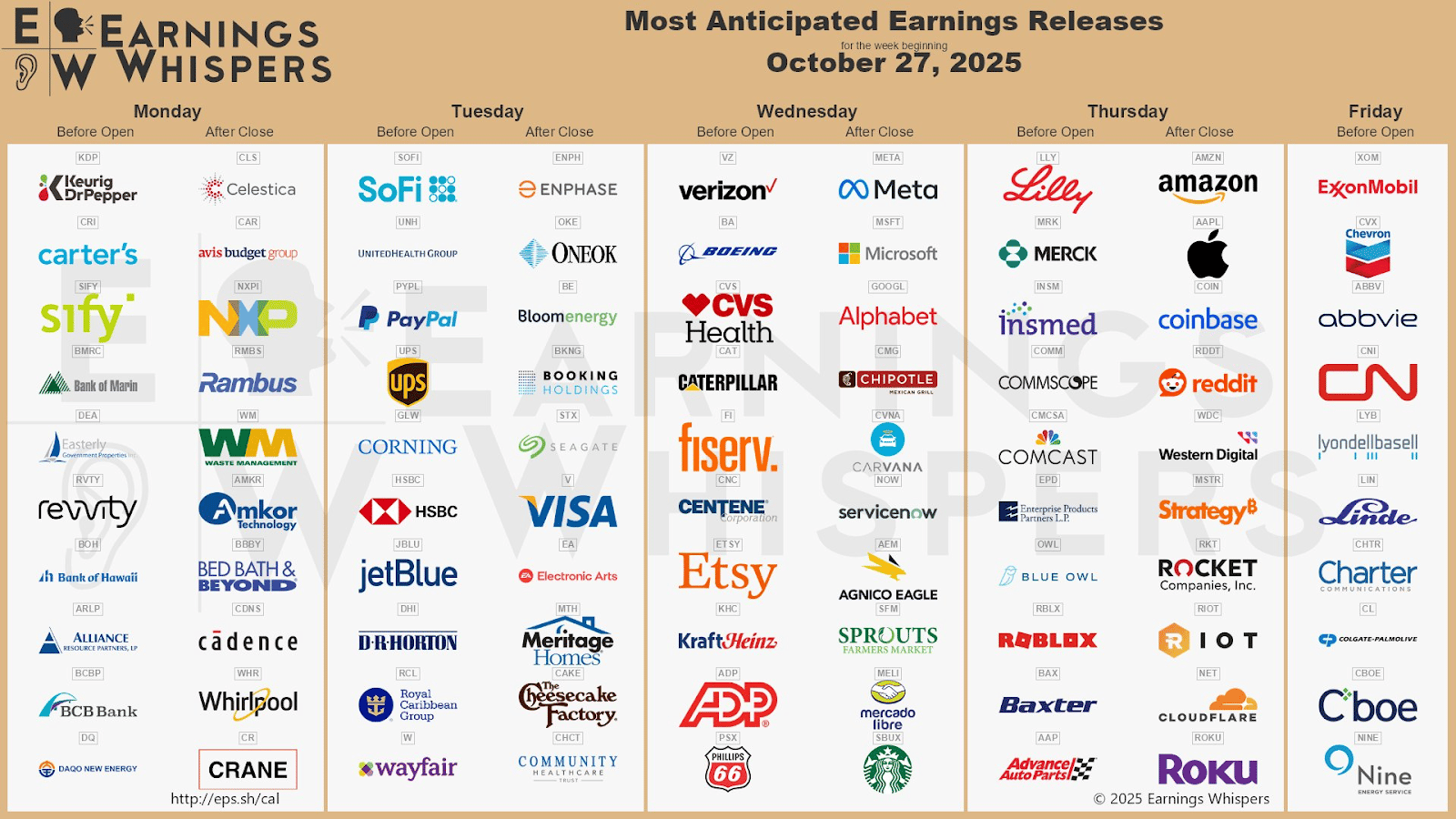

FIVE of the Magnificent Seven report earnings this week.

Monday (10/27): Avis Budget Group, Celestica, Keurig Dr Pepper, NXP Semiconductors, Rambus, Waste Management, Whirlpool

Tuesday (10/28): Amkor Technology, Booking Holdings, Community Healthcare, Corning, D.R. Horton, Enphase, Fiserv, HSBC, JetBlue, ONEOK, PayPal, Royal Caribbean, SoFi, Texas Instruments, UPS, Visa, Wayfair

Wednesday (20/29): ADP, Alphabet, Boeing, Caterpillar, Centene, Chipotle, CVS Health, Etsy, Fiserv, Kraft Heinz, Mercado Libre, Meta, Microsoft, Phillips 66, ServiceNow, Sprouts Farmers Market, Tesla, Verizon

Thursday (10/30): Amazon, Apple, Baxter, Comcast, Coinbase, Honeywell, Insmed, Lilly, Linde, Merck, Reddit, Roblox, Rocket Companies, Roku, Western Digital

Friday (10/31): AbbVie, Charter Communications, Chevron, Cboe, Colgate-Palmolive, CN (Canadian National Railway), ExxonMobil, LyondellBasell, Nine Energy Service

What We’re Watching:

Alphabet (GOOGL)

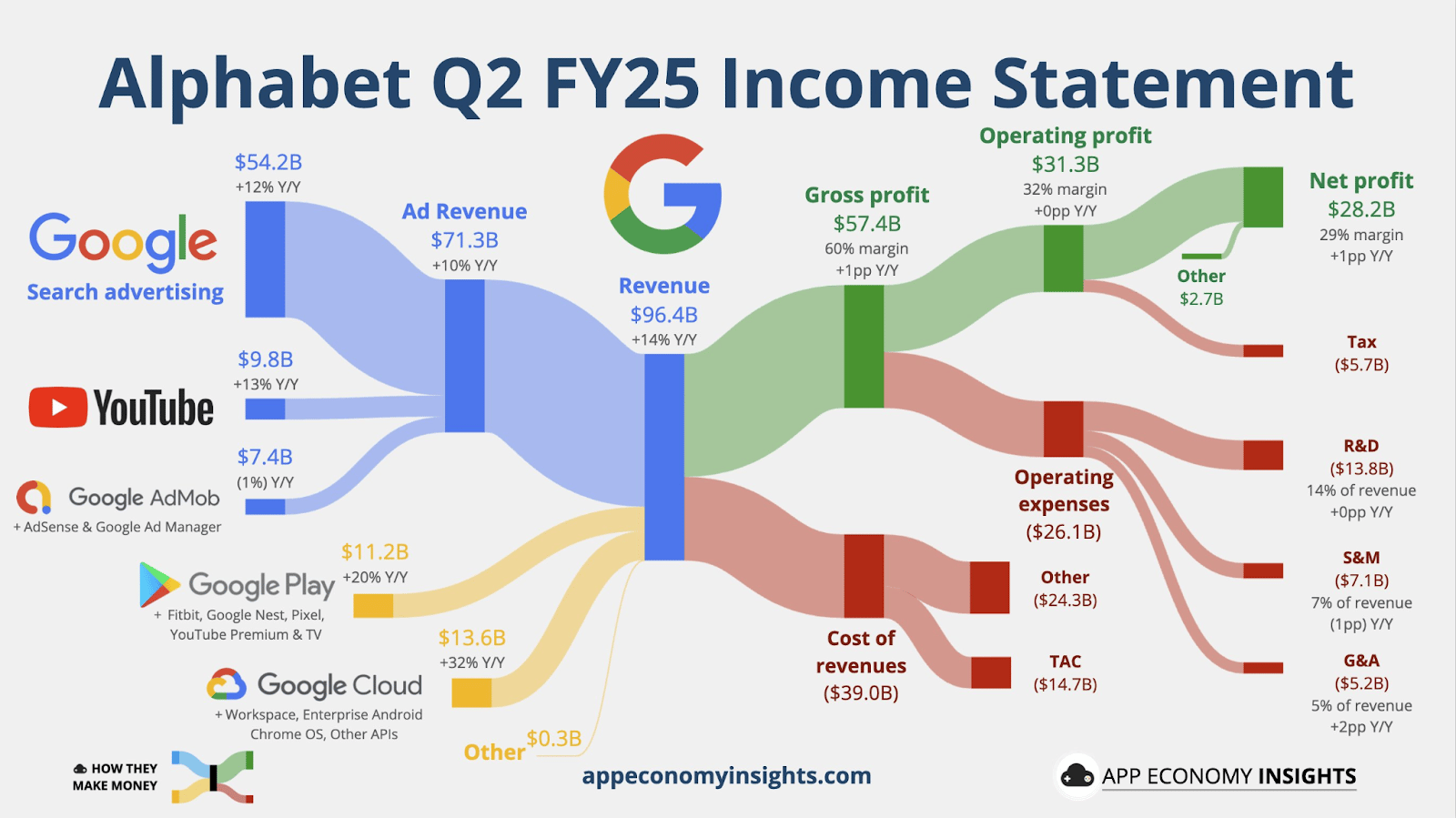

Alphabet (+37.3% YTD) reports Q3 FY2025 earnings Wednesday after the close, with investors watching whether momentum in Google’s advertising, cloud, and AI businesses can sustain double-digit growth amid heavier infrastructure spending and ongoing regulatory scrutiny. The company remains the backbone of digital advertising, but its multibillion-dollar push into AI infrastructure and data centers has put renewed pressure on margins and free cash flow.

In Q2, Alphabet posted $96.4 billion in revenue (+14% YoY) and $2.31 in EPS (+22%), both above expectations. Strength in Search, YouTube, and Google Cloud drove results, with Cloud revenue up 32% to $13.6 billion and operating margin steady at 32.4%, despite higher depreciation tied to AI buildouts. The company also expanded its capital return program while continuing to invest in its AI ecosystem through Gemini, YouTube AI tools, and the Android ecosystem.

Heading into this quarter, I’ll be watching whether AI-driven enhancements in Search and YouTube can translate into incremental ad monetization, and if Cloud’s growth can continue to offset rising costs. Management’s commentary on capex guidance, regulatory risk, and cost discipline will also be key for market sentiment.

“AI is positively impacting every part of the business, driving strong momentum.”

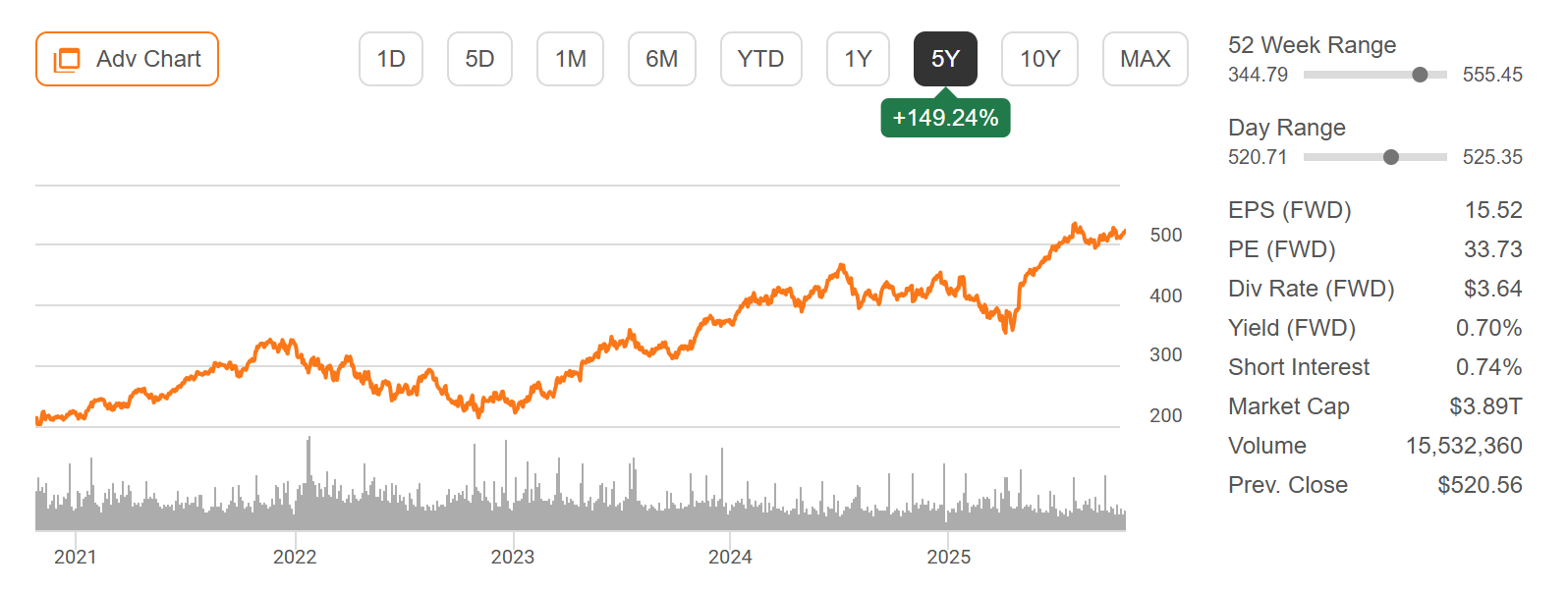

Alphabet, Inc. (GOOGL) Stock Performance, 5-Year Chart, Seeking Alpha

Microsoft (MSFT)

Source: Microsoft Earnings Deck

Microsoft Corporation (+24.2% YTD) reports Q4 FY2025 earnings Wednesday after the close, with investors closely monitoring whether the software and cloud giant’s AI-led growth can translate into resilient margin and guidance upside amid escalating infrastructure spending. Microsoft remains a pillar of enterprise tech by integrating productivity tools, cloud services and AI.

In the prior quarter, Microsoft posted $70.1 billion in revenue (+13% YoY) and $3.46 in EPS (+18%), powered by a 20-22% YoY jump in Microsoft Cloud to ~$42.4 billion and a 33% expansion in Azure and other cloud services. Despite the strong numbers, operating margin narrowed slightly due to AI infrastructure scale-up.

Heading into this release, I’ll be watching whether Microsoft can turn its AI momentum into higher ARPU across Microsoft 365, continue its Azure growth in the 30%+ range, and deliver capital-return clarity during this heavy spending period. How management frames demand, cost leverage and geographical resilience – especially in cloud-sensitive regions – will be critical for the stock’s next leg.

“Cloud and AI are the essential inputs for every business to expand output, reduce costs, and accelerate growth.”

Microsoft Corporation (MSFT) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

Adobe hosts its MAX 2025 conference, Honeywell completes spin-off of Solstice Advanced Materials, and the Trump–Xi Meeting set the stage for a possible deal breakthrough at APEC.

Adobe (ADBE) MAX 2025 Conference

Souce: Adobe

Adobe (-20.5% YTD) will host its three-day MAX 2025 Creativity Conference in San Francisco this week, bringing together designers, illustrators, photographers, and creators to explore the future of digital expression and AI-powered design.

Notable participants include Nvidia, Amazon, and Dell Technologies – all showcasing how generative AI is reshaping creative workflows and hardware performance. The event is expected to spotlight Adobe Firefly, AI-driven content tools, and new cross-platform integrations aimed at empowering creators in the next era of digital media.

Adobe (ADBE) Stock Performance, 5-Year Chart, Seeking Alpha

“AI represents a tectonic technology shift and presents the biggest opportunity for Adobe in decades. Our strategy to harness AI is focused on infusing it across our category-leading applications to provide more value and delivering innovative new AI-first products. We've done a great job executing this strategy by accelerating innovation with a focus on offering greater value to Creative and Marketing Professionals and Business Professionals and Consumers.”

Honeywell (HON) Completes Spin-Off of Solstice Advanced Materials

Source: Justin Sullivan/Getty Images

Honeywell (-4.3% YTD) will officially spin off its advanced materials division, creating a new publicly traded company called Solstice Advanced Materials (SOLS). The separation is designed to sharpen Honeywell’s focus on automation, aerospace, and industrial software, while giving Solstice independence to expand in specialty chemicals and sustainable materials.

Shareholders of record as of October 17 will receive one share of Solstice for every four shares of Honeywell held.

Honeywell (HON) Stock Performance, 5-Year Chart, Seeking Alpha

“Beginning with Honeywell's Q1 2026 quarterly earnings results, the company's reporting segments will be Aerospace Technologies, Building Automation, Industrial Automation, and Process Automation and Technology. The new segmentation is expected to take effect on January 1, 2026, and is the next step in evolving Honeywell's streamlined portfolio to unlock significant value and drive long-term growth.”

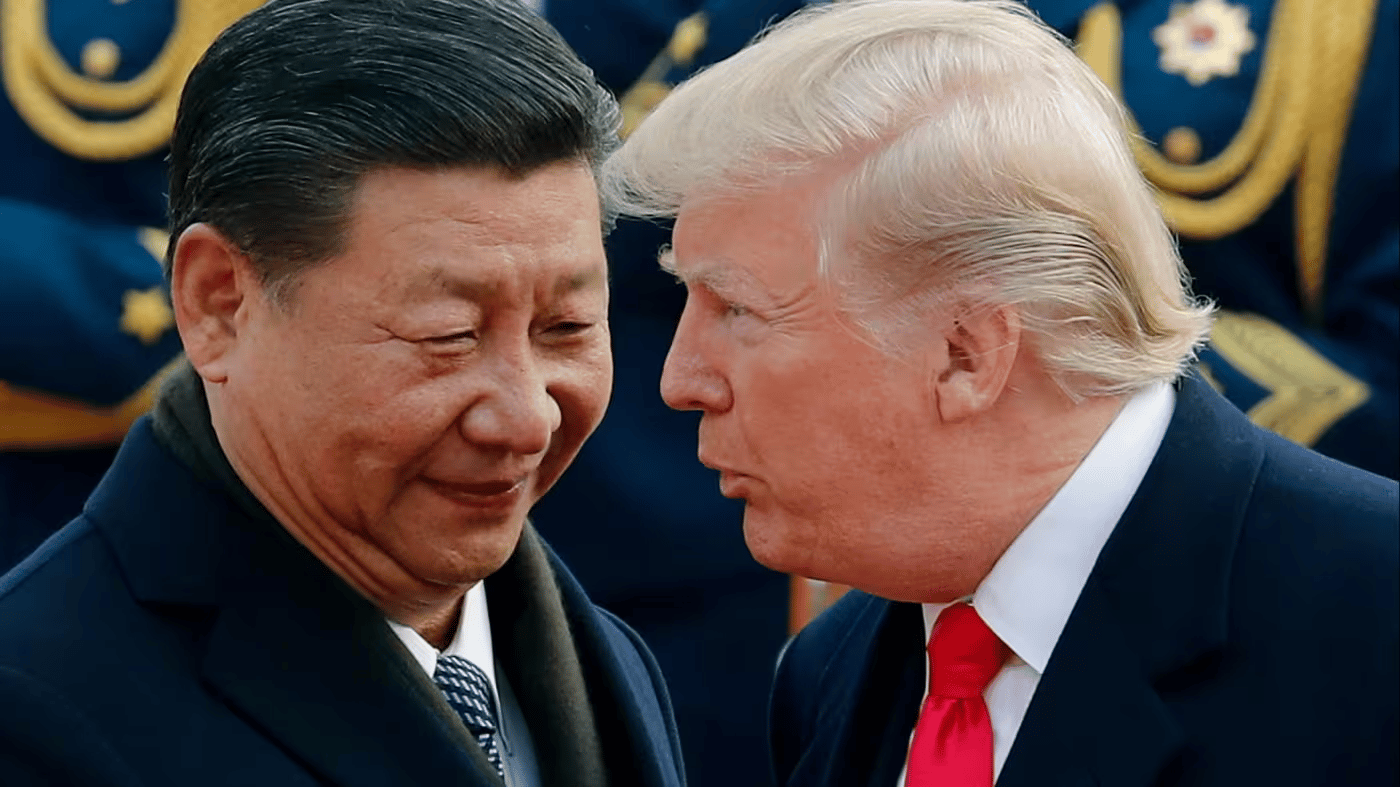

Trump–Xi Meeting Sets Stage for Possible Breakthrough at APEC

Source: Financial Times

Markets are eyeing this week’s Trump–Xi meeting in South Korea for signs of lasting de-escalation after months of tariff threats and trade turbulence. The White House confirmed that the 100% tariff threat on Chinese goods is off the table following a productive round of talks with top Chinese trade officials, paving the way for a potential deal framework ahead of Thursday’s face-to-face meeting.

Both sides appear to be negotiating from strength – with the U.S. pressing for soybean purchases, delayed rare-earth export restrictions, and anti-fentanyl measures, while China seeks relief from certain 20% U.S. tariffs and assurances around tech access. Trump has also floated broader goals including the TikTok sale resolution and potential Chinese cooperation on Ukraine diplomacy.

The meeting coincides with the 2025 APEC Summit in Gyeongju, bringing together 21 Pacific Rim economies to discuss trade and regional coordination. The tone between Trump and Xi – whether conciliatory or confrontational – could set the tone for markets into November.

“I think we have a very successful framework for the leaders to discuss on Thursday.”

Major Economic Events:

Powell speaks, FOMC interest-rate decision, and a new PCE release this week

Monday (10/27): Durable Goods Orders, Durable Goods Minus Transportation

Tuesday (10/28): Consumer Confidence, S&P Case-Shiller Home Price Index (20 Cities)

Wednesday (10/29): Advanced U.S. Trade Balance in Goods, Advanced Retail Inventories, Advanced Wholesale Inventories, Fed Chair Powell Press Conference, FOMC Interest-Rate Decision, Pending Home Sales

Thursday (10/30): Fed Vice Chair for Supervision Michelle Bowman Speaks, GDP, Initial Jobless Claims

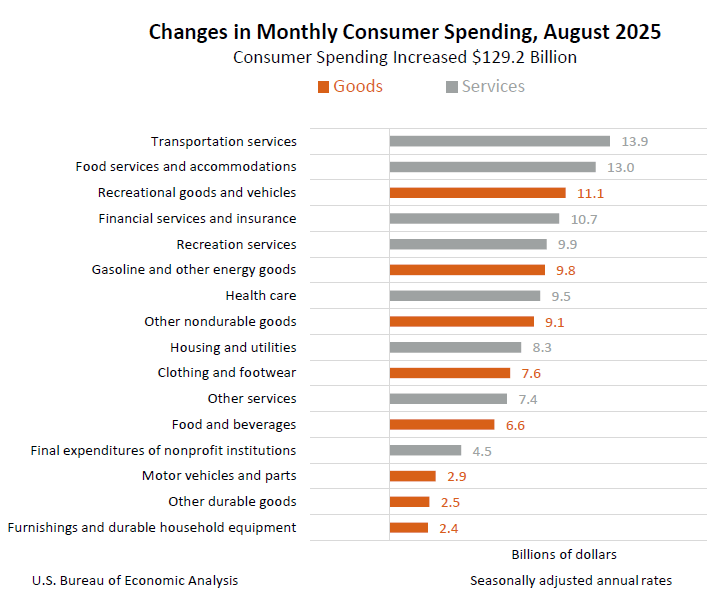

Friday (10/31): Chicago Business Barometer (PMI), Cleveland Fed President Hammack and Atlanta Fed President Bostic Speak, Consumer Spending, Core PCE Index, Core PCE Year Over Year, Dallas Fed President Lorie Logan Speaks, Employment Cost Index, PCE Index, PCE Year Over Year, Personal Income

What We’re Watching:

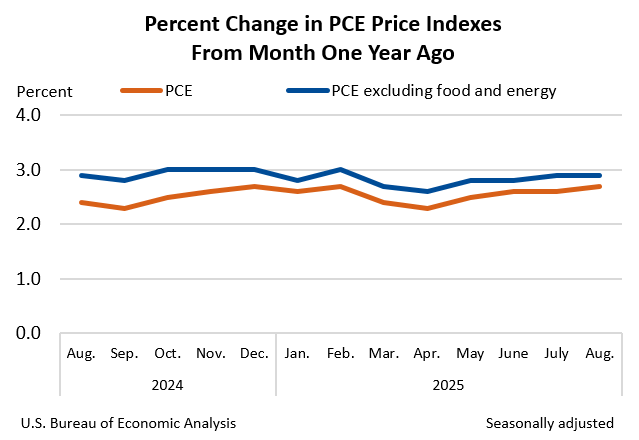

Core PCE Index

The Core Personal Consumption Expenditures (PCE) Price Index – the Federal Reserve’s preferred measure of underlying inflation – rose +0.2% MoM in August, matching July’s pace and expectations. On an annual basis, core PCE increased +2.9% YoY, unchanged from the prior month and consistent with the Fed’s projections.

With both headline and core readings aligned with forecasts, the report reinforces expectations for the Fed to proceed cautiously with additional rate cuts later this year, following September’s 25bps move.

Economists expect the following this week:

Core PCE (MoM): +0.2% vs. +0.2% prior

Core PCE (YoY): +2.9% vs. +2.9% prior

“Inflation is cooling, but not quickly enough for the Fed to declare victory – the path to 2% remains a grind, not a glide.”

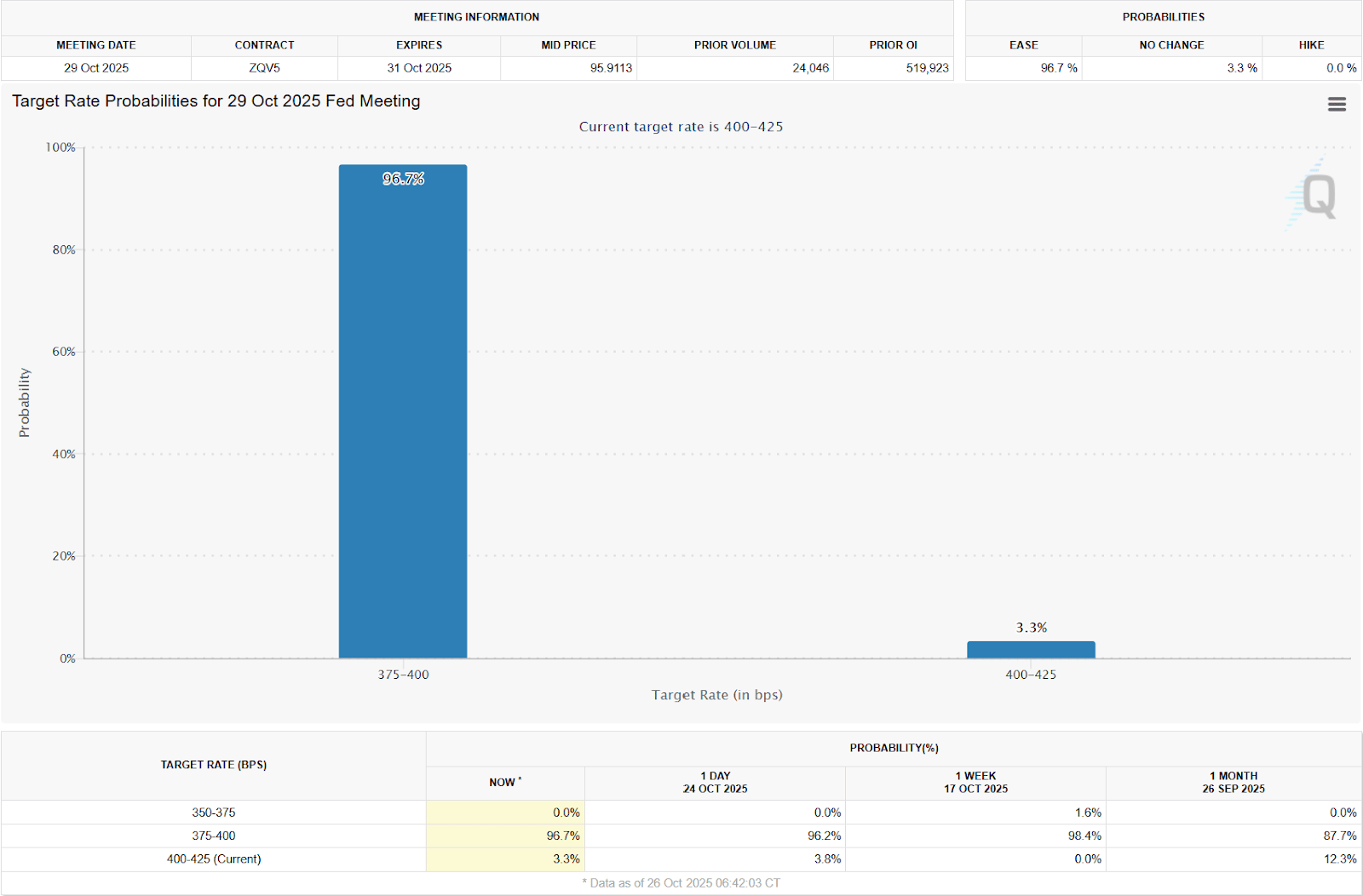

FOMC Interest-Rate Decision

Source: CME FedWatch

The Federal Reserve cut the federal funds rate by 25bps in September, bringing it to the 4.00%–4.25% range, marking the first rate reduction since December. The decision came amid easing inflation and growing signs of labor-market cooling.

The vote was 8-1, with newly appointed Governor Stephen Miran dissenting in favor of a larger 50bps cut. In its updated projections, the Fed signaled two additional cuts (totaling 50bps) by year-end and another quarter-point reduction in 2026, a slightly more dovish path than forecast in June.

The central bank’s new Summary of Economic Projections (SEP) revised GDP growth higher across the board – 1.6% for 2025 (vs. 1.4%), 1.8% for 2026 (vs. 1.6%), and 1.9% for 2027 (vs. 1.8%) – reflecting resilience in consumer spending and investment. Meanwhile, PCE inflation was left unchanged at 3.0% for 2025 but raised to 2.6% (from 2.4%) for 2026, suggesting the Fed still sees a slow path back to its 2% target. Core PCE followed a similar trend, holding at 3.1% for 2025 and ticking up to 2.6% for 2026.

Economists expect the following this week:

Fed Funds Rate: 4.00%-4.25% vs. 4.25%-4.50% prior

“This is the start of a gradual easing cycle, not an emergency pivot. The Fed is cutting to fine-tune, not to rescue.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Cover Image Source: AMG National Trust

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]