- GRIT

- Posts

- 👉 Add The Russell 2000 To Your Watchlist

👉 Add The Russell 2000 To Your Watchlist

Nvidia, Affirm, Alibaba

Together with XFunds

👉 Week in Review — Too Long; Didn’t Read:

Key Earnings Announcements:

Nvidia announced a $60B share buyback program

Affirm flipped GAAP profitable for the first time ever

Alibaba is doubling-down on AI infrastructure

Major Economic Events:

Small cap stocks, specifically the Russell 2000, could experience a very positive few months

Happy Labor Day.

Since 1894, the first Monday of September has honored the contributions of American workers and the labor movement. We hope you’re spending the long weekend with your friends and family!

Before we get started, we wanted to offer a warm welcome to the +592 new subscribers who joined us this week, and the 3,904 of you who joined us during the month of August!

In case you’re new around here, I’m Austin Hankwitz — I’ve been publishing earnings analysis on publicly-traded companies for over half a decade. My podcast, Rich Habits, has hit #1 on Spotify’s Business Podcast chart four times since it’s inception only two years ago.

At the start of 2023, I began my journey of building a $2M Dividend Growth Portfolio from scratch. This twice-weekly newsletter is how I keep you all updated on my progress.

For me, early retirement means $2M invested. For you, it might mean something else. Regardless of your early-retirement number — I hope these weekly synopses of my portfolio progress + what’s been happening in the markets helps you on your own journey.

Every Sunday, we publish the internet’s best summary of what happened in the markets the week prior — earnings analysis, acquisition announcements, economic data, world news, and more.

If you want full access to that info, my portfolio, legendary investor portfolios, livestreams, resources, and more — click here!

Crypto is more than a buzzword — it’s a growing part of the global economy. But accessing it can be complex, volatile, and yield nothing.

The Nicholas Crypto Income ETF (BLOX) aims to change that.

Diversified holdings in crypto-related equities and ETFs

Exposure to Bitcoin and Ether via leading custodians like Fidelity, Coinbase, and Gemini

Income-focused overlay using strategic options to generate weekly cash flow

BLOX is for investors who want crypto exposure and income potential — without the headaches.

👉 Portfolio Updates (YTD Performance):

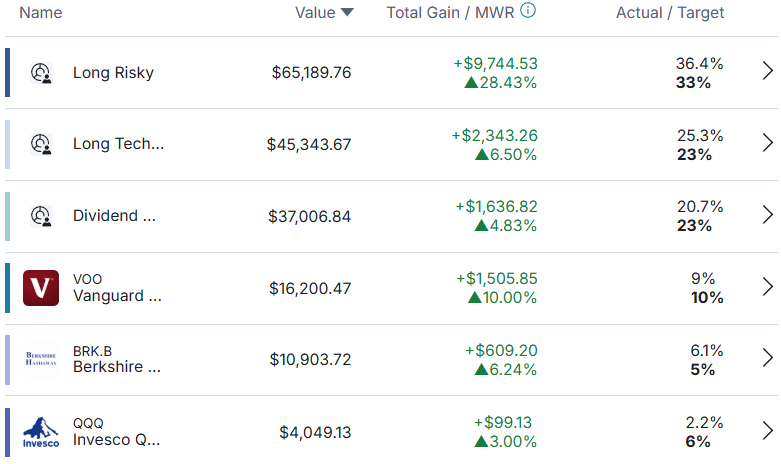

The stock-only portfolio continues to trend in the right direction, up +13% YTD compared to the S&P 500’s +10%. The “Long Risky" subsection is closing in on a +30% YTD gain, led higher by names like Astera Labs (ALAB), SoFi Technologies (SOFI) and Celsius Holdings (CELH) — all names that are up over +100% YTD.

Advanced Micro Devices (AMD) and Nvidia (NVDA) continue to carry the “Long Technology” section of the portfolio, with Analog Devices (ADI) and VICI Properties (VICI) leading the pack YTD for the “Dividend Growth Stocks” subsection.

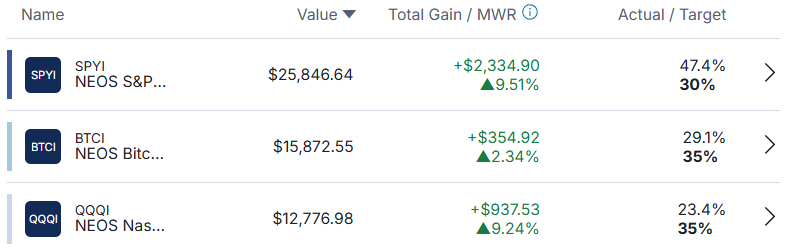

The monthly income portfolio is doing exactly what it’s supposed to be doing — producing monthly income! I just received a $794 distribution from this portfolio — up +$6 from last month.

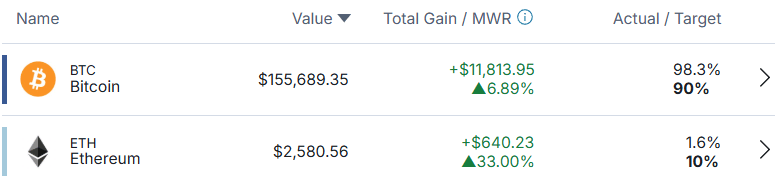

Finally, the Bitcoin position continues to trend in the right direction. We’re experiencing a little bit of a pullback at the moment, but I’m confident that’ll wash away and be the fuel we need to retest recent all-time highs sooner than later.

Want to see every position inside my stock and crypto portfolio?

Click here to become a Premium subscriber for $31 / month. You’ll also unlock access to our monthly livestreams, GRIT Guides on Investing, and more.

👉 Key Earnings Announcements:

Nvidia announced a $60B share buyback program, Affirm flipped GAAP profitable for the first time ever, and Alibaba is doubling-down on AI infrastructure.

Nvidia (NVDA)

Key Metrics

Revenue: $46.7 billion, an increase of +56% YoY

Operating Income: $28.4 billion, an increase of +53% YoY

Profits: $26.4 billion, an increase of +59% YoY

Earnings Release Callout

“Blackwell is the AI platform the world has been waiting for, delivering an exceptional generational leap — production of Blackwell Ultra is ramping at full speed, and demand is extraordinary.

NVIDIA NVLink rack-scale computing is revolutionary, arriving just in time as reasoning AI models drive orders-of-magnitude increases in training and inference performance. The AI race is on, and Blackwell is the platform at its center."

My Takeaway

Nvidia’s earnings results came within Wall Street’s expectations catalyzed by continued growth of the company’s data center segment. NVDA reported record revenue of $46.7B, despite ongoing challenges from US export restrictions on sales to China. As shared in their earnings release, “There were no H20 sales to China-based customers in the second quarter.”

During the earnings call, CEO Jensen Huang emphasized the “immense” AI opportunity ahead, highlighting the ramp-up of the Blackwell platform and the shift toward “agentic” and “reasoning” AI models that demand exponentially more compute power. Jensen Huang called Blackwell the “platform at the center of the AI race,” delivering 3-5X better AI throughput than its predecessor in power-limited environments.

Huang also projected a $3-4 trillion AI infrastructure opportunity over the next 5 years, driven by Hyperscaler capital expenditures doubling to $600B / year.

CFO Colette Kress noted the company’s focus on scaling production and successfully navigating geopolitical hurdles. Kress notes that China represents a $50B / year market opportunity, but restrictions have “closed” it to US firms. He advocated for open collaboration, noting half of AI researchers are in China.

The board also approved a $60B share buy back authorization.

Unrelated, but if you want to read a white paper about how AGI is going to take over the world in 2027 — click here.

Happily holding shares.

Affirm (AFRM)

Key Metrics

Revenue: $876.4 million, an increase of +33% YoY

Operating Income: $58.1 million, compared to -$73.4 million last year

Profits: $69.2 million, compared to -$45.1 million last year

Earnings Release Callout

“Only a few moments ago it was a matter of some debate (outside our walls, of course) whether Affirm would so much as survive the rising Fed funds rate, let alone turn a profit. And a few before that, whether it was possible to make money in consumer lending without the profit pools afforded by late fees and compounding interest. And a little earlier still, whether anyone would even trade the sloppy ease of revolving credit for the binary precision of individually underwritten transactions.

Since more debates are sure to follow, there is just one point I’d like to make. It’s not that Affirm is a great business (though it certainly is) – it’s that the team building Affirm will accomplish whatever we set our collective hearts, minds, and hands to. If you will it, it is no dream. Going forward, we intend to consistently deliver positive operating income while maintaining an aggressive growth rate, investing in future products, and increasing operating leverage.”

My Takeaway

Affirm delivered a breakout quarter, transitioning from a growth-stage fintech into a profitable enterprise. The company posted its first GAAP profit as a public company, with earnings of $0.20 per share—an impressive swing from a $0.14 loss in the prior year and significantly above the $0.12 target. Revenue climbed 33% year-over-year to $876 million, outpacing analyst forecasts and affirming the strength of its business model.

Underlying this success was tremendous momentum in transaction volume: gross merchandise volume surged 43% to $10.4 billion, boosted by customer demand for 0% APR offers and Affirm’s expanding merchant partnerships. The Affirm Card contributed meaningfully to revenues, delivering $67.1 million versus the $58 million estimate.

Affirm’s active user base now stands at 23 million, with growth in both merchant coverage and transaction frequency driving its surge. Management issued optimistic forward guidance, with full-year GMV expected to top $46 billion and first-quarter FY2026 revenue forecast between $855 million and $885 million—both above consensus. These projections suggest confidence in sustained demand, efficient scaling, and the company's ability to offset volume lost from its phased-out Walmart partnership.

Looking ahead, Affirm’s primary challenges lie in controlling costs and maintaining margin gains while scaling. Its heavy investment in marketing and R&D continues to press on expense ratios, even amid growing revenue. That said, its ability to deliver GAAP profitability while losing a significant partner like Walmart, and still forecast robust growth, positions it as a compelling leader in the evolving BNPL landscape.

Adding this one to the watchlist.

Alibaba (BABA)

Key Metrics

Revenue: $34.6 billion, an increase of +2% YoY

Operating Income: $4.9 billion, compared to $5.0 billion last year

Profits: $5.9 billion, an increase of +76% YoY

Earnings Release Callout

“The top-line momentum we have in our business comes from how we’re innovating and executing. Connecting with our customers and members through digital experiences is helping to drive our business, and the way we’re deploying AI will make these experiences even better. We’re people-led and tech-powered, and I love how our associates continue to drive change and results for our company.”

My Takeaway

Alibaba delivered a mixed earnings report that nevertheless found favor with investors thanks to its strategic investments in AI and cloud infrastructure.

Revenue rose +2% to $34.6 billion, reflecting stable trends in China commerce with help from newer initiatives, while headwinds from business disposals kept the headline growth rate muted.

The company’s operating income dipped to $4.9B, a decline of roughly -3%, weighed down by substantial spending on its “quick commerce” initiatives like Taobao Instant Commerce, as well as elevated marketing and user acquisition efforts. These cost pressures contributed to a softer adjusted EBITA and EBITDA, signaling margin erosion in the near term.

Alibaba’s net income climbed to an impressive $5.9B — a +76% increase year-over‑year. This was driven not by core operations, but by valuation gains on its equity portfolio and proceeds from the sale of Trendyol’s local business.

The real highlight came from its Cloud Intelligence Group, which posted revenue of $4.7B — a 26% year-over-year gain as AI adoption accelerated. This growth underscores the company’s pivot toward high-value, enterprise-level services and strategic long-term investments. Alibaba is planning to invest over $50 billion in AI and related infrastructure, including development of its own AI chip to reduce reliance on U.S. technology imports.

The market is betting that Alibaba’s cloud‑AI strategy will help offset softness in its core retail business. Despite the revenue miss and rising expense base, confidence has grown in the company's ability to lead China’s AI and cloud transformation, which could deliver enhanced margins and sustained growth in the years ahead.

Holding shares.

👉 Why Small Caps Should Be On Your Watchlist

Small cap stocks, specifically the Russell 2000, could experience a very positive few months.

Small Cap September?

Following Jerome Powell’s speech in Jackson Hole a few weeks ago, the CME FedWatch Tool has the likelihood of September rate cuts at 86%. This will mark the first rate cuts for calendar year 2025.

So, who has historically benefitted the most from Fed rate cuts?

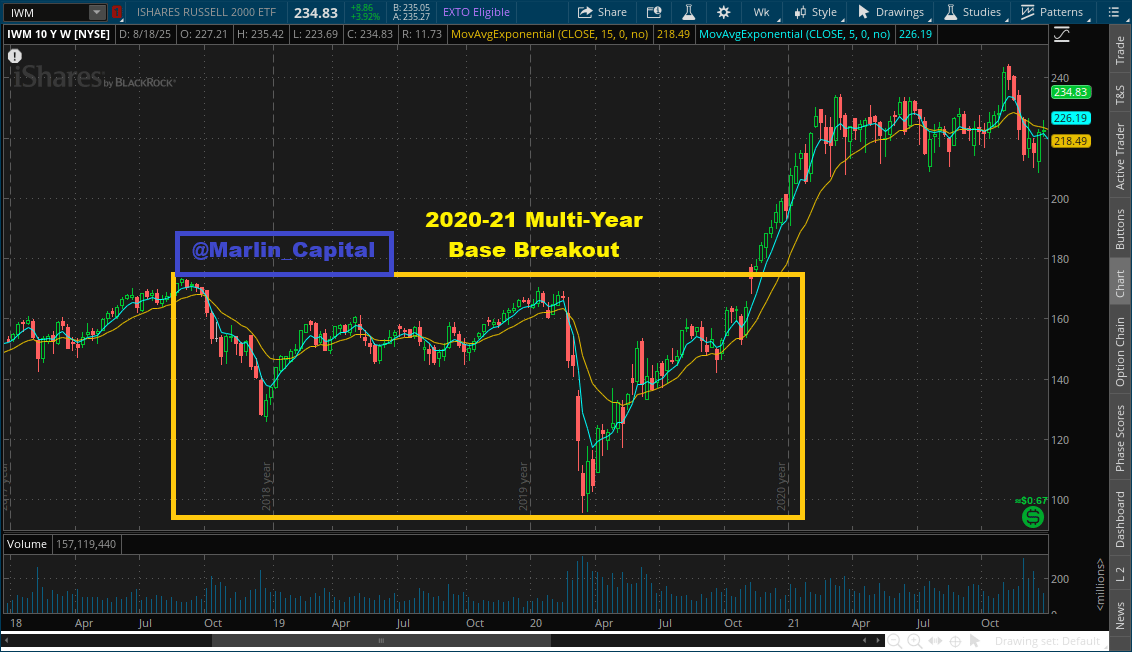

Small cap stocks, and the ETFs / indices they trade inside of. Specifically, the Russell 2000 (IWM).

@Mr_Derivatives on X

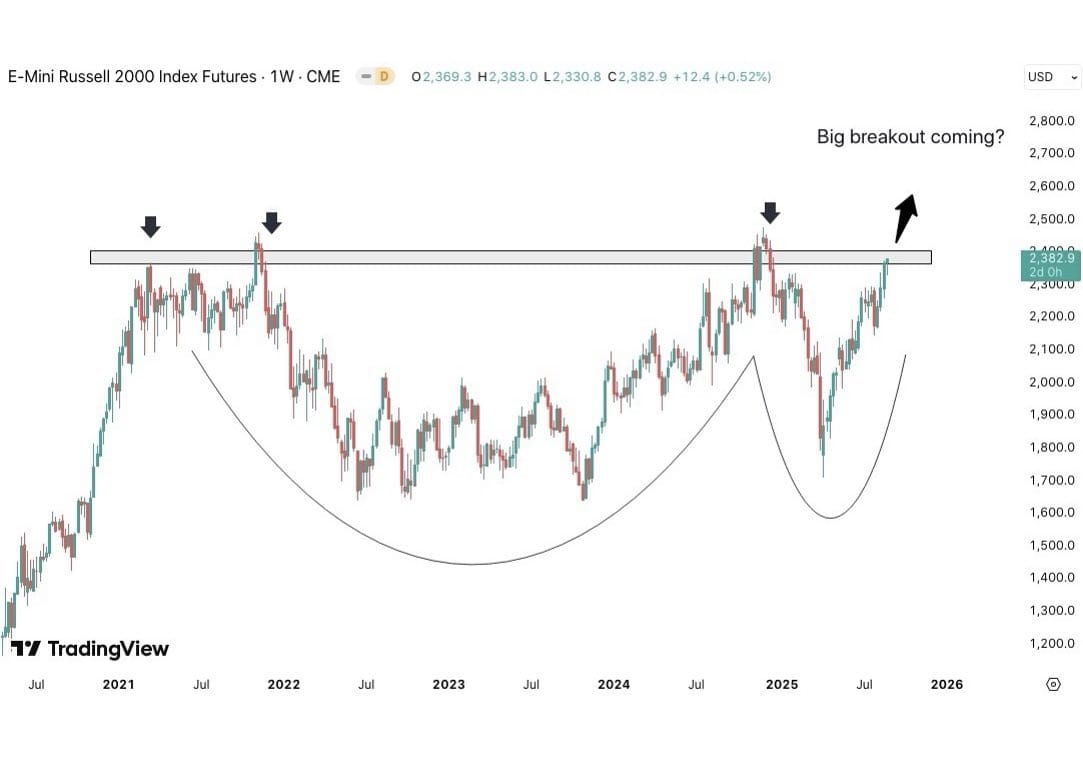

As you can see above, the iShares Russell 2000 Index, IWM, is gearing up to retest its 2021 highs of ~$245 / share. The Russell 2000 Index gained +9.4% during the month of August — further catalyzed by the comments Jerome Powell shared at the Jackson Hole symposium.

Remember, small cap stocks are most negatively affected by high interest rates as these companies usually carry high amounts of debt on their balance sheets. As interest rates fall, these small cap names are able to refinance their debt at lower interest rates, allowing more money to flow to their net income line item (profits).

The Russell 2000 has been “trading sideways” for a few years now. The last time we “broke out” of a “sideways” trading pattern the index rallied +41% as shown below.

@MarlinCapital on X

Below is another chart illustrating this multi-year “cup and handle” formation taking place. If / when we break out of this, I expect to see the iShares Russell 2000 Index, IWMI, break above $300 / share.

@RJB_Financial on X

In my humble opinion, it’s worth adding the Russell 2000, and perhaps the Russell 1000, to your watchlist. A few “Russell” ETFs to consider are:

IWM — the iShares Russell 2000 Index ETF

IWB — the iShares Russell 1000 Index ETF

VONG — the Vanguard Russell 1000 Index ETF

IWF — the iShares Russell 1000 Growth ETF

*Disclosure: Creative Direct Marketing Group (CDMG) Inc. paid to have news shared about CEA Industries becoming the largest corporate holder of BNB. This is not financial advice and provides no guarantee of future returns.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Cover image source:

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]