- GRIT

- Posts

- 👉 Adding a New Stock to the Portfolio

👉 Adding a New Stock to the Portfolio

& Amazon's FCF is up +122%

Happy Sunday, everyone.

Cheers to the extra hour of sleep we all got last night! Can’t wait to cash in on that rest again tonight — I’m exhausted. I spent the weekend hollering “Go Vols” in Neyland Stadium, and I couldn’t be happier about the outcome last night!

I’m sure you all saw the major headlines around Big Tech companies either beating or missing their earnings throughout the week, so I’m not going to reiterate what’s already been said. Instead, we’ll talk about Amazon (cash flow printing machine), Uber, Robinhood, and Reddit.

Let’s dig in!

Have you tried out Blossom yet?

Blossom is the NEW and rapidly-growing social media platform (with already over 175,000+ users) built specifically for investors.

On Blossom, you can transparently see the portfolios and trades of friends, family, and other users — while seamlessly tracking your portfolio to get in-depth insights.

If you love the stock market — you can stay up to date with market news, trends, and events amongst a community of DIY investors.

Whether you’ve been investing for years or are just getting started… Blossom’s thriving community empowers you to connect, learn, and share insights with fellow investors —all in one place.

Also, it’s completely free to join!

Click here to download Blossom Social!

This is a paid promotion by Blossom.

Portfolio Updates (YTD Performance):

A few quick things to mention regarding the portfolio…

Who else is excited about that Bitcoin price moving up and to the right, finally? I’m so optimistic about this “trade” idea — I really think Bitcoin will eclipse $100K per coin sooner than we might think, and I hope to walk away from this ~2.5 year trade $150-200K richer. Remember, I began dollar cost averaging into Bitcoin early-2023 at ~$23K per coin.

I took the $1,015 I received as a monthly distribution from my SPYI position and bought ~4.5 shares of MicroStrategy (MSTR) stock with it.

I deployed another ~$1,300 into Berkshire Hathaway stock late last week.

I plan to deploy another ~$17,000 toward my portfolio during the month of November. At the moment, the plan is to use ~$8,000 of it to beef up my Berkshire Hathaway position, and the other $9,000 opportunistically.

Week in Review — Too Long, Didn’t Read:

Amazon doubled their free cash flow, Uber’s Mobility business is slowing down, Robinhood’s revenue streams are too unpredictable, Reddit is getting added to the portfolio, MicroStrategy announced a $42 billion fundraising target, SMCI tanked after EY said they are too fishy to complete an audit, Buffett’s cash pile got even bigger, the first Q3 GDP Estimate was lackluster and the Jobs Report missed badly on expectations.

Key Earnings Announcements:

Amazon doubled their free cash flow, Uber’s Mobility business is slowing down, Robinhood’s revenue streams are too unpredictable, and Reddit is getting added to the portfolio.

Amazon (AMZN)

Key Metrics

Revenue: $158.9 billion, an increase of +11% YoY

Operating Income: $17.4 billion, an increase of +56% YoY

Profits: $15.3 billion, an increase of +56% YoY

Earnings Release Callout

“We kicked off the holiday season with our biggest-ever Prime Big Deal Days and the launch of an all-new Kindle lineup that is significantly outperforming our expectations; and there’s so much more coming, from tens of millions of deals, to our NFL Black Friday game and Election Day coverage with Brian Williams on Prime Video, to over 100 new cloud infrastructure and AI capabilities that we’ll share at AWS re: Invent the week after Thanksgiving.”

My Takeaway

I’ve said it so many times I might as well tattoo it on my body — if you can predict the cash flow, you can predict the stock price. Amazon is the perfect example of this phenomenon — as you can see above. The black line is their stock price, and the blue line is their historical and expected free cash flow. It’s obvious as to where Wall Street expects it to trend toward in the coming years.

And for good reason! The company delivered $112.7 billion of operating cash flow (+57% YoY), and $47.7 billion of free cash flow (+123% YoY) during the quarter. As you can see, the company went “free cash flow negative” in 2021 and 2022 — which meant they literally took all of the money they made during those years (and some) and reinvested it back into the business — think R&D, infrastructure, technology advancements, etc.

This caused their stock price to fall off a cliff, down -55% in about 12 months. But if you were a patient investor and knew that this company’s entire mantra is “free cash flow,” you accumulated shares for cheap! And now those reinvestments they made are paying off in a BIG way — sending their stock price to new all time highs.

Now you might be asking yourself, “Is it too late? Should I still buy?”

I argue it’s not too late, and here’s why:

1) The vast majority of this cash flow comes from AWS — and the gap between reported growth and their backlog during this last quarter expanded +4%, suggesting accelerating demand. In other words, their AWS backlog grew by +23%, accelerating from +19% last quarter.

2) Their high-margin advertising business segment grew from $12B to $14.3B (+19%) over the last 12-months, and I don’t expect this to slow down anytime soon.

3) Their International operating margins (what used to be a losing business) are now positive 3.5% — which looks a lot like their North American business back in 2019. Today, their North American margins are 6%. Adding another 2-3% operating margin to their International business over the coming years adds another $4B annually to their bottom line.

See? There’s a ton to be excited about! I’m so incredibly long on Amazon.

Uber (UBER)

Key Metrics

Revenue: $11.2 billion, an increase of +20% YoY

Operating Income: $1.1 billion, an increase of +169% YoY

Profits: $2.6 billion, an increase of +1,089% YoY

Earnings Release Callout

“We delivered yet another record quarter of profitable growth at a global scale, reflecting the strength of our platform, which now has over 25 million Uber One members.

We hit another important milestone this quarter, delivering over $1 billion in GAAP operating income for the first time in our company's history, and are on track to deliver 20% Gross Bookings growth on a constant currency basis for the full year.”

My Takeaway

After peaking at +48% year-to-date, Uber’s stock price slid -7% after their earnings were reported. Let’s dig into the details…

The company reported Gross Bookings growth of only +0.6%, below Wall Street’s expectations. With that being said, the company delivered Adj. EBITDA +2.4% above their expectations — putting investors in a weird situation where they now need to try and balance growth and profitability. This slowdown in their Mobility business segment came from inflation in insurance costs, forcing Uber to pass those costs down to the consumer.

Their Delivery business segment, on the other hand, outpaced Wall Street’s expectations — order frequency reached another all-time-high — suggesting their customers aren’t experiencing a weaker economic environment, their Mobility prices are simply too high.

Additionally, Uber now has more than 25M Uber One members (+70% YoY), and their advertising business grew by +80% YoY. Management also reiterated that they’re working with 14 autonomous vehicle partners, including Waymo.

To me, this is a concerning quarter — I don’t like it when companies I’m invested into experience lower-than-expected demand for their products (Mobility). With that being said, this doesn’t break my investment thesis in their business and I’ll eagerly wait to see if this is a trend or simply a blip on the radar.

Holding shares.

Robinhood (HOOD)

Key Metrics

Revenue: $637.0 million, an increase of +36% YoY

Operating Income: $2.0 million, compared to -$2.0 million last year

Profits: $150.0 million, compared to -$85.0 million last year

Earnings Release Callout

“Q3 was another strong quarter, as we drove 36% year-over-year revenue growth, and dropped most of that to the bottom line. We entered 2024 with the goal of delivering another year of profitable growth, so we're excited to have already broken prior full year records for both revenue and EPS.”

My Takeaway

Revenue came in -4% below Wall Street’s expectations as both transaction revenue and net interest income were lower than hoped for. Crypto-specific revenue was also lower than expected, as were equities revenues. However, management shared their continued confidence as the business seemed to be on fire heading into Q4 — with monthly options volumes in October on track to be the highest in company history.

Net deposits were also up over +$4B during the month of October, with $2B of that coming from Robinhood’s promotion week. Cash balances sat at $25B, up +2% vs. September.

Their take-rate on Cryptocurrency trading increased from 0.38% to 0.44% — and their fee rate increased to 0.48%. Management is optimistic these low trading fees will spark continued excitement in the asset class.

Their event contracts business experienced a quick rollout, with 10M contracts having traded hands on day one — and expected to double over the coming days as we head into the election. This could be Robinhood laying the ground work for more futures trading products down the line.

All in all, Robinhood seems to be doing everything right — but what’s tough about this business from the investor’s perspective is beyond their Robinhood Gold subscribers, they don’t have any customers. Uber has customers — people pay them for rides and deliveries. Amazon has customers — obviously. But Robinhood… no one is exactly “paying them” for anything — they have to make their money behind the scenes with take rates, PFOF, among other things.

For this reason, I’ll remain on the sidelines. I’m bullish on the company in general, but not enough to take money out of something like an Amazon or Uber to get the ball rolling (opportunity cost).

Reddit (RDDT)

Key Metrics

Revenue: $384.4 million, an increase of +68% YoY

Operating Income: $6.9 million, compared to -$19.5 million last year

Profits: $29.8 million, compared to -$7.4 million last year

Earnings Release Callout

“It was another strong quarter for Reddit and our communities as we achieved important milestones, including new levels of user traffic, revenue growth, and profitability.”

My Takeaway

Time to buy stock in Reddit.

Yes, I mean that — but not all at once, as their stock price skyrocketed +25% last week after reporting these earnings results. With that being said, this is a textbook “predict the cash flow, predict the stock price” opportunity.

In 2024, the company is expected to report $100M in free cash flow and $218M in operating cash flow. Wall Street also expects the company to report $272M (up +171%) in free cash flow and $455M (up +110%) in operating cash flow in 2025. These figures climb even higher in 2026 as Wall Street expects $400M in free cash flow and $700M in operating cash flow.

Let me be crystal clear here — Reddit will go from $0 in free cash flow to $400M in the next ~24 months, with their operating cash flow increasing by triple digits as well. If (and that’s a BIG if, because this is mostly advertising revenue) this actually happens and Wall Street’s forecasts are correct, Reddit stock should be trading +50-60% higher than current levels in a couple of years time.

The key here is to accumulate shares over a long period of time, especially on red days. That will be my playbook.

A few things to look forward to…

1) Reddit is expected to re-launch its Search tool in the coming months, which given the success of competing Gen AI-driven search tools, could become another layer of monetization for the company.

2) Their top-line monetization funnel (daily active users) continues to grow around the world — with global DAUs up +47% to 97.2M, and US DAUs up +51% to 48.2M. More users = more people to advertise to = more money for the company.

3) The company plans to expand their machine learning translation to 30 countries by the end of the 2025 — which means you don’t have to speak the language the content was written in to read and interact with it. This is how the company scales their DAUs into the 100s of millions very quickly.

All-in-all, really excited to begin nibbling at this one!

Investor Events / Global Affairs:

MicroStrategy announced a $42 billion fundraising target, SMCI tanked after EY said they are too fishy to complete an audit, and Buffett’s cash pile got even bigger.

MicroStrategy Makes Massive Equity Move for More Bitcoin

MicroStrategy announced plans to sell $21 billion in new shares, aiming to surpass Tesla’s 2020 record of $10 billion. This equity sale is part of a larger $42 billion fundraising target, aligned with a symbolic nod to the number 42 from The Hitchhiker’s Guide to the Galaxy. The funds will support MicroStrategy’s Bitcoin acquisition strategy, positioning it as a Bitcoin proxy through both share and debt sales.

The company has already raised $3.5 billion this year and $4.4 billion from convertible debt sales. Despite a slight dip, MicroStrategy’s stock remains up about +405% over the past year, significantly outpacing Bitcoin's growth.

MicroStrategy (MSTR) Stock Performance, YTD Chart, Seeking Alpha

“We believe it’s a unique number with some special characteristics. It’s the sum of 21 plus 21. We all know that 21 is a magic — a magical number in the world of Bitcoin. There can only ever be a maximum of 21 million Bitcoin in circulation.”

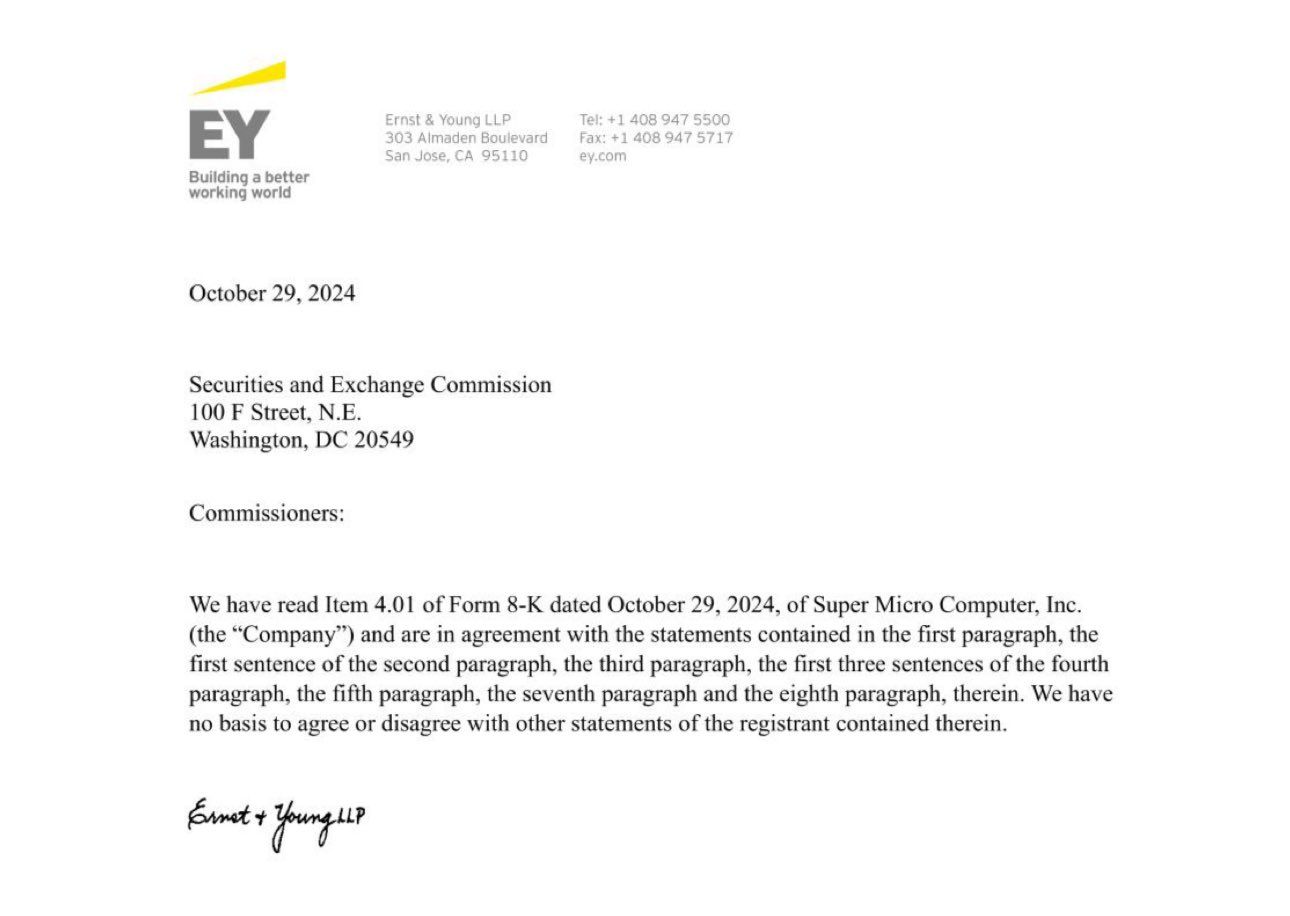

Super Micro Computer (SMCI) Tanked from Audit Worries

Super Micro's stock plummeted -45% this week after the company lost its second auditor in less than two years, erasing its 2024 gains. The image above is the hilariously bad letter that was written by Ernst & Young after they felt the need to back out.

Concerns about accounting irregularities and a potential Department of Justice probe have intensified investor worries. Short seller Hindenburg Research also disclosed a short position, alleging accounting manipulation. Despite these issues, Super Micro plans to provide a business update on its latest quarter on Election Day (Tuesday). The company faces a mid-November Nasdaq compliance deadline due to delayed filings, raising the risk of delisting.

Super Micro Computer (SMCI) Stock Performance, YTD Chart, Seeking Alpha

“We are resigning due to information that has recently come to our attention which has led us to no longer be able to rely on management's and the Audit Committee's representations and to be unwilling to be associated with the financial statements prepared by management.”

Warren Buffett Expands Cash Stockpile

Berkshire Hathaway’s cash reserves hit a record $325.2 billion in Q3 2024, as Warren Buffett increased stock sales and paused share buybacks.

Buffett offloaded $36.1 billion in stocks, including significant portions of Apple (AAPL) and Bank of America (BAC), marking the fourth straight quarter of reductions. Berkshire refrained from buybacks in Q3, following slowed activity earlier in the year as its shares reached record highs.

Shares of BRK have gained +26.7% year-to-date — outpacing the S&P 500’s +20.1% return and pushing Berkshire’s market cap past $1 trillion.

Operating earnings fell by -6% to $10.1 billion due to weak insurance results, slightly under analyst expectations. Buffett’s cautious approach reflects concerns about rising fiscal deficits and potential future increases in capital gains tax rates.

Berkshire Hathaway (BRK) Stock Performance, YTD Chart, Seeking Alpha

“Berkshire is a microcosm of the broader economy. It’s hoarding cash suggests a 'risk-off' mindset, and investors may worry what it means for the economy and markets."

Major Economic Events:

The first Q3 GDP Estimate and the Jobs Report both resulted in misses.

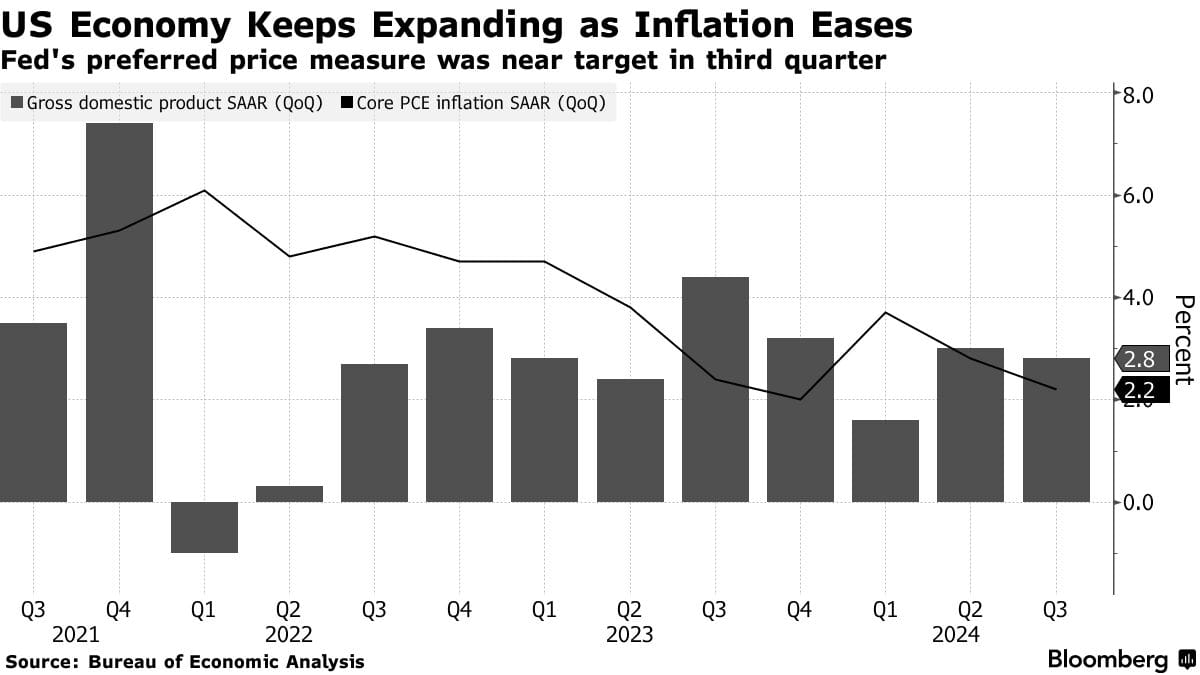

U.S. Q3 GDP (First Estimate)

The U.S. economy grew at an annualized +2.8% rate in Q3, with consumer spending up +3.7%, driven by increased purchases of goods. Defense spending surged +14.9% — contributing to a 5% rise in government spending.

Core inflation increased by +2.2%, aligning with the Federal Reserve's target, while trade deficits slightly restrained GDP growth. Business investments showed mixed results; equipment spending rose, especially in transportation and tech, while residential investment declined due to high mortgage rates.

The steady economic growth is positive news for the Federal Reserve’s gradual rate-cutting path and could support Vice President Kamala Harris’s campaign ahead of the election.

“The headline GDP print for 3Q makes the economy look strong, but beneath the surface things are less stable. Consumer spending, the main growth driver, has been narrowly boosted by upper-income households, while lower-income ones have grown more price-sensitive.”

Jobs Report Disappoints in a Major Way

Source: WSJ

In October, the U.S. added only 12,000 jobs — a sharp decline attributed to hurricanes and a Boeing strike. The unemployment rate remained steady at 4.1%, aligning with expectations. Economists believe the low job figure is temporary, as storms and strikes sidelined workers, distorting the data. Average hourly earnings rose 4% year-over-year, partly due to lower-paid workers being more affected by weather-related disruptions.

With the Federal Reserve expected to reduce interest rates soon, the report provides a mixed outlook ahead of the election. Despite the low job numbers, steady growth in the economy supports a gradual cooling of the labor market, potentially allowing for modest monthly job gains to maintain stability.

“At first glance, October’s jobs report paints a picture of growing fragility in the U.S. labor market, but under the surface is a muddy report roiled by climate and labor disruptions. While the impacts of these events are real and should not be ignored, they are likely temporary and not a signal of a collapsing job market.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Cover image source: Be a Better Dev

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at info@gritcap,io

Reply