- GRIT

- Posts

- 👉 All Eyes on Google & Tesla...

👉 All Eyes on Google & Tesla...

American Airlines, Coca-Cola, Peter Thiel

Welcome to your new week.

Congrats again to all of you that have held steady with crypto and you’ve been getting rewarded over the last few days. With that being said — it’s a new, jam-packed week in the markets.

Paid Subscribers, be sure to join me TODAY (July 21st) at 4pm ET for our monthly livestream! I’ll be walking everyone through my investment portfolio, sharing general updates on the market, as well as exclusive research.

Smart Investors Don’t Guess. They Read The Daily Upside.

Markets are moving faster than ever — but so is the noise. Between clickbait headlines, empty hot takes, and AI-fueled hype cycles, it’s harder than ever to separate what matters from what doesn’t.

That’s where The Daily Upside comes in. Written by former bankers and veteran journalists, it brings sharp, actionable insights on markets, business, and the economy — the stories that actually move money and shape decisions.

That’s why over 1 million readers, including CFOs, portfolio managers, and executives from Wall Street to Main Street, rely on The Daily Upside to cut through the noise.

No fluff. No filler. Just clarity that helps you stay ahead.

Key Earnings Announcements:

Alphabet, American Airlines, Coca-Cola, Domino’s, Intel, and Tesla are a few of the many large companies reporting this week.

Monday (7/21): AGNC Investment, Agilysys, Berkley, Calix, Cliffs, Crown, Dynex Capital, Equity Bancshares, Fastenal, FirstBank, HBT Financial, Medpace, NXP Semiconductors, Preferred Bank, Roper Technologies, Ryanair, SmartBank, Steel Dynamics, Verizon

Tuesday (7/22): Albertsons, AGCO, AGNC Investment, Agilysys, Berkley, BOK Financial, Calix, Capital One, Coca-Cola, Crown, Danaher, D.R. Horton, Enphase, Intuitive Surgical, KeyBank, Lockheed Martin, Matador Resources, Medpace, Northrop Grumman, Omnicom Group, Philip Morris, Quest Diagnostics, Range Resources, RTX, SAP, Texas Instruments, Thermo Fisher Scientific

Wednesday (7/23): Alphabet, Amphenol, AT&T, Chipotle, CoStar Group, EQT, Fiserv, Freeport-McMoRan, GE Vernova, General Dynamics, Hasbro, IBM, Johnson & Johnson, KAR Auction Services, Molina Healthcare, Mr. Cooper Group, Nextera Energy, O’Reilly Auto Parts, Sandvik, ServiceNow, Tesla, Thermo Fisher Scientific, Triumph Financial, United Airlines, United Rentals

Thursday (7/24): Alaska Airlines, American Airlines, Blackstone, Coursera, Deckers, Dow, Edwards Lifesciences, Flex, Honeywell, Intel, Keurig Dr Pepper, Liberty Broadband, Molina Healthcare, Nasdaq, Newmont, Nokia, Orchid Island, Scholastic, Southwest Airlines, Union Pacific

Friday (7/25): 3M, AutoNation, Booz Allen Hamilton, Centene, Charter Communications, Coursera, Gentex, GrafTech, HCA Healthcare, Liberty Broadband, Saia, Southside Bank, Trinet

What We’re Watching:

Alphabet (GOOG)

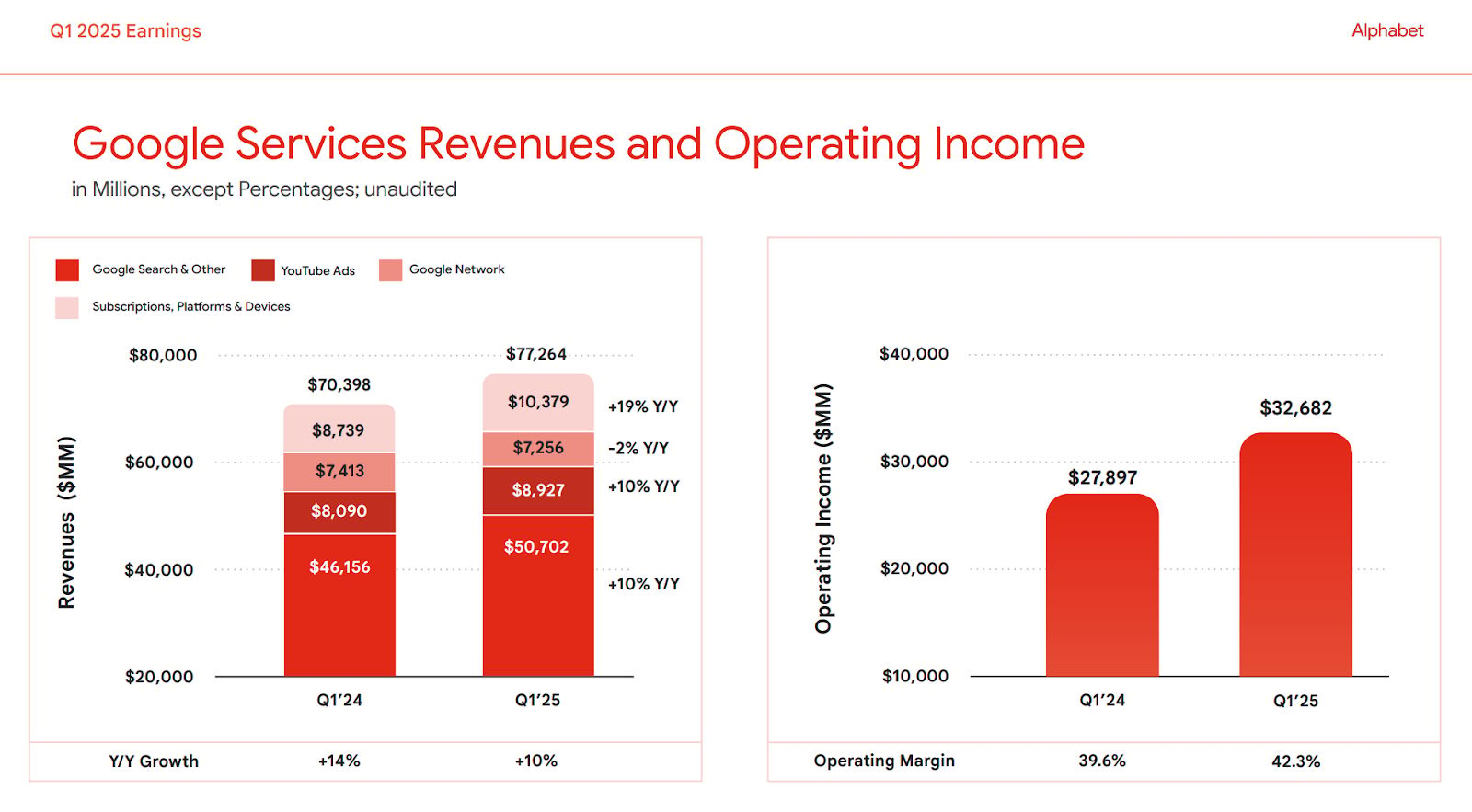

Source: Alphabet Earnings Deck

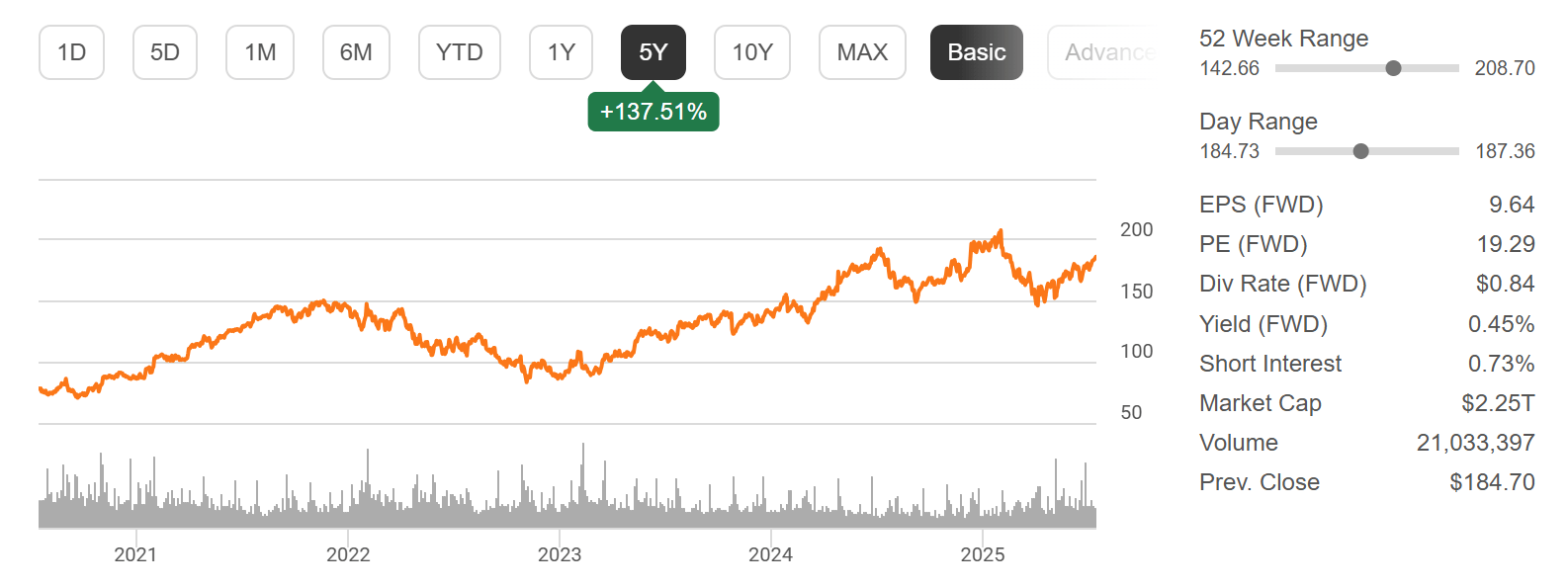

Alphabet reports earnings Tuesday after the bell, with shares -0.5% YTD as investors bet on the company’s aggressive AI rollout and resilient ad business. Last quarter, Alphabet posted $80.5B in revenue (+15% YoY) driven by a rebound in Google Search and YouTube ads, while Google Cloud returned to profitability and grew +28% YoY. Operating margin expanded to 32%, its highest since 2021.

This earnings cycle, investors will focus on how well Alphabet is monetizing AI-powered search and Gemini integrations, whether YouTube ad growth can sustain momentum amid rising competition from TikTok, and how Google Cloud margins hold up against AWS and Azure. Key CapEx trends — particularly spending on TPUs and custom AI chips — will also be in the spotlight.

I’ll be watching for management commentary on Search innovation, AI assistant traction, and any signs of accelerating monetization within Workspace, Cloud, and YouTube Premium as Alphabet pushes deeper into the AI-native product cycle.

Alphabet, Inc. (GOOG) Stock Performance, 5-Year Chart, Seeking Alpha

Tesla (TSLA)

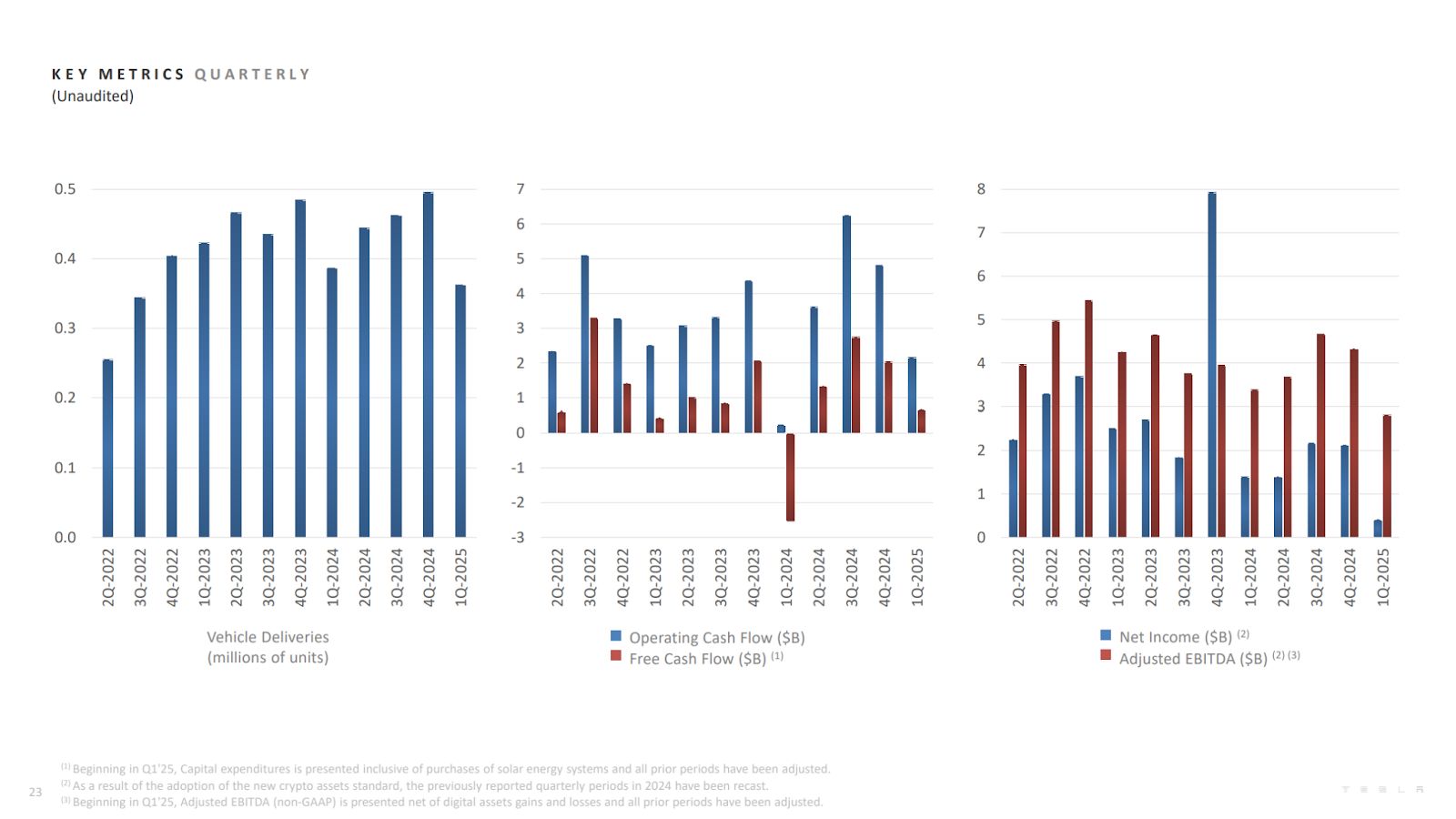

Source: Tesla Earnings Deck

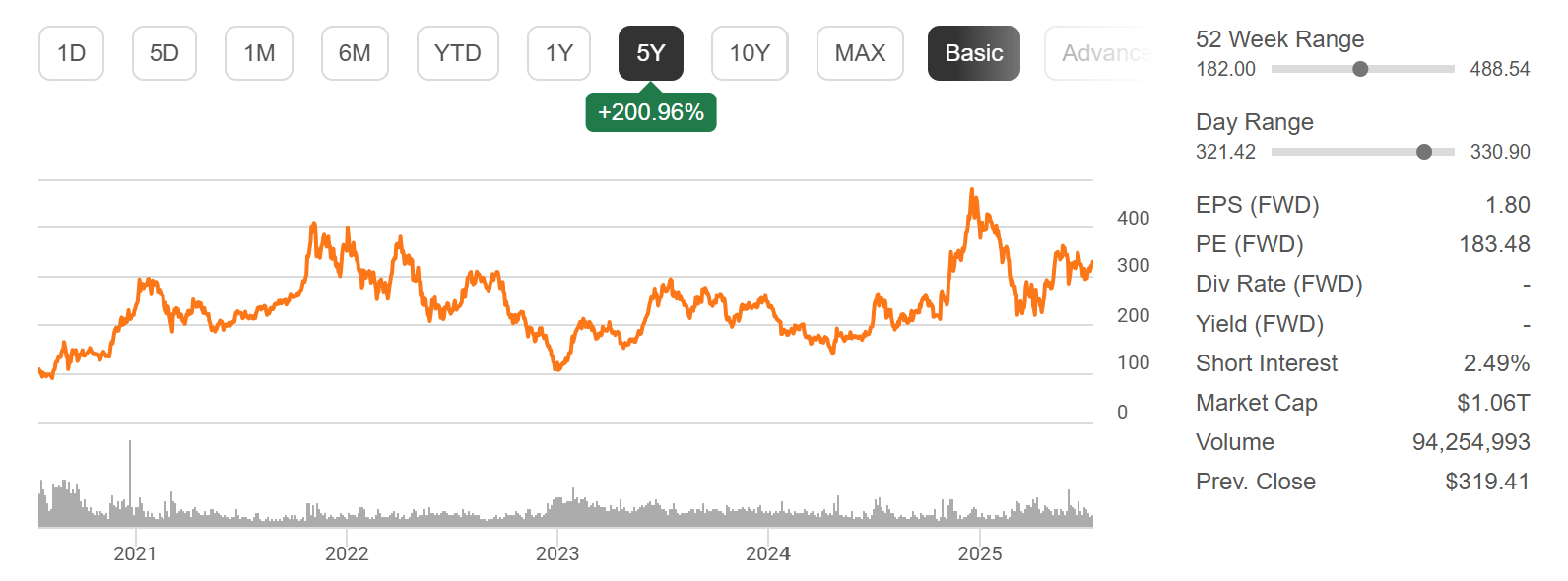

Tesla reports Q2 earnings Wednesday after the bell. Shares are down -18.7% YTD but have rebounded recently, supported by early enthusiasm around its Austin robotaxi service and Musk's recommitment to leadership — Barron’s reports he’s “sleeping in the office” ahead of the report.

Analysts expect Q2 revenue to fall ~11% YoY to ~$22.8B and EPS to drop roughly 23–33% to ~$0.40–$0.44. Investors will be watching closely for updates on vehicle deliveries — reported at 384K in Q2 (–13.5% YoY) — and whether cost cuts help stabilize margins.

This quarter’s narrative will hinge on three themes: 1) traction – and any safety concerns — with the early robotaxi rollout in Austin; 2) competitiveness in China and Europe against BYD and traditional OEMs; and 3) progress on affordable EV models and software monetization through FSD subscriptions and energy storage. I’ll also be listening for any refreshed guidance or margin outlook.

Tesla, Inc. (TSLA) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

The IPO market is heating up and Lutnick is certain the US will land a trade deal with the EU before the Aug 1st deadline.

Bullish Files for IPO

Source: Crypto Briefing

Crypto exchange Bullish, backed by Peter Thiel’s Founders Fund and led by former NYSE president Tom Farley, has filed to go public on the New York Stock Exchange under the ticker BLSH.

Founded in 2020 and based in the Cayman Islands, Bullish reported a Q1 2025 net loss of $348.6M, a reversal from $104.8M in profit a year earlier — with digital asset trading volume steady at $80.2B. The company cites Coinbase, Kraken, and Binance as key competitors.

Farley said the IPO reflects a belief that “the digital assets industry is beginning its next leg of growth,” adding that transparency and compliance will be central to Bullish’s strategy as a public company. The move follows strong public market debuts from other crypto firms like Circle and eToro.

“In the first quarter of 2025, Bullish exchange executed over $2.5 billion in average daily volume, ranking in the top five exchanges by spot volume for Bitcoin and Ether.”

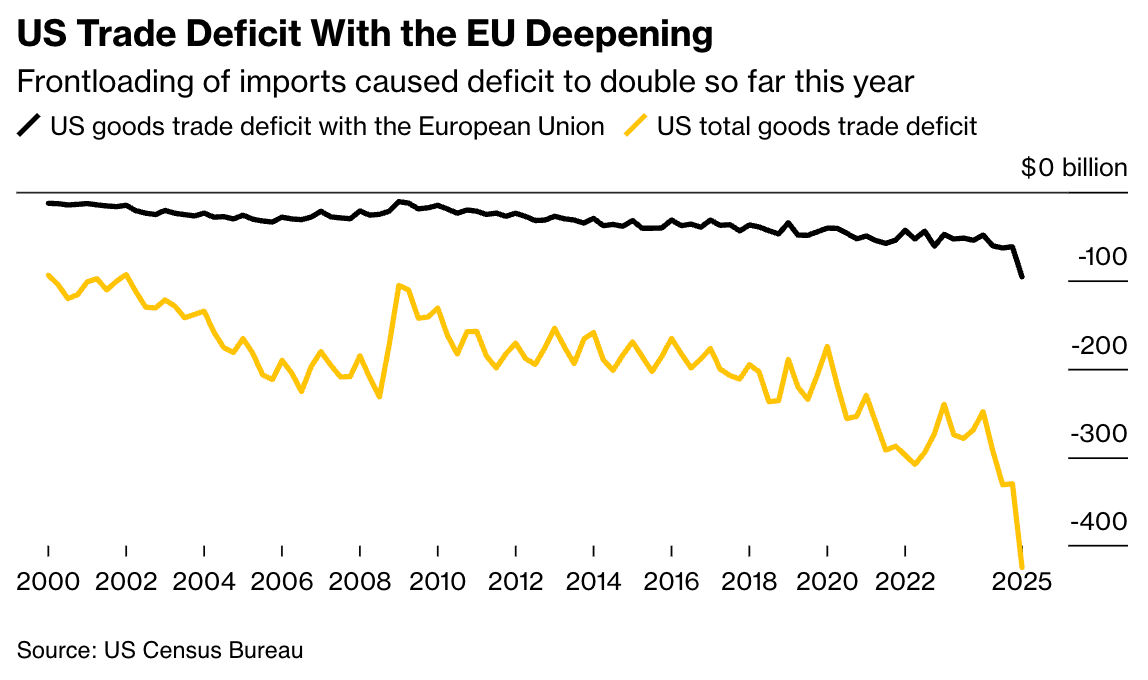

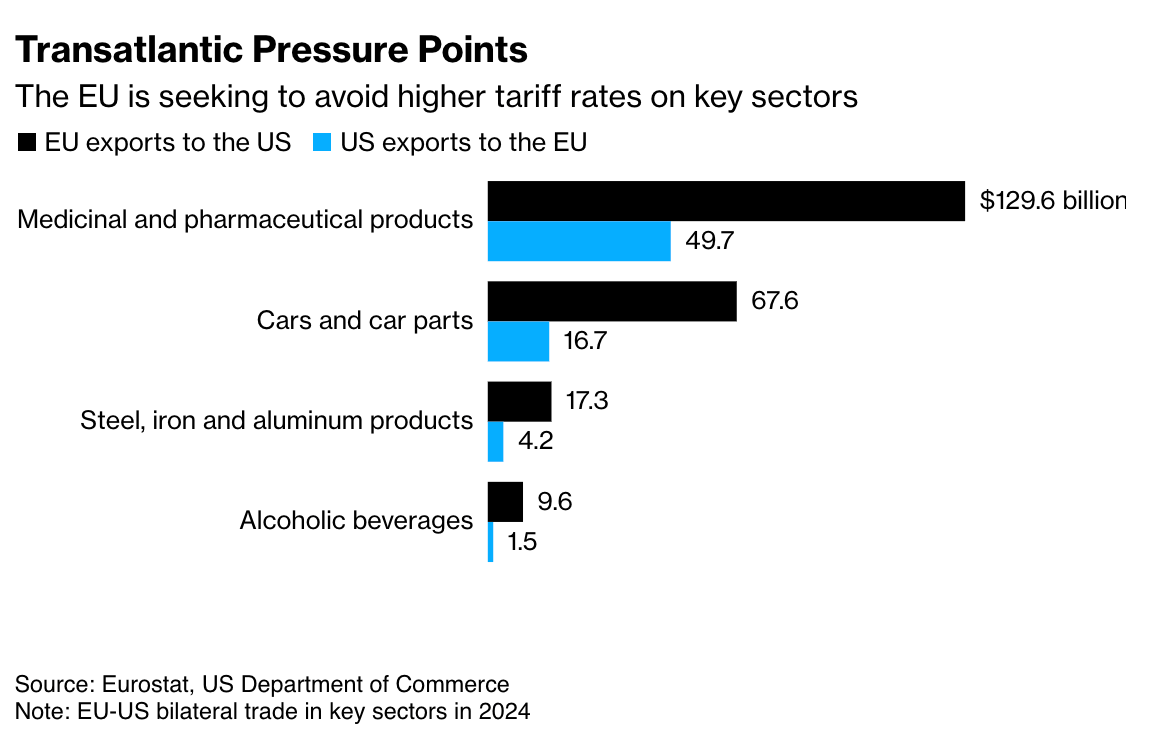

EU Trade Deal Work in Progress

U.S. Commerce Secretary Howard Lutnick said Sunday he’s “confident” a deal can be reached with the EU before the August 1 tariff deadline, after speaking with European negotiators over the weekend.

While President Trump has threatened 30% tariffs on EU and Mexican imports starting next month, Lutnick emphasized there’s still “plenty of room” for agreement — calling the EU and U.S. “the two biggest trading partners in the world.” Still, Lutnick reinforced that August 1 remains a hard deadline: “Nothing stops countries from talking to us after August 1, but they’re going to start paying the tariffs.”

Trump has already sent formal letters to the EU, Mexico, Canada, Japan, and Brazil with proposed blanket tariffs (20–50%) — including a specific 50% levy on copper. Negotiations continue at a tense pace, with investors watching closely for signs of progress or escalation.

“While it’s long accepted that any agreement would be asymmetrical in favor of the US, the EU will assess the overall imbalance of any deal before deciding whether to pull the trigger on any re-balancing measures… The level of pain that member states are prepared to accept varies, and some are open to higher tariff rates if enough exemptions are secured.”

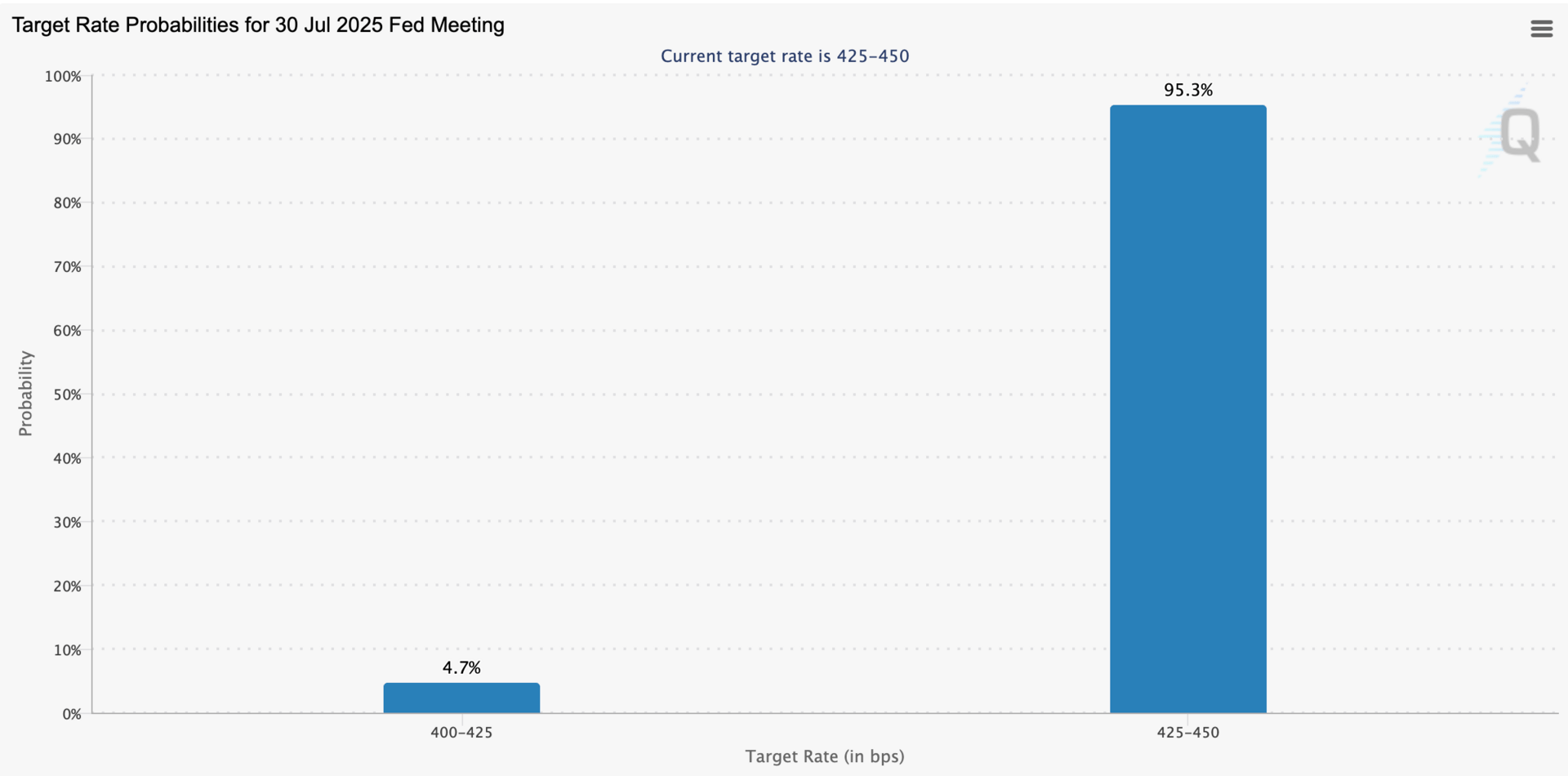

Treasury Secretary Bessent Calls for Review of “Entire” Federal Reserve

Treasury Secretary Scott Bessent called for a comprehensive review of the Federal Reserve, questioning whether the institution has effectively fulfilled its mission. His remarks come amid rising tensions between the White House and the Fed, including speculation that President Trump considered firing Fed Chair Jerome Powell — a move Trump has since denied.

Bessent is reportedly playing a key role behind the scenes, both as a possible Powell successor and as someone who may have influenced Trump to hold off on the dismissal attempt with Powell. He criticized the Fed for its recent handling of inflation, suggesting that interest rates should be lowered given that inflation has largely moderated. Bessent also took aim at the Fed's mindset and expertise, implying that its leadership is out of touch. Separately, the administration has targeted the Fed over a costly $2.5 billion renovation project — further fueling the conflict.

“They were fear mongering over tariffs, and thus far we have seen very little, if any, inflation. We’ve had great inflation numbers. So, you know, I think this idea [is] of them not being able to break out of a certain mindset. All these Ph.D.s over there, I don’t know what they do.”

Major Economic Events:

Durable goods orders and existing home sales take center stage.

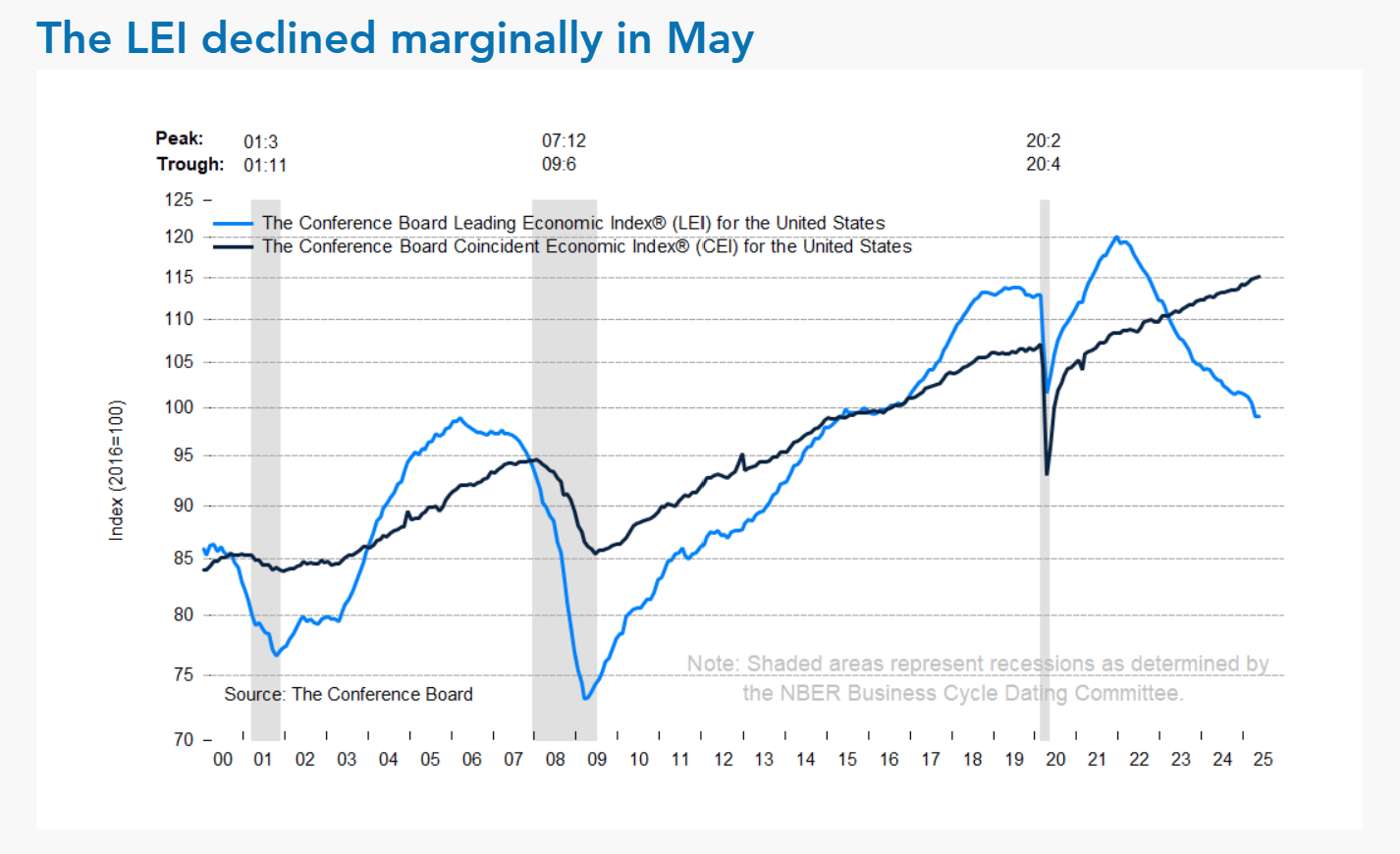

Monday (7/21): U.S. Leading Economic Indicators

Tuesday (7/22): Fed Chair Powell Opening Remarks at Banking Conference

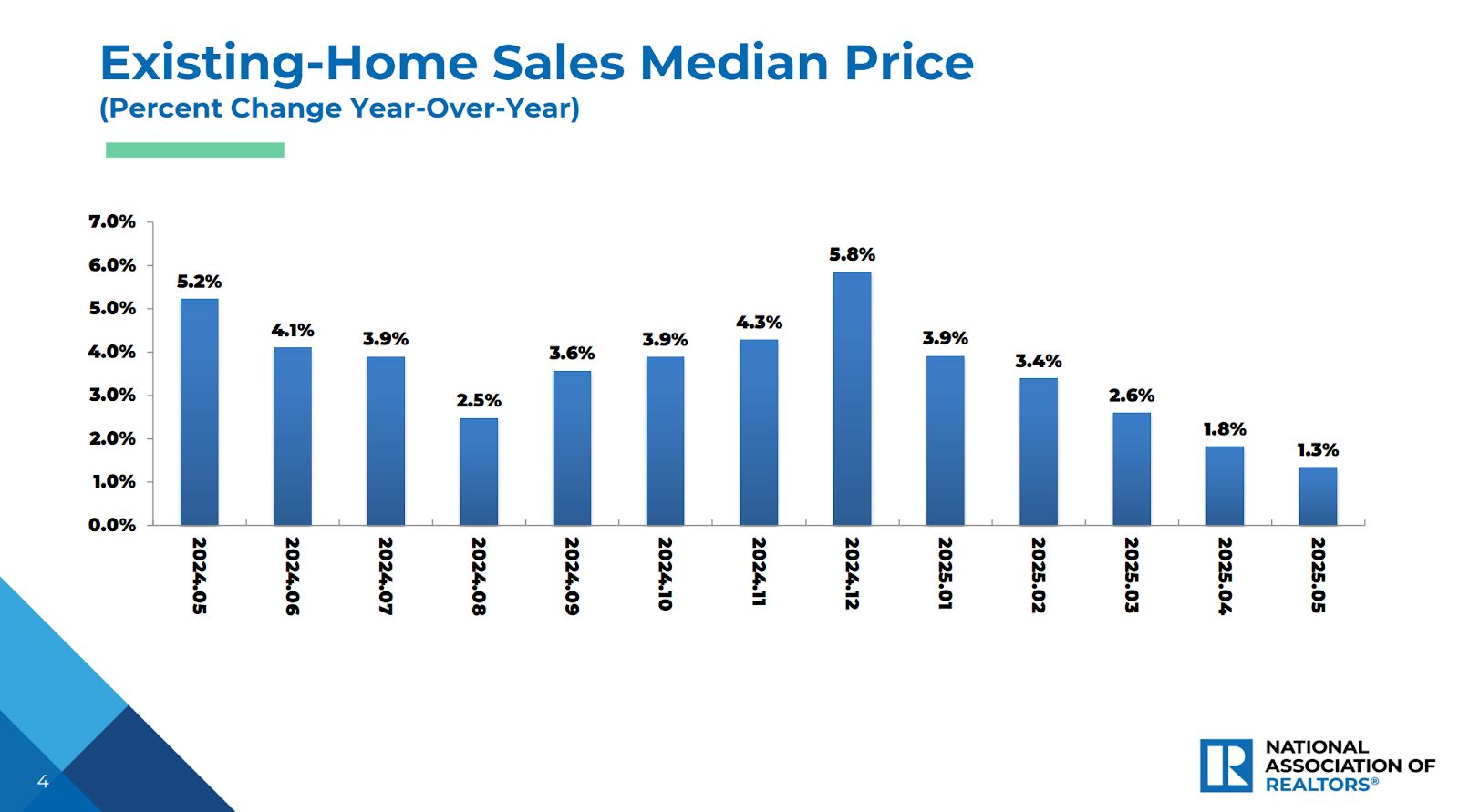

Wednesday (7/23): Existing Home Sales

Thursday (7/24): Initial Jobless Claims, New Home Sales, S&P Flash U.S. Manufacturing PMI, S&P Flash U.S. Services PMI

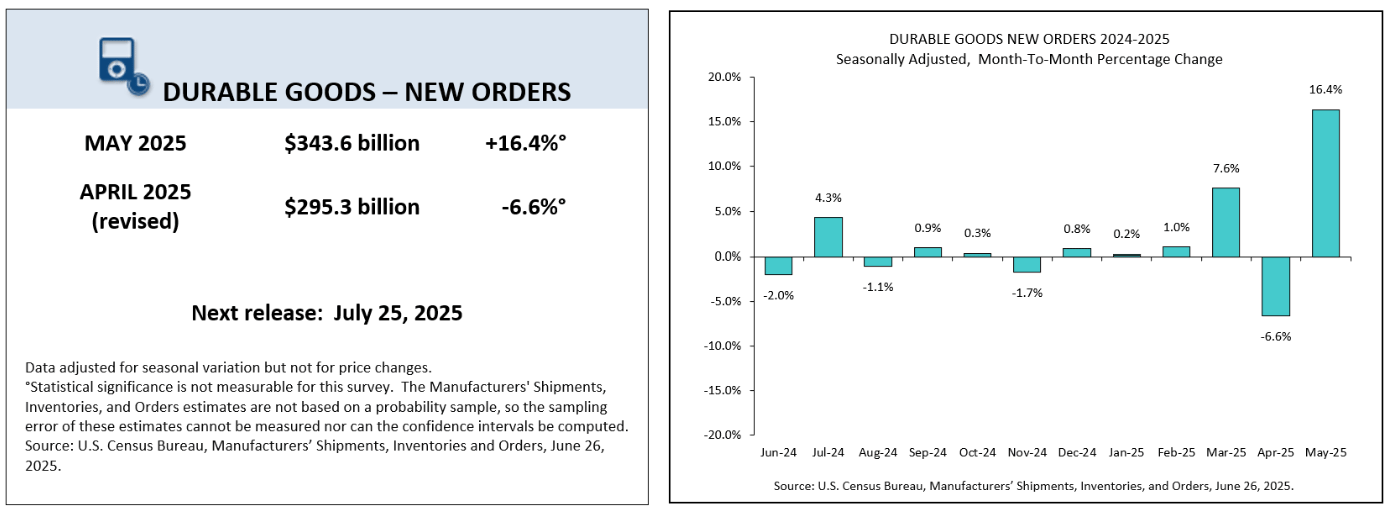

Friday (7/25): Durable-Goods Minus Transportation, Durable-Goods Orders

What We’re Watching:

Durable Goods Orders

Durable Goods Orders surged +16.4% in May to $343.6B, the largest monthly jump since July 2014 — smashing forecasts of an +8.5% rise and reversing April’s -6.6% decline. The gain was driven by a +48.3% spike in transportation equipment, led by nondefense aircraft and parts (+230.8%). Core capital goods orders (ex-aircraft) — a key proxy for business investment — rose +1.7%, building on a +1.4% gain in April and handily beating expectations of +0.1%.

Economists expect the following this week:

Durable Goods Orders (June, headline): +0.4% month-over-month

Core Capital Goods Orders (ex-aircraft): +0.2% month-over-month

“Orders for long-lasting goods skyrocketed 16% in May to mark the biggest increase in 11 years, but the headline number was exaggerated by a flush of new Boeing contracts that masked ongoing weakness in business investment. The increase in durable-goods orders last month more than offset a 6.6% decline in April. Orders have seesawed this year in response to on-again, off-again U.S. tariffs.

The overall trend in orders and business investment, however, remains soft. Many companies have been waiting for a resolution of U.S. trade disputes before forging ahead with big projects.”

Existing Home Sales

Existing Home Sales in the U.S. rose by +0.8% in May to a seasonally adjusted annual rate of 4.03 million units, rebounding from a -0.5% decline in April and topping expectations for a dip to 3.96 million. Sales increased in the Northeast (+4.2%), Midwest (+2.1%), and South (+1.7%), offsetting a -5.4% decline in the West. The median existing-home price climbed to $422,800 — highlighting persistent affordability challenges.

Economists expect the following this week:

Existing Home Sales (June): 4.05M seasonally adjusted annual rate

Median Sales Price (June): $426,000 expected vs $422,800 in May

“The relatively subdued sales are largely due to persistently high mortgage rates. Lower interest rates will attract more buyers and sellers to the housing market. Increasing participation in the housing market will increase the mobility of the workforce and drive economic growth.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Cover image source: Tesla / Benj Edwards

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]