- GRIT

- Posts

- 👉 All Eyes on Oil + Tariff Deadline Approaches

👉 All Eyes on Oil + Tariff Deadline Approaches

GDP, Micron, Nike

Welcome to your new week.

Lots to touch on this week! If you didn’t get a chance to read the Week in Review posted yesterday — it’s linked here.

Let’s dive right in, with a quick word from our friends at Finance Buzz first — check it out!

Tackle your credit card debt by paying 0% interest until nearly 2027

If you have outstanding credit card debt, getting a new 0% intro APR credit card could help ease the pressure while you pay down your balances. Our credit card experts identified top credit cards that are perfect for anyone looking to pay down debt and not add to it! Click through to see what all the hype is about.

Key Earnings Announcements:

Carnival, General Mills, Jeffries, Micron, and Nike highlight this week’s earnings reports.

Monday (6/23): Commercial Metals, FactSet, KB Home

Tuesday (6/24): AeroVironment, BlackBerry, Carnival, FedEx, TD SYNNEX, Worthington Enterprises

Wednesday (6/25): Daktronics, General Mills, H.B. Fuller, Jefferies, Micron, MillerKnoll, NOVAGOLD, Paychex, Steelcase, Winnebago, Worthington Steel

Thursday (6/26): Acuity Brands, American Outdoor Brands, Concentrix, Enerpac Tool Group, HIVE, Lindsay Corporation, McCormick, Nike, Orion, Walgreens Boots Alliance

Friday (6/27): Apogee Enterprises

What We’re Watching:

Micron (MIU)

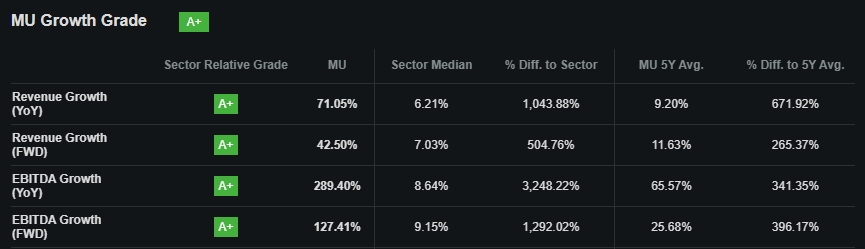

Micron is set to report fiscal Q3 results on Wednesday after the bell, with analysts looking for a major bounce in performance. Expectations are high: earnings are projected to more than double from a year ago, and revenue is forecast to climb over +30% as Micron rides a surge in demand for AI-optimized memory.

A spotlight will be on Micron’s newly shipped 36GB HBM4 12-High memory – built on its 1β (one-beta) DRAM process — which promises 60% faster performance and improved power efficiency over prior generations. With major customers already sampling the chip, investors will be tuned in for commentary around volume ramp, pricing trends, and competitive positioning in the HBM space.

Also in focus: gross margins, AI-related CapEx plans, and the broader outlook for DRAM and NAND as Micron scales into 2026. With shares already up nearly +47% YTD — management’s tone and guidance could decide whether the rally still has legs.

“AI is driving record industry demand for high-bandwidth memory, and Micron is well positioned to lead this transition with our cutting-edge HBM and DRAM portfolio.”

Micron Technology (MU) Stock Performance, 5-Year Chart, Seeking Alpha

Nike (NKE)

Nike reports fiscal Q4 results Thursday after the bell, with Wall Street bracing for an -88% year-over-year drop in profit as the company faces persistent macro pressures, tariff-driven cost inflation, and softening global demand. Shares are down roughly -21% YTD, and investor sentiment has been shaky amid a string of underwhelming quarters.

This week’s report will serve as a key checkpoint for CEO Elliott Hill’s turnaround strategy, especially after Nike announced it will relist its products on Amazon (AMZN) — marking a major shift in its digital distribution playbook. Analysts will be watching for updates on North America performance, digital sales recovery, margin guidance, and how management is navigating pricing vs. inventory risk in the face of rising competition.

Expect commentary on FY2025 outlook, cost-cutting initiatives, and any signs of a rebound in China or EMEA that could support a reacceleration into next year.

“We’re taking bold actions to reenergize growth, simplify the business, and return Nike to its position of strength.”

Nike, Inc. (NKE) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

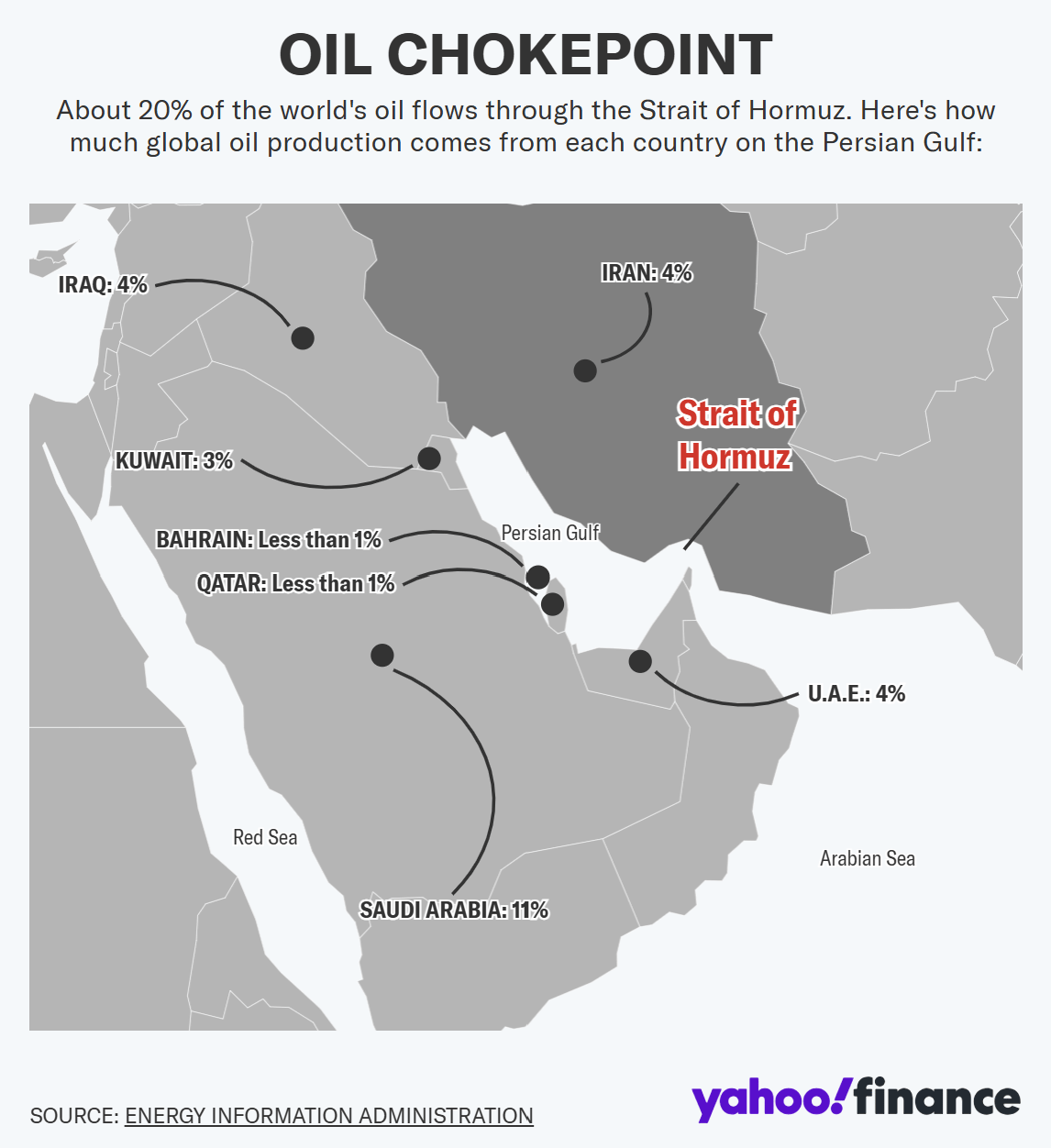

The Strait of Hormuz is Iran’s primary chess piece, let’s not forget about the July tariff deadline, and Apple is reportedly considering a purchase of Perplexity.

Strait of Hormuz Closure Looms

Iran’s parliament has voted to close the Strait of Hormuz — through which roughly 20% of the world’s oil and LNG flows daily — pending final approval from the Supreme National Security Council.

Two supertankers, each with the capacity to carry around 2 million barrels of crude oil, were making their way through the Strait of Hormuz at the entrance to the Persian Gulf — but they executed U-turns within the past 48 hours.

Oil has responded sharply: Brent crude surged nearly +4% to ~$80/barrel and U.S. crude climbed +4.3%, as traders priced in the risk of supply disruptions. Experts warn even partial blockages could spike oil prices above $100 — and in a worst-case scenario, up to $130 — injecting volatility into energy, equities, and inflation data.

“It’s a bargaining chip. Once they use it, it’s gone.”

“Their entire economy runs through the Strait of Hormuz… a closure would be suicidal.”

Tariff Deadline Approaching

Sources: Bloomberg, Apollo Chief Economist

The Trump administration is likely to extend its 90-day pause on implementing individualized tariffs beyond the July 9 deadline, as ongoing trade negotiations with key partners have yet to yield significant results. So far, only two trade agreements—one with the U.K. and another with China—have been reached, far short of Trump’s promise of “90 deals in 90 days.” Treasury Secretary Scott Bessent recently told Congress that if countries continue negotiating in good faith, the pause will be extended, but stressed that non-cooperative nations will face tariffs. Trump's tariff strategy, central to his economic agenda, aims to reshape U.S. trade by using levies as leverage to revive domestic manufacturing.

Legal uncertainty looms, as a recent court ruling temporarily blocked the April tariffs, only to be reversed by an appeals court hours later. With time running out, the administration appears poised to delay enforcement to keep negotiations alive, even as critics question the strategy’s effectiveness and transparency. Let’s see what happens as we approach the Fourth of July holiday and the deadline shortly thereafter.

These delays very well could already be baked into the market. Tariffs haven’t really been the main focus of the news over the last couple of weeks, and we expect them to come back to the forefront.

“Maybe the strategy is to maintain 30% tariffs on China and 10% tariffs on all other countries and then give all countries 12 months to lower non-tariff barriers and open up their economies to trade. Extending the deadline one year would give countries and U.S. domestic businesses time to adjust to the new world with permanently higher tariffs, and it would also result in an immediate decline in uncertainty, which would be positive for business planning, employment, and financial markets.

This would seem like a victory for the world and yet would produce $400 billion of annual revenue for U.S. taxpayers. Trade partners will be happy with only 10% tariffs and U.S. tax revenue will go up. Maybe the administration has outsmarted all of us.”

Apple (AAPL) Held Internal Talks About Buying Perplexity

Source: Stefani Reynolds / Bloomberg

Apple executives have held internal discussions about potentially acquiring AI startup Perplexity, aiming to boost its AI capabilities and reduce reliance on its $20 billion annual search partnership with Google, which is under antitrust scrutiny. The talks are still in early stages and Apple has not yet approached Perplexity with a formal bid, though the company has considered both a full acquisition and a partnership that would integrate Perplexity into Safari and Siri.

Perplexity — recently valued at $14 billion — offers real-time AI-powered search responses, and any acquisition would mark Apple’s largest deal ever, surpassing its $3 billion Beats purchase. Apple’s interest follows a failed attempt by Meta to acquire Perplexity, which instead invested in Scale AI to strengthen its own superintelligence strategy.

Both Apple and Meta are competing intensely for top AI talent, with Apple trying to recruit Daniel Gross — an AI entrepreneur who previously sold a company to Apple—and investing in its own generative AI tools. A major complication for Apple could be Perplexity’s ongoing talks with Samsung, a key smartphone rival, which may announce a significant partnership that could sway Perplexity's strategic direction.

Apple Inc. (AAPL) Stock Performance, 5-Year Chart, Seeking Alpha

“The hunt for talent is part of a bid to catch up in generative AI. The company was slow to deliver its Apple Intelligence platform and still lags rivals in key features. A revamped Siri was delayed indefinitely this year, with the company now aiming to have it ready by next spring.”

Major Economic Events:

A look at the U.S. consumer, housing market, and the third estimate of Q1 GDP.

Monday (6/23): Existing Home Sales, S&P Flash U.S. Manufacturing PMI, S&P Flash U.S. Services PMI

Tuesday (6/24): Cleveland Fed President Beth Hammack Speaks, Consumer Confidence, Fed Chair Powell Testifies to House Financial Service Committee, S&P Case-Shiller Home Price Index (20 Cities)

Wednesday (6/25): New Home Sales

Thursday (6/26): Advanced Retail Inventories, Advanced U.S. Trade Balance in Goods, Advanced Wholesale Inventories, Cleveland Fed President Beth Hammack Speaks, Core Durable-Goods Orders, Durable-Goods Orders, GDP (Second Revision), Initial Jobless Claims, Pending Home Sales

Friday (6/27): Consumer Sentiment (Final), Core PCE Index, Core PCE (Year-Over-Year), PCE Index, PCE (Year-Over-Year), Personal Income, Personal Spending

What We’re Watching:

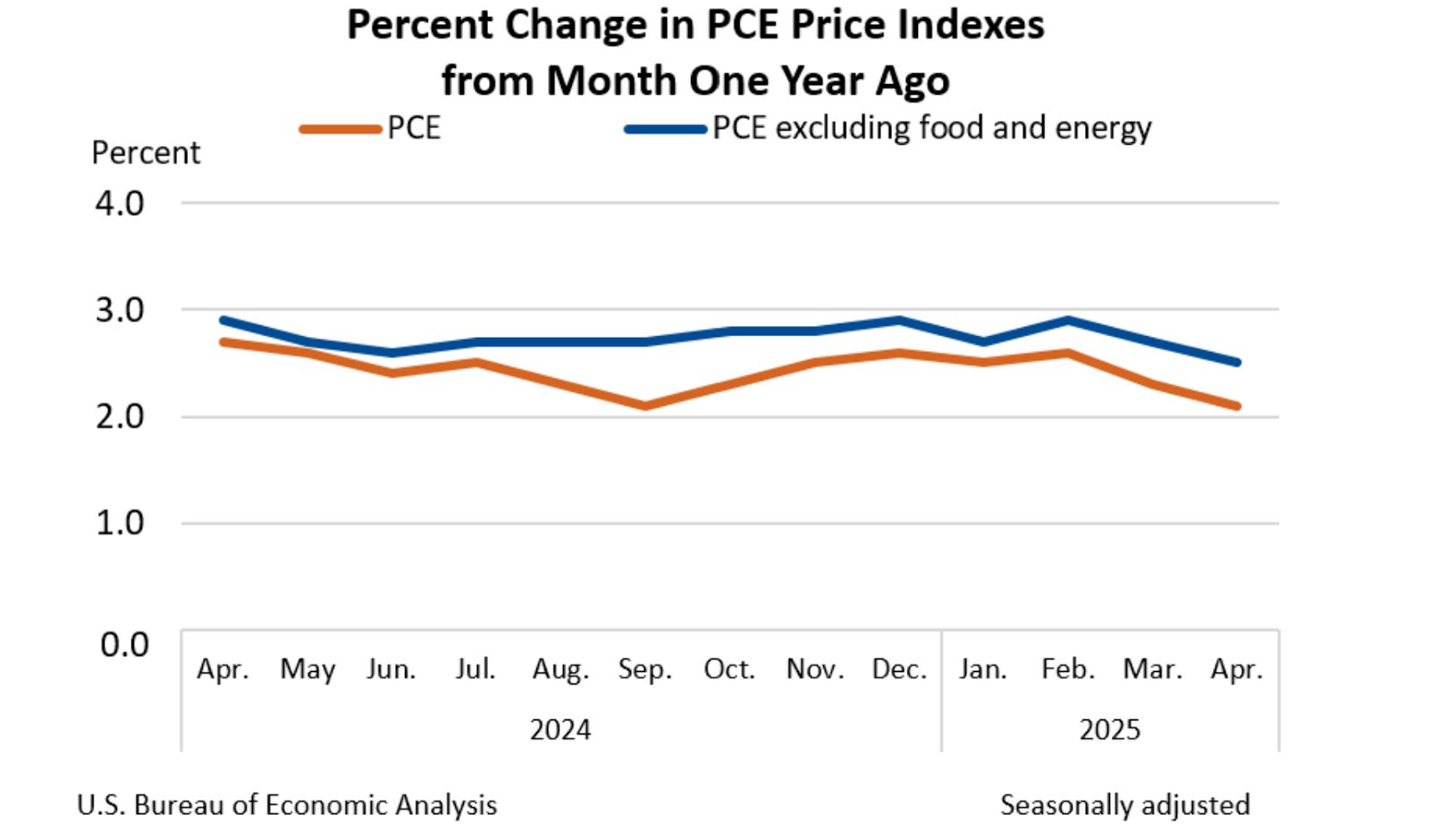

Core PCE

Core PCE — the Fed’s preferred gauge of underlying inflation — rose just +0.1% in April, in line with expectations and the softest monthly gain since late 2023. On a yearly basis, core PCE eased to +2.5%, down from +2.7% in March and the lowest annual increase since March 2021. The data adds to a broader trend of cooling inflation and may bolster the case for a policy shift later this year, even as the Fed remains cautious amid tariff-driven uncertainty.

Economists expect the following this week:

Core PCE (May): +0.3% month-over-month and +2.6% year-over-year

Headline PCE (May): +0.2% month-over-month and +2.5% year-over-year

“Much bigger increases in core goods inflation probably loom as the costs of the new tariffs are eventually passed on. Accordingly, we still think core PCE inflation will peak later this year between 3.0% and 3.5%, if the current mix of tariffs remains in place.”

U.S. GDP Growth Rate

U.S. GDP contracted -0.2% in Q1 2025 (QoQ annualized), slightly better than the initial -0.3% estimate but still marking the first quarterly decline since early 2022. The revision was supported by resilient fixed investment (+7.8%) and a modest uptick in exports (+2.4%), though consumer spending slowed sharply (+1.2%) and federal spending posted its steepest drop in over two years (-4.6%). A 42.6% surge in imports — as businesses front-loaded purchases ahead of tariff hikes — weighed heavily on growth.

Economists expect the third reading (second revision) this week to come in at -0.2% once again. A miss or beat in either direction could directly impact the broader market.

“The narrative after the first release of a modest contraction in first quarter GDP was that domestic demand was strong while a surge in imports weighed on growth. While this story is still true, if anything, revisions to Q1 GDP are less suggestive of still-strong domestic demand. We expect weakening in final private domestic demand to continue throughout the year.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Cover image source: India Today

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]