- GRIT

- Posts

- 👉 All Eyes on the Fed

👉 All Eyes on the Fed

Adobe, Google, Oracle

Welcome to your new week.

And just like that… you’ve begun the second-to-last full week of the year. These are critical days in which you should monitor markets closely and plan ahead for the beginning of 2026!

Read on for everything you should be watching this week.

CLICK HERE to sign up for next week’s livestream! It will take place on Monday, December 15th at 5pm ET. If you can’t make it, you’ll still be able to access the recording.

If you’re interested in becoming a premium subscriber to Grit Capital’s Rate of Return Newsletter, click here for 20% off an annual subscription!

Key Earnings Announcements:

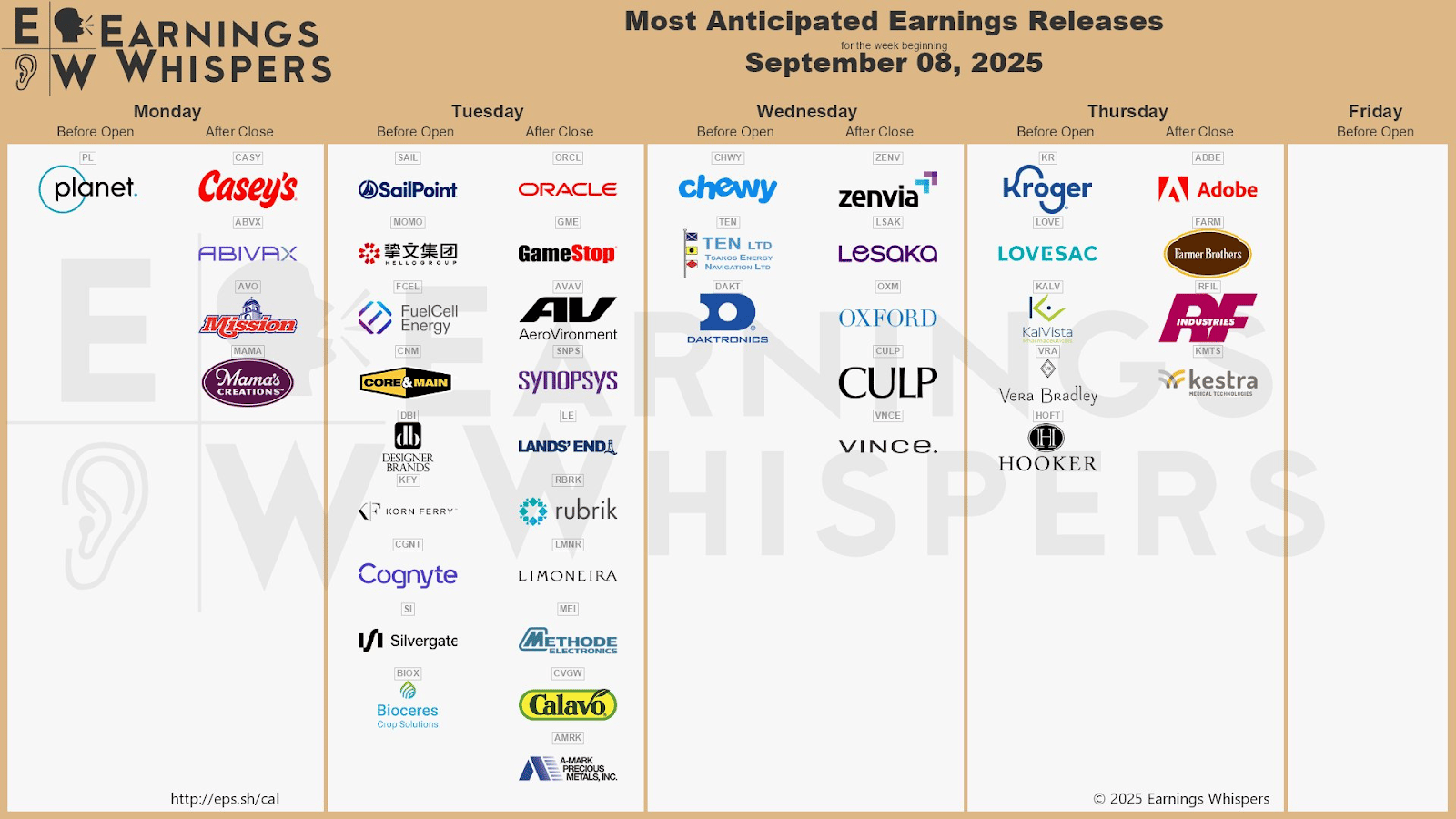

Adobe, Casey’s, Kroger, and Oracle are the biggest earnings reports of the week.

Monday (12/8): Casey’s

Tuesday (12/9): Cognyte, GameStop, Oracle

Wednesday (12/10): Chewy

Thursday (12/11): Adobe, Kroger, Lovesac

Friday (12/12): N/A

What We’re Watching:

Adobe (ADBE)

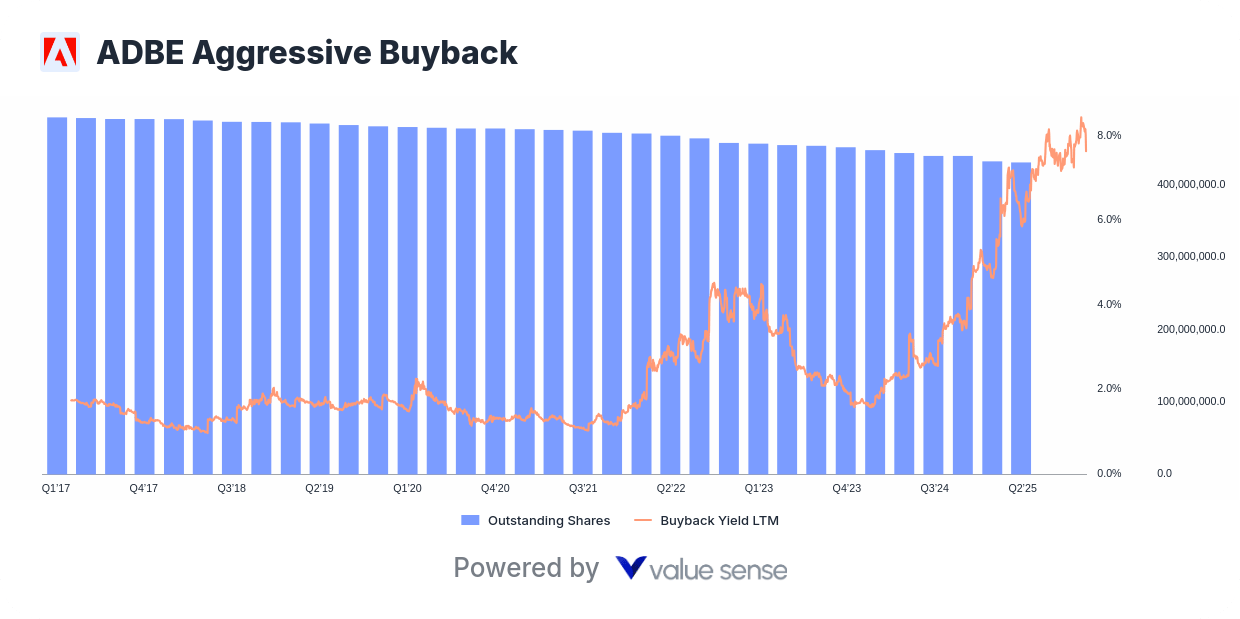

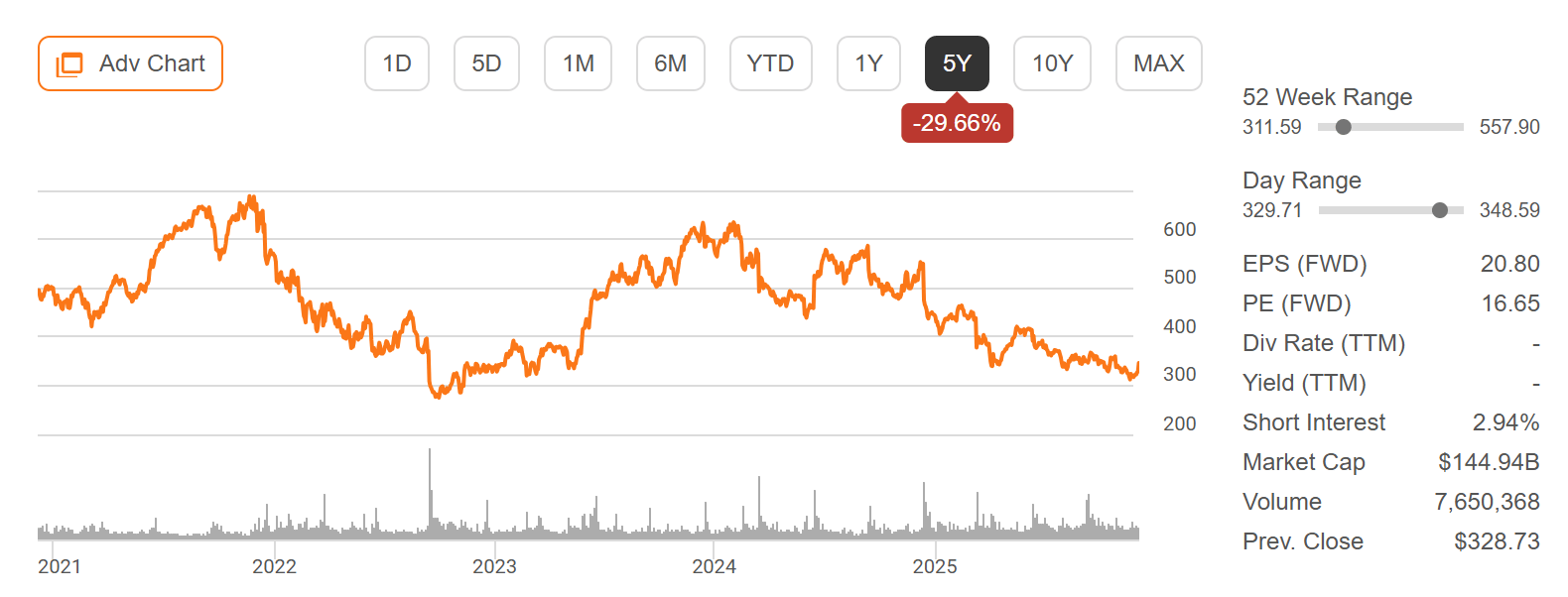

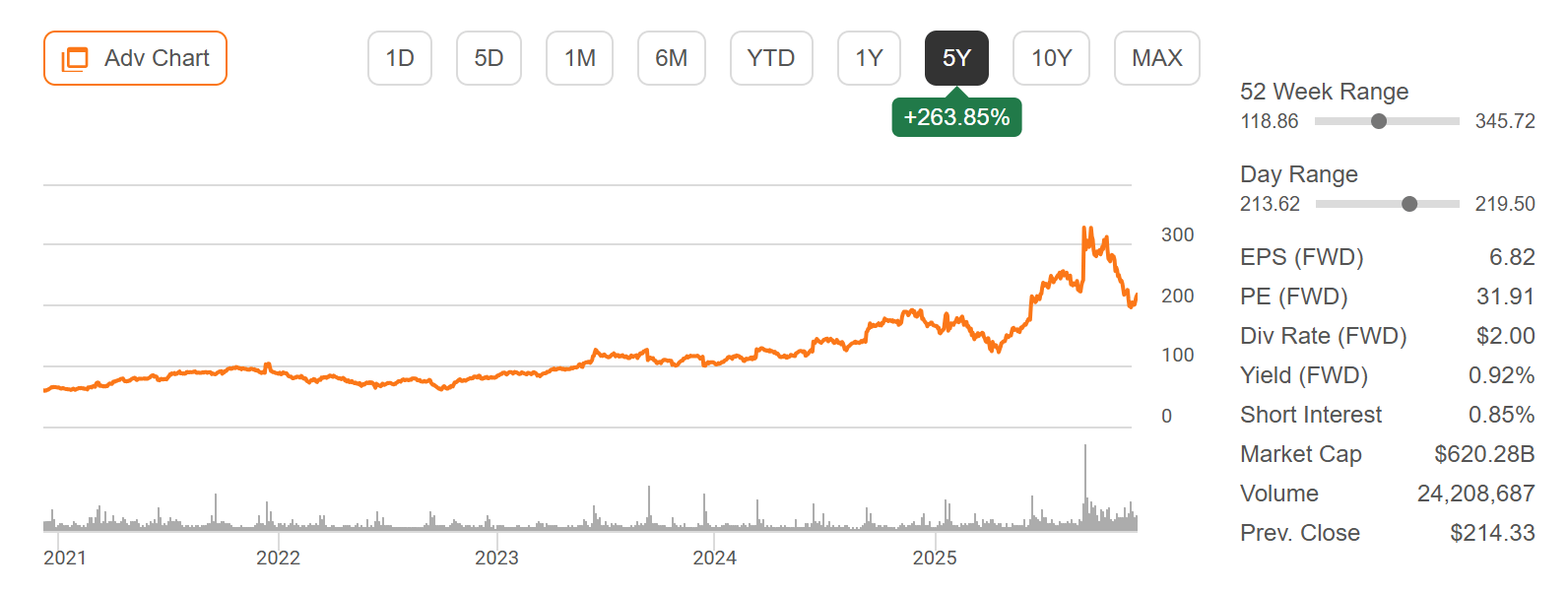

Adobe (+22.1% YTD) reports Q4 FY2025 earnings Thursday after the close, with investors focused on how well the company is converting its aggressive push into generative AI, content automation, and enterprise marketing tools into durable revenue growth. Adobe remains a dominant force in creative software, but the market is watching closely to see whether new AI-native features meaningfully accelerate Creative Cloud and Document Cloud adoption.

Last quarter, Adobe delivered $5.2 billion in revenue (+11% YoY) and $4.60 in adjusted EPS (+15% YoY), both ahead of expectations. Creative Cloud grew +12%, fueled by strong demand for Firefly-powered workflows and rising engagement across Photoshop, Premiere, and Illustrator. Digital Experience revenue rose +10%, though management flagged longer deal cycles among large enterprise clients.

Heading into this print, I’ll be watching whether AI monetization shows up in net-new Digital Media ARR, how enterprise bookings trend in Experience Cloud, and whether management updates FY2026 guidance amid intensifying competition from both traditional peers and AI-native design tools. Commentary on pricing, user growth, and early traction from AI assistants will be key drivers for sentiment.

“We’re building a future where every creator – from hobbyists to global enterprises – can work with infinitely more speed, scale, and imagination.”

Adobe Inc. (ADBE) Stock Performance, 5-Year Chart, Seeking Alpha

Oracle (ORCL)

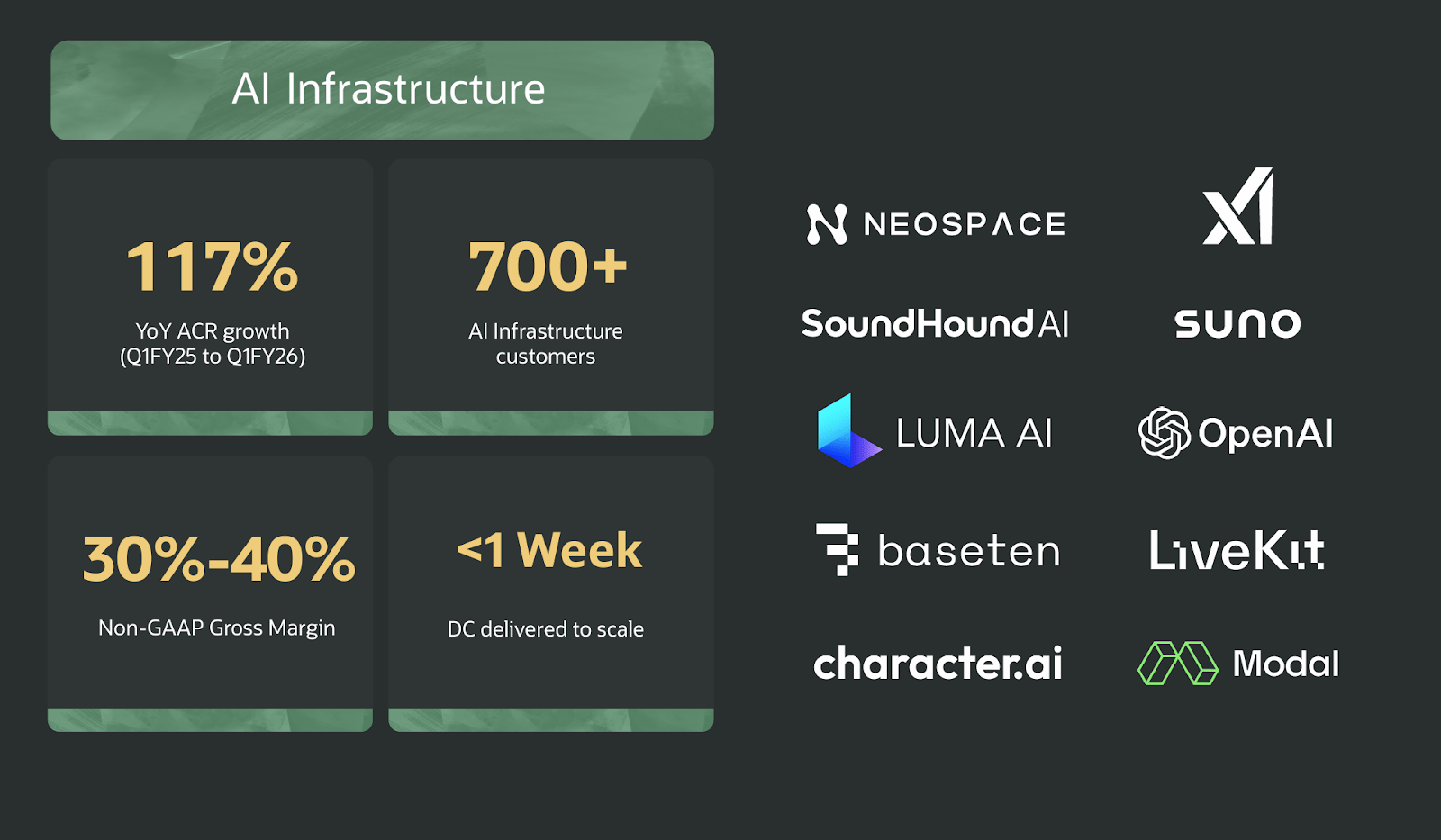

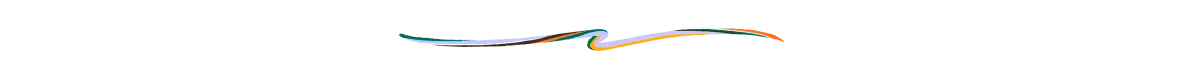

Oracle (+30.5% YTD) reports Q2 FY2025 earnings Monday after the close, with investors focused squarely on whether the company’s massive AI-infrastructure buildout is translating into meaningful top-line acceleration. Oracle has leaned aggressively into AI cloud workloads, signing multibillion-dollar capacity deals – but its heavy capex, rising debt load, and slower legacy-software growth have raised questions about near-term margin pressure.

Last quarter, Oracle posted $13.3 billion in revenue (+7% YoY) and $1.39 in adjusted EPS (+9% YoY), slightly ahead of expectations. Cloud revenue — including IaaS and SaaS — climbed +20% YoY, with management highlighting strong demand for OCI’s GPU clusters and partnerships with companies like Nvidia, Cohere, and OpenAI. However, operating margin compressed modestly due to elevated infrastructure spending and integration costs tied to Cerner.

Heading into this quarter, I’ll be watching whether Oracle can show accelerating cloud-infrastructure growth, updated visibility on its AI-data center buildout, and clearer progress on improving Cerner’s profitability. Commentary on debt financing, capex cadence, and how quickly new GPU clusters are sold out will be critical given recent scrutiny of Oracle’s credit metrics.

“We’re expanding capacity as fast as we can build it – demand for our AI infrastructure continues to dramatically exceed supply.”

Oracle Corporation (ORCL) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

Google will spotlight new XR Platform capabilities in Android Show and IBM is in advanced talks to acquire confluent in $11B AI data deal.

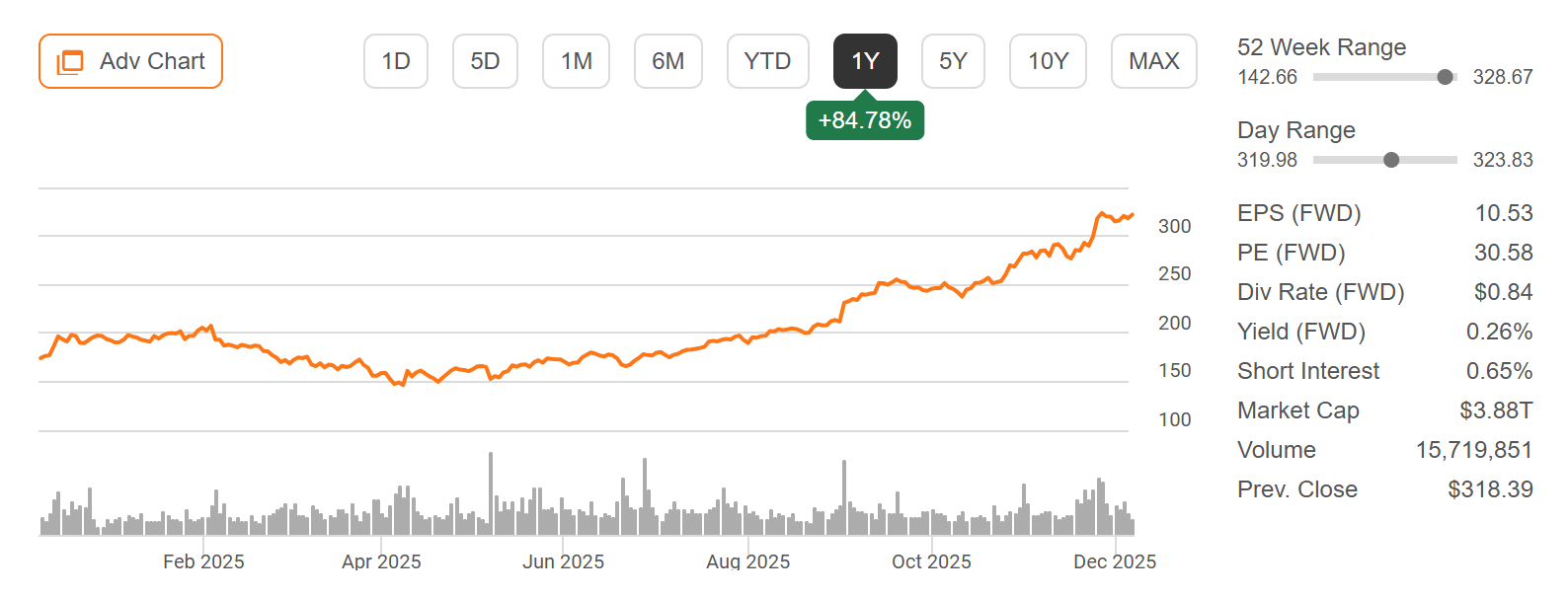

Google (GOOG) to Host the Android Show | XR Edition

Source: Google

Google will host The Android Show | XR Edition, a 30-minute livestream dedicated to the company’s expanding Android XR ecosystem. The event will highlight new capabilities across glasses, headsets, and emerging form factors, with a strong focus on Gemini-powered immersive experiences.

Positioned as Google’s marquee XR update following Samsung’s commercial launch of the Galaxy XR headset, the showcase is expected to outline how Android plans to anchor the next wave of spatial computing, multimodal AI, and mixed-reality applications.

Google (GOOG) Stock Performance, 1-Year Chart, Seeking Alpha

“We’re building Android XR to bring powerful AI into the real world – across every device and every experience.”

IBM in Advanced Talks to Acquire Confluent

Source: Reuters

IBM is in advanced talks to acquire Confluent for about $11 billion, in what would be its largest deal in years and a major step in its strategy to strengthen AI and cloud infrastructure. A final agreement could be announced as soon as Monday, though negotiations remain fluid.

Confluent — valued near $8 billion last week — powers real-time data streaming systems that feed modern AI models across retail, tech, and financial services. Demand for its platform has accelerated as companies scale production of AI.

For IBM, the potential acquisition follows its $6.4B HashiCorp deal and broader efforts to reposition around AI, quantum computing, and hybrid cloud. The company has been restructuring its workforce and leaning more heavily on automation as it shifts toward higher-growth areas.

International Business Machine (IBM) Stock Performance, 1-Year Chart, Seeking Alpha

“AI systems run on real-time data –and platforms like Confluent are becoming foundational.”

Start investing right from your phone

Jumping into the stock market might seem intimidating with all its ups and downs, but it’s actually easier than you think. Today’s online brokerages make it simple to buy and trade stocks, ETFs, and options right from your phone or laptop. Many even connect you with experts who can guide you along the way, so you don’t have to figure it all out alone. Get started by opening an account from Money’s list of the Best Online Stock Brokers and start investing with confidence today.

Major Economic Events:

Investors are expecting to see a rate cut this week, as well as more insight into the job market.

Monday (12/8): N/A

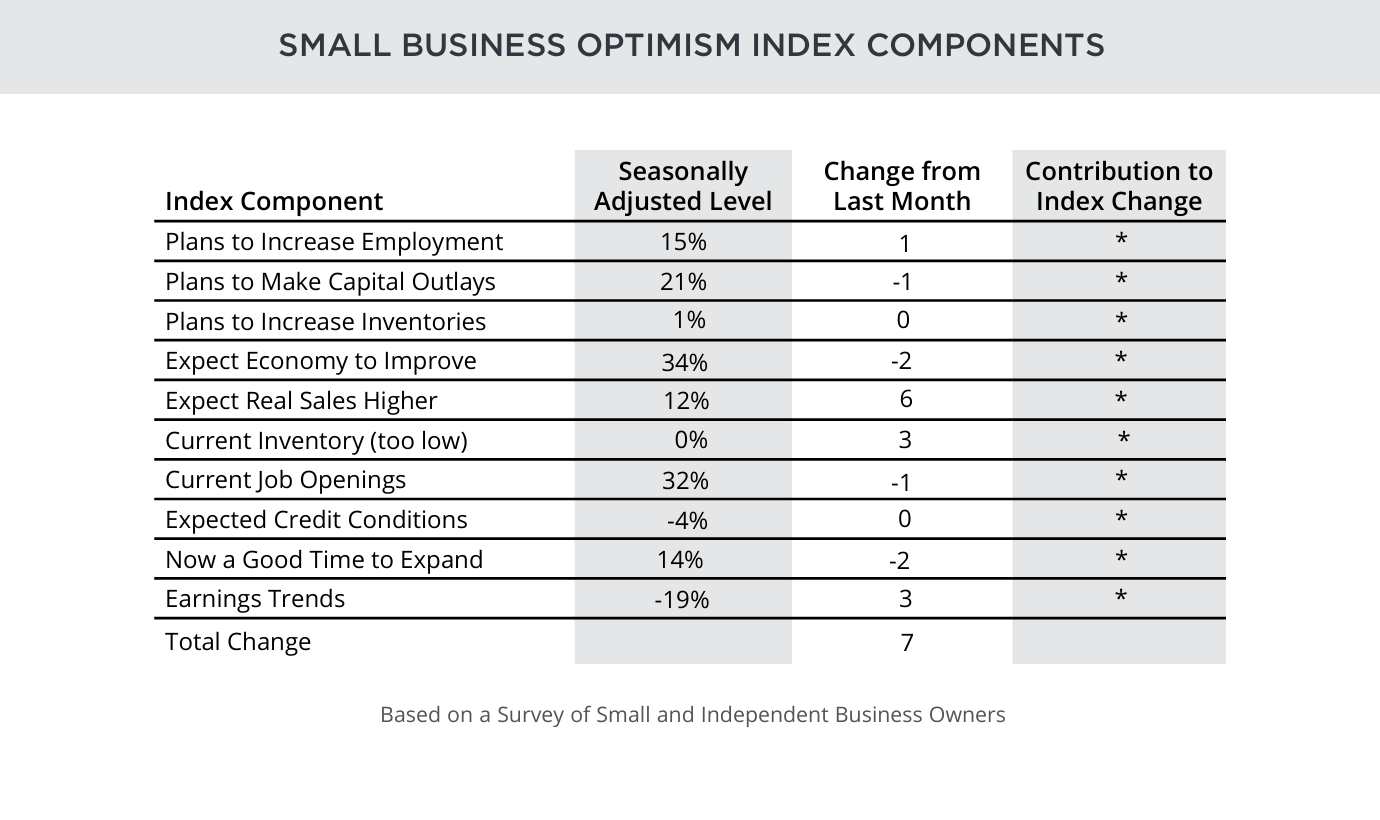

Tuesday (12/9): Job Openings, NFIB Optimism Index

Wednesday (12/10): Employment Cost Index, Fed Chair Powell Press Conference, FOMC Interest Rate Decision, Monthly U.S. Federal Budget

Thursday (12/11): Initial Jobless Claims, U.S. Trade Deficit

Friday (12/12): Cleveland Fed President Hammock Speaks, Philly Fed President Paulson Speaks, Wholesale Inventories

What We’re Watching:

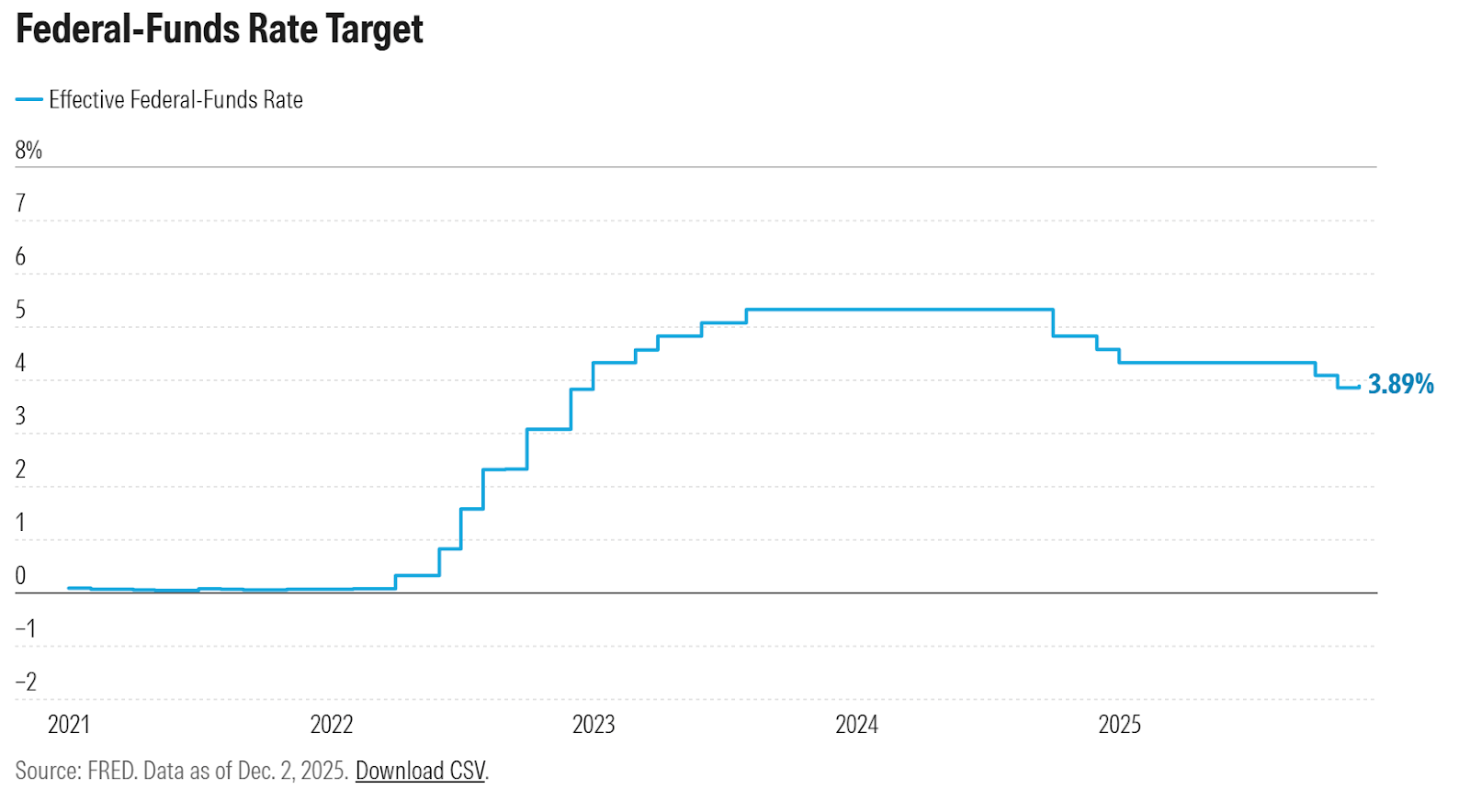

FOMC Interest Rate Decision

Minutes from the Federal Reserve’s October meeting showed broad support for the 25bps rate cut, but deep disagreement over what should happen next. Several officials favored cutting rates further, others preferred to hold steady, and a few opposed easing altogether – underscoring how divided the Committee has become as inflation cools unevenly and growth moderates.

Most participants agreed that additional downward adjustments to the federal funds rate could be warranted, but many emphasized that another 25bps cut in December may not be appropriate. A number of officials said a December cut would make sense if economic data continues to soften as expected, while many others argued for keeping rates unchanged through year-end.

The Fed lowered rates by 25bps to 3.75%–4.00% at the October meeting, marking its second cut of the cycle.

Economists expect the following this week:

• Fed Funds Rate (Dec): 3.75% 4.00% vs. 4.00% - 4.25% prior expectations

• Probability of Dec Cut: ~50% vs. ~35% just weeks ago

“The debate is no longer about whether to cut – it’s about the pace. The Fed is easing, but not unanimously.”

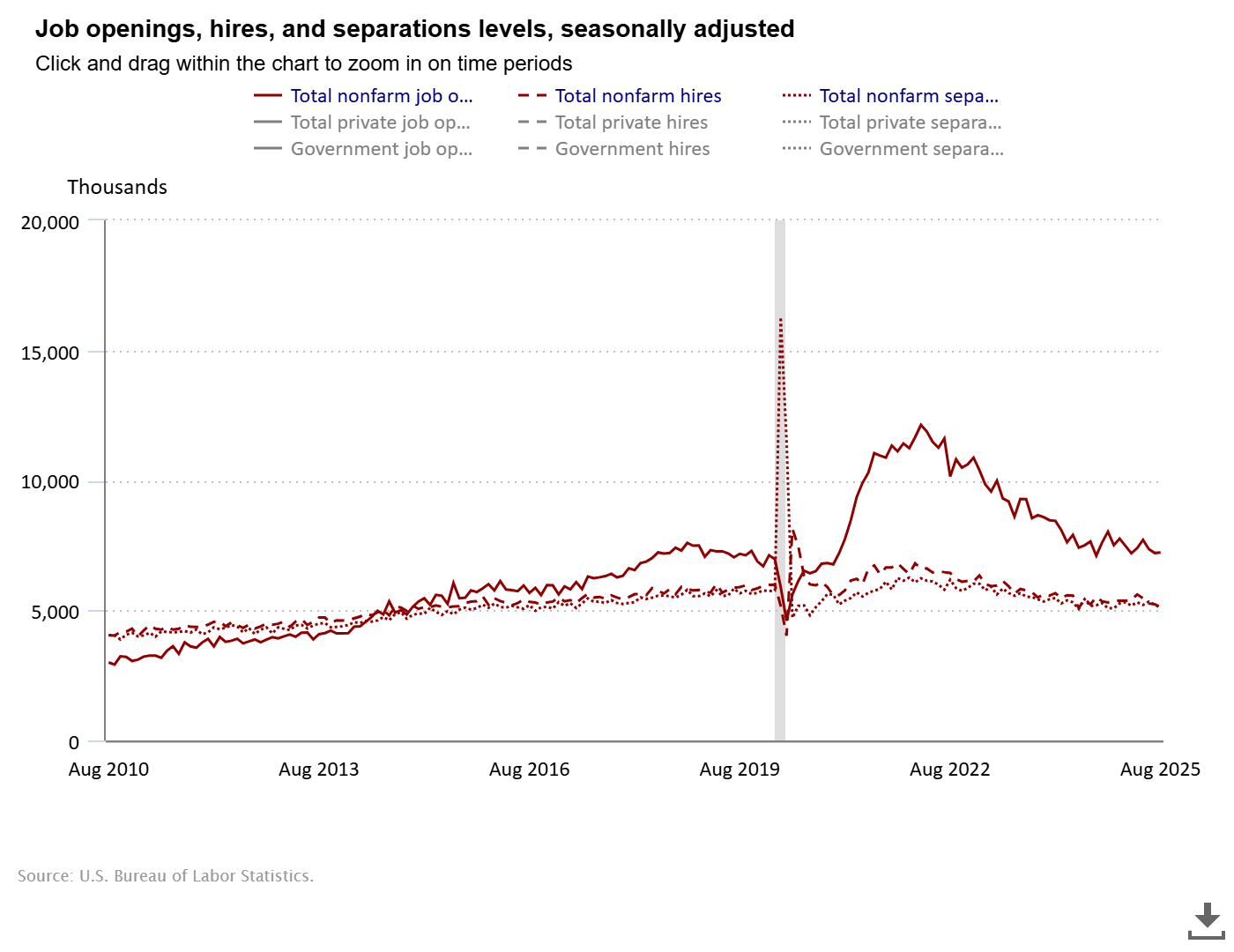

Job Openings

U.S. job openings rose slightly to 7.23 million in August, up 19,000 from July’s revised level and right in line with expectations. The data suggests labor demand is easing gradually, not weakening sharply — a dynamic that supports the Fed’s view of a controlled labor-market cooldown.

Gains were strongest in leisure & hospitality (+97,000), health care (+81,000), and retail trade (+55,000). Openings fell in construction (-115,000) and the federal government (-61,000), reflecting softer demand in rate-sensitive and public-sector categories. Hires and separations held steady at 5.1 million, while quits remained unchanged at 3.1 million.

Economists expect the following this week:

• Job Openings: 7.23M vs. 7.21M prior

• Quits: 3.1M vs. 3.1M prior

“Labor demand is cooling, but it’s far from collapsing — the job market is rebalancing, not unraveling.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Cover Art Sources: Jose Luis Magana / AP / Seattle Times

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]