- GRIT

- Posts

- 👉 ANOTHER Big IPO...

👉 ANOTHER Big IPO...

Cisco, CoreWeave, Oklo

Welcome to your new week.

So far, the stock and crypto markets have completely shaken off an August slump. Read on for everything that could impact the market this week.

Key Earnings Announcements:

Cisco, Circle, Monday.com, Oklo, Rigetti, and more keep earnings season rolling on.

Monday (8/11): AMC, Barrick, BigBear.ai, Franco-Nevada, GoPro, Monday.com, Oklo, Plug Power, Village Farms

Tuesday (8/12): Cardinal Health, Cava, Circle, CoreWeave, H&R Block, Kopin, Rigetti, Sea

Wednesday (8/13): Arcos Dorados, Brinker International, Cisco, Elbit Systems, Innoviz Technologies, Red Robin, Stratasys

Thursday (8/14): Advance Auto Parts, Amcor, Birkenstock, Canaan, First Majestic Silver, JD.com, John Deere, NICE, Nu Holdings, Sandisk, Weibo

Friday (8/15): Flowers Foods, Volition

What We’re Watching:

Cisco (CSCO)

Cisco Systems reports Q4 FY 2025 earnings Wednesday after the bell, with shares currently near 25-year highs, fueled by investor enthusiasm around its AI networking and security momentum.

This earnings cycle, the spotlight will be on whether Cisco’s AI strategy — highlighted by over $600 million in AI infrastructure orders last quarter, approaching $1 billion annualized — continues to gain traction. Analysts expect +7% YoY revenue growth ($14.6B) driven by strength in Splunk, webscale demand, and security offerings. I’ll also be watching for margin stability, tariff-related risks, and commentary on global expansion — especially after CEO Chuck Robbins lauded India’s growth potential and the AI-forward roadmap.

“Another quarter of solid execution… The momentum we are seeing with AI is fueled by the power of our secure networking portfolio, our trusted global partnerships, and the value we bring to our customers.”

Cisco Systems. (CSCO) Stock Performance, 5-Year Chart, Seeking Alpha

Monday.com (MNDY)

Monday.com reports Q2 earnings Monday before the bell, with the stock up +5% this year on strong execution and fresh AI momentum. After trailing the wider software space, MNDY has grabbed attention with consistently robust beats and a rising technical profile. Analysts project ~24%–25% YoY revenue growth to ~$294M, as enthusiasm builds behind its generative AI enhancements and enterprise automation tools.

This cycle, the focus will be on how AI — especially new capabilities like monday sidekick, magic, and vibe — is driving enterprise adoption and premium pricing. Last quarter, the company tied its record free cash flow and operating income to “operational excellence” and AI integration. I’ll be listening for signs that customer stickiness is improving and seeing early returns from recent pricing changes.

“We are thrilled to report… record operating profit, and our highest‑ever adjusted free cash flow for a single quarter."

Monday.com Ltd. (MNDY) Stock Performance, All-Time Chart, Seeking Alpha

Investor Events / Global Affairs:

AMD and Nvidia owe the U.S. Government, Peter Thiel’s crypto exchange is set to begin trading, and Intel’s CEO will pay Trump a visit.

AMD & NVIDIA Chinese Export Tolls

Source: Bloomberg

Nvidia and AMD have struck an unprecedented deal with the U.S. government, agreeing to hand over 15% of revenue from certain chip sales to China in exchange for export licenses. Under the arrangement, Nvidia will share revenue from its H20 AI chips, while AMD will do the same for its MI308 chips — a quid pro quo that export control experts say has no precedent in U.S. policy.

The licenses, granted last week after Nvidia CEO Jensen Huang met with President Trump, reopen access to a market worth an estimated $23B in 2025 sales for Nvidia alone, based on Bernstein’s pre-restriction forecasts. The deal comes amid heated debate in Washington over whether the H20 could aid China’s military AI capabilities, with national security voices warning that the move undermines U.S. tech leadership.

Nivida Corp. (NVDA) Stock Performance, 5-Year Chart, Seeking Alpha

Advanced Micro Devices Inc. (AMD) Stock Performance, 5-Year Chart, Seeking Alpha

“America’s AI tech stack can be the world’s standard if we race.”

Bullish (BLSH) to Begin Trading

Source: Investopedia

Bullish, the Peter Thiel-backed crypto exchange, is set to price its IPO this week – aiming to raise $629M at a valuation north of $4.2B. The debut comes as the crypto market is in rally mode, adding extra tailwinds for investor sentiment.

I’ll be watching whether it rides the recent momentum in a heating IPO market and comes out of the gates strong, or if enthusiasm cools once trading begins. Major stablecoin-issuer Circle Internet had a blowout debut on the NYSE in June and currently trades at more than 400% of its IPO price.

"When an IPO begins marketing, the bankers would rather undershoot on valuation and then price up, rather than overshoot and price down.”

Intel (INTC) CEO to Visit White House

Source: Wall Street Journal

Intel CEO Lip-Bu Tan will visit the White House Monday after President Trump publicly called for his resignation over alleged ties to Chinese businesses. Tan is expected to outline his personal and professional background, stress Intel’s role in U.S. national security, and propose ways the company can work with the administration.

The meeting follows heightened scrutiny after Cadence Design Systems – where Tan served as CEO until 2021 — agreed to plead guilty to selling chip-design tools to a Chinese military university. Intel has pledged $100B over five years to expand U.S. chipmaking and remains the largest recipient of Chips Act funding, but recent slowdowns in its Ohio plant construction have frustrated some lawmakers.

I’ll be watching whether Tan can secure Trump’s support and keep Intel’s strategy on track amid both political and boardroom pressures.

Intel Corp (INTC) Stock Performance, 5-Year Chart, Seeking Alpha

"There has been a lot of misinformation circulating about my past roles... I want to be absolutely clear: Over 40+ years in the industry, I’ve built relationships around the world and across our diverse ecosystem — and I have always operated within the highest legal and ethical standards.”

Major Economic Events:

Consumer Price Index, Producer Price Index, and retail sales take center stage this week.

Monday (8/11): N/A

Tuesday (8/12): Consumer price index, Core CPI, Core CPI year over year, Kansas City Fed President Jeff Schmid speech, Monthly U.S. federal budget, NFIB optimism index, Richmond Fed President Tom Barkin speaks

Wednesday (8/13): Atlanta Fed President Raphael Bostic speaks, Chicago Fed President Austan Goolsbee speaks, Richmond Fed President Tom Barkin speaks

Thursday (8/14): Core PPI, Core PPI year over year, Initial jobless claims, PPI year over year, Producer price index, Richmond Fed President Tom Barkin speaks

Friday (8/15): Business inventories, Capacity utilization, Consumer sentiment (prelim), Empire State manufacturing survey, Import price index, Import price index minus fuel, Industrial production, Retail sales minus autos, U.S. retail sales

What We’re Watching:

Consumer Price Index

The US annual inflation rate accelerated for a second straight month to +2.7% YoY in June (highest since February), up from +2.4% in May and matching expectations. Gains were led by food (+3% vs 2.9%), transportation services (+3.4% vs 2.8%), and used cars & trucks (+2.8% vs 1.8%). Energy prices declined less sharply (-0.8% vs -3.5%), with gasoline (-8.3%) and fuel oil (-4.7%) still down but natural gas prices remaining elevated (+14.2%).

Shelter inflation eased slightly to +3.8%, while new vehicle prices slowed to +0.2%. On a monthly basis, headline CPI rose +0.3% MoM – the largest gain in five months – while core CPI increased +0.2%, below the +0.3% forecast. Annual core inflation ticked up to +2.9% from +2.8%.

Economists expect the following this week:

Headline CPI Monthly Change (July): +0.3%

Core CPI Monthly Change (July): +0.2%

“One reason firms are having trouble hiking prices is that households’ real disposable income growth has been dismal — running at a third of the pandemic peak. Incorporating payroll revisions, we estimate that real income growth actually contracted in June. Yet nominal retail sales were likely robust in July. We caution against equating a strong headline print with resilient consumption.”

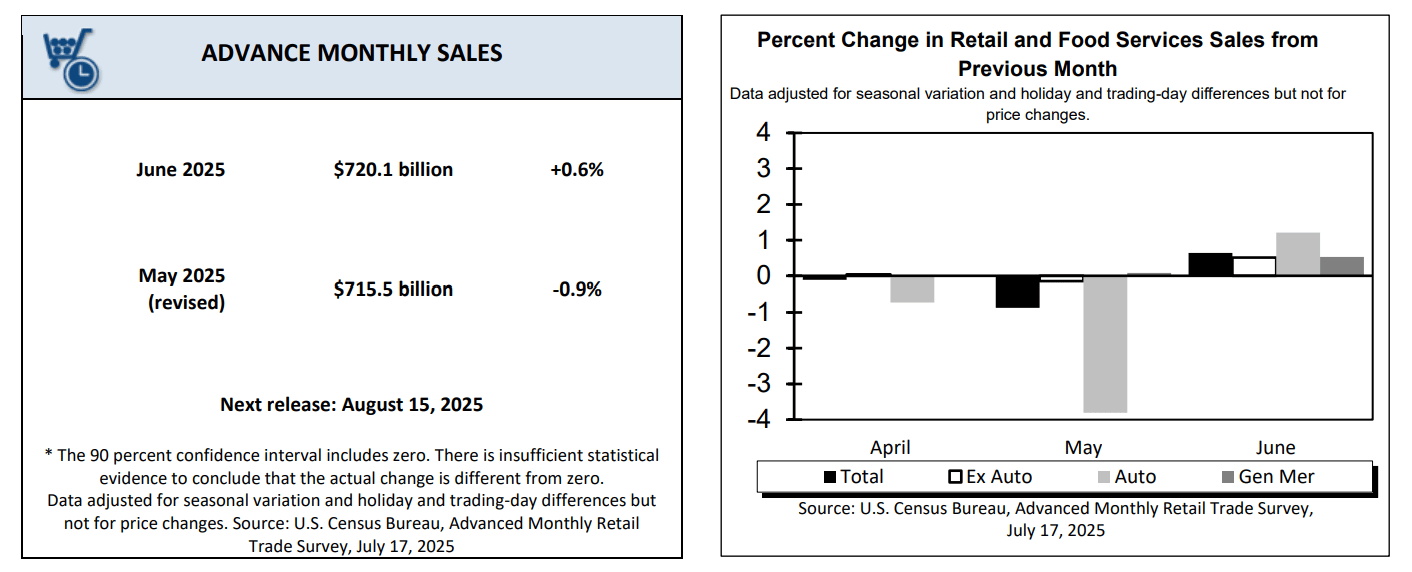

Retail Sales

US Retail Sales climbed +0.6% in June, snapping a two-month losing streak and beating forecasts for a +0.1% gain. Core retail sales (ex-autos, gas, building materials, and food services) – the measure that feeds directly into GDP – rose +0.5%, topping expectations of +0.3% and following a downwardly revised +0.2% in May.

Gains were led by miscellaneous store retailers (+1.8%), motor vehicles & parts (+1.2%), building materials & garden equipment (+0.9%), and clothing (+0.9%). Sales also rose at food services & drinking places (+0.6%), food & beverage stores (+0.5%), health & personal care (+0.5%), general merchandise stores (+0.5%), and nonstore retailers (+0.4%).

Economists expect the following this week:

Headline Retail Sales (July): +0.3%

Retail Sales Ex-Autos: +0.2%

“Don’t count the American consumer out yet… There’s still a lot of trepidation about tariffs and likely price hikes, but consumers are willing to buy if they feel they can get a good deal.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Cover image source: Marco Bello | Getty Images

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]