- GRIT

- Posts

- 👉 Another Big Week for Nvidia

👉 Another Big Week for Nvidia

Hims & Hers, Home Depot, Snowflake

Welcome to your new week.

After Friday’s major sell-off, this week will be critical to determining where the market is heading. As the title of this newsletter indicates… Nvidia’s earnings will be watched closely all around the world.

Before we full dive in, take a moment and check out Betterment below!

Start Earning Today.

Turn out the lights on traditional savings accounts. With Betterment’s high-yield cash account, your money is earning nearly 11x the national average**.

Key Earnings Announcements:

Huge week of earnings headlined by Hims & Hers, Home Depot, NVIDIA, Salesforce and more.

Monday (2/24): Berkshire Hathaway, Dominos Pizza, Hims & Hers, Realty Income, Tempus AI, Zoom

Tuesday (2/25): AMC, Cava, First Solar, Home Depot, Instacart, Intuit, Krispy Kreme, Kuerig DrPepper, Planet Fitness, Workday

Wednesday (2/26): ABInBev, C3.ai, Clear, Icahn Enterprises, IONQ, Joby Aviation, Lowe’s, Marathon Digital, NVIDIA, Salesforce, Stellantis

Thursday (2/27): Dell, Duolingo, GEO Group, Norwegian Cruise Line, Soundhound, TD Bank, TransMedics, Vistra Energy

Friday (2/28): FuboTV, TeraWulf

What We’re Watching:

Hims & Hers (HIMS)

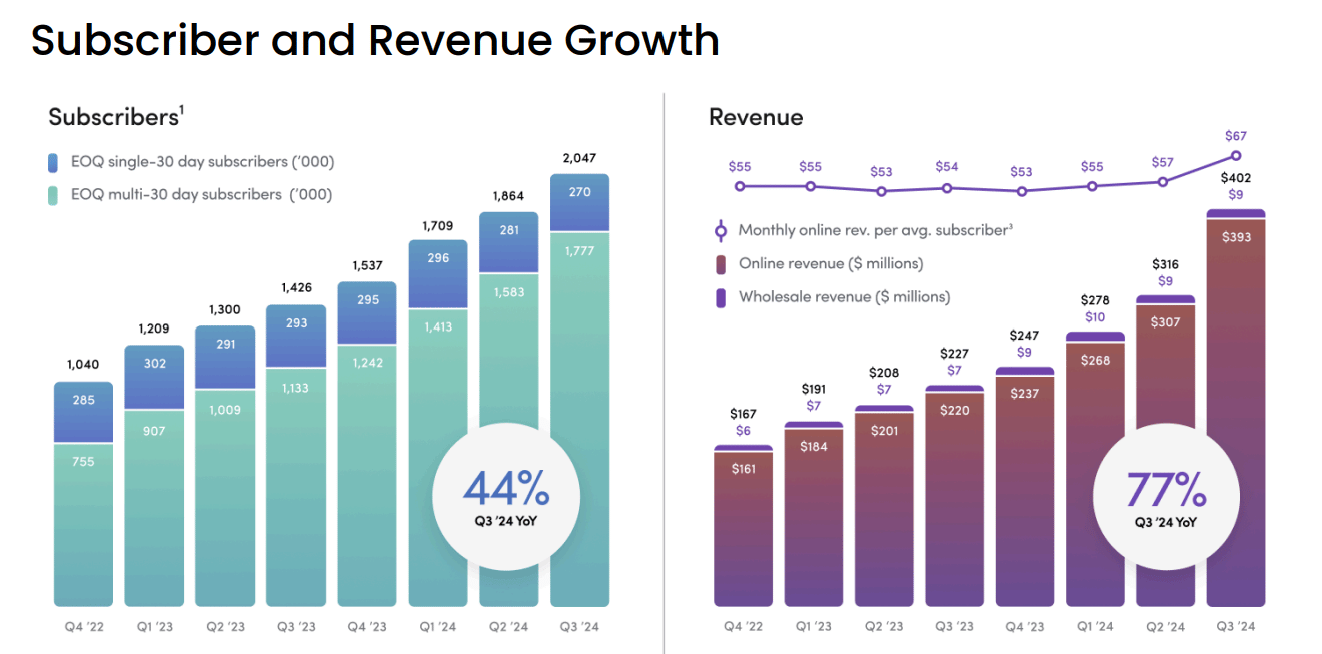

Hims & Hers Health is set to report earnings today (Monday) after the bell, with its telehealth platform riding a wave of momentum. Subscriber growth hit 1.85M last quarter — up +57% YoY — fueled by blockbuster weight-loss offerings like compounded GLP-1s. The recent Trybe Labs acquisition bolsters at-home testing — but Friday’s FDA ruling ending the semaglutide shortage slammed the stock -26%, threatening a key revenue driver.

Despite the hit, Hims & Hers’ pivot to personalized care and a new peptide facility could cushion the blow. The company’s raised 2024 revenue guidance ($1.46B-$1.465B) signals confidence, though regulatory shifts and Amazon’s telehealth push loom as risks.

This stock became my first 10X callout last week. Go HIMS!

Also in case you missed it, here’s the Hims & Hers Super Bowl Ad.

Hims & Hers Health, Inc. (HIMS) Stock Performance, 5-Year Chart, Seeking Alpha

NVIDIA (NVDA)

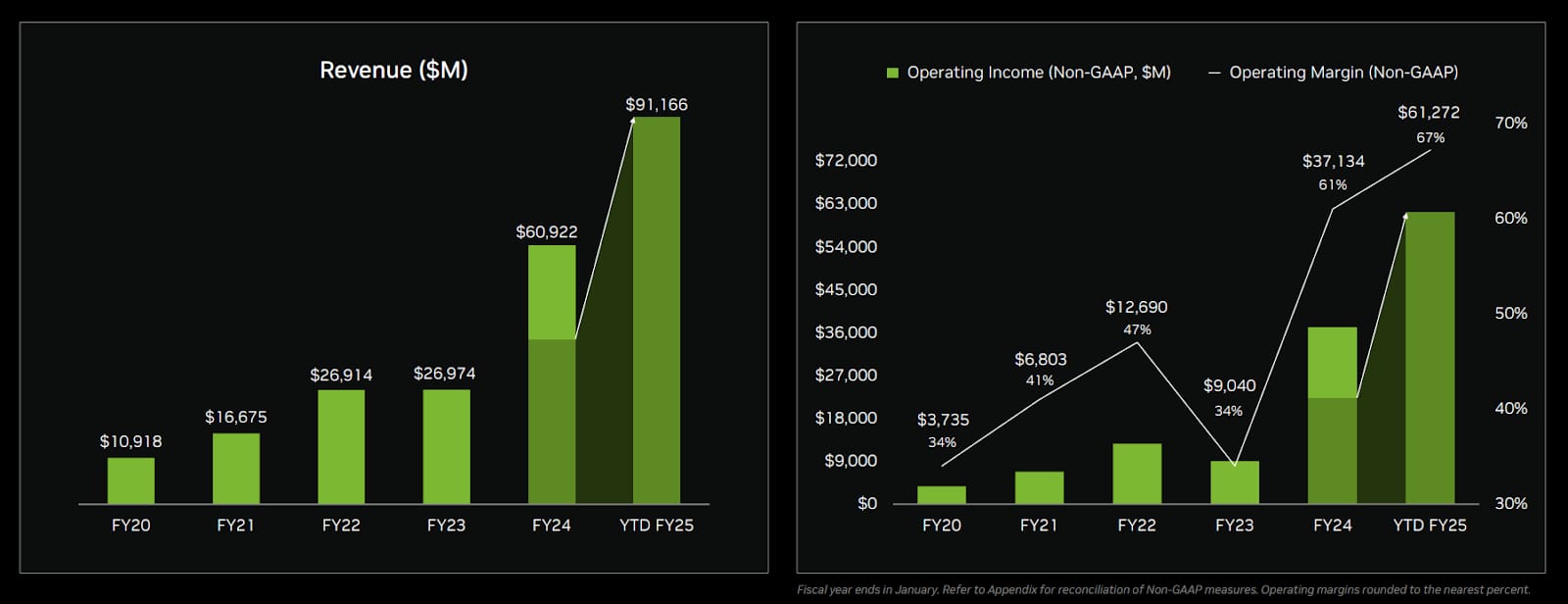

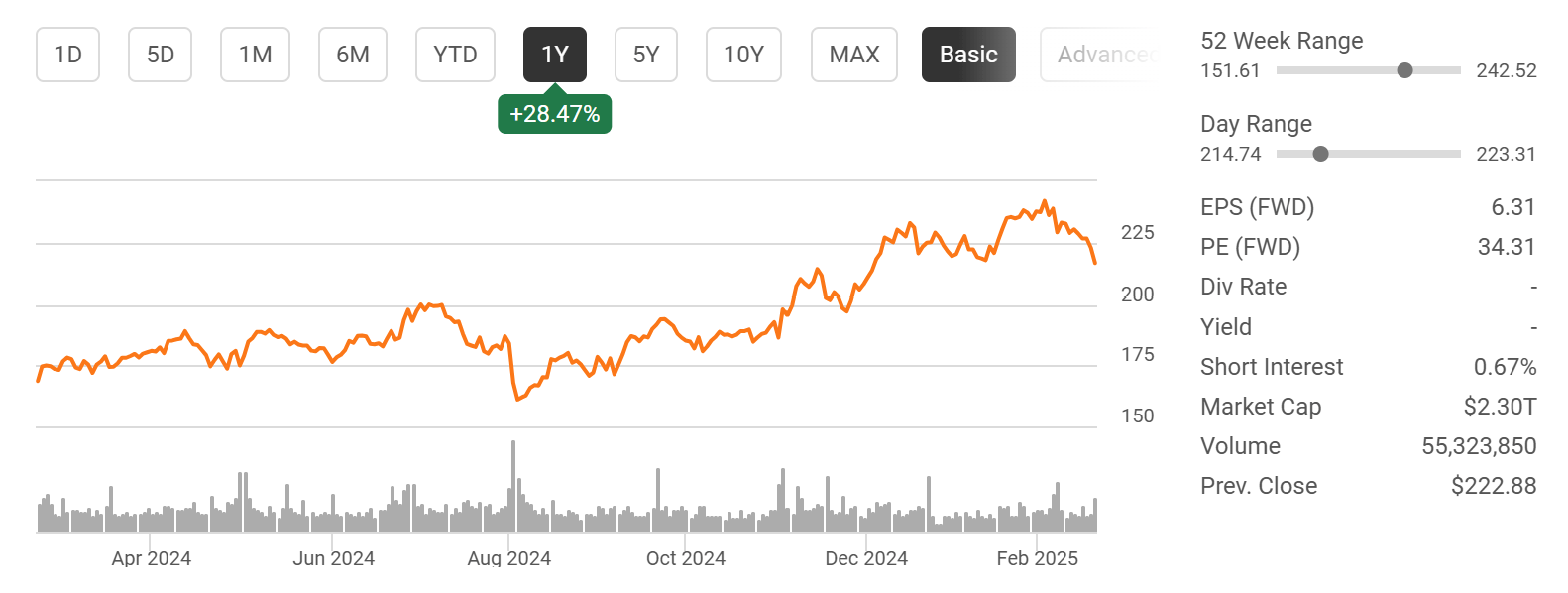

NVIDIA’s data center revenue is poised to steal the show this Wednesday, with Q4 projected to hit $33B — a +78% YoY surge fueled by insatiable AI chip demand. The Blackwell rollout could add $9B alone, though supply constraints might temper the upside. The stock’s hovering at $135, braced for a volatile ride.

AI continues to drive NVIDIA’s dominance, but rivals like DeepSeek and production bottlenecks could test its streak. With a track record of smashing estimates (beating EPS since Q4 2022), this report could either solidify its lead or hint at a slowdown. Buckle up for a wild week because this earnings report could hold the key to the market seeing another leg up.

NVIDIA Corp. (NVDA) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

Amazon’s product event, The Information’s AI Agenda Summit, and PayPal’s investor day.

Amazon Product Event

Source: Performics

This Wednesday, Amazon is set to unveil a turbocharged version of its AI assistant: Rufus.

Rufus is a new generative AI version of Alexa, and there’s speculation around if Amazon will charge a monthly subscription for access. With over 200 million Prime subscribers, even partial adoption of Rufus could generate significant revenue. Even if a subscription isn’t charged, analysts believe that Rufus could greatly impact sales conversion either way.

Speculation is also swirling around a new smart home device. With AI integration ramping up, this launch could signal Amazon’s next big move in connected tech. Despite the anticipation, Amazon's stock performance has been lackluster, down -1.3% year to date — compared to the S&P 500’s +2.3% gain.

Amazon, Inc. (AMZN) Stock Performance, 1-Year Chart, Seeking Alpha

Make no mistake about it — Amazon is a long-term hold for me. If we get a pullback on this name in 2025, I will increase my position.

The Information’s AI Agenda Event

The AI boom has poured billions into data centers, chips, and startups, but with competition heating up, businesses are now asking: Where’s the return?

AI Agenda Live (Feb 27, San Francisco) will tackle the biggest questions in the space, featuring top founders, investors, and scientists. Key topics will include: AI-driven cost savings, competition pressures, enterprise disruption, and the race for AI supercomputers.

With big names like OpenAI, Google, and Anthropic set to unveil their latest models, expect fresh insights into where LLMs are headed — and who’s actually making AI work at scale.

You can view the full agenda here. If any major news comes from this event — we’ll report back to you on X and in Sunday’s newsletter.

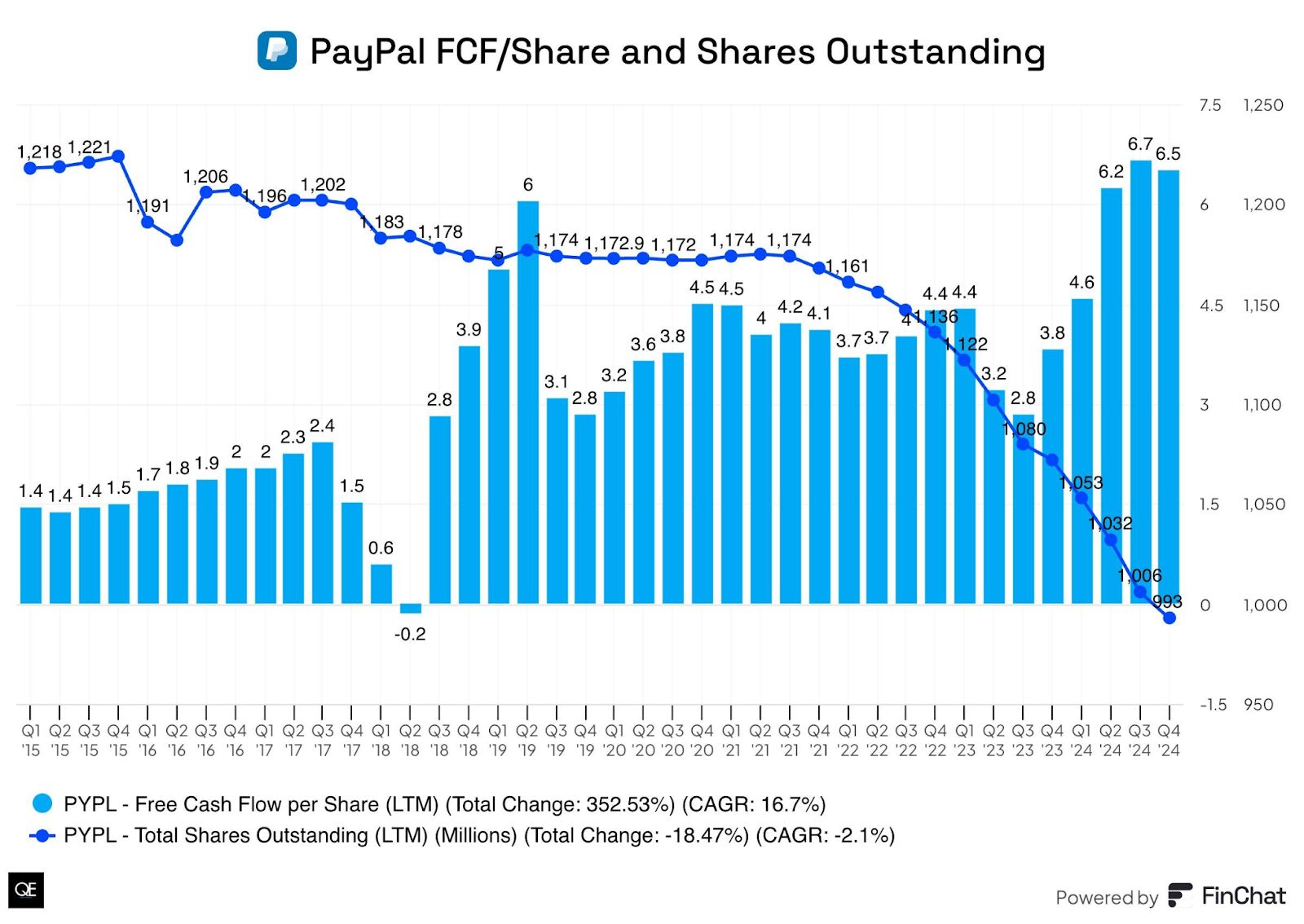

PayPal Investor Day

PayPal’s Investor Day is set to provide key insights into its growth strategy, fintech innovation, and profitability outlook. With competition from Apple Pay, BNPL services, and neobanks intensifying — investors will be watching for updates on AI-driven payments, cost efficiencies, and new revenue streams.

Expect a focus on user engagement, merchant adoption, and monetization efforts as PayPal looks to reignite growth and defend its market share in an evolving digital payments landscape.

PayPal Holdings, Inc. (PYPL) Stock Performance, 1-Year Chart, Seeking Alpha

While shares of PayPal have seen solid performance over the past year (+30.39%) — this name is still down -37.28% over the last five years. PayPal looks and feels undervalued. This week’s investor day will give us a gauge on the company’s direction.

Major Economic Events:

PCE and the U.S. GDP reading are in the spotlight this week.

Monday (2/24): None Scheduled

Tuesday (2/25): Consumer Confidence, Dallas Fed Pres L. Logan Speaks in London, Fed Vice Chair for Supervision M. Barr Speaks, Richmond Fed Pres T. Barkin Speaks, S&P Case-Shiller Home Price Index (20 cities)

Wednesday (2/26): Atlanta Fed President R. Bostic Speaks, New Home Sales

Thursday (2/27): Cleveland Fed President B. Hammock Speaks, Durable-Good Orders, Fed Gov M. Bowman Speaks, Fed Reserve Vice Chair for Supervision M. Barr Speaks, GDP (second reading), KC Fed President J. Schmid Speaks, Pending Home Sales, Philly Fed President Patrick Harker Speaks

Friday (2/28): Advanced Retail Inventories, Advanced U.S. Trade Balance in Goods, Advanced Wholesale Inventories, Chicago Business Barometer (PMI), Chicago Fed President A. Goolsbee Speaks, Core PCE, PCE, Personal Income, Personal Spending

What We’re Watching:

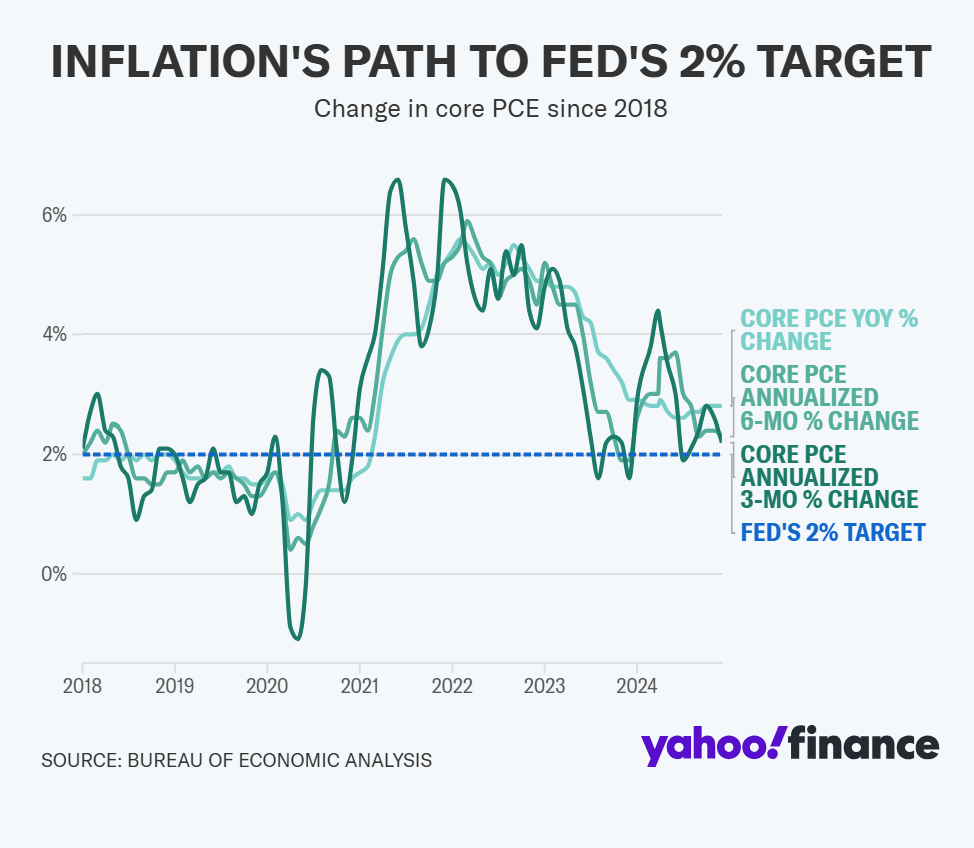

Personal Consumption Expenditures (PCE) Index

The PCE price index — the Fed’s preferred inflation gauge — rose +0.3% in December, the biggest jump in eight months (vs. +0.1% prior). Core PCE (ex-food & energy) ticked up +0.2%, in line with forecasts.

Goods prices rebounded (+0.2%), services inflation accelerated (+0.3%), signaling sticky inflation pressures. With inflation still creeping up, the Fed may stay cautious on rate cuts despite slowing economic growth.

Expectations for this week are below:

PCE Index: +0.3% MoM, +2.6% YoY

Core PCE: +0.2% MoM, +2.8% YoY

“[PCE data] was even a little better than expected. I don’t make too much of any one month, but you know, I’ve been saying that I felt like we are on path to 2%… I have comfort, I won’t say overconfidence, but I have comfort that we’re on that path.”

U.S. GDP, Second Reading for Q4

The first reading of Q4 2024 GDP revealed growth of +2.3% (annualized), slowing from +3.1% in Q3 and missing +2.6% forecasts. Consumer spending remained strong (+4.2%), its fastest pace since early 2023, keeping growth afloat.

With momentum cooling, markets will watch for signs of slower expansion ahead — and whether the Fed sees this as a reason to ease policy sooner than currently expected.

Economists expect the second reading for GDP to also come in at +2.3%. While this might not seem like the biggest headline — even a marginal drop to +2.2% could trouble investors and shake the markets.

“The U.S. economy has performed very well and remains strong, and lower inflation and unemployment position the economy well into 2025… “[The Trump Administration] has signaled a more business-friendly approach to policies and regulation, which should benefit the economy and our clients.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Cover image source: Inc. Magazine

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]

Reply