- GRIT

- Posts

- 👉 Apple's Ready for "Glowtime"

👉 Apple's Ready for "Glowtime"

Adobe, Microsoft, Kroger

Welcome to your new week.

Major congrats to all of the Dell Technologies (DELL) and Palantir (PLTR) investors as they will be joining the S&P 500 — replacing American Airlines (AAL) and Etsy (ETSY).

As we turn the page to this week — keep in mind that the first Presidential debate between former President Trump and VP Harris is on Tuesday night (9/10).

While that may move the markets, let’s dive into everything else that could create headlines.

Key Earnings Announcements:

Earnings season is still in-stride with Academy Sports & Outdoors, Adobe, GameStop, Kroger, and Oracle.

Source: Earnings Whispers

Monday (9/9): Abivax, Mission, Oracle, Rubrik, Skillsoft

Tuesday (9/10): Academy Sports & Outdoors, Cognyte, Dave & Busters, GameStop, Petco

Wednesday (9/11): Manchester United, Vera Bradley

Thursday (9/12): Adobe, Kroger, Lovesac, RH

Friday (9/13): N/A

What We’re Watching:

1) Adobe (ADBE)

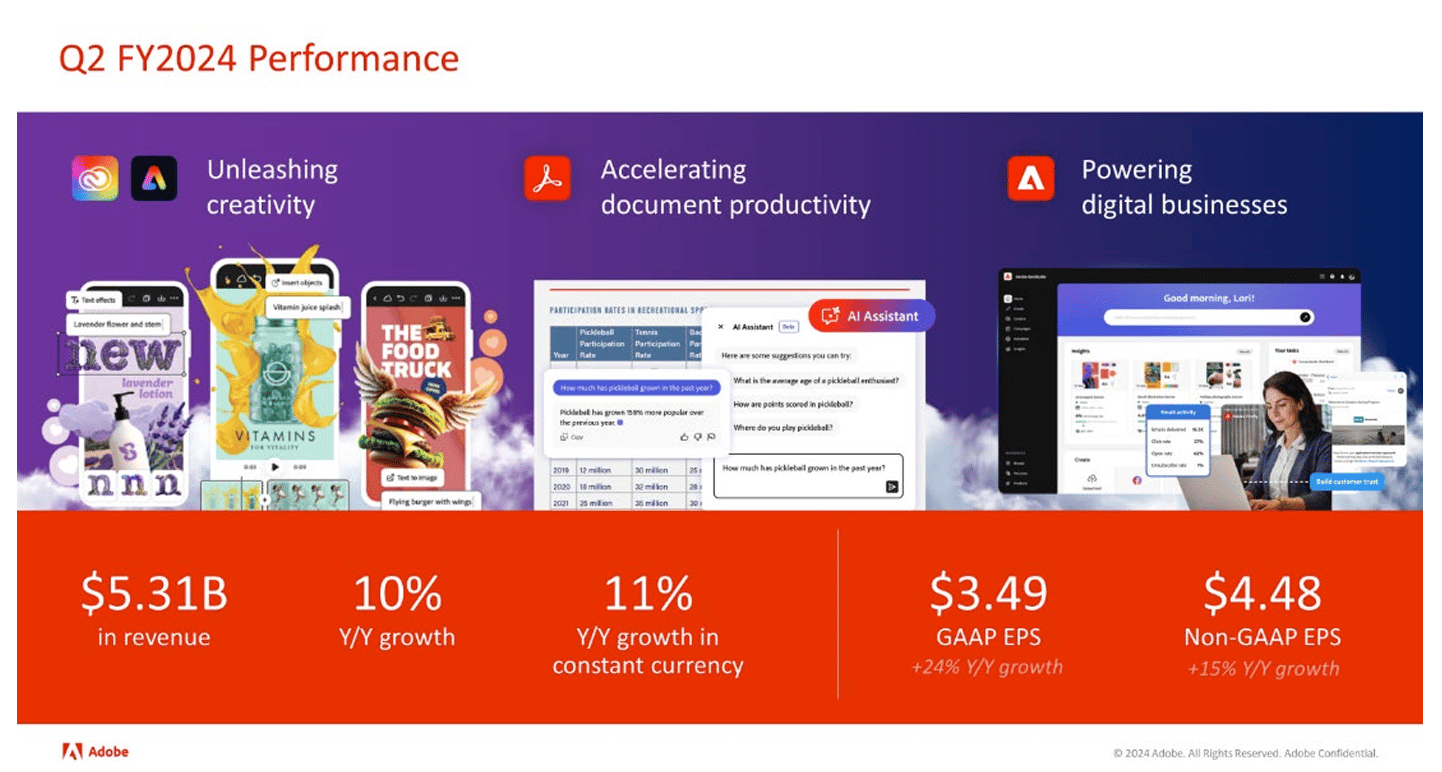

Source: Adobe Investor Relations

Adobe (-5.6% YTD) will release its Q3 FY24 earnings on Thursday, with its MAX Creativity Conference and Analyst Day following on October 14-16. Key areas to watch include Adobe's growth potential from generative AI (genAI) and its positioning against competitors like Canva and Figma.

Canva is emerging as a strong competitor, but it's unlikely to challenge Adobe’s dominance among professional creatives in the near term. Meanwhile, Adobe Express is gaining ground in the lower-tier market – focusing on innovation to compete with Canva's growing market share.

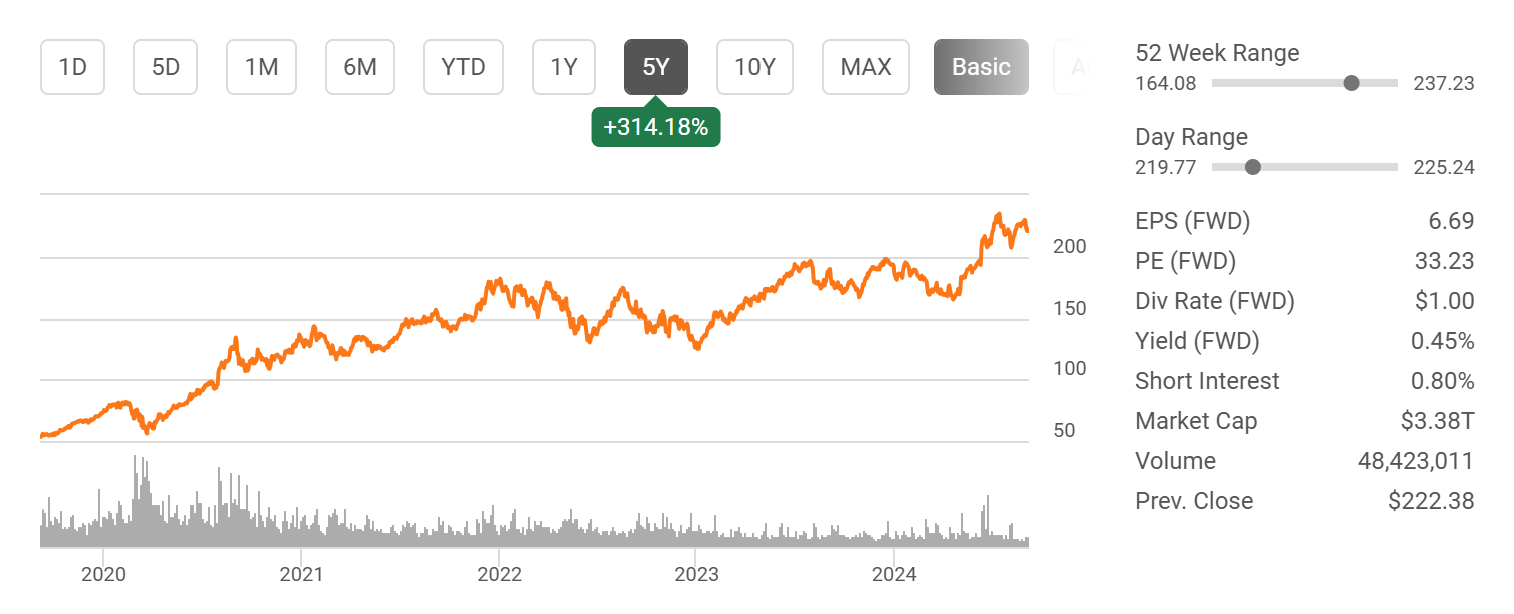

Adobe (ADBE) Stock Performance, 5-Year Chart, Source: Seeking Alpha

2) Kroger (KR)

Source: Kroger Investor Relations

On Thursday — Kroger (+14.3% YTD) posts its quarterly earnings. Kroger’s proposed $25 billion merger with Albertsons (ACI) could significantly expand its presence and scale — transforming the U.S. grocery market.

With Albertsons' strong foothold in the West & Northeast, Kroger would enhance its reach and serve millions of new customers. The deal is expected to generate around $1 billion in “annual run-rate synergies” within four years by streamlining supply chains and operations, potentially offering customers lower prices and better service.

The merger is crucial for both companies to compete against giants like Walmart (WMT), Amazon (AMZN), and Costco (COST) — which dominate the industry with vast resources and consistent innovation. While the Federal Trade Commission (FTC) is currently reviewing the deal, investors are closely watching whether this merger will create a long-term upward trend for Kroger or if market dynamics will prompt a decline.

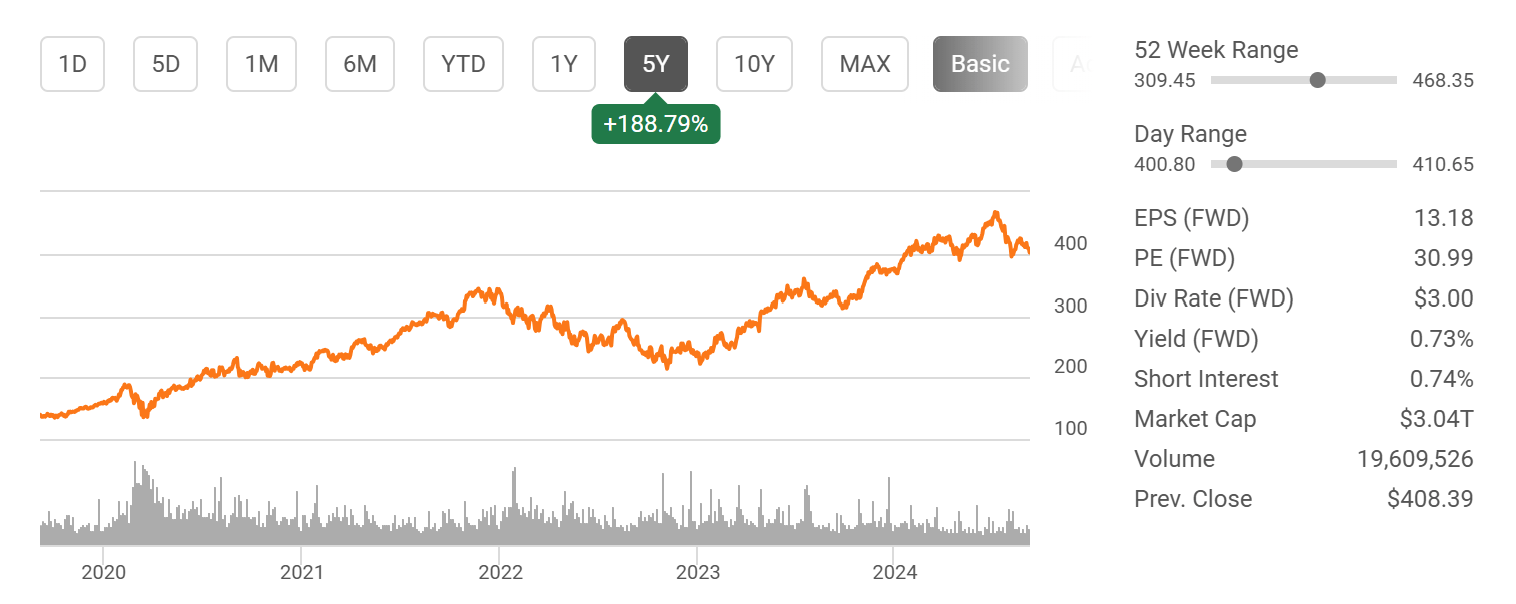

Kroger (KR) Stock Performance, 5-Year Chart, Source: Seeking Alpha

Investor Events / Global Affairs

Big events from Apple, Goldman Sachs, AND Microsoft.

Apple (AAPL) “It’s Glowtime” Event

Source: Apple.com

At Apple's "It's Glowtime" event on September 9, 2024, expect the new iPhone 16 models, featuring Action and Capture Buttons, a more power-efficient OLED display, and camera improvements for low-light and spatial video.

The iPhone 16 Pro models may include a 48MP Ultra-Wide lens and 4K video recording at up to 120 frames per second, along with a larger display size and enhanced AI-powered features. Apple Watch Series 10 will debut with a thinner design, improved health sensors, and better battery life. New AirPods 4 models will also launch, offering Active Noise Cancellation and a USB-C charging port.

Apple (AAPL) Stock Performance, 5-Year Chart, Source: Seeking Alpha

Additional surprises may be revealed, but products like the iPad mini 7 or AirPods Max updates are unlikely to appear.

Goldman Sachs Communacopia & Technology Conference 2024

Source: Goldman Sachs

The Goldman Sachs Communacopia & Technology Conference 2024 is an annual event organized by Goldman Sachs that brings together leaders from the communications, media, and technology sectors. It serves as a platform for companies to present their latest innovations, financial updates, and growth strategies, while investors and industry analysts gain insights into trends shaping these industries.

Goldman Sachs (GS) Stock Performance, 5-Year Chart, Source: Seeking Alpha

Participants include: Applied Materials (AMAT), AT&T (T), ChargePoint (CHPT), DoorDash (DASH), Etsy (ETSY), Hasbro (HAS), Instacart (CART), Lyft (LYFT), Microsoft (MSFT), Nvidia (NVDA), Opendoor Technologies (OPEN), Robinhood Markets (HOOD), Salesforce (CRM), Uber Technologies (UBER), and Warner Bros. Discovery (WBD).

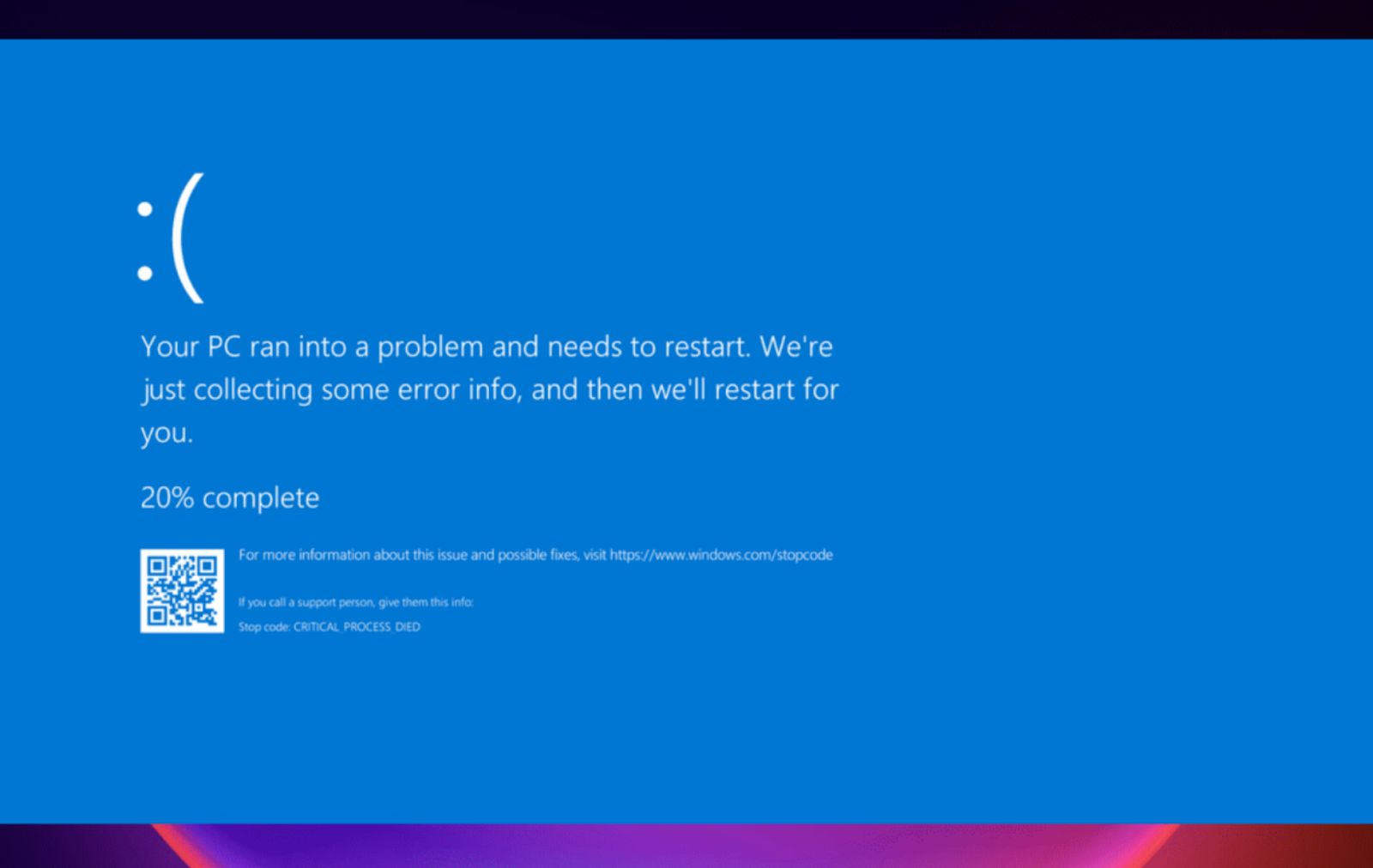

Microsoft (MSFT) Cybersecurity Conference

Microsoft is hosting the Windows Endpoint Security Ecosystem Summit at its Redmond, Washington campus. The event will gather top security companies and government representatives to discuss vulnerabilities that emerged following the CrowdStrike (CRWD) July software update debacle.

Microsoft (MSFT) Stock Performance, 5-Year Chart, Source: Seeking Alpha

The press and public are apparently not invited, creating some pushback about Microsoft's commitment to transparency. It’s tough to tell if this will end up being a market-moving event or if we’ll simply receive a press release update after it finishes up.

Major Economic Events

Updates on inflation for consumers, inflation for producers, and consumer sentiment are all coming this week.

The CME FedWatch tool currently shows a 71% chance of a 25 basis point interest rate cut this month.

Monday (9/9): Consumer Credit, Wholesale Inventories

Tuesday (9/10): Fed Vice Chair for Supervision Michael Barr on Bank Reform, NFIB Optimism Index

Wednesday (9/11): Consumer Price Index (CPI), Core CPI

Thursday (9/12): Initial Jobless Claims, Producer Price Index (PPI), Core PPI, Monthly US Federal Budget

Friday (9/13): Consumer Sentiment (Final), Import Price Index

What We’re Watching:

1) Consumer Price Index (CPI)

Source: CNBC

In July 2024, the U.S. CPI rose by +0.2% month-over-month, recovering from a -0.1% decline in June and meeting market expectations. Shelter prices, up +0.4%, contributed to nearly 90% of the increase.

According to MarketWatch, the median forecast for this week’s release is a +2.6% year-over-year CPI increase and +3.2% Core CPI increase.

2) Consumer Sentiment

Source: Trading Economics

The University of Michigan's consumer sentiment for August 2024 was revised up to 67.9 from 67.8 but fell short of the 68 expected.

The current conditions index improved to 61.3 from 60.9 – while the expectations index remained at 72.1. Year-ahead inflation expectations were revised down to 2.8% from 2.9% — with the five-year outlook steady at 3%.

According to MarketWatch, the median forecast for this week’s consumer sentiment update is a slight improvement from 67.9 to 68.5.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at info@gritcap,io

Reply