- GRIT

- Posts

- 👉 Big, Beautiful... Before the 4th?

👉 Big, Beautiful... Before the 4th?

Tariff Deadlines, Tesla Deliveries, Unemployment Rate

Together with X Funds

Welcome to your new week.

As one of the sleepiest weeks on the stock market’s calendar — the days leading up to Independence Day can still be filled with some fireworks.

Let’s dive in!

Crypto is more than a buzzword — it’s a growing part of the global economy. But accessing it can be complex, volatile, and yield nothing.

The Nicholas Crypto Income ETF (BLOX) aims to change that.

Diversified holdings in crypto-related equities and ETFs

Exposure to Bitcoin and Ether via leading custodians like Fidelity, Coinbase, and Gemini

Income-focused overlay using strategic options to generate weekly cash flow

BLOX is for investors who want crypto exposure and income potential — without the headaches.

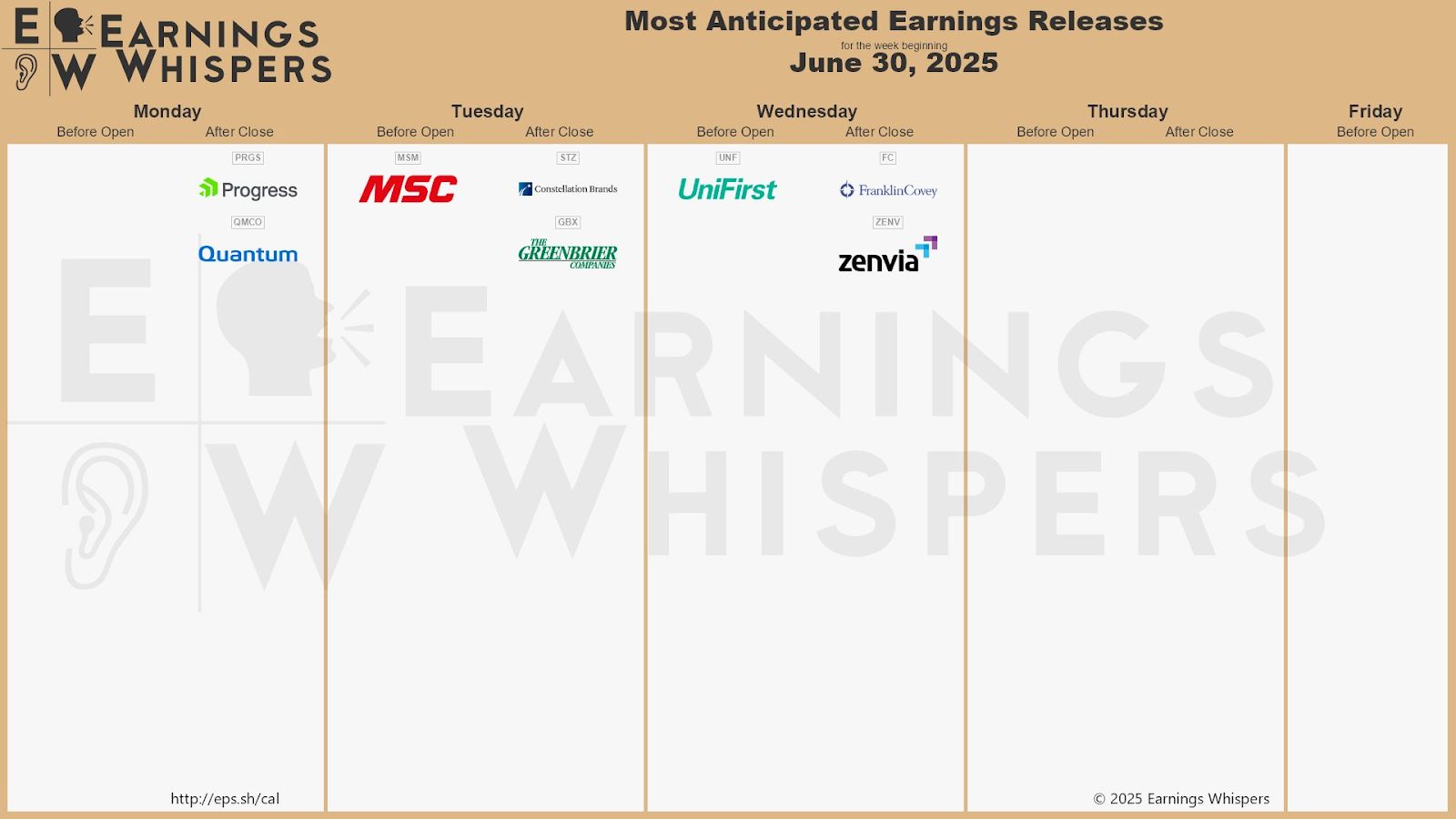

Key Earnings Announcements:

A very quiet week of earnings…

Monday (6/29): Progress Software Corp

Tuesday (6/30): Constellation Brands, Greenbrier Companies, MSC Industrial

Wednesday (7/1): Franklin Covey, UniFirst

Thursday (7/2): None Scheduled

Friday (7/3): None Scheduled (July 4 Holiday)

What We’re Watching:

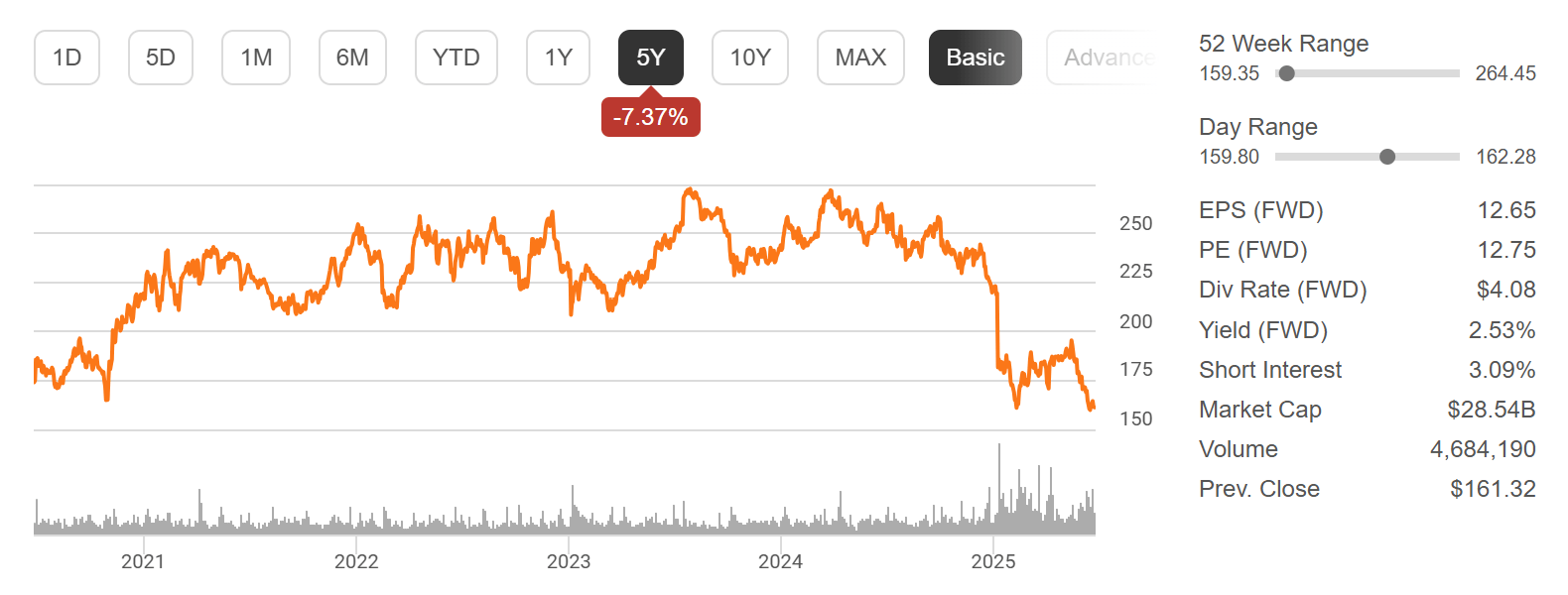

Constellation Brands (STZ)

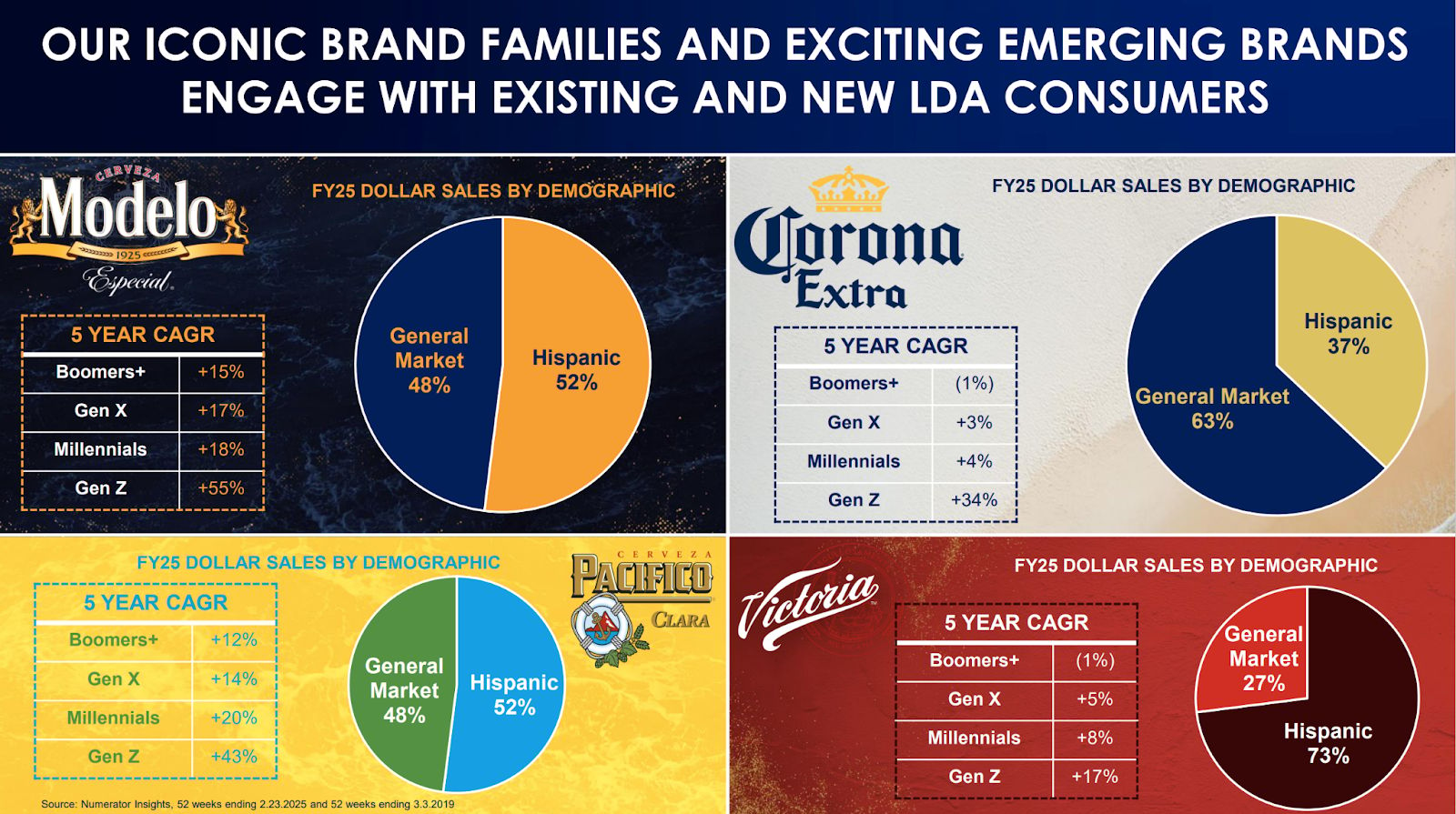

Constellation Brands (STZ) reports earnings Tuesday after the closing bell. Shares are down -27% YTD as the company grapples with weaker wine & spirits demand and cautious consumer spending — but its beer business remains a bright spot, led by strong sales of Modelo and Corona, which continue to gain U.S. market share.

This quarter, investors will watch for momentum in premium beer growth, the impact of recent portfolio reshuffling in wine & spirits, and any commentary on pricing power amid ongoing tariff pressures. Analysts expect revenue of ~$2.66B (+2.7% YoY) and EPS around $3.37, with a focus on FY2026 guidance and any margin upside tied to cost-saving initiatives and ongoing CapEx.

“We’re continuing to invest behind our high-performing beer brands while reshaping our wine & spirits portfolio toward higher-end, higher-growth offerings.”

Constellation Brands (STZ) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

Important data will be released about Tesla deliveries, ongoing trade negotiations before the deadline, and more news on Trump’s tax bill.

Tesla Deliveries

EV delivery reports kick off this week, with Tesla in focus. Analysts expect Q2 deliveries to land around 445,000–455,000 units, down from 466,000 a year ago but rebounding from Q1’s 386,000 figure. Stronger-than-expected performance could help ease investor concerns following recent margin pressures and intensifying competition in China.

Watch for delivery updates from Nio, XPeng, Li Auto, Rivian, and Lucid — alongside legacy automaker sales from Ford, GM, and Toyota. All of them will be offering key insight into shifting demand across EV and hybrid segments.

“Demand for Tesla’s EVs has weakened in key markets like the U.S. and Europe, driven by controversy over Musk’s involvement with the Trump administration. This political backlash has eroded Tesla’s appeal among some buyers, contributing to a projected delivery decline. The company’s first-quarter performance already showed strain, falling short of expectations, and Q2 continues this trend. The departure of Omead Afshar, who led sales and manufacturing in North America and Europe, adds uncertainty, marking another high-profile exit amid Tesla’s challenges.”

Trade Negotiations

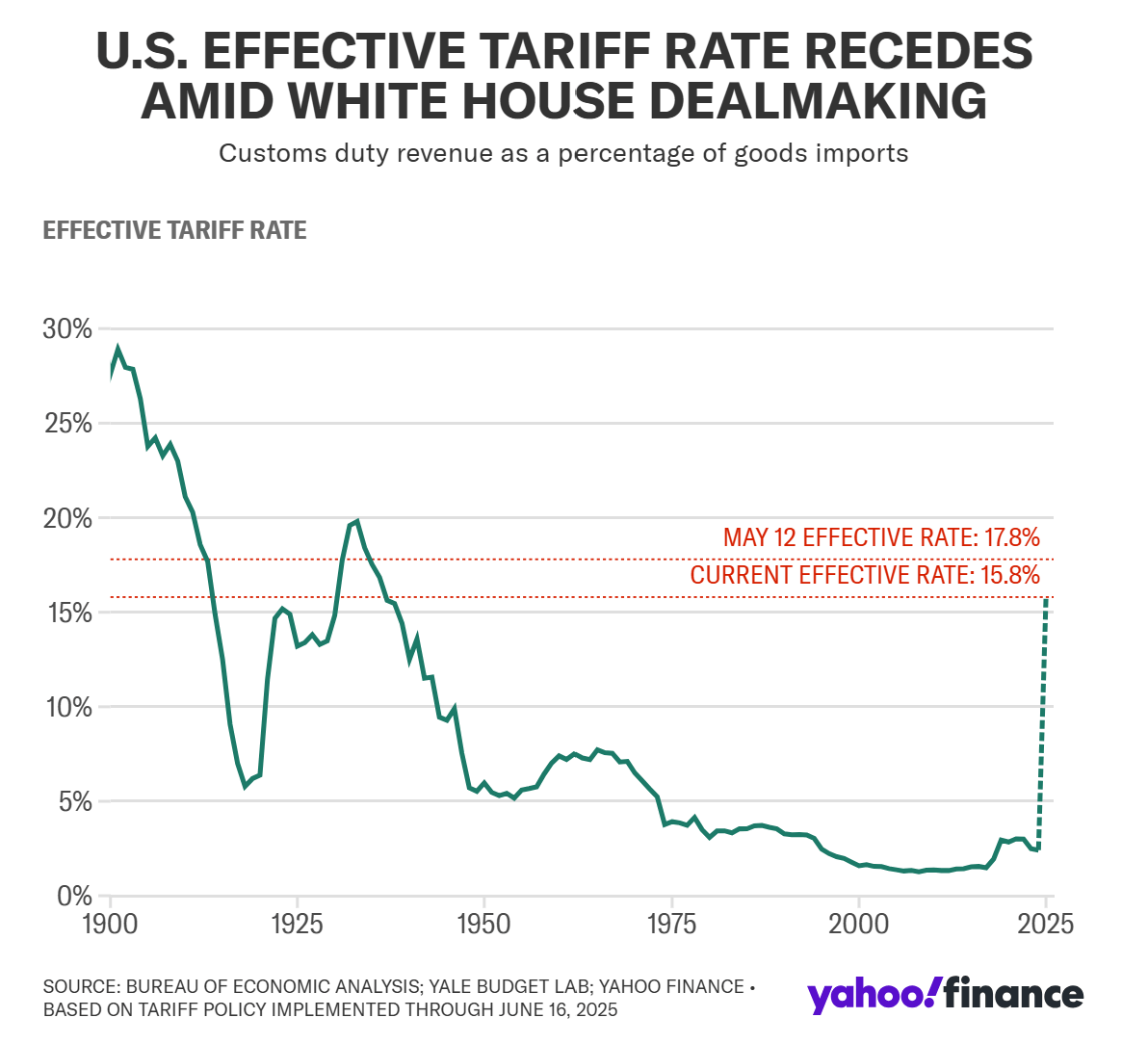

The July 9 tariff deadline set by President Trump looms large as global trade talks enter a critical stretch. While Trump reiterated over the weekend that he “doesn’t think” an extension will be necessary, administration officials have left the door open for flexibility if partners are negotiating “in good faith.”

The U.S. has secured a trade pact with the U.K. and is nearing deals with several major partners – but tensions with Canada escalated after Ottawa introduced a digital services tax, prompting Trump to threaten new tariffs within seven days. Last night, Canada rescinded their digital services tax in order to advance broader trade negotiations with the U.S.

Meanwhile, the U.S. and China struck a key agreement to finalize a May trade framework, with U.S. tariffs on Chinese imports set to start at 30% and China reciprocating with 10% tariffs. With negotiations still underway with the EU, Japan, and others, markets will be watching closely to see whether the White House enforces or delays its July 9 tariff threat.

“We will let Canada know the tariff that they will be paying to do business with the United States of America within the next seven day period.”

Update on The “One Big Beautiful Bill”

Source: The Washington Post

Senate Republicans are racing to finalize President Trump’s sweeping tax package ahead of the self-imposed July 4 deadline — but internal party divisions could derail the plan. The $4.5 trillion legislation extends the 2017 tax cuts and introduces new tax breaks for seniors, car buyers, and hourly workers. However, its $1.2T in spending cuts — including major Medicaid reductions — have sparked backlash from moderates like Senators Murkowski and Collins.

Senate Majority Leader John Thune has only hours to win over key holdouts, including Rand Paul and others demanding deeper cuts. Meanwhile, Trump is applying public pressure from the sidelines, threatening to primary dissenters like Sen. Thom Tillis, who just announced he won’t seek reelection.

A final Senate vote could happen as early as Monday night, with the House vote still to follow. Any delay risks missing Trump’s deadline — and facing his backlash.

“Republican leaders entered the weekend without even knowing what parts of the bill will survive the Senate vote. At one ideological end of the caucus, senators like Tillis and Susan Collins of Maine balked at steeper cuts to Medicaid. At the other end, Rand Paul of Kentucky and Ron Johnson of Wisconsin pushed for more spending cuts. And there was no final agreement on a major increase in the cap on deducting state and local taxes, which blue-state Republican representatives have insisted on.”

“The One Big Beautiful Bill reduces deficits by over $2 trillion by increasing economic growth and cutting waste, fraud, and abuse across government programs at an unprecedented rate. This legislation delivers historic levels of mandatory savings. President Trump’s pro-growth economic formula will reduce the deficit, increase wages, deliver American jobs, and drive down the cost of living.”

Major Economic Events:

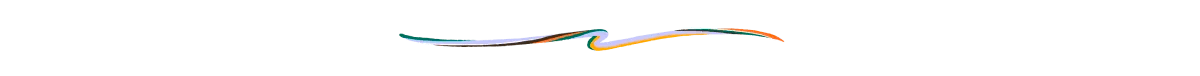

All eyes are on this month’s jobs report.

Monday (6/30): Chicago Business Barometer (PMI)

Tuesday (7/1): Auto Sales, Construction Spending, ISM Manufacturing, Job Openings, S&P Final U.S. Manufacturing PMI

Wednesday (7/2): ADP Employment

Thursday (7/3): Factory Orders, Hourly Wages Year Over Year, Initial Jobless Claims, ISM Services, S&P Final U.S. Services PMI, U.S. Employment Report, U.S. Hourly Wages, U.S. Trade Deficit, U.S. Unemployment Rate

Friday (7/4): None Scheduled (July 4 Holiday)

What We’re Watching:

JOLTs Job Openings

U.S. job openings unexpectedly rose to 7.39 million in April, up by +191K and beating forecasts of 7.10 million. Gains were broad-based, with notable strength in professional and business services (+171K), health care and education (+115K), and retail trade (+46K).

However, openings declined sharply in accommodation and food services (-135K) and in state and local government education (-51K). Hires (5.6M) and total separations (5.3M) were little changed, suggesting labor demand remains stable — but sector-level divergence continues as certain industries cool faster than others.

Economists expect the following this week:

JOLTS Job Openings (May): 7.35 million

Quits Rate (May): 2.2%

Layoffs and Discharges: 1.7 million

“The JOLTS report is a monthly survey released by the BLS that tracks job openings, hiring, and separations (quits, layoffs, and discharges). Unlike the unemployment rate, which measures labor supply, JOLTS data helps gauge labor demand. An increase in job openings is generally a positive sign, indicating ample job opportunities.”

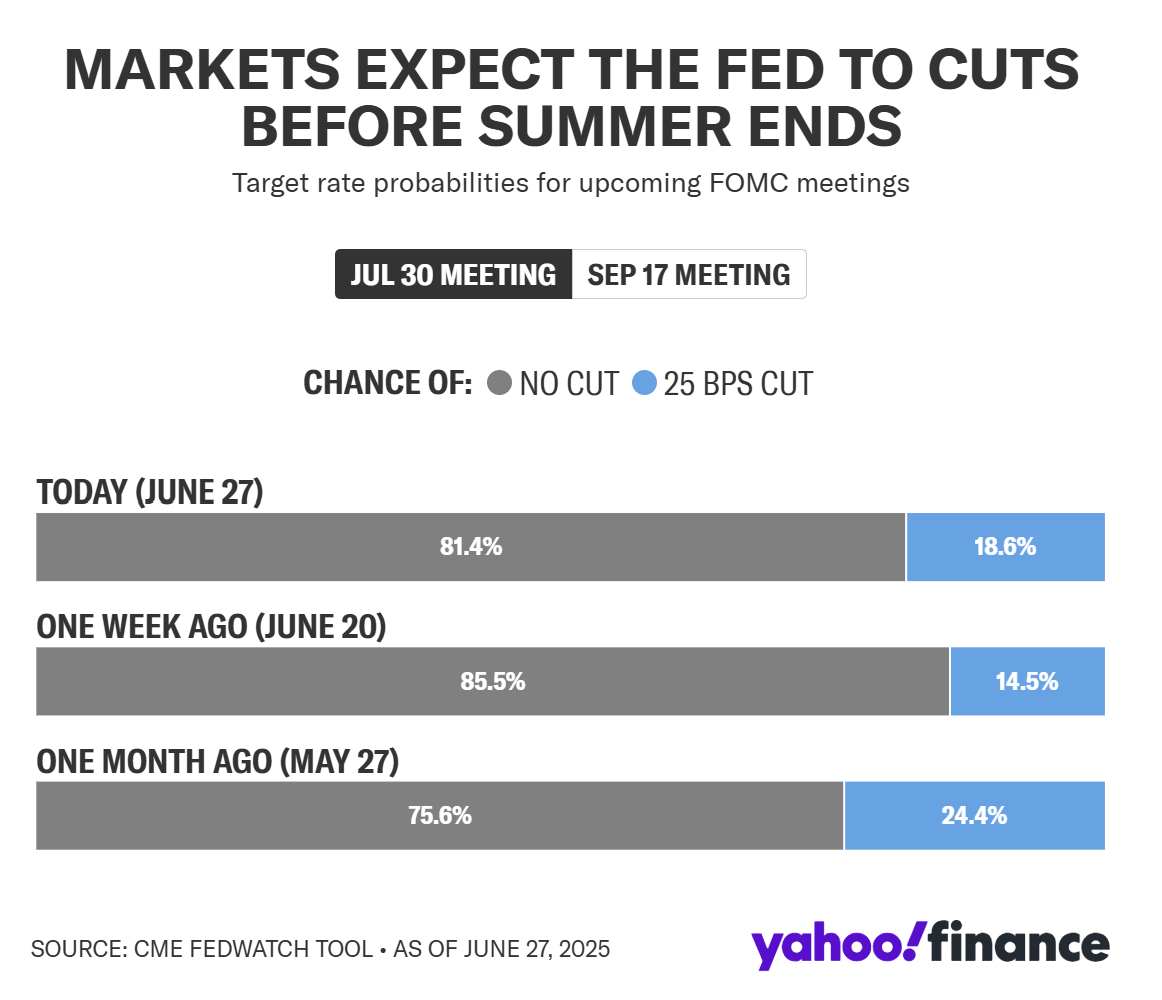

Non Farm Payrolls

U.S. nonfarm payrolls rose by 139K in May – a modest slowdown from April’s downwardly revised 147K, but slightly above expectations. Gains were led by health care (+62K), leisure & hospitality (+48K), and social assistance (+16K), while job losses continued in the federal government (-22K) and manufacturing (-8K).

Revisions to March and April shaved a combined 95K jobs from previous estimates, reinforcing signs of a gradual labor market cool-down. Still, the data reflects underlying resilience – though policy uncertainty and tariffs may weigh on hiring momentum in the second half of 2025.

Economists expect the following this week:

Initial Jobless Claims: 235,000

Unemployment Rate (June): 4.2%

Nonfarm Payrolls (June): 145,000

“The unemployment rate has stayed low mostly because layoffs are still relatively rare. The actual hiring rate — new hires as a percentage of all jobs — has fallen to 2014 levels, when the unemployment rate was much higher, at 6.2%. Economists call it a no-hire, no-fire economy.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Cover image source: BBC / Getty Images

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]