- GRIT

- Posts

- 👉 Biggest Earnings Week of the Season & Trade Deals

👉 Biggest Earnings Week of the Season & Trade Deals

Amazon, Meta, Microsoft

Together with Your Best Credit Cards

Welcome to your new week.

The biggest week of this earnings season, major trade deal news, and Fed drama all continue to headline the market.

Let’s dive right in — and be sure to check out the offer below!

If you are like us, you spend a LOT dining out and probably even more on groceries these days.

You could be earning 4X points on these purchases... and of course you can get a huge welcome bonus offer as well.

Key Earnings Announcements:

Huge week of earnings with Apple, Amazon, Meta, and Microsoft.

Monday (7/28): Alliance Resource Partners, Alerus, Bank of Hawaii, Bank of Marin, Business First Bank, Cadence, Celestica, Crane, Enterprise Products Partners, FEMSA, New Gold, Nucor, Provident Bank, Rambus, Rithm Capital, Steel Dynamics, Tilray, UHS, Waste Management, Whirlpool

Tuesday (7/29): Boeing, Booking Holdings, Caesars Entertainment, Cheesecake Factory, Exelixis, FTAI Aviation, Lithia Motors, Marathon Digital, Merck, PayPal, Procter & Gamble, Penumbra, Seagate, SoFi, Spotify, Starbucks, Teradyne, Texas Instruments, The Trade Desk, UnitedHealth Group, UPS, Visa

Wednesday (7/30): Altria, Amphenol, Applied Blockchain, Arm, AT&T, Carvana, Generac, GE Vernova, Harley-Davidson, Hershey, Humana, Kinross Gold, Kraft Heinz, Lam Research, Meta, Microsoft, Qualcomm, Robinhood, Teva, Thermo Fisher, Virtu Financial

Thursday (7/31): AbbVie, Amazon, Apple, Bristol Myers Squibb, Cameco, Carpenter Technology, Cigna, Cloudflare, Coinbase, CVS Health, Enovix, Etsy, Ford, Lam Research, Mastercard, Norwegian Cruise Line, Reddit, Riot Platforms, Roblox, Roku, Strategy & Bi, T-Mobile, Union Pacific

Friday (8/1): 3M, Cable One, Chevron, CNH Industrial, Colgate-Palmolive, Dominion Energy, Emerson Electric, ExxonMobil, Fluor, LyondellBasell, Regeneron, T. Rowe Price, Xenia Hotels & Resorts

What We’re Watching:

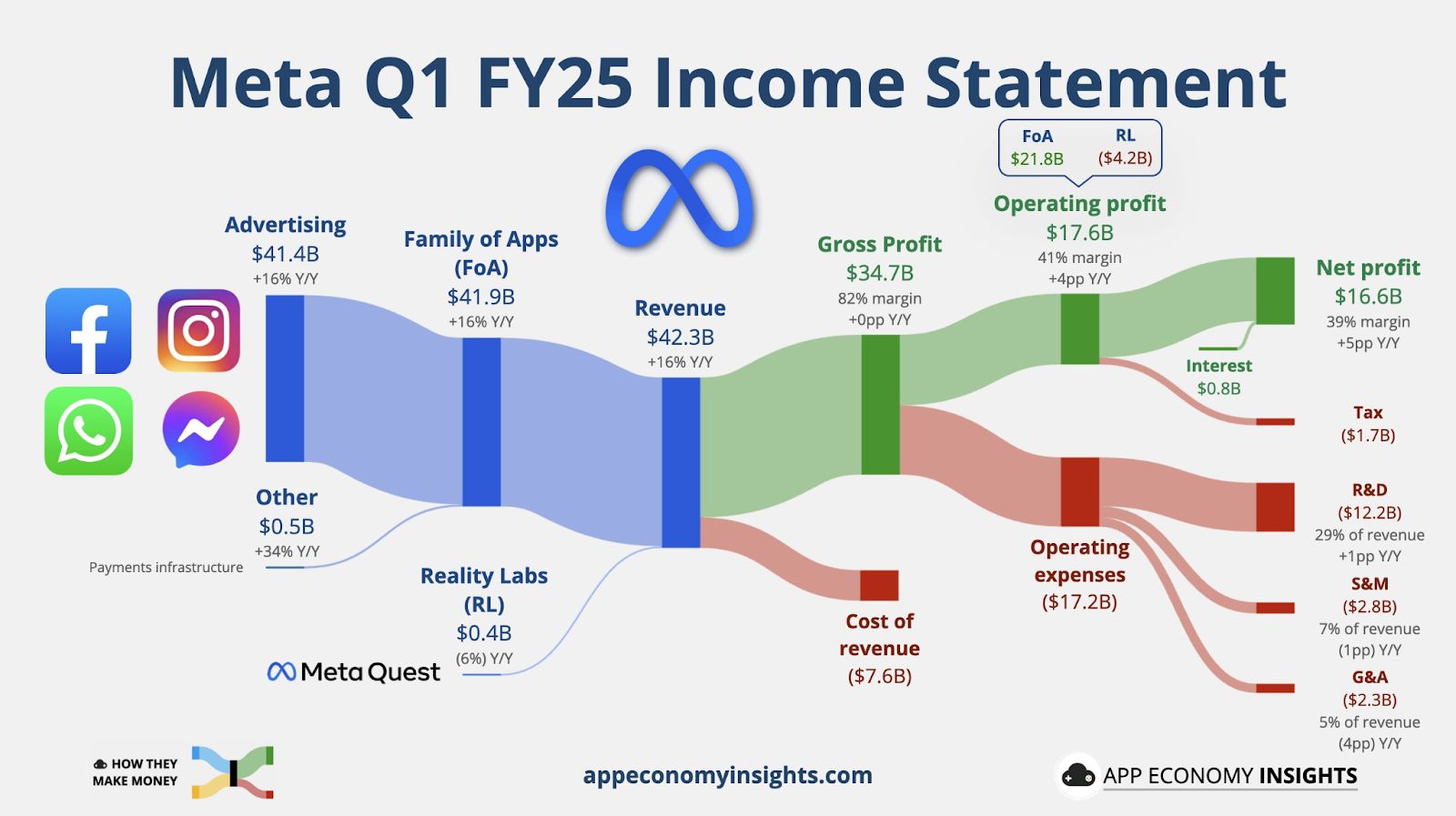

Meta (META)

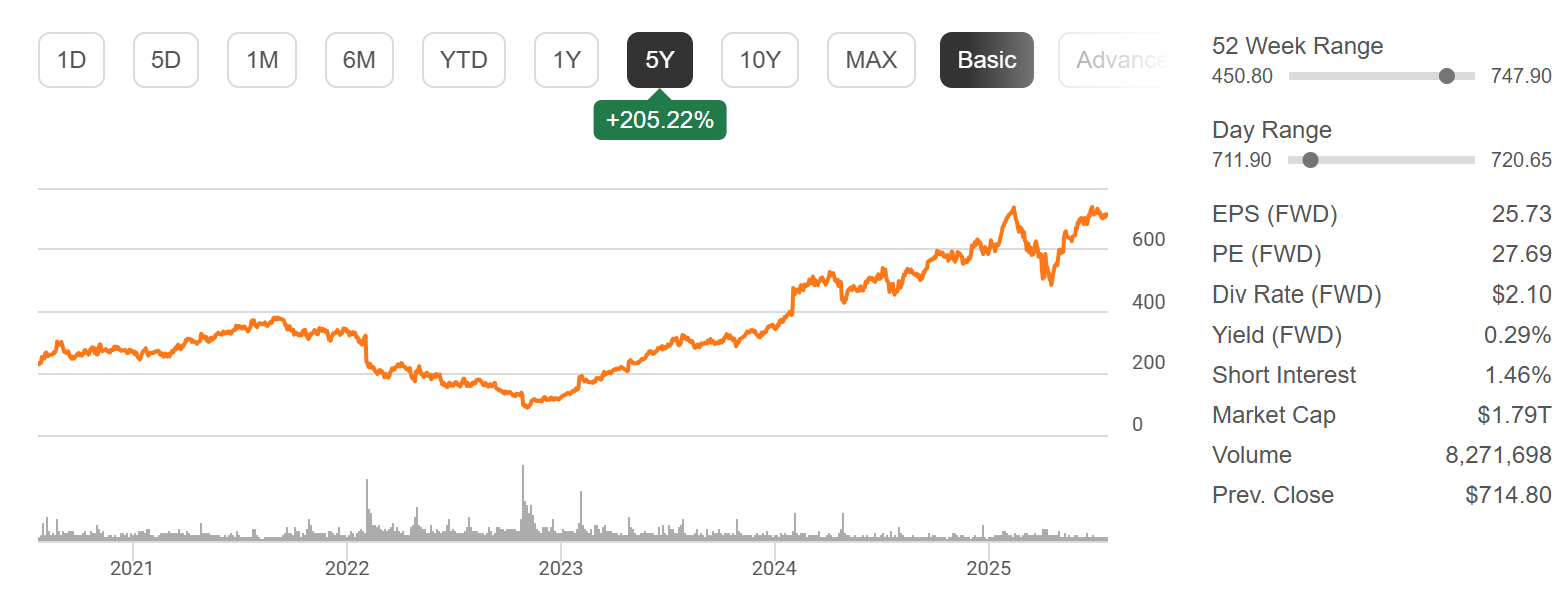

Meta Platforms reports Q2 earnings Wednesday after the bell, with shares up +21.7% YTD as markets rally behind its aggressive AI and infrastructure investments.

This cycle, focus will be on how investments in AI infrastructure (CapEx expected to top ~$68B in 2025) are translating into improved ad performance, engagement, and margin resilience — particularly in family-of-apps monetization and Reality Labs costs. I’ll also be watching for updates on advertiser adoption of AI tools like Advantage+ and Andromeda, engagement growth in Reels and Threads, and any commentary on competitive pressures from Google and Amazon.

I'm excited to hear about Zuck’s full-court press on AI, from recruiting elite talent to building custom chips and superclusters, it’ll be a key narrative this earnings.

“We’re planning to fund all this by … investing aggressively in initiatives that use these AI advances to increase revenue growth.”

Meta Platforms, Inc.(META) Stock Performance, 5-Year Chart, Seeking Alpha

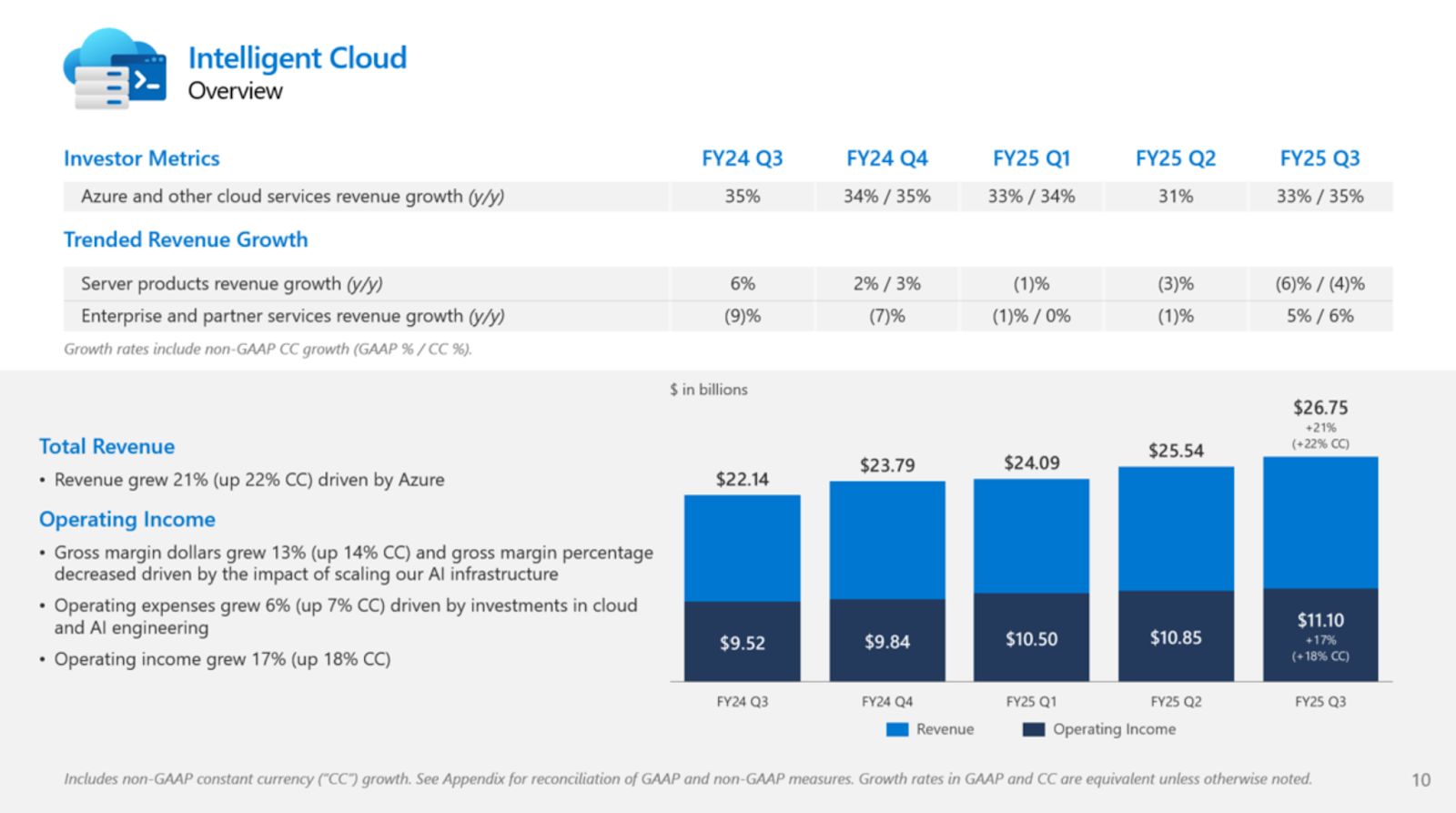

Microsoft (MSFT)

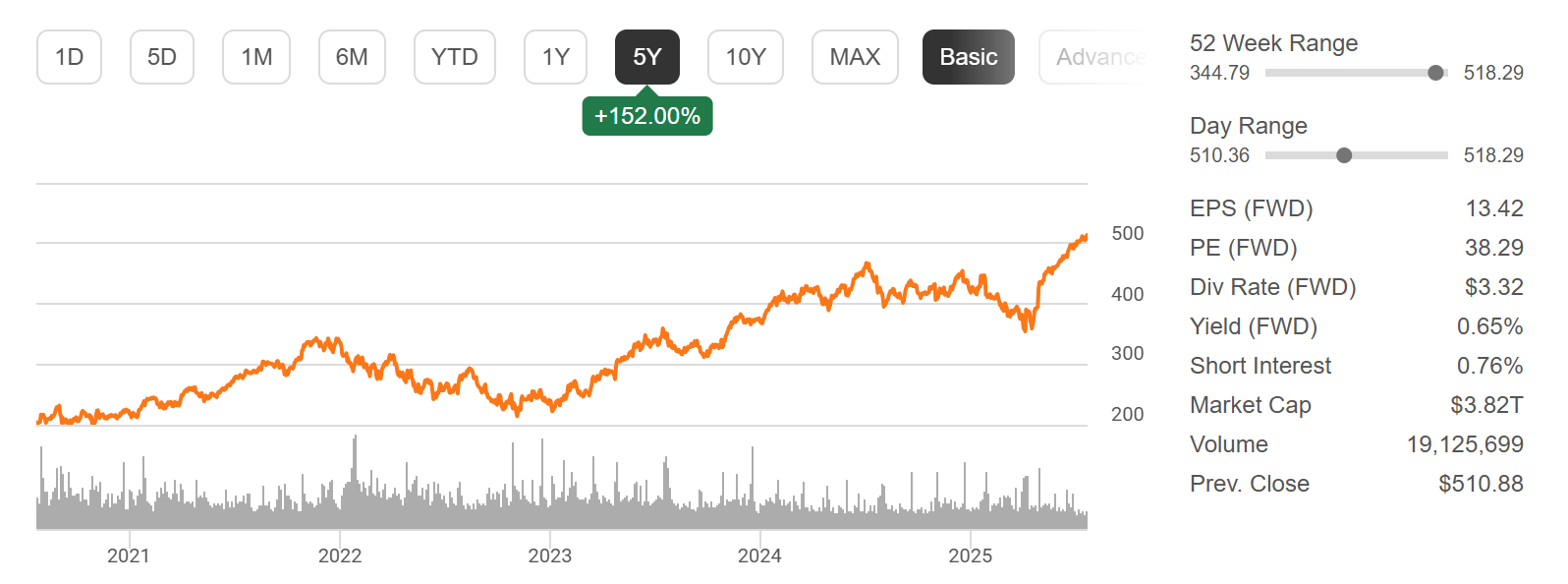

Microsoft reports earnings Tuesday after the bell, with shares up +21.9% YTD. In the prior quarter, Microsoft posted revenue of $61.9B (+17% YoY), with Azure and other cloud services growing +31% — outpacing AWS — and its AI-infused Copilot products starting to see meaningful monetization across Office and GitHub.

This quarter, all eyes will be on Azure’s growth trajectory, the adoption rate of AI services like Copilot, and any updates around integration of OpenAI’s models across Microsoft’s enterprise stack. Analysts also expect further clarity on gross margin expansion and the company’s evolving CapEx strategy to support its $50B+ AI infrastructure buildout.

I’ll be listening for management’s guidance on FY2025 cloud revenue, Copilot attach rates, and commentary on the competitive landscape with Google and Amazon. Microsoft’s results will give a major outlook on broader enterprise tech and AI spending into the back half of the year.

“We’re in the midst of a major platform shift to AI – and Microsoft is leading the way.”

Microsoft Corporation (MSFT) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

Earnings growth is looking strong, EU / U.S. reached a historic trade deal, and the Chinese tariff pause is expected to be extended.

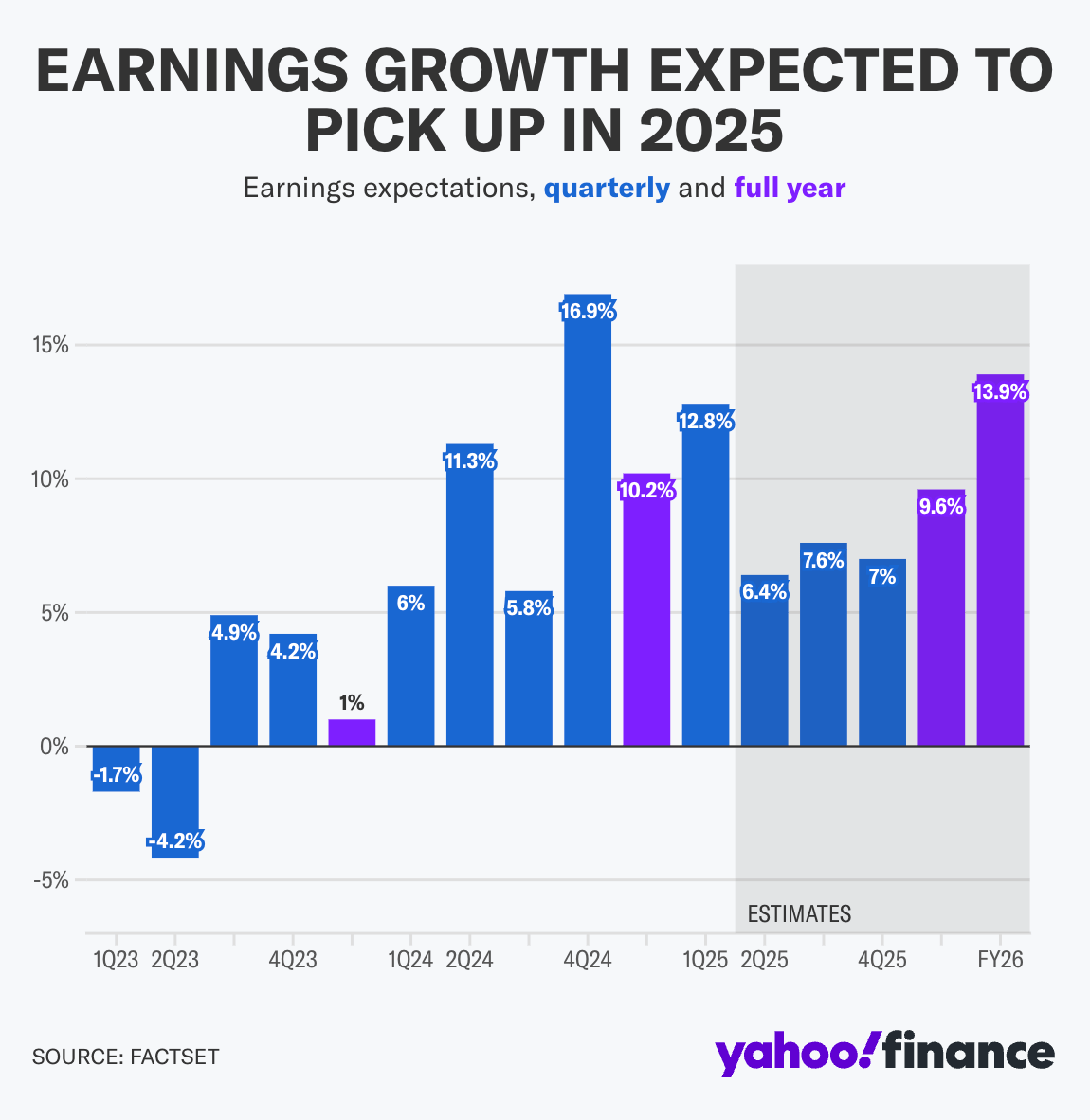

Earnings Growth Could Be Better Than Expected in 2025

Second quarter earnings season is underway, and results have mostly exceeded expectations due to lower forecasts set amid concerns over tariffs, stock valuations, and economic uncertainty. Major tech companies like Microsoft, Apple, Amazon, and Meta are set to report this week, alongside names like Ford, Spotify, and Starbucks. With 34% of the S&P 500 having reported, earnings growth is tracking at +6.4%, better than the +5% forecast at the quarter's start.

Analysts are increasingly optimistic about future earnings, now projecting +13.9% growth in 2026, slightly higher than last month’s estimate. Investor focus is shifting toward capital expenditures in AI, especially after Alphabet's announcement of a $10 billion increase in 2025 spending.

"The question from here is how much more good news do we need to sustain [these] levels."

EU / U.S. Reach Trade Deal

Source: Barron’s

A framework trade deal signed July 27 between President Trump and European Commission President Ursula von der Leyen has averted a looming tariff showdown. The agreement establishes a 15% U.S. tariff on most EU goods — half of the previously threatened 30% — while granting zero tariffs for certain products like aircraft parts, semiconductors, and select agricultural goods. In return, the EU committed to purchase $750 billion of U.S. energy over three years and invest $600 billion in the U.S., including military equipment transactions.

Risk has eased for export-driven sectors such as autos, industrials, and energy, while multinationals with trans-Atlantic footprints — e.g. aerospace, defense, and consumer goods — stand to benefit from improved clarity and stability. The deal is expected to underpin a relief rally in markets sensitive to global trade flows, particularly European stocks and U.S. exporters.

“For the EU, today’s agreement is probably almost as good as it could get.”

“Fifteen percent is not to be underestimated but it is the best we could get… Fifteen percent is certainly a challenge for some, but we should not forget it keeps access to the American market.”

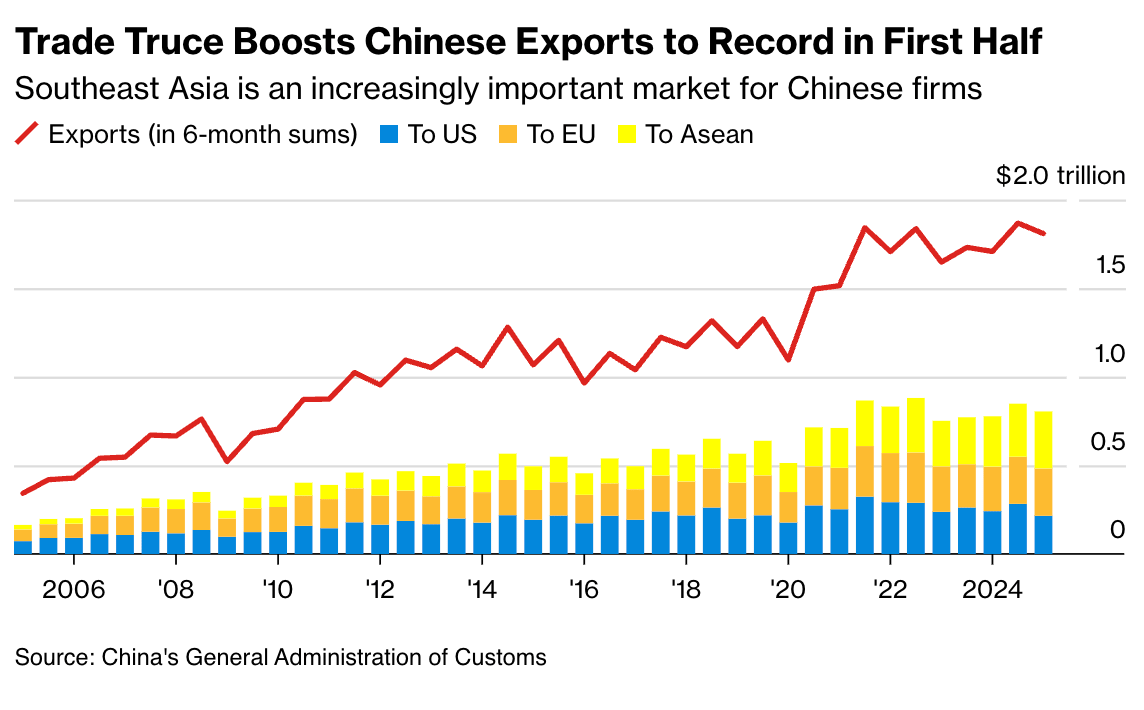

China / U.S. to Extend Tariff Pause

Source: USA Today

The U.S. and China will resume high-level trade talks in Stockholm on Monday, aiming to extend a truce and avoid the return of tariffs exceeding 100%. With an August 12 deadline looming, both sides are under pressure to reach a lasting agreement following a preliminary deal made in June. While major breakthroughs are unlikely, the talks could ease tensions and set the stage for a potential meeting between Presidents Trump and Xi later this year.

Discussions will center on rolling back existing tariffs and addressing export restrictions, particularly on rare earth minerals and advanced tech like Nvidia’s AI chips. China is expected to push for a reduction in multi-layered U.S. tariffs, while the U.S. wants China to shift its economy toward domestic consumption. These talks come amid broader U.S. efforts to secure similar tariff deals with other trade partners and reinforce its economic leverage.

“That then lowers tariffs on the US side, which then opens the door for China to lower tariffs that lets us sell agriculture, lets us sell airplanes, lets us sell automobiles, that lets us sell energy.”

Major Economic Events:

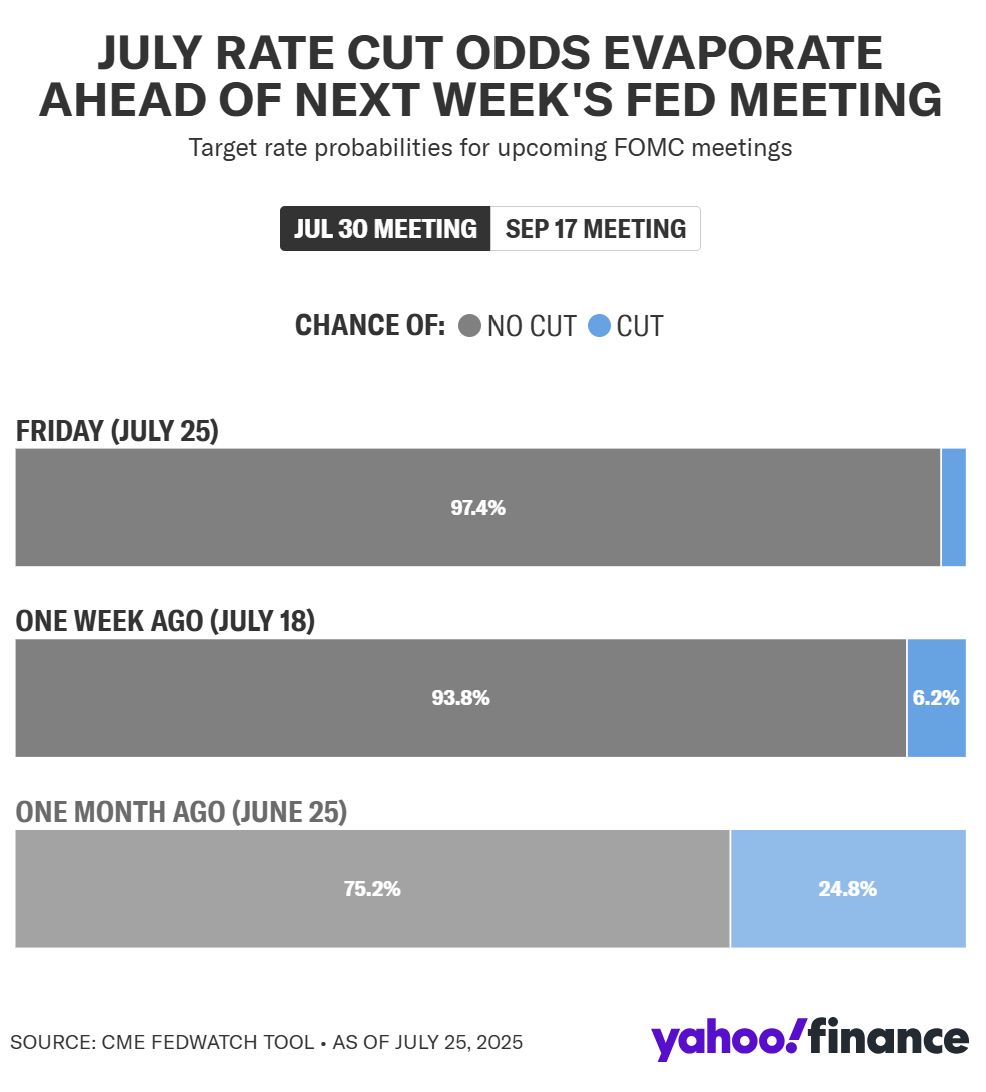

PCE index, FOMC interest rate decision, and the jobs report headline this busy week.

Monday (7/28): N/A

Tuesday (7/29): Advanced Retail Inventories, Advanced U.S. Trade Balance in Goods, Advanced Wholesale Inventories, Consumer Confidence, Job Openings, S&P Case-Shiller Home Price Index (20 Cities)

Wednesday (7/30): ADP Employment, Fed Chair Powell Press Conference, FOMC Interest-Rate Decision, GDP, Pending Home Sales

Thursday (7/31): Chicago Business Barometer (PMI), Core PCE (Year-over-Year), Core PCE Index, Employment Cost Index, Initial Jobless Claims, PCE (Year-over-Year), PCE Index, Personal Income, Personal Spending

Friday (8/1): Auto Sales, Construction Spending, Consumer Sentiment (Final), Hourly Wages Year over Year, ISM Manufacturing, S&P Final U.S. Manufacturing PMI, U.S. Employment Report, U.S. Hourly Wages, U.S. Unemployment Rate

What We’re Watching:

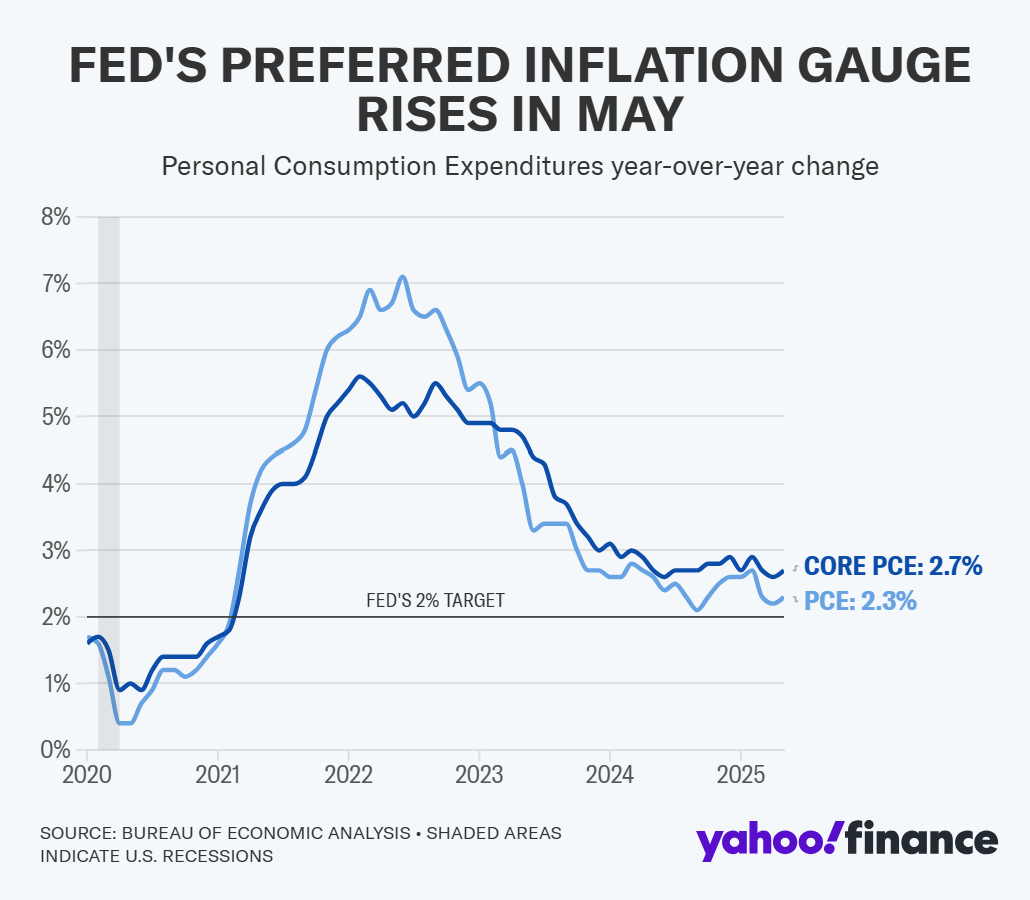

Core PCE

Core PCE — the Fed’s preferred inflation gauge — rose +0.2% in May, matching expectations and slightly accelerating from April’s +0.1% gain. On a year-over-year basis, core PCE rose +2.7%, coming in above forecasts of +2.6% and marking the first annual acceleration since early 2024.

The data signals that underlying inflationary pressures remain somewhat sticky, complicating the Fed’s calculus as it balances policy easing with continued strength in consumer prices and recent tariff uncertainty.

Economists expect the following this week:

Headline PCE (May): +0.2% MoM, +2.5% YoY

Core PCE (May): +0.2% MoM, +2.7% YoY

Personal Income (May): +0.4%

Personal Spending (May): +0.2%

“Core PCE tends to be considerably less volatile than core CPI. This stability makes it a more reliable indicator for the Fed, which has a dual mandate of achieving price stability and maximum employment. Historically, the less erratic nature of core PCE has made it the preferred metric of choice, though the disinflationary trend in core PCE prior to 2022 casts doubt on the effectiveness of the Fed's monetary policy.”

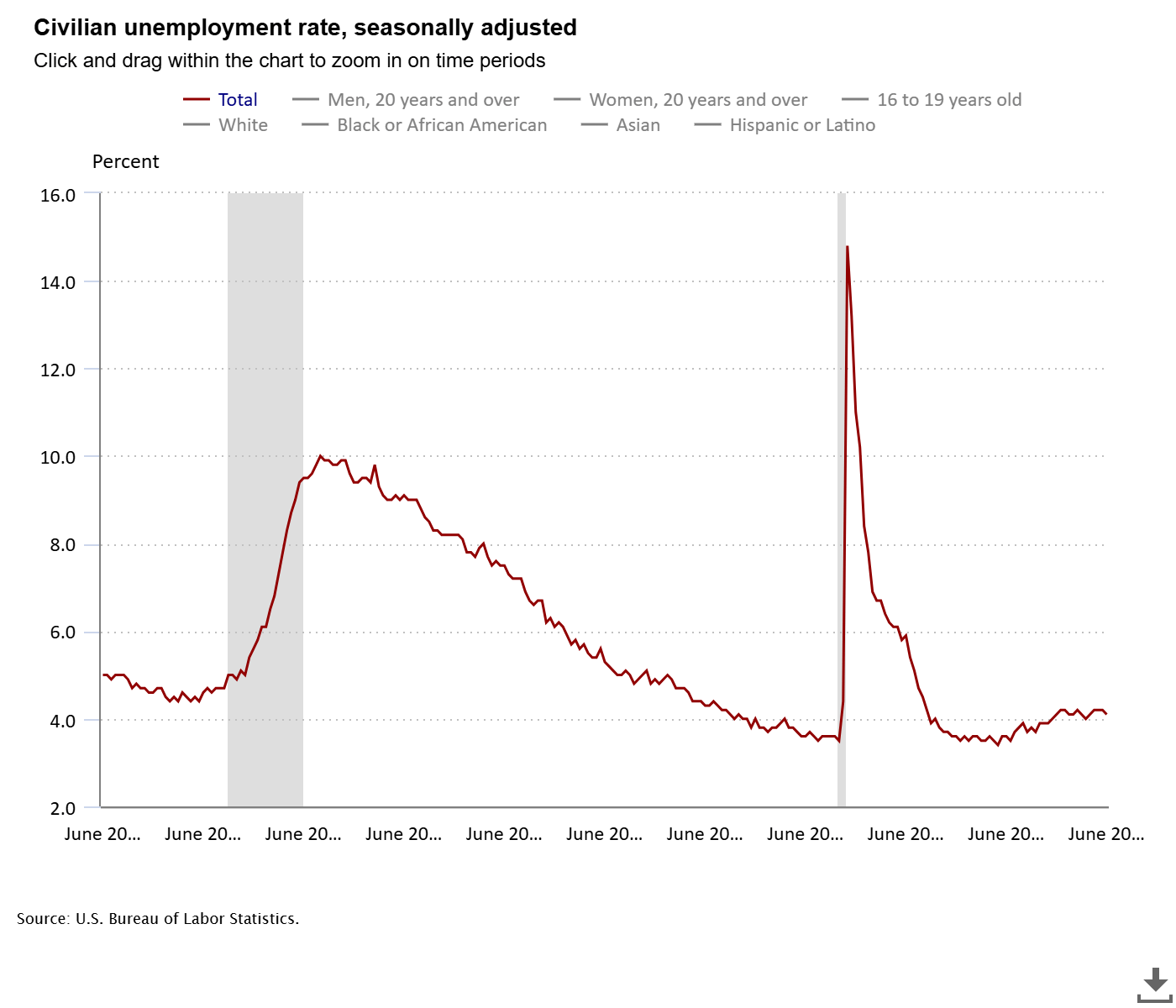

Jobs Report

The July Jobs Report is expected to show a gain of +101,000 nonfarm payrolls – a slight slowdown from June’s +106,000 — with the unemployment rate ticking up to 4.2%, per Bloomberg estimates.

June’s surprise drop in unemployment to 4.1% hinted at lingering labor market resilience, but the trend remains one of gradual softening as hiring slows and policy uncertainty persists.

Economists expect the following this week:

Nonfarm Payrolls (July): +101,000 jobs

Unemployment Rate (July): 4.2%

Average Hourly Earnings: +0.3% MoM, +3.8% YoY

Labor Force Participation Rate: 62.5%

“The US job market continues to largely stand tall and sturdy, even as headwinds mount — but it may be a tent increasingly held up by fewer poles… The headline job gains and surprising dip in unemployment are undoubtedly good news, but for job seekers outside of healthcare & social assistance, local government, and public education, the gains will likely ring hollow.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Cover image source: Barron’s

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]