- GRIT

- Posts

- 👉 Bitcoin Ready to Pop?

👉 Bitcoin Ready to Pop?

Boeing, Tesla, Qualcomm

Together with Kalshi

Welcome to your new week.

Earnings season is picking up the pace in a BIG way!

Let’s dive into everything that you should be watching this week.

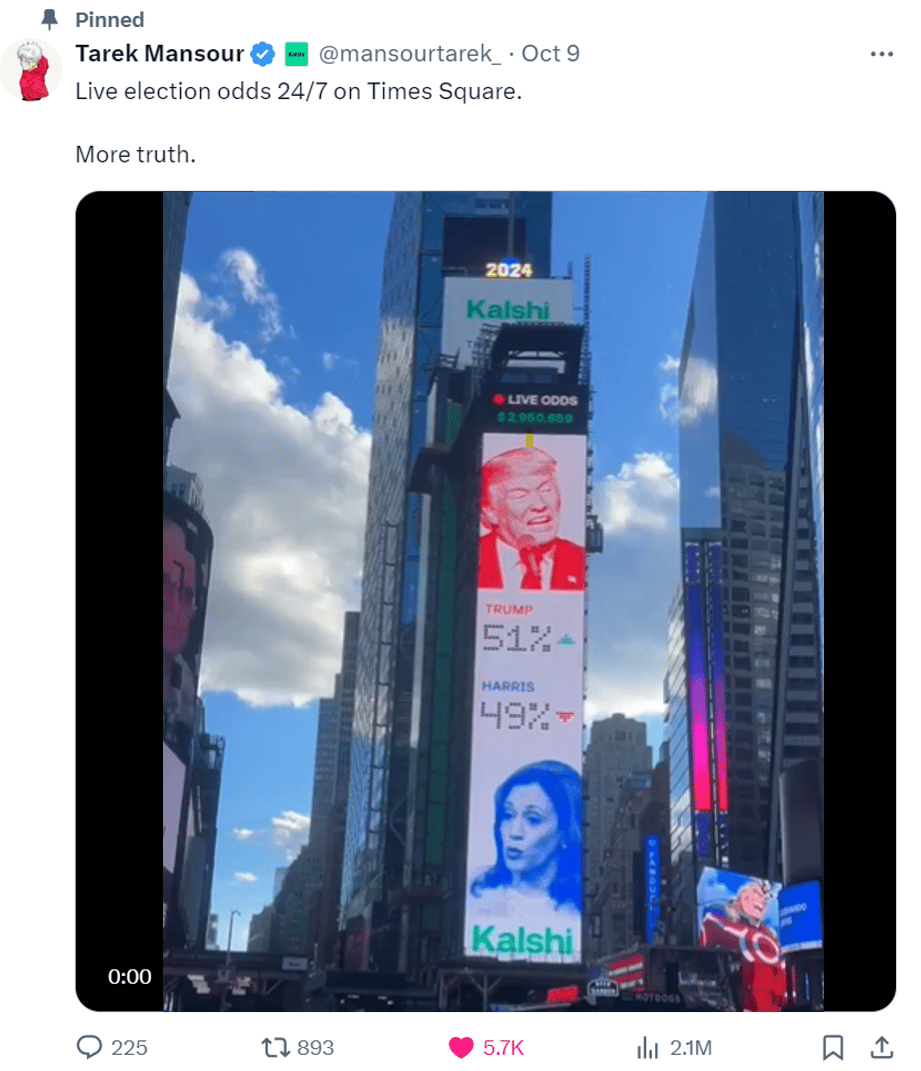

Before we get started, we’d like to call out a HISTORIC political update.

Kalshi just received approval on its “Congressional Control Contracts” – making it legal for anyone to bet on political outcomes … including the upcoming Presidential Election.

If you’ve walked around Times Squares lately, you might already know about this…

In case you’re unfamiliar with Kalshi, it’s a site where you can place bets on things like inflation reports or jobs data — and also when Bitcoin will hit $100K or what music artist has the #1 album this year.

But now they’ve really upped their game. Will Trump beat Kamala? Will Kamala win Pennsylvania? I don’t know, but you can now legally bet on these outcomes in all 50 states!

I’ve personally been using Kalshi since 2021 and I’m definitely going to have some fun with the election events they’re offering.

Click here to get $20 for free when you make a first deposit of $100 or more and place a trade!

This is one-time paid endorsement by Kalshi Inc.

Key Earnings Announcements:

Boeing, Tesla, major airlines, and telecommunication companies highlight the next wave of earnings action.

Monday (10/21): SAP

Tuesday (10/22): 3M, GE Aerospace, General Motors, Texas Instruments, Verizon

Wednesday (10/23): AT&T, Boeing, CocaCola, IBM, NextEra Energy, ServiceNow, Tesla

Thursday (10/24): American Airlines, Dexcom, Nasdaq, Skechers, Southwest, UPS, Tractor Supply Co

Friday (10/25): Centene, New York Community Bancorp, Piper Sandler

What We’re Watching:

Boeing (BA)

Source: Boeing Investor Relations

Boeing (-40.5% YTD) is set to deliver its Q3 earnings on Wednesday, alongside a critical vote by union members on a tentative agreement that could end a month-long strike.

The deal offers a +35% pay hike over four years, up from Boeing's initial offer of +25%, as well as reinstated incentives and improved 401(k) contributions. The strike — which halted production of key aircraft models — was sparked by 95% of the union voting against the previous offer in September.

While the vote outcome may bring workers back, Boeing still faces significant financial challenges. The company is expected to report a -$6 billion loss for Q3, with further pressures from issues like the troubled refueling tanker program and its recent sell-off of defense subsidiaries. CEO Kelly Ortberg expects to get grilled during the earnings call, addressing these hurdles and ongoing efforts to raise capital and reduce losses.

“Our business is in a difficult position, and it is hard to overstate the challenges we face together. Beyond navigating our current environment, restoring our company requires tough decisions and we will have to make structural changes to ensure we can stay competitive and deliver for our customers over the long term.”

The Boeing Company (BA) Stock Performance, 5-Year Chart, Seeking Alpha

Tesla (TSLA)

Source: EV Volumes / Renault Group

Tesla (-11.2% YTD) will report its quarterly earnings on Wednesday, following the recent "We, Robot" event that left analysts begging for data. Global deliveries improved sequentially for the first time this year — boosting profits, along with a possible uptick in automotive gross margins.

However, investor concerns linger after the robotaxi unveiling largely fell short of expectations. The new Cybercab, designed to be fully autonomous without a steering wheel or pedals, is slated for production by 2027 and will likely be a major talking point during the earnings call. Other focuses are expected to be updates on Tesla’s energy storage business and Full Self-Driving (FSD) developments.

One last thing that could be mentioned is that this will be the last Tesla earnings call before the U.S. Presidential Election. Elon Musk would likely have a role related to government efficiency improvements if Trump wins — and analysts are starting to wonder if that would take away any focus from Tesla and Musk’s other companies.

Tesla needs a squeaky-clean report if they want to catch-up with the rest of Big Tech.

Tesla, Inc. (TSLA) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs

Crypto looks ready to pop and Qualcomm (QCOM) host the biggest non-earnings event of the week.

Bitcoin (BTC) near $70,000 After $2.4 Billion ETF Inflow

Bitcoin approached $70,000 last week — boosted by a $2.4 billion inflow into U.S. spot-Bitcoin ETFs over six days — amid growing optimism about U.S. regulatory changes. The cryptocurrency briefly rose +1% before settling at $68,720. Reputable “alt coins” like Ethereum (ETH), Chainlink (LINK), and Solana (SOL) all are trading as if Bitcoin is ready to break toward all-time highs.

Expectations of more favorable crypto regulations after the November 5th Presidential Election, with pro-crypto candidate Donald Trump seemingly leading in the race, have driven inflows. Bitcoin’s recent +10% weekly gain marks its strongest performance in over a month.

“ETFs have been a decentralizing force in TradFi markets that have brought a lot more access and transparency, and importantly, really accelerated in growth during the post crisis 2008, 2009 period…

I find it incredibly meaningful to look at the fact that the bitcoin whitepaper was published on October 31, 2008, and then you have the G20 leaders from around the world meeting to discuss the aftermath of the financial crisis and how do you create more transparency through public reporting…

Then at the same time, DeFi is becoming a reality over the intervening 15 years… Was this a win for Bitcoin? Was this a win for ETPs? To me, the answer is: It’s a win for investors, to the extent we can effectively marry these ecosystems which are solving for the same goals.”

Qualcomm (QCOM) Snapdragon Summit

Qualcomm (QCOM) will host its Snapdragon Summit in Hawaii from Monday through Wednesday, where it is expected to showcase its latest Snapdragon processors. This event will highlight Qualcomm's advancements in mobile and computing technologies.

Qualcomm, Inc. (QCOM) Stock Performance, 5-Year Chart, Seeking Alpha

“We're pleased with the growth and trajectory of AI use cases on smartphones. This continued expansion of AI features is a precursor to next-generation smartphones which we believe will become AI-centric with pervasive on-device AI working across applications in the cloud.

Qualcomm is very well-positioned to help drive this transformation across the industry in the coming years. At our upcoming Snapdragon Summit in October, we will reveal details of our next-generation Snapdragon 8 flagship mobile platform, the first to be powered by our custom Oryon CPU.

This platform, combined with new and unparalleled NPU AI capabilities is already exceeding both our and our customers' performance expectations.”

Major Economic Events:

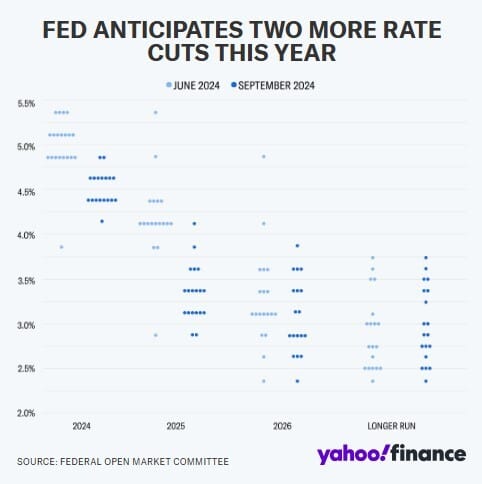

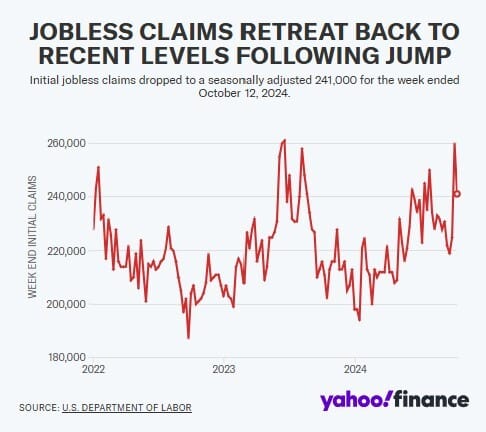

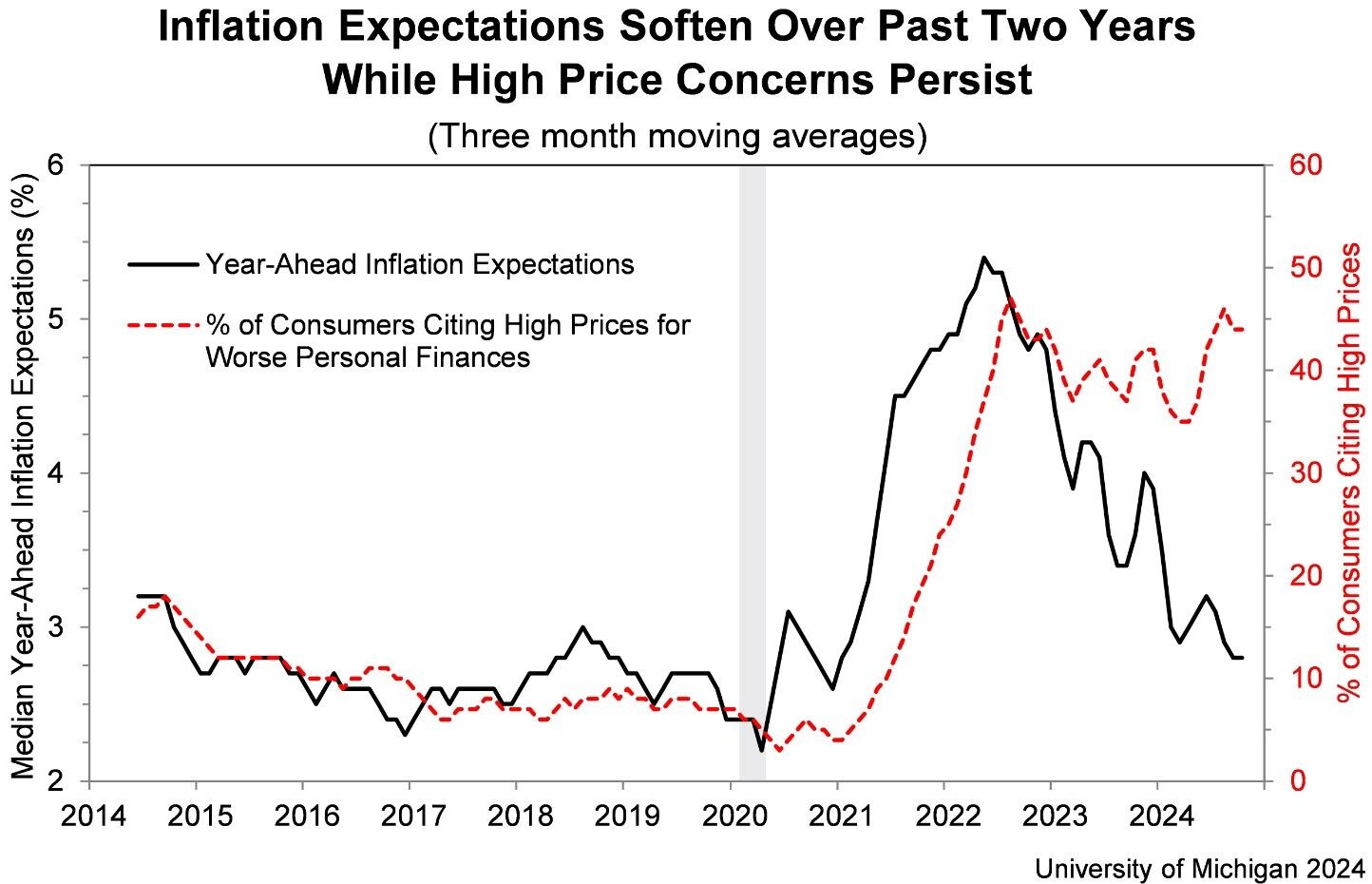

Initial Jobless Claims & Michigan’s Consumer Sentiment Survey highlight this week's economic events.

Monday (10/21): Dallas Fed President Logan Speaks, Kansas City Fed President Schmid Speaks, U.S. Leading Economic Indicators, San Fran Fed President Daly Speaks

Tuesday (10/22): Philly Fed President Harker Speaks

Wednesday (10/23): Existing Home Sales, Fed Beige Book, Fed Governor Bowman Speaks

Thursday (10/24): Cleveland Fed President Hammack Opening Remarks, Initial Jobless Claims, New Home Sales, S&P Flash U.S. Services PMI, S&P Flash U.S. Manufacturing PMI

Friday (10/25): Consumer Sentiment, Durable-Goods Orders, Durable-Goods MinusTransportation

What We’re Watching:

Initial Jobless Claims

U.S. unemployment claims fell by 19,000 to 241,000 in the week ending October 12, the largest drop in three months, after reaching a 14-month high the previous week.

This figure came in below market expectations of 260,000, following a spike caused by disruptions from Hurricanes Helene and Milton, and the labor strike at Boeing.

Median forecasts for this week are 250,000 initial jobless claims (+9,000 week-over-week). It’s important to recognize that jobless claims are becoming a much more important statistic to the broader market as the Fed rate-cutting cycle carries on.

October Consumer Sentiment

The University of Michigan's consumer sentiment for the U.S. dropped to 68.9 in October 2024, down from a five-month high of 70.1 in September and below forecasts of 70.8.

Both current conditions (62.7 vs. 63.3) and expectations (72.9 vs. 74.4) weakened. Inflation expectations for the year ahead rose slightly to 2.9% from 2.7%. View more here.

"Consumers continue to express frustration over high prices. Still, long run business conditions lifted to its highest reading in six months, while current and expected personal finances both softened slightly.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Cover Image Credit: Boeing

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]

Reply