- GRIT

- Posts

- 👉 Can Nike Just Do It?

👉 Can Nike Just Do It?

FedEx, Micron, Nio

Together with FIRE ETFs

Welcome to your new week, and Happy St. Patrick’s Day.

Between the next Fed meeting, a potential Russia / Ukraine ceasefire, Nvidia’s GTC Event, and some major earnings reports — we’ve got a lot to break down.

Two quick callouts first:

Check out my recent interview about the FIRE movement.

You should SIGN UP for the free FIRE webinar this Thursday at 4pm ET!

Let’s dive in.

Key Earnings Announcements:

There are still some big names left to report this earnings season — including FedEx, Nike, Micron, Pinduoduo and Nio.

Monday (3/17): SAIC

Tuesday (3/18): Xpeng

Wednesday (3/19): Five Below, General Mills, Signet Jewelers, Williams-Sonoma

Thursday (3/20): Academy Sports & Outdoors, Accenture, Darden Restaurants, FedEx, Jabil, Lands End, Lennar, Nike, Pinduoduo

Friday (3/21): Carnival Corp, Nio

What We’re Watching:

FedEx (FDX)

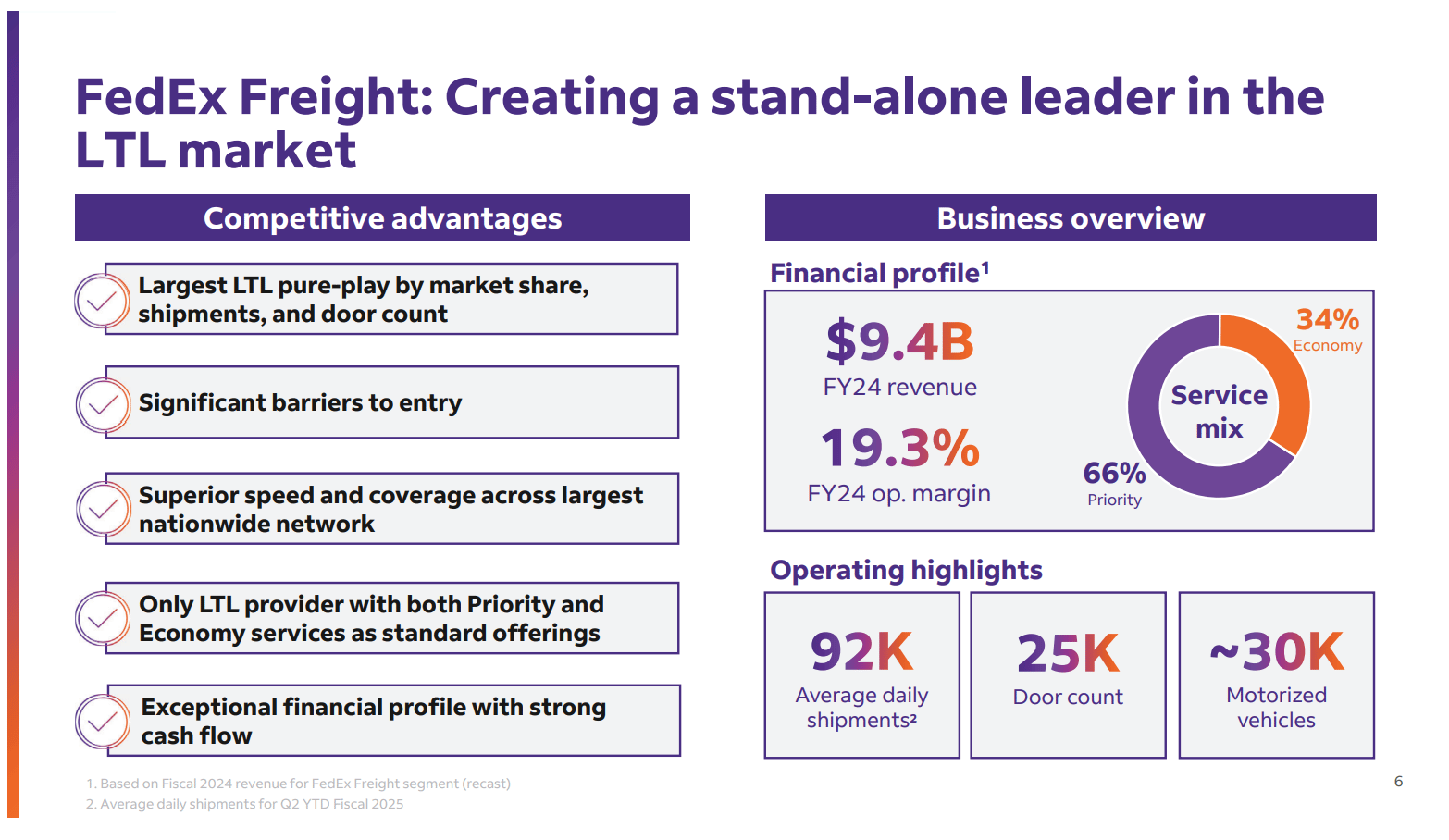

Source: FedEx Q2FY25 Earnings Deck

FedEx (FDX) reports Q3 fiscal 2025 earnings Thursday, with analysts expecting GAAP EPS of $4.44, up +15% YoY, on revenue of $21.91B — flat versus last year’s $22B. Truist Securities kicked off coverage, saying integrating Ground and Express ops will “drive better efficiency and higher margins in FY26 and beyond.” Shares sit at $278, down -5% YTD.

Truist’s Buy rating and $305 target highlight FedEx’s edge as aircraft fleet renewal wraps, slashing future CapEx needs. After Q2’s $4.05 adjusted EPS beat, focus is on DRIVE savings ($2.2B targeted for FY25) and Freight spin-off buzz. Other analysts see risks in soft B2B demand and potential margin compression.

FedEx Corp. (FDX) Stock Performance, 5-Year Chart, Seeking Alpha

Nike (NKE)

Nike (NKE) reports Q3 fiscal 2025 earnings Thursday, with Wall Street expecting GAAP EPS of $0.29, down -62% YoY, on revenue of $11.01B — an -11% drop from last year’s $12.4B. Jefferies has noted that new CEO Elliott Hill’s is tackling issues “head-on, positioning the brand to outgrow the market and take back market share.” As a result, Jefferies recently lifted its price target to $115 from $75. Shares linger at $89, down -20% YTD.

Nike is fighting to reverse a sales slide (Q2’s revenue of $12.4B was -8% YoY) and reclaim turf from Hoka and On Holdings. After Nike beat Q2 estimates with $0.78 EPS, analysts’ focus shifted to wholesale recovery and fresh product drops. Inventory overhang and China softness could be problematic, but a guidance lift might spark a rebound. A lot of eyes are on the Nike “swoosh” this week.

Nike, Inc. (NKE) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

Nvidia GTC Event, a potential peace deal in Ukraine, and Baidu’s DeepSeek-like release.

Nvidia GTC Event

Nvidia (NVDA) will host GTC 2025 from March 17-21 at the San Jose Convention Center and online, with CEO Jensen Huang’s keynote streaming March 18 at 1pm ET.

Down -9.4% YTD, questions surrounding Nvidia’s AI dominance and longevity continue to circulate. The lineup for the event features updates on Blackwell Ultra and Rubin, 3,000+ sessions across 20 industries, and a debut Quantum Day on March 20 with quantum pioneers like D-Wave, IonQ, and Rigetti. Nvidia’s CUDA-Q could pair AI with quantum for breakthroughs like faster drug design.

Morgan Stanley’s Joseph Moore says Blackwell delays are easing and shipments could double Q2’s pace — believing that upcoming guidance for NVDA will be solid. China’s a wild card: Citi pegs $9B-$11B in sales at risk from trade rules — but U.S. demand could potentially bridge that gap either way. After a $5B profit haul last quarter (with ~75% margins) — the market is eager to see if Nvidia will reveal a major catalysts during this year’s GTC Event.

NVIDIA Corp. (NVDA) Stock Performance, 5-Year Chart, Seeking Alpha

Here’s a link to the event’s preview video and here’s the star-studded speaker list.

Potential Peace Deal Between Russia and Ukraine

Source: Getty Images / BBC

President Trump stated that the United States and Russia are discussing the division of assets between Ukraine and Russia to end the three-year war. He plans to speak with Russian President Vladimir Putin on Tuesday about the matter, including land and power plants. Trump will also seek Putin’s support for a 30-day ceasefire, which Ukraine has already accepted, though Russia has made additional demands. Russian officials insist on keeping occupied territories and preventing Ukraine from joining NATO, while also rejecting any NATO troops in Ukraine after a ceasefire.

Meanwhile, Russia continues military offensives, with new support from North Korea . Ukrainian President Zelenskyy has accused Putin of prolonging the war and ignoring diplomatic efforts, as heavy fighting persists in key regions. At the same time, American politicians argue that President Zelenskyy is just as (if not more) guilty of intentionally prolonging the war.

A major announcement could help partially ease the stock market’s intense negative sentiment.

“We will see if we have something to announce maybe by Tuesday. I will be speaking to President Putin on Tuesday… A lot of work’s been done over the weekend. We want to see if we can bring that war to an end.”

Baidu to Launch DeepSeek-Like Model — at Half the Price

Source: United Top Tech via YouTube

Baidu has launched Ernie X1, a reasoning AI model designed to compete with DeepSeek’s R1 model at half the cost. The company also introduced Ernie 4.5, claiming it outperforms OpenAI’s GPT-4.5 while being significantly cheaper. Baidu made its Ernie AI chatbot available for free ahead of schedule and plans to integrate both new models into its consumer products like Baidu Search.

The launch comes amid growing competition in China’s AI sector, particularly from DeepSeek, which disrupted the market with its cost-effective AI model. Analysts believe Baidu’s cloud infrastructure and AI platform will help it stay competitive despite increasing rivalry.

We’re eager to see what new AI developments come this year — especially out of China. It’s a full-blown arms race at the moment — and price points / CapEx are constantly being questioned.

Baidu Inc. (BIDU) Stock Performance, 5-Year Chart, Seeking Alpha

“Citi Research analysts described DeepSeek-R1 as a “disruptive debut” to the industry, and noted that companies have been announcing new releases or upgraded versions of various AI models, which may “have pushed Baidu to accelerate its release schedule. Using its cloud infrastructure and AI cloud’s Qianfan foundation model platform, “Baidu likely will retain its competitiveness despite intensified competition among models amid lowering entry barriers,” they said in a note.”

Major Economic Events:

All eyes are on a retail sales rebound and Powell’s rate cut outlook.

Source: The Street

Monday (3/17): Business Inventories, Empire State Manufacturing Survey, Home Builder Confidence Index, U.S. Retail Sales

Tuesday (3/18): Building Permits, Capacity Utilization, Housing Starts, Import Price Index, Industrial Production

Wednesday (3/19): Fed Chair J. Powell Press Conference, FOMC Interest Rate Decision

Thursday (3/20): Existing Home Sales, Initial Jobless Claims, Philly Fed Manufacturing Survey, U.S. Leading Economic Indicators

Friday (3/21): N/A

What We’re Watching:

FOMC Interest Rate Decision

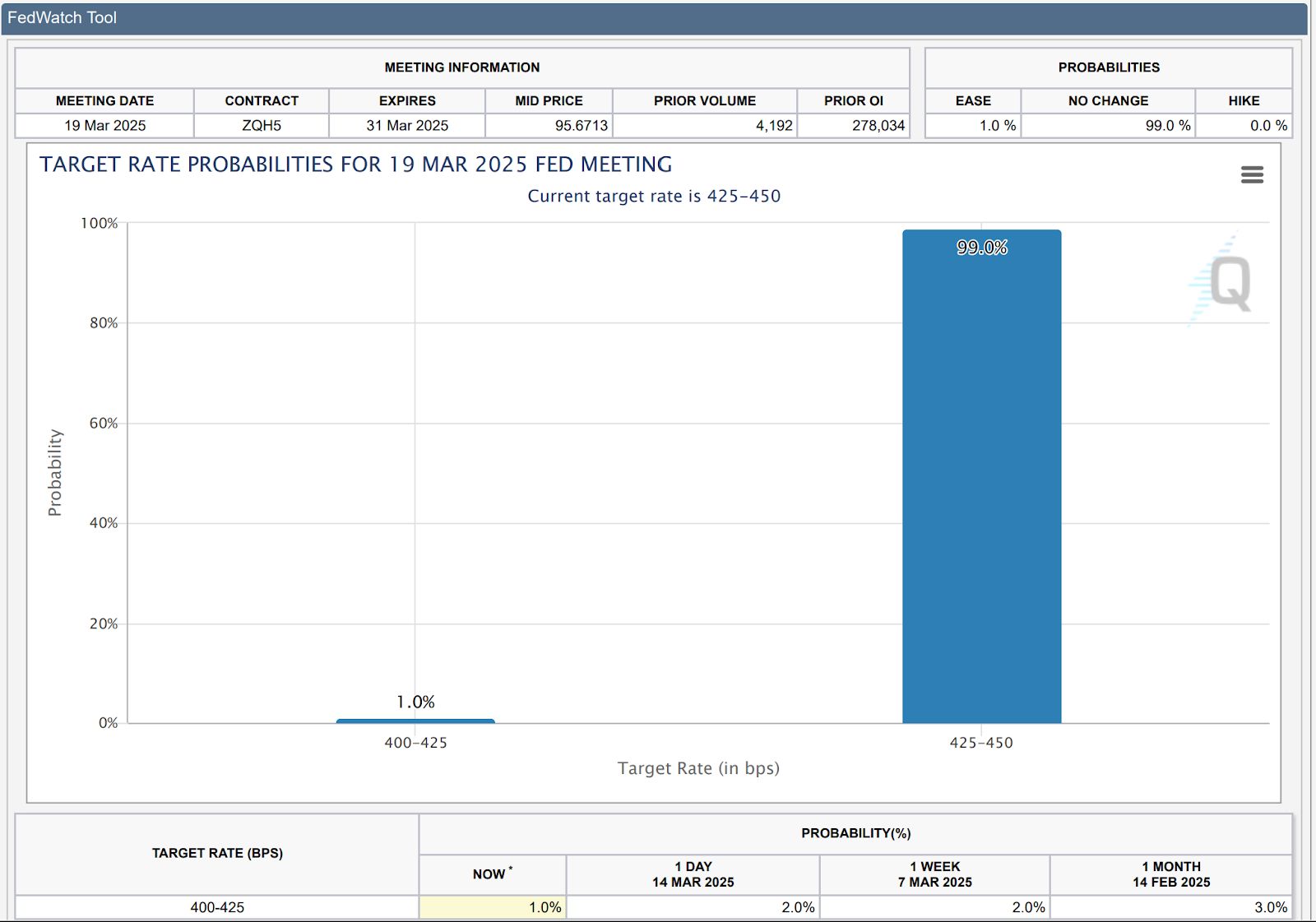

Source: CME FedWatch

The Fed is widely expected to hold rates steady on Wednesday, keeping the fed funds rate at 4.25%-4.5% as policymakers weigh inflation risks, trade policies, and economic uncertainty.

With inflation still above the Fed’s target level of +2%, and tariffs potentially adding more price pressures, Powell’s tone could dictate how markets react. The market is begging for more clarity about if there will be 2, 3, 4, or even 5 rate cuts this year.

“[Powell will] communicate a heavy dose of patience… Chair Powell is likely to sound cautiously optimistic on the economy, but point to a cloudy outlook since policy uncertainty is high.”

Retail Sales (Just Released)

After January’s -0.9% drop, investors were watching February’s retail sales for signs of a consumer spending rebound. Economists were expecting a +0.6% gain, easing fears of a slowdown.

As of this morning (Monday) — the retail sales data was just released with a +0.2% print. This weak result has raised concerns about slowing economic momentum — and potentially even shifting Fed rate-cut expectations.

“The belt-tightening in January followed a relatively impressive holiday season... The pullback might say more about the strong end to 2024 rather than a bend in consumer spending.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Cover image source: Getty Images / SOPA

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]

Reply