- GRIT

- Posts

- 👉 China's Stimulus Injection

👉 China's Stimulus Injection

Meta, Micron, Intel

Happy Sunday, everyone.

If you’re a real estate investor, you’ve likely been on the sidelines for the last 18-24 months as skyrocketing mortgage rates have eaten into your monthly cash flow.

This was caused in-part by the Federal Reserve hiking interest rates at the fastest pace in 40+ years. However, in anticipation of their -50 bps cut — we’ve begun to see mortgage interest rates fall from a high of 7.6% to now ~6.0%.

For the everyday investor, this might not seem important — but if you look further as to who specifically is positively impacted the most from these falling interest rates you’ll quickly find REITs (real estate investment trusts) to be the answer.

Personally, I own both Realty Income Corporation (O) and VICI Properties (VICI) in my portfolio.

If you’re someone looking for broad-based exposure to REITs in general, consider learning more about the VNQ ETF. It’s Vanguard’s Real Estate Index Fund ETF, and it’s up +23% from its April-lows. It takes the “guess work” out of REIT investing.

I’ll continue to add commercial real estate exposure to my portfolio both through publicly-traded REITs like O, and VICI, as well as those found on Fundrise.

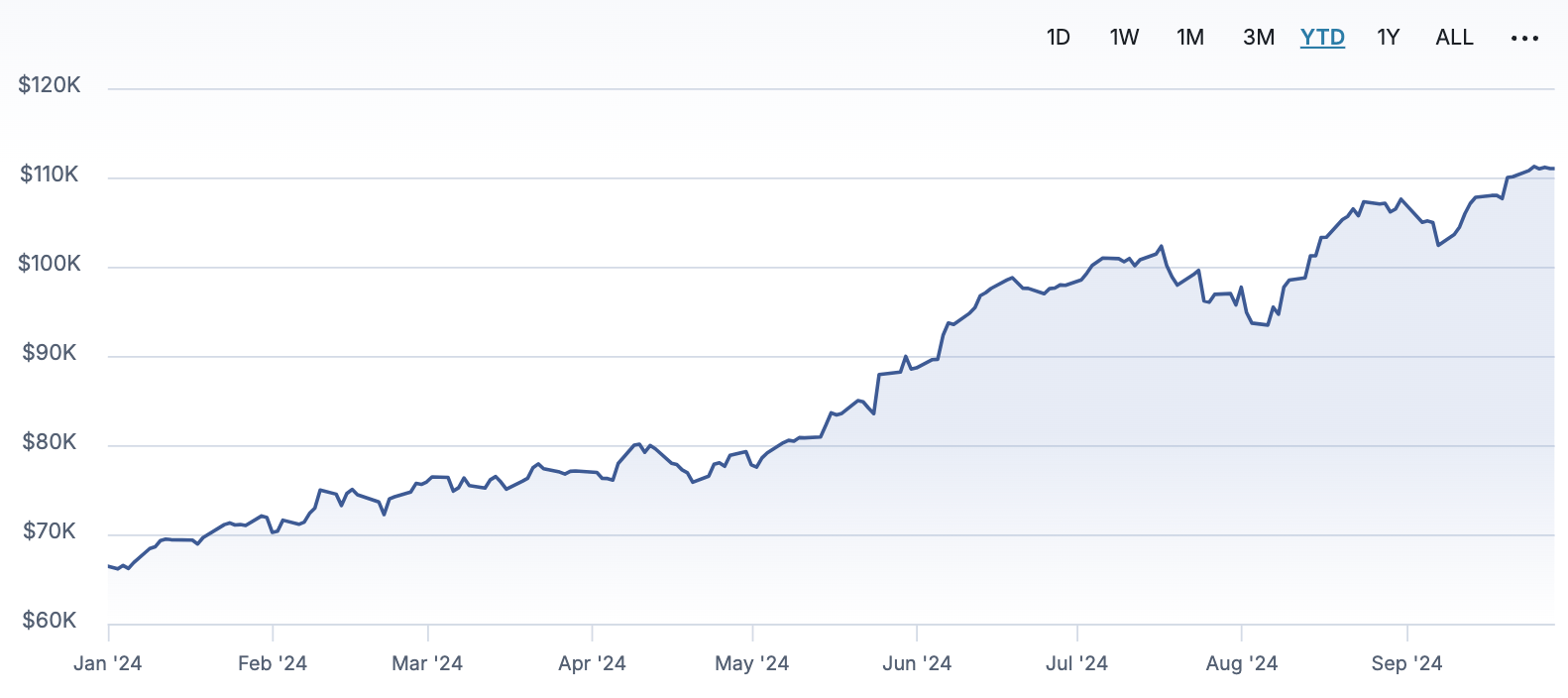

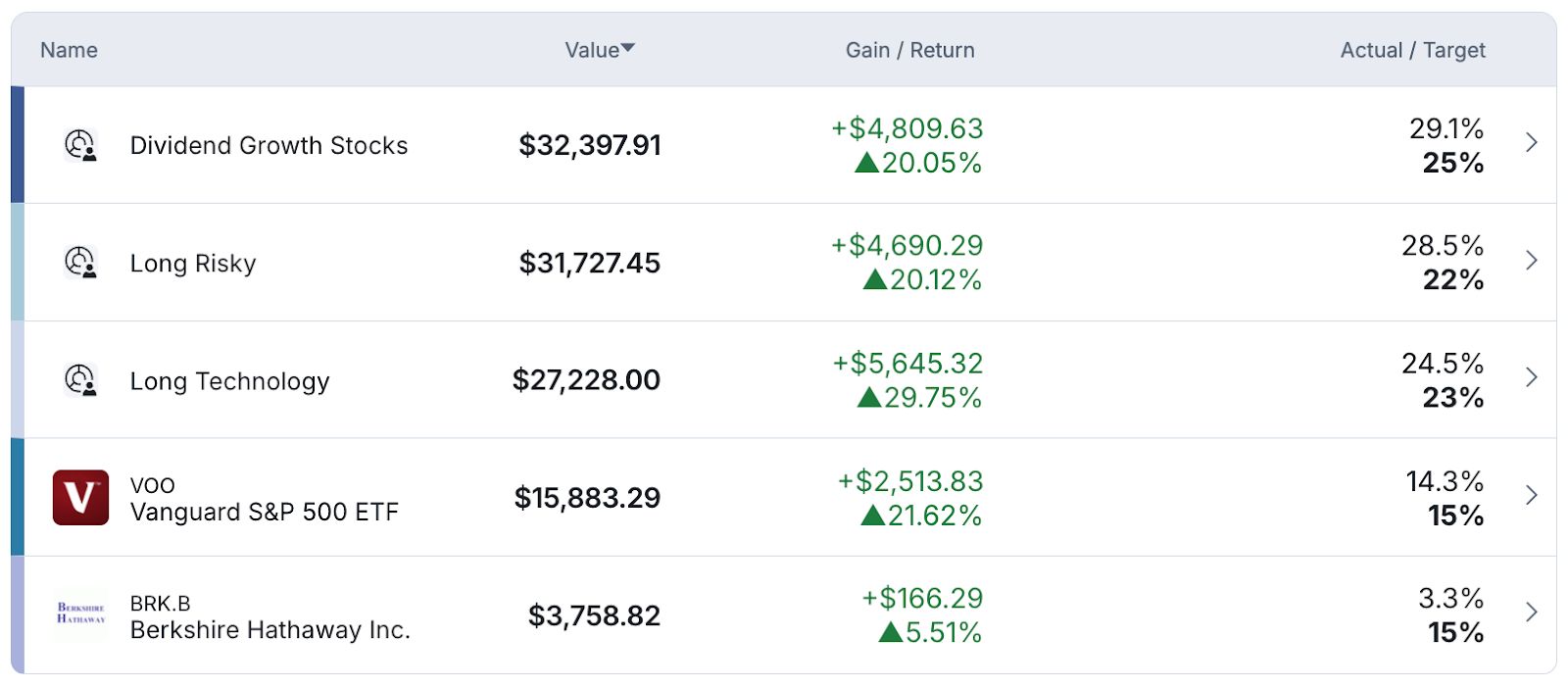

Portfolio Updates:

From a stock perspective, I don’t have many updates to share. I continue to expand upon my three most recent positions (GitLab, DraftKings, and Berkshire Hathaway).

Here’s a link to the webinar I co-hosted last week with Katie Stockton where we reviewed both the fundamental analysis and technical analysis of GitLab and DraftKings. If you’re interested in learning more about how I approach analyzing a stock at a high-level, this webinar is a great example of that.

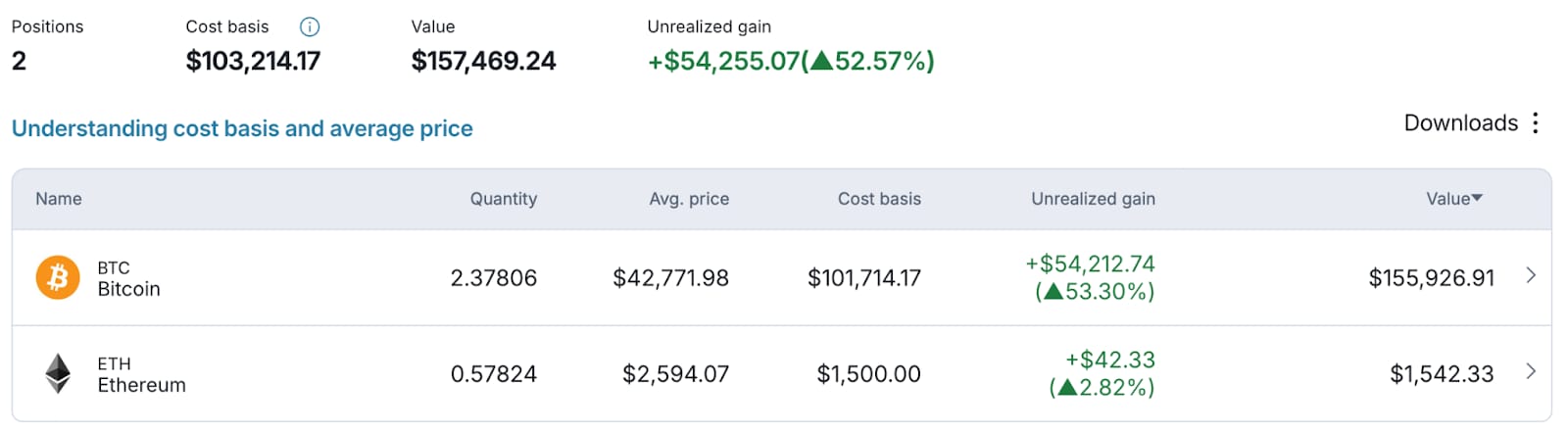

From a cryptocurrency perspective, I added more Ethereum to the mix. I plan to grow this position over the coming months to tens of thousands of dollars. If you’re someone who likes technical analysis, here’s a wonderful analysis explaining why Ethereum could begin to experience some momentum into 2025.

Throughout the month of September I’ve deployed $11,500 of capital across the portfolio, with about $5,000 of it still in cash.

Week in Review — Too Long, Didn’t Read:

Cintas delivered their 41st consecutive annual dividend increase, Micron guided to earnings expansion in Q4, Costco’s e-commerce sales increased by +20%, a stimulus injection could mark the bottom for the Chinese market, Mark Zuckerberg impressed the world at the Meta Connect event, Intel headlines continue with $8.5B in funding from the CHIPS Act, Core PCE had its smallest increase in three months, Q2 GDP came in a 3.0% in its second reading, and consumer confidence had its largest decline since August of 2021.

Key Earnings Announcements:

Cintas delivered their 41st consecutive annual dividend increase, Micron guided to earnings expansion in Q4, and Costco’s e-commerce sales increased by +20%.

Cintas Corporation (CTAS)

Key Metrics

Revenue: $2.5 billion, an increase of +7% YoY

Operating Income: $561.0 million, an increase of +12.1% YoY

Profits: $452.0 million, an increase of +17% YoY

Earnings Release Callout

“Cintas delivered revenue and earnings growth, continued margin expansion and strong cash generation, all of which enabled our balanced approach to capital allocation.

Alongside returning capital to shareholders through our 41st consecutive annual dividend increase and significant share repurchase activity in the quarter, Cintas continued to reinvest in our customers and our employee-partners to ensure we are best positioned to deliver long-term value for our shareholders.”

My Takeaway

Sometimes the most boring companies are the ones that deliver the strongest returns. When I was in college one of the finance major clubs I was in was invited to tour the Cintas HQ in Ohio — nothing out of the ordinary. And here we are 6 years later and their stock price is up +427% — that’s more than Amazon, Microsoft, and Google.

If that doesn’t open your eyes, I don’t know what will!

So what does Cintas do so well? Roll your eyes up on your screen and read that earnings callout again — 41 consecutive quarters of dividend increases and strong cash generation. This quarter was exactly that as the company beat Wall Street’s expectations across the board.

A few callouts:

1) Management shared positive commentary regarding the macro economy (given their business, this is great for everyone), 2) The company increased their forward guidance by +8%, and 3) The company’s value proposition of “better, faster, cheaper” continues to resonate with clients driving broad-based organic growth for the company.

Interestingly enough, Wall Street doesn’t expect much upside on their stock price given the fact it’s trading at the high-end of their historical multiples. However, they do believe CTAS is well-positioned to deliver on their organic growth guidance given their long runway for cross-selling opportunities across their main verticals like healthcare, hospitality, education, and state & local governments.

I largely agree with Wall Street on this one. The time to buy this stock was back in 2023 when it was still trading at a reasonable valuation.

I’ll add them to my watchlist to buy if we experience any weakness.

Micron Technologies (MU)

Key Metrics

Revenue: $7.8 billion, an increase of +93% YoY

Operating Income: $1.5 billion, compared to -$1.5 billion last year

Profits: $887.0 million, compared to -$1.4 billion last year

Earnings Release Callout

“Micron delivered 93% year-over-year revenue growth in fiscal Q4, as robust AI demand drove a strong ramp of our data center DRAM products and our industry-leading high bandwidth memory. Our NAND revenue record was led by data center SSD sales, which exceeded $1 billion in quarterly revenue for the first time.”

My Takeaway

Micron reported revenue of $7.75B, above Wall Street’s expectations of only $7.7B — and they surprisingly guided for sustained low-double digit revenue growth into next quarter.

This much-better-than-feared outlook runs contrary to Wall Street’s expectations of reduced earnings into the next quarter — which caused Micron’s stock price to pop +14% on the news.

Ultimately, strength in datacenter demand is more than offsetting near-term softness in the consumer-centric PC and phone markets. Management sees consumer inventory for PCs and phones normalizing by May 2025. In the interim, Micron anticipates that bit shipments could be seasonally weaker in February’s quarter of 2025.

Unlike two years ago when supply accelerated to meet the artificial spike in end demand, Micron noted instead how wafer capacity has meaningfully decreased in memory (about -15% in NAND). Micron sees DRAM / NAND bit shipments up mid-teens in 2025, weighted toward later in the year.

Wall Street’s $135 / share price target assumes a ~14X forward P/E ratio.

I’m not an investor in this company, as their earnings and free cash flow (shown in blue above) are wildly unpredictable.

Costco (COST)

Key Metrics

Revenue: $79.7 billion, an increase of +1% YoY

Operating Income: $3.1 billion, an increase of +9% YoY

Profits: $2.3 billion, an increase of +9% YoY

Earnings Release Callout

“E-commerce traffic, conversion rates and average order value were all up year-over-year, helping to drive another strong quarter of comparable sales growth.

While continued strength in bullion, was a meaningful tailwind to e-commerce comps, appliances, health and beauty aids, tires, toys, gift cards, hardware, housewares, home furnishings, optical and pharmacy all grew double digits year-over-year. The rollout of buy online and pickup in warehouses for TVs in the US market was also completed in Q4.”

My Takeaway

As you all know, I have several thousand dollars invested into this company — and for good reason. They’re operating a boring, yet sticky business. There were a handful of things I liked… and didn’t like… so let’s jump in.

What I liked:

1) Expanding operating margin — grew by +0.3% to 3.9% led by gross margin expansion of +0.4%.

2) Core comparable sales accelerated in all geographies — traffic was up +5.6% and 6.4% in the US and worldwide. E-commerce sales were up +19.5% led by the items shared in the quote above.

3) Steady membership renewal rates — the worldwide renewal rate remained flat at 90.5%, while US and Canadian markets experienced a +0.2% bump in renewals to 93%.

What I didn’t like:

1) Slight SG&A pressure — SG&A-related expenses increased by +0.1% year-over-year, which on the surface isn’t something to get worried about, but worth noting regardless. According to management, this was due to an increase in wages (a good thing).

All in all, I remain a very happy shareholder. Costco is a defensive name by nature due to their membership model that generates very predictable sales and profits. The company continues to open new clubs in the US and has a meaningful runway for ongoing international expansion, notably China.

I’m long Costco, and will continue to expand my position over time.

Investor Events / Global Affairs:

China’s stimulus, Zuckerberg’s potential “iPhone moment,” and Intel remains in headlines.

China’s Market Magic

Source: WSJ

China has launched an extensive stimulus plan to bolster its economy — including interest rate cuts, reduced reserve requirements for banks, and support for the real estate sector. The People's Bank of China (PBOC) lowered its seven-day reverse repurchase rate and mortgage rates, while also freeing up more capital for banks to lend. Further measures include increased lending for property acquisitions and potential relaxation of home buying restrictions in major cities.

In the stock market, the PBOC introduced a swap facility and a re-lending program to support equity purchases. Additionally, a potential capital injection for major banks and special sovereign bonds are being considered to stimulate growth and reduce local government debt. The urgency and breadth of these measures signal Beijing's commitment to achieving its +5.0% growth target.

Between government subsidies and direct payments to households — the stimulus is expected to be at least $420B.

“…the big question is whether the package unveiled Tuesday will provide much of a boost to the economy, or if easier central-bank policy is really what China’s economy needs.

Borrowing costs are already low, yet credit data suggests households and businesses aren’t that interested in borrowing. Consumer confidence is near record low levels, reflecting anxiety over jobs in a weak economy and the cost of the meltdown in property. Barclays estimates that the property crunch since 2021 has incinerated some $18 trillion in household wealth, equivalent to around $60,000 per family.”

The “iPhone Moment” of Meta Platforms (META)?

Source: David Paul Morris / Bloomberg / Contributor / Getty Images

At Meta Connect 2024, Mark Zuckerberg introduced several new products and features, including Meta's prototype augmented-reality glasses, Orion — which is intended to be the company's first "true AR" glasses. Though not available for purchase yet, the sleek design and holographic capabilities garnered praise from early testers, including Nvidia CEO Jensen Huang. Zuckerberg also showcased limited-edition Ray-Ban smart glasses, equipped with real-time translation and new AI-powered features. They also flexed the inclusion of celebrity voices like John Cena and Awkwafina for chatbots.

Additionally, Meta launched the entry-level Quest 3S mixed-reality headset at an affordable price of $299 — offering enhanced pass-through abilities and competition to Apple's Vision Pro. Meta's AI platform continues to expand, with updates across Instagram, Messenger, and WhatsApp.

Meta Platforms (META) Stock Performance, 5-Year Chart, Seeking Alpha

“In every generation of technology, there is a competition of ideas for what the future should look like… And at Meta we are trying to build a future that is more open, more accessible, more natural, and more about human connection. This is the continuation of the values and ideas that we have brought to the apps and technology that we have built over Meta's first 20 years."

Intel (INTC) Remains in the Headlines

Source: AP Photo / Paul Vernon

Intel and the US government are working to finalize $8.5 billion in funding through the Chips and Science Act by the end of the year, despite Intel's ongoing financial challenges. These talks coincide with Intel’s cost-cutting measures and speculation about potential takeover bids, including interest from Qualcomm (QCOM).

This subsidy package would be the largest under the act, which aims to bolster domestic chip production and reduce reliance on Asian supply chains. The deal is crucial for both Intel and the Biden administration, particularly ahead of the 2024 election. However, any potential takeover could complicate the negotiations, and antitrust concerns may arise if Qualcomm moves forward.

Intel Corp (INTC) Stock Performance, 5-Year Chart, Seeking Alpha

“Intel, once the world’s largest chipmaker, has become the target of takeover speculation since a rapid deterioration of its business this year. The company delivered a disastrous earnings report last month — sending its shares on their worst rout in decades — and is slashing 15,000 jobs to save money. It’s also scaling back factory expansion plans and halting its long-cherished dividend.”

Major Economic Events:

Core PCE, GDP, and consumer confidence.

Core PCE

In August 2024, the core personal consumption expenditures (PCE) price index — the Fed’s preferred inflation gauge — rose by +0.1%. This marked its smallest increase in three months. On an annualized basis, core PCE inflation rose +2.1% — aligning with the Fed’s 2% target.

Consumer spending, adjusted for inflation, also grew modestly by +0.1% — while personal income increased by +0.2%.

The savings rate eased to 4.8%, indicating restrained income growth. Treasury yields and the dollar fell as these figures supported expectations of continued Fed rate cuts, with debate on whether the next cut will be a half or quarter percentage point.

Meanwhile, the goods trade deficit narrowed to $94.3 billion, the lowest since March — signaling a gradual economic slowdown.

“The downside surprise in August’s personal income, spending and inflation data validate the Fed’s decision earlier this month to cut policy rates by 50 basis points. Income growth is cooling, helping to make consumers more discerning in their spending habits. As underlying inflation pressures wane, we think the Fed increasingly will emphasize the full-employment side of its dual mandate.”

Q2 GDP (2nd Reading)

The U.S. economy grew at an annualized rate of +3.0% in the second quarter of 2024, meeting Wall Street’s expectations. This growth is a significant increase from the +1.4% seen in the first quarter, according to the Bureau of Economic Analysis.

Weekly unemployment claims also dropped to 218,000 for the week ending Sept. 21, the lowest since May and below expectations of 223,000.

The Federal Reserve recently cut interest rates by half a percentage point to support the economy, which Fed Chair Jerome Powell described as "in good shape." Looking ahead, the Atlanta Fed's GDPNow tracker projects +2.9% growth for the third quarter, while Goldman Sachs forecasts a +3.0% growth rate.

“…ultimately, we believe, with an appropriate recalibration of our policy, that we can continue to see the economy growing, and that will support the labor market. In the meantime, if you look at the growth in economic activity data — retail sales data that we just got, second-quarter GDP — all of this indicates an economy that is still growing at a solid pace. So that should also support the labor market over time.”

Consumer Confidence

Consumer confidence sank in September as Americans have grown increasingly worried about a cooling labor market. The latest index reading from the Conference Board was 98.7 — below the 105.6 seen in August and lower than what the 104 economists surveyed by Bloomberg expected.

The decrease in consumer confidence from August to September was the largest decline since August 2021.

"Consumers' assessments of current business conditions turned negative while views of the current labor market situation softened further… Consumers were also more pessimistic about future labor market conditions and less positive about future business conditions and future income."

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Cover Image Source: Business Insider / Johannes Eisle / Getty Images / AFP

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at info@gritcap,io

Reply