- GRIT

- Posts

- 👉 Coinbase Joins the S&P 500

👉 Coinbase Joins the S&P 500

Home Depot, Snowflake, Target

Welcome to your new week.

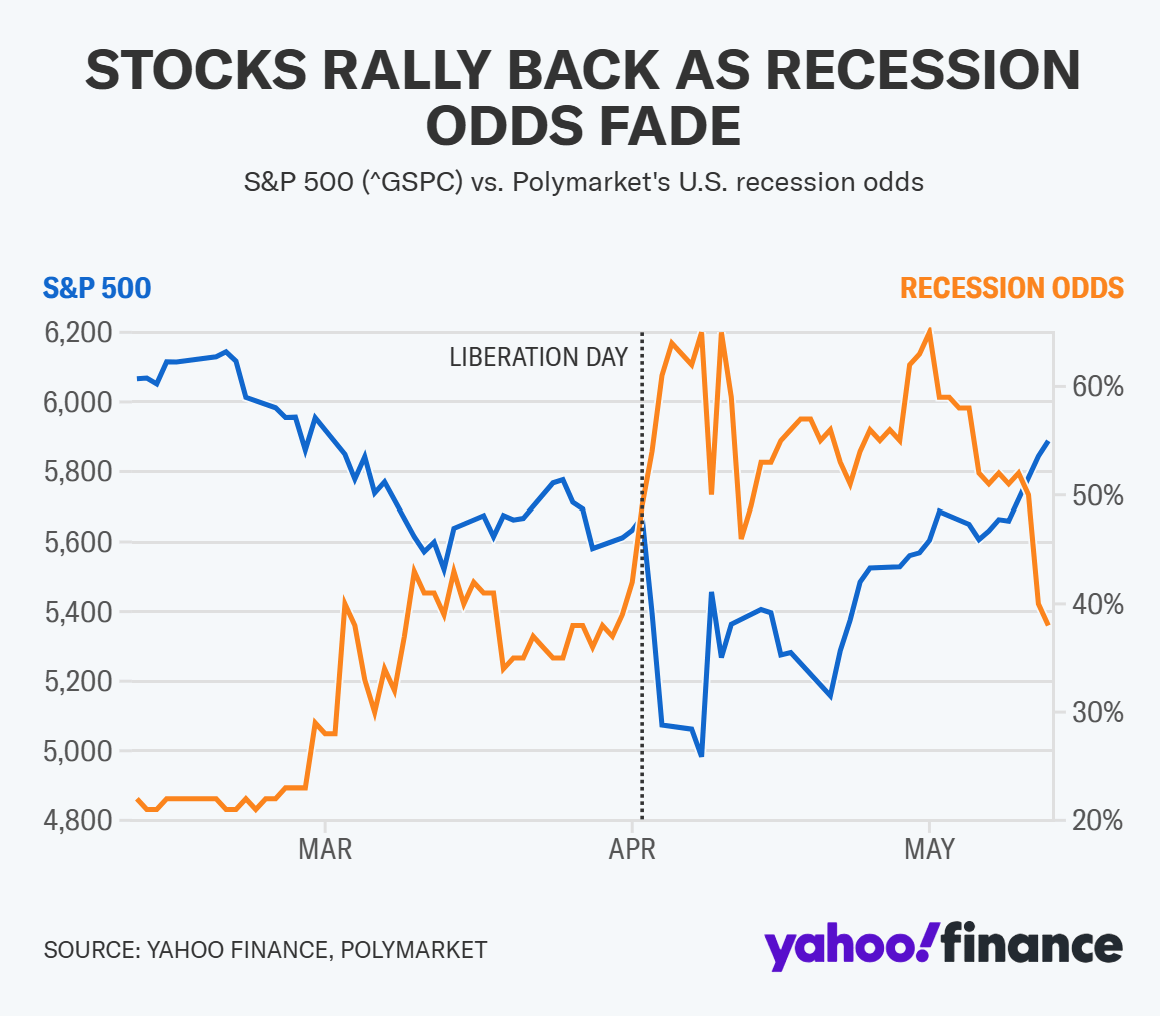

Are you having fun yet in 2025? This has been an absolute roller coaster, and congrats to those that have kept their strong conviction on stocks like AMZN, GRND, HIMS, NVDA, OSCR, and many more.

Also — welcome to the hundreds of new subscribers over the last week!

I encourage you to upgrade your subscription using this link to access my full portfolio, famous investor portfolios, monthly livestreams, and a variety of other resources.

Check out the callout below from a unique news site and then let’s dive into the Investing Week Ahead.

The news site that doesn’t cater to your beliefs. Or try to sell you theirs.

Instead, Ground News shows you how left, center, and right-leaning outlets are covering the same story—so you can easily compare reporting and get a well-rounded perspective on the issues that matter to you.

Join 1M+ readers from all political persuasions who use Ground News to see the news, the world, and themselves a little clearer.

Key Earnings Announcements:

Snowflake and Target highlight another busy week of earnings.

Monday (5/19): Trip.com, ZIM Integrated Shipping

Tuesday (5/20): Bilibili, Home Depot, Palo Alto Networks, Toll Brothers

Wednesday (5/21): Baidu, Canada Goose, Medtronic, Snowflake, Target, TJX, V.F. Corporation, Wix, Zoom

Thursday (5/22): Advance Auto Parts, Analog Devices, Autodesk, BBVA, Deckers, Intuit, Ralph Lauren, Ross Stores, TD Bank, Workday

Friday (5/23): Booz Allen Hamilton, Miniso

What We’re Watching:

Snowflake (SNOW)

Source: Snowflake Earnings Deck

Snowflake reports earnings Wednesday after the bell. Shares are up +18.5% YTD but have cooled in recent weeks as investors grow cautious on cloud spending trends and AI monetization. Last quarter, product revenue grew +32% YoY, but RPO (remaining performance obligations) and new customer growth slowed — key metrics that will be closely watched again this week.

EPS estimates have seen modest upward revisions, but the spotlight remains on Snowflake’s ability to drive operating leverage while investing heavily in AI infrastructure. Management has pitched its Snowpark and Cortex platforms as future growth drivers, but execution will need to follow. I’ll be watching for updates on enterprise adoption, AI workloads, and whether margin expansion remains intact amid rising CapEx.

"We're focused on becoming the data cloud platform of choice for enterprises building the next generation of AI applications."

Snowflake Inc. (SNOW) Stock Performance, All-Time Chart, Seeking Alpha

Target (TGT)

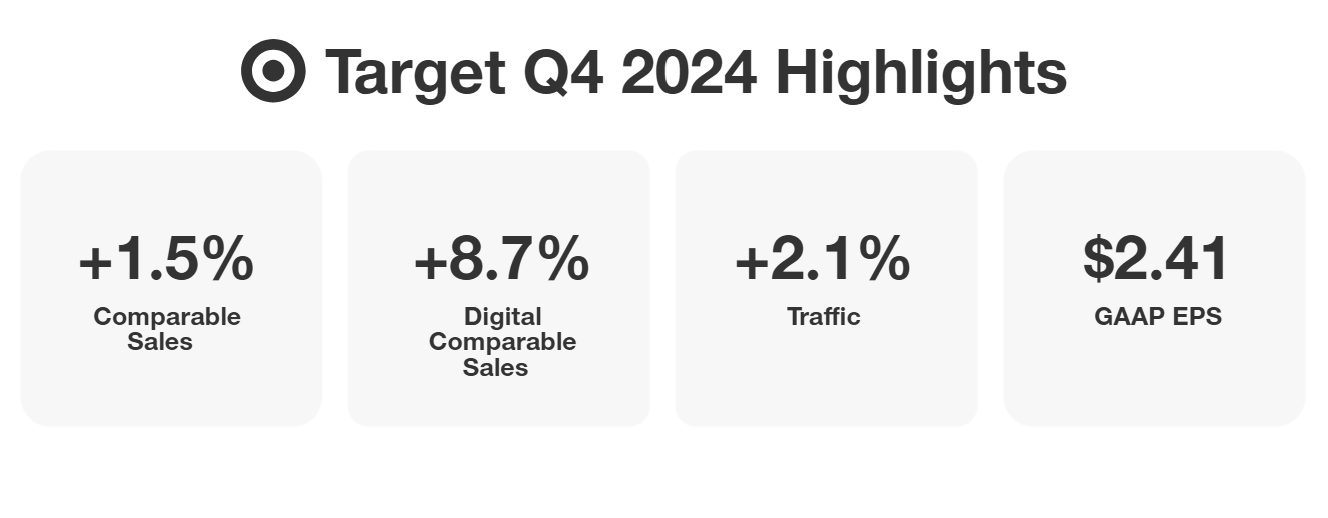

Souce: Target Earnings Infographic

Target reports earnings Wednesday before the bell. Shares have been under pressure in 2025, down -27% YTD, as the retailer faces headwinds from weakening discretionary demand and tariff-related cost pressures. Same-store sales are projected to fall -1.7%, reflecting softer consumer spending and increased competition from Walmart and Amazon.

Despite near-term challenges, Target is investing $4-$5B this year in store remodels, supply chain upgrades, and technology to drive long-term growth. The upcoming earnings call will be critical for assessing the company's turnaround efforts and outlook amid a challenging retail environment.

“Shoppers continue to seek differentiated options and distinctive shopping experiences without sacrificing value, and Target has the scale, strategy, and capabilities to support all the ways consumers shop and engage with brands.”

Target Corp. (TGT) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

Trump and Putin have a big call this morning about a cease-fire, Coinbase has been added to S&P 500, and Computex 2025 will host the largest names in tech.

Cease-Fire Hopes Rise Ahead of Trump-Putin Call

Source: Brendan Smialowski / Getty Images

President Trump is set to speak with Vladimir Putin on Monday in what could be a pivotal moment for cease-fire talks in Ukraine. Despite Moscow launching one of the largest drone barrages of the war over the weekend, Trump struck an optimistic tone, calling for “a productive day” and promising follow-up talks with Zelensky and NATO leaders. With both sides engaging — albeit cautiously — the week ahead may offer early signs of whether a serious diplomatic breakthrough is possible or whether Putin continues to stall while pushing economic overtures behind the scenes.

It’s pretty much impossible to get a firm answer on the number of casualties that have come from this war, but a lot of data points to nearly 1M of collective casualties. It’d be wonderful to see this come to an end soon.

“I will be speaking, by telephone, to President Vladimir Putin of Russia on Monday at 10:00 a.m. The subjects of the call will be stopping the “bloodbath” that is killing, on average, more than 5,000 Russian and Ukrainian soldiers a week, and trade. I will then be speaking to President Zelenskyy of Ukraine and then, with President Zelenskyy, various members of NATO. Hopefully it will be a productive day, a ceasefire will take place, and this very violent war — a war that should have never happened — will end. God bless us all!”

Coinbase (COIN) Added to S&P 500

Coinbase Global is set to join the S&P 500 Index on today (5/19), marking a significant milestone for the cryptocurrency industry.

As mentioned in the most recent Week in Review post — the company recently disclosed a cyberattack that compromised personal data of a subset of its users, including names, addresses, and government IDs. The breach could cost Coinbase up to $400 million in remediation and customer reimbursements. Despite this setback, Coinbase's inclusion in the S&P 500 is viewed as a validation of the crypto sector's maturation and its increasing integration into mainstream financial markets.

I remain bullish on crypto as we head into the summer.

Coinbase Global (COIN) Stock Performance, All-Time Chart, Seeking Alpha

“The timing couldn’t be worse for Coinbase, which is debuting on the S&P 500 index on May 19, 2025, a key milestone that sent its stock soaring 24%—its biggest gain since the post-election rally after Donald Trump’s victory. The S&P 500 inclusion, which requires consistent profitability, is a boon for Coinbase, with index-tracking funds driving demand for its shares… As Coinbase aims to strengthen its security with a new U.S.-based support hub, the crypto giant must address these legal battles to maintain investor confidence in an increasingly volatile market.”

Computex 2025

Source: Joan Cros/NurPhoto via Getty Images

This week’s Computex 2025 conference kicks off in Taipei under the theme “AI Next,” drawing major attention across the tech sector. Keynotes from NVIDIA’s Jensen Huang and Qualcomm’s Cristiano Amon headline the four-day event, with presentations from leaders at Arm, Intel, Adobe, Cadence, Infineon, Seagate, Compal, and NXP. With AI investment ramping globally, Computex 2025 will offer key signals on where the industry’s biggest players see opportunity — and risk — going forward.

You can learn more about “The World’s Largest AI Exhibition” using this link.

““My first night in Taipei is always dinner with C.C.,” Jensen Huang said on Friday, emerging from a restaurant alongside TSMC CEO and Chairman C.C. Wei. The Nvidia boss remains a larger-than-life personality in Taiwan, with crowds following his every move. Investors will be keen to hear more about the chip designer’s strategy to expand its reach.”

Major Economic Events:

Existing Home Sales have been shaky and we should be hearing a lot from the Fed this week.

Monday (5/19): Fed Vice Chair Philip Jefferson Speech, New York Fed President John Williams Speech, U.S. Leading Economic Indicators

Tuesday (5/20): Boston Fed President Susan Collins Participates in Fed Listens event, Federal Reserve Governor Adriana Kugler Speech, Richmond Fed President Tom Barkin Speech, St. Louis Fed President Alberto Musalem Speech

Wednesday (5/21): Richmond Fed President Tom Barkin and Fed Governor Michelle Bowman Participate in Fed Listens Event

Thursday (5/22): Existing Home Sales, Initial Jobless Claims, New York Fed President John Williams Speech, S&P Flash U.S. Manufacturing PMI, S&P Flash U.S. Services PMI

Friday (5/23): Federal Reserve Governor Lisa Cook Speech, Kansas City Fed President Jeff Schmid Speech, New Home Sales

What We’re Watching:

Existing Home Sales

March existing home sales posted their sharpest drop in over two years, falling -5.6% to an annual pace of 4.02 million — well below forecasts. Even with a modest pullback in rates, buyers stayed on the sidelines, signaling that affordability remains a major hurdle. All eyes are on this week’s April report to see if lower borrowing costs have finally started to thaw demand.

Economists expect the annual pace to rise up to 4.12 million in this week’s data release. It’s hard to imagine a “big beat” on any of these releases until we see interest rates begin to come down.

"Home buying and selling remained sluggish in March due to the affordability challenges associated with high mortgage rates. Residential housing mobility, currently at historic lows, signals the troublesome possibility of less economic mobility for society."

Speeches From “Fed Listens” Event

Following last week's remarks from Chair Powell on rising real rates and the risks of more volatile inflation, the Fed continues its policy review with a Fed Listens session this Wednesday. The event, hosted by the Richmond Fed, will gather community insights on how rate policy impacts small towns and rural economies. With Powell reaffirming the importance of anchored inflation expectations and a 2% target, this week’s discussion offers a deeper look into how the Fed adapts its framework amid structural shifts in the economy.

Over the last few months, more and more people are joining President Trump’s “side” — believing that we’ve seen enough evidence for interest rates to come down. We expect to learn more this week about what justifies keeping them elevated in the eyes of the Fed.

“Keeping longer-run inflation expectations anchored was a driving force behind establishing the 2 percent target in the 2012 framework. Maintaining that anchor was a major consideration behind the changes in 2020. Anchored expectations are critical to everything we do, and we remain fully committed to the 2 percent target today… We may be entering a period of more frequent, and potentially more persistent, supply shocks — a difficult challenge for the economy and for central banks.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Cover image source: Anthony Harvey / Stringer / Getty Images / CCN

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]