- GRIT

- Posts

- 👉 Consider Adding BTC + ETH To Your Portfolio in September

👉 Consider Adding BTC + ETH To Your Portfolio in September

Salesforce, Broadcom, Lululemon

Together with XFunds

👉 Week in Review — Too Long; Didn’t Read:

Key Earnings Announcements:

Salesforce’s revenue backlog climbs to $29.4 billion

Broadcom’s AI-specific revenue skyrocketed +63%

Lululemon experiences sluggish sales in the US

Additional Analysis:

Seasonality suggests August and September are wonderful months to accumulate cryptocurrency before an explosive move higher.

Happy Sunday.

Before we get started, we wanted to offer a warm welcome to the +612 new subscribers who joined us this week, and the 3,904 of you who joined us during the month of August!

In case you’re new around here, I’m Austin Hankwitz — I’ve been publishing earnings analysis on publicly-traded companies for over half a decade. My podcast, Rich Habits, has hit #1 on Spotify’s Business Podcast chart four times since it’s inception only two years ago.

At the start of 2023, I began my journey of building a $2M Dividend Growth Portfolio from scratch. This twice-weekly newsletter is how I keep you all updated on my progress.

For me, early retirement means $2M invested. For you, it might mean something else. Regardless of your early-retirement number — I hope these weekly synopses of my portfolio progress + what’s been happening in the markets helps you on your own journey.

Every Sunday, we publish the internet’s best summary of what happened in the markets the week prior — earnings analysis, acquisition announcements, economic data, world news, and more.

If you want full access to that info, my portfolio, legendary investor portfolios, livestreams, resources, and more — click here!

Crypto is more than a buzzword — it’s a growing part of the global economy. But accessing it can be complex, volatile, and yield nothing.

The Nicholas Crypto Income ETF (BLOX) aims to change that.

Diversified holdings in crypto-related equities and ETFs

Exposure to Bitcoin and Ether via leading custodians like Fidelity, Coinbase, and Gemini

Income-focused overlay using strategic options to generate weekly cash flow

BLOX is for investors who want crypto exposure and income potential — without the headaches.

👉 Portfolio Updates (YTD Performance):

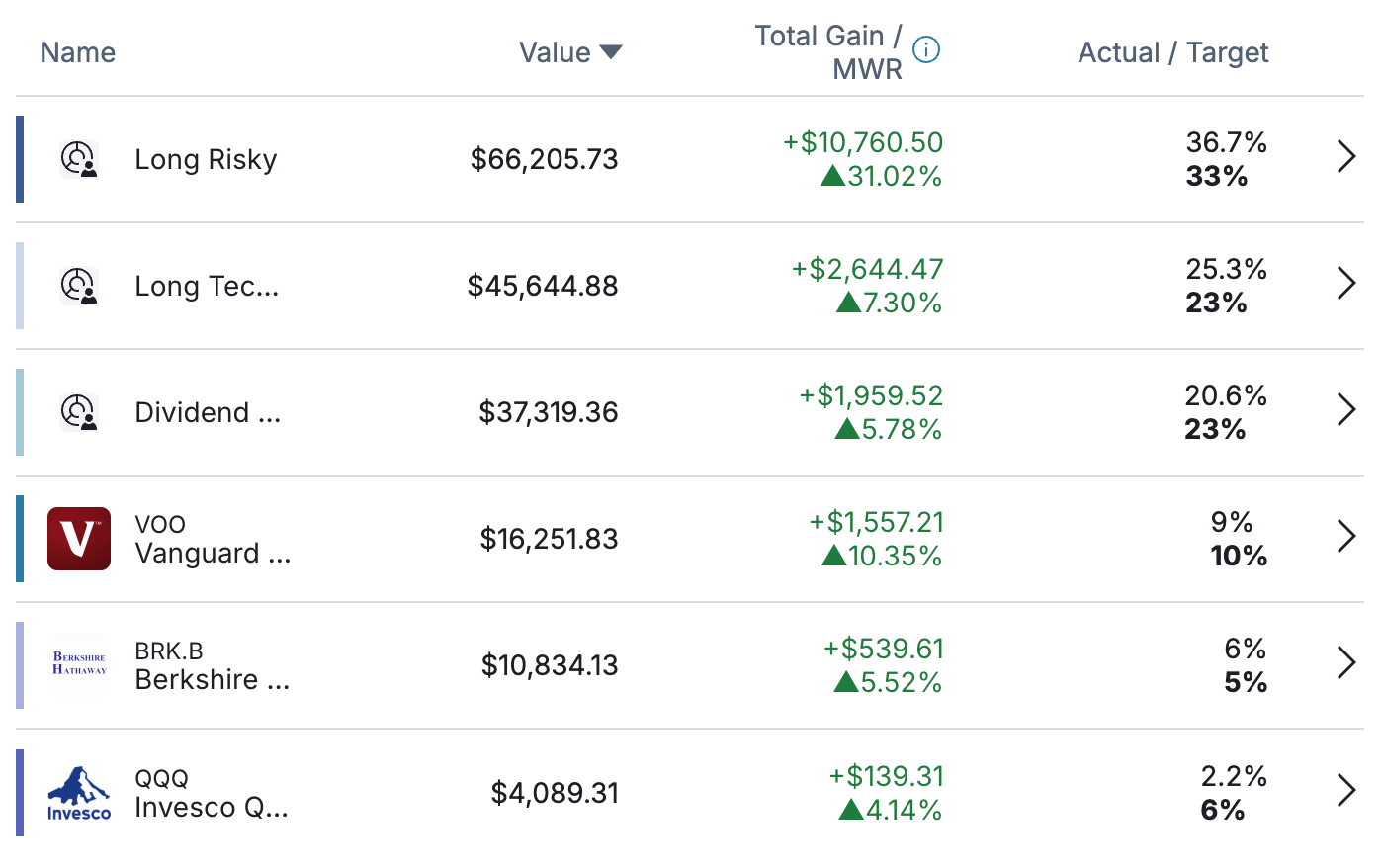

The stock-section of the portfolio is up +14.3% YTD, above both the S&P 500’s +10.7% and the Nasdaq-100’s +12.9%. This outperformance is catalyzed by the “Long Risky” subsection of the portfolio delivering +31.0% YTD returns. Candidly speaking, it’s the only subsection of the stock-only portfolio that’s outperforming the S&P 500 — as the Long Technology section lags the S&P 500 by about -3% and the Dividend Growth Stocks section by about -5%.

This is a prime example as to why it’s so important to ensure you’re investing in such a way that aligns with your risk tolerance. Do I want exposure to high-octane growth stocks? Of course. Do I want it to be my entire portfolio? No, I want to have some steady dividend growth names, some Berkshire Hathaway, among others.

Although I haven’t added any of these names yet to the portfolio, I’m very much focused on adding exposure to two specific sectors of the market:

1) Small caps

2) AI infrastructure

I’ll share more about the AI infrastructure later, but you all should remember from last week’s Week in Review as to why I believe small caps will do exceptionally well over the coming 9-18 months.

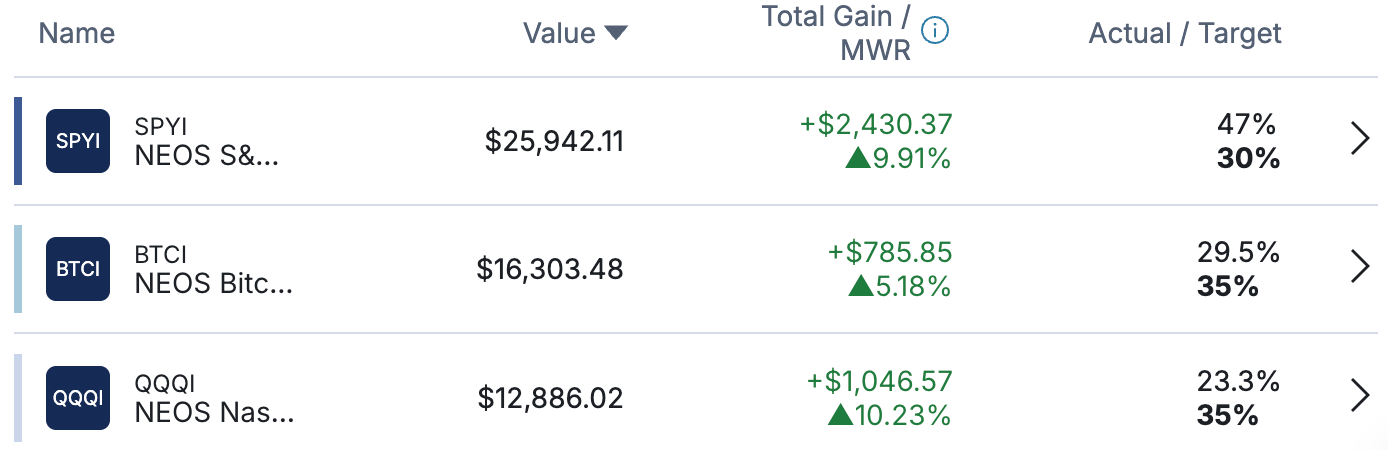

The monthly income portfolio continues to do its job — provide tax-efficient monthly income! Can’t recommend these NEOS funds enough.

SPYI just enjoyed its 3-year anniversary — I highly recommend everyone to read this analysis we published about the ETF on Friday if you haven’t already. SPYI quite literally is in a league of its own — outperforming JEPI and XYLD by +20% and 17%, respectively.

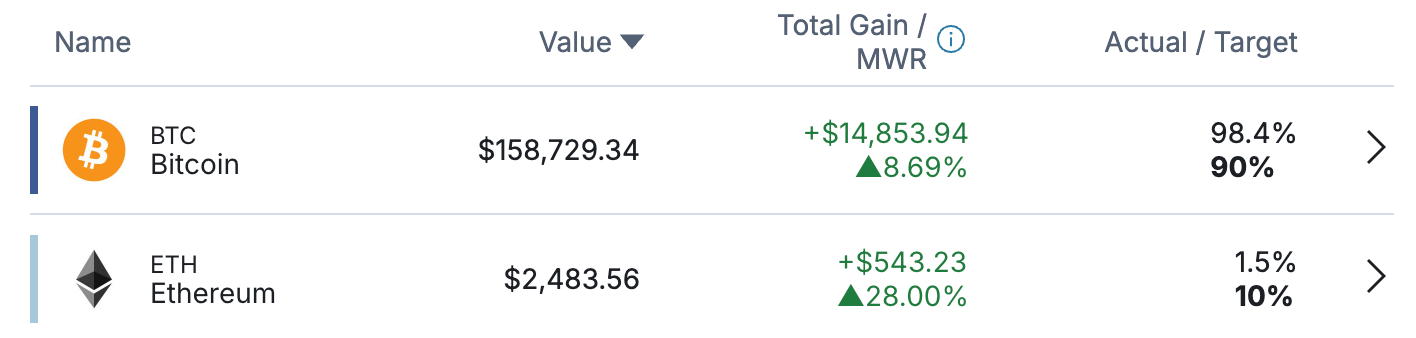

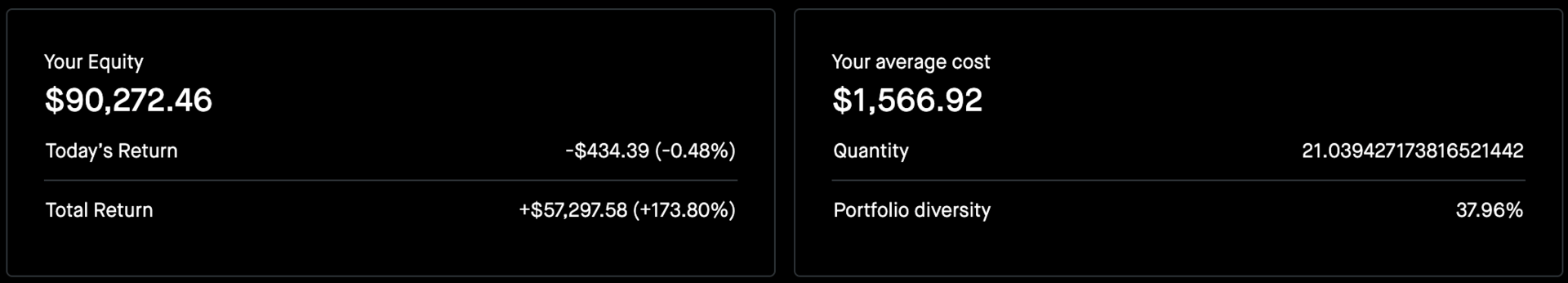

Bitcoin is hovering around $110K, and in my opinion there’s still +20-30% upside to be had from here. Additionally, Ethereum is very much getting read for its next leg higher — hopefully propelling it above $5K.

Want to see every position inside my stock and crypto portfolio?

Click here to become a Premium subscriber for $31 / month. You’ll also unlock access to our monthly livestreams, GRIT Guides on Investing, and more.

👉 Key Earnings Announcements:

Salesforce’s revenue backlog climbs to $29.4 billion, Broadcom’s AI-specific revenue skyrocketed +63%, and Lululemon experiences sluggish sales in the US.

Salesforce (CRM)

Key Metrics

Revenue: $10.2 billion, an increase of +10% YoY

Operating Income: $2.3 billion, an increase of +30% YoY

Profits: $1.9 billion, compared to $1.4 billion last year

Earnings Release Callout

“We delivered an outstanding quarter to close out the first half of the year, with strong performance across revenue, margin, cash flow, and cRPO—and we remain on track for fiscal 2026 to be a record year with nearly $15 billion in operating cash flow.

“Our second quarter results highlight our ability to drive profitable growth while helping our customers and ourselves become agentic enterprises. We exceeded all our financial targets while achieving our tenth consecutive quarter of operating margin expansion, delivering strong returns and maximizing value for our customers and shareholders.”

My Takeaway

Salesforce delivered a strong second quarter, reporting $10.2 billion in revenue — exceeding Wall Street’s expectations. The growth was fueled by continued demand in its subscription and support businesses. The company also reported a meaningful rise in CRPO to $29.4 billion, reflecting sustained backlog and future revenue visibility.

Their GAAP operating margin expanded to 22.8%, compared to 19.1% last year. This marks the 10th consecutive quarter of operating margin improvement — catalyzing free cash flow growth. Salesforce's AI and cloud business continues to gain momentum, with annual recurring revenue from Data Cloud and AI solutions exceeding $1.2 billion, up +120% YoY.

Adoption of Agentforce — the company’s AI agent platform — is gaining traction; over 12,500 deals have been closed, with more than 6,000 now paid. A majority of bookings are from existing customers, signaling strong cross-sell capabilities and integration within the broader Customer 360 ecosystem.

For now, the data cloud momentum, recurring revenue strength, and margin discipline provide a compelling foundation — but investors will be watching the speed and scale of AI monetization closely.

Holding shares.

Broadcom (AVGO)

Key Metrics

Revenue: $15.9 billion, an increase of +22% YoY.

Operating Income: $9.8 billion, an increase of +37% YoY

Profits: $4.1 billion, compared to -$1.9 billion last year

Earnings Release Callout

“Broadcom achieved record third quarter revenue on continued strength in custom AI accelerators, networking and VMware. Q3 AI revenue growth accelerated to 63% year-over-year to $5.2 billion.

Consolidated revenue grew 22% year-over-year to a record $16.0 billion. Adjusted EBITDA increased 30% year-over-year to $10.7 billion reflecting strong operating leverage. Free cash flow was a record $7.0 billion, up 47% year-over-year. Consistent with our commitment to return excess cash to shareholders, we returned $2.8 billion to shareholders in the third quarter through cash dividends.”

My Takeaway

Broadcom delivered another stellar quarter, with revenue hitting $16.0 billion, surpassing Wall Street’s expectations. The growth was catalyzed by continued demand for AI chips and infrastructure software.

AI-related revenue grew by +63% to $5.2 billion, dominating the AI infrastructure space. Management raised their guidance for next quarter to $17.4 billion. Additionally, management shared their $110B backlog, including a $10B AI chip order from OpenAI to be delivered in 2026.

Adj. EBITDA came in at $10.7B, equivalent to a 67% margin — marking Broadcom as one of the most profitable tech companies. The company delivered $7B in free cash flow, representing 44% of revenue generated. The company returned $2.8B to shareholders in the form of dividends during the quarter.

It’s obvious this company will continue to be a major AI winner, especially as their VMWare business continues to benefit from continued demand for infrastructure.

Happily holding shares.

Lululemon (LULU)

Key Metrics

Revenue: $2.5 billion, an increase of +7% YoY

Operating Income: $523.8 million, compared to $540.2 million

Profits: $370.9 million, compared to $392.9 million

Earnings Release Callout

“While we continued to see positive momentum overall in our international regions in the second quarter, we are disappointed with our U.S. business results and aspects of our product execution.

We have closely assessed the drivers of our underperformance and are continuing to take the necessary actions to strengthen our merchandise mix and accelerate our business. We feel confident in the opportunity ahead and plans we have in place to drive long-term growth.”

My Takeaway

Lululemon posted a mixed second quarter earnings. Despite revenue rising by +7%, their US-specific revenue was flat, with comparable sales falling -4%. On the flip side, China and “Rest of World” revenue grew by +25% and +19%, respectively. Operating income decreased by -$524M, resulting in an operating margin -2.1% lower than last year. This margin compression was catalyzed by promotional pricing and rising SG&A costs. Additionally, their gross margin was negatively impacted by tariffs and occupancy.

Lululemon is confronting structural pressures. Inventory rose 21% to $1.7 billion, increasing capital tied in merchandise and potential markdown risk. Management’s strategic outlook acknowledges these challenges. The company intends to inject newness into its offerings by increasing the proportion of new styles from 23% to 35% in its spring line-up. CEO Calvin McDonald admitted the brand had become “too predictable” in its casual wear selection. Furthermore, tariff-related costs—especially from the end of the de minimis exemption—are expected to shave about $240 million off gross profits.

Lululemon’s strength in international markets offers a lifeline for growth, as Asia and other regions continue outpacing North America. However, recovering U.S. performance through product innovation, pricing strategies, and supply-cost efficiency will be essential to restore profitability.

No shares.

👉 Consider Adding Bitcoin and Ether To Your Portfolio

Seasonality suggests August and September are wonderful months to accumulate cryptocurrency before an explosive move higher.

In the financial markets, seasonality is abundant. By seasonality, I’m alluding to the historical performance of specific asset classes throughout the year. For example, the “September Slump.”

This phenomenon showcases the historical performance of the S&P 500 during the month of September. Over the last 90 years, it has averaged a negative return (56% chance) — and when it is negative, it experiences an average decline of -1.14%.

There’s seasonality with all types of things — performance, time of year, asset class, etc. You name it, there’s some sort of historical pattern to be assumed.

One of my favorites include where we are right now in the S&P 500…

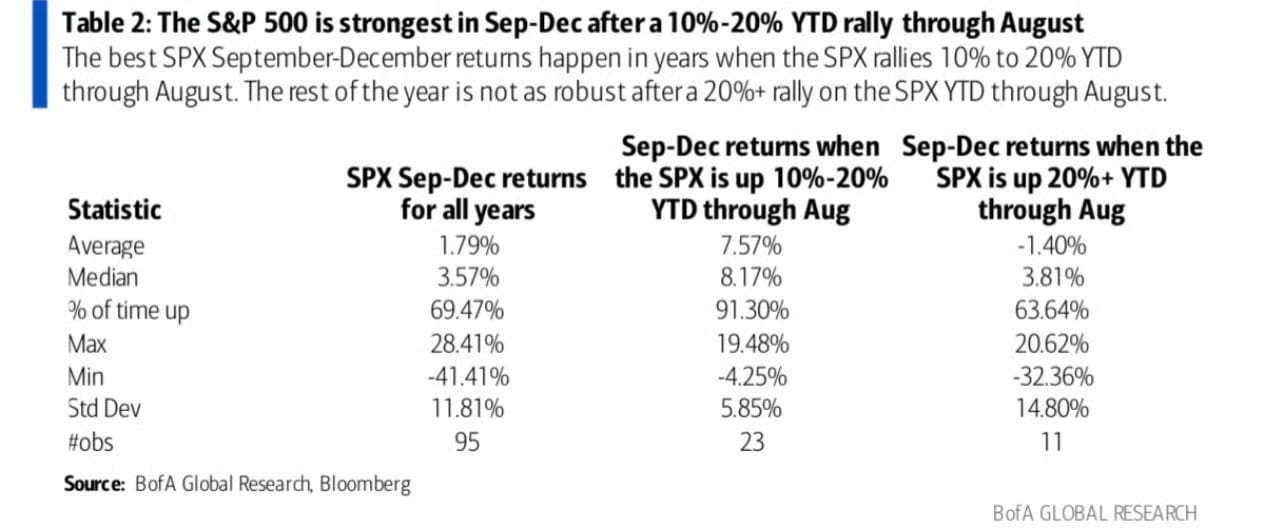

The S&P 500 is now up +10.1% year-to-date through August. Historically, this has often boded well for the remainder of the year (September through December). Over the last 100 years, there have been 23 instances where the S&P 500 delivered year-to-date returns of +10% to +20% through August — and in 21 of those 23 cases the index climbed higher over the following four months, with an average gain of +7.5%.

Seasonality tells us the S&P 500 will continue to trend higher over the remaining four months of the year. Exciting!

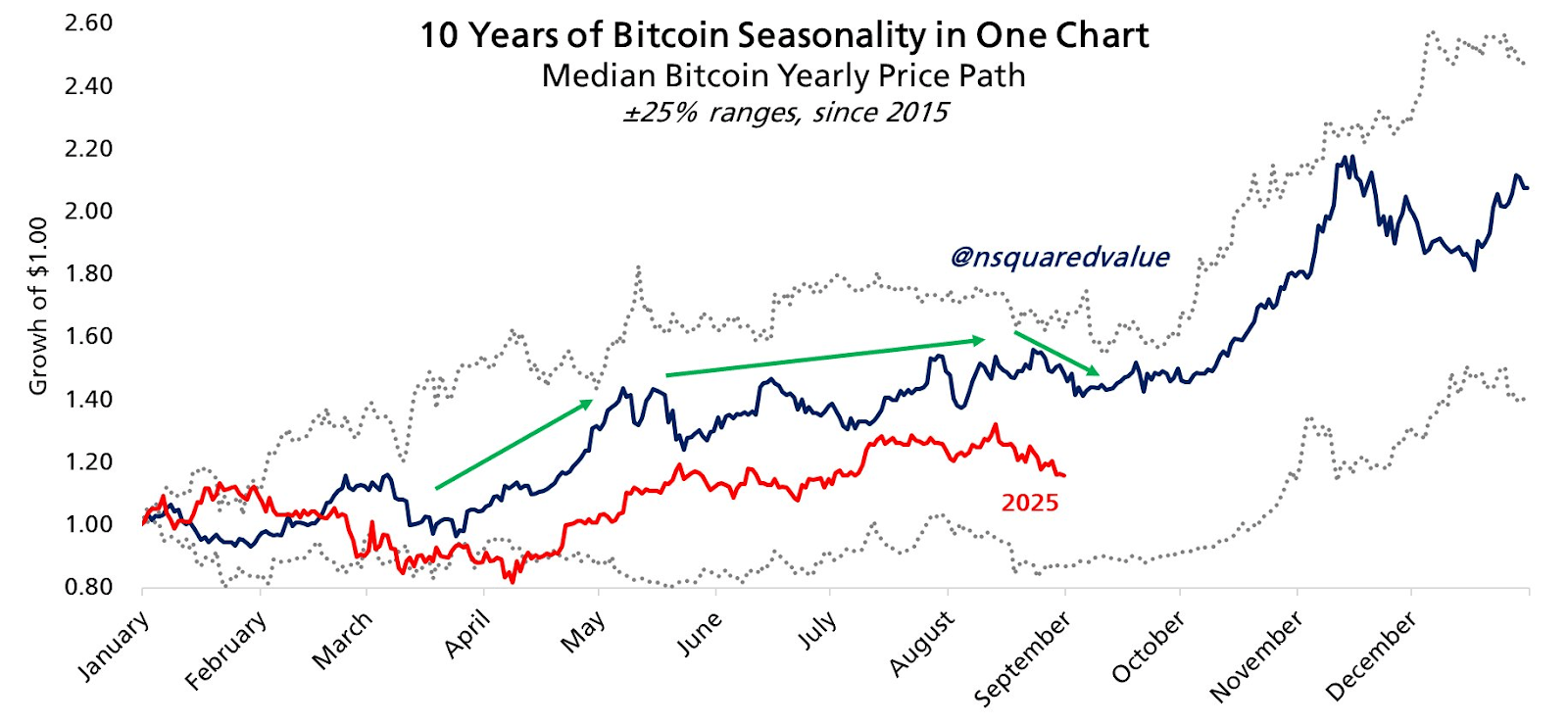

You can take seasonality to better understand any asset class and its historical performance — including cryptocurrency.

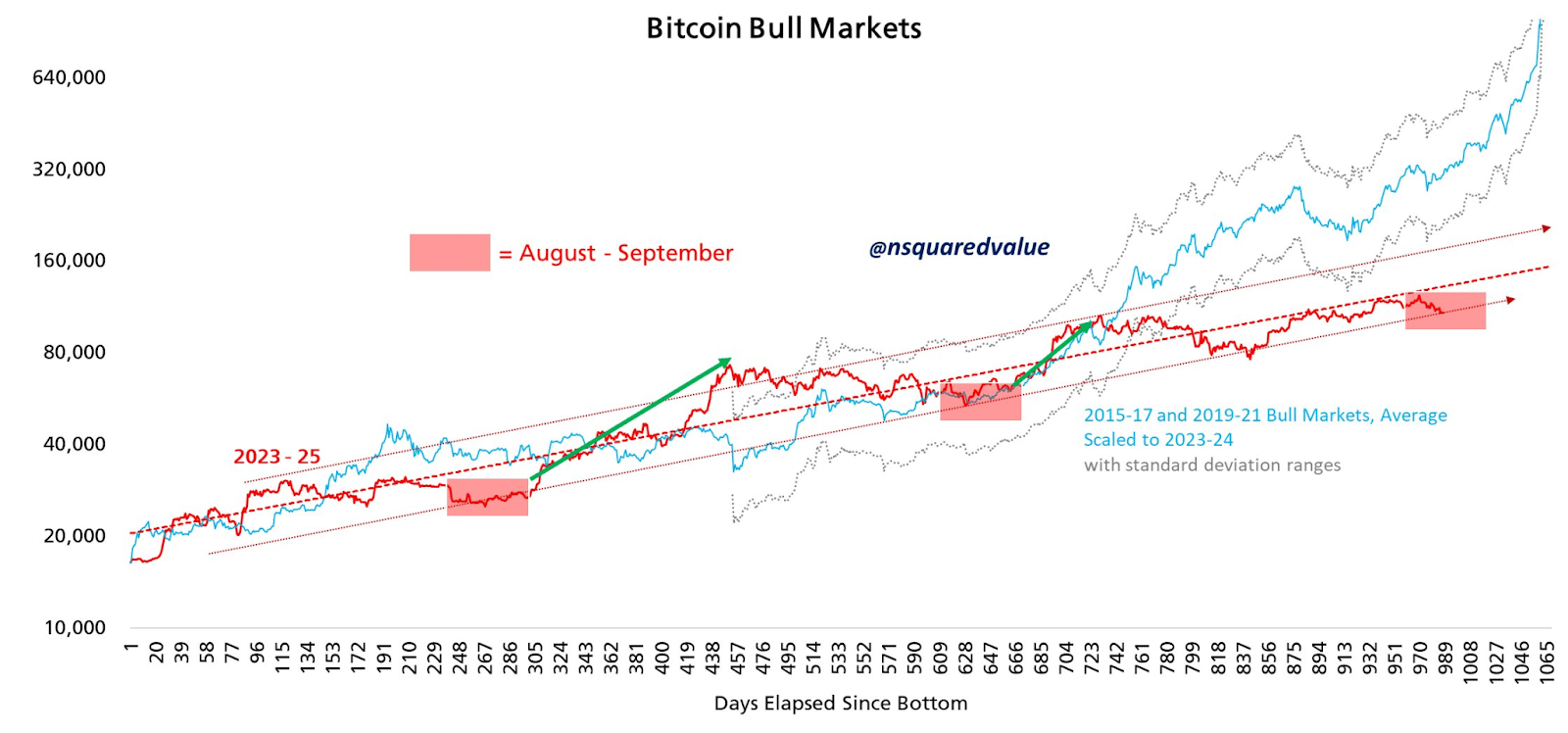

The above chart illustrates the seasonality of August and September for Bitcoin (red rectangles). Historically speaking, during the months of August and September, Bitcoin trades down / sideways before exploding higher.

Here’s another chart illustrating this historical observation since 2015.

At the moment, we’re experiencing that “slump” with Bitcoin — therefore cryptocurrency as a whole.

In my opinion, Bitcoin will continue to trend sideways (or lower) over the coming months before exploding higher — causing “Bitcoin Dominance” to trend back toward 65%. If history repeats itself, we would see some sort of “blow off top” in the coming 2-3 months before “alt coins” (defined as any cryptocurrency that’s NOT Bitcoin) experience a similar rally.

This rally could be exacerbated by the Fed cutting interest rates, forcing investors to find “risk-on” assets to buoy their returns as the risk-free rate declines.

All that to say… consider adding some Bitcoin and Ether to your portfolio. They might surprise you over the coming quarter or two.

*Disclosure: Creative Direct Marketing Group (CDMG) Inc. paid to have news shared about CEA Industries becoming the largest corporate holder of BNB. This is not financial advice and provides no guarantee of future returns.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Cover image source:

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]