- GRIT

- Posts

- 👉 De-Escalation Day Has Arrived!

👉 De-Escalation Day Has Arrived!

Alibaba, Monday.com, Walmart

Together with Squarespace

Welcome to your new week.

For months now — we’ve been saying that the ‘runway’ of the market was becoming shorter and shorter. This meant that if we wanted to truly push higher, we needed a “De-Escalation Day” to arrive in order keep the possibility of reaching new all-time highs before another major market correction.

That day has arrived. We’ll break it all down in the “Investor Events / Global Affairs” section below!

Through Squarespace’s cutting-edge features that combine automation, design presets, creative guidance, and generative AI, Design Intelligence makes it easy to build a beautiful and impactful website. With just a few pieces of information, Blueprint AI generates an entire website customized based off your brand’s goals, name, and personality. It’s AI speed, with Squarespace’s 20+ years of design expertise in website building.

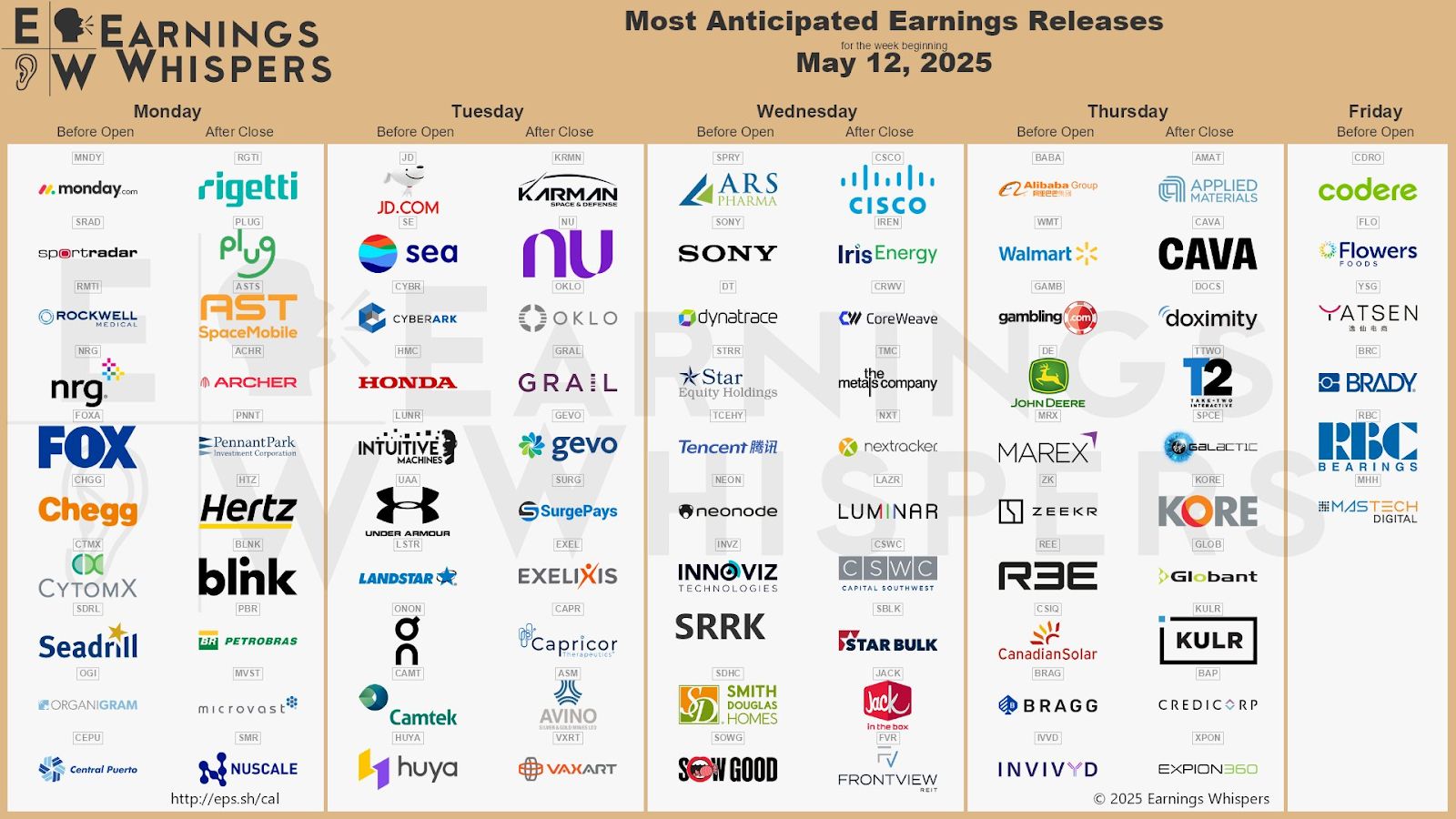

Key Earnings Announcements:

Alibaba, CoreWeave, Monday.com, On Holdings, Walmart, and more report this week. We’ll see if they can keep the momentum in the market going.

Monday (5/12): AST SpaceMobile, Chegg, Fox Corp, Hertz, Monday.com, Plug Power

Tuesday (5/13): Honda, Intuitive Machines, JD.com, Sea Limited, Under Armour

Wednesday (5/14): Cisco, CoreWeave, Dynatrace, Luminar, Sony, Tencent

Thursday (5/15): Alibaba, Applied Materials, CAVA, Doximity, Galactic, John Deere, Walmart, Zeekr

Friday (5/16): Brady Corporation, Codere, Flowers Foods, RBC Bearings

What We’re Watching:

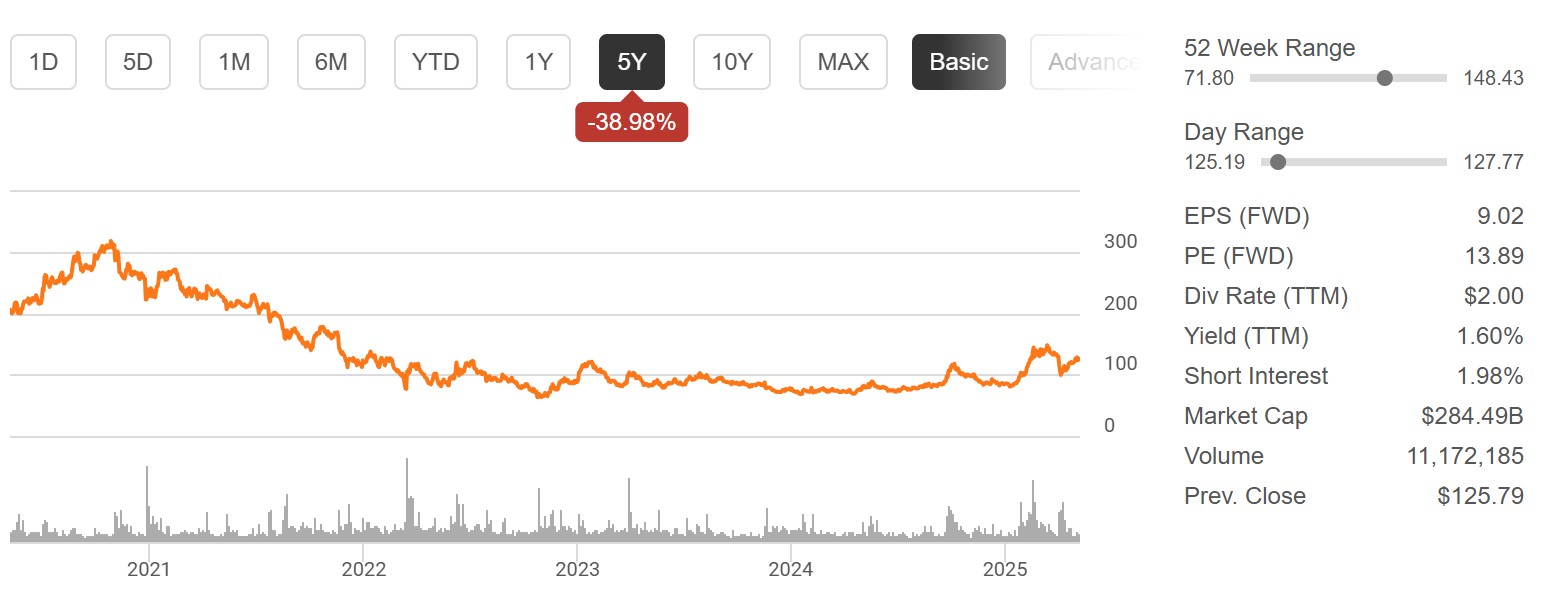

Alibaba (BABA)

Source: Alibaba Earnings Deck

Alibaba reports earnings Thursday before the bell. Shares have rebounded in recent weeks, but macro overhangs and U.S./China tensions keep sentiment cautious. Investors are watching for signs of margin expansion, cloud profitability, and progress on non-core divestments — including updates on Intime Retail and Freshippo.

Margin improvement will be key: BABA is shifting focus toward higher-margin businesses like AI, cloud, and core e-commerce while exiting lower-return ventures. EPS expectations have been revised upward 9 times in the past 90 days — showing optimism. Cloud growth held steady at +13% YoY last quarter, and heavy AI investments could pressure FCF again — but management will need to show early returns. I’ll also be listening for updates on the Qwen3 AI model rollout, international e-commerce growth, and how the company plans to navigate ongoing tariff risks.

"Alibaba is well-positioned to navigate tariff challenges by leveraging our global logistics investments and focus on domestic consumption, while our AI-driven cloud growth continues to drive long-term value."

Alibaba Group Holding Limited (BABA) Stock Performance, 5-Year Chart, Seeking Alpha

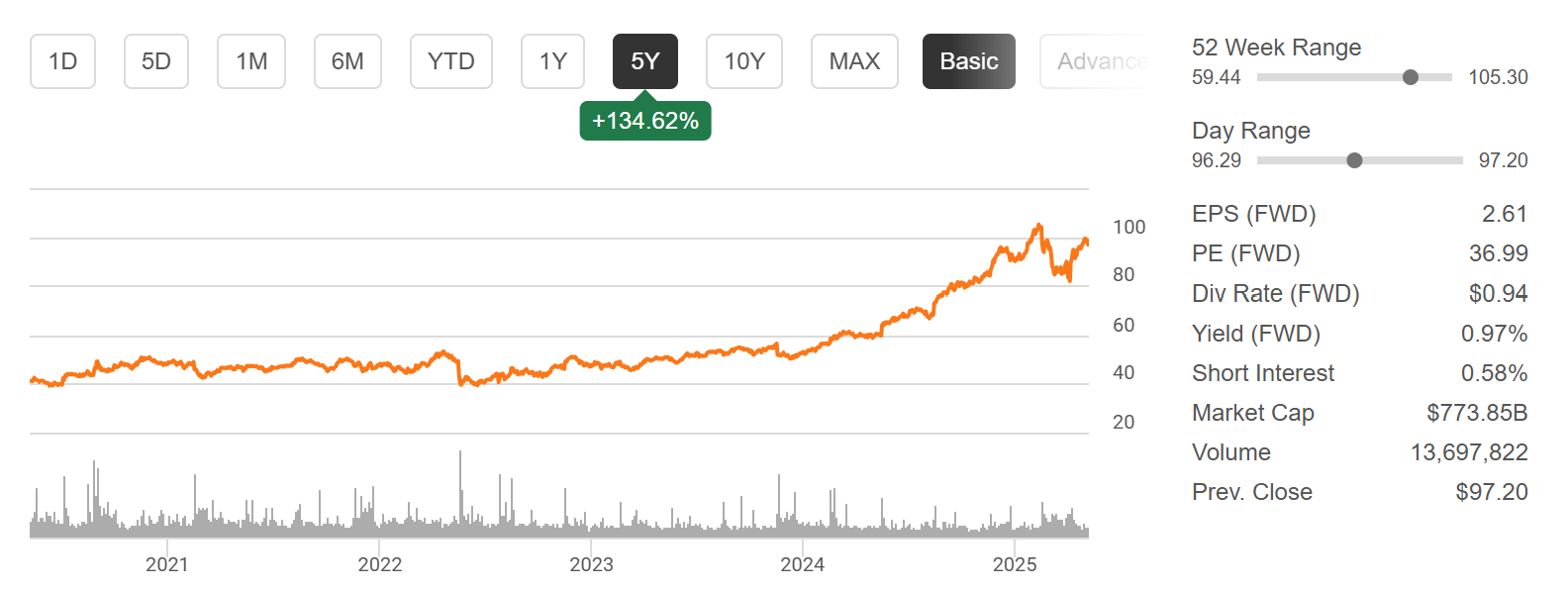

Walmart (WMT)

Source: Walmart Earnings Deck

Walmart reports earnings Wednesday before the bell. Shares are up +13% over the past month and trade at 36x forward earnings — leaving little room for error. Walmart has beaten both revenue and EPS estimates for eight straight quarters, but management’s tone — not the numbers — has often moved the stock. After cautious guidance last quarter, shares fell -5% despite a beat. With inflation fears rising and consumer sentiment sinking to multi-year lows, the Q1 report will serve as a read-through on U.S. households, particularly the higher-income shoppers Walmart has recently attracted.

Source: Wildpixel

E-commerce remains a bright spot, growing +20% YoY last quarter and expected to turn profitable in Q1 — a potential catalyst if confirmed. I'll be watching closely for management commentary on tariffs, consumer behavior, and whether e-commerce profitability and growth can be sustained in a more uncertain environment.

"We see opportunities to accelerate share gains while maintaining flexibility to invest in price as tariffs are applied to incoming goods."

Walmart Inc. (WMT) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

De-Escalation Day has arrived, Trump is signing an executive order on prescription drugs, and India / Pakistan have reached a ceasefire.

De-Escalation Day with China is Here!

Source: Reuters

The White House has officially announced a new trade agreement with China, following a recent deal with the United Kingdom. US tariffs on Chinese imports will be cut to 30% from 145%, while China’s levies on U.S. imports will be cut to 10% from 125%, the two countries said in a joint statement. The agreement includes mutual tariff reductions of 115%, while both countries will retain a 10% baseline tariff. China will remove recent retaliatory tariffs and suspend a 34% tariff for 90 days. The U.S. will eliminate certain new tariffs imposed in April but retain pre-April 2 tariffs, including those related to national security and the fentanyl emergency. Both countries committed to future negotiations to expand market access and address long-term trade imbalances.

The U.S. emphasizes that the 10% tariff helps bolster domestic manufacturing and protect American workers. This deal aims to rebalance trade relations, with U.S. representatives Scott Bessent and Jamieson Greer leading ongoing talks. Additionally, the agreement includes joint efforts to combat the fentanyl crisis by targeting the flow of drugs from China.

Let me be very clear — this is about the best result that could have possibly come out of these negotiations. A major shoutout to Scott Bessent — he NAILED this and the market is responding accordingly.

“The consensus from both delegations this weekend is that neither side wants a decoupling, and what had occurred with these very high tariffs was the equivalent of a trade embargo, and neither side wants that.”

"This is better than I expected. I thought tariffs would be cut to somewhere around 50%. Obviously, this is very positive news for economies in both countries and for the global economy, and makes investors much less concerned about the damage to global supply chains in the short term.”

Trump to Sign Executive Order on Prescription Drugs

Source: Jacquelyn Martin / AP

On May 12, 2025, President Trump announced plans to sign an executive order to lower U.S. drug prices by tying them to the lower prices paid in other countries under a "Most Favored Nation" policy. Trump claims this move will save Americans trillions of dollars and significantly reduce healthcare costs. The pharmaceutical industry opposes the plan, arguing it would hurt innovation and weaken U.S. competitiveness, especially against China.

The proposal could slash drug prices by up to 59%, though Trump has not specified which government programs it would apply to. A similar effort during Trump’s first term was blocked in court and later dropped by the Biden administration. Despite industry pushback, Trump insisted that Americans have unfairly carried the burden of high drug costs for years and promised to prioritize patients over pharmaceutical profits.

“The Pharmaceutical/Drug Companies would say, for years, that it was Research and Development Costs, and that all of these costs were, and would be, for no reason whatsoever, borne by the ‘suckers’ of America, ALONE. Campaign Contributions can do wonders, but not with me, and not with the Republican Party. We are going to do the right thing, something that the Democrats have fought for many years.”

India/Pakistan Ceasefire

India and Pakistan agreed to a U.S.-brokered ceasefire on Saturday, aiming to halt the most intense cross-border fighting in decades. The truce followed four days of missile and drone strikes that left nearly 70 dead and raised fears of broader conflict. Despite the agreement, both sides accused each other of violations within hours, with explosions reported in Kashmir and air defenses activated in border cities. The ceasefire remains fragile, but international diplomacy has so far prevented further escalation.

We’ll see if anything changes this week, as there’s still speculation over whether the ceasefire will truly be followed.

“Both India and Pakistan claimed the ceasefire as a victory, fuelling a surge of nationalistic fervour on both sides of the border. India’s defence minister, Rajnath Singh, said on Sunday the “roar of Indian forces reached Rawalpindi, the very headquarters of the Pakistani army”, referring to India’s missile strikes on Pakistan’s Nur Khan airbase. He said the military offensive, named Operation Sindoor, was “not just a military action but a symbol of India’s political, social and strategic willpower”.

In Pakistan, parades were held near the border to shower the military with petals, and the prime minister, Shehbaz Sharif, declared 11 May to be a day “in recognition of the armed forces’ response to recent Indian aggression.””

Major Economic Events:

This week we get a look at monthly inflation rates (CPI) and retail sales.

Monday (5/12): Fed Governor Adriana Kugler speech, Monthly U.S. federal budget

Tuesday (5/13): Consumer price index, Core CPI, Core CPI year over year, CPI year over year, NFIB optimism index

Wednesday (5/14): Fed Governor Christopher Waller speech, Fed Vice Chair Philip Jefferson speech, San Francisco Fed President Mary Daly speech

Thursday (5/15): Business inventories, Capacity utilization, Core PPI, Core PPI year over year, Empire State manufacturing survey, Fed Chairman Jerome Powell speech, Fed Governor Michael Barr speech, Home builder confidence index, Industrial production, Initial jobless claims, Philadelphia Fed manufacturing survey, Producer price index, PPI year over year, Retail sales minus autos, U.S. retail sales

Friday (5/16): Building Permits, Consumer Sentiment (prelim), Housing Starts, Import Price Index

What We’re Watching:

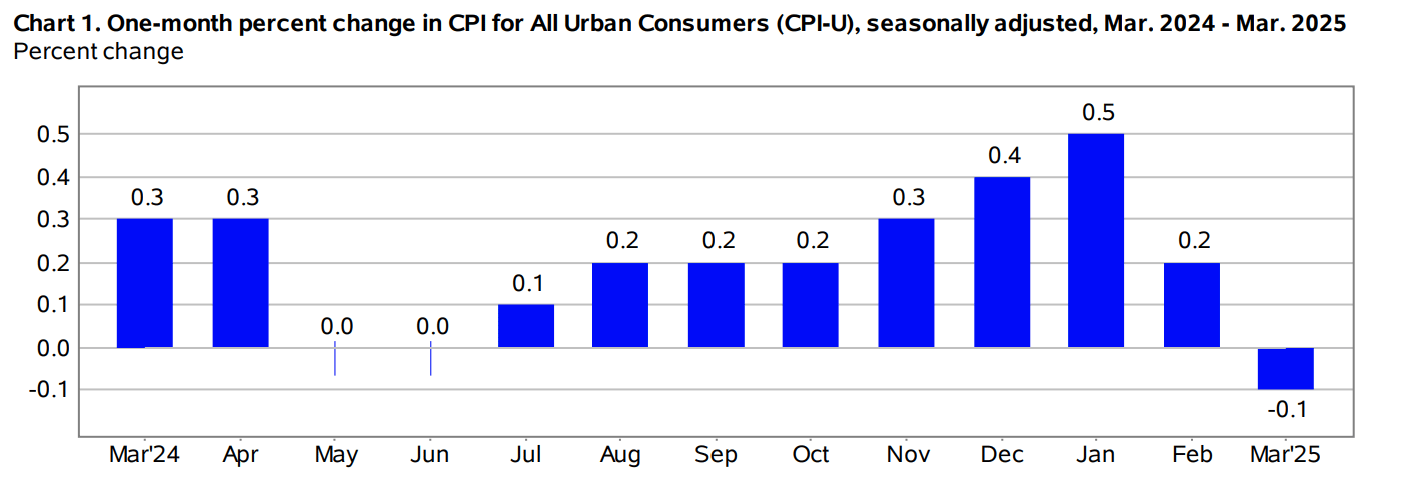

Consumer Price Index (CPI)

Source: U.S. Bureau of Labor Statistics

U.S. consumer prices fell -0.1% in March — the first monthly decline since May 2020 — as energy prices dropped -2.4% and disinflation spread across travel, autos, and recreation. Still, food costs continued to rise, with grocery prices up +0.5% and restaurant prices up +0.4%, while core categories like medical care and apparel also saw gains.

Economists expect this week’s reading to show a +0.2% monthly increase and +2.3% annual increase for the CPI.

“Why is consumer price inflation so moderate even though the costs of tariffs have been borne mostly by the US side? We think it’s because demand is slowing (retail sales, Thurs,), and retailers are finding it difficult to pass on higher prices without suffering a sharp drop in demand — though they’ll still try. If that effect prevails, then the net impact of tariffs will be less inflationary than commonly thought.”

Retail Sales

Source: U.S. Census Bureau

U.S. retail sales jumped +1.5% in March — the largest monthly gain since January 2023 — as consumers accelerated car and parts purchases ahead of looming auto tariffs. Even excluding autos, sales rose a solid +0.6%, pointing to broad-based consumer strength despite policy uncertainty.

Economists expect a mere +0.1% increase in retails sales in this week’s meeting.

“Net, net, these are simply blow out numbers on March retail sales where the rush is on like this is one gigantic clearance sale. Consumers are expecting sharply higher prices the next year and are clearing the store shelves and picking up bargains while they can.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]