- GRIT

- Posts

- 👉 December to Remember in the Market?

👉 December to Remember in the Market?

Amazon, Nvidia, Salesforce

Welcome to your new week…

… and welcome to the month of December! As you get back into the groove of things after Thanksgiving, now is the time to lock in for the last few weeks of the year.

Read on for everything you should be watching this week.

If you’re interested in becoming a premium subscriber to Grit Capital’s Rate of Return Newsletter, click here for 20% off an annual subscription!

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Key Earnings Announcements:

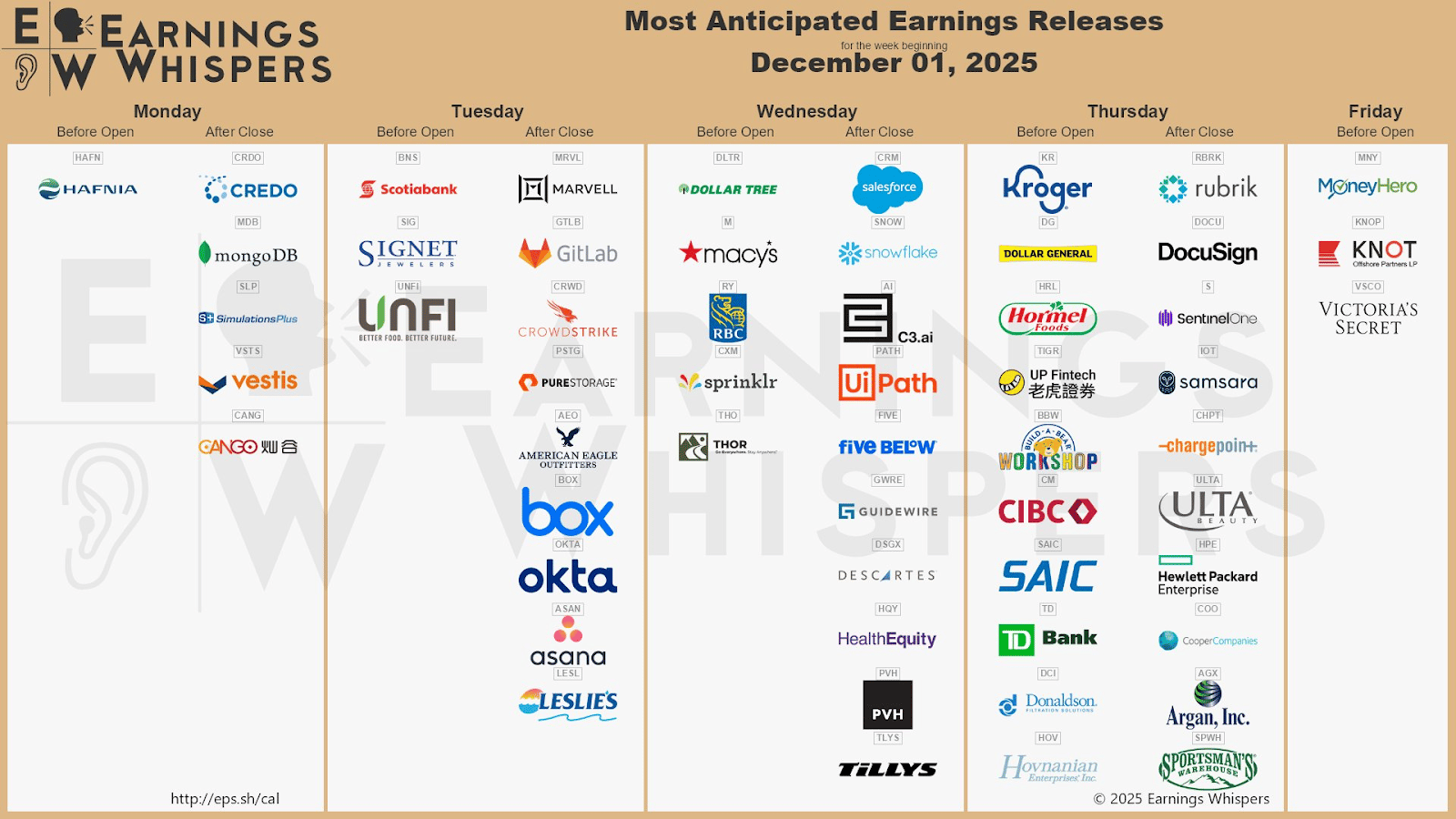

This week is highlighted by American Eagle, CrowdStrike, Dollar General, Marvell, Salesforce, and more.

Monday (12/1): Cango, Credo, Hafnia, MongoDB, SimulationsPlus, Vestis

Tuesday (12/2): American Eagle Outfitters, Asana, Box, CrowdStrike, GitLab, Leslie’s, Marvell, Okta, Pure Storage, Signet Jewelers, Sprinklr

Wednesday (12/3): C3.ai, Descartes, Dollar Tree, Five Below, Guidewire, HealthEquity, Macy’s, PVH, RBC, Salesforce, Snowflake, Thor Industries, Tilly’s, UiPath

Thursday (12/4): ChargePoint, CIBC, CooperCompanies, DocuSign, Donaldson, Hormel, HP Enterprise, Hovnanian, Kroger, Rubrik, Samsara, SAIC, SentinelOne, TD Bank, ULTA Beauty, Up Fintech, Workshop

Friday (12/5): KNOT Offshore Partners, MoneyHero, Victoria’s Secret

What We’re Watching:

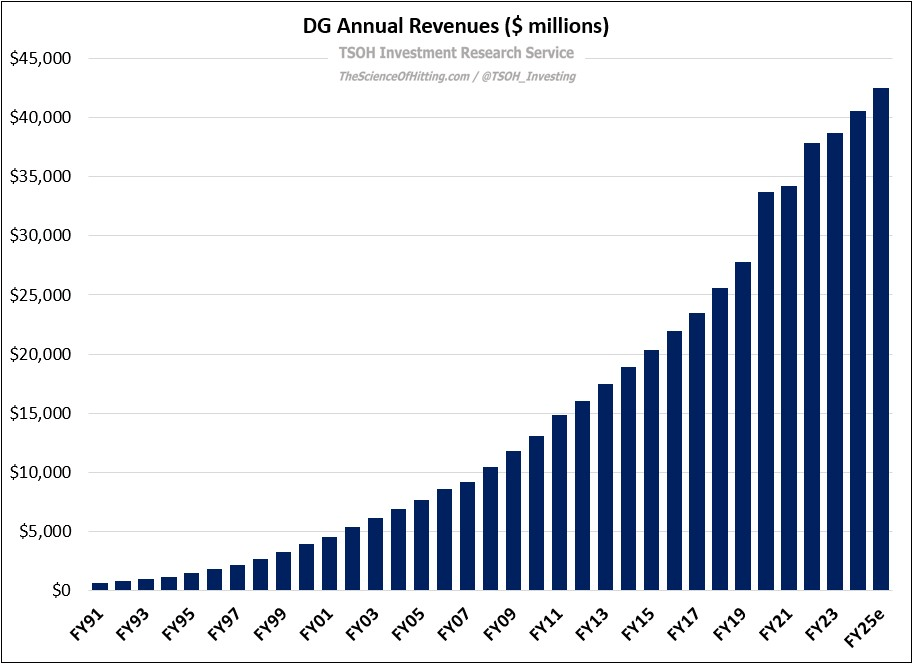

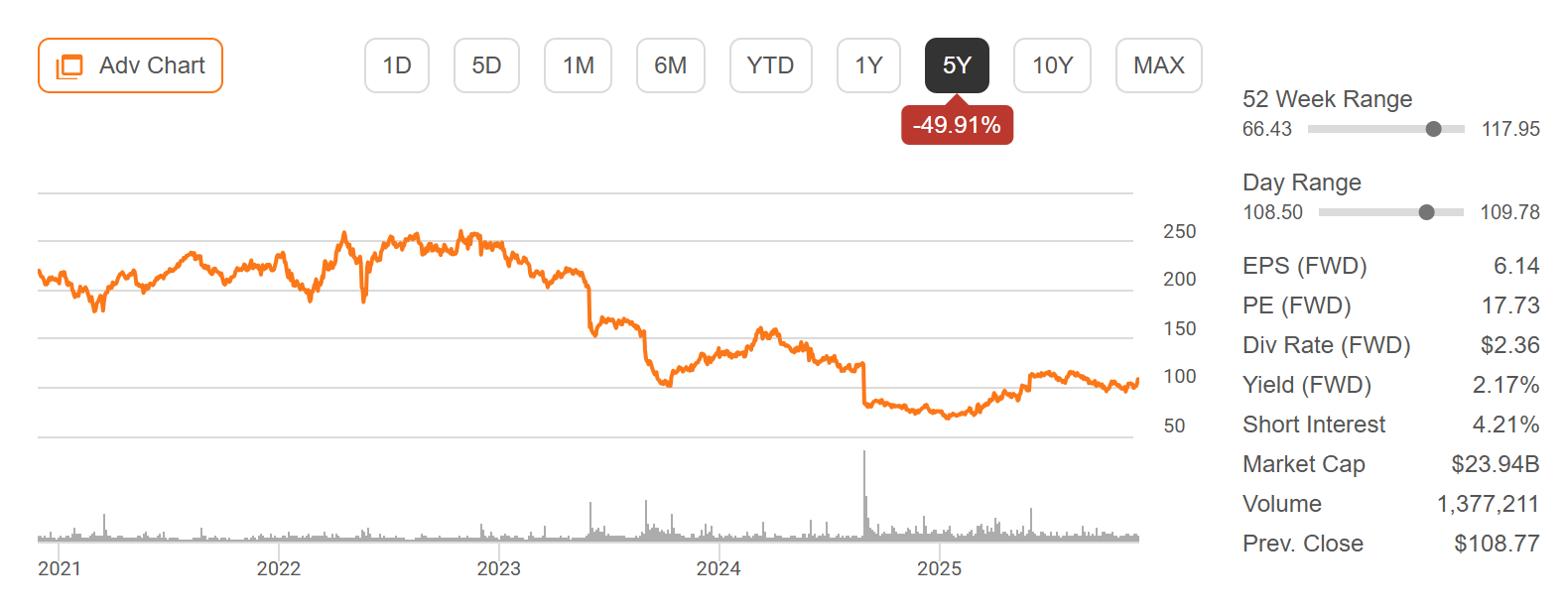

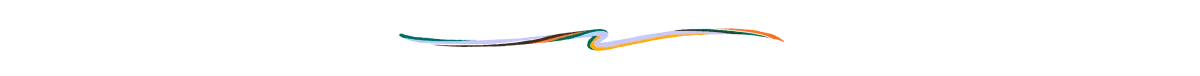

Dollar General (DG)

Dollar General (+50% YTD) reports Q3 FY2025 earnings Thursday before the open, with investors focused on whether the retailer can sustain its operational turnaround as lower-income consumers remain under pressure from high prices and weaker real incomes. After a difficult 2023–2024 marked by inventory issues, shrink, and elevated labor costs, Dollar General has been working to stabilize margins and regain traffic — but visibility into a full recovery remains mixed.

Last quarter, the company posted $10.2 billion in revenue (+3% YoY) and $1.80 in EPS (+11% YoY), with same-store sales rising +2.7% as consumables outperformed. Gross margin improved modestly on better markdown discipline and lower supply-chain costs, though shrink remained a persistent drag. Management also reiterated its effort to streamline store operations and improve in-stock levels after last year’s setbacks.

For Q3, I’ll be watching whether comps can hold up as discretionary categories remain soft, how shrink and labor expenses trend, and whether management offers stronger clarity on FY2025 profitability targets. Commentary on store remodels, distribution efficiency, and any early signs of a consumer rebound at the lower end will be key for sentiment.

“Our focus is squarely on execution – improving the store experience, strengthening our supply chain, and earning back the trust of our core customer.”

Dollar General Corporation. (DG) Stock Performance, 5-Year Chart, Seeking Alpha

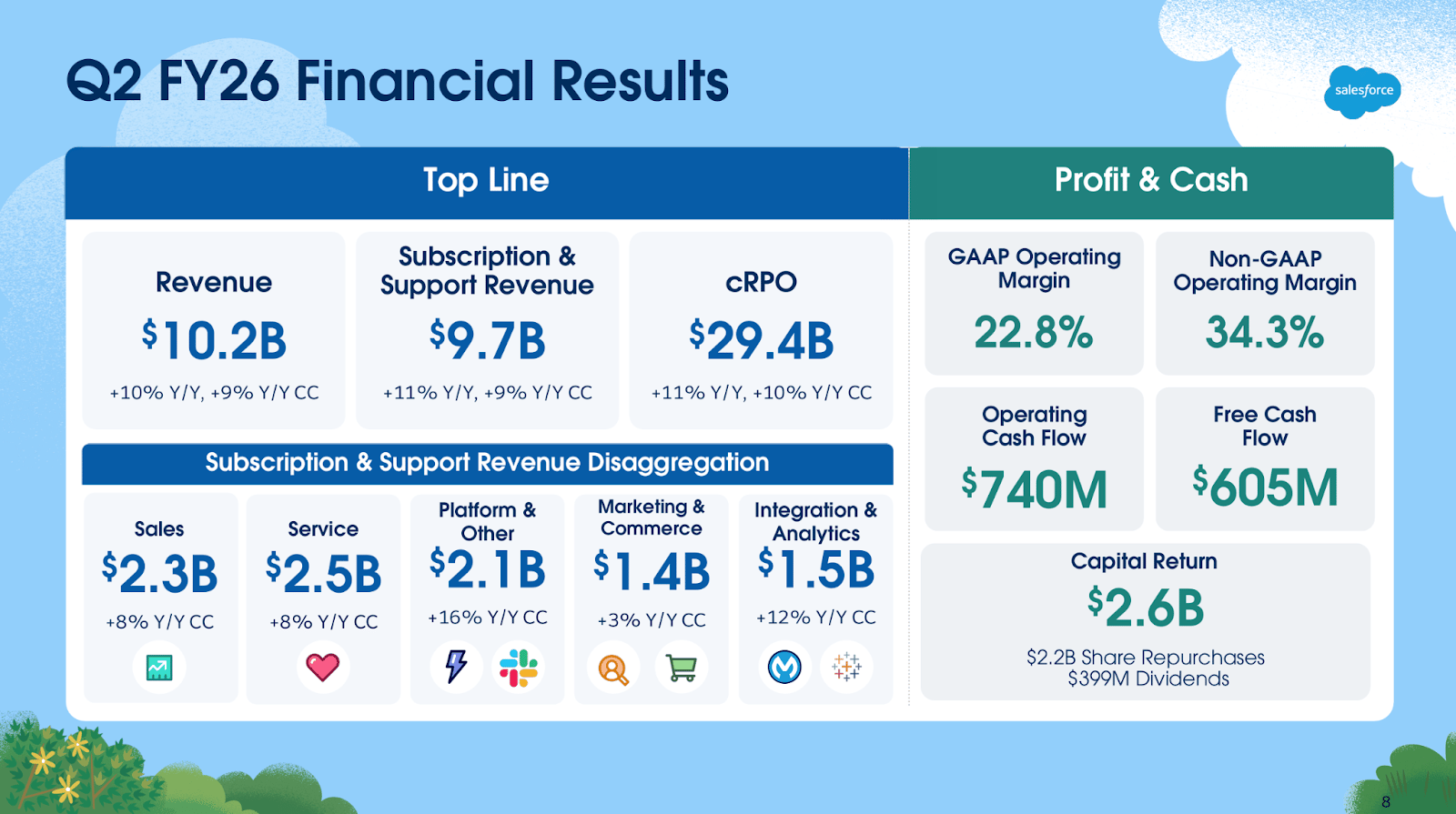

Salesforce (CRM)

Salesforce (-31% YTD) reports Q3 FY2025 earnings Wednesday after the close, with investors watching whether the company can reaccelerate subscription revenue and show margin discipline as it leans deeper into AI-driven enterprise software. Salesforce has positioned itself as a leading platform for agentic AI, data integration, and enterprise automation — but the market remains focused on growth durability and how quickly AI features convert into paid adoption.

Last quarter, Salesforce posted $9.4 billion in revenue (+8% YoY) and $2.44 in adjusted EPS (+17% YoY), both above expectations. Subscription & Support revenue grew +10% YoY, while operating margin held at an impressive ~32%, supported by continued cost controls. Cloud segments — including Data Cloud and Service Cloud — saw healthy demand, though management noted elongated deal cycles in certain enterprise verticals.

Heading into Q3, I’ll be watching whether Data Cloud momentum shows up in RPO and net-new bookings, how AI-related pricing initiatives (like Einstein 1 and agentic workflows) are landing with customers, and whether management updates full-year guidance. Commentary on macro enterprise spending, deal scrutiny, and capital allocation will also shape how the market reacts.

“Every digital transformation now starts with data and AI – and Salesforce is uniquely positioned to power that shift.”

Salesforce, Inc. (CRM) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

Amazon to Showcase Agentic AI and Next-Gen Cloud at AWS re:Invent, Salesforce to Release Full Cyber Monday & Cyber Week Shopping Report, Nvidia to Showcase Cutting-Edge AI Research at NeurIPS 2025.

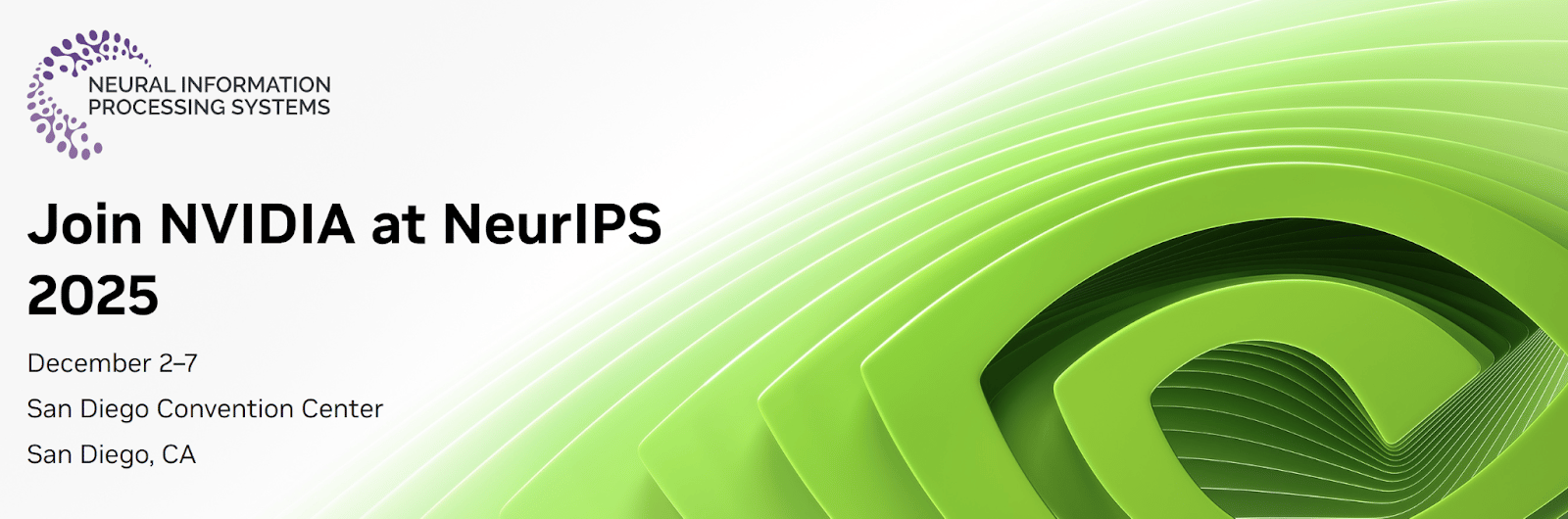

Amazon AWS re:Invent Event

Amazon kicks off its flagship AWS re:Invent conference in Las Vegas next week, one of the most closely watched events in cloud computing. This year’s gathering is expected to spotlight agentic AI, large-scale cloud infrastructure, and deep technical content aimed at developers, enterprises, and AI builders.

Keynotes will feature AWS CEO Matt Garman, senior engineering leaders, and Amazon CTO Dr. Werner Vogels, who will close the event with his annual “future of cloud systems” address. Investors will be watching for updates on Amazon’s AI-inference strategy, custom silicon (Trainium/Inferentia), and how AWS plans to defend share amid intensifying competition from Microsoft and Google.

Amazon, Inc. (AMZN) Stock Performance, 5-Year Chart, Seeking Alpha

“J.P. Morgan’s Doug Anmuth, an analyst who ranks among the top 2% on Wall Street, thinks the pullback partly reflects the timing of Amazon’s $15 billion debt raise, which is “not a big deal, but (comes) amidst a noisy market,” Anthropic’s partnership with Nvidia and Microsoft Azure, and ongoing questions about the timing of Trainium 3, Amazon’s next-gen in-house AI accelerator chip developed for AWS.

With AWS re:Invent coming up this week (December 1-5), Anmuth expects the tech giant will “continue to amplify its AI/cloud strategy and opportunity,” with likely updates on several items. That includes the timeline, performance, and customer adoption for Trainium, with Trainium 3 positioned to be about 40% more price-efficient than Trainium 2.”

Cyber Monday Recap from Salesforce

Source: Michael Nagle / Bloomberg / Getty Images

In addition to Salesforce earnings this week, the company will also publish its comprehensive Cyber Monday recap this week, offering one of the most detailed looks at U.S. and global online shopping trends during Cyber Week. The report will break down total online sales, mobile’s share of spending, and how AI-driven recommendations and personalization shaped consumer behavior.

Investors often treat Salesforce’s holiday data as a high-frequency read on e-commerce demand, digital traffic patterns, and retail sector winners and laggards. This year’s release will also highlight how major retailers performed across categories like electronics, apparel, and home goods, as well as shifts in real-time consumer intent.

Salesforce (CRM) Stock Performance, 5-Year Chart, Seeking Alpha

“Every holiday season, we’re seeing AI play a bigger role in how consumers shop – from discovery to checkout.”

Nvidia at NeurIPS 2025

Nvidia will be a major presence at the 2025 NeurIPS conference, one of the world’s most influential gatherings for artificial intelligence and machine learning. The company is set to feature demos and technical sessions spanning robotics, autonomous driving, simulation, and advanced AI model training.

Nvidia will also co-host talks with research and enterprise partners on applied generative AI, recommendation systems, and production-scale deployments — giving investors insight into how its platform is being adopted across real-world use cases. The event serves as an important barometer for Nvidia’s technological edge and the depth of its AI developer ecosystem.

Nvidia Corp. (NVDA) Stock Performance, 5-Year Chart, Seeking Alpha

“Accelerated computing and AI are reshaping every industry – and the breakthroughs we’re showcasing at NeurIPS highlight how fast the field is moving.”

Major Economic Events:

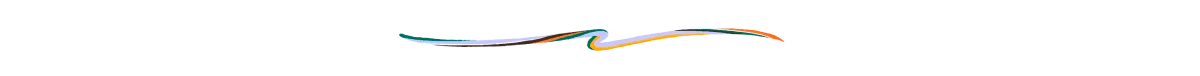

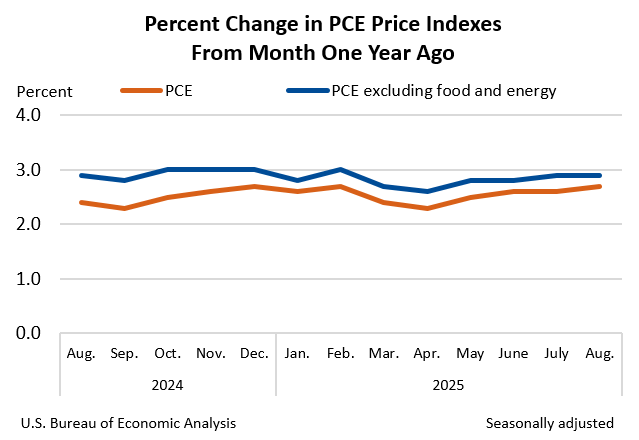

A look at the consumer with a consumer credit, delayed PCE, and Michigan Consumer Sentiment report.

Monday (12/1): ISM manufacturing, S&P final U.S. manufacturing PMI

Tuesday (12/2): Auto sales

Wednesday (12/3): ADP employment, Import price index (delayed report), Import price index minus fuel, ISM services, S&P final U.S. services PMI

Thursday (12/4): Initial jobless claims, U.S. trade deficit

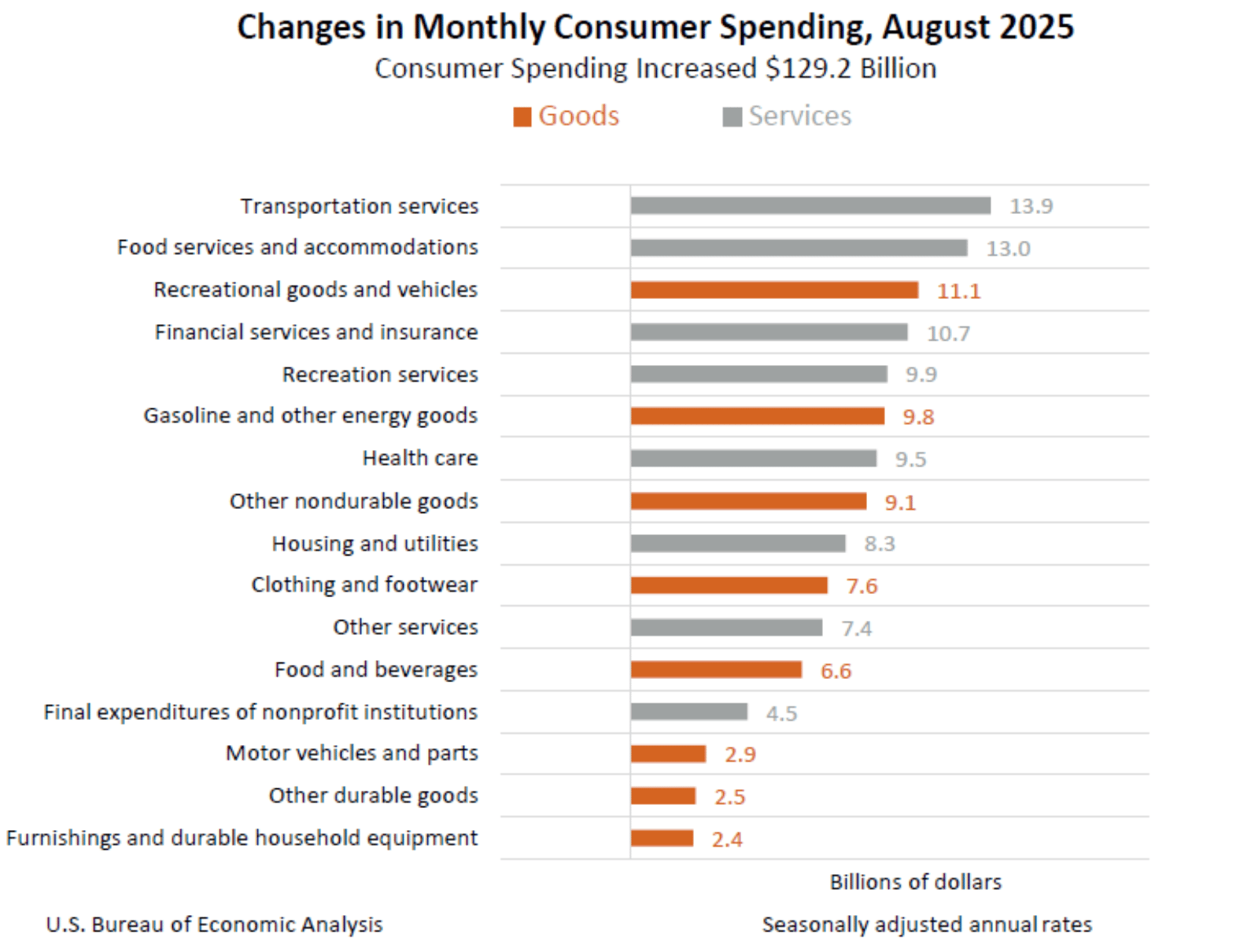

Friday (12/5): Consumer credit, Consumer sentiment (prelim), Core PCE (year-over-year), Core PCE index (delayed report), PCE (year-over-year), PCE index (delayed report), Personal income (delayed report), Personal spending (delayed report)

What We’re Watching:

Core PCE Index

September’s release is finally being published late due to the government shutdown.

The Fed’s preferred inflation gauge — the Core Personal Consumption Expenditures (PCE) Price Index –rose 0.2% MoM in August, matching July’s pace and consensus estimates. On a yearly basis, core PCE increased 2.9% YoY, unchanged from prior readings and consistent with the Fed’s projection for a slow, uneven glide back toward 2%.

The data reinforces the view that underlying inflation is cooling but still sticky, particularly in services, and offers the Fed little reason to accelerate or slow its recently restarted rate-cut cycle. With growth softening and labor-market indicators mixed, policymakers continue to signal a cautious, “one-meeting-at-a-time” approach.

Economists expect the following this week:

• Core PCE (MoM): +0.2% vs. +0.2% prior

• Core PCE (YoY): +2.9% vs. +2.9% prior

“Inflation is easing, but not decisively – the Fed is getting the cooling it wants, just not at the speed it would prefer.”

Michigan Consumer Sentiment

The University of Michigan Consumer Sentiment Index rose slightly to 51.0 in November (from a preliminary 50.3) following the end of the federal shutdown, but the improvement leaves sentiment hovering near historic lows — the second-weakest reading on record.

The Current Conditions Index fell 12.8% to an all-time low of 51.1, reflecting steep declines in personal-finance assessments and major-purchase conditions.

Inflation expectations continued to ease: 1-year expectations dipped to 4.5% (from 4.6%), while 5-year expectations softened to 3.4% (from 3.9%). Late-month equity volatility also weighed on wealthier households, with sentiment among top-stock-owning consumers slipping roughly 2 points from October.

Economists expect the following this week:

Consumer Sentiment (Final): 51.0 vs. 50.3 preliminary

Current Conditions Index: 51.1 vs. 58.6 prior

1-Year Inflation Expectations: 4.5% vs. 4.6% prior

5-Year Inflation Expectations: 3.4% vs. 3.9% prior

“Consumers saw little meaningful change in economic conditions this month – high prices and weakening incomes remain at the forefront of their concerns.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Cover Art Sources: Amazon, mehaniq41/Adobe Stock, FastCompany

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]