- GRIT

- Posts

- 👉 DeepSeek Shakes Market Ahead of Mag 7 Earnings

👉 DeepSeek Shakes Market Ahead of Mag 7 Earnings

Apple, Meta, Microsoft, Tesla

Welcome to your new week.

Yesterday, most of the holdings in your portfolio likely saw some serious movement to the downside. Bitcoin dropped below $98K, alt coins dropped even more substantially, stock market futures sank, and much more. At the time of writing this — Nvidia (NVDA) shares have fallen -12% in premarket trading as well.

The VIX (AKA “The Fear Index”) was up as much as +44% this morning.

So what happened?

Concerns quickly soared due to apparent competitiveness in AI triggered by Chinese startup DeepSeek. They launched a free, open-source large-language model in December — and the whole market is now worried about it…

DeepSeek claims the model was developed in just two months for under $6 million, raising questions about the massive investments U.S. tech firms have made / are making in AI development. The news led to a global sell-off in tech stocks.

Analysts noted that while DeepSeek’s advancements are impressive, U.S. tech giants still have the advantage of access to advanced chips like Nvidia’s GPUs, critical for training large AI models. Some analysts remain skeptical of DeepSeek’s reported costs, suggesting they may not account for prior research, development expenses, or subsidies from the Chinese government.

Keep in mind… the source above is DeepSeek themselves.

What’s the takeaway?

Despite the sell-off, we’d like to caution you about being too fearful. This whole situation is raising question marks about the superiority of America’s AI infrastructure. However — we are being shaken by one startup’s word versus all of Big Tech.

We have no idea what the next news will be regarding this situation. All we know is that we’re not going to let one random Chinese startup convince us that the “AI bubble is bursting” without full information.

As you’ll see more of below — this is a MASSIVE week in the market for Big Tech earnings, and CAPEX will certainly be a major talking point in the earnings calls!

My hunch…. this will be looked back at as a great opportunity to have DCA’d in our portfolios!

Key Earnings Announcements:

Huge week of earnings ahead with 4 of the Mag 7 set to report — Apple, Meta, Microsoft, & Tesla

Monday (1/27): AT&T, Brown & Brown, Nucor, Sofi

Tuesday (1/28): Boeing, Chubb, General Motors, JetBlue, Lockheed Martin, Logitech, Raytheon Technologies, SAP, Starbucks, Sysco

Wednesday (1/29): ADP, ASML, General Dynamics, IBM, Lam Research, Meta, Microsoft, Progressive, ServiceNow, Tesla

Thursday (1/30): Apple, Blackstone, Caterpillar, Comcast, Intel, Mastercard, Nokia, Southwest, UPS, Visa

Friday (1/31): AbbVie, Brookfield, Charter, Chevron, ExxonMobil

What We’re Watching:

Meta (META)

Meta reports earnings this Wednesday with all eyes on its bold AI-driven strategy. The company has committed over $60 billion in AI investments for 2025 — aiming to scale its infrastructure to 1.3 million GPUs by year-end (x2 from 2024) — $30 billion of which is solely for GPUs.

Meta’s leadership in virtual reality (VR), augmented reality (AR), and the Metaverse complements its AI initiatives. However, the payoff for these investments remains uncertain, as Meta has warned of delayed returns amidst fierce competition. While its massive social media platforms and open-source AI strategy could boost user engagement, questions linger about whether the ad revenue will justify such colossal spending.

Investors will look for updates on AI infrastructure spending and its ripple effects on suppliers like NVIDIA, Taiwan Semiconductor, and Arista Networks. I look forward to Meta’s earnings call this week as it could set a great tone for its long-term growth narrative.

Meta Platforms, Inc. (META) Stock Performance, 5-Year Chart, Seeking Alpha

Microsoft (MSFT)

Microsoft reports earnings this Wednesday — with focus on its AI and cloud computing momentum under Satya Nadella’s leadership. The company’s strategic capital allocation — highlighted by its $13 billion investment in OpenAI, and $80 billion in project ‘Stargate’ — has positioned Microsoft as a key AI leader. AI services added 12 percentage points to Azure's growth in Q1 FY2025, with annual recurring revenue from AI expected to reach $10 billion by Q2 FY2025.

However, near-term growth in Azure may face moderation due to data center capacity constraints. To address this, Microsoft’s CAPEX is expected to exceed the $20 billion reported in Q1 — reinforcing AI and cloud leadership.

The ongoing integration of Activision Blizzard will likely weigh on Q2 earnings — operating losses from restructuring and severance costs offsetting the $2 billion in additional revenue generated by the acquisition. Long term, this deal enhances Microsoft’s push into cloud gaming through its Azure platform and Activision’s extensive game portfolio.

Microsoft’s long-term vision remains centered on AI and cloud dominance.

Microsoft Corp. (MSFT) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

Big Tech earnings linger, the Chinese New Year comes at an interesting time, tax season officially begins, and Colombian tariffs.

Mag 7 Earnings Coming Under the Microscope

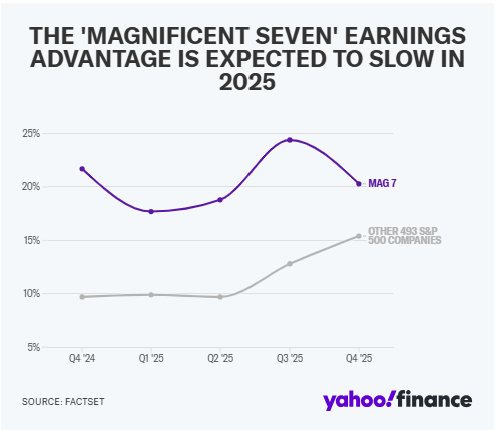

The S&P 500 is poised for its most substantial earnings growth since 2021 — anticipating a +11.7% increase in fourth-quarter profits. The largest portion of this surge is attributed to the "Magnificent Seven" tech giants — Tesla (TSLA), Meta (META), Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), Alphabet (GOOG), and Nvidia (NVDA).

These tech leaders are projected to post +21.7% earnings growth for the quarter — outpacing the +9.7% expected for the remaining S&P 500 companies. However, the gap is projected to shrink in 2025, as broader market sectors catch up and equity returns begin to rebalance.

“Within the S&P 500, 36 companies reported earnings last week, with a sizable number being financials. 80% of S&P 500 firms reported better-than-expected earnings for the quarter. This week marks the second busiest of the fourth-quarter earnings season, with 104 S&P 500 companies scheduled to report. And most crucially, four of the Magnificent 7 report earnings this week.”

Chinese New Year

Source: Newsweek

As U.S. tech stocks fall and Chinese tech stocks rise — trading activity across major Asian markets is mostly closed due to the Chinese New Year. Exchanges in Hong Kong, Shanghai, Shenzhen, and Taiwan are closed for varying durations during the week-long holiday.

With Asia largely offline, it’s an interesting time for the DeepSeek news to be hitting the U.S. markets. Additionally, any unexpected trade or tariff updates from President Trump during this time could result in market responses to Asian markets coming more from the United States than China — considering Asian markets will be quiet.

Hang Sang Index (HSI), 5-Year Performance, Seeking Alpha

Besides the holiday — China’s factory activity unexpectedly contracted in January with a PMI of 49.1, though industrial profits rose +11% in December compared to the previous year. Meanwhile, China introduced new measures to boost equity and bond ETFs, aiming to support its struggling stock market.

In summary — this a crazy time for the DeepSeek news to rock the markets. The whole world has been focusing on Big Tech earnings that are starting this week. Asian markets are mostly offline due to the holiday. Meanwhile — everyone will be searching for answers this week…

Tax Season Officially Begins Today

Source: Forbes

Tax season begins today (Monday), with the IRS officially accepting tax returns. Refunds typically take less than three weeks for electronic filings with direct deposit, while mailed paper returns may take six to eight weeks. Many Americans depend on their tax refunds to make ends meet, with a recent survey finding 45% of those relying on refunds citing the rising cost of living as a key factor.

To track a refund, taxpayers can use the IRS website by providing their Social Security or ITIN, filing status, and exact refund amount. The IRS updates refund information daily, and once marked as sent, it may take five days for direct deposits to appear or several weeks for mailed checks. Refunds could be delayed if the IRS identifies issues requiring additional review or information.

If you’re a small business owner — don’t forget that this Friday is your deadline to file you Form 1099s to the IRS as well!

If you paid contractors in 2024, make sure you do this!

Trump Pauses on Colombian Tariffs

Source: Rolling Stone

President Donald Trump initially threatened a 25% tariff on Colombian goods but reversed the decision after reaching a deal on migrant deportations, shaking global markets briefly. The agreement included Colombia accepting deportees on U.S. military aircraft, resolving a dispute where Colombia had rejected such flights over concerns about detainee treatment.

Trump’s swift tariff threats, though reversed, highlighted his use of economic tools to enforce geopolitical goals, leaving global investors uneasy. The rapid diplomatic resolution signaled a fragile understanding, but Trump’s approach strained U.S.-Colombia relations, already tense due to differing political views. Colombia pledged to maintain dignified conditions for deportees while seeking to strengthen ties through further dialogue in Washington. Despite the temporary resolution, Trump’s tactics showcased his readiness to target even longstanding allies over policy disagreements, particularly on migration.

“Colombia is seeking to improve ties, with Murillo saying he plans to travel to Washington alongside the Colombian ambassador to the US in the coming days to follow up on the agreements between both countries. Still, Trump’s move sends a powerful message to the world, that not even old political allies are safe if they do not cooperate with him.”

— Shawn Donnan, Derek Wallbank, & Eric Martin, Bloomberg

Major Economic Events:

First Fed meeting of 2025 & the Fed’s preferred inflation gauge highlight this week.

Monday (1/27): New Home Sales

Tuesday (1/28): Consumer Confidence, Durable-Goods Orders, S&P Case-Shiller Home Price Index (20 Cities)

Wednesday (1/29): Advanced Retail Inventories, Advanced U.S. Trade Balance in Goods, Advanced Wholesale Inventories, FOMC Interest Rate Decision, Fed Chair Powell Press Conference

Thursday (1/30): GDP, Initial Jobless Claims, Pending Home Sales

Friday (1/31): Chicago Business Barometer (PMI), Core PCE, Employment Cost Index, Fed Gov. Bowman Speaks, PCE Index, Personal Income, Personal Spending

What We’re Watching:

FOMC Interest Rate Decision

Source: Federal Open Market Committee (FOMC)

The Federal Reserve releases its latest policy decision Wednesday at 2:00 p.m. ET, followed by Chair Jerome Powell's press conference at 2:30 p.m. ET, which is expected to drive market volatility.

Markets anticipate the Fed will maintain the current fed funds rate at 4.25%-4.50%, signaling a pause in rate cuts as inflation remains above the 2% target. Despite earlier moves to reduce rates in response to slowing inflation and labor market concerns, the Fed appears set to stay patient until clearer progress is made.

JPMorgan's Michael Feroli predicts a more cautious tone from Powell, describing the press conference as a "duck and cover" moment, with limited new insights on future rate paths.

“The Fed is tasked with the balancing act of using monetary policy to keep the economy hot enough that everyone has a job but not so hot that inflation spikes. Eventually, the Fed aims to reduce its interest rate to a "neutral" level where borrowing costs are neither hold back the economy nor artificially boost it.”

Personal Consumption Expenditures (PCE) Index

Source: Federal Open Market Committee (FOMC)

Friday brings a pivotal update on inflation with the release of December's PCE index. Economists anticipate "core" PCE inflation — excluding food and energy — to be 2.8%, mirroring November's rate. M/M projections suggest a +0.2% uptick – slightly faster than the prior +0.1%.

With this data arriving at the end of the week, it may overshadow insights from Powell's Wednesday press conference. Market focus could quickly pivot toward how these inflation trends, combined with external economic policies, shape the Fed's next steps in its fight against price pressures.

“Sticky inflation appeared to be a little less stuck this morning… The Fed’s preferred inflation gauge came in lower than expected, which may take some of the sting out of the market’s disappointment with the Fed’s interest rate announcement on Wednesday.”

Tackle your credit card debt by paying 0% interest until 2026

Reduce interest: 0% intro APR helps lower debt costs.

Stay debt-free: Designed for managing debt, not adding.

Top picks: Expert-selected cards for debt reduction.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]

Reply