- GRIT

- Posts

- 👉 Dollar General's Turn-Around Story

👉 Dollar General's Turn-Around Story

& Klarna officially files for a U.S. IPO

Together with FIRE ETFs

Happy Sunday.

Before diving in below — check out my recent interview about the FIRE movement.

Also, be sure to SIGN UP for the free FIRE webinar this Thursday at 4pm ET!

Let’s dive into this Week in Review!

Register for the (free) GRIT Money Summit!

U.S. households’ stock allocation hit a record 49% in October, surpassing the 2000 dot-com peak. Since the Great Financial Crisis, stock exposure has doubled, making investing more accessible — but also more complex!

According to JPMorgan, in 2024, retail investors saw returns of just +3.7% by November 2024, far behind the S&P 500’s impressive +25%.

Join the GRIT Money Summit to learn head-on. Gain insights from experts, and empower yourself with the knowledge needed to navigate today’s fast-paced, ever-evolving markets, business and finance landscapes. Don’t be left behind — get equipped to invest with confidence!

Make sure you sign up using the links above!

Now let’s dive right in.

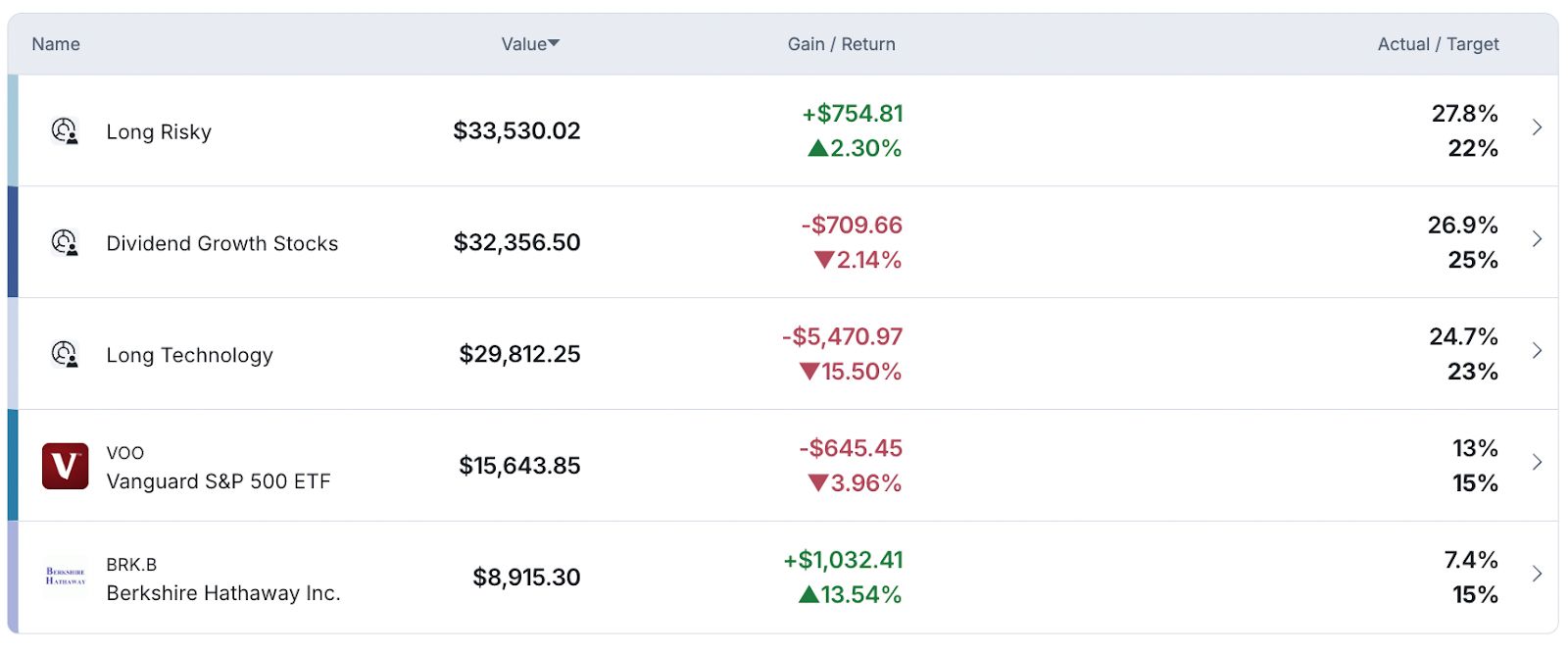

Portfolio Updates (YTD Performance):

I’m optimistic that the stock market (and maybe the crypto market) has bottomed in the short-term. Although it’s impossible to know for sure, I’m hoping the worst is behind us before a retest of the 200-day moving average.

As a quick reminder, I predicted a handful of big market themes for 2025 — one of which was a massive uptick in volatility. Unfortunately, this prediction has served to be true as the S&P 500 and Nasdaq-100 were down as much as -10% and -13%, respectively, from their recent all-time highs this week.

Specifically, I called for “multiple double-digit pullbacks in the indices throughout 2025” — and this prediction has now become “half” true. Emphasis on the word “multiple” in that sentence. To be honest, I had no idea it was going to happen as quickly as it did, which is why I wasn’t positioned defensively. Generally speaking, I have a very defensive stock portfolio — with a heavy weighting of it being invested into Berkshire Hathaway and Dividend Growth Stocks.

With that being said, my “Magnificent Seven” section of my portfolio is down -15% YTD, with Tesla in particular kicking my butt.

Here’s where my head is at — I’m very much in a “sell the rip” mentality. I know I’m up +100%, +200%, +500% or more on some very large positions in my portfolio. I intend to use our relief bounce back to the 200-day moving average as an opportunity to take profits. There are a few ways this relief bounce can take place…

We bounce back to the 200-day moving average, fall back lower and put in a higher low, then rally back above the 200-day moving average and put in new all-time highs — which could mean we’re back to the races again.

We bounce back to the 200-day moving average, fall back lower and put in a higher low, then rally back above the 200-day moving average and put in a lower high — solidifying the market top in February before going lower again.

We bounce back to the 200-day moving average, fall back lower and keep going lower — making the 200-day moving average relief bounce the last chance to “sell the rip.”

Scenario 3, in my opinion, is the least likely scenario to play out. However, this is the scenario I’m going to assume plays out — which means I’ll be “selling the rip” around this moving average.

Once sold, I look forward to accumulating shares of QQQH, SCHD, BRK.B, SLV and KTEC.

I’m building a watchlist of quality companies I want to own for the long-term if we see a material pullback (beyond just a -10% correction) in the markets and I encourage you to do the same. I’ll share my list in the coming weeks.

For crypto, it’s business as usual. Let’s continue to wait and see what happens — do we drop lower and solidify $105K being this cycle’s market top? Or do we hold steady around $75-80K and put in a new all-time high?

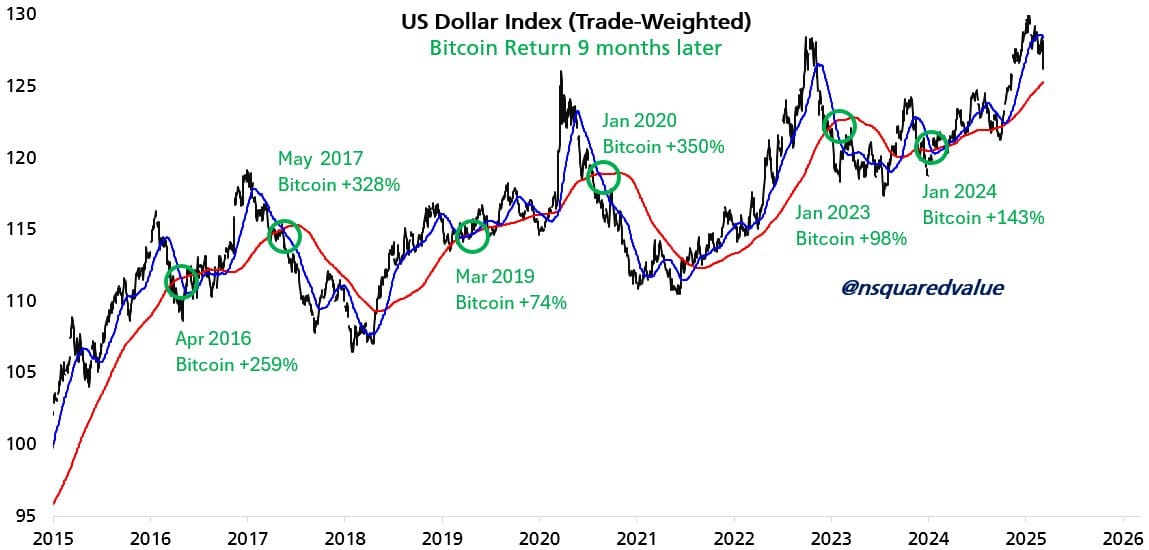

Here’s some hopium for you crypto-bros:

The dollar is approaching a 'death cross' where the 50 day moving average (blue) drops below the 200 day moving average (red). Since 2015, this signal has always been bullish for Bitcoin. The median 9-month forward return in such cases is +200%, much higher than the typical 57%.

Shoutout to Timothy Peterson on X for the research.

One day at a time, as always, with cryptocurrency. Have a plan, and stick to it.

Week in Review —TLDR:

Adobe continues its fall from grace with underwhelming AI-specific revenue, Dollar General is ready to turn things around reaffirming +10% EPS growth in 2026, Dick’s Sporting Goods is repurposing 70% of their new stores in 2025. , the tech sell-off has been painful (but not shocking), Klarna officially filed for its blockbuster IPO, Cloudflare highlighted its partnerships with OpenAI and Nvidia during its investor day, inflation for consumers and producers came in with favorable results, and consumer sentiment continues to slump.

Key Earnings Announcements:

Adobe continues its fall from grace with underwhelming AI-specific revenue, Dollar General is ready to turn things around reaffirming +10% EPS growth in 2026, and Dick’s Sporting Goods is repurposing 70% of their new stores in 2025.

Adobe (ADBE):

Key Metrics

Revenue: $5.7 billion, an increase of +10% YoY

Operating Income: $2.1 billion, an increase of +138% YoY

Profits: $1.8 billion, an increase of +192% YoY

Earnings Release Callout

“Our continued innovation and diversified go-to-market strategy drove a record Q1, with new AI-first standalone and add-on innovations exiting the quarter with over $125 million ending ARR book of business. Our customer-focused strategy, leading product portfolio and strong cash flow position us for sustainable long-term growth and increased market share.”

My Takeaway

As you all might remember, I fully exited my Adobe position at $440 / share mid-January. I opened this position early-2023 around $330 / share, carried it all the way up to $630 / share as Wall Street remained incredibly optimistic that the company would be able to meaningfully monetize Generative AI across their product suite.

As you can see above, their total AI-specific revenue now stands at $150M in ARR — which is nothing to sneeze at! But does NOT justify a $100B+ addition to the company’s market capitalization in a few short quarters. This is why we saw their stock price fall back down to reality at the start of 2024 and continue to fall now in 2025 — their AI-specific revenue just isn’t there.

With that being said, management guided to a $300M in AI-specific revenue by the end of the year. This is encouraging, but even if achieved would only make up roughly 5% of annual revenue. I’m not saying that’s nothing — it’s a whole $300M. But when compared to companies who are reporting their AI-specific revenue is now making up 25%+ of their total annual revenue, this 5% figure is just a drop in the bucket.

Something else that stood out to me was their decelerating remaining performance obligations (RPOs) — coming in at +13% during the quarter, down -3% from last quarter. The reason why this is an important figure to keep an eye on as an investor is because this is “future revenue.” It’s revenue the company has “signed” via contracts sold to customers, but hasn’t yet been realized on their books because the time specific on the contract hasn’t passed. This is the first time their RPOs have decelerated since 2022.

As I said before, I sold this stock for a healthy profit.

I, like Wall Street, had very high expectations for this company as Generative AI was taking the world by storm in 2023 and 2024. The company has failed to monetize this new technology in a meaningful way, with only 2.5% of their 2024 annual revenue derived from AI, and only 5% of 2025 annual revenue expected to come from AI.

I don’t plan to reopen this position anytime soon.

Dollar General (DG):

Key Metrics

Revenue: $14.9 billion, an increase of +25% YoY

Operating Income: $6.3 billion, an increase of +200% YoY

Profits: $5.5 billion, an increase of +332% YoY

Earnings Release Callout

“We were pleased with the underlying performance of the business in the fourth quarter, including improved execution and solid top-line results. We have fortified the foundation of this business over the last year and are confident in our plans and initiatives for 2025 and beyond, as we look to further build on this base and create sustainable long-term value for our shareholders.”

My Takeaway

As you can see above, Dollar General’s stock price (in black) for the last 15+ years has been trading alongside their earnings per share (in blue). We saw a blow-off top during Covid-19, a fall from grace over the last few years, and now their earnings per share seems to be bottoming — with Wall Street expecting it to bottom out and begin climbing again in the coming 24-36 months.

Shares of Dollar General climbed +10% after reporting better-than-expected earnings. Wall Street has become increasingly optimistic the company will be able to offset labor, incentive compensation, and SG&A expenses in 2025 — improving profitability. This includes closing underperforming stores and executing a more disciplined real estate strategy (remodeling ~20% of their stores this year).

Management also shared long-term targets that included +10% annual earnings per share growth starting in 2026. Their operational levers to achieve such targets include shrink / damage improvement, a product mix shift back to discretionary, and extension of their private brand. Supply chain and inventory efficiencies also support a path to expanding profitability during the second-half of 2025.

Shares of Dollar General trade at 13.5X forward earnings, a discount to their three-year average of 19X forward earnings. If the company is able to execute upon these new long-term targets, their stock price could begin trending back above $100 / share — and multiple expansion could take them much higher over time. Shares of Dollar General have never been so cheap from a valuation perspective. Pair that with a 3% dividend yield and I get excited.

I’ll begin to add this name to my “dividend growth stocks” section of the portfolio with the expectation that as they continue to execute upon these long-term growth targets. They’re undervalued, just reported a clear plan to get back on track, and Wall Street liked it enough to send their stock up +10% on the news.

Dick’s Sporting Goods (DKS)

Key Metrics

Revenue: $3.9 billion, an increase of +1% YoY

Operating Income: $386.9 million, an increase of +4% YoY

Profits: $299.9 million, an increase of +1% YoY

Earnings Release Callout

“Our fourth quarter was an exceptionally strong finish to another great year. With a 6.4% Q4 comp we delivered the largest sales quarter in Company history. For the full year, our comps increased 5.2%, we drove meaningful EBT margin expansion, and we gained significant market share.”

My Takeaway

Dick’s Sporting Good’s reported better-than-expected earnings driven by growth in ticket size (+4.4%) and foot traffic (+2.1%). Gross margins expanded by about +0.4% to ~35% driven by lower shipping costs and higher merchandise margin, partially offset by occupancy deleverage. Inventory rose +18% as the company invested in key categories and earlier Spring receipts help them transition to new seasonal products in warmer markets.

Wall Street expects mid-single-digit SG&A growth in 2025 to reflect investments in store, technology, and marketing as DKS aims to accelerate their e-commerce business. The company expects 70% of new store openings in 2025 to be relocations or conversions of existing locations to repurpose square footage.

I’m not a shareholder of this company, although they seem to be doing a lot of things right. Their valuation is what’s holding me back.

Investor Events / Global Affairs:

The tech sell-off has been painful (but not shocking), Klarna officially filed for its blockbuster IPO, and Cloudflare highlighted its partnerships with OpenAI and Nvidia during its investor day.

Tech Sell-Off Recap

Source: Sebastien Bozon | AFP | Getty Images

The tech sector has experienced a massive sell-off, wiping out -$2.7 trillion in market value from the seven largest U.S. tech companies over the past three weeks. The downturn was triggered by fears of a global trade war, sparked by new tariffs from President Trump, along with concerns about rising unemployment and a potential recession. The Nasdaq dropped -4.9% last week, heading for its worst weekly performance since September.

Tesla has suffered the biggest percentage decline, losing -33% of its value, while Nvidia has seen the largest dollar loss at -$577 billion. Apple, Microsoft, Amazon, Alphabet, and Meta have also faced significant declines — with Apple alone shedding -$529 billion in market cap (shoutout to Warren Buffet for selling the top).

Investors initially reacted positively to Trump’s re-election, expecting deregulation and favorable tax policies — but the latest economic uncertainty has reversed those gains. Analysts warn that continued trade tensions and potential regulatory shifts could further impact the valuations of major tech firms. For now, these are simply the -10% range of corrections that we warned of heading into 2025.

Tesla (TSLA) Stock Performance, 5-Year Chart, Seeking Alpha

“We believe investors will require either a catalyst that improves the economic growth outlook or clear asymmetry to the upside before they try to ‘catch the falling knife’ and reverse the recent market momentum.”

Klarna (KLAR) Officially Files for IPO

Source: Axi

Klarna filed for a U.S. IPO on the New York Stock Exchange under the ticker symbol KLAR but has not disclosed pricing details. The Swedish buy now, pay later lender, once valued at $46 billion, saw its valuation drop to $6.7 billion in 2022 but has since rebounded to an estimated $15 billion. Klarna competes with Affirm and Afterpay while expanding its financial services, including banking licenses and lending products.

The IPO highlights the ongoing trend of European tech firms opting for U.S. listings over domestic exchanges. Klarna’s revenue grew +24% to $2.8 billion in 2023, and it returned to profitability with an adjusted operating profit of $181 million. However, market volatility and economic uncertainty, including tariffs and consumer sentiment shifts, could impact its IPO performance.

“We want to accelerate our money transmitting licenses... [Klarna wants to] go after these horrendous credit card fees that American consumers are used to paying.”

Highlights from Cloudflare (NET) Investor Day

Source: NYSE / Cloudflare

Cloudflare’s Investor Day highlighted its strategic focus on AI integration, executive hires, and market expansion. The company is leveraging partnerships with OpenAI and Nvidia to enhance its AI-powered cloud security and performance solutions. Recent leadership appointments signal a commitment to scaling AI-driven operations, strengthening its competitive position.

Investors responded positively, with analysts highlighting Cloudflare’s potential to disrupt the AI infrastructure space. AI spending is projected to exceed $500 billion by 2027, reinforcing the importance of Cloudflare’s investments. As AI adoption accelerates — Cloudflare is positioning itself as a key player in AI-driven cloud security and performance optimization.

Cloudflare (NET) Stock Performance, 5-Year Chart, Seeking Alpha

“Cloudflare is well-positioned to capitalize on AI’s integration into cloud security. The strategic partnerships and leadership expansion indicate a clear roadmap toward sustained growth.”

Major Economic Events:

Inflation for consumers and producers came in with favorable results, and consumer sentiment continues to slump.

Inflation for Consumers (CPI)

US inflation eased to +2.8% in February, slightly below expectations, with core inflation at +3.1%. The consumer price index (CPI) rose just +0.2% for the month, providing some relief amid concerns about the impact of tariffs. Shelter costs — which make up a large portion of the CPI — increased +0.3%, while food and energy prices also rose +0.2%. Used vehicle prices jumped +0.9%, but airline fares dropped -4%.

The stock market showed mixed reactions, while Treasury yields rose as investors weighed inflation trends against policy uncertainty. Economists warn that tariffs could still fuel inflation in the coming months, despite the current easing. The Federal Reserve is expected to hold rates steady at its upcoming meeting but may resume cuts later this year if inflation continues to decline.

“A lot of this inflation data does not incorporate what is to come and what already has happened for tariffs. The vagaries and uncertainties associated with policy are still a much stronger force in the market than anything CPI-related or in terms of one data point.”

Inflation for Producers (PPI)

US wholesale inflation stalled in February as the producer price index remained unchanged, following a +0.6% rise in January. A -1% drop in trade services contributed to the stagnation, but goods prices excluding food and energy rose +0.4%, the highest in over two years. Key categories influencing the Fed’s preferred inflation measure, such as hospital inpatient care and portfolio management costs, showed notable increases.

Economists suggest that while consumers may be shielded from some price hikes, weak demand for goods later this year could pressure retailers’ margins. The report comes as new tariffs on Chinese imports raise concerns about future price increases. Meanwhile, jobless claims showed little change — reflecting continued labor market resilience.

“With consumers’ confidence weak and many people already having brought forwards purchases of durable goods, demand for goods will be very weak later this year, forcing retailers to accept thinner margins.”

Consumer Sentiment

US consumer sentiment plunged to a more than two-year low in March, with the University of Michigan index falling to 57.9 from 64.7 in February. Consumers' long-term inflation expectations surged by the most since 1993 — reaching +3.9% for the next five to ten years. Tariffs were a major concern, with 48% of survey respondents mentioning them and expecting inflationary pressure.

The drop in confidence was widespread across political groups, with the biggest decline among Democrats. Consumers also reported the dimmest outlook for their personal finances on record, raising fears of weaker spending. Economists warn that heightened uncertainty and economic anxiety could significantly slow economic growth.

“Many consumers cited the high level of uncertainty around policy and other economic factors; frequent gyrations in economic policies make it very difficult for consumers to plan for the future, regardless of one’s policy preferences.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Cover image source: Axi

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]

Reply