- GRIT

- Posts

- 🤖 Earnings Analysis on Tesla & Alphabet

🤖 Earnings Analysis on Tesla & Alphabet

& my biggest portfolio winners year-to-date

Happy Sunday.

This Sunday is going to be a bit different. Given the amount of inbound we received this week asking for in-depth analysis on Tesla and Alphabet quarterly earnings — we’re going to focus entirely on that.

Strap in!

Before we get started, we wanted to offer a warm welcome to the +838 new subscribers who joined us this week, and the 3,699 of you who have joined us so far throughout the month of July!

In case you’re new around here, I’m Austin Hankwitz — I’ve been publishing earnings analysis on publicly-traded companies for over half a decade. My podcast, Rich Habits, has hit #1 on Spotify’s Business Podcast chart four times since it’s inception only two years ago.

At the start of 2023, I began my journey of building a $2M Dividend Growth Portfolio from scratch. This twice-weekly newsletter is how I keep you all updated on my progress.

For me, early retirement means $2M invested. For you, it might mean something else. Regardless of your early-retirement number — I hope these weekly synopses of my portfolio progress + what’s been happening in the markets helps you on your own journey.

Every Sunday, we publish the internet’s best summary of what happened in the markets the week prior — earnings analysis, acquisition announcements, economic data, world news, and more.

If you want full access to that info, my portfolio, legendary investor portfolios, livestreams, resources, and more — click here!

Your finances deserve real attention... not guesswork.

Whether you’re planning for retirement, growing your savings, or just trying to make smarter money decisions, it helps to have someone in your corner. That’s where Money Pickle comes in.

We match you with a licensed, SEC-registered financial advisor for a free 1-on-1 conversation — no pressure, no obligation. It’s a simple way to get clarity, avoid costly mistakes, and see if working with an advisor could be the right next step.

Your future self will thank you.

👉 Portfolio Updates (YTD Performance):

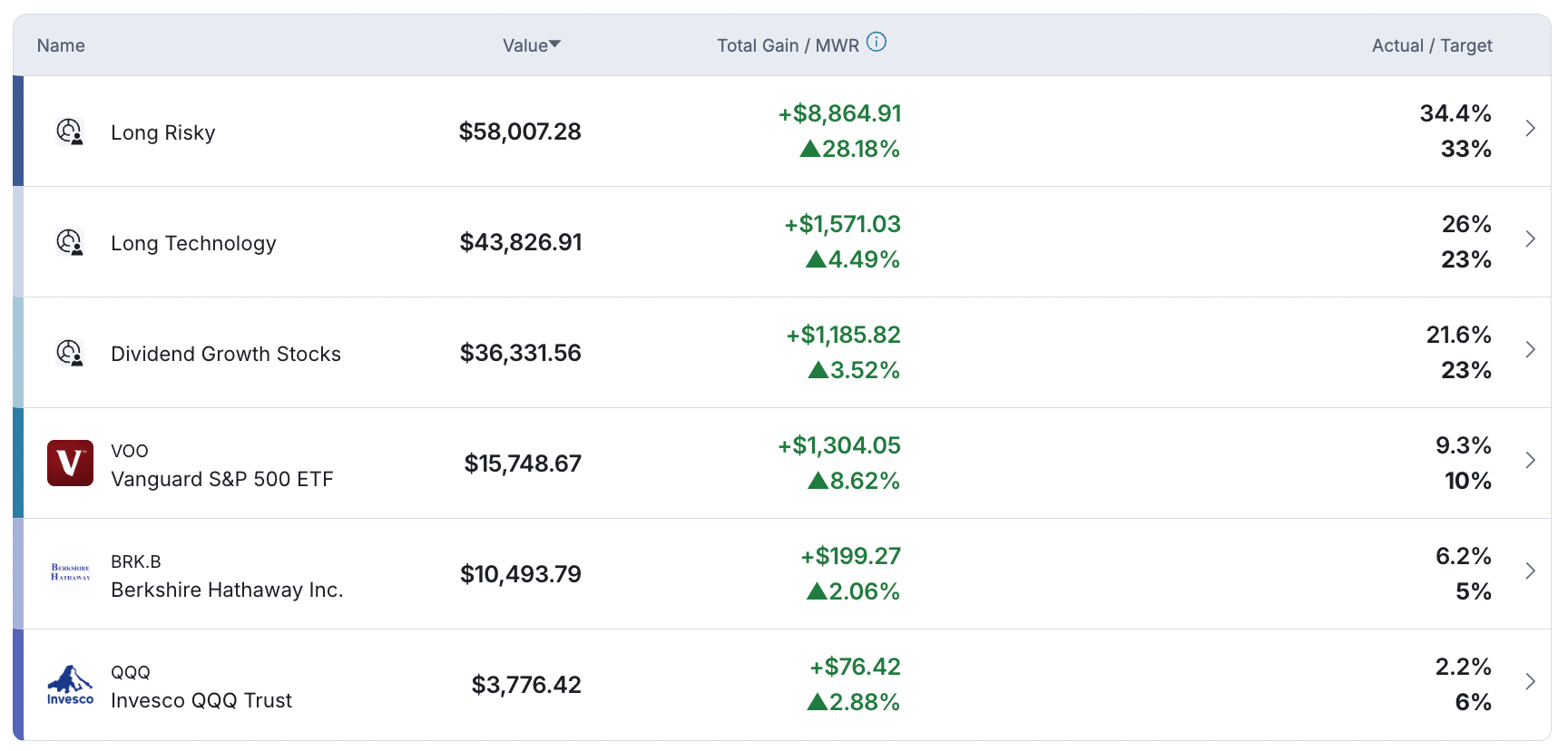

The stock section of the portfolio is trending in the right direction, cumulatively up nearly +11% year-to-date. This outperformance has been catalyzed by the “Long Risky” subsection trending higher. Below is a screenshot of some of the best-performing positions in that subsection of the portfolio — all year-to-date performance.

If you want to see every winning position in my portfolio, subscribe to GRIT VIP — it’s only $1 per day ($31 / month).

The income-side of my portfolio is also trending in the right direction thanks to NEOS ETFs. I was paid $788 on Friday, representing a 17.5% annual yield. I’ll be reinvesting this $788 back into the same funds that paid me.

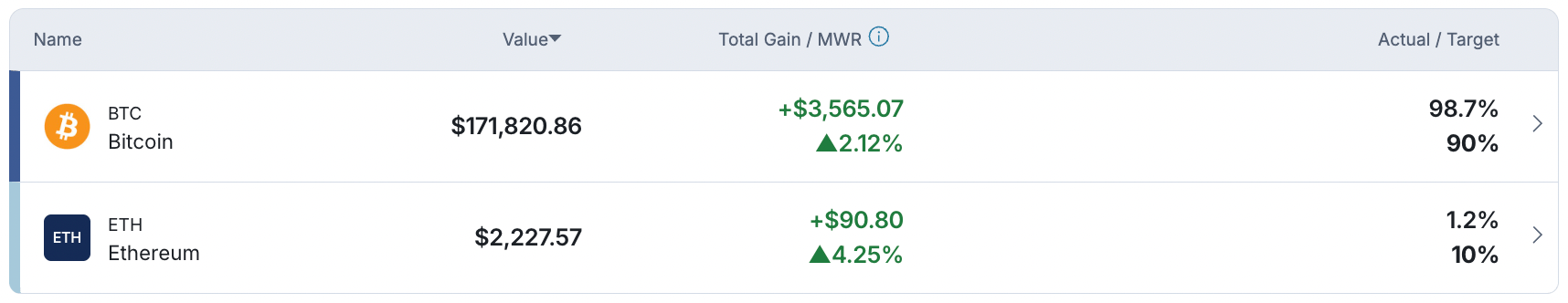

The crypto section of my portfolio is seeing green — with Bitcoin and Ethereum both enjoying some summer momentum.

I continue to believe Bitcoin will trend toward $145K, Ethereum toward $6,000, and Chainlink toward $40 over the coming months. I very much plan to exit 80-90% of my total cryptocurrency position and redeploy that capital into stocks.

Want to see every position inside my stock and crypto portfolio?

Click here to become a Premium subscriber for $31 / month. You’ll also unlock access to our monthly livestreams, GRIT Guides on Investing, and more.

👉 Key Earnings Announcements:

Trump’s tariffs will cost Tesla $300 million, and Alphabet is processing 980 trillion tokens per month.

Tesla (TSLA)

Key Metrics

Revenue: $22.5 billion, compared to $25.5 billion last year

Operating Income: $923.0 million, compared to $1.6 billion last year

Profits: $1.2 billion, compared to $1.4 billion last year

Earnings Release Callout

“Q2 2025 was a seminal point in Tesla’s history: the beginning of our transition from leading the electric vehicle and renewable energy industries to also becoming a leader in AI, robotics and related services.

Our priorities remain the same: delivering affordable and compelling autonomy-capable models that maximize our global fleet of vehicles as our autonomy software continues to rapidly progress, growing the Energy business and advancing our robotics efforts.

My Takeaway

On the surface, everything is trending lower. Revenue is down -12%, operating income is down -42%, and net income (profits) is down -14%. Let’s unpack everything to get a better understanding of what going on behind the scenes, what could be in the cards for Tesla down the road, and ask ourselves if we should continue to own this stock.

👉 Financial Highlights —

Tesla’s automotive revenues contracted -16% YoY due to a decline in deliveries, increased competition (especially in China), and supply chain disruptions caused by tariffs. Their energy storage business set a 12th consecutive quarterly record in number of deployments, despite a (you guessed it) YoY decline in revenue. Their regulatory credit revenue also declined YoY.

Despite these YoY declines, their automotive cost per goods sold reached a record low ($35,100) due to ongoing efficiency gains. Additionally, their energy storage business experienced record high gross margins due to strong demand for their Powerwall and Megapack products.

👉 Operational Highlights —

Tesla successfully launched their Robotaxi service in Austin, TX. As shared above (in bold), Elon believes this quarter marks the beginning of a transition toward AI, robotics, and related services. Elon stated on the earnings call his intention to offer Tesla’s Robotaxi service to ~50% of the US population by the end of 2025. Elon emphasized how well FSD (full-self driving) is being adopted by customers — and believes unsupervised FSD will be available to all US customers for personal use by the end of the year.

Elon stated Tesla’s intention to introduce a new, cheaper vehicle by Q4 of 2025. Musk emphasized balancing cost reduction with profitability, targeting a total cost of ownership per mile competitive with ride-sharing and public transit.

Musk reiterated that Tesla’s long-term value lies in becoming the world’s most valuable company through autonomous vehicles and humanoid robots, potentially surpassing the combined value of the next five largest companies.

👉 Challenges —

There have been countless challenges for this company over the last several months — starting with tariffs. Elon mentioned how tariffs, specifically on Chinese suppliers, is a major challenge that caused limited vehicles to be available in the US thus far in Q3. Additionally, the $7,500 EV tax credit is set to expire in September — which could add strain to an existing smaller-than-normal inventory as buyers rush in to take advantage of the credit before it expires.

👉 What’s the Verdict?

Let’s walk through the Bull case, and the Bear case — starting with the Bull.

Tesla is still an EV leader around the world. They generate ~70% of their revenue from their automotive business, and this business segment will continue to generate tens of billions in annual revenue for the company. Tesla has ~50% EV market share in the United States, with a Supercharger Network to match. They own and operate the world’s largest fast charging network with 70,228 connectors.

Their full self-driving technology is best in class — using cameras and neural networks. They’ve noted potential licensing opportunities in the future, and their Robotaxi business is underpinned by this technology. This business is slated to address half the US population by the end of the year (assuming regulatory approval). I believe this business segment will have a material impact on Tesla’s financials by the end of 2026.

Their non-automotive gross profit margins are at record highs, driven by continued demand in Megapack and Powerwall. Finally, Elon expects Optimus 3 prototypes by the end of 2025, with scale production in 2026. Within five years, Elon believes it could produce 100,000 robots per month.

Now the Bear case — starting with interest rates. Elevated interest rates = lower demand for debt by US consumers, and lower vehicle sales because of it. This negatively impacts automobile margins as Tesla has to continually drop vehicle prices to move inventory. Chinese competition continues to rollout EVs at low costs. These vehicles are gaining strong traction in select markets, and threat Tesla’s global market share.

Full self-driving is very much a bullish talking point, however, lack of execution here by the management team turns this into a potential major drag. Slower-than-expected adoption, insurance issues, and / or government regulatory headwinds could blow all of Elon’s plans right up.

Finally, Elon is general. Sure, he’s a once in a lifetime inventor and visionary — but his relationship with Donald Trump, worldwide backlash, and “go F yourself” mentality absolutely is a drag on the business. Speaking on Donald Trump, his tariffs could cost Tesla up to $300M.

I think Tesla stock is fairly-priced — maybe even mildly over-valued. As we think about the future of this company, automobiles aren’t it. Sure, they drive the majority of the revenue for the business today, but the writing is on the wall with Chinese competitors. That’s why Elon is so aggressively diversifying his business away from vehicles — robotaxis, energy storage, Optimus, etc.

Fast forward five years and Tesla’s business is going to look entirely different than it does today. If you’re like me, you’re investing into that “five years into the future” Tesla — not the current business (slowing vehicle sales, historically low margins, etc.)

Alphabet (GOOGL)

Key Metrics

Revenue: $96.4 billion, an increase of +14% YoY

Operating Income: $31.3 billion, an increase of +14% YoY

Profits: $28.2 billion, an increase of +19% YoY

Earnings Release Callout

“We had a standout quarter, with robust growth across the company. We are leading at the frontier of AI and shipping at an incredible pace. AI is positively impacting every part of the business, driving strong momentum.

Search delivered double-digit revenue growth, and our new features, like AI Overviews and AI Mode, are performing well. We continue to see strong performance in YouTube as well as subscriptions offerings. And Cloud had strong growth in revenues, backlog and profitability. Its annual revenue run-rate is now more than $50 billion. With this strong and growing demand for our Cloud products and services, we are increasing our investment in capital expenditures in 2025 to approximately $85 billion and are excited by the opportunity ahead.”

My Takeaway

On the surface, everything is trending in the right direction. Total revenue is up, their operating margins remains steady, Search revenue is climbing, Cloud revenue is climbing, and the company announced their intention to reinvest $85 billion back into their business to ride this AI wave even higher. Let’s dig in.

👉 Financial Highlights —

Alphabet’s financial performance during the quarter was incredible — revenue and profits both came in higher than expected driven by double-digit growth in Search, YouTube, and Cloud.

Google Search revenue climbed by +12% YoY. AI Overviews are now serving 2 billion monthly users — with AI Mode enhancing reasoning and multimodal functions. Google’s Cloud business grew by +32% and their backlog climbed to $106 billion. The number of $1 billion-plus deals signed during the first half of 2025 matched all of 2024 — net new customers grew by +28% quarter-over-quarter.

Capital expenditures came in at $22.4 billion, with 67% of that being invested into servers and 33% into data centers and networking equipment. Alphabet also returned $13.6 billion to shareholders via repurchases and $2.5 billion in dividends during the quarter — with a $70 billion share repurchase authorization and a +5% dividend increase.

👉 Operational Highlights —

Sundar Pichai emphasized Alphabet’s AI stack, comprising of infrastructure, research, and tooling. Nearly all generative AI unicorns use Google Cloud, and leading AI labs leverage Google’s TPUs. Gemini usage grew 35X YoY, with over 85,000 enterprises building with Gemini. Alphabet’s open-source Agent Development Kit experiences over 1 million downloads in its first three months.

Waymo is expanding to Austin, Atlanta, and Miami, with its first international road trip planned for Tokyo. The sixth generation Waymo Driver aims to lower hardware costs, enhancing its scalability. Pichai highlighted Waymo’s progress in airport access and freeway driving, positioning it as a leader in autonomous mobility.

👉 Challenges —

I wouldn’t say that rising CapEx is exactly a challenge, although it does eat into free cash flow so I suppose it could be thought of as one. Management announced a $10 billion hike in 2025 capital expenditure guidance to $85 billion, driven by Cloud and AI infrastructure. Management also noted macro pressures could negatively impact ad spending during the back-half of 2025. And finally, Alphabet had a $1.4 billion charge related to a Texas data privacy lawsuit. The company continues to deal with ongoing scrutiny from the government over data privacy, antitrust, and AI regulation.

👉 What’s the Verdict?

Let’s walk through the Bull case, and the Bear case — starting with the Bull.

Google is a hell of a cash cow. Their Search business continues to grow by double-digits despite everyone thinking “ChatGPT is going to replace Google.” Their Cloud business continues to grow by 30%+ despite Microsoft and Amazon’s existing market share. They’re reinvesting these profits back into the business to ensure positioning for future growth.

From an AI perspective — Google is now processing 980 trillion tokens per month, up +100% since May. Gemini users have grown to 450M. AI Overview has hit 2 billion monthly active users. The AI Era is entering a phase of steepening capital intensity, and Google has never been better positioned.

Waymo has expanded their San Francisco and Los Angeles service regions by +50% over the last three months, the Austin service area doubled in size, and Atlanta launched through Uber during the quarter. Waymo reached 100 million autonomous miles on public roads across 10 million paid rides. Testing has commenced across 11 cities so far this year including NYC, Philadelphia, San Antonio, Orlando, New Orleans, Nashville, Houston, Boston, Dallas, Las Vegas, and San Diego.

Now the Bear case — antitrust lawsuits and regulatory overhang continue to be the story here. This $1.4 billion law suit settlement ate away ~3% of their operating margins during the quarter. This type of scrutiny could escalate with AI and data privacy regulations, increasing costs and constraining innovation. Additionally, finding the right balance between capital expenditures to the tune of $85 billion and AI-specific revenue is tough.

I think Alphabet stock is undervalued. Over the last several quarters, the negative sentiment around Alphabet stock was the perceived negative risk of generative AI on their Search business. These concerns are overdone, with Alphabet validating its ability to navigate this in the near-term with AI Overview, Gemini, and several other monetizing products. Google Search revenue growth even exceeded Wall Street’s estimates by +3%.

Additionally, their Cloud business is both growing like a weed and is finally profitable. If we look forward 3-5 years, I believe Alphabet stock will be much, much higher than it is today. A near-term price target (12-18 months) would be somewhere between $225-235. Very excited about the future of this company.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

Cover image source: Delta Flight Museum

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]