- GRIT

- Posts

- 👉 Earnings Season Back in Full Swing

👉 Earnings Season Back in Full Swing

Netflix, Procter & Gamble, Taiwan Semiconductor

Welcome to your new week.

Here’s your FINAL REMINDER to sign up for the Q4 Forecast Webinar on Thursday! It’s free and will be recorded! Click here to sign up in a few seconds.

Cheers to the two-year anniversary of the current bull market!

Here are three images we think you’ll like.

1) Perspective on the length of this bull market:

2) The 2-year rate of change is in the 95th percentile for the last 70 years:

Source: Anuron Mitra, SA News Editor

3) Visualizing the length and magnitude of the S&P 500's secular bull and bear markets:

Let’s dive into everything that you should be watching in the market.

What do Nvidia and Amazon have in common?

This is a paid advertisement for Miso Robotics’ Regulation A offering. Please read the offering circular at invest.misorobotics.com.

Well, other than trillion-dollar market caps. Both Nvidia and Amazon chose to collaborate with Miso. Miso’s the leader in AI-powered kitchen robots. That’s why Nvidia offered Miso its premier AI vision tech, and Amazon handpicked Miso to partner and use its RoboMaker simulation environment. Now, Miso launched their first commercial AI-powered robot, and it sold out in seven days. On the back of that success, they’re focused on scaling to 170+ US fast food brands in need.

Key Earnings Announcements:

Big banks, Netflix, Procter & Gamble, and Taiwan Semi headline this week’s earnings reports.

Monday (10/14): N/A

Tuesday (10/15): Bank of America, Citi, Charles Schwab, Interactive Brokers, Goldman Sachs, State Street, United Airlines, UnitedHealth Group

Wednesday (10/16): Abbott, ASML, Discover, Morgan Stanley, US Bancorp

Thursday (10/17): Blackstone Group, Intuitive Surgical, Netflix, TSMC

Friday (10/18): Ally, American Express, Procter & Gamble

What We’re Watching:

Bank of America (BAC)

Bank of America (BAC) reports Q3 earnings tomorrow, amid heightened attention from investors following Warren Buffett’s Berkshire Hathaway (BRK.B) sale of over 9.5M BAC shares last week.

Despite the sell-off, Noah's Arc Capital Management remains bullish, citing the company’s AI advancements could drive cost savings and potentially deliver an earnings surprise. Meanwhile, Seeking Alpha’s Quant Rating and Wall Street analysts maintain a Strong Buy consensus, seeing upside potential in the company’s consumer trends. However, many view Buffett's sales might signal caution ahead of a possible bear market, as Bank of America’s stock continues to underperform compared to the S&P 500.

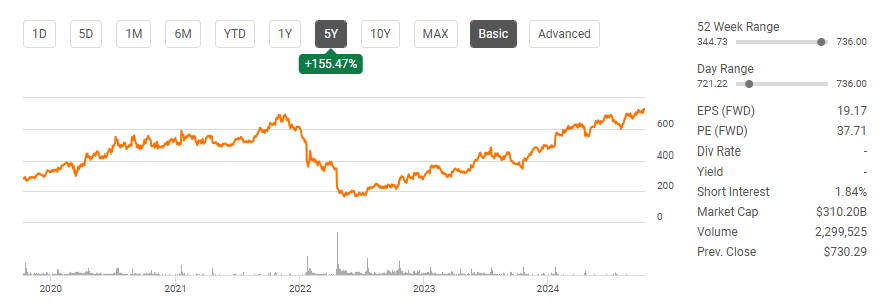

Bank of America Corp. (BAC) Stock Performance, 5-Year Chart, Seeking Alpha

Netflix (NFLX)

Netflix (NFLX) is set to release its Q3 earnings on Thursday after the closing bell, with analysts anticipating 37% Y/Y profit growth and a 14% boost in revenue. NFLX stock has climbed over +96% in the past year and nearly +50% YTD, maintaining a Buy recommendation from most analysts.

Key drivers, such as password-sharing limits, ads, and pricing strategies, are expected to support growth. However, opinions vary — while Oppenheimer and Morgan Stanley are bullish on sustained revenue gains, Citi Research remains Neutral, highlighting challenges in reaching a $25 EPS target by 2025. Despite mixed ratings, Netflix's stronghold in streaming remains a consensus view.

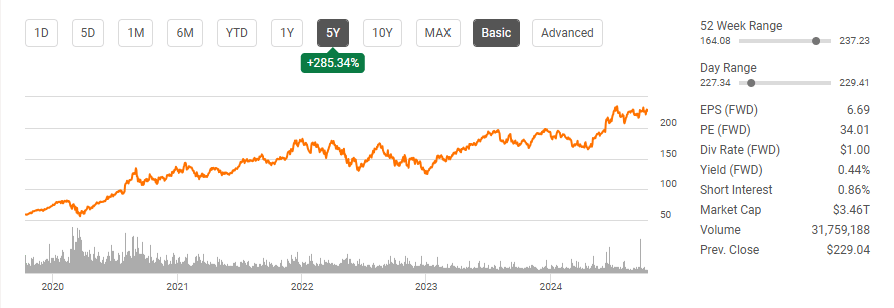

Netflix, Inc. (NFLX) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs

Speculation is rising over the Fed skipping a rate cut, and Apple Vision Pro continues to see struggles.

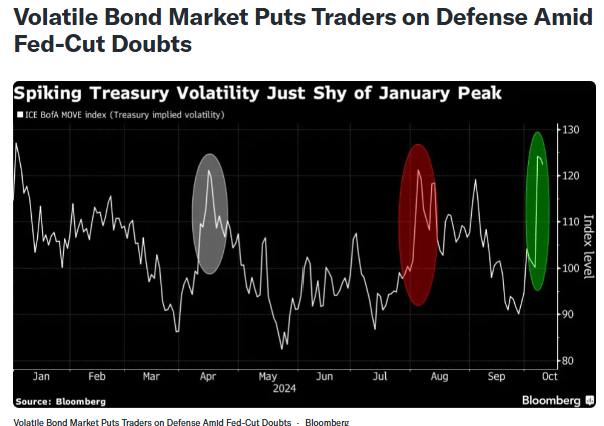

Fed Rate Cuts: On Hold for Now?

Source: CME FedWatch Tool

Speculation is rising that the Fed will skip further rate cuts in November. September’s jobs report, showing a dip in unemployment and strong payroll additions, along with higher-than-expected CPI and PPI readings, suggest the Fed may hold steady.

Minutes from the Fed's September meeting revealed that some officials favored smaller rate cuts, reinforcing this outlook. With the likelihood of no November cut now at 11.4% — up from 3% just a week ago — investors are bracing for a possible rate hold amid strong labor and inflation data.

“As long as inflation remains above 2% and the labor market holds up, there's little reason for the Fed to cut again this year.”

Apple’s (AAPL) Vision Pro Battles Low Demand

Since the Vision Pro’s February launch, app releases have slowed, and sales have struggled to reach 100,000 units per quarter. Priced at $3,499, the mixed-reality headset has found limited appeal amid inflation and high-interest rates.

Bloomberg reports Apple (AAPL) may launch a lower-cost Vision headset as early as next year, priced around $2,000, which could omit features like EyeSight to cut costs. Apple aims to boost sales by expanding its mixed-reality offerings, potentially introducing smart glasses and AirPods with cameras. By broadening its product line, Apple hopes to recover its substantial investments in visual intelligence technology.

Apple, Inc. (APPL) Stock Performance, 5-Year Chart, Seeking Alpha

“The bigger problem for Apple right now is that it's not getting new technology out the door quickly enough… It [Apple] is no longer the leader in several critical new technologies, and that's scary.”

Major Economic Events:

The Empire State Manufacturing Survey and retail sales are in focus.

Monday (10/14): Columbus Day Holiday, Bond Market Closed, Fed Reserve Governor Waller Speaks

Tuesday (10/15): Empire State Manufacturing Survey, Fed Governor Kugler Speaks

Wednesday (10/16): Import Price Index

Thursday (10/17): Business Inventories, Capacity Utilization, Home Builder Confidence Index, Industrial Production, Initial Jobless Claims, Philly Fed Manufacturing Index, U.S. Retail Sales

Friday (10/18): Building Permits, Fed Reserve Waller Speaks, Housing Starts

What We’re Watching:

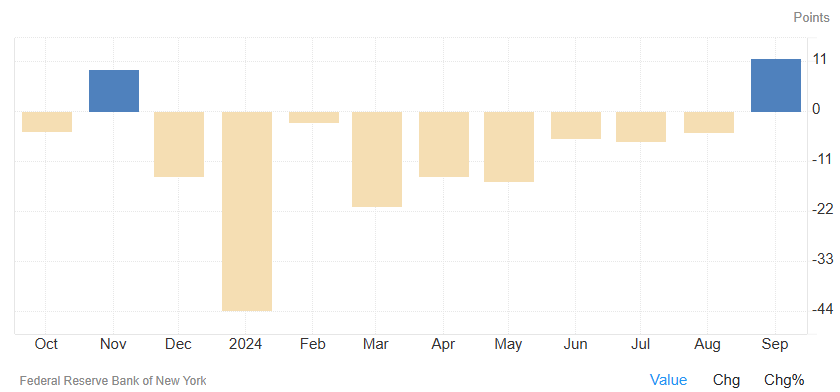

Empire State Manufacturing Index

Source: Trading Economics / Fed Reserve Bank of New York

September’s NY Empire State Manufacturing Index surged to 11.5 — marking the highest level since April 2022. This surprise leap from August’s -4.7 reading signals growth in New York’s manufacturing activity for the first time in nearly a year. New orders are up to 9.4 from -7.9 and shipments rising sharply to 17.9 from 0.3.

Economists are predicting a very moderate result of 0.5 points for the October results.

“The Empire State data have been subject to wide swings on a monthly basis for more than two years. A broader gauge of manufacturing across the US has been stuck in contraction territory for all but one month since October 2022 amid high borrowing costs, restrained business investment and uneven consumer spending.”

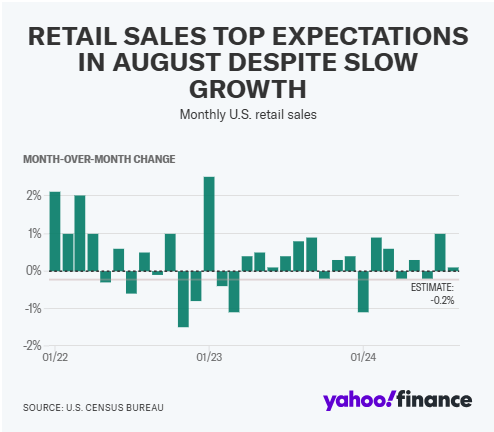

Retail Sales

On Thursday, the September retail sales report is due – economists are forecasting a 0.2% rise. This follows August’s unexpected 0.1% increase – beating the projected decline and highlighting resilient consumer spending. Strong retail data could further support the “no cut” stance going around for the Fed’s next meeting — keeping rates steady unchanged as some view the 50bps cut was large enough.

Economists are estimating +0.3% monthly growth in retail sales, +0.1% when excluding autos.

“Due to geopolitical tensions, uncertainty regarding election outcomes, anticipation of the port strike and lingering inflation in services, shoppers showed caution. However, year-over-year gains showed consumers were still spending on household priorities.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Cover Image Credit: Foundry / TechHive / Ben Patterson

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]

Reply