- GRIT

- Posts

- 👉 Election Time Volatility!

👉 Election Time Volatility!

Arm Holdings, Hims & Hers, Palantir

Welcome to your new week.

The U.S. Election Day is finally here. Remember… regardless of your personal preferences and your hope for the outcome — you are still in the driver’s seat for your life.

Politics and the government definitely matter. We regularly discuss the implications of government decisions on the economy and sometimes the stock market. However, you’re the CEO of your own journey! Remember that and enjoy popping some popcorn for Tuesday evening.

And by the way… do yourself a favor and don’t watch the news for days on end. Vote, and then remember that we’ve all got work to do and money to make!

Have you tried out Blossom yet?

Blossom is the NEW and rapidly-growing social media platform (with already over 175,000+ users) built specifically for investors.

On Blossom, you can transparently see the portfolios and trades of friends, family, and other users — while seamlessly tracking your portfolio to get in-depth insights.

If you love the stock market — you can stay up to date with market news, trends, and events amongst a community of DIY investors.

Whether you’ve been investing for years or are just getting started… Blossom’s thriving community empowers you to connect, learn, and share insights with fellow investors —all in one place.

Also, it’s completely free to join!

Click here to download Blossom Social!

This is a paid promotion by Blossom.

Key Earnings Announcements:

The heat of earnings season rolls on with Arm, Hims & Hers, Palantir, Qualcomm, and more…

Monday (11/4): Berkshire Hathaway, Constellation, Franklin Templeton, Hims & Hers, Palantir, Wynn Resorts

Tuesday (11/5): Apollos Global Management, Ferrari, Super Micro Computer

Wednesday (11/6): Arm Holdings, AMC, Celsius, CVS Health, Novo Nordisk, Qualcomm

Thursday (11/7): Arista Networks, Arbnb, Barrick, Block, Carlyle Group, DraftKings, DataDog, Fortinet, Gero Group, Moderna

Friday (11/8): Embraer, Icahn Enterprises, Sony

What We’re Watching:

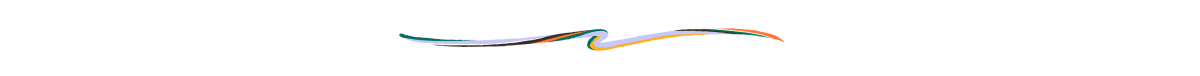

Arm Holdings (ARM)

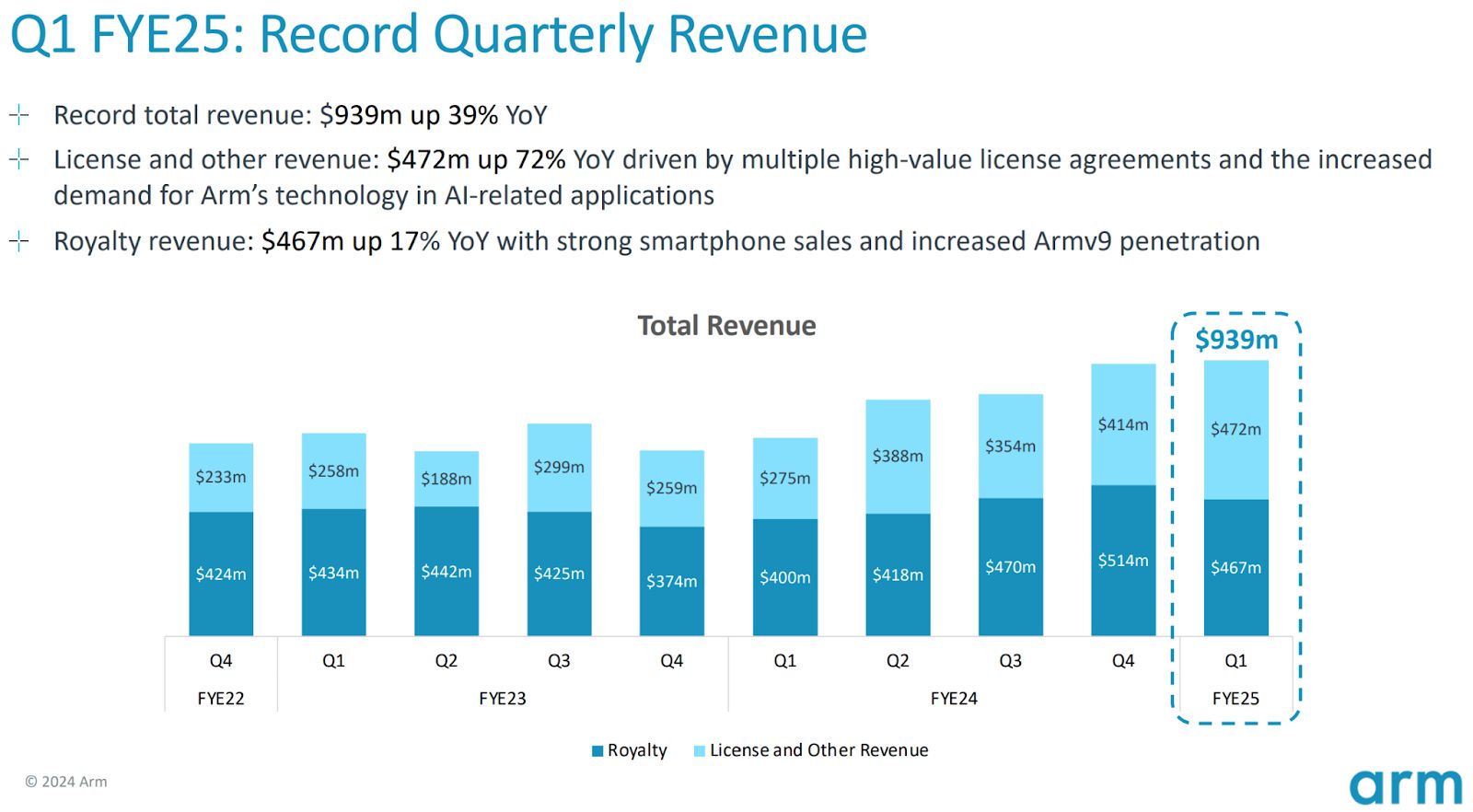

ARM Holdings (+88.3%) shows promising growth potential as more chip designers, including Nvidia and AMD, plan to release ARM-based CPUs and GPUs starting in 2025.

Currently, ARM-based PCs hold a 9.7% market share — with many analysts expecting it to increase because of advantages in power efficiency and customization. However, ARM's high valuation (FWD P/E of 97x) and conservative FY2025 guidance have raised concerns about near-term SaaS monetization and cash flow consistency.

Currently, ARM stock price is in the $150s, supported by bullish sentiment ahead of Q3'24 earnings. Market analysts are watching closely — especially with Microsoft’s exclusivity agreement with Qualcomm set to end in 2024 — which could accelerate ARM's market penetration in the coming years.

Arm Holdings (ARM) Stock Performance, 1-Year Chart, Seeking Alpha

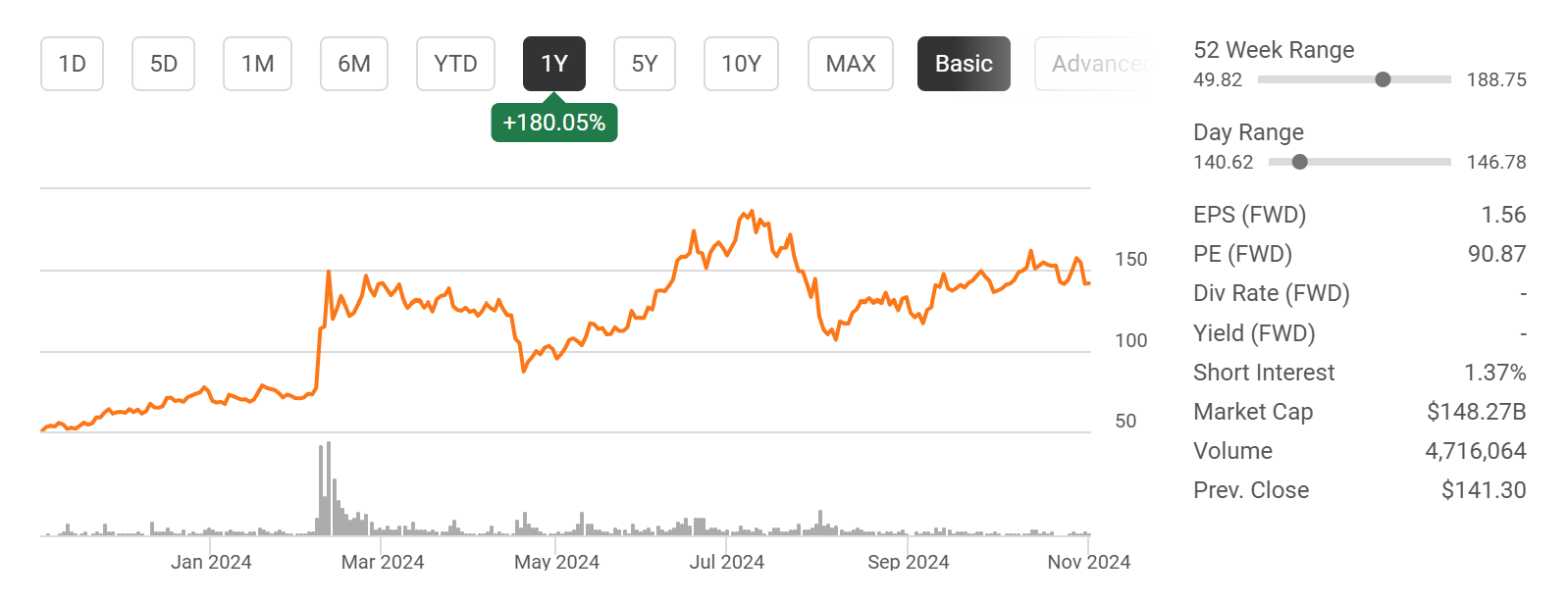

Palantir Technologies (PLTR)

Palantir Technologies (+144.2% YTD) is set to release Q3 earnings after the market closes today. The firm has forecasted Q3 revenue between $697M and $701M and adjusted operating income of $233M to $237M, following Q2’s 27.2% YoY revenue growth. Palantir's recent addition to the S&P 500, increased demand from both government & commercial sectors, and constant new partnerships highlight its sustained momentum.

Notably, Palantir secured a $178.4M contract to develop AI-powered TITAN prototypes for long-range precision in defense and a $99.8M contract with the DEVCOM Army Research Laboratory to expand AI access across multiple military branches.

Further strengthening its defense focus, Palantir’s recent partnership with Microsoft (MSFT) will integrate AI and cloud solutions to support critical national security missions within Microsoft's classified cloud environments. With 11 upward EPS revisions in the last 90 days, Palantir remains positioned for robust growth in AI and defense capabilities.

This is a stock that has absolutely ripped and Palantir CEO Alexander Karp has recently sold over $300M worth of shares. It’s a make-or-break moment for PLTR if it wants to continue upward momentum.

Palantir Technologies (PLTR) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

U.S. Presidential Election, The Future of AI Conference, & Nvidia/Intel swap places in the Dow.

Election Day

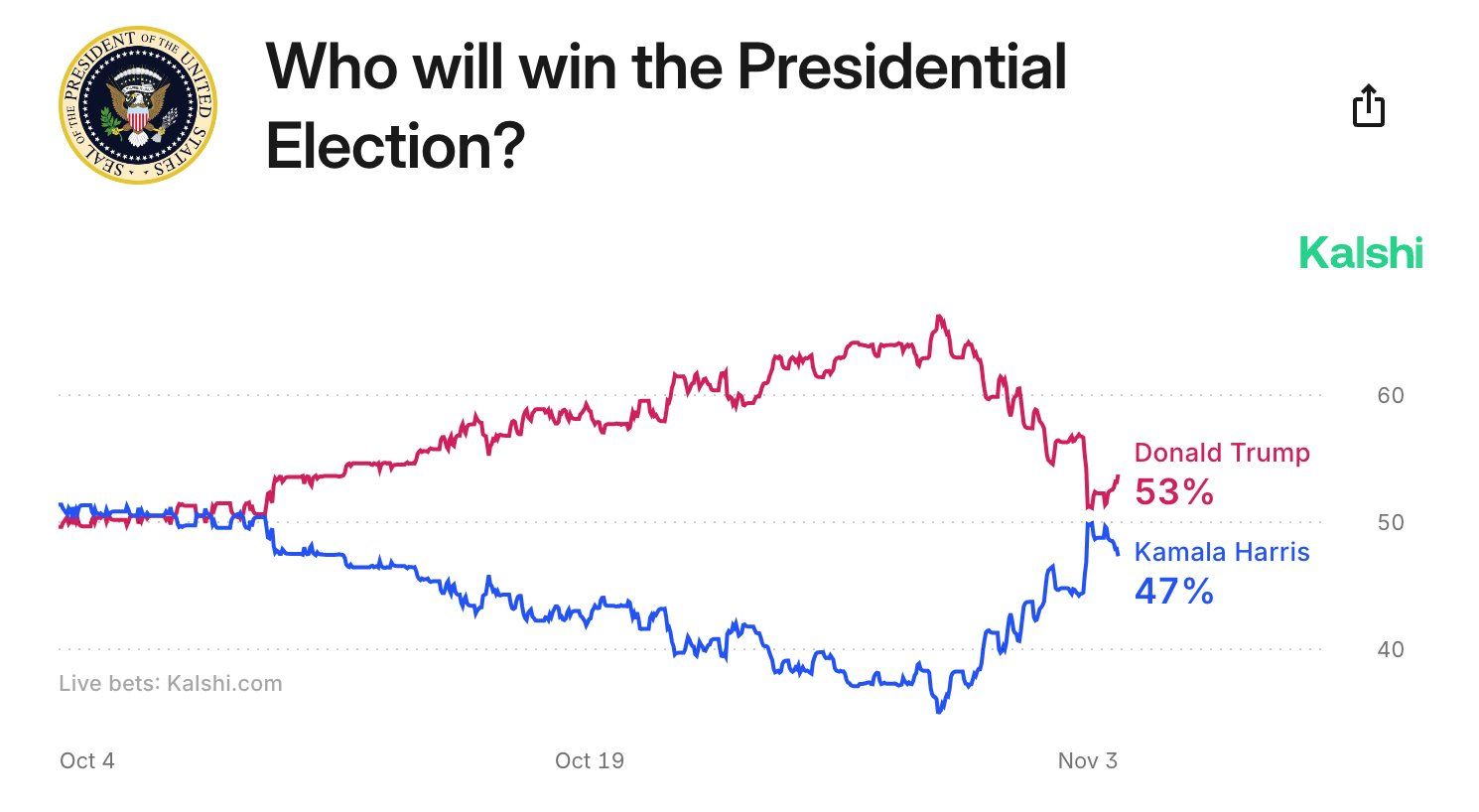

The 2024 presidential election on Tuesday, November 5th will be the most pivotal moment of the week, despite an unusually calm lead-up. October saw the second-lowest volatility for an election year in five decades, and the S&P 500 has posted a strong +20% YTD return.

Markets seem to be relatively prepared for either candidate to win.

Investors are long U.S. equities heading into November, more than they ever have been before a Presidential election. We're heading into the historically strong months for the S&P 500, and it will be interesting to see how rate cuts and the election influence this trend.

Not to mention — it will be very interesting to see how the markets could react if the election gets dragged out over many days. Whichever side wins — we would think that the market would appreciate a decisive victory.

“Markets continually crave certainty, which such a result would provide, and allow those who have hedged election-related risk to unwind those positions and re-enter the fray.”

The Future of AI Conference

The Financial Times Future of AI Summit returns in 2024 to explore the state of AI innovation and its transformative impact across industries. There will be discussions with top experts on real-world applications, investment trends, and the economic and societal implications of AI.

This has become a world-renowned event and we’re expecting to see major headlines as a result.

This two-day, in-person event brings together leaders in strategy, technology, and business, offering insights on scaling AI for growth, navigating ethical challenges, and driving innovation.

Key partners and speakers include, Google Deepmind, Microsoft, AWS, IBM, & more.

Nvidia & Intel Flip Flop

AI leader Nvidia (+174.3% YTD) will replace Intel in the Dow Jones Industrial Average (DJIA) starting November 8 — reflecting Nvidia’s rapid rise and dominance in the AI chip market. Nvidia’s market cap of $3.32 trillion makes it the world’s second-most valuable company — driven by surging demand for AI products.

Intel, once a pioneering tech addition to the DJIA, has struggled in 2024 (-53.8% YTD) lagging behind Nvidia and AMD in AI chip innovation.

“The index changes were initiated to ensure a more representative exposure to the semiconductors industry and the materials sector, respectively.”

Major Economic Events:

The next Fed interest rate decision and key insights on consumer sentiment are both coming this week.

Monday (11/4): Factory Orders

Tuesday (11/5): ISM Services, U.S. Trade Deficit

Wednesday (11/6): S&P final U.S. Services PMI

Thursday (11/7): Consumer Credit, FOMC Interest Rate Decision, Fed Chair Powell Press Conference, Initial Jobless Claims, U.S. Productivity

Friday (11/8): Consumer Sentiment, Fed Gov Bowman Speaks, Saint Louis Fed Pres Musalem Remarks

What We’re Watching:

FOMC Interest Rate Decision

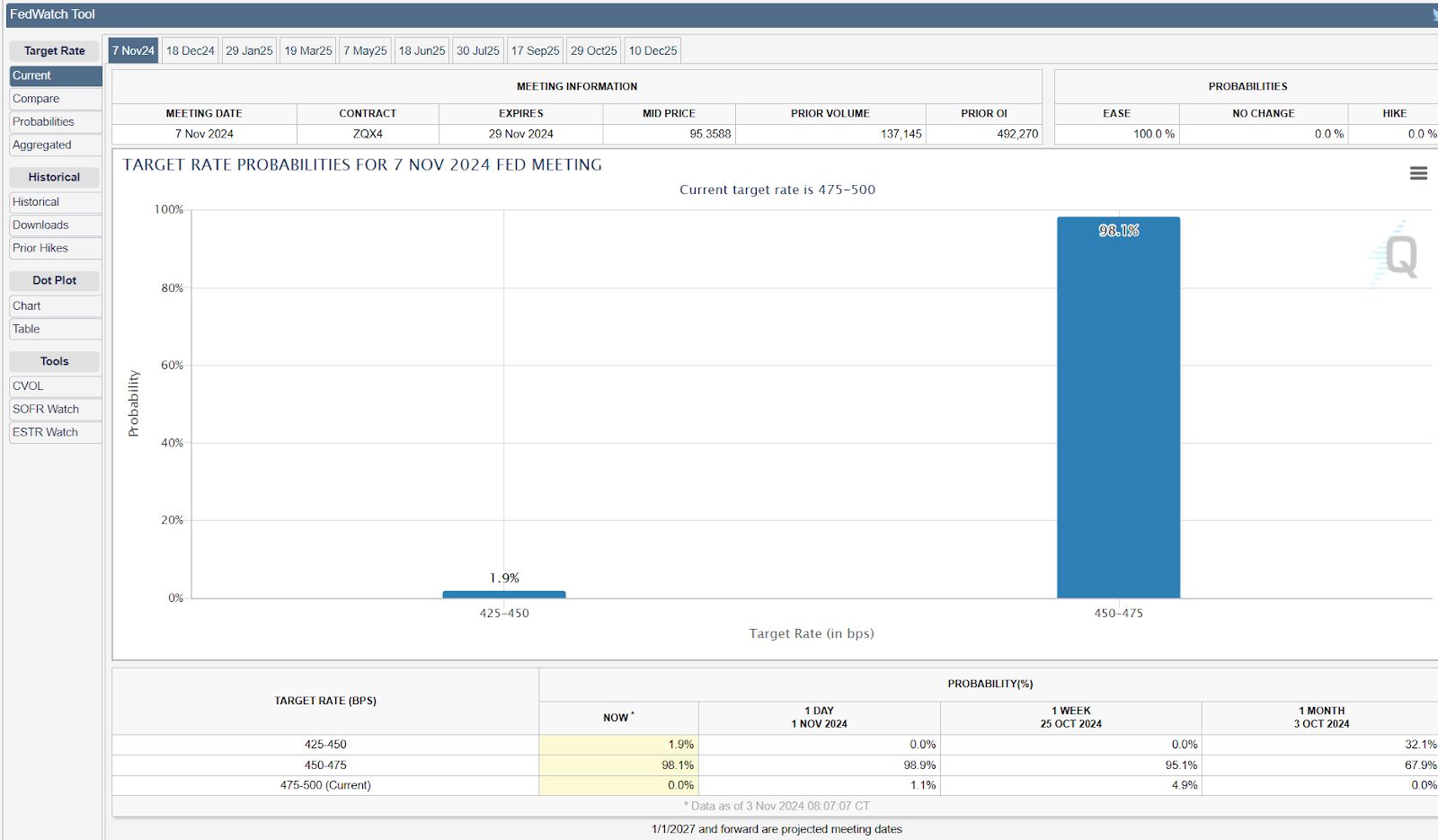

Source: CME FedWatch Tool

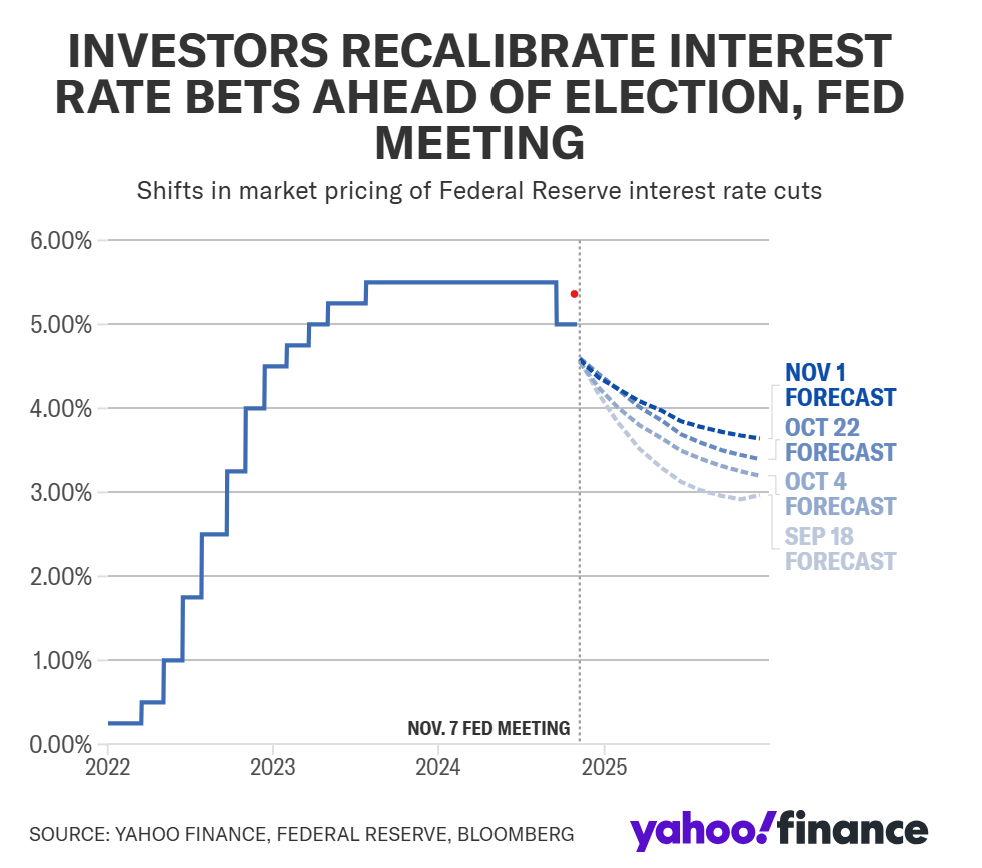

As the Federal Reserve prepares for its next policy announcement on Nov. 7, all eyes are on whether it will signal further rate cuts. While markets feel almost certain about a 25-basis-point cut, recent data on steady economic growth and persistent inflation challenges have led to adjusted expectations — with markets now pricing in about three fewer rate cuts through 2024 than initially forecasted following the Fed's September rate cut.

“Election aside, US policymakers have already communicated a desire to proceed with a more gradual pace of rate cuts after September’s half-point reduction.

Economists widely expect a quarter-point move on Thursday, followed by another in December — and their conviction grew after data on Friday showed the weakest hiring since 2020.”

Consumer Sentiment

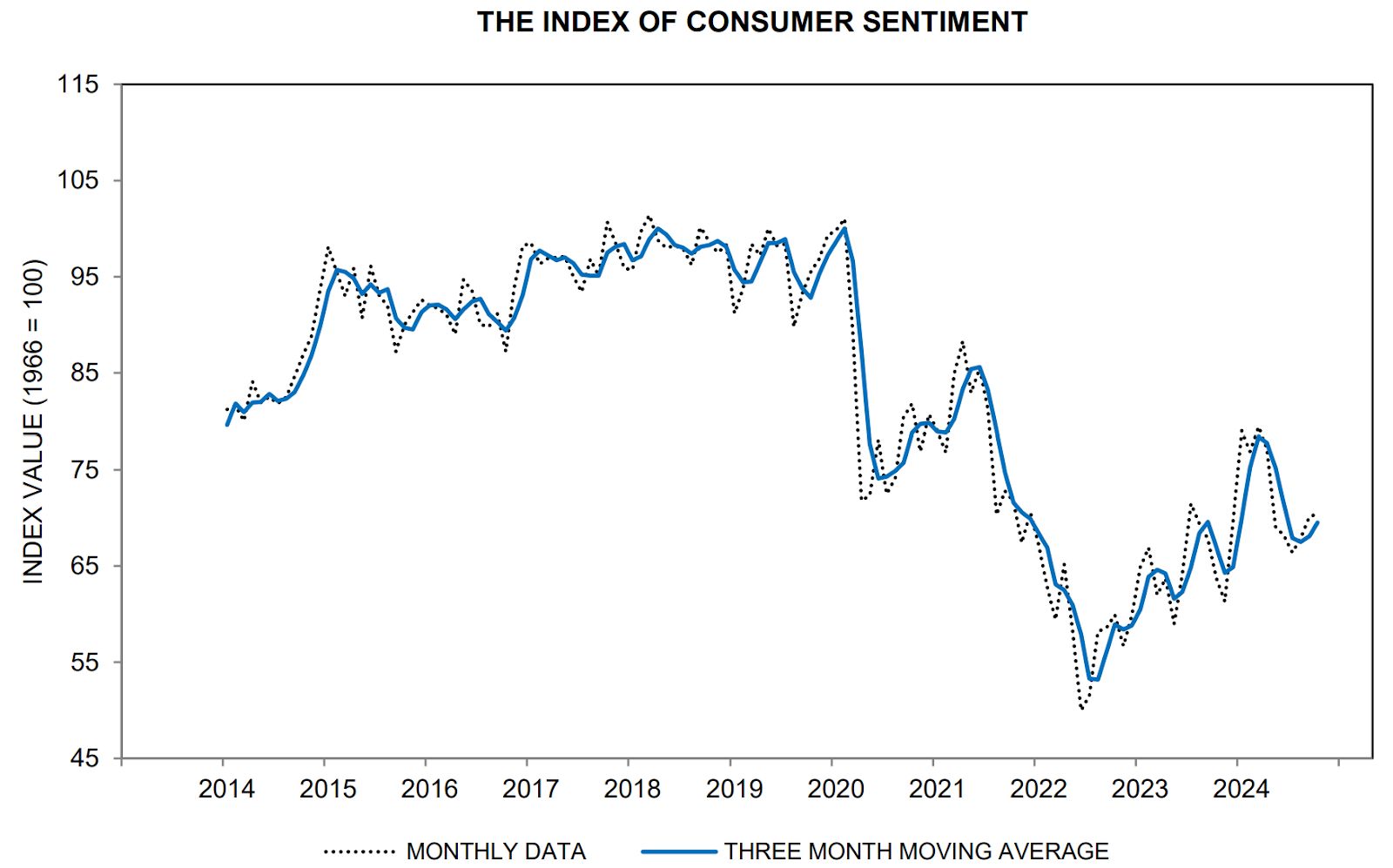

Source: Surveys of Consumers University of Michigan

The University of Michigan’s consumer sentiment index for October 2024 was revised up to 70.5, the highest in six months and marking three consecutive monthly gains.

Both current economic conditions (64.9) and future expectations (74.1) saw upward revisions, reflecting modest improvements in durable goods buying conditions as interest rates ease. The upcoming election of course has large implications for consumer sentiment as well.

“All year, consumers have repeatedly told us that the trajectory of the economy hinges on who becomes the next president.

Given the close nature of the presidential race, many consumers will be updating their expectations of the economy after the election is resolved, and sentiment may be somewhat unstable in the months ahead as consumers form their views on what the next presidency will look like.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Cover Image Credit: Palantir Press Release / David Biedert

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]

Reply