- GRIT

- Posts

- 👉 Fear-Filled Week in the Markets

👉 Fear-Filled Week in the Markets

BlackRock, Inflation, Taiwan Semi, UnitedHealth

Welcome to your new week.

Below is everything you need to know to ride the volatility of the market. As you know — I’m all-but-guaranteeing that it’s here to stay this year!

Let’s dive right in!

Fueled for Fortune

Wired's "rocket fuel of AI" label has Wall Street buzzing. Projections skyrocketing to $80 trillion, akin to 41 Amazons, signal a seismic shift. But here's the kicker: astute investors have a shot at riding the wave with a company primed for supremacy. Dive into The Motley Fool's exclusive report for your front-row seat.

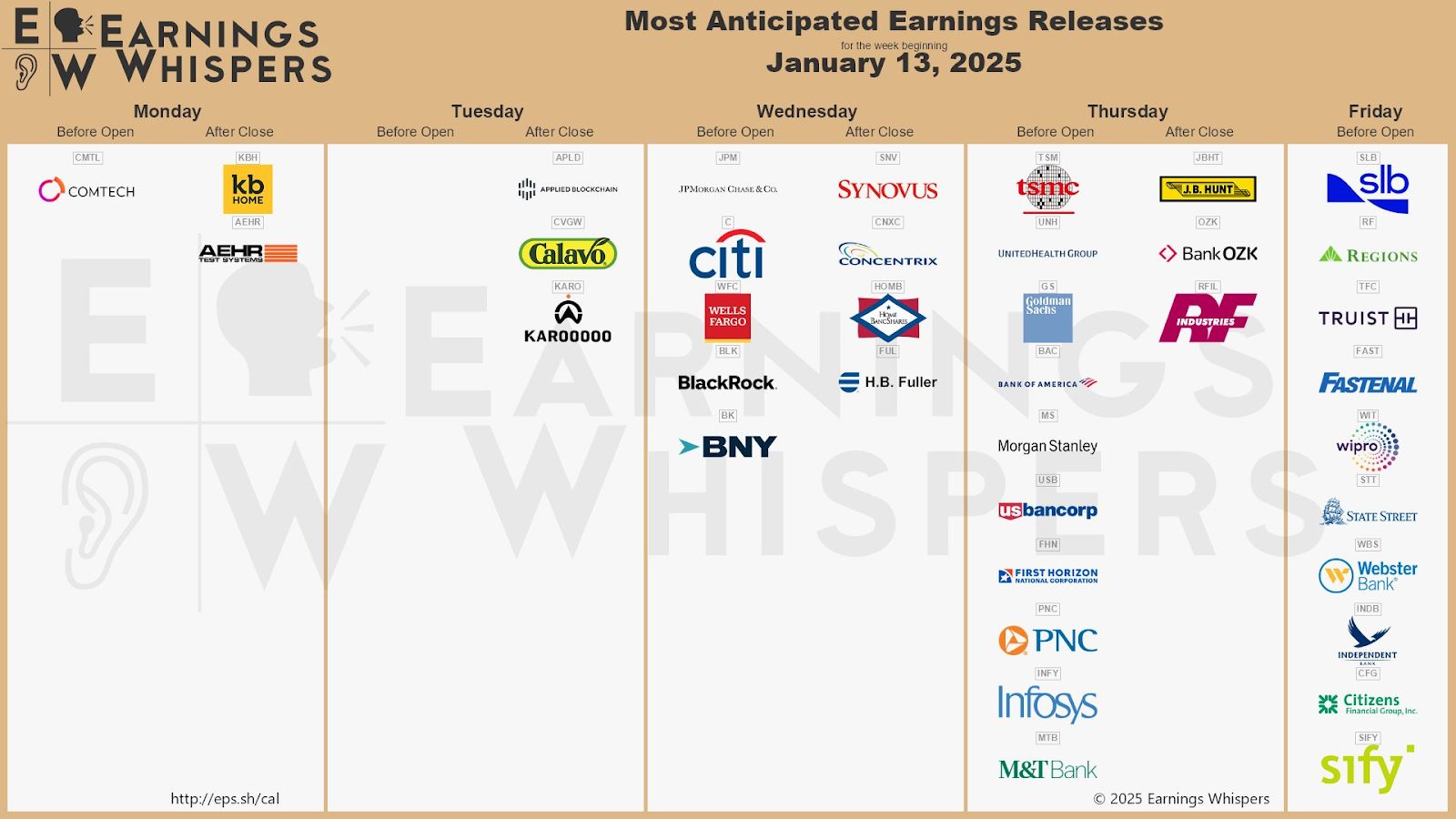

Key Earnings Announcements:

The first series of market-moving earnings reports for 2025 have arrived.

Monday (1/13): KB Home

Tuesday (1/14): Applied Blockchain

Wednesday (1/15): BlackRock, Citi, JPMorgan Chase, Wells Fargo

Thursday (1/16): Bank of America, Goldman Sachs, JB Hunt, Morgan Stanley, Taiwan Semi, UnitedHealth Group

Friday (1/17): Citizens Financial, Fastenal, Regions, State Street, Truist

What We’re Watching:

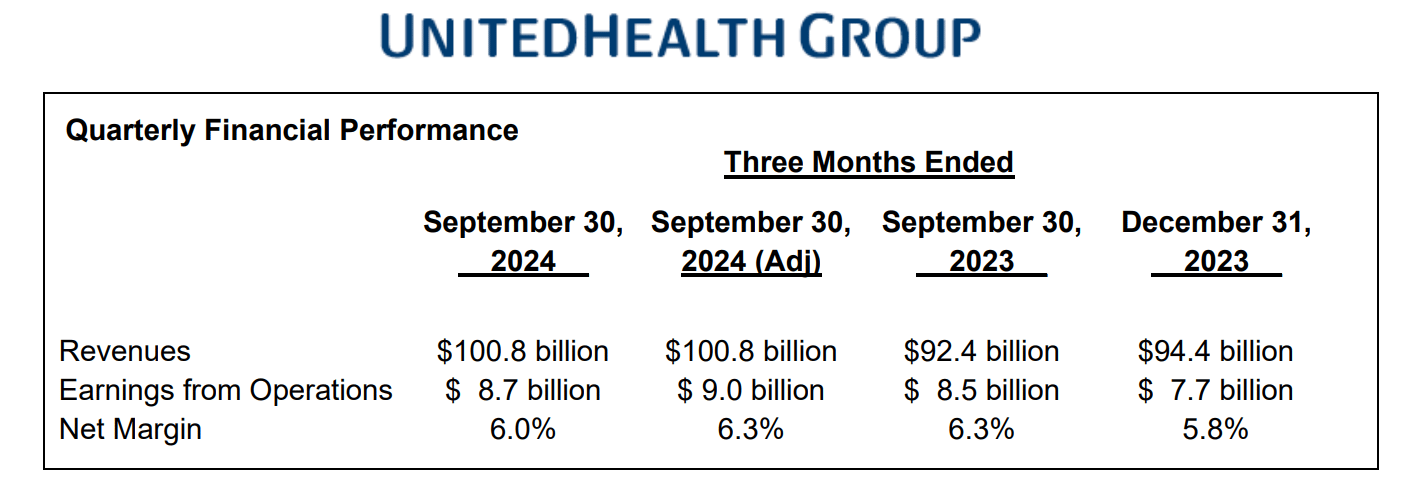

UnitedHealth Group Inc. (UNH)

UnitedHealth Group is scheduled to report Q4 earnings on January 16th. Despite a -3.1% decline over the past year, the company has consistently surpassed EPS estimates — driven by robust performance in its UnitedHealthcare and Optum segments. Attractive valuation metrics and a solid dividend profile suggest a potential buying opportunity.

However, recent events, including the tragic death of UnitedHealthcare CEO Brian Thompson, continue to present uncertainties. Additionally, shareholder concerns over healthcare denial practices and political pressures targeting industry consolidation present challenges.

Regardless — UnitedHealth's diversified operations and market leadership position it for continued stability and growth into 2025.

UnitedHealth Group, Inc. (UNH) Stock Performance, 5-Year Chart, Seeking Alpha

Taiwan Semiconductor Manufacturing Company (TSM)

Taiwan Semiconductor Manufacturing Co. (TSMC) continues to solidify its dominance as the leading AI foundry. It’s posted a +39% stock surge since May — fueled by soaring AI GPU demand and strategic global expansion.

Q4 earnings exceeded expectations, driven by strong revenue growth and the successful ramp-up of new facilities in Japan and the U.S. — reducing geopolitical risk.

TSMC reported a +34% YoY revenue jump in 2024, totaling $87.5B USD. Their most recent data in December alone showed +58% YoY acceleration to $8.4B USD for the month. Robust CapEx in the U.S. and Japan underscores TSMC's long-term strategy to mitigate China-related risks and capture growing AI data center demand.

Taiwan Semi (TSM) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

The January conference circuit continues to roll on. Headlines are guaranteed to come as a result.

ICR Retail Conference

Dubbed the “Super Bowl of consumer conferences” by Jim Cramer, the ICR Retail Conference brings together hundreds of public and private company leaders, institutional investors, analysts, bankers, private equity professionals, and select media to kick off the year with insights into consumer trends and market opportunities. The 27th annual ICR Retail Conference runs from January 13-15 in Orlando — with a busy three day lineup.

Attendees can join panels on critical topics like ESG & Shareholder Activism, M&A, Sports Investment Opportunities, and the IPO Bootcamp, along with lunch lectures from industry leaders.

The three-day event features top brands like Lululemon, Shake Shack, Five Below, Crocs, Darden Restaurants, and Domino’s Pizza.

Historically, the conference has been a catalyst for major stock moves, with companies often providing key holiday sales updates and full-year guidance.

JP Morgan Healthcare Conference

The J.P. Morgan Healthcare Conference, one of the most influential events in the healthcare and life sciences industry, will take place January 13–16 in San Francisco.

Commonly known as "JPM," "JPM Week," or "JPM Healthcare," this annual conference brings together industry leaders, innovative startups, investors, and global healthcare executives to discuss market trends, breakthrough innovations, and future growth opportunities. As a key event to watch, JPM often sets the tone for healthcare investments and partnerships in the year ahead.

JPMorgan Chase & Co. (JPM) Stock Performance, 5-Year Chart, Seeking Alpha

JPM (+40% 1Y) also kicks off big banks earnings this week on Wednesday morning. Analysts expect GAAP EPS of $4.10B on revenue of $41.58B for one of the most important reports of the week.

Needham Growth Conference

The 27th Annual Needham Growth Conference continues to run this week (January 9–17), offering a platform for public and private companies to engage with institutional, private equity, and venture capital investors. The event will feature company presentations, fireside chats, thematic panels, and 1-on-1 meetings tailored to investor interest and company availability.

Some of the attendees include: MaxLinear, Gannett, Atomera Incorporated, BlackSky Technology Inc, and IONQ.

Honestly — the main reasons we’re checking in on this conference is to see if quantum-related stocks like IONQ have a chance to follow up on Jensen Huang’s comments for last week.

As you likely know, Nvidia CEO Huang said that quantum computing is probably about 20 years away from reaching its potential and the whole sector sank. We’re interested to see if there’s more updates from the likes of IONQ and others.

Major Economic Events:

Critical inflation updates and retail sales are in the queue this week.

Monday (1/13): Monthly U.S. Federal Budget

Tuesday (1/14): Core PPI, Fed Beige Book, KC Fed President J. Schmid Speaks, NY Fed President Williams Speaks, NFIB Optimism Index, Producer Price Index

Wednesday (1/15): Consumer Price Index, Core CPI, CHI Fed President Goolsbee Speaks, Empire State Manufacturing Survey, Richmond Fed President Barkin Speaks

Thursday (1/16): Business Inventories, Home Builder Confidence Index, Import Price Index, Retail Sales,

Friday (1/17): Building Permits, Capacity Utilization, Housing Starts, Industrial Production

What We’re Watching:

Consumer Price Index

This week’s Consumer Price Index (CPI) report will offer new insights into inflation trends to close out 2024. Economists project headline inflation rose to +2.9% annually in December — up from +2.7% in November. Monthly prices are expected to increase +0.3%, matching the prior month’s gain.

Core CPI, which excludes food and energy, is forecasted to rise +3.3% YoY for the fifth consecutive month — showing persistent underlying inflation pressures.

“If year-on-year consumer inflation rates fall in the second quarter due to base effects, market participants may be underestimating the potential for two or more rate cuts in 2025.

The economic growth outlook is solid, and the Fed is unlikely to cut rates this month or in March 2025. However, a 0.25% rate cut in May 2025 still seems possible as year-on-year Total CPI consumer inflation likely falls due to base effects.”

Retail Sales

U.S. retail sales rose +0.7% in November — passing expectations of a +0.5% gain and building on October’s upwardly revised +0.5% increase. The data shows increased consumer spending heading into the holiday season.

Markets will closely watch Thursday’s December retail sales report for signs of continued strength. Economists forecast a +0.5% month-over-month rise to close out 2024.

“The holiday shopping season revealed a consumer who is willing and able to spend but driven by a search for value as can be seen by concentrated e-commerce spending during the biggest promotional period.

Solid spending during this holiday season underscores the strength we observed from the consumer all year, supported by the healthy labor market and household wealth gains.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Cover image source: TheStreet

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]

Reply