- GRIT

- Posts

- 👉 Global Affairs Are in Full Focus

👉 Global Affairs Are in Full Focus

Intel, Netflix, World Economic Forum

Welcome to your new week.

Earnings are back in full force, the World Economic Forum is underway, Trump is willing to place new tariffs in order to get Greenland, and so much more…

Let’s dive into everything you need to know for the next few trading days.

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Key Earnings Announcements:

Capital One, Intel, Johnson & Johnson, Netflix, and United Airlines highlight this week.

Monday (1/19): Markets Closed (MLK Day)

Tuesday (1/20): 3M, Netflix, United Airlines, DR Horton, Interactive Brokers, U.S. Bancorp, Fifth Third Bank, Fastenal, KeyBank

Wednesday (1/21): Johnson & Johnson, Halliburton, Ally Financial, Kinder Morgan, Charles Schwab, CACI, Pinnacle Financial, Travelers, RLI Corp, Teledyne Technologies

Thursday (1/22): Procter & Gamble, Intel, GE Aerospace, Capital One, Abbott Laboratories, CSX, McCormick, Huntington Bancshares, Associated Bank, Texas Capital Bank

Friday (1/23): SLB (Schlumberger), Ericsson, Webster Financial, First Citizens BancShares, Comerica

What We’re Watching:

Intel (INTC)

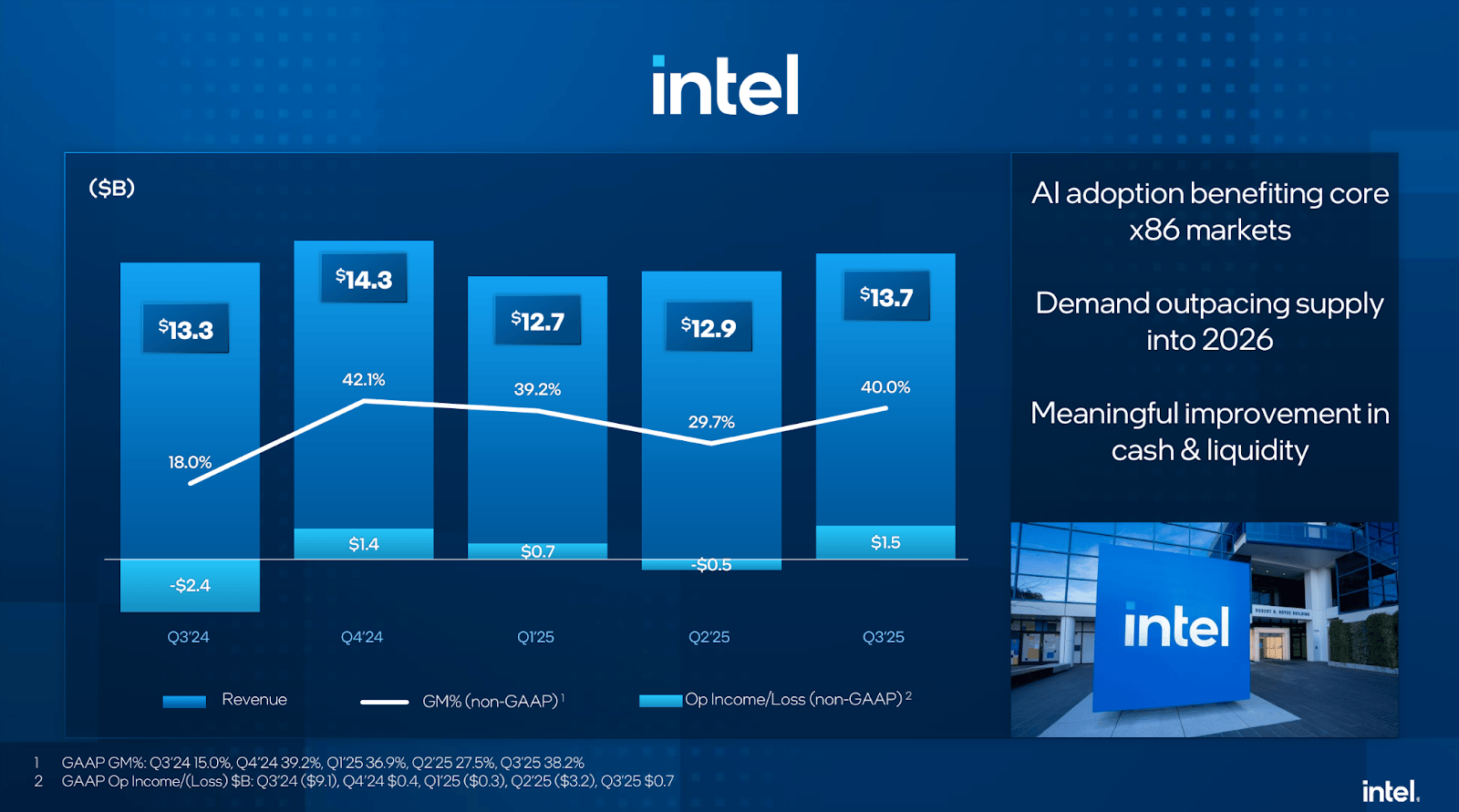

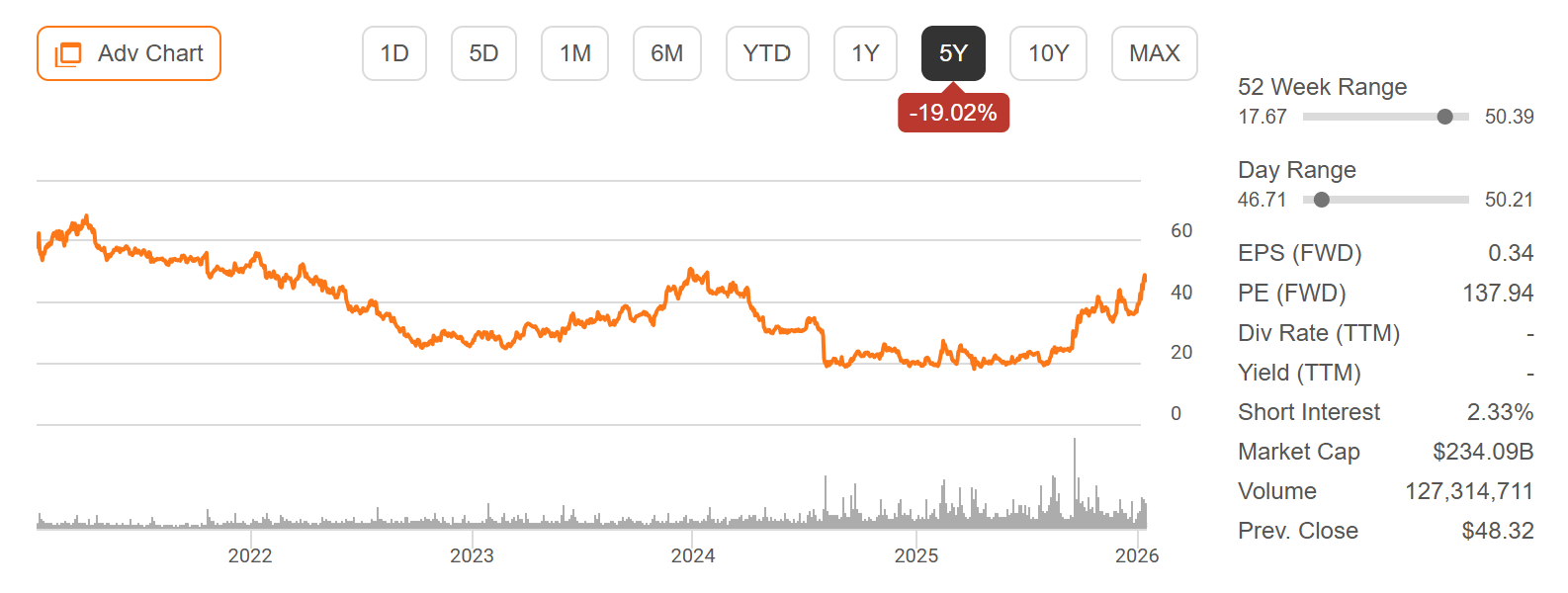

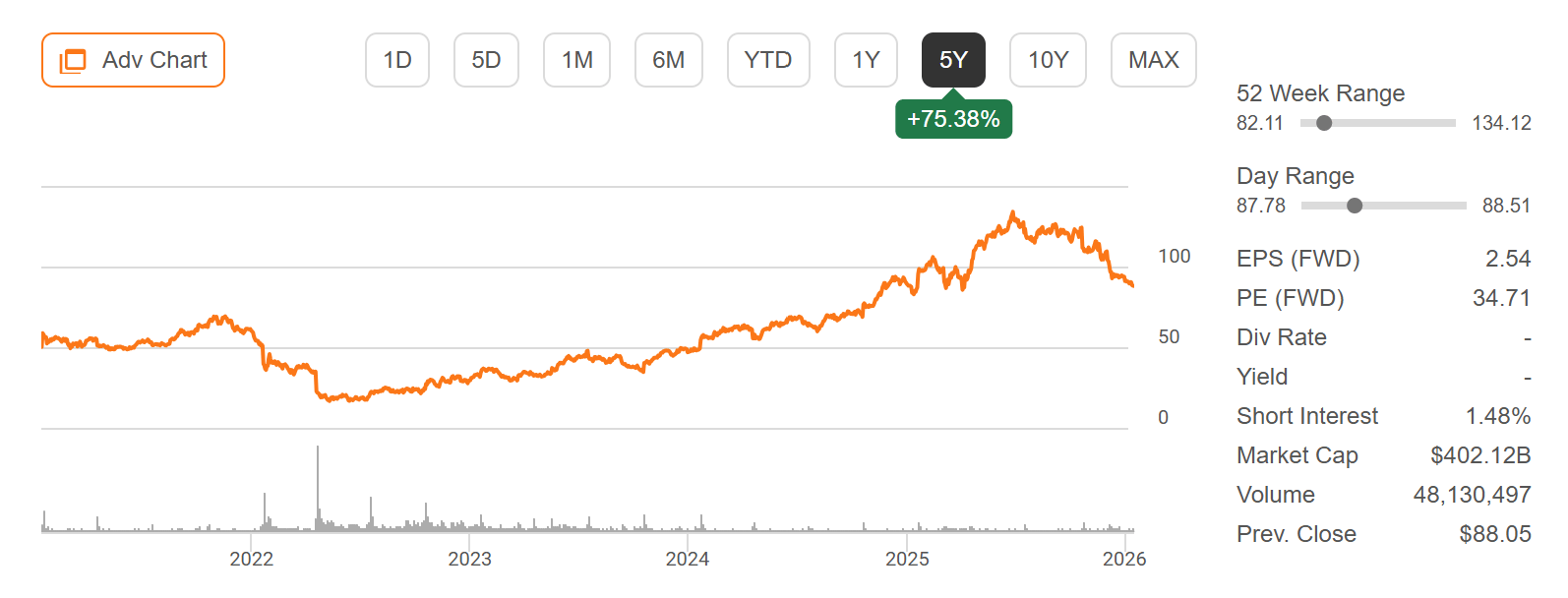

Intel (+27% YTD) reports Q4 FY2025 earnings this week, with investors focused on whether the company’s multi-year turnaround strategy is beginning to show tangible progress amid intense competition in AI chips, data centers, and foundry services.

Last quarter, Intel posted $13.6 billion in revenue (-2% YoY) and $0.41 in adjusted EPS, modestly ahead of expectations as cost controls and improved execution helped stabilize margins. However, data center revenue remained under pressure, and Intel Foundry Services continued to operate at a loss as the company ramps capacity and pursues external customers.

For Q4, I’ll be watching updates on foundry customer traction, capital spending discipline, and progress on next-gen process nodes (Intel 18A). Commentary around AI accelerators, Gaudi adoption, and how Intel plans to compete with Nvidia and AMD — while balancing cash flow and government-backed investment — will be critical for sentiment.

“We’re rebuilding Intel to win in the era of AI – with world-class manufacturing, leadership products, and a resilient ecosystem.”

Intel Corp. (INTC) Stock Performance, 5-Year Chart, Seeking Alpha

Netflix (NFLX)

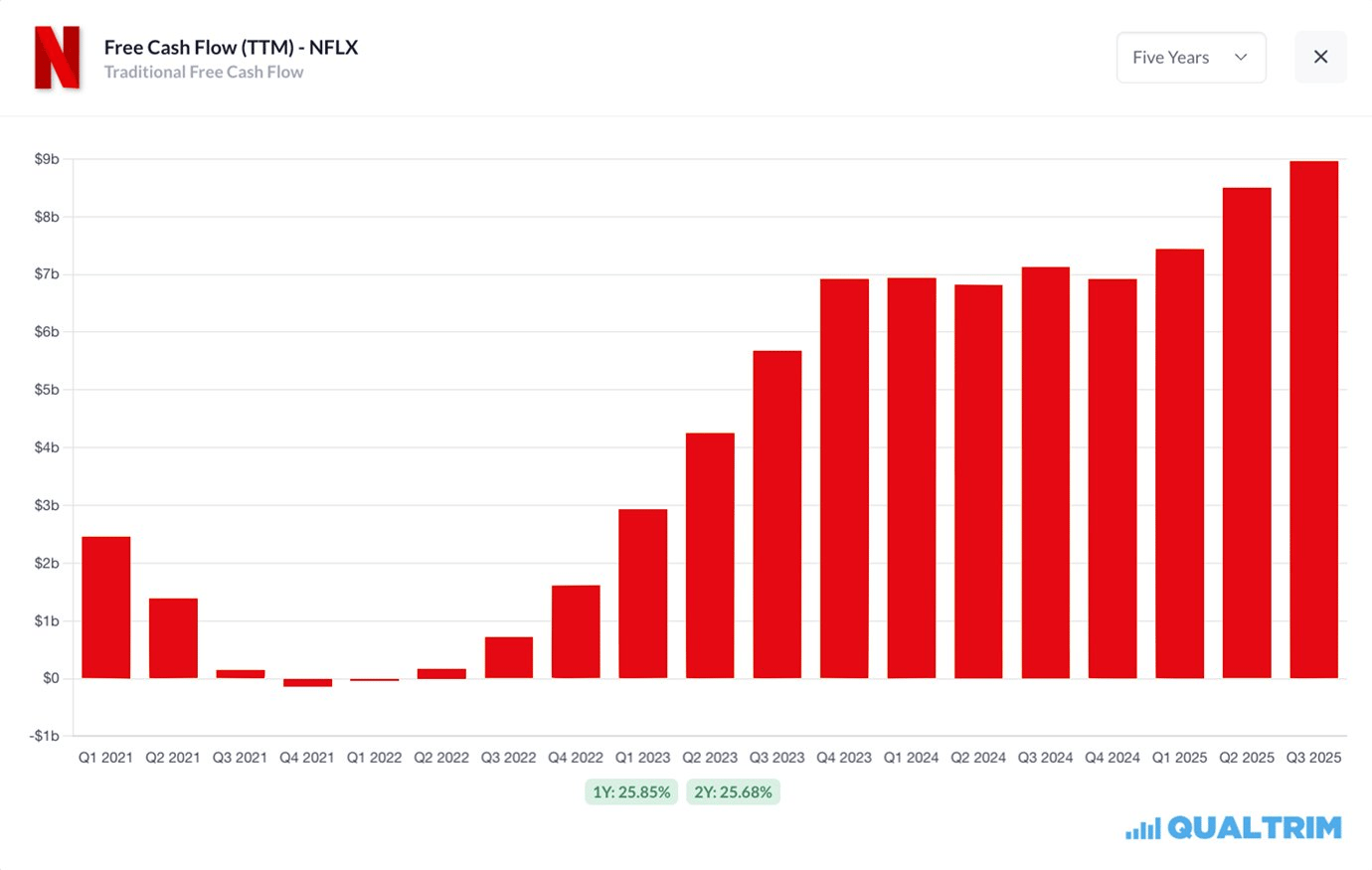

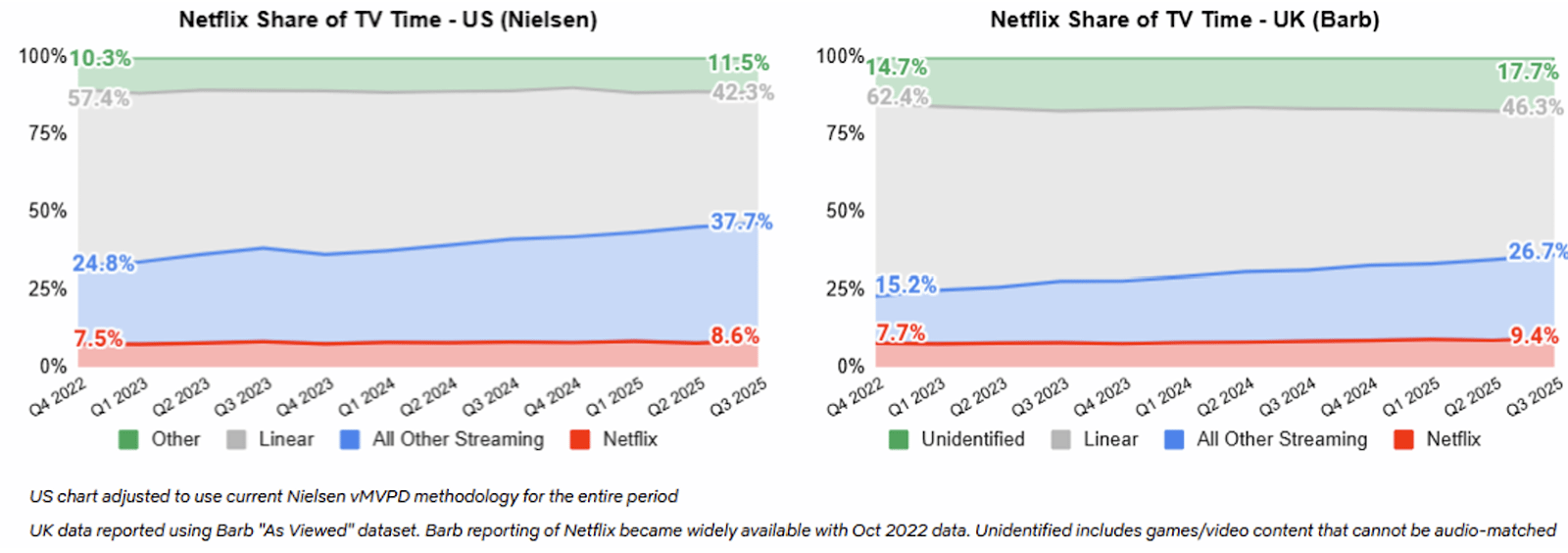

Netflix (-6% YTD) reports Q4 FY2025 earnings this week, with investors focused on whether the streaming giant can sustain subscriber growth, expand margins, and deepen monetization as competition intensifies and strategic ambitions widen.

Last quarter, Netflix delivered $11.1 billion in revenue (+16% YoY) and $7.20 in EPS, beating expectations as paid sharing, pricing actions, and advertising momentum drove strong operating leverage. Management also reiterated confidence in full-year margins, citing disciplined content spending and continued growth in the ad-supported tier.

Heading into this release, I’ll be watching net subscriber additions, ad-tier engagement and ARPU trends, and guidance for 2026 margin expansion. Investors will also be paying close attention to commentary around Netflix’s $83 billion bid for Warner Bros. Discovery, which could reshape the competitive landscape across streaming, content libraries, and global distribution.

“Our goal is simple: build the most loved entertainment service in the world — and do it profitably.”

Netflix Inc. (NFLX) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

Geopolitics and Greenland in focus while Trump delivers a speech at Davos for the World Economic Forum.

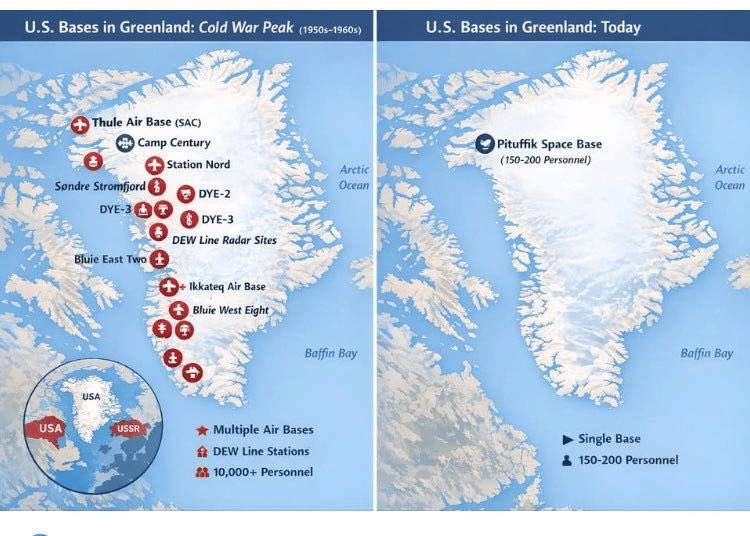

Greenland Remains in Focus

Renewed attention on Greenland has surfaced following revived rhetoric around U.S. strategic interest in the Arctic. In response, Denmark confirmed that a standing 1952 military directive remains in force, requiring Danish forces to immediately engage any unauthorized invading power — without waiting for political approval — across all Danish territory, including Greenland.

While Copenhagen has emphasized it does not expect U.S. military action, the reaffirmation is widely viewed as a signal that sovereignty violations would be treated uniformly, regardless of alliance status. For markets, the episode underscores rising Arctic geopolitical risk, intensifying competition over strategic resources and shipping routes, and the growing overlap between defense policy, energy security, and great-power politics under Donald Trump.

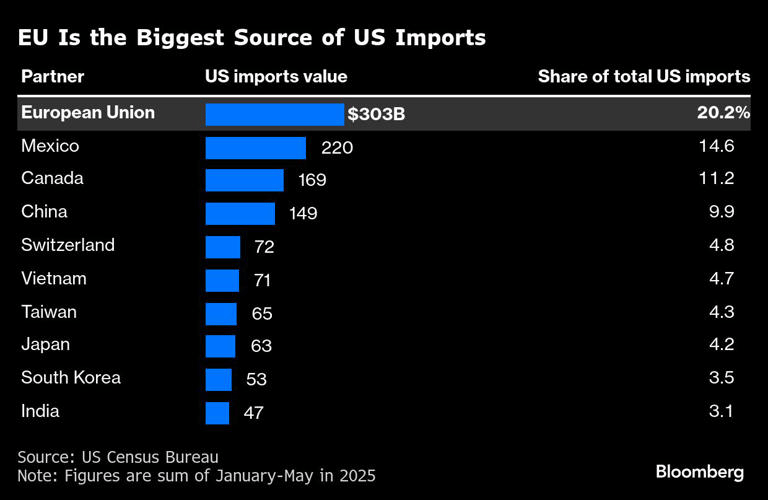

It will be important to watch developments this week, after Trump announced new tariffs starting at 10% — with a proposed increase to 25% in June — on eight European nations, including Denmark, following their plans to conduct NATO military exercises in Greenland in response to U.S. pressure.

“We have subsidized Denmark, and all of the Countries of the European Union, and others, for many years by not charging them Tariffs, or any other forms of remuneration. Now, after Centuries, it is time for Denmark to give back — World Peace is at stake! China and Russia want Greenland, and there is not a thing that Denmark can do about it. They currently have two dogsleds as protection, one added recently. Only the United States of America, under PRESIDENT DONALD J. TRUMP, can play in this game, and very successfully, at that! Nobody will touch this sacred piece of Land, especially since the National Security of the United States, and the World at large, is at stake. On top of everything else, Denmark, Norway, Sweden, France, Germany, The United Kingdom, The Netherlands, and Finland have journeyed to Greenland, for purposes unknown. This is a very dangerous situation for the Safety, Security, and Survival of our Planet.”

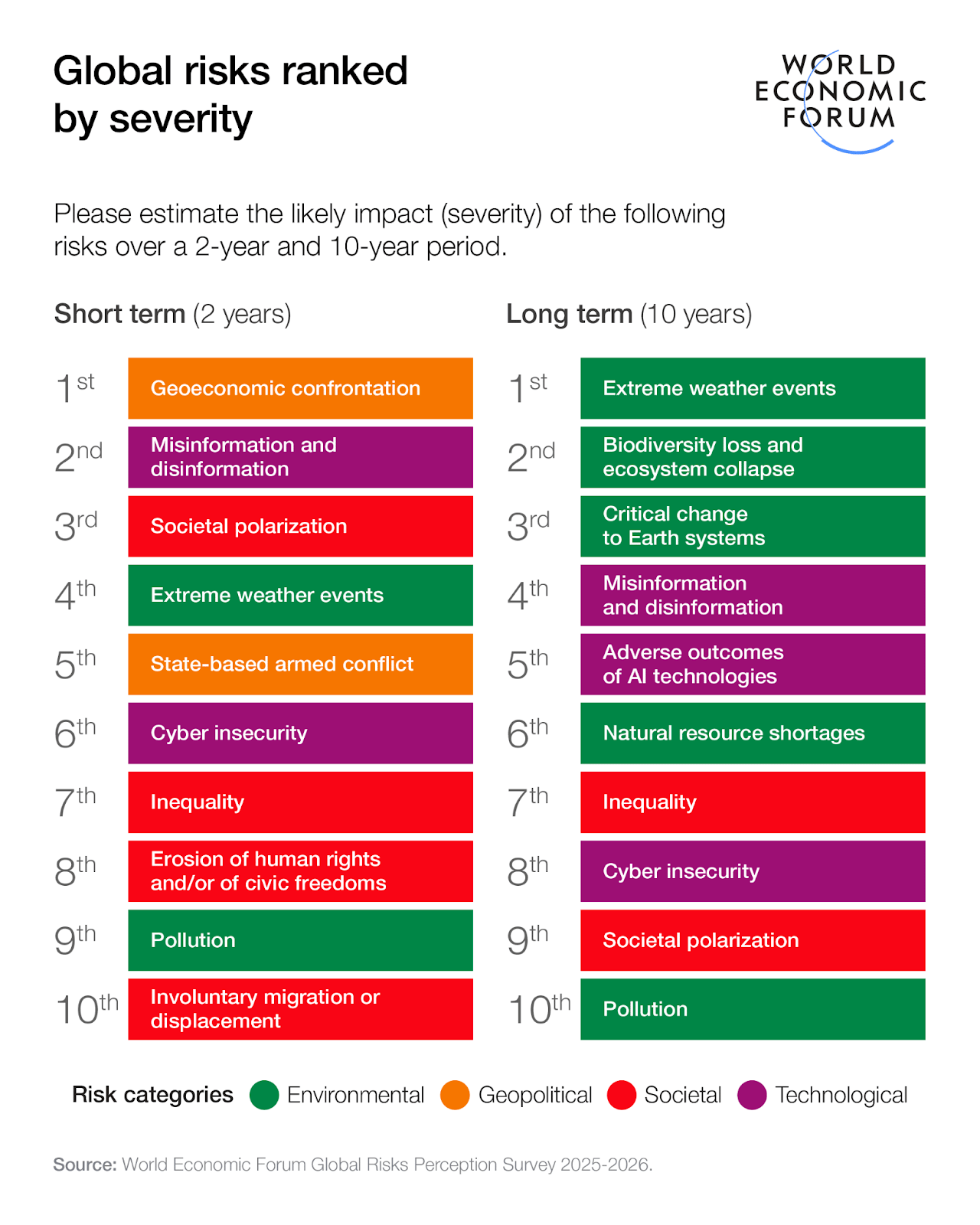

World Economic Forum Annual Meeting

The World Economic Forum’s annual meeting in Davos kicks off this week, bringing together global political and business leaders to discuss AI deployment, economic growth, and geopolitical stability. Davos often serves as an early-year barometer for policy direction, corporate sentiment, and cross-border coordination.

Notable executives scheduled to appear include Nvidia CEO Jensen Huang, Microsoft CEO Satya Nadella, Salesforce CEO Marc Benioff, PepsiCo CEO Ramon Laguarta, JPMorgan Chase CEO Jamie Dimon, and Goldman Sachs CEO David Solomon. Political leaders expected include President Trump, Canadian Prime Minister Mark Carney, French President Emmanuel Macron, German Chancellor Friedrich Merz, European Commission President Ursula von der Leyen, and UN Secretary-General António Guterres.

Investors will be watching for signals on AI regulation, global growth priorities, and geopolitical risk, particularly as markets assess the policy backdrop for 2026.

“Over the years, I have seen many versions of Davos: the fall-out from the Great Financial Crisis and European debt crunch; the trading scandal that rocked French banking giant Societe Generale; the surge of the Arab Spring; the rise and fall of Russia; the spread of the Covid-19 epidemic and now the upending of the world order that has been in place since the end of the Second World War. Everyone has an opinion about this meeting, but one thing is true — it is never dull. And 2026 will certainly be no different.”

Major Economic Events:

The Fed's preferred inflation gauge and a quarterly GDP revision are in focus this week.

Monday (1/19): Markets Closed (MLK Jr. Day)

Tuesday (1/20): None Scheduled

Wednesday (1/21): Construction Spending, Pending Home Sales

Thursday (1/22): GDP (Revision), Initial Jobless Claims, Personal Income, Personal Spending, PCE Index, Core PCE

Friday (1/23): Consumer Sentiment, S&P Flash Manufacturing PMI, S&P Flash Services PMI

What We’re Watching:

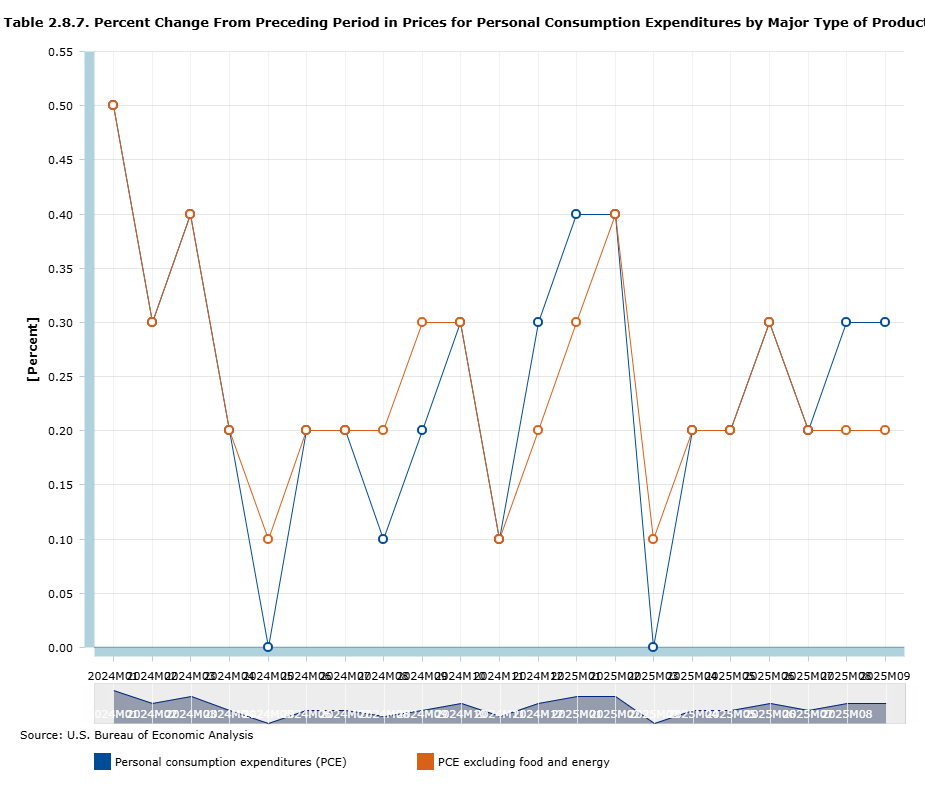

Core PCE Index

The Fed’s preferred inflation gauge, core PCE, rose 0.2% MoM in September, matching the pace seen in August and July and landing in line with expectations. On a year-over-year basis, core PCE eased to 2.8%, continuing its slow but consistent move toward the Fed’s 2% target.

The steady monthly readings suggest underlying inflation pressures – particularly in services – are cooling gradually rather than reaccelerating. With headline inflation already moderating and labor-market data showing signs of balance, the report supports the Fed’s patient, data-dependent approach to policy easing.

Economists expect the following this week:

• Core PCE (MoM): +0.2% vs. +0.2% prior

• Core PCE (YoY): ~2.7%–2.8%

“The underlying trend in core PCE inflation appears to be moving much closer to our 2 percent target than is currently showing in the data. Core services inflation is already roughly consistent with our target, and only core goods inflation remains elevated, but I expect it to start moving down in coming months as the effects of earlier price increases and one-time tariff-related adjustments fade.”

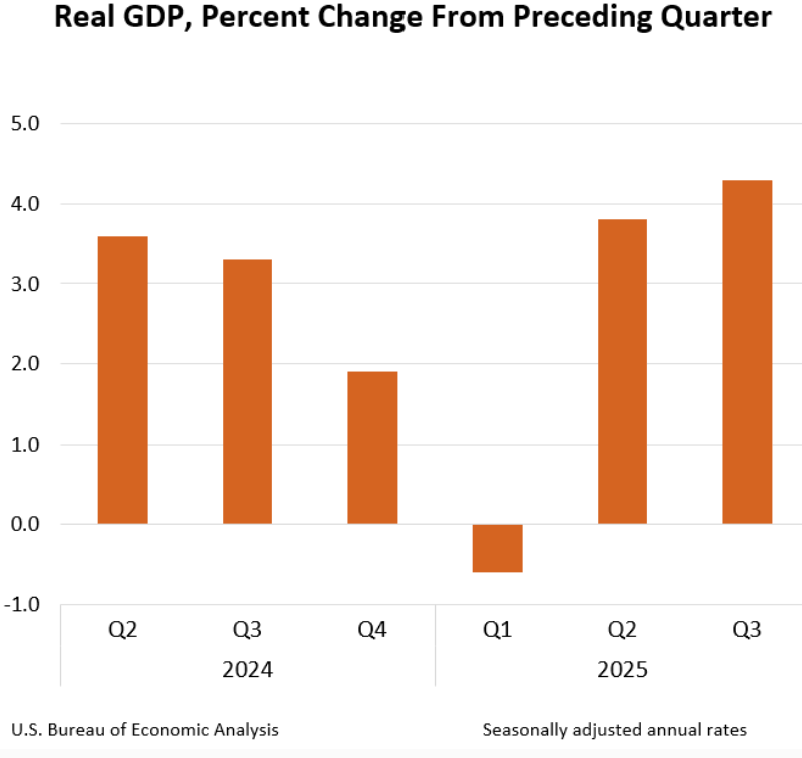

GDP (First Revision)

U.S. GDP expanded at a 4.3% annualized pace in Q3, the strongest growth in two years and well above expectations for 3.3%. The upside surprise was driven primarily by resilient consumer spending, a rebound in exports, and renewed government outlays.

Consumer spending rose 3.5%, its fastest pace this year, with strength across both goods (+3.1%) and services (+3.7%), led by health care, travel, and prescription drugs. Business investment continued to grow, though at a slower rate, as gains in equipment and intellectual property were offset by ongoing weakness in structures and residential investment. Exports surged 8.8%, while imports declined further, providing a meaningful boost to net trade. Inventory drag eased significantly compared to Q2.

Economists expect the following next quarter:

• Q4 GDP Growth: ~2.0%–2.5%

• Consumer Spending: Moderating but positive

• Residential Investment: Continued contraction

“Tax cuts, real wage gains, and rising wealth should sustain solid consumer spending growth.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Cover Art Sources: Wio News

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]