- GRIT

- Posts

- 👉 Government Shutdown Approaches Record

👉 Government Shutdown Approaches Record

AMD, Palantir, Uber

Welcome to your new week.

And welcome to the month of November! Before you know it — the holidays will be here. Now is the time to remain focused on the markets and have a plan for your portfolio!

If you’re interested in becoming a premium subscriber to Grit Capital’s Rate of Return Newsletter, click here for 20% off an annual subscription!

Let’s dive in to everything you need to know this week.

Smart Investors Don’t Guess. They Read The Daily Upside.

Markets are moving faster than ever — but so is the noise. Between clickbait headlines, empty hot takes, and AI-fueled hype cycles, it’s harder than ever to separate what matters from what doesn’t.

That’s where The Daily Upside comes in. Written by former bankers and veteran journalists, it brings sharp, actionable insights on markets, business, and the economy — the stories that actually move money and shape decisions.

That’s why over 1 million readers, including CFOs, portfolio managers, and executives from Wall Street to Main Street, rely on The Daily Upside to cut through the noise.

No fluff. No filler. Just clarity that helps you stay ahead.

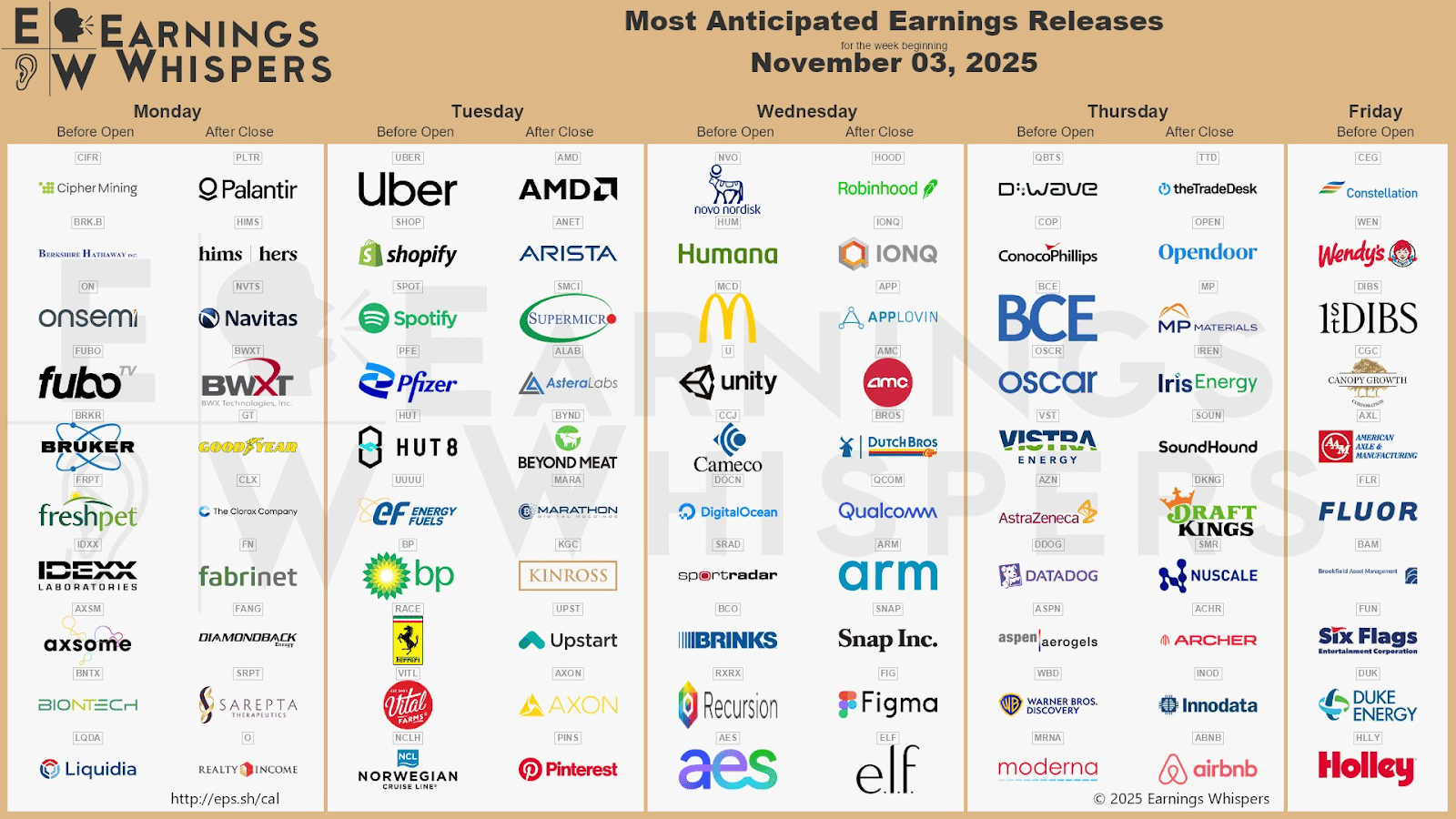

Key Earnings Announcements:

Earnings roll on with AMD, Hims & Hers, Novo Nordisk, Palantir, Robinhood, and more.

Monday (11/3): Axsome, Berkshire Hathaway, BioNTech, Bruker, BWX Technologies, Cipher Mining, FuboTV, Freshpet, Hims & Hers, IDEXX Laboratories, Navitas, Onsemi, Palantir, Sarepta Therapeutics, The Clorox Company

Tuesday (11/4): Arista, Astera Labs, Beyond Meat, Bloom Energy, BP, Diamondback Energy, Enphase, Marathon Oil, Norwegian Cruise Line, Pfizer, Pinterest, Shopify, Spotify, Supermicro, Texas Roadhouse, Uber, Upstart, Vital Farms, Wayfair

Wednesday (11/5): AMC, Applovin, Arm Holdings, Brinks, Cameco, Dutch Bros, e.l.f. Beauty, Figma, Humana, IonQ, Kinross Gold, McDonald’s, Novo Nordisk, Qualcomm, Recursion, Robinhood, Snap, Sportradar, Unity

Thursday (11/6): Airbnb, Archer, AstraZeneca, BCE, Comcast, ConocoPhillips, Datadog, DraftKings, Iris Energy, Moderna, NuScale, Oscar Health, SoundHound, The Trade Desk, Warner Bros. Discovery, Western Digital

Friday (11/7): 1stDibs, Brookfield Asset Management, Canopy Growth, Constellation Energy, Duke Energy, Fluor, Holley, Six Flags

What We’re Watching:

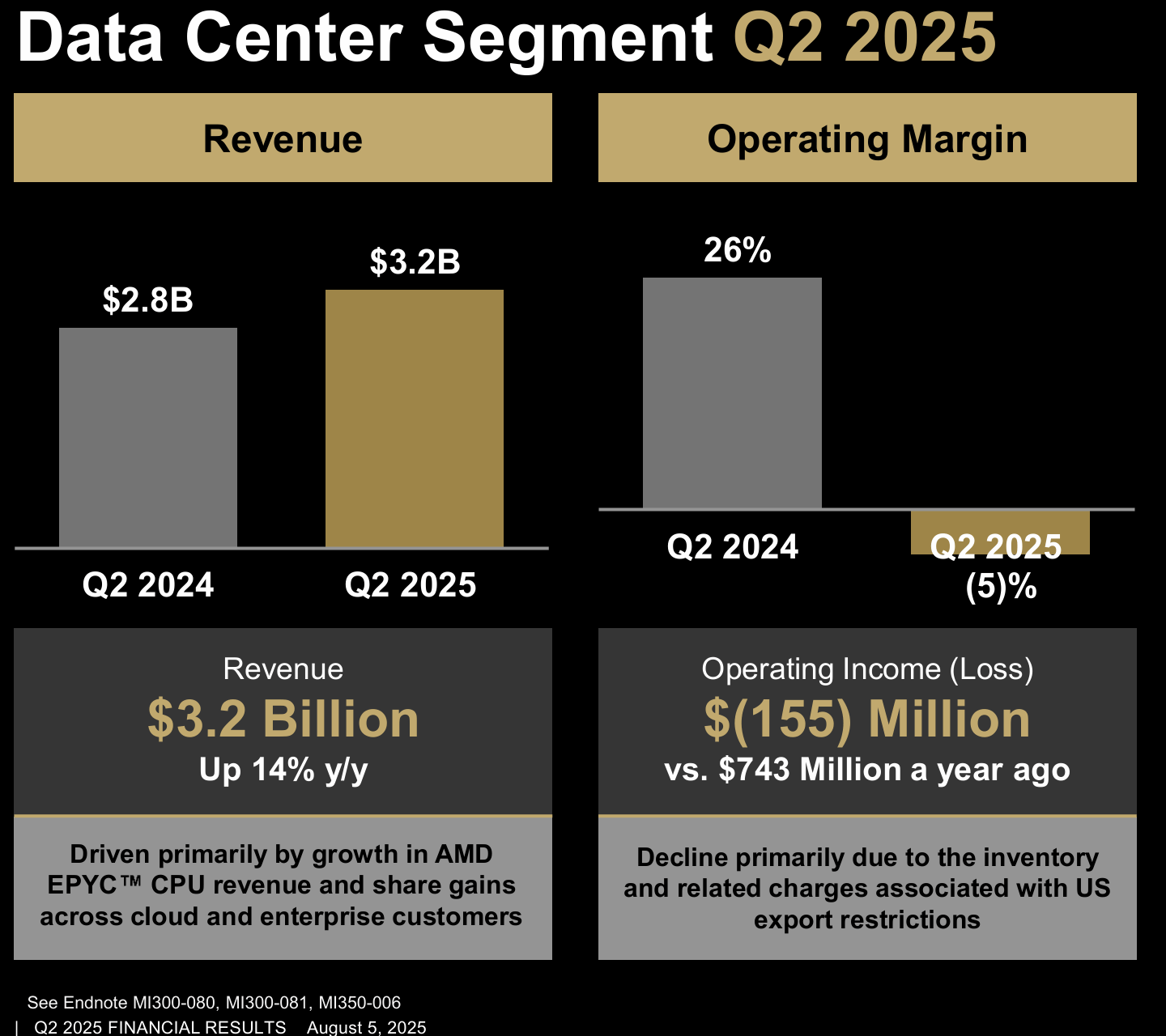

Advanced Micro Devices (AMD)

Source: AMD Earnings Deck

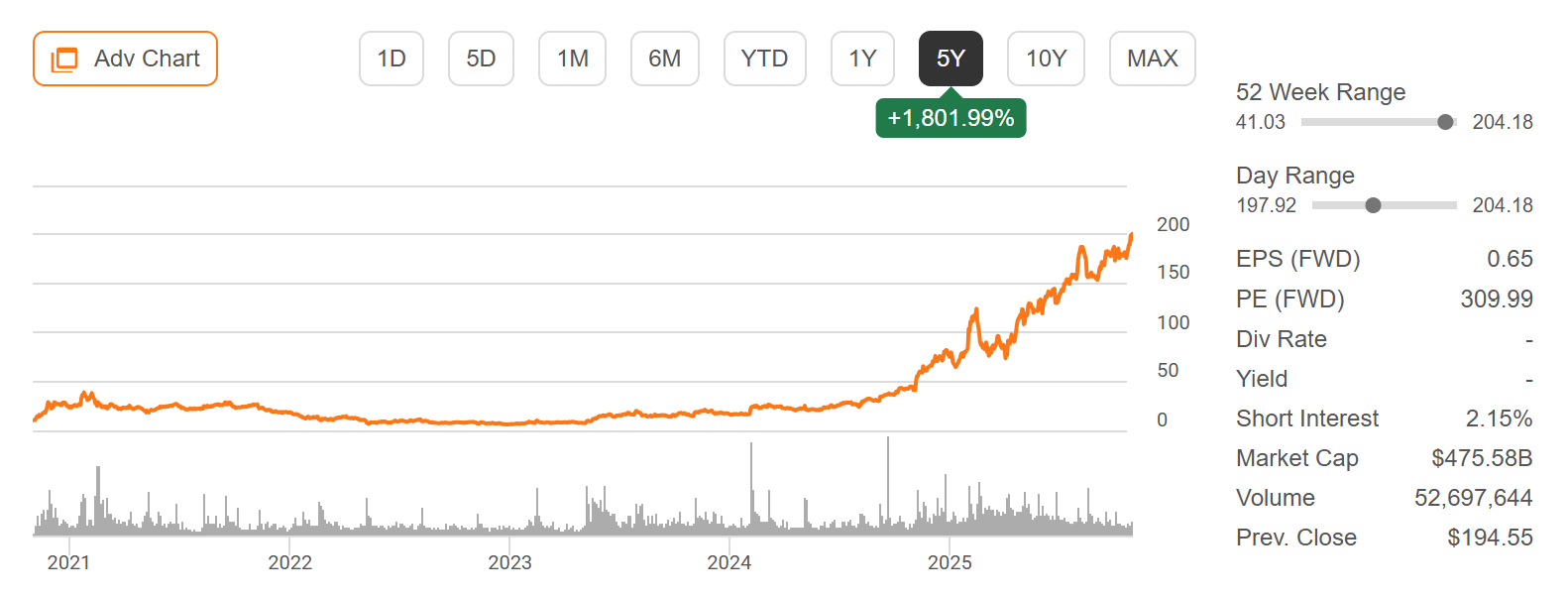

Advanced Micro Devices (+64% YTD) reports Q3 FY2025 earnings Tuesday after the close, with investors closely watching whether the chipmaker’s AI-hardware ramp and data-center momentum can translate into sustained margin gains amid export controls and supply-chain headwinds.

In Q2, AMD delivered $7.7 billion in revenue (+32% YoY), still its highest quarterly topline ever, but profit came under pressure due to an $800 million write-down tied to export restrictions on its MI308 accelerator. Looking ahead, AMD guided Q3 revenue at ~$8.7 billion, representing about +28% YoY growth and a non-GAAP gross margin of approximately 54%.

Heading into the print, I’ll be focused on whether the company can convert its strong top-line guidance into operational leverage and margin stability, how its MI350 series and client-CPU share gains are tracking, and how the China trade/export issue might continue to cloud near-term results.

“We are seeing robust demand across our computing and AI-product portfolio and are well-positioned to deliver significant growth in the second half of the year.”

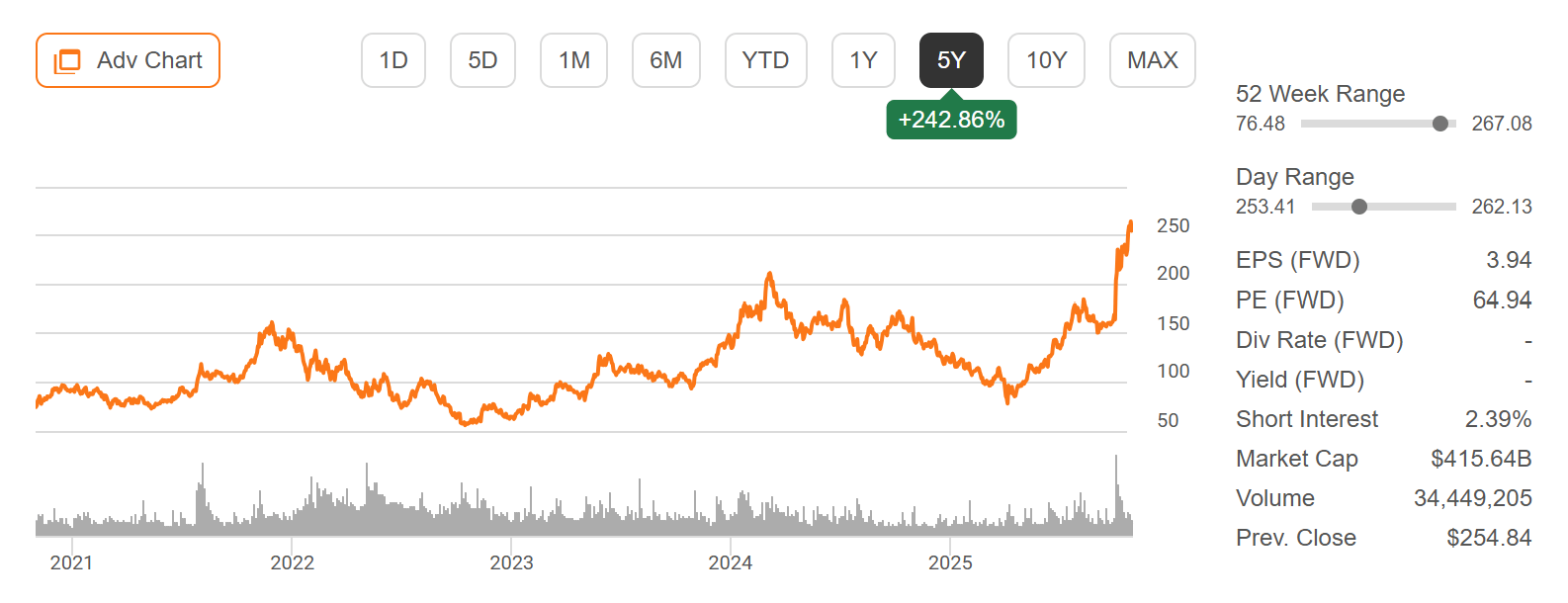

Advanced Micro Devices (AMD) Stock Performance, 5-Year Chart, Seeking Alpha

Palantir (PLTR)

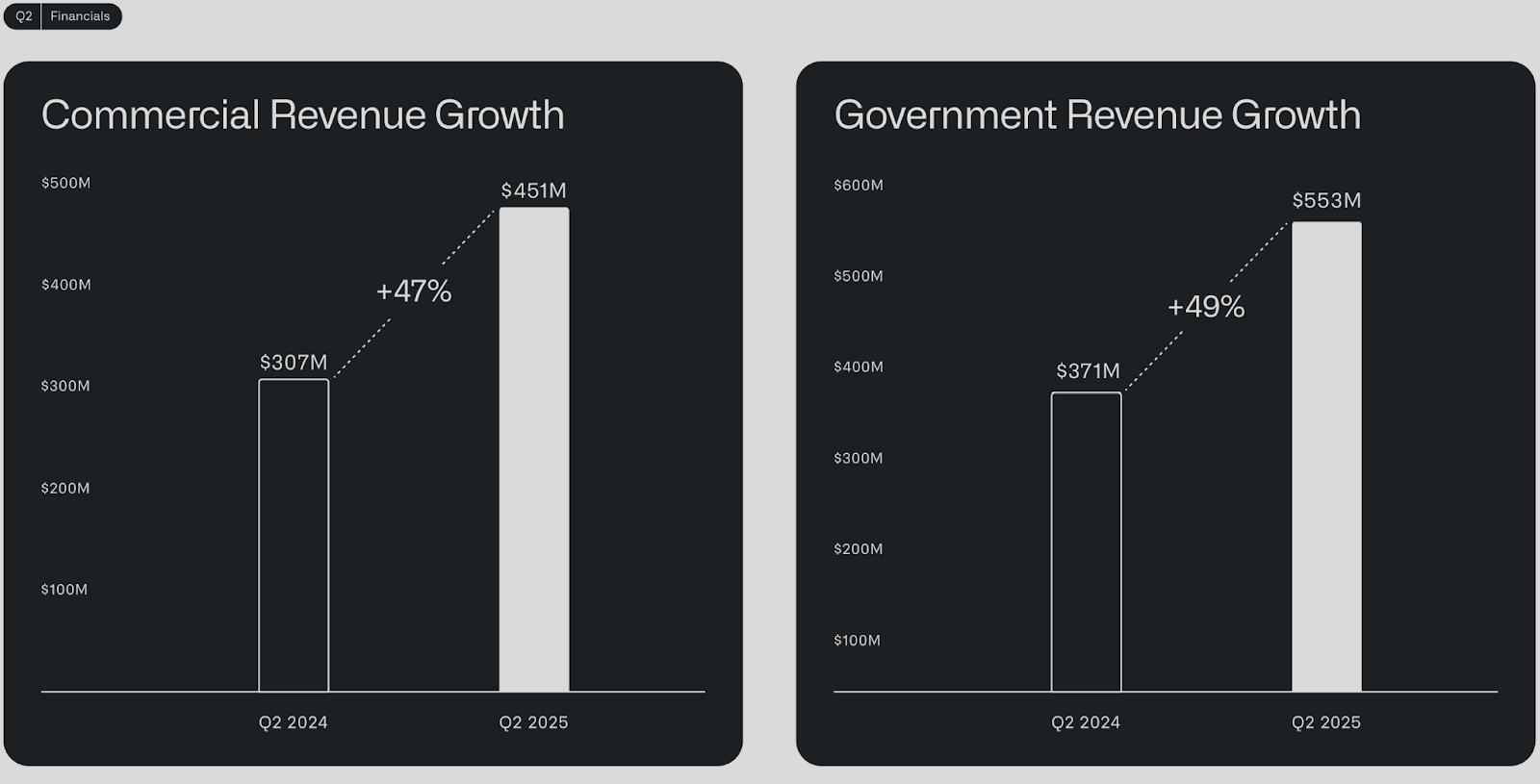

Source: Palantir Earnings Deck

Palantir Technologies (+165% YTD) reports Q3 FY2025 earnings Monday after the close, and investors will be digging into whether its AI-software platform and government contracts can keep delivering against a tough valuation and heightened investor expectations.

In Q2, Palantir posted revenue of roughly $1.0 billion (+48% YoY), marking its first $1 billion quarter and leading the company to raise its full-year 2025 revenue guidance to $4.15 billion, citing “the astonishing impact of AI leverage,” according to CEO Alex Karp.

Heading into the release, I’ll be watching to see if Palantir can show further commercial-segment acceleration (beyond government business), provide clarity on large contract pipelines and recurring revenue growth, and address how it plans to convert scale into profitability amid rising R&D and sales spend.

“As usual, I’ve been cautioned to be a little modest about our bombastic numbers, but there’s no authentic way to be anything but having enormous pride and gratefulness about these extraordinary numbers.”

Palantir (PLTR) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

Government shutdown nears historic length, Pfizer faces Tuesday deadline to counter Novo Nordisk’s Metsera bid, Tesla shareholder meeting puts $1 trillion pay package to a vote

Government Shutdown Nears Historic Length

Source: Associated Press

The U.S. government shutdown is on track to become the longest in American history if it continues through Tuesday night, surpassing the 35-day record set in 2018–2019. The ongoing standoff has now left Wall Street without official economic data for a full month, complicating forecasts and policy decisions across markets. Polymarket bettors see the shutdown ending around November 28 (Black Friday), while Kalshi assigns a 26% chance it lasts more than 55 days, 19% beyond 60 days, and 16% beyond 65 days.

Fed Chair Jerome Powell warned the situation could hinder the central bank’s ability to make informed decisions, saying that operating without key data is like “driving in a fog.” Markets are increasingly concerned that if the shutdown drags on, it could delay a December rate cut and weigh on year-end economic momentum.

“We will only have policy conversations once Democrats stop holding the American people hostage and reopen the government.”

“I just want to be on a path so that people’s bills don’t spike, and I want the president to agree, stop the wrecking ball… If the president engages, we will find a deal I think within hours.”

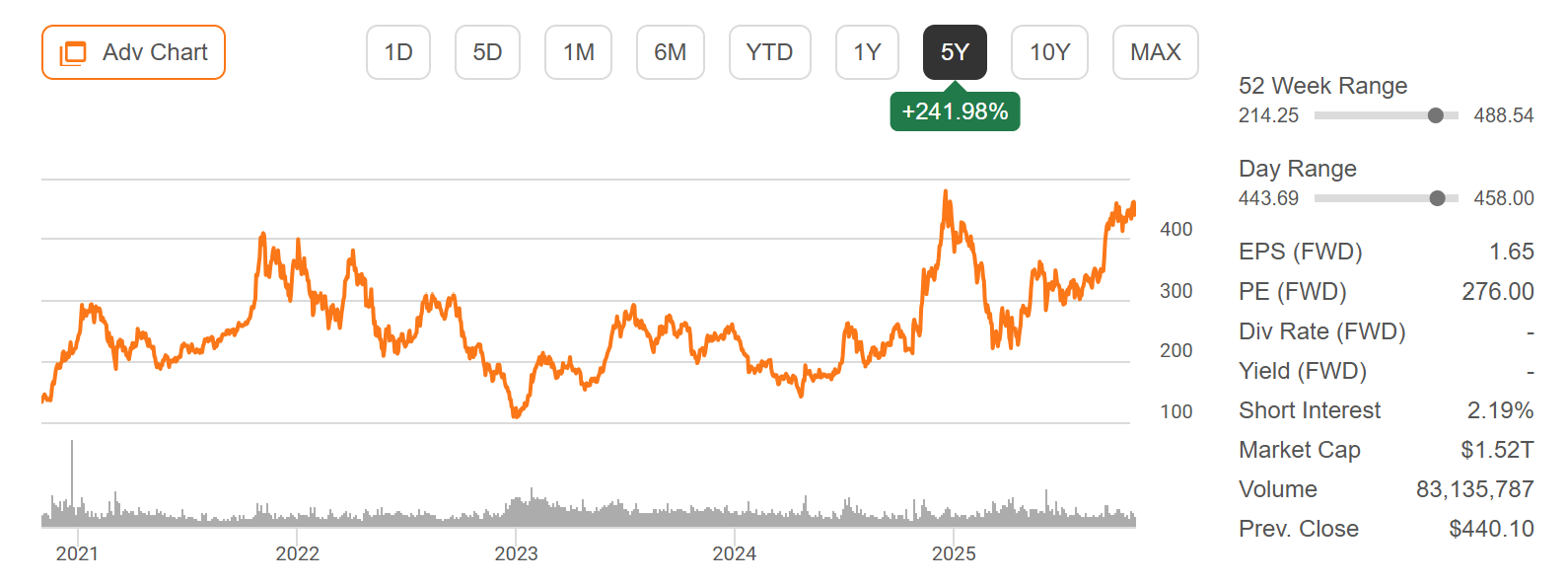

Pfizer (PFE) Faces Tuesday Deadline to Counter Novo Nordisk’s (NVO) Metsera Bid

Source: The Associated Press

Pfizer has until Tuesday to decide whether it will match or raise Novo Nordisk’s offer for Metsera, the biotech firm developing next-generation metabolic and obesity therapies. Novo’s $9B bid positions it to strengthen its dominance in the weight-loss drug market, while Pfizer — seeking to reinvigorate growth after pandemic-era declines – is weighing whether to re-enter the competitive obesity race through acquisition.

The potential bidding war underscores how metabolic health and obesity treatments have become one of the most sought-after frontiers in pharma, with both companies racing to secure leading pipelines ahead of expected multi-hundred-billion-dollar market expansion.

Pfizer (PFE) Stock Performance, 5-Year Chart, Seeking Alpha

“Metsera could be a transformative asset for whoever wins – this is the next major chapter in the metabolic drug race.”

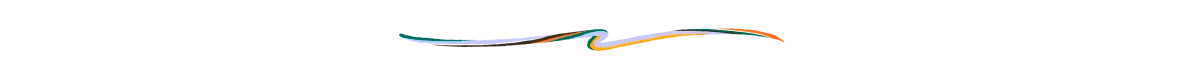

Tesla (TSLA) Shareholder Meeting Puts $1 Trillion Pay Package to a Vote

Tesla (+13% YTD) will hold its highly anticipated shareholder meeting this week at Gigafactory Texas, where investors will vote on Elon Musk’s proposed $1 trillion compensation plan. The meeting is set to shape the company’s strategic direction for the coming decade, testing shareholder confidence in Musk’s leadership amid intensifying competition.

Beyond the pay package, Tesla is expected to provide updates on key initiatives including the robotaxi network pilot, the Cybercab program, the Tesla Semi production ramp, and progress on next-generation Gen 3 Cybercell battery manufacturing. Investors will be watching for clarity on capital allocation, production timelines, and AI integration as Tesla continues its push to position itself at the forefront of autonomous mobility and clean-energy innovation.

Tesla, Inc. (TSLA) Stock Performance, 5-Year Chart, Seeking Alpha

“The fundamental question for shareholders at this year's Annual Meeting is simple: Do you want to retain Elon as Tesla's CEO and motivate him to drive Tesla to become the leading provider of autonomous solutions and the most valuable company in the world?”

Major Economic Events:

The ongoing government shutdown continues to impact economic data.

Monday (11/3): Durable Goods Minus Transportation, Durable Goods Orders

Tuesday (11/4): Consumer Confidence, S&P Case-Shiller Home Price Index (20 Cities)

Wednesday (11/5): Advanced Retail Inventories, Advanced U.S. Trade Balance in Goods, Advanced Wholesale Inventories, Fed Chair Powell Press Conference, FOMC Interest-Rate Decision, Pending Home Sales

Thursday (11/6): Fed Vice Chair for Supervision Michelle Bowman Speaks, GDP, Initial Jobless Claims

Friday (11/7): Chicago Business Barometer (PMI), Cleveland Fed President Hammack and Atlanta Fed President Bostic Speak, Consumer Spending, Core PCE Index, Core PCE Year Over Year, Dallas Fed President Lorie Logan Welcoming Remarks, Employment Cost Index, PCE Index, PCE Year Over Year, Personal Income

What We’re Watching:

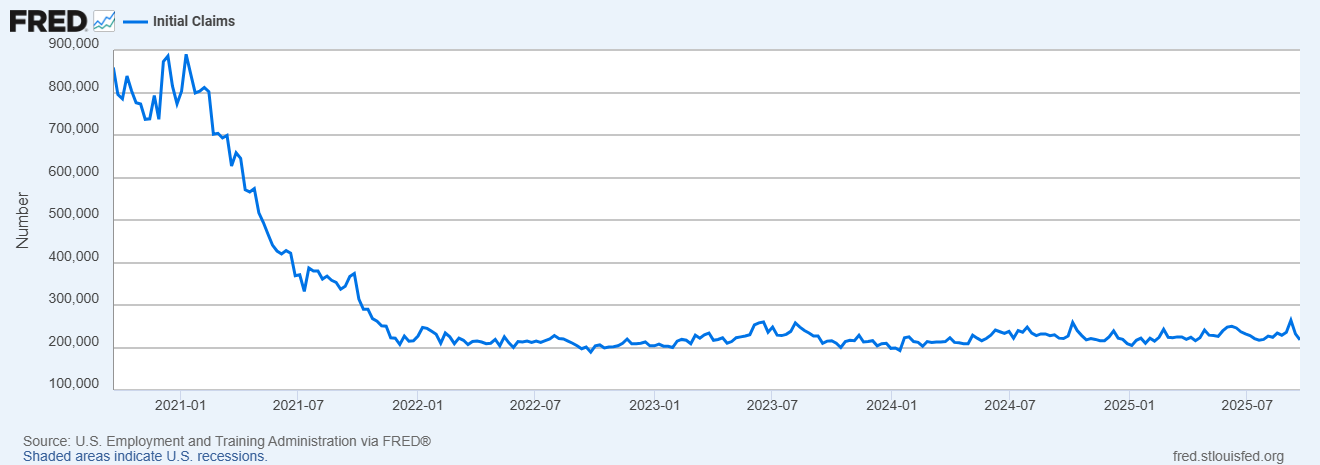

Initial Jobless Claims

Initial jobless claims fell by 14,000 to 218,000 in the third week of September, marking the lowest level in two months and defying expectations for a rebound to 235,000. The data suggests that the labor market remains resilient despite recent signs of slowing job growth and ongoing economic uncertainty.

Continuing claims also edged lower to 1.93 million, the lowest since late May, signaling that displaced workers are still finding employment relatively quickly. The report counters concerns of a sharp labor market deterioration that had contributed to the Fed’s decision to restart its rate-cutting cycle in September.

This data is still highly impacted by the ongoing government shutdown.

Economists expect the following this week:

Initial Jobless Claims: 218K vs. 232K prior

Continuing Claims: 1.93M vs. 1.96M prior

“The latest claims data show the job market is cooling gradually, not collapsing – a key sign that the Fed’s soft-landing scenario remains intact.”

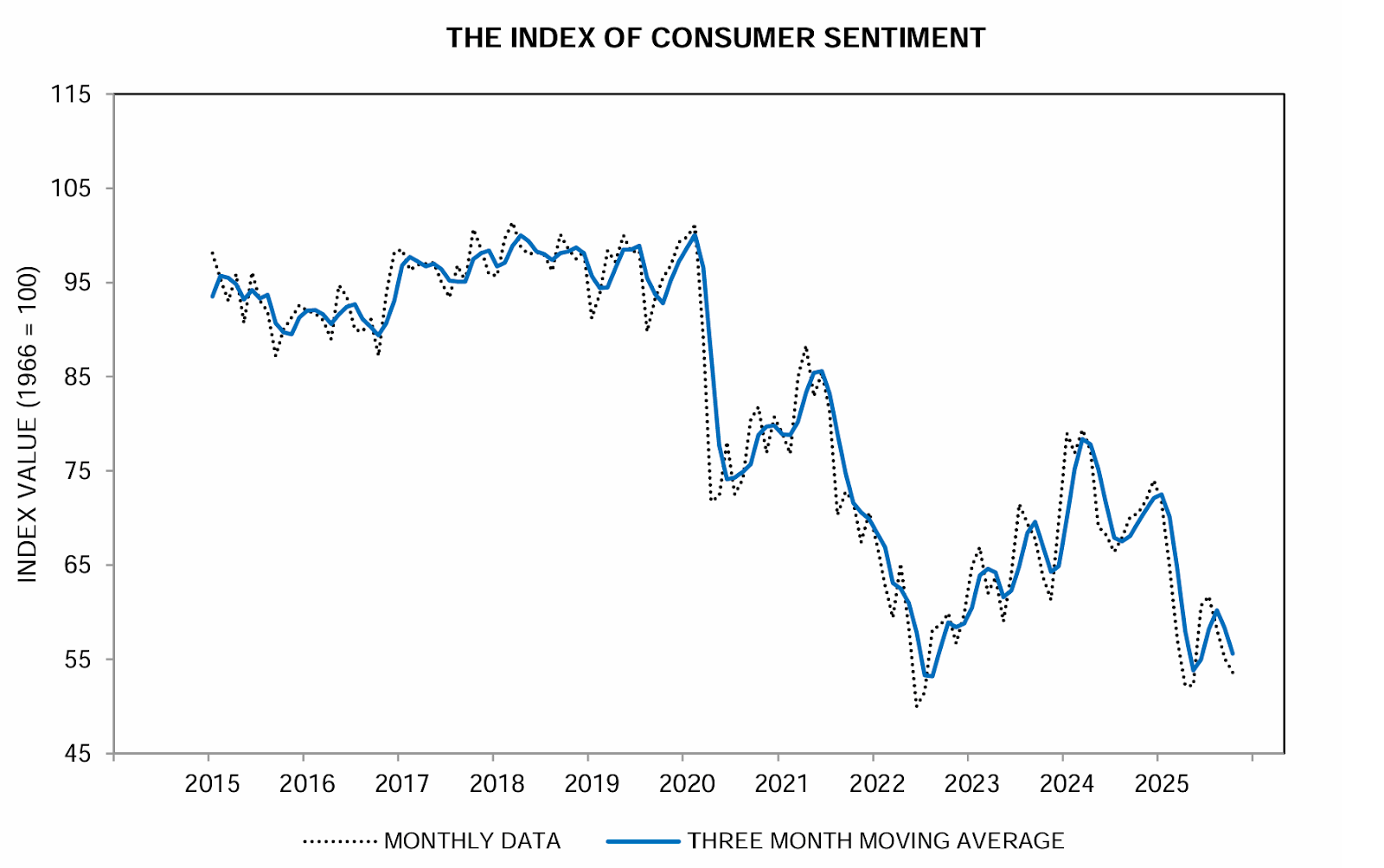

Michigan Consumer Sentiment

The University of Michigan Consumer Sentiment Index was revised lower to 53.6 in October, down from 55.1 in September and marking the weakest reading since May. Both the Current Conditions index (58.6 vs. 61) and the Expectations gauge (50.3 vs. 51.2) slipped, reflecting persistent concerns over high prices and slowing economic momentum.

Inflation expectations for the year ahead eased slightly to 4.6% (from 4.7%), while the five-year outlook rose to 3.9% (from 3.7%), suggesting consumers remain wary of long-term price pressures. Despite the government shutdown, survey data showed little evidence that political uncertainty is affecting sentiment at this point.

Economists expect the following this week:

Michigan Consumer Sentiment (Final): 53.6 vs. 55.1 prior

1-Year Inflation Expectations: 4.6% vs. 4.7% prior

5-Year Inflation Expectations: 3.9% vs. 3.7% prior

“Inflation and high prices remain at the forefront of consumers’ minds, though there’s little sign that recent government tensions are shaping economic perceptions.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]