- GRIT

- Posts

- 👉 Government Shutdown Looms Large

👉 Government Shutdown Looms Large

Amazon, Google, Nike

Together with X Funds

Welcome to your new week.

Earnings reports have slowed down — but major economic data is coming in and Q4 is about to begin. There’s a LOT to discuss!

If you’re interested in becoming a premium subscriber to Grit Capital’s Rate of Return Newsletter, click here for 20% off an annual subscription!

Looking for income in a volatile rate environment? The Nicholas Fixed Income Alternative ETF (FIAX) combines short-term Treasuries with strategic options to target consistent monthly income and manage downside risk.

Here’s what FIAX delivers:

Core exposure to short-duration U.S. Treasuries

Defined-risk option strategies over equities, fixed income, and commodities

Monthly income with a current distribution yield of 8%

With rates shifting and traditional bonds under pressure, FIAX offers an innovative alternative for today’s fixed income-focused investor.

Key Earnings Announcements:

Carnival Corporation, Conagra Brands, and Nike headline a slow week of earnings.

Monday (9/29): Carnival Corporation, Jefferies, Vail Resorts

Tuesday (9/30): Nike, Paychex

Wednesday (10/1): Conagra Brands

Thursday (10/2): N/A

Friday (10/3): N/A

What We’re Watching:

Nike (NKE)

Source: Nike Newsroom

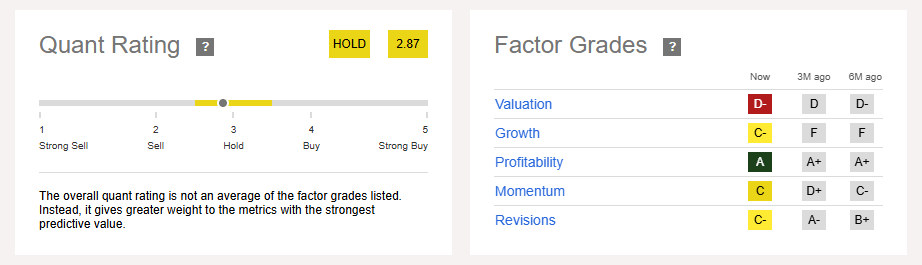

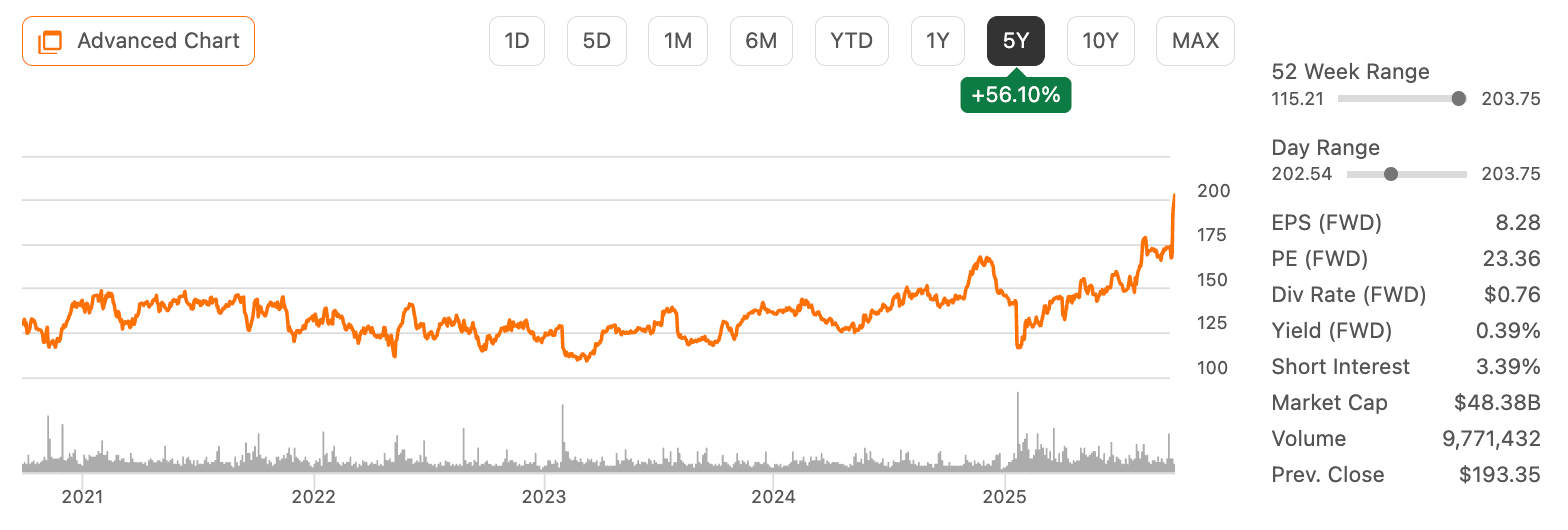

Nike, Inc. (NKE) is set to release its Q1 FY2026 earnings on Tuesday, September 30, 2025, after market close. Analysts anticipate a challenging quarter, with revenue expected to decline approximately -5% year-over-year to around $10.98 billion, and earnings per share (EPS) projected at $0.27, marking a -61% drop from the previous year.

This downturn is attributed to several factors, including increased U.S. tariffs on imports from China, which are anticipated to add up to $1 billion in costs, and a 350–425 basis point contraction in gross margins. Additionally, Nike is facing stiff competition from brands like Hoka and On Holding, and is working to address declining demand in key markets such as China.

Source: Seeking Alpha

In response, CEO Elliott Hill has launched the "Win Now" strategy, focusing on reinvigorating Nike's core sports performance lines, enhancing wholesale partnerships, and reducing promotional activities. The recent collaboration with Kim Kardashian's Skims brand aims to strengthen Nike's position in the women's athleisure market.

The upcoming earnings report will be a key indicator of whether Nike’s strategic moves are translating into improved performance and renewed growth momentum.

Nike, Inc. (NKE) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

Google and Amazon debut AI products for your smart home, a government shut down is looming, and Electronic Arts officially agrees to the largest leveraged buyout in American history.

Google Gemini & Amazon Hardware Events

Alphabet, Inc. (GOOG) Stock Performance, YTD Chart, Seeking Alpha

Google is hosting a Gemini event this week, expected to unveil a major upgrade to Google Assistant – bringing Gemini AI to smart home devices like Nest Cams, speakers, and doorbells. This marks a leap toward more conversational, contextual AI throughout the home.

Amazon, Inc. (AMZN) Stock Performance, YTD Chart, Seeking Alpha

The battle for AI powered homes is heating up. Amazon is staging a full-scale hardware event on Tuesday, September 30, and all signs point to a major push into AI and devices.

What's expected:

New Echo devices powered by Alexa+ (its upgraded generative AI)

A potential color Kindle for richer e-reading

Updates to Fire TV and possibly the debut of Vega OS, Amazon’s new smart TV platform

Amazon has lagged behind its fellow Magnificent Seven peers in 2025 — nailing this event could be the catalyst it needs. Shifting Alexa from “smart assistant” to central intelligence across home devices is the goal.

Potential Government Shutdown Looming

President Donald Trump and congressional leaders are meeting as the U.S. approaches its first government shutdown in nearly seven years. Democrats are seeking $350 billion to extend Obamacare tax credits and reverse certain Medicaid changes, while framing the debate around health care costs. Trump has linked their proposals to immigration funding, asserting that Democrats’ plan could result in significant spending for undocumented immigrants.

Republicans are calling for a short-term funding bill to keep the government open until Nov. 21 before broader negotiations continue, while Democrats want assurances that any agreements will be honored. The White House has warned of potential layoffs of federal workers if a shutdown occurs, which could affect agencies including environment, agriculture, and labor. With both sides holding firm on key issues, Monday’s meeting is expected to be challenging, and the possibility of a shutdown remains.

“Our position has been very clear: cancel the cuts, lower the cost, save health care so we can address the issues that really matter to the American people in an environment where the cost of living is too high.”

"We'll have to see, but I can tell you where his head and his heart are. He wants to do right by the people. He does not want the Democrats to hold up troops' pay. You know, the people who serve in the military, they don't get paid during the shutdown. That's what Chuck Schumer is holding hostage. Why? So that he can add $1.5 trillion in new spending at a time when we're simply just trying to keep the government going for seven weeks so we can have those debates. It's wrong."

Electronic Arts Officially Agrees to Largest Leveraged Buyout in History

Sources: Patrick T. Fallon / Bloomberg

Electronic Arts agreed to be acquired by a private investor consortium in a $55 billion leveraged buyout, the largest on record. The group, which includes Silver Lake, Saudi Arabia’s Public Investment Fund, and Jared Kushner’s Affinity Partners, will pay $210 per share in cash, a 25% premium over EA’s pre-deal stock price. The deal will be financed with about $36 billion in equity — including PIF rolling over its 9.9% stake — and $20 billion in debt arranged by JPMorgan, with a $1 billion breakup fee attached.

EA is selling amid slowing growth in the $178 billion video game industry, where players have shifted toward free-to-play, continuously updated titles over $80 premium releases. Going private is expected to free the company from Wall Street’s quarterly pressure, while its sports franchises such as Madden NFL provide steady revenue. The transaction surpasses the $45 billion TXU buyout in 2007, making it not only the largest LBO ever but also one of 2025’s biggest M&A deals.

Electronic Arts Inc. (EA) Stock Performance, 5-Year Chart, Seeking Alpha

“Our creative and passionate teams at EA have delivered extraordinary experiences for hundreds of millions of fans, built some of the world’s most iconic IP, and created significant value for our business… This moment is a powerful recognition of their remarkable work.”

Major Economic Events:

A massive week of economic data has arrived — Jobs Report, Home Price Index, Factory Orders, Manufacturing Data, and more.

Monday (9/29): Atlanta Fed President Raphael Bostic speech, Cleveland Fed President Beth Hammack speech, Fed Reserve Gov Christopher Waller speaks, Pending home sales

Tuesday (9/30): Chicago Business Barometer (PMI), Consumer confidence, Fed Reserve Vice Chair Phillip Jefferson speech, Job openings, S&P Case-Shiller home price index (20 cities)

Wednesday (10/1): ADP employment, Auto sales, Construction spending, ISM manufacturing, S&P final U.S. manufacturing PMI

Thursday (10/2): Initial jobless claims, Factory orders

Friday (10/3): ISM services, Fed Reserve Vice Chair Phillip Jefferson speech, U.S. employment report, U.S. hourly wages, U.S. unemployment rate, S&P final U.S. services PMI

What We’re Watching:

Jobs Report

The U.S. economy added -911,000 fewer jobs in the 12 months through March 2025 than originally reported, according to the Bureau of Labor Statistics’ preliminary benchmark revision — marking the largest downward revision since at least 2000.

This revision reflects a -0.6% adjustment to total nonfarm employment, compared with a 10-year average absolute change of just ±0.2%. Nearly all sectors were impacted:

Leisure & hospitality: -176K

Professional & business services: -158K

Retail trade: -126.2K

Wholesale trade: -110.3K

The benchmark revision highlights discrepancies between two independently compiled employment measures. A similar downward revision of -818K jobs occurred the previous year. The new figures suggest the labor market has weakened more than previously believed, possibly reinforcing the Fed’s data-dependent case for rate cuts later this year.

On average, economists expect the following this week:

Nonfarm Payrolls: +51K vs. +22K the month prior

“Bloomberg Economics expects nonfarm payrolls for September to add a net +54k jobs. The improvement in net hiring likely came from leisure and hospitality, as temperate weather and a positive wealth effect from the summer stock-market rally drove spending on discretionary services.”

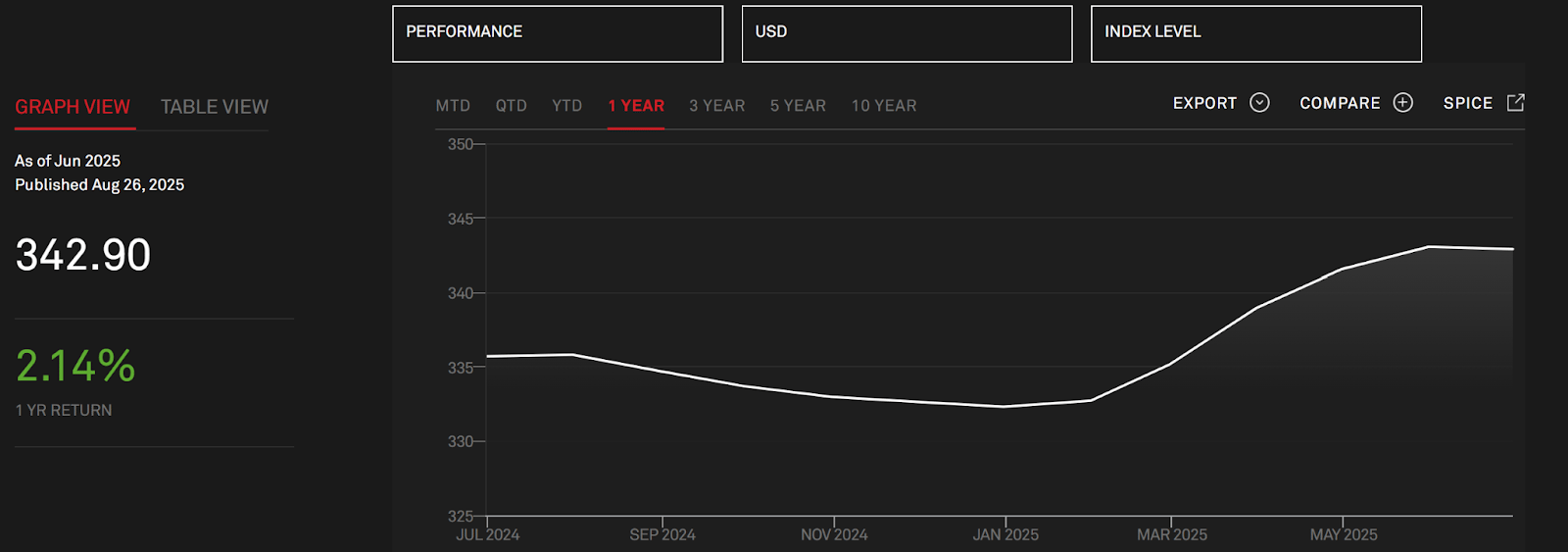

S&P Case-Shiller Home Price Index

Source: S&P Global

The S&P CoreLogic Case-Shiller 20-City Home Price Index rose +2.1% YoY in June 2025, easing from a +2.8% increase the month prior and marking the softest annual gain since July 2023. The slowdown reflects elevated mortgage rates and higher housing inventory, both of which have cooled buyer competition.

Top annual price gains:

New York City: +7.0%

Chicago: +6.1%

Cleveland: +4.5%

Detroit: +4.3%

Largest declines:

Tampa: -2.4%

San Francisco: -2.0%

Month-over-month, prices were largely flat, reinforcing signs of a cooling — but not collapsing — housing market. This week’s reading (July) serves as a key data point on the state of the housing market from the summer months.

“Housing will find its footing and begin to improve more noticeably as the 30-year fixed mortgage rate closes in on 6%.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]