- GRIT

- Posts

- 👉 Has an August Slump Begun?

👉 Has an August Slump Begun?

AMD, Palantir, Uber Technologies

Welcome to your new week.

Despite relatively strong earnings reports, the S&P 500 dropped -2.5% last week. Now we’re gearing up for ANOTHER major series of earnings reports and economic updates.

Let’s dive right in.

Key Earnings Announcements:

It’s a monster week of earnings with AMD, Disney, Hims & Hers, Oscar Health, Palantir, Uber, and more.

Monday (8/4): Axsome, Berkshire Hathaway, BioNTech, BioCryst, Belling, BWXT, Cal-Maine Foods, Freshpet, Hims & Hers, Lattice, Mercado Libre, Navitas, NVT5, Onsemi, Palantir, TG Therapeutics, ThredUp, Tyson, Vertex

Tuesday (8/5): AMD, ANET, Arista, Astera Labs, BP, Caterpillar, Clover, Duke Energy, DuPont, Eaton, Esperion, Lemonade, Lucid, Marriott International, Opendoor, Pfizer, Rivian, Snap Inc., Supermicro, ThredUp, Upstart

Wednesday (8/6): AppLovin, Dave, Disney, Duolingo, DraftKings, E.L.F., Energy Transfer, Fortinet, GEO Group, Geron, IonQ, Jack in the Box, Joby Aviation, McDonald’s, Novo Nordisk, Oscar, Shopify, Six Flags, Symbotic, Uber

Thursday (8/7): Atlassian, Block, Celsius, ConocoPhillips, D-Wave, Energy Fuels, Establishment Labs, Krotos, Lilly, Nuscale, Pinterest, Sony, SoundHound, T2 Biosystems, Targa, Team, The Trade Desk, Twilio, Vistra

Friday (8/8): Canopy Growth, CPI Card Group, FET, FuboTV, PAR, Plains All American, Sylvamo, Tempus, Terawulf, Wendy’s

What We’re Watching:

Advanced Micro Devices (AMD)

Source: AMD Earnings Deck

AMD reports Q2 earnings Tuesday after the bell, with shares up +42% YTD as investors bet on long-term upside from the MI300X AI accelerator ramp and enterprise cloud demand.

This cycle, focus will be on how fast MI300X — AMD’s flagship AI GPU — is scaling against NVIDIA’s dominance. Last quarter, Data Center revenue jumped +80% QoQ, as MI300X deployments at Microsoft, Meta, and others began contributing. I’ll also be watching for updates on AI PC momentum via Ryzen AI, embedded and gaming recovery trends, and signs of margin expansion as high-performance product mix improves.

We’re excited to hear from Lisa Su on AMD’s $4B+ AI revenue outlook for 2025, and whether enterprise adoption is accelerating fast enough to justify lofty AI expectations. With custom silicon, new cloud wins, and XDNA 2 on the roadmap — this earnings print is meaningful.

“We see strong multi-year demand for our AI platforms and expect to gain share as the market expands.”

Advanced Micro Devices, Inc. (AMD) Stock Performance, 5-Year Chart, Seeking Alpha

Palantir (PLTR)

Source: Palantir Earnings Deck

Palantir reports Q2 earnings Monday after the bell, with shares having surged over 103% YTD, making it a top performer on the S&P 500 as investor enthusiasm grows around its AI-driven software platform.

This earnings cycle, all eyes will be on whether Palantir can deliver strong growth in both government and commercial AI demand, with analysts expecting ~$939 million in revenue (+39% YoY). Key highlights include a revised $10 billion U.S. Army IT and software contract, which could see annual revenue rise from $400 million to $600 million over the next two years.

I’ll also be listening for updates on the pace of enterprise AI adoption, pricing transparency, and the commercial pipeline — especially because Palantir trades at a lofty multiple (~250 x forward earnings) and investor expectations are sky-high.

“Palantir is on fire... This is an unvarnished cacophony of twenty years of investment and a massive cultural shift in the U.S.”

Palantir Technologies, Inc. (PLTR) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

More earnings volatility, Boeing defense union strike to start today, and Switzerland got caught in the middle of a trade war.

Earnings Volatility

Roughly two-thirds of the S&P 500 have now reported – and blended earnings growth has surged to +10.3%, more than double the +5% pace expected just a month ago, per FactSet. But under the surface, stock-level volatility is spiking.

Despite headline strength, even minor earnings disappointments are being punished more harshly than usual. According to Evercore ISI, stocks missing both revenue and EPS estimates are falling an average of 4.9% the next day, well above the 5-year average decline of 3.2%. And even beats aren’t always safe from pullbacks.

Even modest guidance cuts are triggering sharp moves — Novo Nordisk dropped -20% after trimming its full-year outlook, while Meta jumped +12% on strong AI and ad performance. With the S&P 500 hovering near record highs, the market is showing zero tolerance for anything short of perfect.

“Use cases for AI are emerging and some companies are already seeing a payoff, meaning this isn’t speculative anymore. That doesn’t mean big tech can’t get ahead of themselves and pull back, but tech is on an inexorable march to be a larger and larger part of the market. That’s been the trend my whole career, and I don’t know why it would stop now.”

Boeing (BA) Defense Union Strike

Source: Barrons

Over 3,200 Boeing defense machinists in St. Louis and Illinois rejected the company’s latest four-year contract offer — despite a proposed 20% base wage increase and improved benefits — and will walk off the job starting at midnight on Monday, marking the first strike at Boeing’s defense operations since 1996.

This strike jeopardizes production of fighter jets and MQ-25 refueling drones, which form a core part of Boeing’s defense and space business — roughly 29% of the company's $22.75B Q2 revenue. While Boeing insists it has contingency plans to maintain operations, the move follows last year’s 33,000-worker commercial strike that cost the company billions. With Boeing under pressure to execute on large Pentagon contracts and stabilize its turnaround, the strike adds another layer of operational disruption.

“IAM District 837 members have spoken loud and clear, they deserve a contract that reflects their skill, dedication, and the critical role they play in our nation’s defense.”

Switzerland Trade Levy

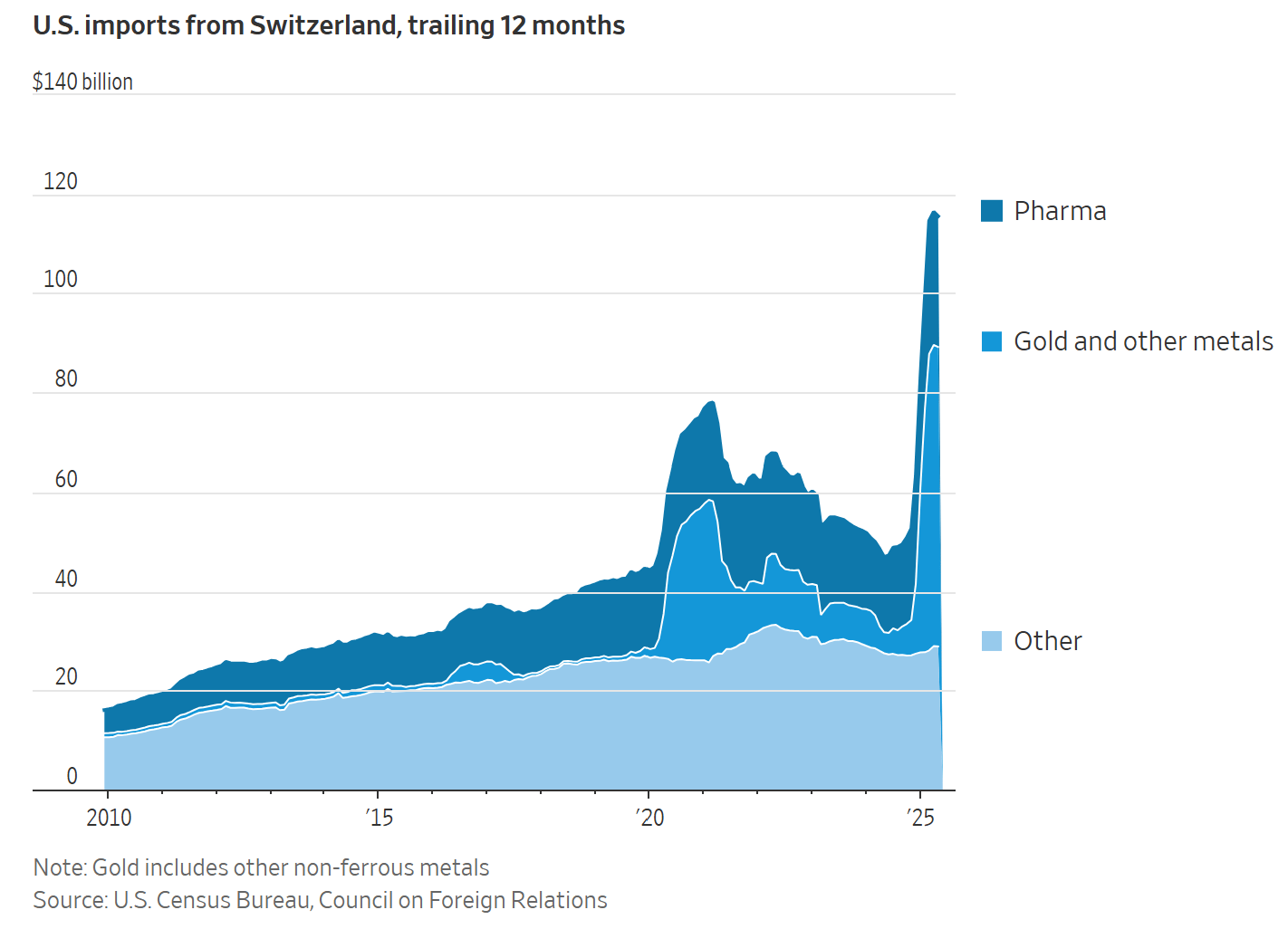

President Trump imposed a 39% tariff on Swiss exports – one of the highest levies issued under the new executive order. The decision shocked Swiss officials and business leaders, many of whom believed a deal was imminent after months of negotiations.

Switzerland, which sends ~19% of its exports to the U.S., now faces a severe disadvantage compared to EU neighbors who secured a more favorable 15% rate. Key exports like precision tools, watches, chocolate, and pharmaceuticals (currently exempt) are in limbo as companies brace for disruption. The Swiss-American Chamber of Commerce had proposed a $150B investment into the U.S. in hopes of averting the tariffs, to no avail.

The economic hit could trim -0.6% off Swiss GDP, with the damage escalating if pharmaceutical exemptions are revoked. The final rate may still be negotiated before the August 7 deadline. Until then, expect heightened uncertainty across global trade.

“The U.S. leads a zigzagging unilateral war on tariffs and this unpredictability imposes a rising risk premium on financial assets. This will lead to a weakening of the Swiss economy, the Swiss Franc and the Swiss equity market, particularly the all-important export sector.”

Major Economic Events:

ISM services PMI and U.S. trade deficit are in the spotlight this week.

Monday (8/4): Factory orders

Tuesday (8/5): ISM services, S&P final U.S. services PMI, U.S. trade deficit

Wednesday (8/6): Fed Gov. Lisa Cook and Boston Fed President Susan Collins on panel

Thursday (8/7): Atlanta Fed President Raphael Bostic speech, Consumer credit, Initial jobless claims, U.S. productivity, U.S. unit-labor costs, Wholesale inventories

Friday (8/8): None scheduled

What We’re Watching:

ISM Services PMI

ISM Services PMI ticked up to 50.8 in June, rebounding from May’s contractionary 49.9 reading and topping expectations of 50.5. The gain was driven by a broad-based uptick in business activity (54.2 vs 50), new orders (51.3 vs 46.4), and export orders (51.1 vs 48.5) — signaling a modest recovery in service-sector demand.

Inventory levels also firmed (52.7 vs 49.7), though supplier delivery performance continued to slow (50.3 vs 52.5) and backlog of orders fell again to 42.4. Price pressures eased slightly (67.5 vs 68.7), but tariffs and operating cost inflation remained top concerns among firms.

Economists expect the following this week:

ISM Services PMI (July): 51.0 est.

Business Activity Index: 54.0 est.

Prices Paid Index: 67.0 est.

“The past relationship between the Services PMI® and the overall economy indicates that the Services PMI® for June (50.8 percent) corresponds to a 0.7-percentage point increase in real gross domestic product (GDP) on an annualized basis.”

U.S. Trade Deficit

The U.S. trade deficit ballooned to $71.5B in May, up from a revised $60.3B in April — marking one of the largest monthly increases since 2022. The widening gap was driven by a 4% drop in exports to $279B, following a record high in April, with sharp declines in non-monetary gold, natural gas, and finished metal shapes.

Imports dipped slightly by 0.1% to $350.5B, a 7-month low, as reduced purchases of computer accessories and metals offset gains in computers, autos, and pharmaceuticals. The largest deficit was with the EU (-$22.5B) — while gaps with Mexico, Canada, and Vietnam also widened. Notably, the deficit with China narrowed to $14B, the lowest in months.

Economists expect the following this week:

U.S. Balance of Trade (June): $68.5B expected deficit

Exports (June): +0.5% MoM

Imports (June): +1.2% MoM

“President Trump is using tariffs as a powerful tool to reduce our trade deficit and put America First after decades of unsustainable trade deficits that threaten our economic sovereignty and national security. The Trump administration continues to engage with our trading partners to achieve fair, balanced, and reciprocal trade.”

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Cover image source: Fabrice Caffini / AFP / Business Insider

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]