- GRIT

- Posts

- 👉 Is Nike Ready to Run?

👉 Is Nike Ready to Run?

Carnival, Jobs Report, Tesla

Welcome to your new week.

Let’s dive right in.

Key Earnings Announcements:

Carnival Corporation and Nike headline another slow week of earnings.

Monday (9/30): Carnival Corporation

Tuesday (10/1): McCormick, Nike, Paychex

Wednesday (10/2): Conagra, Levi’s, RPM

Thursday (10/3): Constellation Brands

Friday (10/4): Apogee

What We’re Watching:

Carnival Corporation (CCL)

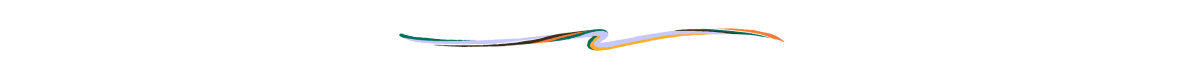

Carnival Corporation is set to report its Q3 earnings on Monday. Wall Street is expecting EPS of $1.15 (+30% YoY) and revenue growth to $7.81 billion (+14% YoY). Strong demand for cruises has driven the company’s recovery, with consumers eager for vacations and higher ticket prices supporting revenue. Despite softer growth compared to Q2, analysts anticipate earnings upside and margin expansion — Carnival has a strong track record of outperforming expectations.

Looking ahead, while 2024 is shaping up as a record year for cruises, there are few concerns that post-COVID travel demand could slow in 2025. However, bullish analyst ratings and numerous upward revisions to EPS and revenue estimates reflect confidence in Carnival’s near-term outlook.

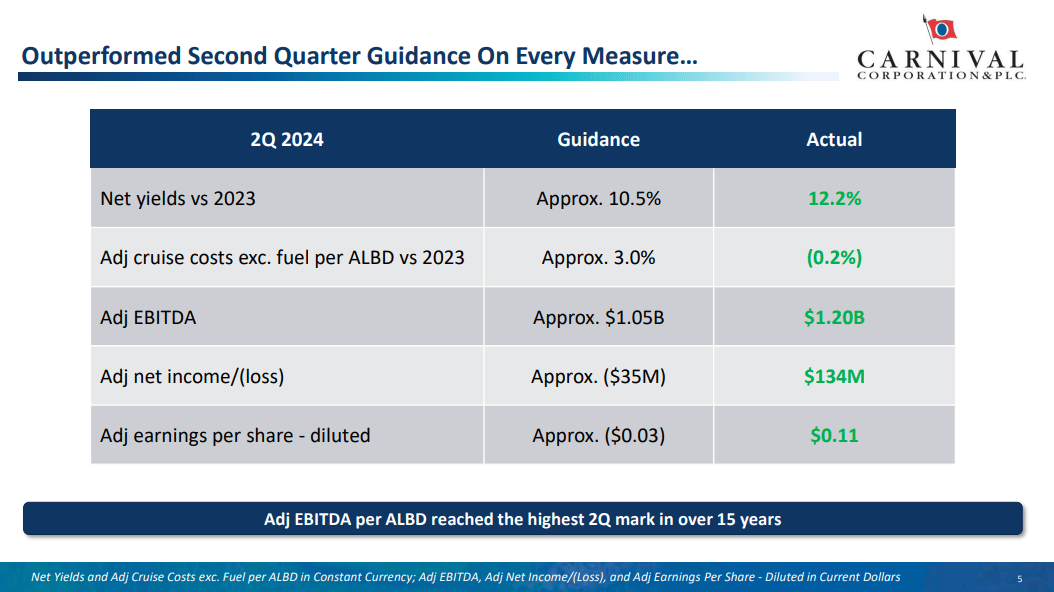

Carnival Corp. (CCL) Stock Performance, 5-Year Chart, Seeking Alpha

Nike (NKE)

Nike (-17.6% YTD) will release its FQ4 earnings on October 1. Projections are indicating a -8.5% YoY revenue drop to $11.65 billion. This decline is largely attributed to weaker performance in North America — with footwear revenue expected to dip -9.4% and apparel revenue down -7.9%. Analysts are also eyeing Nike's gross margin rate (forecasted at 44.4%) and operating income (forecasted at $882.1 million).

Nike shares have surged recently — largely due to Elliott Hill coming on as CEO effective October 14. While Hill’s leadership has investors optimistic, some analysts caution that Nike could issue conservative FQ1 and full-year guidance during the earnings call.

Nike’s regional and product-specific outlook — especially regarding trends in China — could signal broader consumer trends for other global brands like Starbucks (SBUX), Estée Lauder (EL), & Skechers (SKX).

Nike Inc. (NKE) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs

The merger of DirecTV & Dish, the stock split of SMCI, and Tesla + other EV companies report deliveries.

DirecTV to Acquire Dish Network for $1

Source: ADWEEK / Adobe Stock / DirecTV / Dish

DirecTV announced its acquisition of Dish Network for $1 — assuming billions of dollars of Dish's debt as both companies face challenges retaining subscribers in the streaming-dominated era.

The merger aims to create a more competitive force against streaming services, providing more scale and investment opportunities for the combined entity. DirecTV will receive a $10 billion loan from TPG to help Dish manage upcoming debt maturities, while continuing to operate Dish and Sling TV under their current brands. The deal still requires approval from Dish bondholders.

AT&T Inc. (T) Stock Performance, 5-Year Chart, Seeking Alpha

This marks the end of decades of merger talks between the two satellite TV rivals, offering both companies a way to address financial pressures and compete more effectively. Antitrust concerns are less pronounced now due to the rise of broadband options in rural areas.

SMCI 10-1 Stock Split #1

Source: David Paul Morris / Bloomberg via Getty Images / Kiplinger

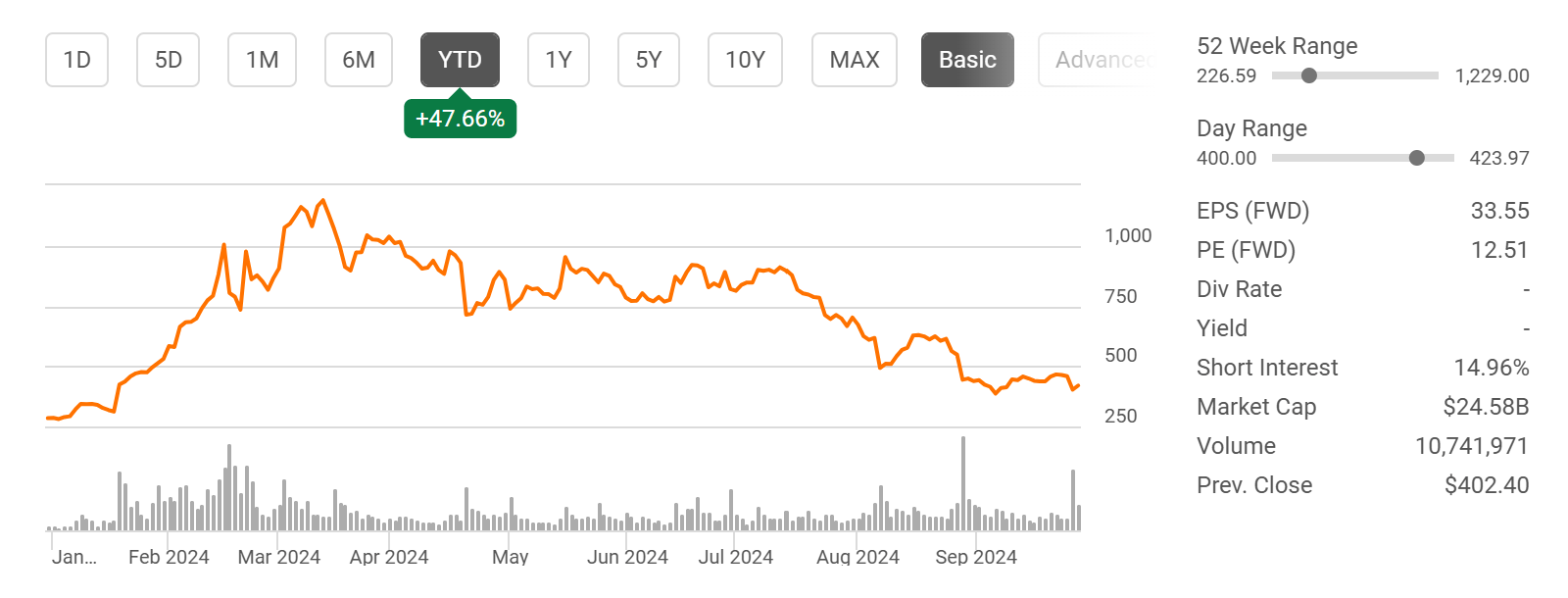

Super Micro Computer will implement a 10-1 stock split on Monday, aimed at increasing liquidity and accessibility for investors. Despite the recent -70% plunge from its March 2024 highs — SMCI still boasts a 1-year total return of over +60%, driven by its leadership in AI servers.

Super Micro Computer, Inc. (SMCI) Stock Performance, YTD Chart, Seeking Alpha

While bearish sentiment has dominated, analysts remain cautiously optimistic, with upward revenue revisions and confidence in Supermicro's fundamentals following recent challenges. The stock split could attract new buyers, potentially signaling an inflection point for the company’s recovery while they face public scrutiny with an ongoing DoJ probe.

Tesla Deliveries

Source: Getty / Shutterstock / Independent

Tesla delivery numbers come in this week alongside major EV competitors like Nio (NIO), XPeng (XPEV), Rivian (RIVN), Li Auto (LI), and Lucid (LCID). The broader U.S. auto market is expected to see a slight decline in September sales — down -1.8% YoY — with total Q3 new-vehicle sales projected to increase +0.2%.

Despite modest growth — rising inventory and high interest rates are squeezing consumer demand that has led to a drop in retailer profit per unit by -29% compared to last year.

Tesla, Inc. (TSLA) Stock Performance, YTD Chart, Seeking Alpha

Tesla's performance will be closely watched considering industry-wide challenges such as their increased monthly payments for consumers. With vehicle prices still slow to drop, Tesla’s ability to navigate this tough market will be key, as demand continues to be influenced by economic pressures. This is a BIG week for the EV landscape around the world.

Major Economic Events:

September’s jobs report will have the eyes of every investor.

Monday (9/30): Chicago Business Barometer (PMI), Fed Reserve Chair Jerome Powell Speaks, Fed Reserve Governor Bowman Speaks

Tuesday (10/1): Auto Sales, Construction Spending, ISM Manufacturing, Job Openings, Fed Reserve Governor Cook Speaks, Fed Speakers Join Panel about Technology-Enabled Disruption

Wednesday (10/2): ADP Employment, Cleveland Fed President Hammack Speaks, Fed Reserve Governor Bowman Speaks, Richmond Fed President Barkin Speaks, St. Louis Fed President Musalem Speaks

Thursday (10/3): Initial Jobless Claims, ISM Services, Factory Orders, Minneapolis Fed President Kashkari & Atlanta Fed President Bostic Speak

Friday (10/4): U.S. Hourly Wages, U.S. Nonfarm Payroll, U.S. Unemployment Rate, New York Fed President Williams Speaks

What We’re Watching:

Nonfarm Payrolls

Source: Trading Economics

The US economy added +142K jobs in August 2024, more than a downwardly revised +89K in July — but below forecasts of +160K.

A nonfarm payroll increase of +144K is expected this week. The upcoming jobs report is easily one of the most important of the year.

Unemployment Rate

Source: Trading Economics

The U.S. unemployment rate eased to 4.2% in August 2024, down slightly from 4.3% in July — with 7.1 million unemployed. Permanent job losses remained steady at 1.7 million, while temporary layoffs fell by -190,000 to 872,000.

Bank of America US economist Aditya Bhave wrote in a note to clients "Layoffs are the key indicator to watch: as long as they stay low, the base case will likely remain a soft landing."

The unemployment rate is expected to hold steady at 4.2% this week.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Cover Image Credit: Nike Investor Relations

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at info@gritcap,io

Reply