- GRIT

- Posts

- 👉 Jam-Packed January Ending Soon...

👉 Jam-Packed January Ending Soon...

Boeing, Canada, Microsoft

Together with Quantify Funds

Welcome to your new week.

Let’s be honest — this has been an exhausting start to the year in the markets. Just a few things that will be in focus this week…

Major earnings reports

The largest cryptos like BTC and ETH risking substantial drops to the downside

Fed meeting

Greenland

Iran

Japan

Government shutdown lingering

And so much more…

It’s as important as ever to be an informed investor. Read on for everything you should keep you eyes on!

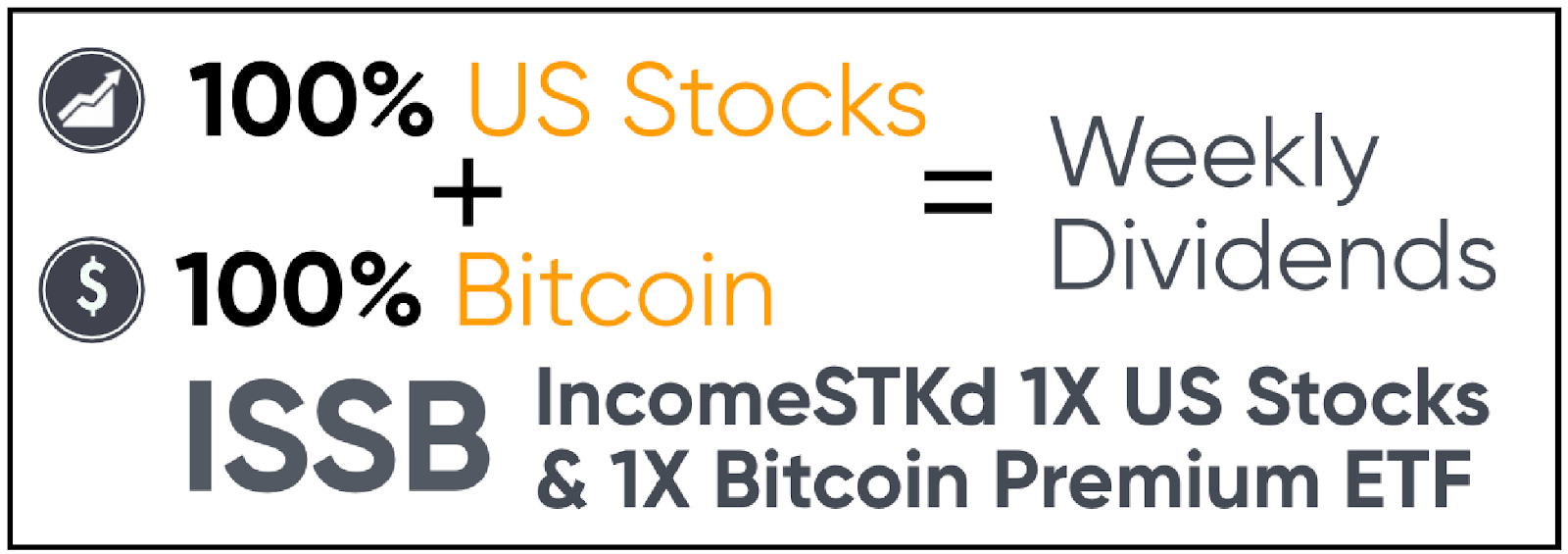

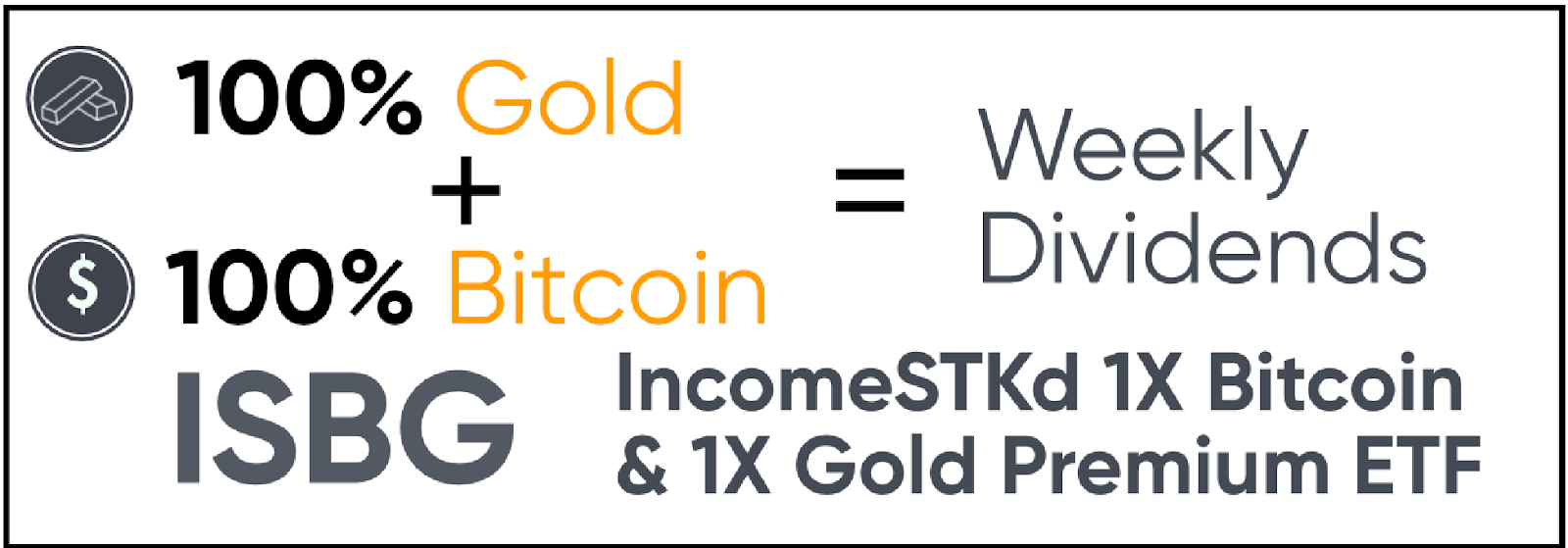

Together with Quantify Funds

Total Return & Weekly Options Income

Tax Efficient Options Strategies

Return Stacking — Addition Without Subtraction

Learn more at https://docs.quantifyfunds.com/kbjMUv7t8hq

Key Earnings Announcements:

103 S&P 500 companies report this week — including an important commercial / defense manufacturer + big tech giants.

Monday (1/26): AGNC, Baker Hughes, Nucor, Ryanair, Steel Dynamics

Tuesday (1/27): Boeing, General Motors, Northrop Grumman, Texas Instruments, UnitedHealth Group, UPS

Wednesday (1/28): ASML, AT&T, IBM, Lam Research, Meta Platforms, Microsoft, Starbucks, Tesla

Thursday (1/29): Apple, Caterpillar, Mastercard, Visa, Western Digital

Friday (1/30): American Express, Chevron, ExxonMobil, Verizon, Charter Communications, SoFi

What We’re Watching:

Boeing (BA)

Boeing (+16.1% YTD) reports Q4 earnings this week, with investors focused on whether operational stabilization and improving aircraft deliveries can begin to translate into better cash flow after another turbulent year.

Last quarter, Boeing posted $18.1 billion in revenue (+4% YoY) but continued to burn cash as production disruptions, regulatory scrutiny, and higher costs weighed on results. Commercial Airplanes deliveries improved modestly, while Defense & Space remained pressured by fixed-price contract charges. Management reiterated its goal of stabilizing 737 MAX production and improving execution across programs.

For this report, I’ll be watching delivery cadence for the 737 MAX, free cash flow trajectory, and any updates on regulatory oversight and quality controls. Commentary on supply-chain normalization, customer confidence, and the pace of balance-sheet repair will be critical for investor sentiment.

“We are making the changes needed to restore trust and stabilize our business for the long term.”

Boeing Company (BA). Stock Performance, 5-Year Chart, Seeking Alpha

Microsoft (MSFT)

Microsoft (-3.7% YTD) reports Q2 FY2026 earnings this week, with investors focused on whether AI-driven growth across Azure, Microsoft 365, and enterprise software can continue to offset margin pressure from heavy infrastructure spending.

Last quarter, Microsoft delivered $64.7 billion in revenue (+15% YoY) and $2.95 in EPS (+19% YoY), driven by strong performance in Microsoft Cloud and sustained demand for Copilot products. Azure revenue grew in the low-30% range, though management flagged that AI capacity constraints and elevated capex would continue to weigh on near-term margins.

Heading into this release, I’ll be watching Azure growth trends, AI monetization across Office and Dynamics, and signals on capex intensity into 2026. Any update on Copilot adoption, pricing leverage, or AI workloads translating into higher ARPU will be key for the stock’s next move.

“Cloud and AI are the essential inputs for every business to expand output, reduce costs, and accelerate growth.”

Microsoft, Inc. (MSFT) Stock Performance, 5-Year Chart, Seeking Alpha

Investor Events / Global Affairs:

Canada–U.S. trade tensions stay in focus, U.S. takes $1.6B stake in USA Rare Earth (USAR), and Japan markets are on edge as bonds sell off.

Canada-U.S. Trade Tensions Stay in Focus

Canada’s Prime Minister Mark Carney reiterated that Ottawa has no plans to pursue a full free-trade agreement with China, pushing back against Donald Trump’s threat to impose 100% tariffs on Canadian goods if such a deal were pursued. Carney stressed that his recent engagement with China was limited to specific tariff adjustments, not a comprehensive trade pact, and that Canada is respecting its commitments under the US–Mexico–Canada Agreement (USMCA).

Under the agreement, Canada will permit up to 49,000 Chinese electric vehicles to enter the market each year at a reduced 6.1% tariff, following its October 2024 move — alongside the U.S. — to raise tariffs on those vehicles to 100%.

“What we have done with China is to rectify some issues that have developed in the last couple of years… entirely consistent with CUSMA.”

“If Governor Carney thinks he is going to make Canada a ‘Drop Off Port’ for China to send goods and products into the United States, he is sorely mistaken.”

U.S. Takes $1.6B Stake in USA Rare Earth (USAR)

USA Rare Earth, Inc. (USAR) Stock Performance, YTD Chart, Seeking Alpha

The USA Rare Earth Inc is back in focus after reports that the Donald Trump administration plans to invest $1.6 billion for a 10% stake in the company, underscoring a renewed push to secure domestic rare-earth supply chains critical to defense, EVs, and AI infrastructure.

Rare earths have long been a geopolitical flashpoint, with China historically dominating global production and processing. Washington’s new investment signals a more assertive industrial strategy to reduce dependence on foreign sources, bolster supply-chain resilience, and support U.S. manufacturing competitiveness. The move also dovetails with broader federal efforts under the CHIPS and Science Act, Inflation Reduction Act, and defense appropriations that prioritize strategic materials and dual-use technologies.

Markets have responded with enthusiasm: the stock climbed ~+9% Friday and ~+46% over the past five trading days as traders priced in the potential for accelerated production, new capital flows, and expanded government offtake agreements.

“This is the fourth equity investment into critical minerals companies announced by the administration following the acquisition of equity stakes in MP Materials (NYSE: MP), Lithium Americas (TSX: LAC) and Trilogy Metals (TSX: TMQ) last year.”

Japan Markets on Edge as Bonds Sell Off

Japan’s financial markets came under renewed strain after the Bank of Japan warned that government bond yields are rising too fast and signaled it is prepared to step in with bond-buying if conditions turn disorderly. The comment followed a sharp selloff in long-dated JGBs that pushed yields to record highs, even as the BoJ held its policy rate steady near 0.75% and reiterated that further hikes are likely in 2026.

The warning triggered violent currency moves, the yen briefly fell before snapping higher within minutes. Traders pointed to speculation around official “rate checks” and the growing risk of direct intervention. Despite the rebound, the currency remains near multi-decade lows against major peers.

Political uncertainty is adding fuel to the fire. Prime Minister Sanae Takaichi dissolved parliament and called a snap election, while floating fiscal proposals that could materially widen deficits, intensifying pressure on long-term bonds. At the same time, the BoJ raised its underlying inflation outlook, reinforcing expectations that policy normalization is coming.

“If the yen slides hard, Japan has to defend it, and the fastest lever is selling reserves, including Treasuries… That’s how a Japan problem turns into higher US yields at exactly the wrong moment.”

Major Economic Events:

Consumer confidence, durable goods orders, and the Fed’s interest rate decision are in focus.

Monday (1/26): Durable Goods Orders, Durable Goods Orders (Ex-Transportation)

Tuesday (1/27): Consumer Confidence

Wednesday (1/28): FOMC Interest Rate Decision, Fed Chair Powell Press Conference

Thursday (1/29): Factory Orders, Initial Jobless Claims, U.S. Productivity, U.S. Trade Deficit, Wholesale Inventories

Friday (1/30): Chicago Business Barometer (PMI), Core PPI, Core PPI (YoY), Producer Price Index (PPI), PPI (YoY)

What We’re Watching:

Durable Goods Orders

New orders for U.S.-manufactured durable goods fell 2.2% MoM in October, sharply reversing September’s upwardly revised +0.7% gain and missing expectations for a -1.5% decline. The pullback was driven primarily by a steep drop in transportation equipment (-6.5%), with both nondefense (-20.1%) and defense aircraft orders (-32.4%) plunging.

Outside of aircraft, the picture was more mixed. Non-defense capital goods excluding aircraft –a key proxy for business investment – rose 0.5%, suggesting underlying corporate spending plans remain intact despite macro uncertainty. Machinery (+0.8%) and fabricated metals (+0.5%) also posted gains, partially offsetting weakness in capital goods and primary metals.

Economists expect the following this week:

Durable Goods Orders (MoM): -2.2% vs. +0.7% prior

Core Capex Orders (ex-aircraft): +0.5% vs. flat prior

“Durable goods remain noisy month to month, but core capital spending continues to show resilience — a sign businesses are cautious, not retreating.”

Fed Interest Rate Decision

Source: FedWatch CME Group

Minutes from the Federal Reserve’s December meeting showed broad agreement that rate cuts are likely in 2026 if inflation continues to ease, though policymakers remain split on the balance of risks. Some officials warned that sticky inflation could still require restrictive policy, while others argued for deeper cuts to counter signs of labor-market softening.

The Fed cut rates by 25bps to a 3.5%–3.75% range, marking its third cut of the year and matching market expectations. The decision was not unanimous: two members dissented in favor of holding steady, while newly appointed Governor Miran pushed for a larger 50bps cut.

The updated Summary of Economic Projections (SEP) showed greater optimism around 2026 growth, with policymakers citing a smaller-than-feared drag from tariffs and more confidence in a gradual inflation cooldown.

Economists expect the following this week:

Fed Funds Rate (Current): 3.5%–3.75%

2026 Rate Cuts Priced In: ~2–3 cuts

Inflation Risk vs. Labor Risk: Evenly balanced

“The Fed is no longer debating whether to cut – it’s debating how fast and how far. That tension will define policy in 2026.”

– Julia Coronado, President, MacroPolicy Perspectives

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Quantify Funds Disclosures: The Funds do not invest directly in Bitcoin or Gold bullion. ISSB & ISBG use leverage to “stack” the total return of holdings in the Fund’s Bitcoin strategy, Gold strategy & US Equity strategy. There is no guarantee the Quantify Funds ETFs will make weekly distributions and the amounts may fluctuate from week to week. Distributions may be comprised of option premiums, dividends, capital gains, and interest payments. To view both current and historical monthly estimates of ETF distribution composition, investors may view the 19a-1 notices available on each corresponding Fund's webpage. Distributions classified as return of capital will reduce an investor’s cost basis in Fund shares owned, which may result in higher taxes paid in the future when the Fund shares are sold, even if the shares are sold at a loss compared to the original investment. Investing involves risk. Principle loss is possible. Distributed by Foreside Fund Services LLC.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.

Grit is a publisher of financial information, not an investment advisor. Grit does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. Grit does not guarantee the accuracy or completeness of the information provided in this page. All statements and expressions herein are the sole opinion of the author or paid advertiser.

Cover Art Sources: Stephen Brashear / Stringer via Getty Images

THE INFORMATION CONTAINED ON THIS WEBSITE IS NOT AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, AND DOES NOT PURPORT TO BE AND DOES NOT EXPRESS ANY OPINION AS TO THE PRICE AT WHICH THE SECURITIES OF ANY COMPANY MAY TRADE AT ANY TIME. THE INFORMATION AND OPINIONS PROVIDED HEREIN SHOULD NOT BE TAKEN AS SPECIFIC ADVICE ON THE MERITS OF ANY INVESTMENT DECISION. INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION AND DECISIONS REGARDING THE PROSPECTS OF ANY COMPANY DISCUSSED HEREIN BASED ON SUCH INVESTORS’ OWN REVIEW OF PUBLICLY AVAILABLE INFORMATION AND SHOULD NOT RELY ON THE INFORMATION CONTAINED HEREIN. INVESTORS SHOULD OBTAIN INDIVIDUAL INVESTMENT ADVICE BASED ON THEIR OWN CIRCUMSTANCES BEFORE MAKING AN INVESTMENT DECISION

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned.

The author, publisher or insiders of the publisher may currently have long or short positions in the securities of the companies mentioned herein, or may have such a position in the future (and therefore may profit from fluctuations in the trading price of the securities). To the extent such persons do have such positions, there is no guarantee that such persons will maintain such positions.

Any projections, market outlooks or estimates herein are forward looking statements and are inherently unreliable. They are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur. Other events that were not taken into account may occur and may significantly affect the returns or performance of the securities discussed herein. The information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and Grit undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional material.

Grit does not accept any liability whatsoever for any direct or consequential loss, however arising, directly or indirectly, from any use of the information contained herein.

By using the Site or any related social media account, you are indicating your consent and agreement to this disclaimer and our terms of use. Unauthorized reproduction of this newsletter or its contents by photocopy, facsimile or any other means is illegal and punishable by law.

Please read: Terms of Use, Privacy Policy, Disclosure Policy and Disclaimer Policy

If you have any questions please contact us at [email protected]